The company accrued vacation pay in one month and paid it out the next

The employee went on vacation in April. The company calculated and accrued vacation pay on March 31, and issued it in April.

The date of receipt of income in the form of vacation pay is the day of their issuance (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). When the company accrued vacation pay does not matter. Therefore, include these payments in sections 1 and 2 of the calculation in the second quarter.

On lines 100 and 110, record the date of issue. The deadline for transferring tax on vacation pay is the last day of the month in which the company issued them (Clause 6, Article 226 of the Tax Code of the Russian Federation). April 30 is a day off. Therefore, in line 120, write down the nearest working day - May 4 (letter of the Federal Tax Service of Russia dated 05.11.16 No. BS-4-11 / [email protected] ).

If a company accrues vacation pay in June and pays it out in July, this payment will be included in the calculation for nine months.

For example

In March, the company accrued vacation pay to the employee - 12,000 rubles. The company issued the money to the employee on April 4. On this day, personal income tax was withheld - 1,560 rubles. (RUB 12,000 × 13%). The company included vacation pay in sections 1 and 2 of the half-year calculations. In June, the company accrued vacation pay to another employee - 19,000 rubles. The company issued the money only in July, so these vacation pay were reflected in sections 1 and 2 of the calculation for nine months. The company filled out vacation pay in section 2 of the half-year calculation as in sample 33.

Sample 33. How to fill out vacation pay that the company accrued earlier than it issued:

Top

The procedure for reflecting payments

The procedure for reflecting vacation pay in report 6 is as follows:

- If they are accrued and transferred to individuals. persons separately from the main income, then they reflect 2 parts of the calculation in a separate block, since for them there are established deadlines for the transfer and payment of income tax;

- if vacation pay was paid along with the main salary (for example, with the subsequent dismissal of an individual), also indicate in separate columns of the second section. In this case, the transfer dates are the same, but the deadline for transferring income taxes is different.

In the second part of the declaration, vacation pay is reflected in separate fields, since the dates of transfer of personal income tax from earnings and these remunerations do not coincide. The norm is explained by tax authorities in BS 4-11-8312.

The first part of report 6 in column 20 will include the total amounts of profit, the tax calculated on them on line 40 and the withheld income tax on line 70.

For the transition period, if the deadline for transferring the tax to the treasury falls on a weekend, they are guided by the general rules of transfer and apply the norms of Article 6.1, paragraph 7 of the Tax Code. In this case, it is transferred on the first weekday following it.

In part 1 of the report, the amounts of accrued profit (field 20), calculated and withheld income tax (columns 40 and 70, respectively) will be included in the period of remuneration payment. Part 2 of the calculation is completed in the next reporting quarter.

https://youtu.be/7AXjt4XXO1E

The company issues vacation pay late

The company transferred vacation pay to the employee after he went on vacation.

The company is obliged to transfer vacation pay no later than three calendar days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). If the company issued the money late, the date of receipt of income does not change. This will be the day the vacation pay is actually issued. Therefore, it does not matter whether the company paid the holiday pay late or not.

In lines 100 and 110, in any case, reflect the day of issue. On line 120, write down the deadline for transferring personal income tax. For vacation pay, this is the last day of the month in which the company issued the money (clause 6 of Article 226 of the Tax Code of the Russian Federation). For delays in vacation pay, the employer must pay the employee compensation - at least 1/300 of the rate of the Central Bank of the Russian Federation. Compensation for delayed wages or vacation pay is not subject to personal income tax (clause 2 of Article 217 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated June 4, 2013 No. ED-4-3/10209). Therefore, do not reflect such a payment in the calculation.

For example

The employee went on leave on April 4. The deadline for transferring vacation pay is April 1 (letter of Rostrud dated July 30, 2014 No. 1693-6-1). But the company transferred vacation pay only on April 7 - 28,000 rubles. On this day, she withheld personal income tax - 3,640 rubles. (RUB 18,000 × 13%). In lines 100 and 110 of section 2, the company wrote 04/07/2016. The deadline for personal income tax transfer is April 30. This is a weekend, so in line 120 the company recorded the nearest working day - 05/04/2016.

