There are often cases when a company's fixed assets require modification, completion or technical repurposing. This happens, for example, when operating equipment cannot comply with the new technologies introduced, but with appropriate reconstruction it will serve for a very long time. The issue of saving money is also important here, which is always acute in any organization: as a rule, modernizing production is cheaper than completely replacing equipment. Naturally, reconstruction costs are exclusively capital in nature and increase the initial cost. Let's consider how the cost of a modernized object increases, and we will learn how to calculate depreciation after modernization in accounting .

Depreciation after modernization

Companies have the right to modernize fixed assets that are either fully depreciated or still have a residual value. In both situations, it is necessary to take into account reconstruction costs and calculate depreciation. How to do it? The algorithm of actions is as follows:

- Accumulation of all modernization costs, i.e. collection of documented expenses and drawing up the total amount. Modernization work can be carried out by attracting third-party specialized companies, or on your own (if there is appropriate potential). The document confirming the commissioning of the facility modernized by the contractor is the acceptance certificate signed by representatives of the company and the contractor, and the scope of work and the amount of costs is the act f. KS-2 and certificate of cost of work f. KS-3. Work on the reconstruction of the facility using economic means (on our own) is confirmed by a whole block of documents: requirements-invoices for the release of goods and materials, limit cards, work orders. Completion of work and commissioning is recorded by an internal acceptance certificate indicating the full cost of the work;

- Registration of the protocol of the inventory commission for the commissioning of a modernized facility with a decision to increase the cost of the facility and increase the useful life after modernization, if the capital work carried out actually increased the SPI. In accounting, there is no procedure for determining a new SPI if an object with an expired term is being modernized, however, clause 20 of PBU 6/01 and clause 60 of the Guidelines for fixed assets accounting, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n, allow the extension of SPI if As a result of the work carried out, the functional characteristics of the facility improved. At the same time, changing the SPI of the reconstructed OS in accounting is a right and not an obligation of the company. Note that most often the SPI is extended by the amount of time necessary to write off capital costs.

- According to the Ministry of Finance, the amount of modernization costs increases the initial cost (IC) of the fixed assets, and the depreciation rates for writing off these costs are those that were initially applied when the property was put into operation. This opinion also works in practice.

Modernization of fixed assets in accounting and tax accounting

Moral and physical wear and tear of equipment, machines, workshops, production lines and other objects classified as fixed assets is a natural consequence of their active use. To restore the operational characteristics of the OS, the enterprise uses the upgrade procedure.

This is done in one of two ways:

- contracting

, when third-party legal entities, individual entrepreneurs, and citizens are involved; - economic

, when the enterprise carries out modernization measures on its own.

The decision to upgrade is made by management based on data on the state of the operating systems used. The formal expression of this decision is an order. This document gives a start to real work and records the need for certain expenses, therefore it must contain data on the reasons and timing of modernization, as well as the names of the responsible persons.

Important

:

When modernization of fixed assets is carried out, accounting and tax accounting must reflect this complex process. Responsibility for reflecting work is shared by the management of the enterprise and the financially responsible accounting department.

Depreciation calculation after modernization:

example of calculating depreciation for a fully depreciated object

In 2020, the company completed the modernization of the production line belonging to the 4th depreciation group with SPI from 5 to 7 years. Substation lines upon commissioning (January 2010) – 500,000 rubles. The SPI was set at 80 months. Depreciation rate (RA) – 1.25% (1/80 month). Depreciation was calculated from February 2010 to September 2020, and at the end of 2020, when it was decided to reconstruct the line, the facility was completely depreciated. In March 2020, the corresponding work was completed, the amount of reconstruction excluding VAT was 350,000 rubles. From April 2020, the company begins to write off modernization costs, using the mechanism for calculating depreciation as follows:

C after modernization is 850,000 rubles. (500,000 + 350,000). The NA should be the same as at the time the line was entered, i.e. 1.25%. Consequently, the amount of monthly depreciation will be 10,625 rubles. (RUB 850,000 x 1.25/100). The costs of the completed modernization should be written off over 32 months at 10,625 rubles. (340,000 rubles), in the 33rd month the amount of depreciation will be 10,000 rubles.

