Deadlines for submitting the SZV-STAZH report in 2020

The SZV-STAGE form is submitted once a year to the Pension Fund office and contains information about the length of service of all personnel over the past year.

For the SZV-STAZH report, the deadlines for submission are quite long: from the beginning of January to the end of February, but no later than March 1. At the same time, the standards governing the deadlines for submitting the report do not contain information about postponing the deadline if it falls on a weekend. Since 03/01/2020 is a Sunday, it is safer to report before Friday 02/28/2020. In this case, the employer should report early during 2019 if:

- The employee applies for a pension.

The report is drawn up only for this employee and is submitted to the Pension Fund within 3 days from the date of his application for a pension.

- The employer is liquidated or closed.

SZV-STAZH is issued for all employees, including those who work under a civil contract (GPC), for the period from January 1 to the date of liquidation of the company (closure of the individual entrepreneur).

The deadlines for submitting the document to the Pension Fund branch are shown in the table:

According to paragraph 4 of Art. 11 of the Law “On Personal Accounting” dated 04/01/1996 No. 27-FZ, the employer is obliged to issue SZV-STAZH to the insured person upon dismissal, termination of a civil contract, as well as upon request. You need to issue a report:

- within 5 days from the date of the employee’s application;

- on the day of dismissal;

- on the day of termination of the civil contract.

In this case, the report is drawn up in the form of an extract about a specific insured person. In this case, there is no need to send anything to the Pension Fund.

Fine for SZV-STAZH not provided to a dismissed employee

When the dismissal of an employee is related to retirement, the company is obliged to submit an SZV-STAGE for it to the Pension Fund of the Russian Federation no later than three calendar days from the date of receipt of the person’s application. In addition, he needs to be given a copy of the completed form in hand on the day of dismissal (Article 11 of Law No. 27-FZ).

If the dismissal is not related to retirement, reporting should be done as usual (see previous section). But the employee is also given a copy of the information on the day of dismissal.

The employee is 55 years old and is retiring. On May 10, an application was submitted to the company.

Moreover, from 10.02. until 22.02. the woman was on sick leave, and from 01.05. to 05.05. - on administrative leave.

The company prepared the SZV-STAZH form and submitted one copy to the Pension Fund of Russia and gave the other to it.

This is interesting: Fine for losing a passport in 2020

For failure to comply with the above legislative requirements, the company and its officials face administrative liability under Article 5.27 of the Administrative Code (see Table 1).

Table 1

. Fines for failure to submit the SZV STAZH and failure to issue a copy to the employee

Amount for primary violation

Amount for repeated violation

1 - 5 thousand rubles or warning

Form and procedure for passing SZV-STAZH in 2020

The SZV-STAZH form was approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p. The report form can be downloaded here.

The decree does not provide for the submission of a zero form.

Read more about this in the material “SZV-STAZH - is zero reporting submitted?”

NOTE! If the company employs only a manager—the only founder—then the SZV-STAZH form must also be drawn up for him and submitted to the Pension Fund.

For a sample of filling out the SZV-STAZH form for 2020 and the nuances of filling it out, see the article “How to fill out the SZV-STAZH form for 2019 for submission in 2020?”

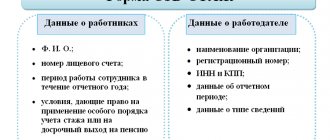

The report includes information about employees with whom employment or civil law contracts were in force in the previous year, regardless of whether wages were accrued to them:

- FULL NAME.;

- SNILS;

- period of work in the reporting year;

- information about working conditions;

- information about the employee's dismissal.

Employers have the right to submit a SZV-STAZH report to the Pension Fund of Russia both on paper and in electronic form. But a paper version of the report will be accepted only if the employer has 24 employees or fewer. If information is issued for 25 or more people, then only an electronic report format certified by an electronic signature is available (Clause 2 of Article 8 of Law No. 27-FZ).

When sending reports electronically, be sure to ensure that you receive a receipt from the Pension Fund for accepting the reports.

We explained why this needs to be done in the material “An important change in reporting to the Pension Fund from October 1, 2020.”

Fines for failure to pass SZV-STAZH in 2018

Articles on the topic

Form SZV-STAZH - annual. But in some cases it must be completed within a year. The Pension Fund of Russia will fine you for failure to submit the form on time. The amount of the fine varies. It depends on several factors.