Along with vacation pay, the company transferred compensation for delays - 71.87 rubles. (RUB 28,000 × 1/300 × 11% × 7 days). This amount is not subject to personal income tax. The company did not reflect compensation for delays in the calculation of 6-NDFL. The company filled out Section 2 as in sample 34.

Sample 34. How to fill out late vacation pay:

Top

The company called the employee back from vacation

The employee received vacation pay and went on vacation. A week later, the company called the employee back from vacation and recalculated vacation pay. He returned the extra vacation pay minus personal income tax.

In 6-NDFL, the company shows the income that the employee received. The employee used only part of the vacation. The rest of the days he worked, and the company accrued wages for this period.

In line 020 of section 1, fill in only vacation pay for the rest days used. Do not show the amounts returned by the employee in the calculation. In lines 040 and 070, record the accrued and withheld tax on this part. Similarly, fill out income and tax in lines 130 and 140 of section 2.

The employee returned his vacation pay minus personal income tax. Do not return the tax from this part to the employee. If, when paying vacation pay, the company paid personal income tax on the entire amount, it has the right to reduce future payments to the budget by the overpayment.

For example

The employee went on leave for 14 days from May 10. On May 6, the company issued vacation pay - 32,000 rubles, withheld and transferred personal income tax - 4,160 rubles. (RUB 32,000 × 13%). A week later, the company recalled the employee from vacation. As a result, he only used half of the rest days - 7 days. Income in the form of vacation pay amounted to 16,000 rubles. (RUB 32,000. 14 days × 7 days). Personal income tax - 2080 rub. (RUB 16,000 × 13%). The employee returned half of the vacation pay, but minus personal income tax - 13,920 rubles. (16,000 - 2080). The company did not reflect this amount in the calculation of 6-NDFL. For overpayment - 2,080 rubles. the company has reduced future personal income tax payments. The company filled out Section 2 as in sample 35.

Sample 35. How to fill out vacation pay if the employee only used half of the rest days:

Top

How to reflect carryover vacation pay in the 6 personal income tax declaration

The report reflects remuneration according to the general rules:

- Regardless of the date of transfer of income tax, accrued income, calculated and withheld income tax will fall into section 1 of report 6 in the payment period;

- the transfer of these remunerations is reflected in the second part of the declaration in a separate block according to the date of payment of remuneration and income tax.

In other words, carryover vacation pay should be reflected in report 6 of personal income tax according to the accrual period in the first section and payment in the second section in accordance with BS 4-11-9248.

The company issued vacation pay in two installments

The employee went on vacation from the 1st of the next month. The company calculated vacation pay from known payments and transferred it three days before the start of the vacation. After that, I recalculated and paid additional vacation pay.

The company cannot accurately determine the average earnings if the employee goes on vacation from the 1st day of the month. After all, when calculating vacation pay, the company takes payments for the 12 months preceding the vacation. And vacation pay must be issued three days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). Therefore, vacation pay will need to be calculated twice and paid extra next month.

Additional payment is also vacation pay. In such a situation, the deadline for transferring personal income tax is the last day of the month in which the company issued the money (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Also, tax payment deadlines will differ if the company delays vacation pay. For example, part is paid out before the holiday, and the rest is paid in the next month. Personal income tax will need to be withheld from each payment and transferred on the last day of the month in which the employee received the money.

The company will show the average earnings for the same vacation twice in lines 100–140 of section 2. And if it paid extra vacation pay in the next quarter, they will be included in the calculation for nine months.

For example

The employee went on vacation on June 1.

The company issued vacation pay on May 27 - 10,000 rubles. Personal income tax - 1,300 rubles. (RUB 10,000 × 13%). On June 1, the company recalculated vacation pay and paid the employee an additional 2,000 rubles. Personal income tax - 260 rubles. (RUB 2,000 × 13%). The company filled out 6-NDFL, as in sample 36.

