Travel accounting: basic procedures

Participation of an employee on a business trip is a process that consists of the following main procedures:

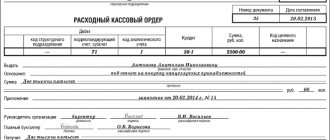

1. Issuing advances and daily allowances to the employee.

The exact deadline for issuing advance funds, as well as the procedure for their calculation, is not established by law. But in any case, they are issued before a business trip. If the advance is not issued, the employee has the right to refuse the trip, and this will not be a violation of work duties.

2. Checking the advance report and establishing specific items of travel expenses.

This procedure is carried out after a business trip upon submission of an advance report by the employee. Depending on the results of the audit, amounts of money are classified into certain categories (we will study how exactly later).

3. Reimbursement of overexpenditures made at the expense of the employee’s personal funds, or, conversely, deduction of the shortfall from him (if there is an overexpenditure or shortage).

Unconfirmed expenses, as well as expenses exceeding the daily allowance limit, are subject to return to the company. In turn, if an employee makes any expenses on a business trip at his own expense, the company must reimburse them.

4. Payment of wages to an employee on a business trip.

During a business trip, the employee continues to be on the company’s staff and receives a salary. But it is accrued according to a special scheme (we will consider its features below).

Now let’s study in more detail the specifics of these accounting transactions, as well as what accounting entries are used to reflect these transactions in the accounting registers.

https://youtu.be/BcyLrKr7LEI

Travel expenses in the contract with the customer

Often the parties stipulate that travel expenses of employees of the performing organization will be paid separately based on actual costs, and questions often arise about how to arrange this.

It should be noted that only your own employees can be sent on a business trip, so the indication of third-party workers in the business trip agreement does not mean that the customer can reflect these costs as travel expenses. And in this case, the customer organization does not keep accounting records of travel expenses; this will be payment for the services of the performing organization. It is advisable to indicate in the contract that these are reimbursable expenses or a variable part of the cost of services, which is calculated based on the actual costs of travel for the contractor’s employees, and also stipulate whether it is necessary to provide copies of documents and the deadlines. Registration of travel expenses is necessary for the customer only to check their cost, but not for reflection in accounting. It should be taken into account that if the contractor applies the general taxation system, then VAT must be charged on the cost of reimbursed services (Letter of the Ministry of Finance dated April 22, 2020 N 03-07-11/22989).

If the customer is a foreign organization, the territory of the Russian Federation is not recognized as the place of provision of services and the cost of services is not subject to VAT, then the reimbursed expenses are not subject to VAT, since they are part of the total cost of services. Depending on the terms of the contract, the business trip of the contractor’s employees can be considered as an auxiliary service that is not taxed in accordance with clause 3 of Art. 148 Tax Code of the Russian Federation.

Accounting for business trips: issuing advances and daily allowances

Before leaving on a business trip, an employee receives:

1. Advance.

The traveler uses this amount to cover planned, most probable (and most often well-calculated) expenses, for example: travel, accommodation. Calculation of advance amounts to be issued is carried out on the basis of the manager’s order to send him on a business trip.

2. Daily allowance.

An employee receives a daily allowance to cover everyday, not always planned and calculated expenses. One way or another, the employee spends the daily allowance in any case at his own discretion, and he is not obliged to report on it.

The minimum and maximum daily allowance (the limit of expenses that the traveler makes at the expense of the enterprise) are established by the employer in local regulations. A daily allowance of 700 rubles per day for business trips in Russia and 2,500 rubles per day for trips abroad is not subject to personal income tax and social contributions.

Despite the fact that advance payment and daily allowance are essentially different payments from the point of view of tax accounting, in the accounting registers their issuance is recorded using the same entry:

- Dt 71 Kt 50 - if the advance and daily allowance are issued from the cash register;

- Dt 71 Kt 51 - if payments are transferred to the employee’s card.

The employee thus receives in his hands or in his bank account the amount for which he is obliged to report with documents attached. The accounting department, having studied the report and documents, will make a decision on whether to reimburse the employee for certain amounts or, conversely, to claim the shortfall from him.

An employee rests at the location of a business trip

Let’s say an employee spends some time at the place of business trip, using it for recreation: he stays for vacation after the business trip or, conversely, first uses vacation, and then performs an official task in the same place. In this case, is it possible to recognize travel expenses for an employee in tax accounting and is it necessary to withhold personal income tax from the amount of such expenses?

According to the financial department, if the period of stay at the place of business trip significantly exceeds the period established by the order on sending on a business trip, then in fact travel is paid not to or from a business trip, but to or from vacation. In this case, the cost of travel is recognized as the employee’s income for personal income tax purposes (letters of the Ministry of Finance of Russia dated July 30, 2014 No. 03-04-06/37503, dated September 12, 2013 No. 03-04-08/37693).