MOVING FROM 1C TO BUCHSOFT Transferring data from your 1C is now easy! BukhSoft transfers all data without loss and checks it! Find out more ⟶

Filling out the SZV-STAZH online in the BukhSoft program will help you avoid a fine. It will automatically prepare a form for submission to the Pension Fund, taking into account all changes in legislation on the new form. The form will be tested by all PFR verification programs. Try it for free:

We also bring to your attention the new SZV-STAZH form and examples of filling it out in excel format:

Responsibility for late submission or errors in the SZV-STAZH form

Art. 17 of Law No. 27-FZ provides for the following financial sanctions against the employer:

- For failure to submit the SZV-STAZH report to the Pension Fund office within the established time frame, as well as for providing incorrect information about employees, the employer faces a fine of 500 rubles. for each insured person.

- If the form is submitted in paper form instead of an electronic file, the policyholder will be fined 1,000 rubles.

But that's not all. For failure to provide an employee with a copy of the SZV-STAZH upon dismissal, the employer faces liability for non-compliance with labor legislation, provided for in paragraph 1 of Art. 5.27 Code of Administrative Offences. The amount of sanctions in this case will be from 1,000 to 5,000 rubles. for officials and individual entrepreneurs who committed an offense, and from 30,000 to 50,000 rubles. to the employer as a legal entity.

Fine for late submission of SZV-STAZH to the Pension Fund of Russia

The Law on Accounting provides for the deadline for submission of the SZV-STAZH form on March 1 of the year following the reporting year (Article 11 of Law No. 27-FZ).

The amount of the fine for failure to file will depend on the number of insured employees who need to report. Article 17 of Law No. 27-FZ requires payment of 500 rubles for each such employee.

The company employs four employees. The company did not pass the SZV-STAZH for them. The amount of the fine will be:

500 rub. x 4 people = 2000 rub.

To avoid making mistakes with the form and in the calculations, use:

For incomplete and unreliable data specified in the form, the punishment is similar.

We recommend that you check the completed form (redblock - https://www.buhsoft.ru/testirovanie-otchetnosti) for errors and report in advance. The optimal time is mid-February. In this case, the company has enough time to resend the SZV-STAZH.

The Pension Fund often sets personal deadlines for submitting the report. The Foundation does this in order to reduce the load on reception centers. If there are a large number of reports received, technical failures may occur. Sending SZV-STAZH in the last days carries the risk of its untimely receipt by the Fund. It's safer to report in advance. But firms have the right to ignore the recommended deadlines. There are no penalties for this.

Who and how to take SZV-STAZH in 2020

The maintenance of individual records is regulated by Law 27-FZ dated April 1, 1996; unified forms are contained in Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 16, 2018. From the above documents it follows that the SZV-STAZh report is submitted in 2020 (Article 1 27-FZ):

- Russian and foreign legal entities;

- separate divisions that conduct independent accounting and have separate registration with the Pension Fund of Russia;

- family communities of the peoples of the Far North, Siberia and the Far East;

- farms;

- Individual entrepreneurs and individuals using hired labor;

- international organizations operating in the Russian Federation.

The form includes information about employees who have entered into a contract with the employer:

- Employment contracts.

- Civil contracts providing for the accrual of contributions to the public insurance company in the amount of the remuneration due (including author's order and licensing agreements).

Information about the length of service of citizens with official unemployed status is submitted to the fund by the employment service.

Based on Article 8 27-FZ, the SZV-STAZH report for 25 or more individuals is presented exclusively in the form of an electronic document via telecommunication channels or through the government services website. Policyholders with fewer employees may choose to submit the form on paper or electronically.

How to avoid a fine for SZV-M

In this situation, you can report on the next working day.

Although the rule on postponing deadlines is not directly provided for in paragraph 2.2 of Article 11 of Law No. 27-FZ dated 04/01/1996, you can proceed by analogy with the calculation of RSV-1 (PFR letter No. 09-19/4844 dated 04/07/2016). Why are formalists fined? There are two reasons for a fine:

- the report was not submitted on time;

- reported on time, but did not provide data on all employees and people with whom civil contracts were concluded.

In both cases, the fine is 500 rubles for each person indicated in the report. How to calculate the amount of the fine?

Deadline for submitting SZV-STAZH for 2020

The deadline for submitting the SZV-STAZH form for 2020 in accordance with the reporting deadlines approved in paragraph 2 of Article 11 of 27-FZ is March 2, 2020. The transfer from Sunday, March 1, to the next next working day is due to Art. 6.1 Tax Code of the Russian Federation.