Sample 36. How to reflect vacation pay issued in two installments during the quarter:

The employee went on vacation on July 1.

The company issued vacation pay on June 28 - 10,000 rubles. The company reflected this payment in section 2 of the half-year calculation, as in sample 37. On July 1, the company paid an additional 2,000 rubles to the employee. The company will reflect this payment in the calculation for nine months.

Sample 37. How to reflect vacation pay that the company paid extra in the next quarter:

Top

How to take into account rolling holidays and recalculate them?

No less pressing will be the question of how to reflect vacation pay that transfers to another period in form 6-NDFL. The sequence of actions will be as follows:

- The income received in the form of vacation pay, as well as the tax accrued on their amount without taking into account the period to which they relate, are fully included in section 1 of the form in the period of their actual accrual.

- The transfer of vacation pay will be reflected in section 2 depending on its date and the deadline for paying income tax.

In other words, when solving the problem of how to reflect carryover vacation pay in 6-NDFL, you need to focus not on the period for which they are paid, but on the date of actual transfer and payment of personal income tax.

You will have to recalculate vacation pay in 6-NDFL in the following cases:

- The amount of accruals for vacation was determined incorrectly - in this case, it is necessary to recalculate vacation pay and submit an updated report with the correct data.

- If circumstances arise that require an adjustment of the amounts by force of law (for example, illness during the period of annual leave, recall of an employee from vacation), the corresponding correct data must be entered into the reporting during the recalculation period. This position is defended by the Federal Tax Service in its letter dated May 24, 2016 No. BS-4-11/9248.

The company issues vacation pay several times a month

Almost all employees take one day of vacation per month. The company transfers vacation pay several times a month, and pays personal income tax once - at the end of the month.

The company has the right to transfer personal income tax on vacation pay once a month. The deadline is the last day of the month in which the company transferred money to employees (clause 6 of Article 226 of the Tax Code of the Russian Federation). But the date of receipt of income in the form of vacation pay is the day they are issued. Personal income tax must be withheld on the same date. This means that for each payment the dates in lines 100 and 110 will be different. Therefore, in section 2, fill out as many lines 100–140 as the number of times the company issued vacation pay.

For example

Employees take one day of vacation per month. In April, the company issued vacation pay five times: - April 4 - 12,000 rubles, personal income tax - 1,560 rubles. (RUB 12,000 × 13%); — April 7 — 9,000 rubles, personal income tax — 1,170 rubles. (RUB 9,000 × 13%); — April 11 — 18,000 rubles, personal income tax — 2,340 rubles. (RUB 18,000 × 13%); — April 14 — 7,000 rubles, personal income tax — 910 rubles. (RUB 7,000 × 13%); — April 26 — 11,000 rubles, personal income tax — 1,430 rubles. (RUB 11,000 × 13%).

The deadline for transferring personal income tax is April 30. This is a day off, so personal income tax can be transferred no later than May 4. The company completed section 2 as in sample 38.

Sample 38. How to fill out section 2 if the company issued vacation pay several times a month:

Top

Example of forming a declaration

The date of reflection of earnings is the last day of the month in which they are accrued. Vacation pay is paid on the day of payment according to the letter of the Ministry of Finance 03-04-06-2187.

The income tax withholding date coincides with the date of profit payment. The deadline for transferring personal income tax to the treasury is the last day of the month in which such profit is paid.

Let's give an example of filling out 6 personal income tax.

In the third quarter, revenues were paid on the following dates:

- July 10 – 25,000 (tax 3,250);

- August 21 – 47000 (tax 6110);

- Income tax is transferred to the treasury at the same time as payment;

- On September 29, vacation pay of 27,616 rubles was accrued. The payment to the employee was made on the next day, October 2.

Recalculation of personal income tax into 6-personal income tax: all complex cases

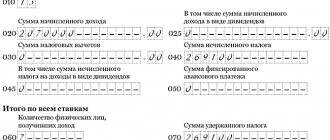

In the 3rd quarter the profit amounted to:

25000+47000 = 72000 rubles.

