Terms and concepts

Fixed assets are used in accounting at their historical cost.

In accordance with PBU 6/01, the initial cost of fixed assets may change in the case of:

- In cases of completion

- Additional equipment.

- Reconstructions.

- Modernization.

- Revaluation of fixed assets.

Let's look at the last revaluation in this summary.

Revaluation of fixed assets is regulated by the following laws:

A) PBU 6/01 “Accounting for fixed assets” - This law on revaluation states that:

— Fixed assets are revalued no more than once a year.

-If the fixed assets were revalued once, then they should be revalued regularly every year.

-Revaluation in financial statements should be reflected separately.

B) Order of the Ministry of Finance of 2003 No. 91N “On approval of Guidelines for accounting of fixed assets” This law on revaluation states that:

-If the difference between the current (market) value and the original cost is significant, then you need to revaluate, if not significant, then there is no need to revaluate. In accounting, the materiality level is set at 5%.

-An example of calculation (methodology) for revaluation of initial cost and depreciation.

-The revaluation is reflected in invoice 83, the first deduction is in other expenses.

Accounting: markdown

In accounting, the amount of depreciation for each fixed asset item is reflected in the following entries:

Debit 91-2 Credit 01 – the initial (replacement) cost of the fixed asset has been reduced;

Debit 02 Credit 91-1 – accrued depreciation on fixed assets has been reduced.

At the same time, for a fixed asset that was previously revalued, make these entries only for the amount of the depreciation, which exceeds the amount of additional capital formed during previous revaluations. Determine the amount of additional capital using analytical accounting data (for example, using a statement of the results of revaluation of fixed assets). Reflect the amount of depreciation of fixed assets within the amount of additional capital from previous additional valuations with the following entries:

Debit 83 subaccount “Revaluation of fixed assets” Credit 01 – the initial (replacement) cost of a fixed asset is reduced within the limits of additional capital formed during previous revaluations of this object;

Debit 02 Credit 83 subaccount “Revaluation of fixed assets” - the accrued depreciation on a fixed asset is reduced within the limits of additional capital formed during previous revaluations of this object.

This procedure for reflecting in accounting the results of the revaluation of fixed assets is established in paragraph 48 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

An example of how a primary depreciation of a fixed asset is reflected in accounting

As of December 31, Alpha LLC conducted an initial revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the original cost of the computer should be reduced by 2000 rubles, and the amount of accrued depreciation – by 200 rubles.

Alpha's accountant made the following entries in the accounting records:

Debit 91-2 Credit 01 – 2000 rub. – the initial cost of the computer was reduced based on the results of revaluation;

Debit 02 Credit 91-1 – 200 rub. – the accrued amount of depreciation on the computer was reduced based on the results of the revaluation.

An example of how a subsequent depreciation of a fixed asset is reflected in accounting. Based on the results of the previous revaluation, the fixed asset was overvalued

As of December 31, Alpha LLC carried out a subsequent revaluation of the computer. The organization has no other office equipment.

Based on the results of the revaluation, the replacement cost of the computer should be reduced by 2000 rubles, and the amount of accrued depreciation – by 200 rubles. The total amount of the markdown was 1800 rubles. (2000 rub. – 200 rub.).

In connection with previous revaluations, additional capital in the amount of 800 rubles is listed on computer account 83.

Alpha's accountant made the following entries in the accounting records:

Debit 83 subaccount “Revaluation of fixed assets” Credit 01 – 889 rub. (2000 rubles × 800 rubles: 1800 rubles) – based on the results of the revaluation, the replacement cost of the computer was reduced within the limits of the additional capital formed during previous revaluations;

Debit 91-2 Credit 01 – 1111 rub. (2000 rubles – 889 rubles) – the replacement cost of the computer was reduced based on the results of the revaluation in excess of the additional capital formed during previous revaluations;

Debit 02 Credit 83 subaccount “Revaluation of fixed assets” – 89 rubles. (200 rubles × 800 rubles: 1800 rubles) – based on the results of the revaluation, the accrued amount of depreciation on the computer was reduced within the limits of the additional capital formed during previous revaluations;

Debit 02 Credit 91-1 – 111 rub. (200 rubles – 89 rubles) – based on the results of revaluation, the accrued amount of depreciation on the computer was reduced in excess of the additional capital formed during previous revaluations.

Why is it necessary to revaluate the value of fixed assets? (Essence)

The author thinks it is necessary to reevaluate the OS because:

- Revaluation is the reduction of the original value to the market value. (to the real) let’s say you bought a building 10 years ago for 2,000,000 rubles, but these buildings are sold at 5,000,000 rubles per hour, the actual cost of the building should be reflected in the reporting at 5,000,000 rubles and not 2 000,000 rubles (including recalculation of depreciation).

- Secondly, there is such a thing as inflation, money becomes cheaper over time. Therefore, it is important to write off depreciation taking into account inflation; the cost of production will be more expensive, and the profit will be less in the end. To avoid the formation of unjustified profits (increased), when purchasing fixed assets, depreciation was enough to purchase a new OS, taking into account current prices for the same OS (fixed asset).

