Filling out form 6-NDFL raises many questions among tax agents who accrue and pay income to individuals. Since an error in calculation can lead to a fine, any reporting indicator must correspond to accounting data. Line 040 in 6-NDFL is no exception. When filling it out, the employer is obliged to take into account the ratios developed by the Federal Tax Service for verification.

The calculation of 6-NDFL was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018). It shows generalized amounts of income and personal income tax. The report consists of two sections, the first of which is filled in with a cumulative total, and the second contains data for the last quarter of the reporting period.

Features of the 6-NDFL report

This type of accounting documentation is relatively new, introduced in 2020.

6-NDFL is a mandatory reporting document. The information contained in it concerns employee profits and accrued income tax.

The form must be submitted to the Federal Tax Service quarterly. One of the features is the entry of some data on an accrual basis, which is due to the specifics of wage payment. It is transferred in the month following the month of accrual. Due to the fact that profits are paid in the next month, there are time gaps between the day the tax is withheld and the day the wages are paid. If the first days of the month are non-working days, the gaps that arise between these dates are very significant. The next difference is the presence of information contained in other reporting documents, which allows you to compare and reconcile data.

https://youtu.be/-m0RgjUzafI

Calculation submission date on the title page

Let's start with the title page. In it, inspectors will first of all check the date of submission of the calculation . It must comply with the deadline established in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation - no later than the last day of the month following the corresponding period. This means that the calculation must be submitted for the first quarter - no later than April 30 (in 2020 - May 4), for the six months - July 31 (in 2016 - August 1, since July 31 is Sunday), for 9 months - October 31. And the calculation for the year must be submitted no later than April 1 of the following year (for 2020 - April 3, 2020, since April 1 is a Saturday).

You can transfer the tax earlier. This conclusion can be drawn from the control ratio date on line 120 of the calculation > date of transfer according to the KRSB NA data (date of payment of the personal income tax amount). Let's say that on line 120 the deadline for submitting the report is the 4th, and the tax agent was able to transfer the tax on the 1st. It turns out that 4 > 1, which means that the CS is satisfied and there is no violation. It will be worse if in the calculation the tax agent indicates the submission date later than the deadline established in the Tax Code of the Russian Federation. For example, in line 120 the deadline for submitting the calculation is the 4th, and the tax is transferred on the 6th (4 < 6). Tax officials will regard this as a possible violation - failure to submit a calculation within the deadline established by the Tax Code of the Russian Federation . When establishing such a fact, the tax inspectorate must draw up a report in the manner prescribed by Art. 101.4 Tax Code of the Russian Federation. Based on the act, a decision will be made to hold the tax agent accountable in accordance with clause 1.2 of Art. 126 of the Tax Code of the Russian Federation. According to this article, failure by a tax agent to submit calculations to the tax inspectorate at the place of registration within the prescribed period entails a fine from the tax agent in the amount of 1,000 rubles. for each full or partial month from the day established for its submission .

Control ratios

Each type of reporting allows the use of control ratios. This term refers to the correspondence of the numeric data of a certain row to the total value of other rows. In some cases, reconciliation takes place according to the “more or less” principle: it is important that the numbers entered in one column are more or less than the data indicated in other sections.

The control ratios applied to 6-NDFL require reconciliation between the 2-NDFL and DAM forms. In addition, representatives of the tax office carry out an audit based on a comparison of data inside the form.

In June 2020, the Federal Tax Service updated the formulas used for reconciliations. Most of the checkpoints are the same as previous versions. According to the rules of the new edition, the inspector will take into account the report even without the necessary correlation between the lines. The reason for refusal to accept Form 6-NDFL may be:

- discrepancy in the amounts of contributions in section 1;

- discrepancy between the amounts of contributions under section 3.

In order not to waste time on preparing corrective statements, you must first pay attention to these sections and check the report according to the established formulas.

What ratios are subject to control reconciliation?