Income tax on amounts: 3250 + 6110 = 9,360 rubles.

An example of filling out personal income tax with vacation pay for 9 months:

Amounts accrued on September 29 and paid on October 2 are not included in the 9-month report. They will be included in the annual declaration in both sections 1 and 2.

6 personal income taxes for the 3rd quarter will include vacation pay for October if they were paid in September.

The company pays compensation for additional leave

The director and chief accountant each have four additional days of vacation. Sometimes employees take compensation instead of extra days.

Employees have the right to receive monetary compensation in exchange for additional vacation days (Article 126 of the Labor Code of the Russian Federation). The date of receipt of income for such a payment is the day on which the company issued the money. On the same day, withhold personal income tax. That is, in lines 100 and 110 the company will record the date of payment.

The deadline for transferring personal income tax on vacation pay is the last day of the month in which they were issued. But compensation for additional vacation days is not vacation pay. The deadline for remitting tax on such a payment is the next business day.

For example

The director has the right to 4 additional days of vacation. The employee wrote an application to replace the rest days with monetary compensation. The company issued money on May 12 - 17,000 rubles, on the same day withheld personal income tax - 2,210 rubles. (RUB 17,000 × 13%). The deadline for tax payment is May 13. The company completed section 2 as in sample 39.

Sample 39. How to fill out compensation for additional vacation days in section 2:

Top

The procedure for reflecting in 6-personal income tax paid together with wages and separately from it, vacation pay

How to reflect vacation pay in 6-NDFL has worried every accountant since the introduction of this tax reporting. In practice, the following possible situations occur:

- Vacation pay is issued separately from salary - vacation pay must be shown on the form as a separate line. This approach to the inclusion of vacation pay in 6-NDFL is explained both by the individual procedure for their calculation and by a separate deadline for transferring the tax.

- The dates for payment of vacation pay and wages are the same - to register vacation pay in 6-NDFL, they also use section 2 and also enter them separately. This procedure is explained by the deadline allotted for transferring personal income tax from them to the budget.

It turns out that the only circumstance that determines the separate reflection of vacation pay in 6-NDFL in both cases will be a special deadline for paying income tax on them. As a result, filling out 6-NDFL for vacation pay will have the following sequence.

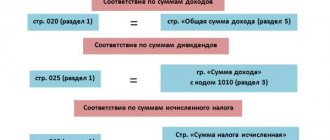

Their size is reflected in section 1 as part of income on line 020 and the calculated amount of personal income tax on line 040 in any case. The accrued tax when reflecting vacation pay in 6-NDFL will only be included in the total amount of personal income tax paid in line 070 only when it is transferred in the current period. It should be remembered that if the tax payment day coincides with a weekend or non-working holiday, the transfer will be postponed to the next working day. Therefore, the payment deadline may be postponed to the next quarter.

Vacation transfers from one month to another

The company issued vacation pay to the employee in May. But rest days occur in May and June.

The date of receipt of income in the form of vacation pay is the day when the company issued the money (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). It doesn’t matter what days you rest on. Therefore, fill out the payment in one block for the period 100–140. The company withholds personal income tax from vacation pay on the day of issue, so write down this date on line 110. In line 120, enter the deadline for the transfer of personal income tax. For vacation pay, this is the last day of the month in which the company issued money to the employee (Clause 6 of Article 226 of the Tax Code of the Russian Federation).

For example. On May 23, the company gave the employee vacation pay - 18,000 rubles. On the same day, personal income tax was withheld - 2,340 rubles. (RUB 18,000 × 13%). The deadline for transferring personal income tax is 05/31/2016. Vacation falls on 5 days in May - 28-31st and 3 days in June - 1st-3rd. The company did not divide vacation pay between months, but recorded lines 100–140 in one block, as in sample 40.

Sample 40. How to fill out vacation pay if the vacation is for two months:

Top