Transactions in foreign currency and the subsequent revaluation of foreign currency are relevant today for any enterprise, regardless of its size, form of ownership and focus of production. In an era of crisis, both giants like Gazprom and Lukoil, and medium and small businesses strive to operate in several areas of activity at once in order to stay afloat.

So a construction company can engage in trade, and a law firm can invest part of its assets in investment activities. Very often, enterprises, especially those working in the field of medicine or high technology, have to purchase equipment and consumables from foreign partners. All this requires foreign currency, and transactions in foreign currency, in turn, require special control and accounting.

Revaluation of balances in foreign currency - is it necessary to recalculate at the end of the month?

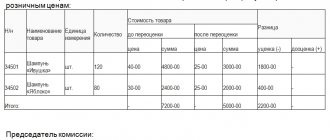

As can be seen from the table above, foreign currency funds are revalued on all possible grounds listed in PBU 3/2006. This is an accounting item that can be revalued even daily (for example, this is what banks are supposed to do).

For ordinary enterprises, daily recalculation of currency balances is, as a rule, not required. Therefore, revaluations and accounting for exchange rate differences are performed when the period is closed (standardly a month). That is, the end of the month in this case plays the role of an interim “reporting date”. Accordingly, at the end of the month it is necessary to make an interim revaluation of currency items.

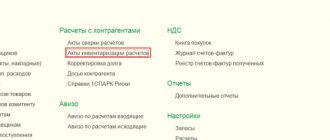

NOTE! Most modern accounting programs (for example, 1C) perform revaluation of balances in foreign currency during the month-end closing operation automatically. The user only needs to monitor the timely updating of the currency directory so that the revaluation results are correct.

What is currency revaluation?

Transactions in foreign currency and the subsequent revaluation of foreign currency are relevant today for any enterprise, regardless of its size, form of ownership and focus of production. In an era of crisis, both giants like Gazprom and Lukoil, and medium and small businesses strive to operate in several areas of activity at once in order to stay afloat.

So a construction company can engage in trade, and a law firm can invest part of its assets in investment activities. Very often, enterprises, especially those working in the field of medicine or high technology, have to purchase equipment and consumables from foreign partners. All this requires foreign currency, and transactions in foreign currency, in turn, require special control and accounting.

What is the average rate and when can it be used?

As a general rule, to carry out the recalculation, the foreign exchange rate established by the Central Bank of the Russian Federation on the date on which the recalculation occurs is taken.

However, this rule has 2 important nuances:

- if the agreement to which the recalculated transaction or item relates has a currency clause (that is, other rules for recalculation and linkage to the official Central Bank exchange rate are established), the recalculation must be performed as stated in the agreement (clause 5 of PBU 3/2006);

Read more about this: “Sample of a currency clause in a contract and its types.”

- if during a period an enterprise carries out a large number of similar transactions in foreign currency, and the exchange rate of this currency changes insignificantly, the enterprise can use the average exchange rate for the period for recalculation (clause 6 of PBU 3/2006).

IMPORTANT! A short period of time is taken as the period for applying the average rate: no more than a month.

The average rate is the weighted average of rates for a period. You can calculate it yourself, or you can use ready-made calculations from the same Central Bank. For the most popular currencies, average monthly rates can be found both on the Internet and in the media.

What is currency revaluation

Considering that the Russian ruble is the only currency allowed in the accounting of organizations, all transactions must be assessed in rubles. The same applies to bank accounts, even if they are created for settlements in foreign currency. In addition, the revaluation of foreign currency is carried out in the presence of the following transactions:

- cash payments in cash and non-cash forms;

- other monetary documents whose denomination is expressed in the currency of foreign countries;

- financial foreign exchange investments;

- debt of debtors and organizations to creditors expressed in foreign currency;

- foreign currency investments in tangible assets and other assets.

Revaluation of currency balances is carried out in accordance with the norms of PBU 3/2006, which oblige the accounting of assets and liabilities expressed in foreign currencies according to certain rules. The frequency of recalculation depends on the type of asset. For example, banks must revaluate foreign currency on a daily basis according to the current exchange rate. Other organizations are not required to carry out daily revaluation; it is enough to carry out similar operations when closing the accounting period. Dates for asset price revisions may coincide with the following events:

- carrying out operations;

- end of the period (last day of the month).

How to revalue liabilities denominated in foreign currencies

In relation to liabilities, the revaluation of foreign currency is carried out according to the general procedure set out in PBU 3/2006. For clarity, let us present an example of such a revaluation.