In the event of liquidation or reorganization of the policyholder, information must be transferred to the Pension Fund of the Russian Federation within a month from the date of signing, respectively, the interim liquidation or separation balance sheet. If an employee applying for a pension writes an application asking for information about the periods worked in the current year, the SZV-STAGE form must be generated for him no later than 3 days later. For dismissed employees, data is submitted in the organization’s general report for the year in which the employment contract was terminated.

Is there a mandatory fine for late submission of documents in 2020?

For current explanations on filling out the report, read the article “Eight questions about SZV-M in 2020.” Attention: in 2020, the RSV-1 form was canceled.

But in addition to the SZV-M form, you must now submit a new report on the insurance experience of employees to the Pension Fund.

Read more about the new reporting to the Pension Fund in the materials of the magazine “Salary”:

- How to supplement or correct information in SZV-STAZH

- SZV-STAZH and six more mandatory documents for dismissed workers

- SZV-STAZH in 2020 upon liquidation of the company

You can choose a convenient subscription option, download the invoice and pay by card on our special page.

Procedure for filling out the SZV-STAZH report for 2020

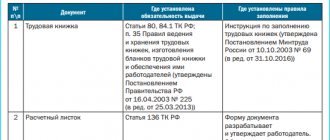

The employer must form a SZV-STAGE based on personnel orders, other personnel records, and information from civil contracts. You can fill out the paper form manually using block letters, ink or a ballpoint pen (any color except red and green). You can prepare and print a report using technical means (PCs, laptops, printers, etc.).

Section 1 “Information about the policyholder”

The first section must provide information that allows you to identify the employer:

- Registration number in the Pension Fund of Russia.

- TIN, consisting of twelve characters for individual entrepreneurs and individuals, and ten for legal entities (dashes are inserted in the remaining two positions).

- Checkpoint only for legal entities.

- The short name contained in the Charter, Certificate of Registration or in an identity document.

The type of form is also indicated here depending on the information it contains:

Supplementary reports are generated for employees whose data was missing or contained errors in the original ones. For persons who have reached retirement age, when applying for a pension, information is submitted for the time that has passed since the beginning of the current year. On March 1 of the following year, the same information is included in the original form.

Section 2 “Reporting period”

Section 2 indicates the period for which the SZV-STAZH is submitted:

- in the original form this is the previous year ended;

- in the form for calculating pensions - current.

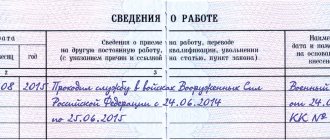

Section 3 “Information about the period of work of insured persons”

In columns 1 to 5 of the third section for each employee the following is indicated:

Next, enter information about the periods worked. If there are two or more of them, each is shown in a separate line, but columns 1-5 in the second and subsequent lines are not filled in. Data presentation format:

- from dd.mm.yyyy to dd.mm.yyyy, where

dd.mm.yyyy – day, month and year of start and end of work. These dates must be within the reporting period. For an employee who has worked the full year 2020, the first period will begin on 01/01/2019, and the last will end on 12/31/2019. When applying for a pension, the end of the period is the last day before the expected date of retirement.

In gr. 8 the code assigned to a certain category of territorial conditions is entered, which should be selected from the classifier (appendix to resolution 507p). In gr. 9, codes of working conditions are entered that give the right to early receipt of pension benefits. The codes are contained in the same classifier. For each period with special conditions, it is necessary to calculate the number of full months and days to be counted based on paragraphs 2.3.14 and 2.3.15 of resolution 507p. The results obtained are reflected in gr. 11. Codes for periods are also entered here:

- being on maternity or child care leave;

- provision of services and performance of work under a civil contract;

- filling a government position;

- off-the-job training courses;

- suspension from work through no fault of the employee;

- others.

When filling out the question often arises “What is DLOTPUSK in SZV-STAZH”, use the instructions and example.

If in gr. 11 you need to display more than one code, this is done in several lines. If available in gr. 11 designations of periods not included in the length of service giving the right to early retirement, in gr. Codes 8 and 9 are not entered.

In gr. 12 and 13 reflect the symbols and information necessary for calculating an early pension for periods of work during which contributions at the additional rate were paid. For example, if the code “PLANE” is in column 12, the flight hours are entered in column 13. For the code in column 12 “27-SM” in column 13 the rate or its share occupied by the medical worker is indicated. In gr. 14 data is entered:

- About the date of dismissal of the employee in the format dd.mm.yyyy.

