Late submission of SZV-M: how to avoid a fine

Let's figure out what the penalty is for failure to submit SZV-M or errors in it and how to avoid punishment. Liability for violators is provided for in several regulations. To make it easier for readers to navigate, we offer a table that contains the elements of the offense, the basis for punishment and the amount of sanctions.

What is the offense? What is the penalty? Grounds for prosecution Failure to provide information within the prescribed period (after the 15th day of the month) 500 rubles for each insured person per insured (organization or individual entrepreneur) Part 3 of Article 17 of the Federal Law of 01.04.

https://www.youtube.com/watch?v=ytaboutru

submission of a report on paper instead of the provided electronic form 1000 rubles per policyholder, Part 4, Article 17 of Federal Law No. 27-FZ dated 01.04.1996 The relevant document is sent to the policyholder within 5 days from the date of the verdict. It comes into force after 10 days from the date of delivery to the entrepreneur. Nobody wants to pay a fine.

Therefore, it is advisable not to violate the rules for submitting a report on insured persons. It is better to prepare and send the document not on the last day, but at least several days in advance.

This will reduce the risk of being late, for example, due to technical failures. Another recommendation is to carefully check the information sent to the Pension Fund. Even after the report has already been submitted.

If the policyholder discovers the error before the fund employee, he will not be punished.

The accountant submitted the SZV-M in a timely manner, but due to carelessness did not include one employee in the form. To correct this oversight, a supplemental form was submitted with the employee's information. However, the accountant did not manage to submit it on time. As a result, a fine of 500 rubles followed.

If there is only one forgotten employee or there are several, it doesn’t matter. But in large companies, such forgetfulness can result in very tangible problems.

Is it legal to impose a fine in such a situation? After all, only the supplementary form was submitted beyond the deadline for submitting reports, while the primary one was submitted on time. Arbitration practice is ambiguous, for example:

- Resolution dated December 25, 2017 No. F03-5001/2017. The judges sided with the Pension Fund. The argument is this: in the supplementary form, information about forgotten employees was submitted for the first time. They were missing in the original form, therefore information about them was received by the fund late.

- Resolution of the AS of the East Siberian District dated October 5, 2017 No. A78-1989/2017. The court supported the insured. In his opinion, the supplementary form SZV-M is, in essence, a correction of errors in the original report. And no fine is imposed for this.

So, judicial practice suggests that in such a situation there is still a chance to challenge the fine. So if the amount is really significant, you should go to court.

https://youtu.be/ZNySENaRjQA

Addendum SZV-M

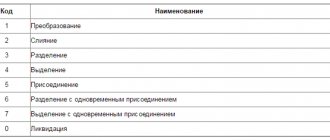

According to the resolution of the Board of the Pension Fund of Russia dated 01.02.2016 No. 83p, which approved the SZV-M form “Information on insured persons”, in its paragraph (section) 3 it is necessary to indicate the code that corresponds to its type.

So, “additional” means that it is a complementary form. It is submitted in order to supplement the information previously accepted by the Pension Fund about insured persons for a given reporting period (month).

There are no other rules governing the delivery of the supplementary SZV-M. This is also why numerous disputes arose between policyholders and the Pension Fund.

The situation for all employers is approximately the same. The first form SZV-M was submitted on time. After some time, the employer finds the “forgotten” employees and submits a supplementary report. But the Pension Fund of the Russian Federation believes that the reports regarding these employees were submitted untimely.

Legal basis

In 2020, SZV-M is submitted for the previous month no later than the 15th day of each current month.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

Responsibility for failure to submit SZV-M is determined by Article 17 of Law No. 27-FZ {amp}lt;On Persucheta in the OPS system˃. Thus, companies and individual entrepreneurs in 2020 are required to pay an amount of 500 rubles. Moreover, for each employee who had to be indicated in the SZV-M form. And these are all persons who have signed an employment or civil contract with the employer.

Let us note that the legislation provides for equal liability for failure to submit the SZV-M and violation of deadlines in relation to it.

A fine is also imposed for entering incomplete and/or incorrect data into the report. Such cases include, for example:

- an error made in the TIN, SNILS;

- absence of full name

Moreover, the amount of the fine in the situations considered is the same: 500 rubles for 1 individual included in the SZV-M.

We recommend

What is the penalty for failure to submit the SZV-M report?

Organizations and individual entrepreneurs making payments and other remuneration to individuals are required to submit a report in the SZV-M form to the territorial divisions of the Pension Fund of Russia. This obligation was enshrined in 2019 in paragraph 2.2 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.”

The same law also provides for liability in the form of fines for late delivery of SZV-M. Article 17 of the law states that failure by the policyholder to submit within the prescribed period or submission of incomplete and (or) false information will entail a fine of 500 rubles in relation to each insured person.