Example

On November 29, 2019, I received imported goods worth $60,000. The company settled with the foreign supplier in two payments: 12/15/2019 - USD 40,000 and 01/10/2020 - USD 20,000. The following entries were made in Omega's accounting records:

11/29/2019 Dt 41 Kt 60 — RUB 3,846,030. (60,000 × 64.1005 - Central Bank exchange rate on the date of operation);

11/30/2019 Dt 60 Kt 91 — 1,128 rub. (60,000 × 64.0817 – 3,846,030) - revaluation was performed at the end of the month;

12/15/2019 Dt 60 Kt 52 — RUB 2,502,176. (40,000 × 62.5544) - recalculation was performed on the date of the transaction (payment to the supplier);

12/31/2019 Dt 60 Kt 91 - 104,612 rub. (1,342,726 – 1,238,114) - revaluation of the liability in currency at the end of the period (details of obtaining the figure are presented in the table).

The balance under the contract that the company still owes to the supplier is $20,000. Of all the revaluations for the period, the account had a certain ruble balance as of December 31, 2019. And this balance differs from the amount that is obtained if 20,000 US dollars are recalculated at the Central Bank exchange rate for US dollars as of December 31, 2019. Therefore, the essence of posting Dt 60 Kt 91 is to “equalize” the ruble balance in the liability account so that the ruble equivalent of the currency amount corresponds to the exchange rate on the desired date.

| date | A comment | Dt | CT | ||

| U.S. dollars | rubles | U.S. dollars | rubles | ||

| 29.11.2019 | Operation | 60 000 | 3 846 030 | ||

| 30.11.2019 | Balance (revaluation) | 1 128 | |||

| 15.12.2019 | Operation | 40 000 | 2 502 176 | ||

| 31.12.2019 | Account balance based on ruble turnover for the period | 20 000 | 1 342 726 | ||

| Balance at the exchange rate as of December 31, 2019 ($20,000×61.9057) | 1 238 114 | ||||

10.01.2020

Dt 60 Kt 52 — 1,224,680 rub. (20,000 × 61.2340);

Dt 60 Kt 91 - 13,434 rub. (on the same principle as year-end revaluation - see table below).

| date | A comment | Dt | CT | ||

| U.S. dollars | rubles | U.S. dollars | rubles | ||

| 01.01.2020 | Remainder | 20 000 | 1 238 114 | ||

| 10.01.2020 | Operation | 20 000 | 1 224 680 | ||

| 10.01.2020 | Account balance based on ruble turnover for the period | 0 | 13 434 | ||

| Balance at the exchange rate as of 01/10/2020 | 0 | ||||

Is it necessary to recalculate the value of assets abroad?

If an enterprise has branches in other countries and in these branches activities are carried out that lead to the emergence of foreign currency assets and liabilities, then such assets and liabilities are subject to conversion into rubles when preparing the reporting of the parent enterprise in the Russian Federation.

In general terms, the revaluation procedure is similar to the similar procedure for converting value in foreign currency into rubles on the territory of the Russian Federation:

- in the same way, the exchange rate of the Central Bank of the Russian Federation in force in the Russian Federation on the date of recalculation is taken;

- the procedure for recalculation depending on the type of asset or liability is also similar to the domestic Russian one.

The differences provided for in Section IV of PBU 3/2006 are that:

- Foreign turnover within the period (income and expenses) can be recalculated at the average exchange rate of the Central Bank of the Russian Federation for the currency used. And such a rate is calculated according to the formula:

(K1 × KDD1 + K2 × KDD2 + … + Ki × KDDi)

SK = ———————————————————-,

DP

Where:

SC - average rate;

K is the exchange rate value in effect during the period;

KDD - the number of days during which the K rate was in effect in the period;

DP - number of days of the period.

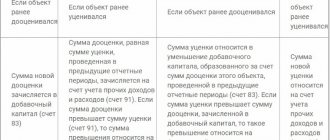

- Differences arising as a result of recalculation of income and expenses are included in the financial results of the period. But the differences from recalculation of the value of foreign assets and liabilities (balance sheet items) apply to the additional capital of the enterprise and do not affect the financial results. Only if an enterprise closes a branch or winds down its activities, the final results of exchange rate differences that arose during the operation of this branch can be transferred from additional capital to the financial result.

Which account is used for currency revaluation?

52 - settlements have been made with the supplier with an assessment of obligations as of this date;

Dt sch. 91 (60) Set of accounts. 60 (91) - negative (positive) exchange rate difference is reflected;

Dt sch. 01 - fixed assets are capitalized;

Dt sch. 04 - intangible assets are capitalized;

K-t sch. 08 - expenses for the acquisition of objects were written off on the date of their acceptance for accounting as part of these assets;

Dt sch. 01, 04 Set count. 75 - assets received as a contribution to the authorized (share) capital are accepted for accounting, recalculated into rubles at the exchange rate of the Central Bank of the Russian Federation on this date;

Dt sch. 01, 04 Set count. 98 - assets were received free of charge with a currency valuation and converted into rubles at the exchange rate of the Central Bank of the Russian Federation on that date.

