What are the consequences of late payment of wages?

There are fines for non-payment of the advance (Part 6, Article 5.27 of the Administrative Code):

- guilty officials will pay from 10,000 to 20,000 rubles;

- from 30,000 to 50,000 rubles will be paid by the organization;

- from 1,000 to 5,000 rubles will be paid by the individual entrepreneur.

Fines for repeated violations will be:

- for officials - from 20,000 to 30,000 rubles or disqualification for a period of one to three years;

- for legal entities - from 50,000 to 100,000 rubles;

- for individual entrepreneurs - from 10,000 to 30,000 rubles.

Then the employer must pay the employees an advance no later than the working day immediately preceding this weekend/holiday. Let's say an advance is paid in a company on the 21st. In July, this date falls on a Saturday, respectively. The advance must be paid to employees no later than July 20 (Friday).

For late payment of the advance (as well as the salary itself), the employer faces a fine:

- from 30 to 50 thousand rubles. – for the organization;

- from 10 to 20 thousand rubles. – for its officials;

- from 1 to 5 thousand rubles. - for individual entrepreneurs.

Moreover, if the employer does not correct himself and continues to pay wages (including advance payments) at the wrong time, the punishment will be more severe:

- from 50 to 100 thousand rubles. – for the organization;

- from 20 to 30 thousand rubles. - for its officials. Disqualification from 1 to 3 years is also possible;

- from 10 to 30 thousand rubles. - for individual entrepreneurs.

In addition, if the advance payment is late (either one-time or multiple), the employer must pay compensation to the employees for the delay.

Our Calculator will help you calculate the amount of such compensation.

Essentially, a whole set of measures was developed to change the order that had developed over the years and return the situation to the legal field. The list of responsibilities primarily affects employers, who will now find it unprofitable to violate the introduced norms. The fine for non-payment of wages in 2020 has been increased and there is a risk of administrative and criminal liability.

- The provisions of the law (No. 273) on incentives for timely payment of salaries came into force.

- Accrual occurs every fifteen days and the same period is given to pay employees.

Info

Ignoring a written request and the absence of any practical actions to correct the situation is a reason for the employee to suspend the performance of his official duties. This is a forced measure aimed at stimulating the employer to fulfill its obligations. Suspension of an employee's work If there is a delay in salary for more than 15 days, the employee has the right to suspend the performance of official duties until the debt owed to him is repaid (Art.

142 TK). To do this, he is obliged to inform the employer of his intentions in writing. During the period of suspension, he may not appear at the workplace at all, but must resume work the next day after receiving a notification from his superiors about his readiness to pay what is due on the day he returns to the workplace.

Constitution of the Russian Federation;

- Art. 57, 136, 140, 164, 192, 195, 236-237, 383 of the Labor Code (hereinafter referred to as the Labor Code);

- Art. 5.27 Code of Administrative Offenses (CAO);

- Art. 145.1 of the Criminal Code (CC);

- With. 122,223,226 Tax Code (TC);

- Art. 151, 195, 314, 393 of the Civil Code (CC).

Certain adjustments were made to the above acts of Federal Law No. 273 dated June 3, 2016, which should be taken into account. Frequency of salary payments stipulated by law and the concept of delayed wages. The employer, according to the law, must pay subordinates remuneration for work twice - every half month. The first payment is an advance, the second is a transfer of the remaining amount.

Labor Code of the Russian Federation), arbitration practice showed that the employer could avoid liability for late payment of wages, vacation pay and other amounts due to the employee if he proved that the delay was not his fault (clause 55 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 N 2).

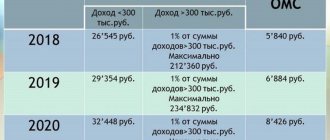

With the entry into force of Law N 90-FZ * (1), all organizations and institutions, regardless of their form of ownership, for violation of deadlines for the payment of wages and other payments in favor of employees are obliged to pay the amounts due to them, taking into account interest for the delay in the amount of not less than 1 /300 of the current Central Bank refinancing rate*(2) for each day of delay. This compensation must be paid regardless of whether the employer is guilty or not of the delay in these payments.

- 1,000–5,000 rubles when the employer, an individual entrepreneur (IP), was at fault;

- 30,000–50,000 rub. for enterprises.

In addition, paragraph 7 of this article provides for more stringent liability when the offense was committed by a person who had previously been punished under paragraph 6. In this case, the fine will increase:

- up to 30,000 rub. in relation to individual entrepreneurs;

- 150,000 rub. for legal entities;

- 30,000 rub. for officials, who may also be subject to disqualification for up to 3 years.