- About the periods counted towards length of service for unemployed citizens. This may be the time of receiving unemployment benefits, being involved in public works, or moving to a place of employment. In column 14 the value “WITHOUT” is entered, and the start and end dates of the periods are entered in columns 6 and 7.

Sections 4-5

The fourth and fifth sections of the SZV-STAZH are filled out only in the form sent in connection with the assignment of a pension. Section 4 should confirm or refute the fact of accrual of insurance premiums at the basic and additional rates for the specified period of work. Section 5 is filled out by organizations that have agreements with non-state funds on early pension provision for workers with hazardous working conditions.

Rules for submitting reports using the SZV-TD form

Since 2020, employers have been generating a new SZV-TD report for the Pension Fund of Russia. The report is devoted to data included in work books. Its introduction is associated with the beginning of the accumulation of information about labor activity in electronic form for the purpose of maintaining electronic work books on its basis.

Data on personnel events is accumulated in a separate section of individual personal accounts, the creation and maintenance of which is assigned to the Pension Fund of Russia (clauses 1, 1.2 of Article 6 of the Law “On Individual (Personified) Accounting..." dated 04/01/1996 No. 27-FZ). The set of information for this section corresponds to the contents of the paper work book (clause 2.1 of article 6 of law No. 27-FZ).

In 2020, you must submit the SZV-TD report once a month no later than the 15th. It should reflect personnel events that occurred during the past month (subclause 1, clause 2.5, article 11 of law No. 27-FZ). If there were no such events, there is no need to submit a report.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Along with information about the current personnel event, the employee must also fill in information about his personnel status available to the reporting employer as of 01/01/2020.

If the number of employees exceeds 24 people, the SZV-TD should be sent to the Pension Fund electronically (clause 2.6 of Article 11 of Law No. 27-FZ).

The form of the report and the rules for filling it out were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p.

Report SZV-M and SZV-Stazh: general provisions

SZV-M and SZV-Stazh are forms of individual personalized accounting containing data about employees of the organization or employees of individual entrepreneurs. Control over the provision of personalized accounting information is assigned to the territorial bodies of the Pension Fund of Russia.

SZV-M includes individual data about the employee (full name, SNILS, INN), SZV-Experience - information about the periods of insurance coverage and the grounds for early registration of a pension.

Who serves

Reporting forms SZV-M and SZV-Stazh are submitted by all employers (both legal entities and entrepreneurs), regardless of the form of ownership, organizational structure, income level, or number of employees.

Obligations for the preparation and submission of SZV-M and SZV-Stazh are assigned, among other things:

- individuals registered as individual entrepreneurs with one or more employees;

- organizations that do not have employees, and whose activities are controlled by the director-sole founder;

- companies that are in the process of liquidation. In such cases, the report includes the individual liquidator with whom the GPC agreement was concluded, or members of the liquidation commission (if the agreement is executed for a company and not an individual).

The SZV-M and SZV-Stazh reports include all employees of the organization registered under employment contracts or brought to work on the basis of GPC agreements. The reports reflect information about employees who have worked in the organization from the 1st day.

Individual entrepreneurs submit reports SZV-M and SZV-Stazh for employees; information about themselves is not reflected in the reports.

Submission deadlines

The law establishes the following deadlines for submitting SZV-M and SZV-Stazh reports in 2020:

Submission form: electronic or paper

The form for submitting SZV-M and SZV-Stazh reports depends on the number of employees employed by the employer. If the average number of employees of an organization/individual entrepreneur is up to 24 people inclusive, then reporting forms can be submitted to the Pension Fund on paper. If the number of employees is 25 people or more, then the employer is obliged to submit SZV-M and SZV-Stazh reports exclusively in electronic form, via telecommunication channels.

Confirmation of submission of the electronic form SZV-M and SZV-Stazh is an electronic receipt for acceptance of documents received by the employer from the Pension Fund of Russia.

How to correct errors in the SZV-M form without penalties

The fact that he has no salary does not affect this obligation, nor does the absence of a properly executed employment contract. In the SZV-M form, policyholders must indicate the number of the compulsory pension insurance insurance certificate (SNILS), last name, first name, patronymic and TIN (if known) each insured person:

- performers under civil contracts (the subject of which is the provision of services or performance of work).

- officially employed part-time workers;

- full-time employees employed on the basis of an employment contract;

- remote employees with employment contracts;

This is interesting: There is a fine for violating the stop line

New fines for SZV-M and SZV-Stazh in 2020

On October 1, 2019, the legislative changes provided for by Order of the Ministry of Labor of the Russian Federation No. 385n dated June 14, 2019 came into force. The new provisions increase penalties for employers who file SZV-M and SZV-Stazh with errors.