- To increase the net assets of the organization with an increase in the value of the fixed assets (Net Assets = Asset - Liabilities is relevant in Joint Stock Companies.

- In IFRS (International Financial Reporting Standards), this is the obligation to carry out revaluation.

Conducting a revaluation is a RIGHT and not an obligation.

To carry out the revaluation it is necessary:

- The initial cost of the OS as of December 31, 2019.

- The amount of accrued accumulated depreciation as of December 31, 2019.

- Documented confirmed current value of fixed assets (market).

Examples

Markdown precedes revaluation

Markdown

Management reestimated the cost of fixed assets by the end of 2019.

The primary cost is 400,000. The current cost is 350,000. The amount of accumulated depreciation is 80,000.

Calculations are performed in the following order:

- The revaluation coefficient is determined to be 0.875 (350,000 divided by 400,000).

- Discounted depreciation – 70,000 (80,000 times 0.875).

- The amount of depreciation markdown is 10,000 (subtract 70,000 from 80,000).

- The amount of the cost markdown is 50,000 (subtract 350,000 from 400,000).

- The final value of the perfect markdown is 40,000 (subtract 10,000 from 50,000).

Revaluation

As of December 31, 2020, the fixed asset was revalued. The current cost is 450,000. Their original cost is 350,000. Over the past year, they have accumulated depreciation of 40,000.

Calculations are carried out in the following order:

- The total amount of depreciation is 110,000 (40,000 is added to 70,000).

- The perfect revaluation coefficient corresponds to 1.3 (450,000 divided by 350,000).

- The amount of revalued depreciation is 143,000 (110,000 multiplied by 1.3).

- The revaluation amount is 100,000 (350,000 is subtracted from 450,000).

- The additional estimate of depreciation is 33,000 (110,000 is subtracted from 143,000).

- The final value of the revaluation is 67,000 (100,000 minus 33,000).

The revaluation is reflected in accounting by the following entries:

| Operation | Sum | Debit | Credit |

| Reflection of revaluation by an amount corresponding to the depreciation performed previously | 50000 | 01-account | 91.1-account |

| Depreciation is overestimated (as part of the markdown made previously) | 10000 | 91.2-account | 02-account |

| Replacement cost is overestimated (more than the value of the previous markdown) | 50000 (50000 is subtracted from 100000) | 01-account | 83-score |

| Depreciation is overestimated (above the previous depreciation value) | 23000 (10000 is subtracted from 33000) | 83-score | 02-account |

Revaluation precedes markdown

Revaluation

By the end of 2020, additional assessment is being carried out. The primary cost is 200,000.

The current cost is 250,000. The amount of depreciation is estimated at 40,000.

The following calculations are performed:

- The perfect revaluation coefficient is 1.25 (250,000 divided by 200,000).

- Depreciation is recalculated to 50,000 (40,000 multiplied by 1.25).

- The revaluation value for depreciation corresponds to 10,000 (40,000 is subtracted from 50,000).

- The revaluation of the object itself is 50,000 (200,000 is subtracted from 250,000).

- The total value of the revaluation is 40,000 (10,000 is subtracted from 50,000).

Markdown

By the end of the next year 2020, a markdown is being made. During this year, we accumulated depreciation of 20,000. The current cost is 150,000. The cost of the operating system corresponds to 250,000.

The following calculations are performed:

- The revaluation coefficient being performed corresponds to 0.6 (150,000 divided by 250,000).

- Accumulated depreciation (total amount) – 60,000 (20,000 is added to 40,000).

- The discounted depreciation totals 36,000 (60,000 multiplied by 0.6).

- The markdown amount is 100,000 (250,000 minus 150,000).

- The total amount of markdown carried out is 64,000 (100,000 minus 36,000).

The markdown is reflected in accounting using the following entries:

| Operation | Sum | Debit | Credit |

| Reflection of the markdown within the value of the previous revaluation of the asset | 50000 | 83-score | 01-account |

| Depreciation is reduced (within the amount of the previous revaluation) | 10000 | 02-account | 83-score |

| The replacement cost of the asset is assessed (to the extent that it exceeds the value of the asset's revaluation) | 50000 (for this, 50000 is subtracted from 100000) | 91.2-account | 01-account |

| Depreciation is discounted (within the value of the asset's revaluation) | 26000 (for this, 10000 is subtracted from 36000) | 02-account | 91.1-account |

The procedure for revaluation and documentation.

I said above that the current market value must be documented, this could be:

- Written confirmation of the price of the OS for a similar OS from the manufacturer of the OS (hereinafter referred to as the Fixed Asset).

- Information from state statistics bodies.

- Price data published in the media (newspapers, magazines, etc.).

- Expert opinion.

The right to conduct revaluation must be enshrined in the accounting policies of the organization. In accordance with Manual 91N, paragraph 45, before revaluation, the availability of fixed assets for which we are going to revaluate must be checked. An Order (administrative document) must be drawn up.