When an employer faces criminal liability for violating the terms of payment of wages The article on delays in wages in the Criminal Code of the Russian Federation is Art. 145.1. It provides for 3 elements of crime. Ch.

Attention

In this case, there is no need to prove the employer’s fault. Even delays that occurred due to an error by the servicing bank or a technical failure in the operation of equipment or software must be compensated. Art. 236 of the Labor Code of the Russian Federation provides for the minimum amount of compensation for delayed wages.

It can be increased by a local act of the enterprise, as well as a collective or labor agreement. Example of calculation The period of delay was 5 days. The key rate is 9%. The amount of delayed wages is RUB 20,000. The amount of compensation will be equal to: 20,000 × 9% / 150 × 5 = 60 rubles.

What to do if wages are delayed for more than 15 days: article of the Labor Code of the Russian Federation Often employees have a question: what to do when wages are delayed for more than 15 days? The answer is given by the article on wage arrears (Art.

There are fines for non-payment of the advance (Part 6, Article 5.27 of the Administrative Code):

- guilty officials will pay from 10,000 to 20,000 rubles;

- from 30,000 to 50,000 rubles will be paid by the organization;

- from 1,000 to 5,000 rubles will be paid by the individual entrepreneur.

Fines for repeated violations will be:

- for officials - from 20,000 to 30,000 rubles or disqualification for a period of one to three years;

- for legal entities - from 50,000 to 100,000 rubles;

- for individual entrepreneurs - from 10,000 to 30,000 rubles.

| Status | Fine, rub. |

| Executive | 10 000 – 20 000 |

| Individual entrepreneur with hired staff | 1000 – 5000 |

| Company | 30 000 – 50 000 |

| Status | Fine, rub. |

| Executive | 20 000 – 30 000 |

| Individual entrepreneur with hired staff | 10 000 – 30 000 |

| Company | 50 000 – 100 000 |

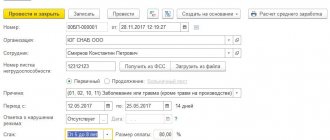

EXAMPLE delayed wages for 33 days (calendar) to several employees in the total amount of 137,400 rubles. The actual transfer date is November 7, 2020. For violation of labor law, the employer must pay:

- full salary: RUB 137,400;

- compensation payments: 137,400 × 10% × 1/150 × 33 = 3022.8 rubles.

- a fine issued by inspectors for late wages in the amount of 35,000 rubles.

What are the consequences of delayed payment of wages under the Labor Code of the Russian Federation:

- For each day of delay, compensation must be paid to the employee (Article 236 of the Labor Code of the Russian Federation).

- If wages are delayed by more than 15 days, the employee has the right to suspend work until it is paid, notifying you in writing. During the suspension, pay him the average salary, calculated in the same way as for a business trip (Article 142 of the Labor Code of the Russian Federation).

- Reporting a delay in wages to the labor inspectorate is the basis for an unscheduled inspection (clause “b”, clause 10 of the Regulations on labor supervision).

- The fine for delayed salaries for an organization is from 30,000 to 50,000 rubles, for an official - from 10,000 to 20,000 rubles. In case of repeated violation - from 50,000 to 100,000 rubles. and from 20,000 to 30,000 rubles. accordingly (parts 6, 7 of article 5.27 of the Code of Administrative Offenses of the Russian Federation).

- Criminal liability for non-payment of wages for more than 3 months threatens the manager if there is selfish or other personal interest (Article 145.1 of the Criminal Code of the Russian Federation).

Let us remind you that, by virtue of Art. 392 of the Labor Code of the Russian Federation, for the resolution of an individual labor dispute regarding non-payment or incomplete payment of wages and other payments due to an employee, he has the right to go to court within one year from the date of the established deadline for payment of these amounts, including in the case of non-payment or incomplete payment of wages wages and other payments due to the employee upon dismissal.

If you find an error, please highlight a piece of text and press Ctrl Enter.

In labor relations, such a violation of workers' rights as non-payment of wages is quite common.

In this case, non-payment should be understood as a delay in remuneration of workers, occurring both for reasons beyond the control of the employer, and with the deliberate unlawful intent of the employer.

Categories of working citizens in this case have the right to protect their interests by all available means in order to bring the unscrupulous employer to justice.