General audit department on the issue of modernization of a fully amortized OS

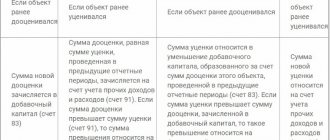

Revaluation of an asset is carried out by recalculating its original cost or current (replacement) cost, if this object was revalued earlier, and the amount of depreciation accrued for the entire period of use of the object. When deciding on the revaluation of fixed assets, it should be taken into account that subsequently they are revalued regularly (no more than once a year), so that the cost of fixed assets at which they are reflected in accounting and reporting does not differ significantly from the current (replacement) cost. Please note that the entire group of similar objects is subject to revaluation. However, both the choice of asset groups for revaluation and the specific method of its implementation are left to the discretion of the organization itself. Having decided to revalue any of the groups of similar fixed assets, the organization must independently develop and consolidate in its accounting policies a method (procedure) for revaluing fixed assets (clause 7 of PBU 1/2008 “Accounting Policy of the Organization”). Thus, revaluation of OS is the right of the organization, and not its responsibility. Full repayment of the cost of fixed assets through depreciation is not the basis for mandatory revaluation of such objects. Considering that in the situation under consideration, the revaluation of these fixed assets was never carried out, the organization does not need to revaluate fully depreciated fixed assets, unless this is expressly provided for in the accounting policy.

We recommend that you familiarize yourself with the following materials: — Encyclopedia of economic situations. Revaluation of OS (prepared by experts); — Encyclopedia of economic situations. Liquidation of OS (prepared by experts).

Tags: having considered the question, we came to the following conclusion: fixed assets, the cost of which has been fully repaid by depreciation, are subject to write-off, if more are used by the organization, depreciated objects continue to be used must be taken into account in the accounting account, mandatory revaluation of objects, including the connection with full repayment of the cost, a justification for the conclusion of the rule is required, the accounting procedure for writing off the revaluation of fixed assets, further installed

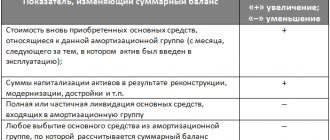

Calculation of depreciation during modernization

If an object with an existing residual value is being reconstructed, then monthly depreciation is calculated according to accepted standards throughout the entire period of capital work. Clause 23 of PBU 6/01 dictates the suspension of the accrual of depreciation if it continues for more than 12 months. The Tax Code of the Russian Federation in this case agrees with a similar approach (clause 3 of Article 256 of the Tax Code of the Russian Federation). After the modernized facility is put into operation, the amount of monthly deductions changes, since both the SPI and the cost of the operating system change.

The calculation of depreciation for an asset begins on the first day of the month following the month in which this object was accepted for accounting; for example, for an object put into operation in March, depreciation will begin to be calculated according to the adjusted calculation on April 1. And it doesn’t matter whether depreciation accumulations were suspended due to exceeding the legally established reconstruction period or not.

When using the linear method, depreciation in accounting is calculated using the formula:

A = (OS + M) / SPI, where:

- OS - residual value of fixed assets;

- M - modernization costs;

- SPI - new SPI after modernization or the remaining one if it has not been changed.

Modernization of a fixed asset: Tax accounting subtleties

In addition, a transfer and acceptance certificate is drawn up, which officially assigns the contractor responsibility for the transferred material assets. If the contractor causes damage to the customer's property, the act will become the official basis for a claim for damages. If there is no acceptance certificate, there are no grounds for compensation.

Upgrading equipment on your own is also accompanied by completing the necessary paperwork. Thus, the transfer of an asset to the repair service is carried out using an invoice. If the equipment is located on the territory of one service during the entire period of modernization work, no other documents are required.

After the modernization is completed, a certificate of delivery of the object is drawn up (if the work was carried out by contract, two copies must be drawn up). The actual transfer is carried out in the presence of commission members, representatives of the contractor or the person in charge.

Do you need a bonus?

Roughly speaking, premium depreciation is a method of calculating accelerated depreciation. It turns out that you can immediately attribute part of the cost of the object to expenses in tax accounting and reduce the taxable base for income tax by their amount. But when accounting, it is completely inconvenient, since a difference is formed between accounting and tax accounting. After all, such a “premium” is not provided for in accounting. Consequently, this will result in a deferred tax liability being recorded.