New fines for SZV-M and SZV-Stazh have been in effect since October 1, 2019, so many organizations and individual entrepreneurs have already experienced them for themselves. To warn employers in 2020, we will talk in detail about the new sanctions.

According to the new procedure, employers who made errors in the SZV-M and SZV-Stazh reports can submit a corrective document no later than the standard reporting deadline. This rule applies to both the correction of errors discovered by the employer independently and the correction of information based on the comments of the Pension Fund.

In 2020, it will be possible to correct errors made in SZV-M and SZV-Stazh, and not “accumulate” a fine, provided that the corrective form is submitted:

- no later than the 15th day of the month following the reporting month - for SZV-M;

- no later than March 1 of the next reporting year - for SZV-Stazh.

If errors are discovered later than the established deadline, or earlier, but the employer was unable to submit the corrective form within the specified period, then in this case the Pension Fund of Russia will assess a fine in accordance with the general procedure.

Delay in filing SZV-M and SZV-Stazh: what threatens employers in 2019

In 2020, the following penalties are provided for employers who violated the deadline for providing SZV-M and SZV-Stazh:

- 1000 rub. for each full or partial month of delay in submitting a report;

- 500 rub. for each employee not included in the report, or for whom data was provided incorrectly.

If the employer discovers an error in the report, but submits the corrective form after the established deadline, then he is recognized as having violated the reporting procedure and general penalties are applied to him.

Example of calculating a fine

As of January 1, 2019, Factorial LLC employs 12 employees on the basis of employment contracts.

On January 21, 2019, a new employee was hired at Factorial LLC under a GPC agreement.

On 02/11/2019, the accountant of Factorial LLC submitted a SZV-M report to the Pension Fund of Russia, including 12 employees working under employment contracts. The employee hired under the civil process agreement was not included in the report.

On February 18, 2019, the accountant discovered a mistake and sent the Pension Fund of Russia a corrective form SZV-M, which included data on the new employee.

Since the corrective report was submitted later than the deadline (02/15/2019), the Pension Fund of the Russian Federation accrued to Factorial LLC:

- a fine of 1,000 rubles. for less than a month of delay in submitting the report;

- fine 500 rub. for failure to provide personalized accounting information for 1 employee.

Fines for late delivery of SZV-M in 2019 and the procedure for their collection

However, this does not mean that in practice levers cannot be found to reduce the fine. Firstly, not every Pension Fund employee will impose a fine on an employer who independently discovered and corrected inaccuracies in the submitted report.

Secondly, the company always retains the right to apply to the court to reduce the size of the sanctions imposed on it.

It is important to note that in 2020 there have been some changes that affect the filing of reports by employing companies.

From this year, control over insurance premiums, except for those paid “for injuries”, is carried out by the Federal Tax Service.

Regulatory framework

The SZV-STAZH form represents a relatively new format for reporting to the Pension Fund of Russia. It must be submitted to the Federal Tax Service every year. The reporting procedure submitted by policyholders – legal entities and individual entrepreneurs – has recently undergone changes. Today, this issue is being resolved by the Federal Tax and Duty Service, which accepts a single report in a new format .

But the funds managed to retain some of their powers, so they have recently introduced new reports. The updates are enshrined in Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2020. In accordance with them, policyholders undertake to provide the following forms:

- SZV-STAZH (information about the insurance experience of citizens working at the enterprise);

- EDV-1 (information about the policyholder transferred to the Pension Fund of the Russian Federation for the purpose of conducting personalized accounting operations);

- SZV-KORR (data on updating personal account information);

- SZV-ISH (information about earnings, amount of payments and other remuneration).

Where to take the SZV-STAZH

The SZV-STAZH form is submitted to the territorial body of the Pension Fund of the Russian Federation at the place of registration of the policyholder - a legal entity or an individual (clause 1 of Article 11 of Law No. 27-FZ).

An organization that includes separate subdivisions (OPs) submits SZV-STAZH at the place of registration of each “separate unit”, which (clause 3, clause 1, article 11 of the Federal Law of December 15, 2001 No. 167-FZ (hereinafter referred to as Law No. 167-FZ)):

- has a separate bank account(s);

- accrues payments and rewards in favor of individuals.

Please note that the above “signs of independence” of the OP have been applied since 2020. At the same time, the company no longer needs to independently register with the Pension Fund of the Russian Federation at the location of the “responsible” divisions created in 2020. The Federal Tax Service will provide all the necessary information for this (clause 2 of Article 11 of Law No. 167-FZ).

