Concepts of maternity leave and length of service

In the scientific literature you can find the general concept of vacation. This includes time while the employee is not working caring for children. There are several reasons for using rest:

- birth of a baby into a family

- the need for further care

Enterprise management and employees view maternity leave as paid days of rest. This right is guaranteed by law. The leave can be used by the father, mother or other relative who cares for the baby after birth. Initially, the woman goes on sick leave. The duration is set to 140 days. In some situations, the vacation is extended.

The grounds for extension are:

- woman bears several children

- complications when a baby is born

A woman carrying a child can take advantage of this right. Payment is accrued throughout the sick leave period. The main condition is the official registration of labor relations.

Law No. 173 provides that sick leave must be included in the total length of service. During this time, the management of the enterprise transfers funds for the employee to the pension authorities. At the end of sick leave, you need to decide whether to go on maternity leave or not.

The maternity period can last until the child is one and a half or three years old. The legislator indicates that the time while benefits are transferred to the employee is included in the length of service. This continues until the baby reaches one and a half years of age.

See what length of service includes for calculating a pension:

How to correctly calculate length of service on maternity leave?

Upon reaching retirement age and retiring, the pension fund will make all the necessary calculations automatically. This is due to the fact that the employer insures all of its employees. And when a woman goes on maternity leave, after providing sick leave, the pension fund will receive all the necessary data from the employee’s personal account. When calculating pension contributions, the time spent on vacation from the moment of leaving until the child reaches 1.5 years will be taken into account.

If we summarize all the information described above in this article, it turns out that:

- Pregnancy and childbirth are included in the length of service (the number of children and duration does not matter);

- Child care – up to 1.5 years and a total of not exceeding 6 years;

- Child care after 1.5 years is not included in the calculation;

- Caring for a child of any age is not included in the calculation if the total time spent caring for previous children is already more than 6 years.

All pension payments can be guaranteed only if all necessary conditions are met:

- The woman must be registered in the social insurance system;

- The age must correspond to the generally accepted or preferential age;

- You must also achieve a minimum work experience.

Does maternity leave count?

The order of the Ministry of Health reflects the sequence of actions that must be performed to calculate the periods included in the length of service. The act states that a month contains thirty days, a year - twelve months. If the period when the employee cared for the baby coincides, the days are counted taking into account what is reflected in the application of the expectant mother. Sometimes the documentation does not reflect the dates when the woman was employed and began to use the right to leave - the calculation begins in July. If the date is not specified, the middle of the month is taken as the basis.

To apply for maternity leave for the expectant mother, you will need to present to the management of the organization a paper issued by the housing complex, where the woman is registered. A certificate is used to prove the presence of pregnancy.

Conditions for inclusion

It is necessary to follow the procedure reflected in the law so that the woman retains the right to receive payments. Since the beginning of 2007, new rules have been introduced; they provide for the need to take into account the established restrictions. This concerns the limitation of the deadline for calculating length of service. A maximum of six years of experience is accrued for the period under review.

During this time, a woman can give birth to four children. Accordingly, when each child reaches one and a half years of age, further time spent on vacation is not included in the length of service.

Legal acts do not limit the number of decrees. A woman uses this right at her own discretion. It is necessary to take into account the nuances that arise when a mother leaves from one maternity leave to another. The time while a woman cares for a baby is, to a certain extent, included in the length of service.

From maternity leave to maternity leave: payments for the second

Is maternity leave included in the length of service for establishing pension payments, or will the woman have to work off the missing years? In this article we will analyze the rules for accounting for periods of temporary disability associated with the birth of a child.

How do maternity leave and length of service relate? Every working woman preparing to become a mother seeks an answer to this question.

She needs to decide whether to devote herself to the child throughout the entire time allotted by the laws or to go to work as early as possible, trying to reduce the period of forced leave in order to take care of her future pension.

In order for this dilemma to be resolved to everyone’s satisfaction, let us consider the legal norms and legislative innovations relating to this issue.

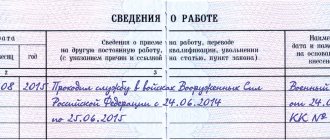

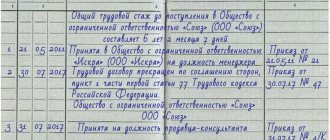

Some employees of the Pension Fund are wondering how to correctly calculate the length of service according to the work book using computer programs. First you need to collect data on those periods of time during which the owner of the work not only worked, but also:

- studied;

- received any social benefits;

- was on maternity leave (up to one and a half years);

- was registered with the employment service;

- was in public service;

- participated in the political or public life of the country;

- served time in prison;

- was listed among political prisoners.