Let us note the nuances of this form that distinguish it from others:

- Issued quarterly;

- The information in it is formed incrementally from the beginning of the year;

- Created separately for all divisions of the company;

- Contains consolidated (summary) information on income, tax deductions, accrued and withheld personal income tax amounts of the division's contingent.

A characteristic feature of the report is the presence of amounts carried forward to the next period, since wages are paid at the end of the month for which they are issued, and the timing of tax calculation and withholding do not always coincide. Form 6-NDFL has undergone changes in 2020, so the report for 2020 will have to be submitted using a new form. Details, form and procedure for filling out the new form can be found here.

Checking the 6-NDFL control ratio begins with linking the lines according to the proposed formulas.

For example, the ratio is considered correct when line 020 ≥ page 030. If the inequality is not maintained, then there is an error, since the total tax deduction (030) should not exceed the amount of accrued income (020).

The control ratios of 6-NDFL line 040 are expressed in the formula:

- page 040 = (page 020 – page 030) x page 010, i.e. the amount of accrued tax corresponds to the product of accrued income (minus deductions) by the current rate. If the equation does not hold true, therefore, the amount of accrued tax is incorrect (underestimated or, conversely, overestimated). In this calculation, a minor error due to rounding is acceptable, calculated by multiplying line 060 (number of employees) by 1 rub. and the number of lines is 100 (date of receipt of income).

- line 040 ≥ line 050. If the value of line 040 is less than the value of line 050, then most likely the amount of the fixed advance payment is overestimated.

Tax authorities have developed a new report form, as well as a format for submitting it electronically. You will have to report for 2020 using a new form. It must be submitted no later than 04/02/2018.

Changes in the report affected the design, the title page, the introduction of a new barcode, the addition of codes for company reorganization forms, the introduction of a new registration procedure for reorganization and new codes for places of payment submission.

The composition of the form, its calculation part and the algorithm for checking for comparability with the data of the lines within the report and with the information of overlapping forms remained unchanged.

So, having made minor adjustments to the report form, the Federal Tax Service did not affect the sections where the main values are calculated and did not cancel the use of control ratios, therefore, the calculation of tax amounts must be carried out based on previous legislative acts and using the verification formulas listed above.

Previously, in reference 2, the totals of taxes withheld and calculated were equal. How should the data be displayed after the personal income tax calculation 6 has been approved?

As of the date of filing certificate 2, all amounts of withheld tax have already been transferred to the treasury. Therefore, the amounts in the calculation must match. This also applies to December wages, which were paid in January. This norm is stated in letters BS-4-11/3283 dated March 2, 2015. and ED-4-3/ [email protected] dated February 3, 2012.

The first section of Form 6 must reflect the accrual of wages for December and the taxes withheld from it. These recommendations are in paragraph 2 of letter GD-4-11/14507 dated August 9, 2020. Filling out the section will be as follows:

- 020 – wages for December should be included;

- 040 – accrued tax must be added;

- 070 – salaries for December need to be summed up only if they are paid in December, since tax is withheld only when it is transferred to employee accounts. This norm is reflected in paragraph 4 of Article 226 of the Tax Code.

Example

Let's look at an example of filling out reports if the company employs only 1 employee.

In this case, only one certificate 2 should be generated at the end of the period:

- For the calendar year, the employee received a salary of 540 thousand rubles;

- Tax calculation and transfer in the amount of 70.20 thousand rubles;

- A gift was given, valued at 150.0 thousand rubles. It was handed over after the December payroll was accrued. His income tax was 18,890 rubles. and was not withheld and transferred;

- applied a deduction in the amount of 4.0 thousand rubles;

- the amount of dividends on transactions with securities amounted to 50.0 thousand rubles. Personal income tax – 6.5 thousand rubles. withheld and transferred;

- Dividends from other income of 25.00 thousand rubles were paid. Income in the amount of 3.25 thousand rubles. – withheld and transferred.

