When there is no point in submitting an updated 6-NDFL

Most of the errors made when generating the report on Form 6-NDFL can be corrected by submitting an updated (corrected) declaration to the tax office. However, there are a number of special blots that cannot be corrected even by adjusting the document. Such serious errors include:

- incorrectly specified TIN number, reporting organization or individual entrepreneur;

- incorrect code of the tax division in which the organization or individual entrepreneur was registered;

- an error in the presentation period code (CPPR), which is intended to indicate the reporting period (quarter) for which reporting occurs.

All of the above shortcomings are considered very serious errors, due to which tax officials may refuse to check the primary report altogether. In such a situation, there is only one way out: urgently filling out a new primary report, in which all the data will be indicated correctly, and such form 6-NDFL must be submitted before the deadline for submitting the document for verification (the last day of the month following the reporting month).

If the tax agent fails to submit a corrected document on time, he will be subject to a fine. For each full or partial month of delay, the fine will be 1,000 rubles.

According to clause 3.2 of Article 76 of the Tax Code of the Russian Federation, if a tax agent does not provide reporting documentation in Form 6-NDFL within 10 days after the end of the established period, then the Federal Tax Service has the right to block the agent’s bank account and stop all transactions on it. This measure is explained in the letter of the Federal Tax Service No. ГД-4-11/14515 dated August 9, 2020.

In what cases is it necessary to correct the report?

So, in what cases will it be necessary to adjust the declaration? You will have to send clarifying information if the following errors were made in the document:

- Inaccuracies regarding the checkpoint - of course, the Federal Tax Service will accept such a declaration, however, most likely, it will require that the information on this code be clarified;

- Errors regarding OKTMO. In the event that this code does not apply to the territory served by the Federal Tax Service, the receiving party may again ask for clarification. If the Federal Tax Service Inspectorate works exactly according to the code specified in OKTMO, then the person submitting the report may experience incorrect charges for this code. Again, in order to correct this error, a clarifying report should be sent.

- There is an error in the reporting organization's location code. This indicator will be especially important for those who have separate divisions, and more than one. Each such division must separately generate a report, even when all of them, together with the main division, are registered with the same Federal Tax Service;

- An error in relation to tax rates, and the matter may not only be in the incorrectly specified amount. Different rates must be separated by different report sheets, which is required by Form 6-NDFL.

- Errors regarding the number of people working in the organization, as well as the accruals they received and when they received them. Errors regarding taxes that were paid or not paid and when they were paid. It is in relation to these errors that the Federal Tax Service may have quite reasonable claims regarding unreliable information included in the report.

Just as with any other tax calculation, errors in Form 6-NDFL cannot be canceled or canceled, or replaced with correct data. That is why the corrective report implies the replacement of 6-NDFL entirely.

The law does not limit the number of clarifying declarations.

The difference between the clarification and the primary report 6-NDFL

The corrected document and the original document are essentially no different from each other. This is the same form 6-NDFL. The only differences between them are:

- the updated document must contain correct data, without repeating old ones or introducing new errors;

- on the title page of the declaration, in the “correction code” field, you must indicate the serial number of the corrected document. On the primary report, the code “00” is indicated in these cells. On the updated 6-NDFL, the adjustment code “01” must be indicated. If more corrections are required, the next document will be marked with the correction code “02” and so on.

There are no further differences between the primary and updated 6-NDFL report.

Serial number of the updated report 6-NDFL

Nuances of filling out adjustments

When adjusting the declaration, the following nuances should be taken into account:

- The OKTMO code was incorrectly indicated if the above code refers to the territory from which the Federal Tax Service Inspectorate operates and to which the declaration was submitted. In the event that the OKTMO code has nothing to do with the organization submitting the declaration, then you should first submit a corrective report with zero digits in order to reset the declaration, and only then send a report with the correctly written code. In addition, it would be useful to send a letter to the Federal Tax Service, which would clarify that 6-NDFL is canceled due to the fact that the code was incorrectly written in it.