B. Inventory

Dt sch. 07, 10, 11, 41 Set count. 60 - ownership of inventory acquired for a fee was obtained, converted into rubles at the exchange rate of the Central Bank of the Russian Federation on this date;

Dt sch. 60 Set count. 52 - settlements have been made with the supplier with an assessment of obligations as of this date;

Dt sch. 91 (60) Set of accounts. 60 (91) - negative (positive) exchange rate difference is reflected;

Dt sch. 07, 10, 11, 41 Set count. 75 - reserves were received as a contribution to the authorized (share) capital, converted into rubles at the exchange rate of the Central Bank of the Russian Federation on this date;

Dt sch. 07, 10, 11, 41 Set count. 98 - material and production inventories were received free of charge in currency valuation.

1.2. Revaluation of currency balance sheet items.

When preparing the balance sheet, currency values are revalued. Its purpose is to update the indicators of the financial condition of the organization, expressed in foreign currency. In addition, revaluation can be considered as one of the ways to take into account inflationary impacts.

All monetary items of the balance sheet expressed in foreign currencies are subject to revaluation. Among them: balances of funds on current foreign currency accounts of the organization opened in banks in the country and abroad; balances of funds on special (including transit) accounts of the organization opened in the country and abroad; payment documents - bills of exchange, letters of credit, checks, etc.

Unlike cash items, non-cash items are not revalued when preparing the balance sheet. Such positions are various types of property of the organization acquired with funds in foreign currency and accounted for at historical cost: fixed assets, intangible assets, long-term securities (shares, etc.), raw materials, supplies, purchased semi-finished products, components, low-value and wear-and-tear items items, work in progress, unfinished construction work, goods shipped, etc.

Non-monetary items also include the organization's liabilities - authorized capital, retained earnings, additional and reserve capital and other special-purpose funds, profit, reserves and some others. Non-monetary positions are shown in the balance sheet in amounts determined by converting foreign currency into rubles at the Central Bank exchange rate in effect at the time of the transaction in foreign currency, the result of which was the acceptance of the listed assets and liabilities for accounting.

Example. The Stavropolgrazhdanproekt organization purchased production equipment for a total amount of $1 million using a bank loan. USA. At the official rate 1 dollar. USA = 30 rub. the cost of this equipment will be recorded in accounting in the amount of 30 million rubles. The same amount will be registered as a debt to the bank for the loan received. If, when preparing the balance sheet for the reporting period, the exchange rate becomes equal to 31 rubles. for 1 dollar USA, then the loan debt should be revalued. Taking into account the new exchange rate, it will amount to 1 million 3 million rubles. At the same time, the cost of the equipment will continue to be recorded in the amount of 1 million rubles.

Revaluation is made by the amount of the difference between the estimates of the above-mentioned monetary items of the balance sheet at the official exchange rate on the date of compilation of the balance sheet and on the date of their registration in accounting (or the date of preparation of the previous balance sheet, if the item was formed before the departure period). In this case, the last calendar day of the reporting period is taken as the date for drawing up the balance sheet. In other words, balance sheet currency items are revalued as of the balance sheet date. When maintaining accounting records using computer technology, it is possible to revaluate account balances in foreign currency as exchange rates change.

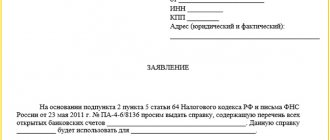

Question 2. The procedure for opening foreign currency accounts in the Russian Federation and abroad.

2.1. The procedure for opening foreign currency accounts in the Russian Federation.

An organization, depending on the currency transactions carried out, can open a foreign currency account in a bank located both in Russia and abroad.

According to the procedure for carrying out foreign exchange transactions on the territory of Russia, the organization is obliged to open a foreign currency account with an authorized bank. Banks located in Russia open the following types of foreign currency accounts for organizations:

- current transit account (current account in foreign currency);

- transit currency account.

An organization opens a current transit account to carry out currency transactions.

A transit currency account is an intra-bank account and serves to identify the bank's foreign currency receipts in favor of organizing and accounting for foreign exchange transactions. In this situation, there is no need to conclude a separate bank account agreement, since the bank opens such an account without the will of the organization simultaneously with the opening of a current foreign currency account. To close a transit currency account, the organization will also not need to do anything - the bank will close it independently, simultaneously with the current transit account.

An organization must report the opening (closing) of a foreign currency account to the tax office at its place of registration. Information must be submitted within seven working days from the date of opening (closing) the account.

According to the rules, all funds in foreign currency received in favor of the organization are first credited to its transit currency account. The exception is currency transfers within the same bank, which immediately go to the current currency account. This applies to funds received:

Pages:12next →

Cash in foreign currency accounts is reflected in accounting and reporting in national currency. Revaluation of currency items is carried out monthly and on the date of business transactions at the Central Bank exchange rate.