Filling out Form 6 for this example will be as follows:

Certificate 2 is issued for one employee

Reference ratio for this example

When a completed report is received from an enterprise, the tax office checks it for compliance with the control indicators. The legislation provides for a procedure for checking reports, identifying inconsistencies and an algorithm for issuing demands and applying penalties. Tax officers have access to all information on the taxpayer, all reports are consolidated in the taxpayer’s card.

- Errors inside the report are errors associated with incorrectly specified values in the columns of the report, that is, the relationship between the lines is not satisfied (such errors are found by special accounting programs).

- Lack of necessary relationships between values in three documents: 2-NDFL, 6-NDFL and income tax return (such errors can only be detected manually).

If errors are identified, the inspector requests an explanation of the information from the accountant. If a response to the request is not sent, the tax office may order an audit. During the audit, the organization will be required to provide originals of all documentation used to complete the report to confirm the accuracy of the information.

To relieve all accounting personnel from such worries, it is recommended to independently take such actions as checking 6-NDFL, and if an error is discovered by the organization, immediately provide clarification. When filling out, you need to focus on typical errors, including typos, since a typo is considered as unreliable information, even when it is obvious as a technical error.

Before sending 6-NDFL to the inspector, you should check it for compliance with the form of the report form and the electronic format, as well as for the correctness of completion and accuracy of the indicated indicators in the sections of the report. The control ratios developed and established by law, which were developed by the tax authorities themselves, will help to verify the correctness of the calculations.

These indicators will help to detect inconsistencies in the form of banal typos and analyze whether the report is drawn up correctly. The first section of 6-NDFL contains all the information on the enterprise on a cumulative basis for all previous quarters from the beginning of the year, including the current one, and the second section contains information only for the current quarter .

To begin with, it is recommended to perform such a simple operation as checking the correctness of filling out 6-NDFL on the title page, then we check both parts of the report. The first sheet contains basic information about the company (name with explanation, codes, address, telephone, etc.); information about the inspection where the enterprise is registered.

For each branch of the enterprise, a separate report is generated and submitted, which indicates the codes of the corresponding enterprise; a personal report is provided to the parent company. In accordance with the new changes made to the rules for filling out the title page of personal income tax-6, two lines have been allocated specifically for successors and three location codes have been added presentation of the report.

The first section must indicate the totals for all previous tax periods for all individuals to whom the company paid money. If the company paid income taxed at different tax rates during the past reporting period, it will be necessary to provide the completed first part of the report for each rate at on a separate sheet.

If personal income tax was calculated at the rates: 13, 15, 30, 35%, then in lines 10 to 50 the manager or accountant of the enterprise enters information in each section number 1, and lines from 60 to 90 - only on page 1 of this first section. If all payments were made based on the tax rate, for example, 13%, then the organization draws up one first section, filling out all lines from 10 to 90.

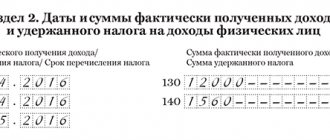

The design of the second section is more difficult than the first. Here it is very important not to make mistakes with dates and amounts. The second section consists of identical blocks for placing information on dates and amounts with lines from 100 to 140. To reliably fill out the second section, you must indicate the dates correctly. To accurately enter information, you need to prepare documentation, from which you can highlight:

- Date of actual receipt of income. This date is not the date when money is issued to an individual. This refers to the date of accrual of income (for salary, for example, this is the last day of the month).

- The date of personal income tax withholding from this income. This is the number of tax withholding from income, and not the number of the payment order for the transfer of tax.

- The last day of the period when the organization was obliged to transfer the personal income tax withheld from this income to the budget.

If these three numbers are the same, then the accountant groups the information and indicates it in one block of lines from 100 to 140. If the dates differ, the blocks are filled out individually for each date, and the number of blocks corresponds to the number of date options.

Example

Applying benchmark ratios within a report

Accounting programs primarily reconcile data within a form without using additional sources.