If you want to know how much you will be fined for late submission of SZV-M in 2020, then you need to multiply 500 rubles by the number of individuals about whom you must report - employees and those with whom your organization has entered into civil law contracts.

An example of calculating a fine.

Let’s assume that the organization is late submitting the SZV-M report for January 2020. It had to be submitted no later than February 15th. However, in fact, the report was submitted to the Pension Fund only on February 22. A total of 105 people are listed in the report. Therefore, the fine for late submission of SZV-M in 2020 will be 52,500 rubles (500 × 105).

| How many individuals are there in SZV-M | Amount of fine |

| 1 | 500 rub. |

| 2 | 1000 rub. |

| 3 | 1500 rub. |

| 4 | 2000 rub. |

| 5 | 2500 rub. |

| 6 | 3000 rub. |

| 7 | 3500 rub. |

| 8 | 4000 rub. |

| 9 | 4500 rub. |

| 10 | 5000 rub. |

| 11 | 5500 rub. |

| 12 | 6000 rub. |

| 13 | 6500 rub. |

| 14 | 7000 rub. |

| 15 | 7500 rub. |

| 16 | 8000 rub. |

| 17 | 8500 rub. |

| 18 | 9000 rub. |

| 19 | 9500 rub. |

| 20 | 10,000 rub. |

| 21 | 11,000 rub. |

| 22 | 11,500 rub. |

| 23 | 12,000 rub. |

| 24 | 12,500 rub. |

| 25 | 13,000 rub. |

The report in the SZV-M form, submitted to the Pension Fund of the Russian Federation, is monthly. And it concerns the accounting information.

The reporting date is the 15th based on the results of the past month (clause 2.2 of Article 11 of the Federal Law of 01.04.96 No. 27-FZ). Moreover, if the deadline falls on a weekend or holiday, the deadline is postponed to the next working day. That is, everything here is according to the classics of the genre. Moreover, there are no rules on postponing deadlines in the special Law dated 04/01/96 No. 27-FZ - the provisions of Article 193 of the Civil Code are applied (letter of the Pension Fund of December 28, 2016 No. 08-19/19045).

Please note: the report can be submitted in advance. For example, the reporting month has not yet passed, and you will not have time to report on its results on time (say, you are going on vacation). Then you can give up early, before the end of the month for which you need to report. When reporting for the past month, nothing prevents you from immediately presenting the SZV-M for the current month, if you are absolutely sure that the data will not change. In all such cases, it is better to accompany the report with an appropriate explanatory note. We have provided a sample with the necessary wording.

Explanatory note on early delivery of SZV-M - example 2019

https://www.youtube.com/watch?v=ytcreatorsru

If you are late with the report or do not meet the allotted deadlines, there will be a fine accordingly.

The Pension Fund recalled the details for payment of penalties by companies and entrepreneurs in Moscow and the Moscow region for failure to submit (late submission) of information in the SZV-M form. The BCC for both Moscow and Moscow region employers is the same - 392 1 1600 140. As for other details, employers registered in Moscow fill out the “penalty” payment as follows: INN 7703363868, KPP 770301001; Recipient of the Federal Financial Inspectorate for Moscow (for the State Pension Fund Branch for the city of Moscow)

Moscow and Moscow region); Recipient bank of the State Bank of Russia for the Central Federal District; And payers registered in the Moscow region are as follows: TIN 7703363868; Gearbox 770301001; Recipient of the Federal Financial Commission for the Moscow Region (for the State Branch of the Pension Fund of the Russian Federation for Moscow and the Moscow Region); Recipient bank of the State Bank of Russia for the Central Federal District; Let us remind you that for late delivery of SZV-M, a fine of 500 rubles is established for each insured person.

Newsletter for accountants Every day we select news that is important for the work of an accountant, saving you time. Receive free accounting news by email.

What mandatory details must an entrepreneur fill out: If the TIN is not provided, this is not considered a fundamental error and is quite acceptable. But it is still advisable to fill out a separate column provided in SZV-M for TINs known for at least several employees.

SZV-M is submitted electronically if the enterprise has more than 24 permanent employees registered. The number of citizens up to 24 allows the preparation of a paper version of the document.

- for April the paper must be submitted on May 10;

- for May – June 10;

- for June – July 11;

- reporting for July is sent by mail or given directly to the Pension Fund employee on August 10;

- for August, the document must be submitted for verification and registration on September 12;

- for September – October 10;

- for October – the fixed date is November 10;

- for November – December 12;

- for December 2020, reporting is submitted already in 2020, namely on January 10 (if the date falls on the New Year holidays, it is postponed to the next working day).

Do not forget that if an enterprise with more than 24 employees, contrary to the law, provided paper reporting.

This is considered an administrative violation, and a fine for the offense is 200 rubles.

Interestingly, the table should include information on employees, including those with civil contracts. Even if a worker is fired today, information on him is still entered into the current reporting month.