If you decide to send a declaration with the correct code as a primary report, then most likely you will have to pay a fine.

- The declaration combined the information that should have been divided into departments. If such an error occurs, only the submitted report can be clarified, and all the others will have to be redone and submitted as primary. It is important to comply with the deadlines, otherwise you will have to pay a fine for late reports.

In the cases described above, in order to avoid a fine, you should be as careful as possible about the deadlines for submitting reports.

By the way, the clarifying report must be filled out in the same way as the primary report. These rules are prescribed in law No. ММВ-7-11/450.

Errors in 6-NDFL that can be corrected

Other types of documentation errors can be corrected by submitting a “clarification”, that is, a corrected version of the primary document.

It is worth noting that the formation of the 6-NDFL calculation must be taken very seriously. It is better to completely eliminate any errors in the document, or carefully check it before submitting it to the tax office for inaccuracies.

If errors were discovered before submitting the document for verification, you can simply fill it out again. Otherwise, Article 126 of the Tax Code of the Russian Federation calls for a fine to be imposed on the person who provided the document with incorrect data.

The generation of an updated 6-NDFL report is inevitable if there are the following errors in the primary document:

- Checkpoint. This error is not considered serious. The tax authorities accept such a document for verification, which does not relieve the tax agent from the obligation to submit a corrected 6-NDFL report on time.

- OKTMO. This error occurs quite often when, for example, a separate division of an enterprise indicates OKTMO of the head office in the 6-NDFL declaration. If the branch and the main enterprise are located in the coverage area of the same Federal Tax Service, then the document does not need to be adjusted at all. If it is a separate division.

For each separate division you must submit a separate 6-NDFL declaration. In the Title Page it is necessary to indicate the checkpoint and OKTMO at the place of registration of the subsidiary (clauses 1.10 and 2.2 of the Procedure, approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11 / [email protected] dated October 14, 2015). Errors made must be corrected and clarified in clarification.

The clarification procedure is as follows:

- first you need to submit an updated version of 6-NDFL with the same checkpoints and OK, you need to enter “001”, and put zeros in the sections;

- then you need to generate a primary 6-NDFL report indicating the checkpoint and OKTMO of the branch whose tax activities are reflected in the report;

- In the sections of the new declaration, it is necessary to enter correct data on income, taxes and dates of their circulation.

And explanations for each of the mistakes made are attached to the 6-NDFL declaration.

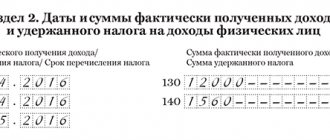

- Interest rate. In addition to the fact that all interest rates that were applied during the entire reporting period must be indicated correctly, a separate declaration sheet is filled out for each of them. This applies only to Section 1 “Generalized indicators”; Section 2 “Dates and amounts of income actually received and withheld personal income tax” does not need to be divided into blocks; it is enough to fill it out once on the first sheet of the report.

- Errors in indicators. This means any errors made in the exact indicators: the amount of income and taxes calculated, withheld and transferred to the budget, shortcomings in indicating deductions, taxes not withheld or returned, erroneous data on the number of employed employees, etc.

Tax on carryover salary was reflected as unwithheld

The company issued salaries for March in April. I withheld personal income tax only in the next reporting period, so I recorded the tax in line 080.

Sometimes companies that did not pay wages for March before submitting the calculations filled out line 080. In it they recorded the tax that they calculated but did not withhold. After all, in fact, personal income tax will be withheld only in April. At the same time, line 080 needs to reflect only personal income tax, which the company will not be able to withhold until the end of the year. After the annual reporting, inspectors will compare line 080 with the amount of unwithheld tax from the 2-NDFL certificates (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ).