As I said above, in order to carry out a revaluation, the current and previous prices must differ significantly. For example, at the end of the previous reporting year, the current cost of fixed assets was 1000 tons. Rub. and the current cost of a homogeneous group of fixed assets is 1100 rubles, we find the difference 1100-1000=100 100/1000=10% 10% A significant difference, which means it is necessary to re-evaluate the fixed assets.

Or Example of a non-significant difference: The previous market value is 1000, the current current value is 1020 Difference = 1020-1000 = 20 20/1000 = 2% 2% is not a significant difference, which means revaluation is not necessary.

An organization may revaluate:

- For all fixed assets.

- A group of homogeneous operating systems.

- Several groups of homogeneous operating systems.

Order of conduct

Revaluation of OS is carried out at the enterprise in the following order:

- An audit of non-current assets in need of revaluation is carried out. It is necessary to check their actual availability.

- An appropriate administrative act of the organization's management is drawn up, ordering the revaluation of existing fixed assets.

- Certain assets are revalued by the relevant specialists of the enterprise at the current (replacement) cost through direct recalculation, carried out according to actual market prices, or indexation.

- The results of the revaluation of fixed assets (revaluation, depreciation) are adequately reflected in the relevant accounting registers.

Revaluation of existing fixed assets implies updating their original (primary) value.

However, if these assets have already been revalued before, their current (replacement) value is subject to recalculation.

In addition, it is necessary to recalculate the amount of depreciation accrued (accumulated) during the operation of the corresponding object.

It is important to note! that the primary value of a property (asset) can be revalued both in the direction of its increase (this is the so-called revaluation) and in the direction of its decrease (we are talking about markdown).

The specifics of accounting for the results of such updating will be determined by whether a revaluation of a specific fixed asset has previously been carried out.

What is OS revaluation?

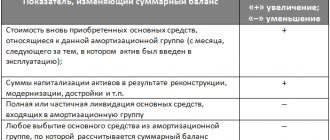

If a revaluation has not previously been made for specific fixed assets, accounting actions are carried out according to the following rule: the amount of revaluation of the asset is recorded as part of the so-called additional capital of the enterprise and, accordingly, is displayed on the credit of accounting account 83, known as “Additional capital”.

If an estimated revaluation of fixed assets has already been made, revaluation operations for similar objects are recorded in accounting somewhat differently.

Thus, the next revaluation of previously revalued fixed assets will be taken into account in the accounting registers as follows:

- If an asset has already been revalued earlier at this enterprise, the value of its next revaluation is taken into account in accounting account 83.

- If an asset has already been discounted before at a given enterprise, the amount of its revaluation, corresponding to the size of the discount made for previous reporting periods, is subject to credit to account 91, which, as is known, is used to account for other income and expenses. If the amount of the additional valuation of a fixed asset turns out to be greater than the amount of its depreciation recorded in accounting account 91, the amount of this excess must be attributed to accounting account 83 (the dynamics of additional capital are taken into account).

Reflection of revaluation in accounting

If a markdown has not previously been made for a specific asset, its revaluation is recorded as follows:

| Operation | Debit | Credit |

| Increase in primary value | 01-account | 83-score |

| Increasing the amount of depreciation | 83-score | 02-account |

If a depreciation was previously performed for a specific fixed asset object, its revaluation is taken into account as follows:

| Operation | Debit | Credit |

| Revaluation by an amount corresponding to the depreciation performed previously | 01-account | 91.1-account |

| Depreciation is overestimated (as part of the markdown performed previously) | 91.2-account | 02-account |

| Replacement cost is overestimated (more than the value of the previous markdown) | 01-account | 83-score |

| Depreciation is overestimated (more than the previous depreciation value) | 83-score | 02-account |

Markdown concept

If any revaluation has not previously been carried out for specific fixed assets, the corresponding accounting operations are performed according to the following rule: the amount of the depreciation of the asset is taken into account in the accounting account of other income and expenses of the enterprise and, accordingly, is reflected in the debit of accounting account 91, known as “ Other income and expenses."

Rule! The depreciation is taken into account as part of other expenses on account 91.

If a recalculation of the cost of fixed assets has already been made before, revaluation transactions are reflected in accounting in a different way:

- If an asset belonging to a given company has already been subject to revaluation before, the amount of its depreciation is taken into account in accounting account 83 by reducing the amount of additional capital formed by accumulating the amounts of revaluation of the asset for previous reporting periods. If the amount of the markdown turns out to be greater than the amount of its revaluation, then the amount of this excess must be included in the financial result as an element of other costs (account 91).

- If an asset belonging to this organization has already been discounted previously, the amount of its next markdown is taken into account in accounting account 91.