Table 1. Reconciliation

| Right | Wrong |

| 020 = > 030 | 020 |

| 040 = ((020 - 030) x 010): 100 | 040 ≠ ((020 - 030) x 010): 100 |

| 020 - 025 ≥ 050 section 1.1 | 020 — 025 |

According to previous test ratios, the reconciliation of personal income tax profits took place taking into account the data in line 030. This method was not effective. Due to the fact that this column contains information about child benefits that should not be displayed in column 020, discrepancies inevitably arise during comparison. To display the data more correctly, inspectors check the tax base for contributions based on personal income tax profits minus dividends: it is necessary that the profit either equals or exceeds the tax base.

Table 2. Applications of control ratios

| Line | Reconciliation subject | Note |

| 010 | The total data must be greater than or equal to one of the components of the consumable part | The total amount of benefits paid should not be less than its part |

| 030 | If the number in column 1 of line 30 is greater than zero, check for the presence of indicators in columns 2 and 3 | If there were insured events, then the number in column 1 must be greater than zero |

| 060 | The relationship between total data and sums of parts | Line 060 ≥ sum of lines 061 and 062 |

If inconsistencies are identified in the provided form 6-NDFL, representatives of the competent authorities will require clarification

When checking line 040, it is necessary to take into account the possible error caused by rounding of data. Example:

- Initial data: number of employees - 30 people;

- total income for 8 months - 352,455 rubles;

- the amount of tax deductions is 32,000 rubles;

- withheld personal income tax - 37,070 rubles.

Features of filling out the report

6-NDFL reflects information about the accrued and withheld tax amount. Withholdings must be filled out as a cumulative total, just like all values from Section 1 of the report. That is, the calculation for 9 months indicates the amount of tax from January to September. If the tax is calculated at differentiated rates, then lines 010-050 are filled out on separate sheets for each, and the total amount on the first page of the report is indicated on pages 060-090. Unlike income and deductions, the amount of deductions is indicated without kopecks. The report simply does not have the required number of cells.

When filling out a report, agents often make a serious mistake - they indicate the same amounts of accrued (p. 040) and withheld (p. 070) tax. This situation is possible if both operations were performed in the same reporting period. The difference occurs when the salary for the current quarter is issued to the employees in the next quarter. On page 040, the amount of accrued salary including tax will be indicated, and on page 070, “0” will be indicated, since personal income tax must be withheld when paying income.

Reconciliation of data in form 6-NDFL with information in form 2-NDFL

Due to the fact that 2-NDFL is issued for each employee separately, it is imperative to check the equality between the indicator in line 060 of 6-NDFL and the number of issued 2-NDFL.

Table 3. Control ratios between 6-NDFL and 2-NDFL

| Line 6-NDFL | Title of section 2-NDFL (total for each employee) |

| 020 | Total income |

| 025 | Profit from dividends |

| 040 | Calculated tax amount |

| 080 | Amount of tax not withheld by the tax agent |

| 060 | Number of issued certificates |

How to fill out line 040 in 6-NDFL for 2020

Section 1 is intended for generalized indicators for the entire period. On page 040 6-NDFL, tax agents show the amount of calculated tax for the reporting/tax period for all individuals, starting from January 1 of the current year. It is filled out according to tax registers.

Line 040 is directly related to accrued income and the applicable tax rate. Therefore, if different tax rates on personal income were applied, you need to fill out several pages of Section 1, according to their number.

Example 1: Filling out multiple sections 1

In 2020, Most LLC accrued income to all personnel in the amount of 2,640,000 rubles. One of the employees is a non-resident; his annual salary is 480,000 rubles. Since different tax rates were applied (13% for residents and 30% for non-residents), you need to fill out the first two sections of the form.