Do not forget! Starting from 2020, all Russian organizations are required to inform the tax authorities at their location about vesting a separate division with the authority to accrue payments and remuneration in favor of individuals. A month is allotted for this from the date of issuance of the order to vest the “isolation” with the appropriate powers (clause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation). Tax officials, in turn, will inform pensioners about this.

Responsibility measures

Relatively recently, policyholders began to report to the Pension Fund about their length of service by submitting the SZV-STAZH form. For erroneous data in the information provided, ignoring deadlines, or failure to provide a document, the law provides for penalties, the amounts of which will be discussed further.

Failure to submit a form in 2020

In paragraph 2 of Art. 11 Federal Law No. 27 of April 1, 1996 states that the employer must report to the Pension Fund by March 1 . This is the deadline when you need to provide information about the length of service gained by employees in the past year. Despite the fact that some branches of this organization have developed their own schedules for receiving information (before the due date), the fund has the right to charge fines only if the information was not submitted before March 1 (inclusive) .

The amount of fines imposed for ignoring the reporting requirement depends on the number of insured persons about whom information must be submitted. For each individual employed, you will have to pay 500 rubles, which is prescribed in Part 3 of Art. 17 Federal Law No. 27.

Providing Incorrect Data

Indication of false information that contradicts reality also implies the accrual of fines. It will also be impossible to avoid punishment if the employer makes an accidental mistake. The penalty amount will be 500 rubles for each individual in respect of whom incomplete or incorrect information is found.

In a number of situations, officials will also be forced to pay the amount of the penalty, as specified in Art. 15.33.2 Code of Administrative Offenses of the Russian Federation. However, there is a range of fines for them, amounting to 300-500 rubles .

Punishment will also follow if the format of the reporting provided is not followed. If the number of employees of the institution exceeds 25 people, the report is submitted using electronic channels. Ignoring this rule results in a fine in an amount equal to 1000 rubles.

Failure to issue the SZV-STAZH form to employees

The company that is the insurer is obliged to provide information about the length of service to employees who quit on the last day of work, which is prescribed in Part 4 of Art. 11 Federal Law No. 27. And this does not depend on whether the employee asks to show him a document or not.

Along with this, if the retiring specialist retires, it is required to send the data to the Pension Fund of the Russian Federation 3 days from the date of the employee’s request, as stated in Part 2 of Art. 11 Federal Law No. 27.

If the data was not presented to the employee and was not sent to the fund, the policyholder will be forced to pay a fine in accordance with the provisions of Art. 5.27 Code of Administrative Offenses of the Russian Federation. The amount in this case depends on several factors:

- the number of times the offense is committed;

- person who is subject to a penalty.

Late delivery deadline

The SZV-STAGE form contains detailed information about the insurance length of employees who were active and terminated. It also includes information about the persons with whom contracts were concluded. In Art. 11 Federal Law No. 27 states that the deadline for submitting the report is March 1 of the year following the reporting period. If you miss it, the employer will be forced to pay fines, the amount of which depends on the number of employees.

Who should take SZV-STAZH and for whom?

Information on the insurance experience of individuals in the SZV-STAZH form is submitted by all insurers (Article 1, Clause 1, Article 8 of Federal Law No. 27-FZ of April 1, 1996 (hereinafter referred to as Law No. 27-FZ)):

- organizations (including foreign) and their separate divisions;

- Individual entrepreneurs, notaries, lawyers, other private practitioners,

for insured persons performing work:

- under an employment contract;

- under a civil law agreement (GPC) (provided that insurance premiums are charged on the remuneration due).

In simple terms, SZV-STAZH must be passed by all employers for employees and customers under civil contracts for performers.

Notice! Individual entrepreneurs (lawyers, notaries, private detectives, etc.) without employees do not submit the SZV-STAZH form.

The fact is that the obligation to submit SZV-STAZH to the Pension Fund of the Russian Federation arises from policyholders (clause 2 of Article 11 of Law No. 27-FZ). And an entrepreneur (notary, lawyer, etc.) becomes an insured only when he enters into an employment contract or a GPC agreement with an individual and registers with the Pension Fund as an insured (Clause 1, Article 11 of Law No. 27-FZ).

Thus, an individual entrepreneur without employees (contractors) does not provide information about the insurance period at all.

How to transfer a copy correctly

In a number of situations, the Pension Fund offers legal entities and officials personal deadlines for submitting reporting documentation . This approach helps reduce the load on reception points during the period when legal entities begin to bring filled out forms en masse.