Accounting and postings

If a markdown has not previously been made for a specific asset, its revaluation is recorded as follows:

| Operation | Debit | Credit |

| Additional assessment of primary cost | 01-account | 83-score |

| Increasing the amount of depreciation | 83-score | 02-account |

If a depreciation was previously performed for a specific fixed asset object, its revaluation is taken into account as follows:

| Operation | Debit | Credit |

| Revaluation by an amount corresponding to the depreciation performed previously | 01-account | 91.1-account |

| Depreciation is overestimated (as part of the markdown performed previously) | 91.2-account | 02-account |

| Replacement cost is overestimated (more than the value of the previous markdown) | 01-account | 83-score |

| Depreciation is overestimated (more than the previous depreciation value) | 83-score | 02-account |

Accounting, calculation of revaluation of fixed assets.

Revaluation calculation:

Let's consider the procedure for calculating the amount of revaluation of initial cost and depreciation:

- Revaluation (Increase in value).

- Markdown (Decrease in cost).

A) Overestimation. Consider an example:

Revaluation is carried out for the first time.

The initial cost of the OS is 2,500,00 rubles.

The amount of accumulated depreciation is 700,000 rubles.

Current (market value) 3,000,000 rubles.

SPI (useful life) 120 months, straight-line accrual method.

Solution:

The revaluation of the initial cost will be 500,000 rubles. (3,000,000-2,500,000).

Debit 01 Credit 83-500,000 rubles.

Fixed assets revaluation coefficient 1.2 (3,000,000 /2,500,000).

The amount of accumulated depreciation after revaluation of fixed assets will be 840,000 rubles. (1.2*700,000).

The amount of depreciation adjustment (revaluation) will be 140,000 rubles. (840000-700000)

Debit 83 Credit 02-140,000 rubles.

Starting next year, depreciation on fixed assets per month will be. 25,000 rubles. (3,000,000/120).

B) Markdown. Let's look at an example:

Initial cost of the fixed asset: 1,000,000 rubles.

Current cost (expert assessment) 800,000 rubles.

Amount of accumulated depreciation: 200,000 rubles.

SPI (useful life) 24 months. Linear method.

Solution:

The difference between the original and current cost is 200,000 rubles. (1,000,000-800,000), a posting is made for this amount

Debit 91 Credit 01,200,000 rubles.

Conversion factor 0.8 (800,000/1000,000).

What should be the accumulated depreciation after revaluation of 160,000 rubles. (0.8*200,000)

Depreciation markdown (adjustment) -40,000 rubles. (160000-200000)

Debit 02 Credit 91-40,000 rubles.

Depreciation from next year will be. 33,333 rubles (800,000/24)

Revaluation entries:

Depending on the markdown, revaluation being carried out for the first time, or the markdown after revaluation, or the revaluation after markdown, the postings will be different. Let's look at each of them in detail in different situations:

- Additional assessment is carried out for the first time.

- The assessment is carried out for the first time.

- The first was markdown, then revaluation.

- The first was an additional valuation, then a markdown.

1) Additional assessment is carried out for the first time , during the first additional assessment the following entries will be made (Let's use the example from task A):

a) Debit 01 Credit 83-500,000 rubles. -An additional estimate of the original cost was made.

b) Debit 83 Credit 02-140,000 rubles. - Depreciation was adjusted.

2) The markdown is carried out for the first time (we will use the conditions of task B, read above):

a) Debit 91 Credit 01-200,000 rubles. - Markdown of original cost

b) Debit 02 Credit 91-40,000 rubles - Markdown (adjustment) of accrued depreciation.

3) The first was markdown, then revaluation . (We will use the conditions and data of the solutions to problems A and B)

The previous markdown cost of the OS was reduced by 200,000 rubles.

The previous markdown reduced depreciation by 40,000 rubles.

An additional assessment of the cost of the fixed assets was made to 500,000 rubles.

Depreciation was additionally estimated by 140,000 rubles.

Solution: revaluation of wiring:

a) Debit 01 Credit 91-200,000 rubles - Additional valuation of fixed assets within the limits of the previous markdown.

b) Debit 91 Credit 02-40,000 rubles. Additional assessment of depreciation within the limits of the previous markdown.

c) Debit 01 Credit 83-300,000 rubles. (500000-200000) -Additional valuation in excess of the previous markdown.

d) Debit 83 Credit 02-100,000 rubles (140,000-40,000) - Additional valuation in excess of the previous markdown.

4) The first was an additional valuation, then a markdown.

Example conditions:

Previous revaluation of the cost of fixed assets (on account 83): 500,000 rubles.

Previous additional estimate of depreciation (on account 83): 140,000 rubles.

Current markdown of the original cost: 700,000 rubles.

Current depreciation markdown: 200,000 rubles

Postings:

a) Debit 83 Credit 01-500,000 rubles. Depreciation within the limits of the previous revaluation.

b) Debit 02 Credit 83-140,000 rubles. Markdown of depreciation within the limits of the previous revaluation.

c) Debit 91 Credit 01-200,000 rubles. (700000-500000) Depreciation in excess of the previous revaluation.

d) Debit 02 Credit 91-60,000 rubles. (200000-140000) Depreciation markdown in excess of the previous revaluation.