After collecting all the data, you need to select the desired program. The popular 1C program is best suited for counting. You should enter digital values in the free fields, and you can get information about the periods of interest for the employee’s activity by selecting the required section in the menu.

Calculating continuous work experience is meaningless. It does not bring a person any benefit in the form of additional social benefits or other allowances.

When you go on maternity leave for the first time, everything is clear: sick leave payments and compensation calculations based on length of service. But, if an employee, while on her first maternity leave, is again in a situation, what monetary compensation is due? How are they calculated?

In some cases, it is beneficial to go to work, at least for one day, for example, if the salary has increased. In this case, the calculation of payments will be calculated on the basis of the higher salary.

Conditions The list of documents is specified in Article 255 of the Labor Code of the Russian Federation.

Payments are made the same as for the first time:

- Sick leave is calculated from 140 days to 200 if the birth was difficult.

- Monthly benefits are calculated based on the salary from the date the application was written, in this case it is 100% of the salary.

- One-time benefit for birth.

- For her second child, a woman receives a maternity capital certificate from the state.

Monthly payments for caring for a second child up to 1.5 years old minimum 6284.65 rubles regional coefficient.

You can calculate the amount yourself: take the entire salary for the last two years and divide it by the number of days in previous years. The output is the average salary. It is this amount that needs to be multiplied by the number of days of maternity leave. When an employee leaves immediately from the first maternity leave for the second, then the salary before the first departure or the minimum salary at the time of leaving is taken into account. The amount of monetary compensation cannot be lower than the minimum wage.

If the employee does not intend to take advantage of the second maternity leave, then she can transfer this right to close relatives and return to work herself.

- Liquidation of the enterprise. If this process is started, then official relations with all employees, including pregnant women, are severed. In this case, it is necessary to contact the social protection authorities, the benefits will be paid by the Social Insurance Fund.

- Enterprise bankruptcy. If the employer is declared bankrupt by the court, then the transfers come from the local social security office.

- In the case where the location of the boss is unknown. In this case, it is necessary to go to court and recover due payments.

More on the topic Calculation of pensions for those born before 1967

But you should know some nuances in which the FSS authorities may refuse:

- Finding employment immediately before going on leave under the Labor and Employment Regulations. This may be interpreted as a desire to receive benefits. This is facilitated by the employee’s insufficient qualifications and a specially created position for her.

- A sharp and unreasonable increase in the salary of a pregnant woman in relation to other employees.

- If all required benefits have been received previously.

- In the case when the employee went to work and continues to work. You cannot work in an organization and be on maternity leave at the same time. Benefits are paid as compensation for disability.

Having determined the amount of the estimated pension, you can calculate the amount of the estimated capital used to calculate the IPC. To do this, the final value must be multiplied by a correction factor. Its value is 5.6148 - the product of annual indexation coefficients from 2002 to 2014. inclusive.

Example:

- SP including valorization = 800 rub. The amount of the estimated capital will be 4,491.84 rubles. (800 x 5.6148 = 4,491.84).

Example:

- The PB value as of 01/01/2015 was 64.1.

- PC = 4500 rub.

- The number of IPCs will be 70.20 (4,500 / 64.1 = 70.20).

The increase in pension for Soviet service will be equal to 5,720.60 (70.20 x 81.49 = 5,720.60), where 81.49 is the cost of PB as of January 1, 2019.

A woman’s absence from work is always confirmed by a sick leave certificate or a personal statement. When there is sick leave, an application is not needed. If for some reason a woman wants to go on maternity leave later than expected (perhaps she wants to receive a salary longer or the salary is more than the disability benefit), then she will have to write an application.

Payments are calculated based on the dates indicated on the sick leave certificate or the employee’s application. According to the new rules, the calculation period is considered to be the last 2 years worked (the current year is not taken into account in the calculation). Either both of these years took place at the same company, or different ones. When at different jobs, a certificate of income received at the previous job is provided. In any case, the benefit amount will be calculated from the Social Security Fund.

Even if a woman spends the required 6 years at home, her work experience will be equal to three years.

