Let's figure out what kind of fine threatens if the individual entrepreneur does not register the employee

Next, the employer must issue a hiring order and make a corresponding entry in the labor record.

From this moment on, the applicant officially becomes a full-fledged employee of the company. If an individual entrepreneur does not register an employee, the fine in accordance with 5.27 of the Code of Administrative Offenses of the Russian Federation will range from 5 to 10 thousand rubles. In case of repeated violation, the amount increases to 30-40 thousand. In addition, the relevant authorities have the right to stop the activities of individual entrepreneurs for a period of up to 90 days, which most often means the loss of a much larger amount. It is quite simple to establish the presence of unregistered employees of an individual owner. For example, when submitting reports to the tax office, inspectors may pay attention to the total volume of work performed (goods produced, services provided). If it becomes clear that one person is simply not able to do all this himself, then questions will arise for the businessman. Therefore, hiding such an employee is more difficult than some entrepreneurs might think.

Responsibility for the employment of migrants

Illegal employment of refugees is an even greater responsibility

An even more serious offense for an employer is the employment of illegal migrants. Organization managers have to be extremely careful when attracting foreigners to work: in this case, the company is guaranteed constant attention from regulatory authorities. The most common violations:

- The employee started work illegally, that is, he does not have a patent or other permits. In this case, he may be deported from the country, and large fines will be imposed on the employer.

- The employer did not notify the migration service about hiring a foreigner, or the notification was submitted untimely. It is necessary to notify the FMS even after termination of a contract with a foreign citizen.

- The foreigner was hired in a profession other than that specified in his patent. In this case, he will need to be fired, and the employer will have to pay a fine.

- The company uses foreign labor without obtaining special permission.

In these and other cases of violation of migration legislation, officials face a fine of 35 to 70 thousand rubles, and legal entities face a fine of up to a million rubles.

In addition, if illegal hiring of foreign labor is detected, the organization’s activities are suspended for a period of 14-90 days, which leads to very serious losses. Strengthened state control forces organizations to refuse to hire foreign labor or strictly comply with all required formalities.

Fine for an unregistered employee

- conclude an employment contract with him;

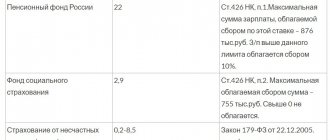

- be registered with the Pension Fund of Russia and the Social Insurance Fund and submit relevant reports there on time;

- document the personnel procedure: application from the person being hired, enrollment order, registration of a personal card, entry in the employment record, signature in familiarization with the job description, etc.

The fact of a violation can be revealed as a result of a desk (upon submission of reports) or an on-site (in-depth and thorough) inspection. Tax officials have the right to study in detail the current year of activity and the 3 previous ones, while they are allowed by law to interview witnesses, inspect premises, seize documents, etc.

Fine for an unregistered individual entrepreneur 2020 for

During their work, any entrepreneurs, including individual entrepreneurs, can commit offenses in various areas of legislation: tax, labor and others. These offenses can be committed either intentionally, on purpose, or through ignorance or mistake. In all cases, this is punishable by up to a criminal article. But more often this punishment comes in the form of a fine.

- Special or intentional. Some individual entrepreneurs may deliberately violate the law, for example, in order not to pay taxes or pay them in a smaller amount.

- Random. In its activities, an individual entrepreneur, like any other entrepreneur, has to deal with a huge amount of information. Therefore, it is not difficult to make a mistake, for example due to inattention, for which, nevertheless, you will need to bear responsibility.

- Out of ignorance or lack of experience. Some individual entrepreneurs may try to optimize their finances, in particular tax payments: legislation allows this to be done, for example, by choosing a taxation system, by choosing a method for writing off goods, etc. But due to insufficient preparation of the individual entrepreneur or his accountant, an error may occur.

Fine for an unregistered individual entrepreneur 2020 for

First of all, a new chapter 50.1 has been introduced into the Labor Code of the Russian Federation, which is entirely devoted to regulating the labor of foreign workers. This means that foreigners have finally and irrevocably been equalized in legal status with Russian citizens, including in terms of guarantees. An employment contract with a foreign worker will need to include information about his work permit and documents confirming the legality of his stay on the territory of the Russian Federation.