Managers who violate the labor code in terms of non-payment of wages may incur various types of liability.

If the employee claims, the employer may be held liable.

What is the employer's liability for non-payment of wages in 2020 provided for by law, and what size of sanctions can be imposed?

The employer's criminal liability for non-payment of wages can be qualified according to the provisions of Article 145.1 of the Criminal Code of the Russian Federation.

Rules and features of calculating employee compensation

The basic rule of calculation is the following: for each day of non-payment of wages (or other benefits), an individual entrepreneur or organization is obliged to pay compensation amounts, which are expressed as a percentage (of the amount of debt).

The amount of compensation for delayed payment of wages that the employer must pay is fixed in law. It must be equal to (or higher than) one three hundredth of the refinancing rate of the Central Bank of the Russian Federation, which is valid for the period of delay.

If the norm is provided for by a collective agreement or local act that is in force in the organization (IP), the amount of compensation payment may be increased. Such documents may be:

- regulations on labor rights;

- regulations on the procedure for payment of wages;

- individual employment contract of the employee.

Please note that the obligation of an organization or individual entrepreneur to pay compensation arises regardless of whether there are signs of guilt in the actions or inactions of the employer that led to the delay in wages.

Note that if the period of time during which the wages were delayed included weekends (holidays), then they are taken into account along with working days.

In addition, if a collective agreement or other act of the organization establishes an amount of compensation greater than that provided by law, then the difference is subject to personal income tax (NDFL).

In a situation where the payday falls on a holiday (or weekend), payment should be made on the last day before the holiday (or weekend).

Let's give an example: payment of wages at an enterprise is set on the 6th day of the month. The 6th fell on Saturday, which is a day off. Payment of wages on Monday the 8th is considered late, which means that the head of the organization will have an obligation to pay compensation for the delay. Thus, to avoid delays, salaries must be paid on Friday, the 5th.

The main consequences of non-payment of wages in 2019

Firstly, the wording is incorrect in part

no later than the 10th and 25th of each month

Andrey

Specific dates must be indicated (Article 136 of the Labor Code of the Russian Federation).

Secondly, the wording may not be correct

On the 25th, wages for the first half of the current month are paid in the amount of 50% of the salary amount; On the 10th day of the next month, the final payment is made based on the results of work for the previous month;”

Andrey

if, in addition to the salary, there are some allowances/additional payments (but not bonuses!) - for overtime work, night shifts, work on holidays and weekends, for “harmfulness”, etc., then they should also be paid in proportion to the time worked, in including in advance.

Thirdly, the statement

Those who have not worked for the company for the full first half of the month do not receive an advance. The advance is only due to those who have been in the company since 12/01/2017. Receive the full payment for December on 01/10/18.” And supposedly there is a wording somewhere in the laws that “you need to work 15 working days for the advance to be paid.”

Andrey

Thus, the Labor Code of the Russian Federation does not define specific terms for payment of wages, as well as its amount for half a month. These issues are related to legal (collective agreement) regulation at the institution level. We believe that the employee has the right to receive wages for the first half of the month in proportion to the time worked.

At the same time, we believe that when determining the amount of wage payment for the first half of the month, it is necessary to take into account the employee’s salary (tariff rate) for the time worked, as well as bonuses for the time worked, the calculation of which does not depend on the assessment of the results of work for the month as a whole, as well as on fulfillment of monthly working hours and labor standards (labor duties) (for example, compensation payment for night work in accordance with Article 154 of the Labor Code of the Russian Federation, allowances for combining positions, for professional excellence, for length of service, and others).

As for incentive payments accrued based on the results of meeting performance indicators (assessed based on the results of work for the month), as well as compensation payments, the calculation of which depends on the fulfillment of the monthly working time standard and is possible only at the end of the month (for example, for overtime work , for work on weekends and non-working holidays in accordance with Articles 152 and 153 of the Labor Code of the Russian Federation), we believe that these payments are made upon the final calculation and payment of wages for the month.

In our opinion, a decrease in the amount of wages for the first half of the month when calculated can be considered as discrimination in the field of labor, a deterioration in the labor rights of workers. Question: ... About the amount of wages for the first half of the month. (Letter of the Ministry of Labor of Russia dated August 10, 2017 N 14-1/B-725) In accordance with the current part six of Article 136 of the Labor Code of the Russian Federation, wages are paid at least every half month on the day established by the internal labor regulations, collective agreement, or employment contract.