In order to make all the necessary calculations, you will need a pen, a piece of paper and your work book. To calculate work experience, you must also take into account what is not included in work experience:

- Studying at a university;

- Parental leave after 1.5 years.

But for your convenience, we can recommend that you go online and find specially designed calculators, where you can set all the necessary parameters, and the system will calculate everything automatically, taking into account all the specified periods and the data you entered.

- statement;

- passport;

- employment history;

- SNILS;

- children's birth certificates.

The principal conditions affecting the size of the pension are the following periods:

- being on maternity leave on the basis of sick leave;

- caring for a child up to one and a half years old on the basis of a corresponding application and order from the employer.

These periods are calculated in the same way as if the woman continued to work.

In addition, while caring for a child up to one and a half years old, the employee is awarded pension points, which affect the validity of the right to retire and its size. So, for one year of caring for the first child, 1.8 points are assigned, for the second - 3.6, for the third and subsequent ones - 5.4 points.

The main condition for assigning pension points is the fact that the employer has transferred insurance contributions for the employee. Persons caring for a child under 1.5, but who do not have official work and are not individual entrepreneurs, cannot count on receiving points.

Attention! Interruption of service does not mean that a woman will be left without benefits. She has the right to receive all payments in full.

Accounting for insurance experience

Labor law standards indicate that the time while an employee cares for children should be included in the length of service.

If the expectant mother is carrying one baby, then the period starting from the thirtieth week of pregnancy is included. When a woman is carrying several children, this time begins at 28 weeks. This period ends after the babies reach one and a half years of age.

Some enterprises accrue maternity benefits until the child’s age exceeds three years. In this situation, the management of the company transfers funds to the Pension Fund. This period must be included in the insurance period. For parents who are government employees, it is stipulated that the length of service must include the time until the child turns 1.5 years old.

During the specified time, the employee is deprived of the ability to work because he is caring for children. From payments due to citizens, funds are transferred to the Social Insurance Fund. The organization where the parent works makes contributions to the fund. As a result, pension benefits accumulate. This applies to the insurance and social parts of the pension. The insurance component subsequently affects the pensioner’s allowance.

Maternity leave during retirement

The birth of children is an important event in a woman’s life. The state, for its part, provides support. For a certain period of time before and after childbirth, maternity leave is issued, as well as leave to care for a newborn. A woman has the right not to go to work for up to three years.

What is maternity leave

Maternity leave is a temporary break from work provided for the birth of a child and caring for him. It is issued on the basis of a sick leave certificate.

The start date is usually the thirtieth week of pregnancy. The total duration of maternity leave is 140 days. Usually 70 days are taken before the onset of labor and 70 after. If two or more children are born, another forty days are added.

For difficult births, sixteen days are added.

When adopting a child, you are entitled to leave for seventy days. Based on the order of the Ministry of Health and Social Services. Development No. 255 of December 29, 2006, social benefits are paid during maternity leave.

Its size is calculated according to the indications:

- average earnings;

- the entire period worked;

- duration of vacation.

The employee’s job must be retained throughout the entire period. An employer has no right to fire a woman.

Is maternity leave included in the calculation of length of service for a pension?

Based on Art. 255 and 256 of the Labor Code of the Russian Federation, the length of service during maternity leave is calculated. It is this document that guarantees a woman’s job security.

Is it taken into account when calculating pensions?

The pension is calculated taking into account the period while the employee was on maternity leave and contributed funds to the insurance portion. If the maternity leave was used before 2002, the information must be recorded depending on what is written in the work book. Since this period, an individual accounting system has been introduced. You can confirm your work activity using other documentation.

Similar rules apply to persons who hold a position that makes it possible to receive pension payments earlier than the general rule. Special conditions apply in this situation.

These specialties include those who work in conditions equivalent to those in the north. In addition, a person can work in an area where there is an increased level of radiation. He has the right to claim preferential pensions.

If a woman does not return to work when the baby turns 1.5 years old, further time is considered as leave without pay. She is due a payment from the Social Insurance Fund. It amounts to 60 rubles. Payment is made every month. At this time, contributions to the Social Insurance Fund are not paid. Therefore, when calculating pension benefits, the period of maternity leave from one and a half years to the child’s third birthday is not taken into account. The main requirement for including maternity leave in the length of service is the contribution of funds to the insurance fund.