We recommend reading: You Can Sell Your Apartment If You Have a Writ of Execution

I advise you to contact them if necessary. I opened an IP here. Satisfied, everything was fast, no problems. Very nice girls in the department))) Quite a good price, many others were more expensive when I was choosing. They explained everything in detail and gave advice on many issues. It’s very convenient that they took me to the notary right away, again, a nice girl went with me))))))))) When I opened an individual entrepreneur, I didn’t need an account, now I do, right now I’m also opening it through ECLEX, they have such a service there too, again very convenient.

Fine for unregistered individual entrepreneur 2020-2020 for

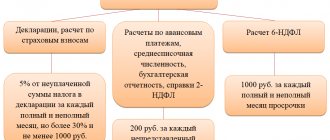

This type of liability occurs if there has been large-scale tax evasion for an unregistered employee. Types and extent of liability for an unregistered employee If an individual entrepreneur or an official of an organization evades registration of an employee, administrative or criminal liability arises. It depends on the type of responsibility what fine for an unregistered employee must be paid. The extent of responsibility of an individual entrepreneur for an unregistered employee: According to the Code of Administrative Offenses of the Russian Federation - penalties from 1000 to 5000 rubles.

Minimum wage and salary: when comparing, do not forget about allowances and regional coefficients. The salary of an employee who has worked his full working hours for the month cannot be less than the minimum wage. In this case, the salary is taken into account taking into account all allowances and increasing factors.

What fines can an employer face for evading personnel registration?

Responsibility for neglecting employment rules largely depends on the status of the employee. Affects the severity of the sanction and the severity of the offense. In most cases, labor inspection is limited to monetary fines.

| Violation | Short description | A comment |

| Employee evasion | The employer faces administrative liability. Article 5.27 of the Code of Administrative Offenses of the Russian Federation provides for a monetary penalty of 5–10 thousand rubles. A fine is imposed for refusing to draw up an employment contract or drawing up a civil agreement instead. Lack of documents entails a number of negative consequences. The audit materials are transferred to the tax service. The employer has to pay insurance fees on remuneration for the entire period of employment. Additionally, the merchant is subject to fines under Art. 122 of the Tax Code of the Russian Federation. The amount of recovery is 20% of the arrears. If the regulatory authority manages to prove intent, the fine increases to 40%. The entrepreneur also has to pay penalties. Another fine will be imposed for failure to fulfill the duties of a tax agent for personal income tax. The recovery will be 20% of the amounts payable to the budget (Article 123 of the Tax Code of the Russian Federation) | Article 2.4 of the Code of Administrative Offenses of the Russian Federation classifies entrepreneurs as officials. Punishment is assigned to them in accordance with the specified status. When applying sanctions for offenses provided for in Chapter 18 of the Code of Administrative Offenses of the Russian Federation, entrepreneurs are treated as legal entities (Article 18.1 of the Code of Administrative Offenses of the Russian Federation) |

| Illegal employment of foreigners and stateless persons | The fine for individual entrepreneurs for an unregistered foreign worker in 2020 is provided for in Art. 18.15 Code of Administrative Offenses of the Russian Federation. Thus, violation of employment rules will cost an entrepreneur 250–800 thousand rubles. The same amount will be charged to a businessman if he was required to obtain a special permit to hire a migrant. For neglecting the procedure for notifying the bodies of the Ministry of Internal Affairs of the Russian Federation, you will have to pay another 400-800 thousand rubles. An alternative sanction in all cases is suspension of work for 14–90 days. If the violation was committed by employers in Moscow, the Moscow region, the Leningrad region or St. Petersburg, the sanctions will be harsher. The fourth part of Art. 18.15 of the Code of Administrative Offenses of the Russian Federation provides for increased fines. The recovery will be 400,000–1,000,000 rubles. A separate component is the use of illegal migrant labor at retail sites. In this case, Art. 18.16 Code of Administrative Offenses of the Russian Federation. Entrepreneurs face a penalty of 350–700 thousand rubles or administrative blocking of activities for 90 days. In the capital, St. Petersburg, Leningrad region and Moscow region, the fine increases to 450,000–1,000,000 rubles. Additional fines will be imposed under Art. Art. 122 and 123 of the Tax Code of the Russian Federation. Their size does not differ from the sanctions imposed for Russians evading registration. |