These requirements are established for the payment of wages accrued to an employee for working hours worked in a specific period, fulfillment of labor standards (job duties). Taking into account the new edition of Article 136 of the Labor Code of the Russian Federation, wages for the first half of the month must be paid on the established day from 16 to 30 (31) the date of the current period, for the second half - from the 1st to the 15th of the next month.

Incentive payments (additional payments and allowances of an incentive nature, bonuses and other incentive payments) are one of the components of wages and can be paid for periods other than half a month (month, quarter, year and others). By virtue of part two of Article 135 of the Labor Code of the Russian Federation systems of additional payments and bonuses of an incentive nature and bonus systems are established by collective agreements, agreements, and local regulations.

Bonuses and other incentive payments are awarded for labor results, achievement of relevant indicators, that is, after the indicators have been assessed. Thus, the timing of payment to employees of incentive payments accrued for a month, quarter, year or other period can be established by a collective agreement , local regulations.

Thus, if the regulations on bonuses establish that the payment of bonuses to employees based on the results of a period defined by the bonus system, for example, for a month, is carried out in the month following the reporting month, or a specific date for its payment is indicated, and based on the results of work for the year - in March of the next year or a specific date for its payment is also indicated, then this will not be a violation of the requirements of part six of Article 136 of the Labor Code of the Russian Federation in the new edition. Question: ... About the timing of payment of bonuses to employees. (Letter of the Ministry of Labor of Russia dated February 14, 2017 N 14-1/OOG-1293)

term and amount This is the mechanism for issuing advance payments and salaries according to the new rules. Rostrud employees confirm this, recommending that advance payments be made exactly in the middle of the month. Withholding and transfer of personal income tax Transfer of tax should be made no later than the next day after the payment of wages.

advance payment - on the 15th and full salary for the past month - on the 1st. In July 2007 there were 22 working days. On the date of issue of the first part of the salary, the employee worked 10 working days. The amount of the first payment will be 2,727.27 rubles. (RUB 6,000 / (22 x 10) work days). Therefore, when paying an advance, the institution must give the employee at least 2,727.27 rubles.

But if the internal labor regulations, labor or collective agreement stipulate that the first part of earnings is accrued in a larger amount, then the amount of payment may exceed this amount. Consideration of the content of the claim revealed the following. An employment contract was signed with the applicant, but at a certain point (during a change of ownership) it was terminated by the employee on his own initiative.

On the day of his dismissal, he did not receive the funds due to him. He repeatedly made attempts to resolve the matter pre-trial by contacting management for negotiations, but were unsuccessful. The defendant did not appear at the court hearing. Instead, the authority received a document about the company’s disagreement with the charges due to the change of owner, the temporary non-functioning of the company for this reason and the lack of funds to pay off the debt.

The amount of debt was not indicated. Letter of Rostrud dated September 8, 2006 N 1557-6, in particular, states that the part of the salary that the Labor Code of the Russian Federation obliges to pay to employees after half a month cannot be less than the tariff rate or salary for the time actually worked (actually completed work).

If the amount of the advance paid is less than the amount of wages for the time worked, this means that payment of the missing amount on the day of monthly calculation will also be considered a late payment. The date of payment and the specific amount of the advance (may be more than half a month’s salary) must be established in the internal labor regulations, labor or collective agreement.

View more:

- warning or imposition of a fine on officials in the amount of 10,000 to 20,000 rubles;

- fine for individual entrepreneurs – from 1,000 to 5,000 rubles;

- fine for organization - from 30,000 to 50,000 rubles.

- a fine in the amount of up to 120,000 rubles or in the amount of wages or other income of the convicted person for a period of up to 1 year;

- or deprivation of the right to hold certain positions or engage in certain activities for a period of up to 1 year;

- or forced labor for up to 2 years;

- or imprisonment for up to 1 year.

For complete non-payment of wages for more than 2 months, as well as for these violations that resulted in grave consequences, more severe liability is provided (Parts 2, 3 of Article 145.1 of the Criminal Code of the Russian Federation).

Therefore, he will be given benefits for three months. An entrepreneur is not always ready to make a full payment upon dismissal. The injured employee must follow similar actions as in the case of delays in payment of wages.

Before contacting the inspectorate, prosecutor's office or court, you need to make a list of your claims and present them to your employer. Refusal to comply with legal requirements will allow an inspection and trial, after which a positive verdict will be issued. Suspension of work What is the best thing to do and what step will be correct after another delay in payment, if it exceeds half a month. Of course, the employee will be able to continue working, but he also has the right to suspend activities for a certain time.