Traditionally, such situations arise in the last days before reporting deadlines. Institutions have the right to ignore them and report on a general basis until March 1 without the need to subsequently pay fines .

Will there be a fine for incorrectly filling out SZV-STAZH?

In the resolution dated March 24, 2020 in case No. A14-4671/2019, the Central District Court explained whether the accuracy of information about insured persons is affected by the indication in the SZV-STAZH form of work periods and vacation periods in the wrong order.

The crux of the matter

The company, within the prescribed period, submitted to the Pension Fund information about the insurance experience of the insured persons in the SZV-STAZH form. Fund specialists discovered errors in the information provided. They consisted in the fact that the company incorrectly indicated the work periods and vacation periods for a number of employees.

The pension fund sent a notice to the company with a proposal to eliminate the violations within five days. Having not received corrected information from the company within this period, the fund sent it a second notification. The next day after receiving the repeated notification, the company submitted a revised SZV-STAZH form.

The fund's specialists considered that the clarifying information was submitted in violation of the five-day deadline and brought the company to justice under Art. 17 of the Federal Law of 01.04.96 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system” (hereinafter referred to as Law No. 27-FZ). According to this norm, failure by the policyholder to provide within the prescribed period or provision of incomplete and (or) false information is punishable by a fine of 500 rubles. for each insured person.

The company went to court.

Court decision

Article 15 of Law No. 27-FZ provides for the right of the policyholder to supplement and clarify the information transmitted to him about the insured persons. Individual information is provided by policyholders in written or electronic form in accordance with the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons, approved by Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n (hereinafter referred to as the Instructions).

Paragraph 37 of the Instructions establishes that if errors are detected in the individual information provided, the policyholder is given a notification that they have been corrected. Within five working days from the date of receipt of the notification, the policyholder must submit updated individual information to the Pension Fund.

The courts indicated that in the reporting form the company mixed up the order of indicating the work periods and vacation periods of the insured persons, as a result of which it was fined for providing false information. However, the Pension Fund did not take into account that the list of information annually submitted by policyholders, given in Part 2 of Art. 11 of Law No. 27-FZ is exhaustive and is not subject to broad interpretation. This list does not say that information regarding periods of work and vacation periods of insured persons must be submitted in a certain order. In addition, indicating work periods and vacation periods in the wrong order does not and cannot affect the accuracy or otherwise of the information. Therefore, the shortcomings committed by the company do not form the objective side of the offense charged to it.

The courts also noted that the company submitted the original report within the statutory deadline. After receiving the relevant notifications, she took prompt action and quickly corrected certain items in the report, which demonstrates her conscientious behavior. Thus, the Pension Fund had no grounds for applying penalties to the company.

What information is indicated?

One page of the document must contain the following details :

- FULL NAME;

- SNILS;

- working conditions code;

- code of grounds for early retirement;

- duration of performance of labor duties at the enterprise.

Each form must be completed by one employee only. Next, it is certified by the signature of the originator. Certification is carried out by hand or in electronic format. The color used to design the document can be any color, but not green or red.

In order to correctly fill out the document, it is necessary to enter the following information about the insured person:

- salary and other income information;

- information about benefits provided to employees;

- materials on insurance premiums;

- data on the period of the citizen’s labor activity, including corrective information.

Who takes the SZV-TD and when does the fine arise?

Personnel events requiring the submission of a report are as follows (clause 2.4 of article 11 of law No. 27-FZ, clause 1.4 of appendix No. 2 to resolution No. 730p):

- recruitment;

- dismissal;

- transfer to another job of a permanent nature;

- establishing another profession or qualification;

- canceling a previously recorded personnel event;

- receiving an application from the employee to choose the method of maintaining a work record book;

- receiving from an employee an application for the provision of information about his work activities, accumulated in electronic form.

The list is open. Therefore, the report should also be generated in relation to other personnel situations that previously required reflection in a paper work book (for example, renaming an employer or prohibiting an employee from holding a certain position).

All persons with whom employment agreements have been concluded, including part-time workers and remote working employees (clause 1.4 of Appendix No. 2 to Resolution No. 730p) must get into SZV-TD (if there are related personnel events).

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

Like any other information reflected on an individual personal account, data on labor activity must be:

- reliable;

- full;

- submitted to the Pension Fund on time.

Failure to comply with these requirements leads to a fine (Article 17 of Law No. 27-FZ). Responsibility is administrative, i.e. it is established by the Code of Administrative Offenses of the Russian Federation and is equivalent to that applied for violations of labor legislation.