Is maternity leave included in the length of service for calculating a pension?

Maternity leave is not only a cash benefit for child care, but also a guaranteed pension. So it’s worth finding out in advance how maternity leave can affect your retirement and how it will affect your length of service.

The concept of maternity leave and seniority

Maternity leave, according to legal norms, is provided to working citizens after pregnancy and childbirth for a period established by law. It comes in three types.

- Maternity leave issued due to the birth of a child. Its duration, according to the disability law, ranges from 141 to 195 days. Leave is provided to girls in the pre- and post-natal stages and depends on the degree of complexity of the birth and the number of babies.

- A maternity leave taken to care for an infant until he reaches the age of one and a half years. During this period of time, financial support is guaranteed, and any family member can apply for it.

- Maternity leave, which was issued to care for a child until he reaches the age of three. This period of time is not paid for by the employer, and either parent can also apply for it.

Work experience is the time during which an employee was engaged in labor activity. On its basis, the amount of pension payments, social benefits for temporary disability and, in certain cases, wages is calculated.

How is maternity leave counted?

Based on Order of the Ministry of Health and Social Development of the Russian Federation N91 dated February 6, 2007, length of service during maternity leave is calculated in accordance with the following data:

- when determining working periods, a month and a year are considered to be equal to 30 days and 12 months, respectively;

- if the vacation periods issued to care for each of several children coincide, the dates will be counted directly upon the employee’s application;

- entries on the amount of length of service for a pension are entered on the basis of information presented in the work book or its replacement documents, namely: certificates from the employer, extracts from the archive, calculations of payments received, etc.;

- without providing a supporting document, work experience will be credited only on the basis of a court decision, when making which testimony was taken into account;

- if the provided documentation does not contain the dates of confirmation in the position and departure on the required maternity leave, then July 1 of the year will be accepted as such, but if the date of the month is not indicated, the 15th will be taken.

How time on maternity leave will be taken into account when retiring

In accordance with the conditions of Russian labor legislation, while a woman is on maternity leave and caring for a child, the length of service for calculating the pension amount is retained, but under certain conditions. The total duration of periods of maternity leave cannot be more than 6 years.

The basis for calculating this period is the birth of four children with subsequent care for them until each is 1.5 years old.

If the period of maternity leave is more than six years, then the remaining time will not be included in the length of service and will not affect the date of retirement and the amount of pension accruals.

Calculation of maternity leave

In the process of calculating the total amount of payments that should be provided to a woman when she goes on maternity leave for childbirth and child care, her total earnings are taken into account.

It is calculated for the previous 2 years before the birth, the duration of the maternity leave itself and the number of days in the current calendar year.

In this case, days of suspension from work and registered as sick leave are not taken into account, and only payments from which contributions to the social insurance authorities are recognized as official income.

Calculation example:

For two years, Alena’s salary was 30,000 rubles. As a result, over 2 years her total income amounted to 720,000 rubles. As a result, the calculation is carried out as follows:

- in 2020 there are only 365 days, based on this 1315 rubles. - daily earnings;

- 150 days – the duration of her maternity leave;

- in accordance with the calculation formula, the total amount of maternity leave payments will be: (720,000 / 365) * 150 = 295,890 rubles.

If over the previous two years the employee has already gone on maternity leave, then the period until the date of maternity leave will be counted.

Does maternity leave count towards insurance coverage?

The first six months of maternity leave will be counted both in the work and insurance experience. At the same time, leave to care for an infant until he reaches the age of one and a half years is already taken into account only in the first of them.

The only exception can be a situation in which a woman gave birth before October 6, 1992, when such a norm was adopted, since the legislative act does not have retroactive force. At the same time, the period of caring for a child until he reaches the age of three is taken into account when calculating pension payments exclusively for work experience.

- The main legislative documents that regulate issues regarding women’s rights to work, as well as the provision of freedoms and guarantees by the state, include the following regulations.

- Constitution of the Russian Federation, published in 1993

| Article | Description |

| 6 | Features of citizenship of the Russian Federation |

| 15 | The Constitution of the Russian Federation has the greatest legal force compared to other legislative acts |

| 17 | Human rights and freedoms must be recognized and guaranteed in the Russian Federation |

| 18 | Validity of human rights and freedoms on the territory of the state |

| 19 | All people are equal before the law and justice |

| 55 | List of basic rights of a citizen of the Russian Federation |

Labor Code of the Russian Federation.

| Article | Description |

| 255 | Providing leave due to pregnancy and subsequent childbirth |

| 256 | Providing leave to look after a small child |

It should also be mentioned that not many employers can provide a young mother with a full social package. Therefore, the employee needs to personally study all the nuances associated with maternity leave.