Important

The estimated unpaid amount on time is 10,000 rubles, the delay period is 19 days, the refinancing rate is 10.5% (0.105). Compensation for the entire period of delay is as follows: 10,000 * 19 * 1/150 * 0.105 = 133 rubles. A more complex example looks like this. The local act defines the following dates for settlements with the team:

- 10th – payment of salaries;

- 20th – advance payment.

The advance payment for January 2020, due to the financial difficulties faced by the company, was transferred to the bank card of sales manager K.I. Gorkov.

- Issuance of vacation pay no later than 3 days before the start of the vacation.

- Establishing other deadlines for making payments. Yes, Art. 140 of the Labor Code of the Russian Federation requires full payment to be made when dismissing an employee on his last working day.

- lack of funds in the employer’s bank account;

- incorrect application of legislation, expressed in the establishment of payments once a month, floating dates for the payment of wages, etc.

| No. | Violation | Punishment |

| Partial non-payment of wages and other payments established by law within a period of more than three months, committed for selfish gain by the head of the organization, in accordance with clause 1 of Art. 145.1 of the Criminal Code of the Russian Federation | Fine up to 120,000 rubles or in the amount of the salary or other income of the culprit for the previous year | |

| Complete non-payment of wages and other payments established by law within a period of more than two months, as well as wages below the minimum wage established by federal law, committed for selfish gain by the head of the organization, in accordance with clause 2 of Article 145.1 of the Criminal Code of the Russian Federation | Fine from 100,000 to 500,000 or in the amount of the salary or other income of the offender for three years | |

| Actions provided for in the above parts, resulting in grave consequences, in accordance with paragraph 3 of Article 145.1 | Fine from 200,000 to 500,000 rubles or in the amount of the salary or other income of the offender for a period of one to three years |

Rostrud does not allow everyone to pay a fixed advance

Methods for calculating an advance payment can be reduced to three main options:

- percentage of salary;

- in proportion to the time worked;

- fixed amount in rubles.

Companies prefer the first two options. This was shown by a survey on the website zarp.ru.

How do you calculate salary advances?

The results of a survey of visitors to the site zarp.ru: 40% of the salary - 35%, 50% of the salary - 19%, 43.5% of the salary - 3%. We determine the actual salary for the first half of the month - 34%, We pay a fixed amount in rubles - 9%. Ivan Ivanovich Shklovets, deputy head of the Federal Service for Labor and Employment, comments: “The Labor Code does not determine how to determine the size of the salary advance. The company has the right to set a percentage of the salary, for example 40%, with an adjustment for the actual time worked in the first half of the month (editor’s note - see example 1).” An advance in a fixed amount, for example 5,000 rubles, does not violate the law, but carries risks for the employer. He will be obliged to pay it, even if the employee was sick in the first half of the month, was on vacation, or on a business trip. At the end of the month, the salary may be less than the advance payment. An accountant will not be able to withhold personal income tax. Let's look at the problems of other methods of calculating the advance.

Requirements of the Labor Code of the Russian Federation

Labor legislation requires the employer to pay timely and regularly. Accruals must be made at least twice a month on time.

The exact dates are specified in the contract, employment agreement or internal documentation. The general rule for the payment period is no later than 15 days from the end of the period for which the accrual was made. The payment date determined by the employer must fall on these days. If it overlaps with weekends or holidays, funds must be transferred in advance.

Also see “What percentage of salary can or should an advance be made up.”

When an employer bears criminal liability

It is not always possible to get away with a fine for non-payment of wages. When management delays this for a long time, pursuing selfish interests (which has irrefutable evidence), the perpetrators are brought to justice. Their actions are qualified under Art. 145.1 of the Criminal Code of the Russian Federation. It all depends on the severity of the damage caused (see table).

| Crime | Punishment |

| Part of the salary is not paid for more than three months. We are talking about amounts not exceeding half of the employee’s full earnings. | According to the first part of Art. 145.1 of the Criminal Code of the Russian Federation, a private individual/director of an enterprise will be punished: • a fine of up to 120,000 rubles. or about a year's salary; • deprivation of the right to practice one’s profession – up to 12 months; • performing forced labor for up to two years; • restriction of freedom for up to 12 months. |

| Full salary is overdue for more than two months. | Responsibility arises under the second part of Art. 145.1 of the Criminal Code of the Russian Federation: • fine for non-payment of wages: 100 – 500 thousand rubles. or deduction of an amount equal to income for 3 years; • performing forced labor for up to 3 years, deprivation of the right to practice one’s profession for up to 3 years (the latter is not always the case); • imprisonment for up to three years; deprivation of the right to practice one’s profession for up to 3 years (the latter is not always the case). |