The accountant of Most LLC filled out the 1st page of Section 1 as follows:

- p. 010 - 13 – tax rate for residents;

- line 020 – 2,160,000.00 – accrued income of resident employees (2,640,000 – 480,000 = 2,160,000);

- line 040 – 280,800 – calculated tax amount, 13% of income (2,160,000 x 13% = 280,800).

Page 2 of Section 1 was completed as follows:

- p. 010 - 30 - tax rate for non-residents;

- line 020 – 480,000.00 – non-resident salary;

- pp. 040 – 14 4000 - calculated tax on the income of a non-resident employee (480,000 x 30% = 280,800).

In this case, the totals for lines 060-090 summed up for all rates must be filled out only on the first page of section 1.

Reconciliation of data from form 6-NDFL and RSV

Since these types of certificates relate to reports on employees, it is natural to assume that many indicators from these reports should match.

The Federal Tax Service offers one control ratio between the lines: the difference between 020 and 025 6-NDFL should not be less than 030 of section 1.1 of the RSV.

We should not forget that if an organization submits 6-NDFL to the inspection, it must also submit the DAM

Third-party data for additional verification

The last 4th group of control relations includes rule 4.1:

The value of line 050 “Amount of fixed advance payment” of Section 1 of the 6-NDFL declaration cannot be omitted if the tax agent has been issued a patent that obliges the employer to make such a payment (clause 6 of Article 227.1 of the Tax Code of the Russian Federation). Filling out line 050 occurs if the tax agent operating under the above-mentioned patent provides a notification confirming the right to underestimate the amount of calculated personal income tax by the amount of advance payments paid.

If line 050 of the 6-NDFL report is completed, and notification of the existence of a patent was not provided to the tax service, the amount of calculated tax will be considered illegally underestimated.

The amounts in lines 020 “Amount of accrued income” and 025 “Amount of withheld tax on dividend income” are compared by the Federal Tax Service with line 050 “Base for calculating insurance premiums” of Section 1, subsection 1.1 based on contributions. This is provided for by the control ratios to the ERSV (Letter of the Federal Tax Service of the Russian Federation No. ГД-4-11 / [email protected] dated December 29, 2020). If the income according to the 6-NDFL report turns out to be less than the contribution base, the tax agent will be obliged to explain this situation.

Knowledge of the control ratios used by tax services when checking 6-NDFL reports will help the document preparer, already at the stage of its preparation, to check those parameters that the tax authorities will focus on when reconciling data. This will reduce the risks of identifying incorrect data in the 6-NDFL report, the need to submit explanations on them, and submitting updated reports.

Explanations for data discrepancies

If during the inspection the inspector finds errors, he has the right to charge additional mandatory contributions to the state treasury, apply administrative penalties in the form of a fine or penalty, or request an explanatory letter.

The inspector has the right to send a request for explanations even if he has not identified any serious errors. Inconsistency of data when reconciling control ratios may be the subject of an explanatory note, but is not considered a violation. Such discrepancies are often caused by carryover payments in the form of accrued but not transferred fees under contract agreements, for example. The tax office's request must be responded to within 5 business days. In case of delay in explanation, a fine of 5,000 rubles may be assessed.

Having mastered the principle of working with control ratios, an accountant will be able to identify miscalculations before submitting reports to the Federal Tax Service and protect the company from the application of penalties.

What accruals are taken into account in line 040

First of all, let's look at what line 040 is in 6-NDFL and what is included there.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

It reflects the tax withheld by the employer - the tax agent from the income that was accrued in favor of employees.

The composition of taxable charges is determined by Art. 210 of the Tax Code of the Russian Federation in accordance with paragraph 1 of Art. 223 Tax Code of the Russian Federation. Taxable charges include, in particular:

- payments made under an employment contract - on the final day of the month for which the salary was accrued;

- payments under civil contracts - on the day the work contractor receives the funds;

- compensation paid to an employee upon dismissal - on the employee’s last working day;

- vacation payments - on the day of receipt;

- benefits for a certificate of incapacity for work - on the day the employee receives the funds;

- payments for travel expenses - on the day of signing the advance report drawn up based on the results of the trip.