Labor law compliance audits rarely involve identifying a single violation. As a rule, an entrepreneur commits a number of offenses. As a result, the penalties are cumulative. When answering the question of what fine you will have to pay for an unregistered employee, it is worth remembering an integrated approach. The penalty increases if violations of labor protection legislation are discovered. Thus, evasion of providing an employee with personal protective equipment is punishable under Art. 5.27.1 Code of Administrative Offenses of the Russian Federation. The fine under the fourth point of the norm is 20–30 thousand rubles. Responsibility will also come for refusal to conduct a special assessment of the workplace (5–10 thousand), lack of instruction, training, internship (15–25 thousand).

Individual entrepreneur fine for an unregistered employee 2020

Under these circumstances, the individual violator will face administrative or criminal liability. Its type depends on the period during which the worker was not registered, and, accordingly, mandatory payments were not received for him. This will allow you to calculate the amount of damage caused. If this period is, say, several months, it is worth waiting for administrative consequences. And if it is several years, they will be punished criminally.

If an individual entrepreneur evades formalization or improperly formalizes an employment contract or has entered into a civil contract that actually regulates labor relations between the employee and the employer, he may face a fine under Part 4 of this article in the amount of 5,000–10,000 rubles, in case of repeated violation the fine will increase to 30,000–40,000 rubles.

Criminal liability of the employer-entrepreneur

Law enforcement officers initiate a case if a businessman causes major damage to the budget or causes serious harm to an employee. Bringing unscrupulous employers to criminal liability is carried out on the following grounds:

- Evasion of payment of insurance fees (Article 198 of the Criminal Code of the Russian Federation). An act is recognized as a crime when the arrears reach 900 thousand rubles for 3 years in a row. The share of unpaid contributions must be at least 10% of the entrepreneur’s total obligations to state funds and the budget. In addition, major damage is considered to be 2,700,000 rubles. In this case, the period of the debt and its relationship with other deductions are not taken into account. The punishment for the crime is a criminal fine of 100–300 thousand rubles, forced labor for up to 1 year, arrest for 6 months or imprisonment in a correctional institution for a year. If the convicted person does not have the funds to pay the fine, his earnings (income) for a period of up to 2 years are withheld. Sanctions become tougher when the arrears reach a particularly large size. This is recognized as a debt of 4,500,000 for 3 years (20% of total liabilities) or 13,500,000 rubles for the entire period of violation.

- Delay of wages (Article 145.1 of the Criminal Code of the Russian Federation). If evasion from concluding an employment contract is accompanied by withholding money, the entrepreneur also faces criminal liability. Partial non-payment of labor for 3 months or more will result in a fine of up to 120 thousand rubles, disqualification for up to 1 year, forced labor for up to 2 years or imprisonment for 12 months for a businessman. If a businessman does not pay wages at all for more than 2 months in a row, the punishment becomes more severe. The fine increases to 500 thousand rubles, and the period of disqualification and detention in a correctional institution is up to 3 years.

- Neglect of labor protection rules (Article 143 of the Criminal Code of the Russian Federation). Unofficial employment is often accompanied by a violation of the procedures for training, testing knowledge, and conducting internships. Illegal workers are not fully provided with protective equipment. If, as a result of such violations, serious harm is caused to people’s health, the entrepreneur faces a fine of up to 400 thousand rubles, compulsory work for 180–240 hours, imprisonment for a year with or without disqualification, as well as correctional labor for 12 months. Much tougher sanctions are provided for crimes that lead to the death of an employee. The maximum penalty for such an act will be 5 years of imprisonment in a correctional institution.

Criminal legislation does not distinguish between Russians and foreign workers. Individual entrepreneur fines for unregistered employees are assessed according to uniform rules, and other types of punishments are applied by the court, taking into account the gravity of the act.