The sequence of filling out the columns in SZV-M is approximately as follows: What to do if the employee himself is not sure of his own TIN?

For example, a couple of numbers are erased on a blank form - do not write as you think, ask the employee to clarify this point in advance with the relevant government agency.

The fine for failure to submit the SZV-M - how realistic it is to be fined and for what violations, what is the size of the fine and how to avoid it.

We will try to find answers to these and some other questions from the legislator and in documents issued by the Pension Fund of Russia.

- the amounts of the insurance pension and its fixed payment are paid without taking into account indexation during the period of work of the pensioner;

- after he stops working, the ban on indexation of these amounts will be lifted.

However, the pensioner still retains the right to submit to the Pension Fund a statement about the fact of his employment (termination).

He can use it to speed up the process of starting to index his pension after dismissal.

Let's look into situations that are non-standard for such cases, which are why policyholders have most of the questions. The main principle when deciding whether to include information about individuals in the SZV-M is the following: Thus, for the purposes of filling out the form, the following does not matter (letters from the Pension Fund of the Russian Federation dated 06.05.

2016 No. 08-22/6356, dated July 27, 2016 No. LCH-08-19/10581): Such features of concluding contracts with an individual, such as part-time work / combining professions, also do not matter. The only people not included in the form are foreign citizens - highly qualified specialists temporarily staying in the Russian Federation, who are not insured in the compulsory pension insurance system (Art.

7 of the law of December 15, 2001 No. 167-FZ). IMPORTANT! From the above it follows: a report in the SZV-M form cannot be zero (with an empty table). Read about one of the non-standard situations that arise when submitting reports in the article

Art. 17 of Law No. 27-FZ establishes liability for the following violations in the SZV-M form:

- failure to submit a report;

- violation of the deadline for its submission;

- failure to provide information about the insured person;

- incomplete or unreliable presentation of information about the insured person.

For any of these violations, a fine of 500 rubles is provided.

for each employee whose information is to be included in the form for the reporting period. Thus, significant penalties for the policyholder may arise due to an accidental error, which is simply impossible to exclude due to a technical or human factor.

Fine for non-compliance with order

Since 2020, the legislation on personalized accounting has introduced a new fine related to SZV-M. Note that it is not related to the out-of-date presentation of monthly reporting. The new fine concerns the method of submitting the SZV-M.

Please note that in 2020, it is possible to report using the SZV-M form “on paper” only if the report includes information for less than 25 people. If the report includes 25 or more insured persons, then you need to submit the report in the form of an electronic document signed with an enhanced qualified electronic signature (paragraph 3, paragraph 2, article 8 of the Federal Law of 01.04.1996 No. 27-FZ “On individual (personalized) ) registration in the compulsory pension insurance system").

If in 2020 an organization or individual entrepreneur does not comply with the specified requirement regarding the method of submitting the SZV-M, then inspectors from the Pension Fund of the Russian Federation will have the right to impose a new fine of 1,000 rubles. Since 2020, this fine has been added to Article 17 of Federal Law No. 27-FZ dated April 1, 1996.

Pension Fund specialists issue a payment demand to the violator, which must be fulfilled within 10 days. In some cases, a longer period is provided (it is indicated in the same document).

https://www.youtube.com/watch?v=ytdevru

In case of non-fulfillment, the amount is written off by collection from the account of the company or individual entrepreneur.

There are two ways in which the Pension Fund of Russia can fine a company.

- The pension fund will send you a request stating the amount to be paid;

- The fund can instruct the bank to forcefully debit money from your account.

Most often, the scheme is this if the organization does not satisfy the requirements of the Pension Fund of Russia to pay a fine within the period specified there. The pension fund will send a collection order to your bank and will withdraw the money anyway.

Another question that accountants ask is where to pay the fine for SZV-M in 2020? The fine is issued to you by the Pension Fund, so you need to pay it using the fund’s details. KBK take 392 1 1600 140. The beginning of the code “392” just means that the administrator of this payment is the fund.

Will there be a fine?

The first question that worries an employer when identifying errors in the original SZV-M: is it possible to add an employee by adjusting the SVZ-M without a penalty?

If you manage to submit to the Pension Fund the corrective SZV-M for the forgotten employee quickly, there will be no fine before the end of the deadline established by law for submitting the original SZV-M. Let us remind you that the SZV-M for the reporting month must be submitted to the Pension Fund no later than the 15th day of the month following the reporting month (clause 2.2 of Article 11 of Law No. 27-FZ dated 01.04.1996).