You may also like

Source: https://zavtrapensiya.ru/pensioneram/otdelnym-kategoriyam-grazhdan/zavisimost-pensii-ot-dekreta

Accrual of points

Since the beginning of 2020, an important factor that affects the amount of benefits is accumulated points. In accordance with the law, these points are called the individual pension coefficient. These points are kept in the pension authorities and in the personal account of the retired person.

From 2020, 1 IPC is equal to 81.49 rubles.

However, it is worth remembering that for each subsequent child the number of points increases. We will consider the calculation of points in more detail in Table 1.

| For which child is it charged? | Number of points for 1.5 years of maternity leave |

| First | 2,7 |

| Second | 5,4 |

| Third | 8,1 |

| Fourth | 8,1 |

Video about calculating the size of a future pension:

Possible exceptions and nuances

Speaking of exceptions and nuances, there are practically none in this matter, and they are not provided for. Since the entry into force of new legislation on January 1, 2014, the insurance period has increased from 3 to 4.5 years.

Expert opinion

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

This has become convenient for women caring for 3 children at the same time. After all, the calculation will take into account the period until each of the babies turns 1.5 years old.

But along with this, there is a clause in the legislation that if a woman went on maternity leave before October 6, 1992, the length of service will be taken into account for the entire period spent on leave.

Carrying out recalculation

Initially, you will need to find out what maternity leave and length of service are. If you have this knowledge, you can talk about the gap included in the length of service. The time while the employee was carrying and giving birth to a baby and receiving sick leave benefits is taken into account when calculating the insurance period. In addition, this period is subject to inclusion in the total length of service and benefit length.

To receive additional payments for children, a woman must have two or more children. To receive allowances, a recalculation must be carried out. A woman should have a small salary or working period.

These factors are taken into account individually or in combination. If pension payments are calculated based on benefits, recalculation will not be possible.

In some situations, a person loses the right to use preferential seniority. This happens if a person receiving early benefits replaces the working period with the time during which he cared for the baby. This rule applies to persons who are not of retirement age. As a result, this measure will lead to the loss of the right to assign early payments.

When on the second day maternity benefits are fully paid at the birth of a child (prenatal)

A woman spends 1.5 years on maternity leave with social support and the second half of the time at her own expense.

Let us recall that on January 1, 2020, a gradual increase in the retirement age began in Russia. However, for people with extensive work experience, a benefit is provided - the possibility of early retirement (2 years earlier than the generally established dates). Women with 37 years of experience and men with 42 years of experience will be able to take advantage of this right. Also see “What is included in the length of service for a pension based on length of service“.

- labor (general) - these are periods of official labor activity, confirmed by entries in the work book. Work experience may include such concepts as general, preferential and special work experience. In the Law of Ukraine “On Pensions”, the concept of total work experience is mainly used to distinguish it from the length of service that gives the right to pension benefits

- insurance (pension) is a period of time during which a person was subject to compulsory state pension insurance and for which monthly contributions were paid in an amount not less than the minimum insurance contribution (Article 24 of the Law of Law “On Compulsory State Pension Insurance”)

- special - this is the total duration of a certain labor activity in the relevant types of work, giving the right to early assignment of a labor pension

- preferential is a period of work in harmful, dangerous or specific conditions for a full working day. The list of industries, works, professions, positions and indicators by which the period of labor activity can be classified as preferential length of service has been approved by resolutions of the Cabinet of Ministers of Ukraine

With the introduction of the insurance period (01/01/2004), it no longer mattered how long a person actually worked - what matters is during what period and how much the employer paid for him to the Pension Fund. Work experience obtained before January 2004 is automatically equal to the insurance period. After this date, the period of payment of insurance contributions is important for calculating the pension.

With several decrees in a row

Often a second baby appears in a family before the mother has completed her first maternity leave. The woman will need to draw up an application and close her leave, opening a new one. If these actions are not completed, then you should prepare for the consequences:

- Some benefits cannot be issued

- experience is not accrued

Existing features must be taken into account. These include the fact that the total duration of one vacation cannot exceed a three-year period. If a woman takes several maternity leave in a row, the insurance period does not exceed three years.