It also shows the income of employees in kind, as well as in the form of benefits received or the right to dispose of income.

Income received in kind includes:

- payment for services in the interests of the employee;

- goods transferred to an employee for performing certain work or services;

- remuneration expressed in non-monetary equivalent.

These incomes are taken into account on the day they were received by the employee.

Basic correlations to check

In 2020, the control ratios for form 6-NDFL are still approved by letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/3852.

Below we present them all, but in a form that is simplified for understanding and use. Reference ratio (CR)

If the CS is not performed

Which norm of the Tax Code of the Russian Federation may have been violated?

Description of the violation

Title page 6-NDFL (p.

001) 1.1 Submission date < = established by art. 230 of the Tax Code of the Russian Federation for the period of clause 1.2 of Art. 126

clause 2 art.

Labor Code of the Russian Federation If the average salary is the minimum wage, but the average salary is < the average salary in a constituent entity of the Russian Federation for the corresponding sector of the economy for the previous tax period (calendar year), then the amount of the tax base may be underestimated

In these CS we are talking about the average salary, which is determined for each employee on the basis of 2-NDFL certificates. Its indicator should not be less than:

- Minimum wage;

- average salary in the region by economic sector.

If at least one of these ratios is not met, the Federal Tax Service will consider that the tax base is underestimated.

Then, on the basis of clause 3 of Art.

Deductions provided) × Tax rate for a given type of income.

It is this amount that will appear in line 040 of the 6-NDFL calculation. That is, in relation to the report it will look like this:

(Page

020 – Page 030) ×Page 010 / 100.

If the calculated indicator does not coincide with the specified amount, this will not always be an error. The tax is calculated in full rubles. According to rounding rules, the tax amount is less than 50 kopecks. is discarded, and 50 kopecks. and more is rounded to the nearest ruble (rounding error). A discrepancy in any direction of up to 1 ruble is acceptable. for each individual. The published control ratios for checking Form 6-NDFL provide the following formula for calculating the permissible error:

Page 060 × 1 rub.

DNI submitted for all taxpayers by this tax agent (the ratio applies to 6 personal income taxes for the year) Article 126.1, Article 226, Article 226.1, Article 230, Article 23, Article 24 of the Tax Code of the Russian Federation if line 020 at the corresponding rate (line 010) <, the sum of lines “Total amount of income” at the corresponding tax rate of personal income tax certificates 2 with attribute 1, submitted for all taxpayers by this tax agent, and lines 020 at the corresponding tax rate (line 010) of appendices No. 2 to the personal income tax, submitted for all taxpayers by this tax agent, then the amount of accrued income is underestimated/overestimated. In accordance with clause 3 of Article 88 of the Tax Code of the Russian Federation, send a written notification to the NA about identified errors, contradictions, inconsistencies with the requirement to provide the necessary explanations within five days or make appropriate corrections within the prescribed period .

Such a situation at the junction of two quarters is not considered uncommon and can also arise when depositing earnings.

What is line 040 equal to?

The answer to the question: what is line 040 equal to in 6-NDFL - gives the control ratio of clause 1.3 from the letter of the Federal Tax Service dated March 10, 2016 No. BS-4-11 / [email protected] as:

(page 020 – page 030) / page 010 × 100%.

Line 020 reflects the amounts that were accrued in favor of employees, with the exception of those payments that are not subject to personal income tax under Art. 217 of the Tax Code of the Russian Federation in accordance with the letter of the Federal Tax Service of Russia dated 01.08.2016 No. BS-4-11/ [email protected]

Line 030 reflects deductions provided to employees.

Line 010 indicates the tax rate at which transactions reflected in this section of the declaration are taxed.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

If during the reporting period the employer made accruals that were taxed at different rates, then the first few sections will appear in 6-NDFL. Each of them will reflect its own value of line 040.