Another type of violation related to the submission of SZV-TD is non-compliance with the method of sending the report to the Pension Fund for employers who are required to submit it electronically. The fine for this offense is established by Law No. 27-FZ.

Changes in 2020

Representatives of the Government of the Russian Federation developed and approved a new form of this form for 2020, so there have been some changes in the structure of the document.

- Props "page" has been completely eliminated, so specifying the page number value is no longer required.

- There is no need to duplicate the TIN, checkpoint, or registration number.

The changes also affected the rules for drawing up the document.

- Column 8 does not need to be filled out if column 11 contains the code value DETIPRL.

- The list of persons for whom reports are submitted has been expanded. Additionally, changes were made to clause 1.5. The heads of enterprises, who were the only participants, were included in the form.

- Adjustments were also made to the procedure by which the report is filled out by the Employment Center. Currently in gr. 14 the indication “BEZR” is required.

Structure of SZV-STAZH and procedure for filling out the form

The SZV-STAZH form includes five sections:

- section 1. “Information about the policyholder”;

- section 2. “Reporting period”;

- Section 3. “Information about the period of work of the insured persons”;

- Section 4. “Information on accrued (paid) insurance contributions for compulsory pension insurance”;

- Section 5. “Information on paid pension contributions in accordance with pension agreements for early non-state pension provision.

The procedure for filling out section 1 of the SZV-STAZH form

Section 1 of the SZV-STAZH form indicates the registration number in the Pension Fund of the Russian Federation, INN and KPP, as well as the short name of the policyholder in the fields of the same name.

In the “Information Type” block, an “X” indicates the type of form being presented:

- “initial” – if information is submitted for the first time;

- “supplementary” – if the original information contains errors that do not allow the data on the personal accounts of individuals to be taken into account;

- “appointment of pension” - if in order to assign a pension, an individual needs to take into account the period of work in the calendar year for which the SZV-STAZH form has not yet been submitted.

The procedure for filling out section 2 of the SZV-STAZH form

Section 2 of the SZV-STAGE form indicates the reporting period - the calendar year for which information about the insurance period is provided. For example, when submitting a report for 2020, the policyholder will enter the value “2017” in the “Reporting period” field.

The procedure for filling out section 3 of the SZV-STAZH form

In section 3 of the SZV-STAGE form, the following information is indicated for each insured person: full name (columns 2-4), SNILS (column 5), periods of work (columns 6 and 7), special codes regarding periods of work (column 11).

Remember the following rules:

- Last name, first name, patronymic “physicist” are indicated in the nominative case;

- Information regarding periods of work of an individual should not extend beyond the reporting period. For example, when reporting for 2017, dates can only be within the period from 01/01/2017 to 12/31/2017;

- When filling out SZV-STAZH with the “pension assignment” type, the period of work is filled in up to the date of expected retirement.

The table below presents some codes that the policyholder must use to explain the periods of work of the insured person. Let us recall that until 2020, section 6 of the RSV-1 form was filled out using a similar principle. Now this principle is used in SZV-STAZH.

| Code | Explanation |

| "AGREEMENT", "NEOPLDOG", "NEOPLAUT" | These codes are used to indicate periods of work under civil contracts. If payment to the contractor was made during the reporting period, then the code “AGREEMENT” is indicated. Otherwise, the code “NEOPLDOG” or “NEOPLAVT” is entered. |

| "CHILDREN" | This code is used to indicate the period of parental leave |

| "NEOPL" | This code is used to designate a period of unpaid leave, downtime due to the fault of the employee, an unpaid period of suspension from work (preclusion from work), etc. |

| "QUALIF" | This code is used to indicate a period of off-the-job training |

| "SOCIETY" | This code is used to indicate the period of performance of state or public duties |

| "SDKROV" | This code is used to indicate the days of donation of blood and its components and the days of rest provided in connection with this |

| "SUSPENDED" | This code is used to indicate a period of suspension from work (non-admission to work) through no fault of the employee |

| "UCHOTVUSK" | This code is used to indicate the period of additional leave for employees combining work and study |

| "DLCHILDREN" | This code is used to indicate the period of parental leave from 1.5 to 3 years |

| "Chernobyl Nuclear Power Plant" | This code is used to indicate the period of additional leave for citizens exposed to radiation due to the Chernobyl disaster |

| "DOPVIKH" | This code is used to indicate additional days off for carers of disabled children |