Disposal of fixed assets that were subject to revaluation

For a similar article adapted to P(s)BU (Ukraine), see

Depreciation, loss, disposal of fixed assets (Property, Plant and Equipment), accrual/receipt of compensation, as well as any acquisitions that replace them are all different economic events, separate business transactions that are subject to separate accounting. (Clause 66 IAS 16). In this case, impairment transactions are carried out in accordance with IAS 36 Impairment of Assets, and all other transactions, in particular, derecognition (write-off upon withdrawal from use or disposal to a third party) are carried out in accordance with IAS 16 Property, Plant and Equipment. The same standard (IAS 16) determines the initial cost of replacement assets (restored, acquired, constructed or constructed as a replacement for those disposed of).

Disposal of revalued fixed assets

The credit balance on the corresponding capital account (Revaluation Reserve), formed in connection with the revaluation of a certain fixed asset item, is written off directly to the retained earnings account upon disposal of this item (clause 41 of IAS 16).

Example. Write-off of overvalued objects upon sale.

The initial (gross book value) value of the object subject to additional valuation is 25.0 thousand. e. The amount of depreciation accumulated before the revaluation amounted to 10.0 thousand. e. Net book (residual) value i.e. equal to 15.0 thousand. e.

The object was increased to 18.0 thousand. i.e. in terms of net book value (residual) value, and in terms of depreciation - up to 12.0 thousand. i.e. (proportional method of revaluation), i.e. by 3.0 thousand. e. and by 2.0 thousand. that is, accordingly.

After additional valuation, the property was sold for 22.0 thousand. e.1

Postings in the IFRS concept

| Transaction/Account | Report | Debit | Credit |

| 1. Additional valuation of an asset | |||

| Fixed assets | B | 5000 | |

| Depreciation | B | 2000 | |

| Revaluation reserve (Capital gain from revaluation). | B | 3000 | |

| 2. Sale of an overvalued object | |||

| Cash | B | 22000 | |

| Depreciation | B | 12000 | |

| Fixed assets | B | 30000 | |

| Profit from the sale of an object | B | 4000 | |

| Revaluation reserve | B | 3000 | |

| retained earnings | B | 3000 | |

| Total revolutions | 42000 | 42000 |

Postings in the PBU concept

| Operation | Debit | Credit | Sum |

| Additional valuation of an asset: | |||

| 1. Increase in the value of an asset | 01 | 83 | 5000 |

| 2. Increase in accumulated depreciation | 83 | 02 | 2000 |

| Sale of an overvalued property: | |||

| 3. Invoice presented to buyer | 76 (62) | 91.1 | 22000 |

| 4. The object is written off for sale | |||

| — in terms of net book value | 91.2 | 01 | 18000 |

| - regarding depreciation | 02 | 01 | 12000 |

| 5. The cost of the sold object is written off as a decrease in income from sales | 91.1 | 91.2 | 18000 |

| 6. The revaluation reserve relating to the sold asset was written off. | 83 | 84 | 3000 |

| 7. Receipt of money to the current account. | 51 | 76 (62) | 22000 |

When an item of fixed assets is taken out of service, either for the purpose of sale (see example) or for liquidation, the reserve accumulated during the revaluation process is transferred to the retained earnings account in full. However, even during the operation of the object (that is, when we are not talking about its disposal), a certain part of the reserve relating to this object can be transferred to the account of retained earnings. In this case, the transfer is subject to the amount determined as the difference between the amount of depreciation calculated on the basis of the revalued book value of the object and the amount of depreciation calculated on the basis of its value before the revaluation (clause 41 of IAS 16).

Thus, the amount of reserve funds transferred annually to the retained earnings account is equal to the increase (due to revaluation) in the absolute value of annually accrued depreciation.

For example. The cost of the fixed asset before revaluation was 120.0 thousand. e. After additional valuation, it amounted to 160.0 thousand. e. The increase in value (40.0 thousand cu) is reflected in accounting as a reserve for future revaluations.

The annual depreciation rate is 5%. Depreciation is calculated in a straight-line manner and the object has no salvage value (an extremely rare case). That is, if before the revaluation the amount of annual depreciation was equal to 6.0 thousand. That is, then after revaluation this amount is already 8.0 thousand. e. per year. That. increase in value in the amount of 2.0 thousand. That is, the difference between the new and old depreciation amounts can be transferred annually from the reserve account to the retained earnings account. In the PBU concept, this is done by the same posting as transferring the entire amount of the reserve upon disposal of an object: Dt 83 Kt 84 (see example above).

1VAT, for the sake of simplifying the example, is omitted.

Commercial organizations do not have an obligation to revaluate unless this is stipulated in their accounting policies. If fixed, then the revaluation should be carried out on the last day of the year with a frequency of no more than once a year. At the same time, it is important for the accountant to correctly reflect in the transactions the results of the revaluation of fixed assets, including the revaluation or depreciation of the value of objects.