Example. In May 2008, Romania LLC put into operation a machine, the initial cost of which was 100,000 rubles, the useful life of 60 months (third depreciation group). Depreciation is calculated using the straight-line method. After 13 months of operation, a decision was made to modernize the machine on our own in the amount of 40,000 rubles. (without VAT). The modernization was carried out in June 2009. The organization's accounting policy for 2009 provides for the one-time inclusion in expenses of 30 percent of the cost of work on modernizing a fixed asset. The useful life has not changed.

Before modernization.

The depreciation rate was 1.67 percent (1: 60 months x 100%). The monthly depreciation amount is RUB 1,670. (RUB 100,000 x 1.67%). The facility was in operation for 13 months. The total amount of depreciation charges was 21,710 rubles. (RUB 1,670 x 13 months).

After modernization.

In tax accounting:

The depreciation bonus is equal to 12,000 rubles. (RUB 40,000 x 30%).

When calculating the monthly depreciation amount, the depreciation bonus is not taken into account, so the amount of depreciation deductions in tax accounting will be 2137.6 rubles. .

In accounting:

The residual value of the machine, taking into account modernization, is 118,290 rubles. (100,000 - 21,710 + 40,000). The remaining term is 47 months (60 - 13). The depreciation rate is 2.13 percent. Thus, the amount of depreciation charges in accounting will be 2519.6 rubles. (RUB 118,290 x 2.13%).

The difference in depreciation amounts is 382 rubles. (2519.6 - 2137.6). A deferred tax liability of RUB 2,400 is formed.

Features of application

In order to apply bonus depreciation when modernizing fixed assets, the following conditions must be met:

- the object being modernized must be an object of fixed assets;

- the use of bonus depreciation must be fixed in the accounting policy of the organization, as well as its percentage. Please note: the depreciation bonus is applied to all fixed assets or not applied at all (Letter of the Ministry of Finance of Russia dated March 13, 2006 N 03-03-04/1/219). Although there is another opinion among officials that the taxpayer independently chooses the criteria for attributing depreciation bonuses to expenses. That is, you can stipulate in your accounting policy that the depreciation bonus will apply only to fixed assets whose initial cost is at least 500,000 rubles. (Letter of the Ministry of Finance of Russia dated April 10, 2007 N 03-03-05/83);

- a fixed asset item that is subject to modernization must be used in the organization’s income-generating activities (Letter of the Ministry of Finance of Russia dated August 8, 2005 N 03-03-04/1/153).

According to paragraph 9 of Art. 258 of the Tax Code, the depreciation bonus does not apply to fixed assets that are received free of charge. In addition, bonus depreciation for costs of modernization of fixed assets is not applied;

- to inseparable improvements to leased property (Letters of the Ministry of Finance of Russia dated May 24, 2007 N 03-03-06/1/302, dated May 22, 2007 N 03-03-06/2/82). If the tenant modernizes the leased objects at his own expense (with the obligatory consent of the lessor to carry out such improvements), then he has the right to include this modernization in his depreciable property and depreciate them during the lease term (clause 1 of Article 258 of the Tax Code of the Russian Federation). But at the same time, the tenant does not have the right to write off the depreciation premium for modernization of the leased property as expenses at a time. This premium applies only to capital investments in own fixed assets;

- if a fixed asset item was purchased by a leasing company for leasing (Letter of the Ministry of Finance of Russia dated March 3, 2008 N 03-03-06/1/132). However, there are opinions of courts and experts that contradict the letters of the Ministry of Finance. The use of a depreciation bonus by the lessor is legal, since such property is depreciable, is taken into account on the taxpayer’s balance sheet, and the amount of depreciation is included in its expenses (Resolution of the Federal Antimonopoly Service of the Ural District dated June 14, 2007 N F09-4482/07-C3).

In relation to fixed assets acquired by a leasing company into ownership and transferred for short-term lease (leasing) without the right of redemption, the financial department considers it possible to apply a depreciation premium in the generally established manner (Letter of the Ministry of Finance of Russia dated May 6, 2006 N 03-03-04/2 /132).