Fines for an individual entrepreneur for an unregistered employee

The situation is particularly acute in the case of dismissal, since unscrupulous employers refuse final payment and do not pay compensation for unused vacation. It is almost impossible to recover these amounts in court, since there is no evidence of labor relations.

The employee must perform his duties in accordance with the job description. The employer, in turn, provides all conditions for carrying out work activities. In addition, he is obliged to calculate wages and transfer taxes and contributions to regulatory authorities. Also, the individual entrepreneur must provide vacation according to the schedule and pay sick leave.

What fine does an individual entrepreneur receive for an unregistered employee?

The size of the sanction will depend on the losses caused by the employer to the state . Among other things, its legal status matters: whether it carries out entrepreneurial activities or is a private organization. A separate type of punishment is provided, among other things, for the employment of illegal migrants. Let's look at each of these aspects in more detail.

All entrepreneurs and organizations, regardless of their type of activity, must comply with Russian legislation. They are also responsible for the official employment of hired workers. To do this, you need to draw up a written contract with the future employee - then there will definitely be no problems with the law. But the use of labor resources without a supporting document is a fairly major violation of the Labor Code of the Russian Federation.

We recommend reading: Which categories of Chernobyl victims have benefits for kindergarten

Fine Individual Entrepreneur for an Unregistered Worker 2020

If inaccuracies or errors are discovered in employment contracts, employees working in individual entrepreneurs may also be issued a fine . For minor offenses, such as delay in drawing up a contract by several days, inaccuracies or errors in its content, etc., it is also appointed.

In our country, quite often you can encounter a situation where individual entrepreneurs, in an attempt to save on taxes, do not enter into employment contracts with an employee. This is a direct violation of the legislation of the Russian Federation and is punishable in accordance with it. It is worth considering this issue in detail.

Liability for legal entities

For legal entities, responsibility falls both on the organization itself and personally on the personnel responsible for hiring, for example, the head of the organization and the human resources department. Evasion from concluding an employment contract entails a fine on a legal entity from 50 to 100 thousand rubles. Officials are subject to a fine of 10-20 thousand rubles.

Repeated cases, according to the Code of Administrative Offenses, increase the fine to 200 thousand rubles. And officials will face dismissal under the article and disqualification for up to three years.

Fine for unregistered individual entrepreneurs

Like organizations, individual entrepreneurs must strictly comply with the requirements of labor legislation when hiring employees. Employment must necessarily be accompanied by the execution of a contract: it is drawn up in two copies - one remains with the employer, the second - with the employee. If the employee began his duties before the contract was signed, the employer is given only three days to complete all formalities and prepare the necessary documents. REASONS FOR FINES FOR UNOFFICIAL EMPLOYMENT An unregistered worker is a harm to the state.

We decided to summarize the most popular questions we received and answer them in this article. Question 1. What fines are provided for carrying out trade without registering an individual entrepreneur and carrying out other business activities without registering an individual entrepreneur? Responsibility for committing an administrative offense expressed in carrying out business activities without state registration as an individual entrepreneur (including the sale of goods without registration as an individual entrepreneur) is provided for by the Code of Administrative Offenses of the Russian Federation.

Is it necessary to officially register an employee with an individual entrepreneur?

Official registration of an employee with an individual entrepreneur is a prerequisite. As soon as an individual entrepreneur enters into an employment contract with a person, he actually becomes an employer. This agreement must be concluded no later than three days from the date of hiring. Within 10 days, the individual entrepreneur registers the workforce with the Social Insurance Fund, and within 30 days with the Pension Fund. An unemployed individual entrepreneur faces a fine.

What fine is imposed if illegal employees are identified?

Also, for everyone who has worked for more than five days, it is necessary to issue work books. The maintenance of books is regulated on the basis of the Labor Code and other regulations.

Important! Labor legislation is mandatory for employers to comply with.