Other important points of OS revaluation

Tax accounting of revaluation.

The amount of revaluation and depreciation is not recognized as income or expense in tax accounting (which means it does not affect the calculated income tax)

Since the amount of accrued depreciation in accounting and tax accounting is different, it is applied

18 PBU “Accounting for calculations of income tax of organizations”, 77 and 09 accounts. (I’m not strong in this 18 PBU, maybe someday I’ll thoroughly study the topic)

Accounting for the sale of overvalued fixed assets.

When selling fixed assets that have been overvalued, the accumulated overvaluation on account 83 is written off to account 84.

Wiring:

Debit 83 Credit 84 - The amount of additional valuation of retired fixed assets has been written off.

Let us quote from manual 91N “When a fixed asset item is disposed of, the amount of its revaluation is written off from the debit of the additional capital account in correspondence with the credit of the organization’s retained earnings account.”

Types of revaluation

As a result of recalculation, the value of an asset may either increase or decrease. In the first case, we talk about additional valuation, in the second - about depreciation of the object.

Revaluation accounting scheme:

Example of revaluation of fixed assets with postings

The Albatross organization has a fixed asset worth 100,000 rubles. At the time of revaluation, accrued depreciation amounted to RUB 25,000. As a result of the revaluation, the cost of the fixed assets was determined to be 110,000 rubles.

When the cost of the OS increases, we receive an additional valuation. Consequently, it will be necessary to recalculate accumulated depreciation.

By calculating the depreciation rate, we can overestimate the amount of depreciation:

- 25,000 rub./100,000 rub. = 25%;

- that is, 110,000 rubles * 25% = 27,500 rubles.

When revaluing fixed assets, the organization’s accountant made the following entries:

| Dt | CT | Operation description | Amount, rub. | Document |

| 01 | 83 | Reflection of the cost of revaluation (110,000-100,000=10,000) | 10 000 | Accounting information |

| 83 | 02 | Reflection of depreciation recalculation (27,500 - 250,000 = 2,500) | 2 500 | Accounting information |

Example of depreciation of fixed assets with postings

Fixed asset worth RUB 200,000. and accumulated depreciation of 50,000 rubles. was revalued in accordance with the market value of similar objects. The new cost is determined to be 160,000 rubles.

When the cost of the OS decreases, we get a markdown:

- We determine the degree of wear: 200,000 rubles/50,000 rubles = 25%;

- We calculate the new amount of depreciation: 160,000 rubles. * 25% = 40,000 rub.

Postings for depreciation of fixed assets in accounting:

| Dt | CT | Operation description | Amount, rub. | Document |

| 91.2 | 01 | Reflected decrease in the value of the object (200,000-160,000) | 40 000 | Accounting information |

| 02 | 91.1 | A decrease in accrued depreciation is reflected (50,000 - 40,000) | 10 000 | Accounting information |

Economic meaning of revaluation

Revaluation of fixed assets can help reduce the tax burden. In particular, reduce the amount of property tax.

Revaluation of fixed assets is carried out only in accounting, therefore, after it is carried out, differences inevitably arise with tax regulations, which also affects income tax.

How to recalculate the cost of an operating system - procedure

The revaluation process must be carefully prepared:

- First of all, this is the study of information about fixed assets - what initial cost is subject to adjustment.

- The commission is assembled on the basis of the order of the head.

- The range of fixed assets subject to revaluation is determined.

- The process itself is carried out according to the chosen method.

- The results obtained are then reflected in the company's accounting.

Methods

Today, due to changes in legislation, only one recount option is used - direct recalculation.

In this case, information is used as a base from the following sources:

- data from the database of manufacturers of similar objects;

- data regarding price levels from government or statistical sources;

- expert assessment of independent specialists.

The abolition of the index deflator established by Decree No. 315 of 1996 occurred as a result of the adoption of Decree of the Government of the Russian Federation No. 121 of 2002, which abolished the previous version.

But new indices were not installed, so the index method has lost its relevance, although it is used in some companies.

Documenting

According to the algorithm, the revaluation of fixed assets should be carried out on the basis of an order from the manager, and a list of objects with a brief description should also be generated - the date of acquisition, the date of acceptance for accounting and an indication of the current price.

In addition, other documents on this object are being studied. An accounting certificate for the revaluation is generated, which indicates the relevance of the event.

Based on the results of the inspection, a report on the work done is drawn up, indicating the price indicated by the commission.

New data is also recorded in the OS-6 inventory card for the facility.

Sample order

The manager's order is formed taking into account the requirements for the preparation of such documentation and its sample is fixed in the accounting policy of the organization.

The structure of the document is as follows:

- Name of the organization;

- title of the document with justification, for example, “On the revaluation of fixed assets”;

- date and document number;

- then the main part of the manager’s order is indicated, where the reason for the recalculation is initially indicated - “Due to a significant change in prices, I order a revaluation of fixed assets for real estate”;

- after which the list can be indicated in a tabular version - the name of the objects, inventory number and cost during the period of acceptance for production;

- Next, you should indicate what cost should be taken for the initial, for example, cadastral value;

- after this, responsible persons are appointed, and responsibility for each stage may be assigned to different employees.