Currency items on the balance sheet include:

— foreign currency in cash, on deposit and loan accounts at the bank, including letters of credit;

— monetary documents in foreign currency;

— short-term and long-term securities denominated in foreign currency;

— accounts receivable and payable, loans and borrowings denominated in foreign currency.

As a result of revaluation, exchange rate differences are formed.

Exchange rate difference is the difference between the valuation of an asset or liability in national currency, the value of which is expressed in foreign currency at the rate of the Central Bank on the date of fulfillment of obligations and on the last day of the reporting month, and the valuation of these assets and liabilities in national currency at the rate of the Central Bank on the date their acceptance for accounting and on the last date of the previous reporting month.

How is revaluation carried out for tax purposes?

There is no separate recalculation of amounts in foreign currency into rubles specifically for the purpose of calculating income tax. Income and expenses generated in accounting as a result of exchange rate differences take part in determining the tax base:

- income from revaluation increases the tax base as part of non-operating income (clause 11 of article 250 of the Tax Code of the Russian Federation);

- expenses arising from revaluation reduce the tax base as part of non-operating expenses (subclause 5, clause 1, article 265 of the Tax Code of the Russian Federation).

NOTE! The results of the revaluation of currency balances are taken into account not only for calculating the “ordinary” income tax under OSNO. When applying special regimes, where the amount of tax is related to the income actually received, the financial result from fluctuations in foreign exchange rates is also taken into account when calculating the tax.

For example, a positive difference is considered the income of a simplifier: “The exchange rate difference from the sale of currency is the income of a simplifier.”

The impact of revaluation on VAT calculations deserves a separate discussion. The revaluation provisions for accounting of advances and payments for acquired tangible assets, as well as works and services, are related to the requirements of the Tax Code of the Russian Federation in terms of determining the amounts on which VAT payable and deductible is calculated.

Conversion into rubles for the operations listed in the previous paragraph is performed once, on the date of the operation. Accordingly, the resulting ruble amount will be the basis for calculating VAT for payment or deduction. Provided that the transaction is subject to VAT according to the legislation of the Russian Federation.

Results

All operations on revaluation of currency balances are regulated by PBU 3/2006. Revaluation and recording of its results for accounting and tax purposes are mandatory procedures. This is due to the fact that it is mandatory for Russian enterprises to record all transactions in rubles. Thus, it is also necessary to convert into rubles those accounting objects that have an initial valuation in foreign currency.

In most cases, recalculation is performed on the date of the transaction with such objects and at the end of the reporting period. However, individual items of foreign currency assets may be revalued more often, even daily. First of all, this concerns cash and its equivalents in foreign currency.

Sources:

- Tax Code of the Russian Federation

- PBU 3/2006, approved. by order of the Ministry of Finance of Russia dated November 27, 2006 N 154n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Why is it necessary to revaluate foreign currency accounts?

A foreign exchange account is opened by a business entity for the purpose of correct and timely organization of accounting and control of currency movement. Currency funds are credited to it and written off. Each incoming and outgoing transaction is accompanied by a bank statement, to which payment documents are attached.

Within the framework of a foreign currency account, the enterprise carries out mutual settlements between residents, focused on transactions with the alienation of funds and their acquisition. It is also possible to conduct them with non-residents. All types of currency values can be used for calculations, including state currency and domestic securities.

Mutual settlements with organizations are carried out in national currency

The currency account reflects all financial transactions related to customs authorities - fees and duties for the import and export of all types of valuables, currency and securities. It takes into account transfers of foreign and national currencies.

A negative factor in production activity may be the exchange rate difference between the current and previous assessment of the object of the financial transaction, expressed in ruble equivalent. Such errors can cause errors in the tactics and strategy of a business entity, for which state regulatory authorities impose penalties. To prevent such developments at the legislative level, it was decided to carry out regular revaluation of the currency.

It is taken into account that obligations between the parties can also be expressed in rubles, which are subsequently calculated based on the exchange rate at the time of signing the contractual relationship. If the parameter has been changed, the total amount is also subject to correction. Revaluation of currency into an account is carried out in the following situations:

- preparation of financial statements;

- changes in the value of foreign currency in relation to the national one;

- replenishment;

- write-offs.

In financial statements, all transactions are expressed in rubles, even if they were carried out in foreign currency. Since the exchange rate changes constantly, the amounts reflected in the accounting records after such changes become inaccurate and must be adjusted accordingly. When carrying out the operation, the official exchange rate current on the day of the revaluation is taken as the basis. The essence of the procedure is to determine the exchange rate difference between the currency in the current and previous reporting periods. It is worth noting that before conducting settlement transactions, you should make sure that the rate set by the bank is correct.