When an employee comes to an entrepreneur, the individual entrepreneur must ask him for registration:

- passport;

- book about work activity;

- military ID. Provided to men between 18 and 27 years of age who are eligible for military service;

- TIN. If the employee is not an individual entrepreneur, then it is not necessary to have a TIN;

- medical book. Its presence is necessary for workers in the catering industry, medicine, and salespeople in grocery stores;

- a document from the Ministry of Internal Affairs stating that there is no criminal record;

- educational documents.

Referring to these papers, the individual entrepreneur draws up an employment contract. It must be in two copies. There is a standard form of the agreement, but it is possible to make changes and additions to it.

The agreement must necessarily indicate:

- FULL NAME;

- information from the passport;

- the place where the contract is drawn up, as well as the date of conclusion.

Also, the drawn up contract specifies information such as position, working hours, benefits, etc.

After the contract is concluded, it is necessary to issue an order stating that the person has been hired, as well as make an entry in the work book.

The employee is obliged to perform his functions on the basis of the job description. The individual entrepreneur must create all the conditions for performing these functions. The responsibilities of the IP also include:

- payroll;

- transfer of contributions and taxes to the relevant authorities;

- granting leave;

- sick pay.

Important! The relationship between employer and employee is regulated by the Labor Code.

Based on Article 64 of the Labor Code, an individual entrepreneur cannot unreasonably refuse a person a job. In case of any violation of their rights, a person can contact the labor inspectorate.

Fine for unregistered individual entrepreneurs

This document, which must be in writing, must contain the signatures of the employer and the person taking up the position. Copies of the agreement must be kept by both parties. If it is established that there is an employee in the organization who has not gone through the official registration process, a fine will be collected from the responsible person of the enterprise.

Responsibility of individual entrepreneurs for unregistered employees An individual entrepreneur must, by law, register all of his employees. In addition, starting from 2020, the responsibility of individual entrepreneurs for unregistered workers is becoming stricter. By neglecting to draw up an employment contract, the individual entrepreneur exposes not only the employee, but also himself. Read on to find out what a fictitious staff threatens an entrepreneur with. An unregistered employee is a loss both for the state (the individual entrepreneur does not pay taxes for him) and for the employee (he does not have seniority and does not receive a pension).

Reasons to impose a fine on an individual entrepreneur

An individual entrepreneur can be held liable if he:

- actually allowed a person to work without properly registering the employment relationship;

- does not pay taxes, fees and charges for an illegal employee;

- provides false information to regulatory authorities;

- engages a foreigner as an employee without complying with the legally established procedure;

- provides accommodation to a migrant without appropriate documents;

- uses the labor of an officially undocumented foreigner.

The peculiarity of cases involving the involvement of individual entrepreneurs for illegal workers is that the commission of one offense entails a number of other illegal acts. For example: at first he did not formally register the employee, and accordingly, he evades paying taxes, fees and contributions, which entails administrative sanctions. If the amount is sufficient, they may be prosecuted.

Rice. 2. Roundup of illegal foreign workers.

About the responsibility of individual entrepreneurs for hiring foreigners without a patent in the following story:

What to do as an illegal immigrant

The worker himself suffers most from unofficial employment. It deprives him of social guarantees: length of service, contributions to a future pension, payment for sick time, labor holidays, maternity benefits. In addition, the entrepreneur can leave such an employee without wages for the time worked.

In the latter case, you must file a complaint. You can simultaneously write a statement to the police and the prosecutor’s office and support it with the necessary evidence: documents, photographs, videos, witness statements, etc.

How an employee who worked for almost a year without official registration solved his problem is described in the following story:

What is the expected fine for individual entrepreneurs for unregistered workers?

Registration first of all consists in the fact that an employment contract is drawn up between the individual entrepreneur and the employee, which serves as documentary evidence of official registration. This document contains the most important information about both the employee and the entrepreneur. It also contains a lot of other necessary data, and this includes the position that the employee will hold, his salary and responsibilities. This document must be signed by both parties, otherwise it will not have any legal force.

If, in the event of significant violations, the entrepreneur is not given a real or suspended prison sentence, then another punishment may be applied. It may consist of a ban on future business activities or a ban on working in a specific area of activity in which the violation was detected.