The most severe punishments are applied when illegal actions of management led to serious consequences: illness, suicide, etc. If guilt is fully proven in court, the consequences are as follows:

- payment of a fine for late payment of wages in the amount of 200 - 500 thousand rubles. or income for 1 – 3 years;

- imprisonment for a period of 2 to 5 years, deprivation of the right to profession for a period of up to 5 years (the latter is not always the case).

The Investigative Committee is involved in the investigation of criminal cases under this article. To hold the employer liable, it is necessary to submit a corresponding application to the Investigative Committee at the place of residence.

Deadlines for payment of wages

All employers are required to pay wages at least every half month. Salaries must be paid no later than the 15th day after the end of the period for which they were accrued. That is, the deadline for the advance payment is the 30th day of the current month, and for salaries - the 15th day of the next month (Part 6 of Article 136 of the Labor Code of the Russian Federation).

There is no concept of “half a month” in current legislation. The norm from Part 6 of Article 136 of the Labor Code of the Russian Federation means that salaries must be paid at least twice a month. Specific deadlines are determined in the Labor Regulations, collective or employment agreement.

The first half of the month is always the period from the 1st to the 15th of the current calendar month. The second half of the month is the period from the 16th to the last day of the calendar month. The main thing is to set specific deadlines for the payment of salaries. For example, according to the Labor Regulations, salaries are paid on the 5th and 20th. Then fulfill the requirement of Part 6 of Article 136 of the Labor Code of the Russian Federation (letters of the Ministry of Labor of Russia dated April 18, 2020 No. 11-4 / OOG-718, dated September 23, 2020 No. 14-1 / OOG-8532).

If the established payment day coincides with a weekend or non-working holiday, pay the salary the day before (Part 8 of Article 136 of the Labor Code of the Russian Federation

Administrative fines to the employer for delays in wages, provided for in Art.

5.27 of the Code of Administrative Offenses of the Russian Federation are not the only sanctions applied to employers who violate the terms of payment of wages, according to Part.

Compensation calculator for delayed wages-2018

Info

You cannot indicate intervals instead of specific dates, because this violates clause 6 of Art. 136 Labor Code of the Russian Federation. Thus, by accruing 1 part of the salary on the 9th day, and the other on the 28th, the head of the company will violate the Labor Code of the Russian Federation on accruing salary once every 15 days, at least. Norms and procedure for determining the deadlines of the Labor Code of the Russian Federation and Federal Law No. 272 of July 3, 2020.

on making adjustments to the laws of the Russian Federation to increase the responsibility of employers for violations of the labor code relating to the calculation of wages in 2020, regulates the procedure and periods for payment of wages. Who sets the deadlines for accruing salary? According to the Labor Code of the Russian Federation and Federal Law No. 272, the manager sets the date for issuing salaries to employees in 2020 independently.

Employer bankruptcy

Let’s assume that due to insufficient funds, the employer has outstanding payments due to employees for more than three months (wages, severance pay, etc.). In this case, the head of the debtor organization or the individual entrepreneur himself must apply to the arbitration court with an application for bankruptcy.

This is provided for in paragraph 1 of Article 9 of the Law of October 26, 2002 No. 127-FZ. Also, employees (including former employees) can apply to the arbitration court to declare the employer bankrupt for debts on wages and other payments. This is stated in paragraph 1 of Article 7 of the Law of October 26, 2002 No. 127-FZ.

Employees have the right to hold a meeting. Deadline – no later than five working days before the date of the meeting of creditors. The organization and holding of the meeting of employees is entrusted to the arbitration manager. At the meeting, employees elect their representative who will protect their interests in the bankruptcy process of the employer. The procedure for holding a meeting is described in detail in Article 12.1 of the Law of October 26, 2002 No. 127-FZ.

Claims for payment of arrears of wages and other remuneration to employees (including former employees) are included in the register of creditors' claims by the insolvency administrator or the registrar upon the proposal of the insolvency administrator. If such claims are disputed, they are included in the register on the basis of a judicial act establishing the composition and amount of these claims (clause 6 of Article 16 of the Law of October 26, 2002 No. 127-FZ).