When a third child appears in the family, the length of service is not accrued. This does not mean that you will not be able to receive benefits.

To process payments, you need to write an application and send it to the management of the enterprise where the mother is employed. In addition, you can apply for payments to pension or social authorities. Depending on the type of payment, the requirements for the required package of documents change.

Maternity leave is included in the length of service, which is reflected in the law. Many organizations respect the rights of their employees. Women are provided with incomplete social services. package. Therefore, it is necessary to carefully study the issues of going on maternity leave and calculating the deadlines for a pension. If the mother is on maternity leave until the child reaches the age of three, not the entire period is included in the length of service.

Top

Write your question in the form below

Calculation of the maternity period when applying for a pension

The length of service for calculating a pension is the period from the moment a woman goes on maternity leave until the child is 1.5 years old. On average, accounting for individual periods spent raising a child is as follows:

- the period of pregnancy and childbirth is included in full, regardless of its duration and the number of children born during a woman’s life;

- the period of caring for a baby up to 1.5 years is fully taken into account in the insurance period, but is limited to 6 years for mothers with many children;

- a period of up to 3 years is not taken into account;

- the period for caring for a child at any age is not taken into account.

Maternity leave is a temporary paid release from the performance of one’s duties at work, to which every woman has the right for the purpose of the successful completion of pregnancy and childbirth. After the birth of the baby, the mother deserves a rest. Moreover, she must constantly be near the child. This vacation is divided into two parts:

- for pregnancy and childbirth;

- for child care up to three years old.

The first part directly depends on how the pregnancy and the birth itself proceed. So, when all is well, its total duration will be 140 days. If complications are detected, the leave is extended to 156 days. If two or more babies are born, the leave is extended to 194 days.

The next part of the vacation falls on the period of time until the child turns one and a half years old. Not only the mother, but also another family member can apply for it.

Vacation with financial support is included in the length of service. In the future, the woman giving birth or, again, someone else from the family has the right to remain on maternity leave for up to three years.

This part is already at our own expense.

If we talk about work experience, then this is the entire working period of the employee. It can also be divided into types:

- general labor;

- insurance;

- preferential.

The first involved calculating the entire time of a person’s professional activity. Later it was replaced by the SS, which accepts for calculation only the time when contributions to the Pension Fund are made. The third type is awarded only to certain categories determined by government decision. Maternity leave will not apply to all of the above types.

Family Law {amp}gt; Decree {amp}gt; Does maternity leave count towards seniority?

Is maternity leave included in the length of service? This question is asked by every working woman who is preparing for childbirth or is already raising children.

Should she make the most of the vacation time that is legally available to her?

Or should she go to work as early as possible to accumulate a decent pension? Let's look at it in this article.

Is maternity leave included in the length of service? This question undoubtedly concerns most women who are raising small children or are just preparing to experience the happiness of motherhood. After all, the amount of future pension salary, and therefore a comfortable old age, depends on the length of work.

Maternity leave is divided into several types:

- for pregnancy and childbirth (B&C);

- for caring for a newborn until he is one and a half years old;

- caring for a small child under three years of age.

Let's take a closer look at what length of service is and for what types of leave it can be accrued.

Maternity leave is not only a cash benefit for child care, but also a guaranteed pension. So it’s worth finding out in advance how maternity leave can affect your retirement and how it will affect your length of service.

The birth of children is an important event in a woman’s life. The state, for its part, provides support. For a certain period of time before and after childbirth, maternity leave is issued, as well as leave to care for a newborn. A woman has the right not to go to work for up to three years.

The rules for calculating length of service and approving pension payments have undergone major changes since 2014. Is maternity leave included in the length of service? Domestic legislation responds positively to this, but the woman will need to prove registration in the pension insurance structure and the fact that her employer paid all the necessary contributions in full.

Maternity leave is a paid period of time that pregnant women can take advantage of. Issues related to obtaining maternity leave and regulating labor relations are considered in the Labor Code of the Russian Federation.

The labor legislation of the Russian Federation provides the following list of guarantees for pregnant women.

- Limitation of the right to involuntary dismissal.

- Registration of a certificate of incapacity for work for the period of pregnancy and childbirth. The duration of maternity leave is 140 days, and in case of multiple births or complications it is 194 or 156 days.