At the end of the document there must be signatures of the manager and persons related to the revaluation process.

order for revaluation of fixed assets – word.

The decision has been made: re-evaluate fixed assets!

You do not have the right to revalue fixed assets during the year. The ban on this is established in clause 15 of PBU 6/01 “Accounting for fixed assets”. It says that a commercial organization can revalue groups of similar fixed assets no more than once a year (at the end of the reporting year). Therefore, you should postpone the revaluation until the end of 2020. In the meantime, you can carefully prepare for this event. We'll tell you what points you should pay special attention to.

Lifetime commitment

Let's start with the fact that the revaluation of fixed assets is voluntary. But if the company has made the appropriate decision, then revaluation is carried out regularly so that the value of fixed assets at which they are reflected in accounting does not differ significantly from the current (replacement) cost. This is expressly provided for in clause 15 of PBU 6/01.

In addition to issuing an order for the organization, it is necessary to make changes to the accounting policies. As a general rule, the accounting policy adopted by the organization must be applied consistently from year to year (clause 5 of PBU 1/2008 “Accounting Policy of the Organization”). At the same time, adjustments are made to it, in particular, in the event of changes in business conditions or other factors that could have a significant impact on the financial position of the organization or the financial results of economic activity (clause 10 of PBU 1/2008).

Determining the new value of objects

What the revaluation of fixed assets is and why it is needed is stated in paragraph 41 of the Methodological Instructions for Accounting for Fixed Assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n (hereinafter referred to as the Methodological Instructions). Revaluation of fixed assets is carried out in order to determine the real value of objects by bringing their original value into line with market prices and reproduction conditions on the date of revaluation. That is, the company needs to determine the current (replacement) cost of fixed assets. It refers to the amount of money that the company would pay on the date of revaluation if it were necessary to replace any object (clause 43 of the Methodological Instructions). When determining the current (replacement) cost, the following can be used:

- data on similar products received from manufacturing organizations;

- information on price levels available from state statistics bodies, trade inspectorates and organizations;

- information on price levels published in the media and specialized literature;

- technical inventory bureau assessment;

- expert opinions on the current (replacement) cost of fixed assets.

The first revaluation of fixed assets is carried out by recalculating their original cost and the amount of depreciation accrued over the entire period of use of the object. Subsequently, the current (replacement) cost is recalculated (clause 15 of PBU 6/01). Revaluation is carried out by indexation or direct recalculation of the value of fixed assets at documented market prices (clause 43 of the Guidelines).

Accounting depends on the results of the revaluation

As we have already said, the revaluation of fixed assets is carried out at the end of the reporting year. Thus, in accounting, the results of revaluation are reflected separately on the last day of the calendar year, that is, December 31.

As a result of revaluation, the value of fixed assets may increase or decrease. The rules for accounting for additional valuation (depreciation) of fixed assets are established in clause 15 of PBU 6/01 and are described in detail in clause 48 of the Methodological Instructions.

During the first revaluation, the amount of revaluation of objects is credited to the additional capital of the organization. The accountant must make the following entries:

Debit 01 Credit 83

— the initial cost of the fixed asset was increased by the amount of the revaluation;

Debit 83 Credit 02

— accrued depreciation on fixed assets was increased by the amount of the revaluation.

If, as a result of the revaluation of a fixed asset, its value has decreased, then the amount of the write-down is included in the financial result as other expenses. The postings will be like this:

Debit 91-2 Credit 01

— the initial cost of the fixed asset was reduced by the amount of the markdown;

Debit 02 Credit 91-1

— accrued depreciation on fixed assets was reduced by the amount of the markdown.

Income tax and PBU 18/02

Cases when the initial cost of fixed assets changes in tax accounting are listed in clause 2 of Art. 257 Tax Code of the Russian Federation. There is no such basis for adjustment as revaluation of objects in this Code norm. Consequently, the results of the revaluation of fixed assets carried out in accounting when calculating income tax are not taken into account (letter of the Ministry of Finance of Russia dated September 10, 2015 No. 03-03-06/4/52221).

Due to the fact that the results of revaluation are reflected in accounting, but not in tax accounting, differences may arise according to PBU 18/02 “Accounting for calculations of corporate income tax.”

So, if a company has overvalued fixed assets, then the recorded amount in account 83 “Additional capital” will not affect the final financial result in accounting, and it is not reflected in tax accounting at all. Therefore, in this case there will be no differences according to PBU 18/02. But they will arise in relation to the amount of depreciation that will be accrued after revaluation - in accounting it will be greater than in tax accounting. Consequently, a permanent difference appears, which leads to the formation of a permanent tax liability (clauses 4, 7 of PBU 18/02).