There is no need to reflect personal income tax on the rolling salary in line 080. At the same time, inspectors believe that there is no need to clarify the calculation for the first quarter. The company will withhold tax when it pays employees. And it will show this amount in line 070 of the calculation for the six months.

For example

The company issued salaries for March on April 4 - 970,000 rubles, personal income tax - 126,100 rubles. (RUB 970,000 × 13%).

Calculation for the first quarter.

In line 020, the company reflected the income of seven “physicists”, taking into account the salary for March - 2,070,000 rubles, in line 040 the calculated personal income tax - 269,100 rubles. (RUB 2,070,000 × 13%). In line 070, the company recorded personal income tax minus tax from the March salary - 143,000 rubles. (269,100 - 126,100). Tax on March salary was shown in line 080.

Semi-annual calculation.

The company did not provide an update for the first quarter. In April, I issued the March salary. Afterwards, I did not accrue or pay any income. The company added personal income tax from wages for March to the withheld tax in line 070. Line 080 was not filled out. The remaining lines in section 1 were filled in as in the first calculation (see sample 102).

Sample 102. How to reflect in section 1 of the calculation for the half-year personal income tax from the March salary:

Sometimes companies that did not pay wages for March before submitting the calculations filled out line 080. In it they recorded the tax that they calculated but did not withhold. After all, in fact, personal income tax will be withheld only in April. At the same time, line 080 needs to reflect only personal income tax, which the company will not be able to withhold until the end of the year. After the annual reporting, inspectors will compare line 080 with the amount of unwithheld tax from the 2-NDFL certificates (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ).

There is no need to reflect personal income tax on the rolling salary in line 080. At the same time, inspectors believe that there is no need to clarify the calculation for the first quarter. The company will withhold tax when it pays employees. And it will show this amount in line 070 of the calculation for the six months.

For example

The company issued salaries for March on April 4 - 970,000 rubles, personal income tax - 126,100 rubles. (RUB 970,000 × 13%).

Calculation for the first quarter. In line 020, the company reflected the income of seven “physicists”, taking into account the salary for March - 2,070,000 rubles, in line 040 the calculated personal income tax - 269,100 rubles. (RUB 2,070,000 × 13%). In line 070, the company recorded personal income tax minus tax from the March salary - 143,000 rubles. (269,100 - 126,100). Tax on March salary was shown in line 080.

Semi-annual calculation. The company did not provide an update for the first quarter. In April, I issued the March salary. Afterwards, I did not accrue or pay any income. The company added personal income tax from wages for March to the withheld tax in line 070. Line 080 was not filled out. The remaining lines in section 1 were filled in as in the first calculation (see sample 102).

Sample 102. How to reflect in section 1 of the calculation for the half-year personal income tax from the March salary:

Top

Penalties for providing incorrect data

For each report indicating distorted data, the fine is 500 rubles. That is, if in one report on Form 6-NDFL there are 4 errors in calculations based on incorrect data, then a sanction will be assessed in the amount of 2,000 rubles. But if errors in calculations were noticed by officials or other persons before the reporting documentation was checked by Federal Tax Service employees, no penalties will be imposed (Article 126.1 of the Tax Code of the Russian Federation).

Tax inspectors may impose a fine for any errors in filling out declaration sheets: the use of incorrect codes, typos and grammatical errors, corrections, errors in arithmetic calculations, etc. However, paragraph 1 of Article 112 of the Tax Code of the Russian Federation provides for a reduction in the amount of the fine, citing mitigating circumstances given in the letter of the Federal Tax Service No. ГД-4-11/14515 dated August 9, 2020:

- no attempts to understate tax were recorded;

- no adverse consequences for the state budget were identified;

- the rights of individuals were not violated.

Paragraph 2 of Article 230 of the Tax Code of the Russian Federation provides for the use of paper only if the number of employees receiving income does not exceed 25 people. Otherwise, there will be a fine for improper submission of documents.

https://www.youtube.com/watch?v=2erGFno_EOw