- After the maternity leave has come to an end, a woman has the right to go on maternity leave until the age of one and a half years. During this period she will receive part of her salary.

- If desired, a woman can extend her maternity leave, but she will no longer receive money.

Attention! According to the amendments made to the legislation, the period of leave to care for an infant is 4.5 years.

The date when a woman goes on maternity leave is set by her. It is allowed to present a completed certificate of incapacity for work at any time during pregnancy.

The following categories of women are entitled to receive maternity benefits due to pregnancy and childbirth:

- officially employed;

- registered with the security service as unemployed;

- female students who are studying full-time at a university;

- persons liable for military service who work in units of the armed forces.

Maternity benefits must be no less than the minimum wage.

For the entire period of bearing the baby and taking leave to care for him, the woman retains her current job and working conditions. But in order for the maternity leave to be taken into account when determining pension payments, the following conditions will need to be met.

- The woman confirmed that she had reached the preferential or general retirement age.

- The elderly person was registered in the insurance system, and the personal account contains information about the accrued insurance period.

- The employer transmitted re-registration data throughout the entire length of service and paid all necessary insurance premiums in full.

If these conditions are met, the maternity leave will be taken into account when determining the length of service for calculating pension payments.

When confirming the right to a pension, the following rules are used:

- a maternity leave, which is confirmed by a certificate of incapacity for work, is included in the work experience without any restrictions;

- the period of caring for a child up to one and a half years of age also counts towards the length of service: during this time, the employer makes all necessary contributions for the woman;

- the period of caring for a child up to 3 years of age is not included in the insurance period, since the woman is not paid a salary during this time;

- The maximum period of maternity leave, which is included in the length of service for periods of caring for children up to one and a half years of age, is 6 years.

Preferential conditions apply to women whose maternity leave occurred before October 6, 1992. In case of retirement due to special working conditions (in industries that are not safe for health), the time spent caring for a child up to 3 years of age is included in the special length of service.

More on the topic Pension Fund personal account - login to the site

When establishing the duration of maternity leave, experts take into account the following.

- The maternity period begins from the moment the sick leave for pregnancy is provided until the end of 140 days (if the birth was complicated or multiple, then this period increases).

- The period of child care begins from the moment you go on vacation until the child reaches one and a half years of age.

Additionally, a woman has the right to go back to work after giving birth until the end of her term or to go on maternity leave until she is one and a half years old not immediately. In such a situation, the employer keeps separate records of vacation and work time. At the same time, the entire period is included in the pension period.

When a woman reaches retirement age, she does not need to obtain any certificates or papers from her employer. The Pension Fund branch requests all the required data from its personal account independently.

If the employer did not prepare reporting documentation and did not transfer contributions during the maternity leave period, the woman will need to initiate legal proceedings to prove her legal right to receive a pension.

To include vacation periods in your work experience before registering as an insured person, you will need to prepare archival documentation - for example, an employment contract, a certificate of earnings, a work book.

Is it possible to retire early? Domestic legislation establishes that in some situations this is permissible - for example, a woman raised a disabled child from childhood until he reached the age of 8, gave birth to at least 2 children and worked for 12 years in the Far North or for 17 years in areas where are equated with them. In this case, the woman must have the required insurance experience.

Maternity leave is included in the total length of service, which should be taken into account when approving a pension. Work experience is calculated taking into account certain points. Thus, the period of caring for a child aged 1.5-3 years is not included in the length of service.

When a woman reaches retirement age, the Pension Fund will request all the required information from her personal account. If any problems arise (for example, the employer did not prepare reports for the period of maternity leave, did not transfer contributions), you will need to go to court.

If you have any questions, our duty lawyer is ready to advise you free of charge ↓

Limitations and nuances of taking into account maternity leave in the work and insurance history Is maternity leave included in the length of service for calculating a pension according to the law? Existing legislation provides expectant mothers going on maternity leave with a fairly wide range of social guarantees. Thus, they can count on payment of average earnings during maternity leave at the expense of the Social Insurance Fund, on maintaining their job, and providing them with additional payments and benefits, for example, for early registration.

And, among other things, to retain the right to receive length of service, which would be counted towards labor activity in order to obtain the opportunity to claim pension benefits. The provisions of this law concern the legal regulation of the concept of length of service and labor pension, which have been reformed since the year.