If the legal reporting deadlines have passed, you will have to fight off the fine in court. In any case, the Pension Fund of Russia will issue it to the company (500 rubles for each forgotten employee) and to its manager (300-500 rubles according to Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

The fund's specialists will only record the violation in the protocol, and the court will consider it (clause 4, part 5, article 28.3, part 1, article 23.1 of the Code of Administrative Offenses of the Russian Federation). Moreover, it does not matter to the Pension Fund that the company independently identified and corrected the error (letter from the Pension Fund of March 28, 2018 No. 19-19/5602). The Fund believes that only information that has already been reflected in the original SZV-M can be adjusted without penalty. And a forgotten employee is a set of new data that was missing in the original report.

Can the fine be reduced?

It is often possible to reduce the amount of the fine for late submission of SZV-M if the violations were committed by the policyholder under extenuating circumstances. And there are many examples of this in arbitration practice. Such circumstances may include:

- Short period of delay. In the understanding of judges, this is usually no more than 16 days.

- Primary violation. For those who have never done anything like this before, the fine for the first time can be reduced considerably.

- No arrears in payment of insurance premiums. If the payer is in good standing, they may meet him halfway and reduce the amount of sanctions.

- Technical problems: lack of communication, electricity, software failures, and so on. Often, fines are completely waived.

- Difficult life circumstances of persons on whom, due to their job responsibilities, the delivery of the SZV-M depends.

The following table provides examples of mitigating circumstances.

| Judgment | Mitigating circumstances taken into account by the court | Pension Fund fine (in rubles) | Fine by court decision (in rubles) |

| Resolution of the AS of the West Siberian District dated 10.10.17 No. A81-5854/2016 |

| 34 500 | 3 450 |

| Resolution of the AS of the East Siberian District dated 09/06/17 No. A78-15400/2016 |

| 208 000 | 1 000 |

| Resolution of the AS of the West Siberian District dated March 30, 2017 No. A27-17653/2016 |

| 411 500 | 20 000 |

| Resolution of the AS of the Ural District dated May 24, 2017 No. A76-27244/2016 |

| 54 500 | 5 450 |

| Resolution of the Volga-Vyatka District Administration of July 17, 2017 No. A28-11249/2016 |

| 74 000 | 0 |

You can earn a fine for SZV-M in 2020 for several reasons. But first, let us remind you that the SZV-M form is submitted to the Pension Fund of the Russian Federation on a monthly basis by all companies and individual entrepreneurs that have paid employees, including those under GPC agreements.

So, when submitting a report in the SZV-M form in 2020, the organization and individual entrepreneur may be fined:

- for late delivery of SZV-M;

- for errors when filling out the form, especially if they are related to the company’s imprint, as well as the full name, SNILS, and TIN of your employees;

- for incorrect submission form SZV-M.

Important! Companies in 2020 face a new fine for SZV-M, even if the company submitted the report on time and without errors.

Find out what you will be fined for

In 2020, there is an unshakable rule. If an enterprise or individual entrepreneur employs 25 or more people, a report in the SZV-M form can only be submitted in electronic form. Violation of this rule is punishable by a fine. At the same time, companies with less than 25 employees have the right to choose the form of filing the SZV-M: paper or electronic.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

The legislation does not provide for mitigating circumstances for violators to reduce the amount of the fine or its maximum limit. Therefore, failure to submit reports on insured persons inevitably leads to additional costs for companies. But in practice things are different.

Organizations and individual entrepreneurs have the right to apply to the court:

- Recognize the Pension Fund's decision on the fine as partially invalid.

- Ask to reduce the amount of the sanction.

Reason – the violation occurred for the first time or the duration of the delay was insignificant. The document should indicate a reference to paragraph 5 of the reasoning part of the resolution of the Constitutional Court of the Russian Federation No. 2-P dated January 19, 2020. There are cases when the claim is satisfied and the costs are reduced by half.

What's happened?

The Ministry of Labor of Russia issued order No. 385n dated June 14, 2018, which adjusted the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons, approved by order of the Ministry of Labor and Social Protection of the Russian Federation dated December 21, 2020 N 766n, including in part filling out and submitting a monthly report in the SZV-M form. The amendments affected the possibility of safe correction for employers (i.e., without fines) of errors in reports submitted to the Pension Fund in the SZV-M form. The document has already been registered by the Ministry of Justice and will come into force on October 1, 2018, so employers still have time to prepare for the new rules of the game.

Important court decision in 2020

In 2020, the Constitutional Court of the Russian Federation decided that it is impossible to hold an individual entrepreneur administratively liable as an official for violations in the field of personalized accounting if he has already been fined as an insured.

https://www.youtube.com/watch?v=upload

As a general rule, the Law on Persuchet establishes liability for the policyholder, and the Code of Administrative Offenses of the Russian Federation - for a specific official guilty of an offense. However, when an entrepreneur turns out to be both, it turns out that he is fined twice. As the Constitutional Court of the Russian Federation indicated, this is contrary to the Constitution. The court noted that it is necessary to make changes to the Code of Administrative Offenses of the Russian Federation.