But with regard to the application of the provisions of PBU 18/02 in a situation where the revaluation resulted in a writedown of fixed assets, options are possible. From a literal reading of this standard, it follows that three types of permanent differences will arise in accounting. The first is when the initial cost of a fixed asset decreases (in accounting there is another expense, in tax accounting there is no expense - a permanent tax liability appears). The second is when the amount of accrued depreciation decreases (there is other income in accounting, but there is no income in tax accounting - a permanent tax asset appears). The third is that with further accrual of depreciation (in accounting, the amount of depreciation will be less than in tax accounting - a permanent tax asset appears).

But there is another option, which follows from Interpretation P82 “Temporary differences in income tax”, approved by the Accounting Methodological Center on October 15, 2008. The amount of depreciation of fixed assets (account 91 balance for this transaction) leads to the formation of a deductible temporary difference. Accordingly, the deferred tax asset must be shown in accounting (clauses 11, 14 of PBU 18/02). The amount of depreciation accrued in accounting will be less than in tax accounting. In this regard, the deductible temporary difference will decrease, and the deferred tax asset will be partially repaid (clause 17 of PBU 18/02).

Methods of revaluation

The law defines two possible methods for changing the book value of fixed assets:

- indexation – the cost of fixed assets is adjusted based on special statistical deflator indices;

- direct recalculation relative to real market prices is used more often, since currently Rosstat does not regularly publish the statistical indices necessary to apply the first method.

NOTE! If this or that fixed asset has already been revalued, then in the future this procedure requires a recalculation at its replacement cost, taking into account the accrued amount of depreciation during the use of this property.

Documenting

To carry out the revaluation of the operating system, preparatory work is carried out, which consists of the following:

- checking the availability of fixed assets subject to revaluation;

- drawing up an order from the manager to conduct a revaluation as of the end of the reporting year, the order indicating groups of similar objects;

- a list of objects subject to revaluation is compiled. It indicates the exact name of the OS, date of acquisition (construction, manufacture), date of acceptance of the object for accounting.

What is needed for revaluation

Before starting the OS revaluation procedure, you need to carry out a number of preparatory activities, such as:

- Checking the availability of fixed assets subject to revaluation. This stage ends with the preparation of a statement with a list of revalued objects.

- Making a decision on revaluation and documenting it. Issuance of an organization order for all services that will take part in this process. The text of the order should reflect the following features:

- objects subject to revaluation;

- revaluation methodology (method, method of reflection on the balance sheet);

- persons responsible for conducting and processing the revaluation.

- Collection and adoption of the necessary related information:

- information on the level of market prices for similar fixed assets (according to statistical data, information from trade inspections, etc.);

- data on market value from the media and special literary sources;

- information about the cost of products from partners and competitors;

- expert opinions.

Impact on tax accounting

From a tax point of view, neither revaluation nor depreciation of fixed assets affects the amount of income or expenses of the organization, since the funds were not actually spent or acquired. Therefore, the income tax on the results of the revaluation will not change. This is reflected in the Tax Code of the Russian Federation and in letters of the Ministry of Finance of Russia dated July 8, 2011 No. 03-03-06/1/412, dated September 8, 2011 No. 03-03-06/1/544.

ATTENTION! The Tax Code provides for changes in the value of fixed assets only in cases clearly defined by law, such as reconstruction, modernization, liquidation, etc. (Part 2 of Article 257 of the Tax Code of the Russian Federation). Revaluation is not included in this list.

However, the revaluation will affect the tax base calculated for paying property taxes.

Therefore, in accounting and tax accounting, the amount of depreciation for a given fixed asset or homogeneous group will be reflected differently. Such a permanent difference causes the appearance of a permanent tax asset (clause 7 of PBU 18/02).

The essence of revaluation of fixed assets

The property of an enterprise changes its value over time as a result of wear and tear (physical and/or moral). Market processes occur in parallel, changing the price of various assets at different speeds: real estate, equipment, tools, vehicles, etc. The revaluation is carried out precisely in order to bring these data to a single indicator.

The dynamics of the market value of assets is very uneven, it is difficult to assess from the point of view of certain factors, therefore the value of property at any given moment does not reflect its real price in modern market conditions. Hence, significant distortions in various asset parameters are possible:

- cost;

- depreciation charges;

- profitability of funds;

- bases for taxation.

So, revaluation of an organization’s fixed assets is a clarifying measure to bring the residual value of assets to the level of their actual price on the market, that is, establishing the full price that would be needed to restore or renovate them to their original state in modern realities.

FOR EXAMPLE. Two years ago, the company purchased new equipment that cost 50,000 rubles. Over two years, it lost 7 thousand rubles as a result of depreciation. Thus, its residual value according to accounting documents will be 43 thousand rubles. But as a result of certain market processes (the manufacturer released an improved model), the real cost of such equipment of a given level of wear on the market is only 35 thousand rubles. This means that today it can be sold for exactly this amount. It is necessary to carry out a revaluation, as a result of which this equipment will be reflected on the balance sheet at a cost of 35 thousand rubles, which is its real market price, reliable for financial accounting.