At the same time, the Ministry of Finance’s explanations regarding travel expenses are contradictory. In some letters, officials indicate that expenses cannot be recognized in tax accounting (letters from the Ministry of Finance of Russia dated November 20, 2014 No. 03-03-06/1/58868, dated November 8, 2013 No. 03-03-06/1/47813). In others, such expenses can be taken into account, but only if the delay or earlier departure occurred with the permission of the manager, who confirms the expediency of the expenses. After all, the expenses would still have been incurred regardless of the date of their implementation (letters dated August 11, 2014 No. 03-03-10/39800 (clause 2), dated July 30, 2014 No. 03-04-06/37503 (clause 2) and etc.).

But if an employee stays at the place of a business trip (or goes on a business trip in advance) for the weekend, expenses can be taken into account in any case (letter of the Ministry of Finance of Russia dated November 20, 2014 No. 03-03-06/1/58868), and the employee’s income for personal income tax purposes costs travel is not recognized (letter of the Ministry of Finance of Russia dated August 11, 2014 No. 03-03-10/39800).

Also read about how to calculate payments during business trips and how to confirm a business order.

Postings for travel expenses: return of unspent amounts and reimbursement of overexpenses

Within 3 working days after the end of the business trip, the employee sends the employer an advance report and supporting documents, against which the expenses issued to the employee as part of the advance will be verified (clause 26 of the Regulations on Business Travel, approved by Decree of the Government of Russia dated October 13, 2008 No. 749).

Based on the results of studying the report and the documents submitted with it, the accounting department will determine 3 types of monetary amounts:

1. Spent by the employee and confirmed by the advance report and supporting documents.

2. Amounts corresponding to daily allowance limits.

3. The amount initially given to the employee before the business trip.

Next, the sum of the indicators for points 1 and 2 is subtracted from the indicator for point 3.

If the result is positive, then the employee will have to return the corresponding amount to the company’s cash desk.

The following entries are recorded in the accounting registers:

- Dt 50 Kt 71 - when returning funds to the cash desk; or

- Dt 51 Kt 71 - when returning funds to the company’s bank account.

If the result is negative, the company must reimburse this amount, since the employee will be considered to have spent his money.

In this case, the transaction will be classified as travel expenses - the entries for it are the same as in the case of payment of advances and daily allowances: Dt 71 Kt 50.

Features of accounting for expenses on a foreign business trip

When sending an employee on a business trip abroad, several features must be taken into account.

A significant difference is the determination of the amount of daily allowance. The amount of daily allowance changes for the period of a business trip (clause 17 of the Regulations): when traveling within Russia, daily allowance is paid in the amount established for domestic business trips, and on the territory of foreign countries - in the amount established for business trips to this state. In a local act, daily allowances can be set either in the same amount for all foreign business trips, regardless of the country, or depending on the state.

Daily allowance and other expenses can be issued in foreign currency. Accounting for travel expenses in foreign currency is carried out in rubles.

For the day of departure from Russia, daily allowance must be paid according to the norms for travel through foreign territory, and upon return - according to the norms for domestic Russian business trips (clause 18 of the Regulations). The date of border crossing is determined by the stamps in the passport. If an employee leaves and returns on the same day, then the daily allowance is paid in the amount of 50% of the norm established for a business trip to this state.

From an accounting point of view and to determine to which account the costs of a business trip are attributed, it does not matter whether a business trip is within the territory of the Russian Federation or abroad.

In addition, when traveling abroad, the costs of obtaining a foreign passport, visa, other documents necessary for the business trip, payments and fees are additionally reimbursed (clause 23 of the Regulations).

Reflection of the results of a foreign business trip in accounting will be similar to a business trip in the Russian Federation, and travel expenses will also be written off depending on the purpose of the trip. But due to the fact that expenses are incurred in foreign currency, there will be specifics regarding the recognition and conversion of currency into rubles.

If travel allowances are issued in rubles, then expenses incurred in foreign currency by bank transfer (with an employee’s ruble card) must be converted into rubles at the rate that was in effect on the date of payment. If travel allowances were issued in cash, then the ruble conversion rate based on the certificate of currency purchase is accepted. In the absence of such a certificate, the rate is accepted on the date of issue to the employee of an advance in rubles (Letter of the Ministry of Finance of Russia dated January 21, 2020 No. 03-03-06/1/2059).

For the purpose of tax accounting of travel expenses, the date of expenses will be the date of approval of the advance report (clause 5, clause 7, article 272 of the Tax Code of the Russian Federation).

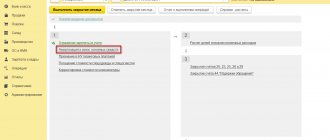

Checking the expense report: expense entries

The procedure discussed above (when an accountant determines whether an employee should return something to the company or, conversely, whether the company is obliged to pay him compensation) is closely related to determining the amounts corresponding to specific types of expenses of the traveler. For these purposes, the same expense report and supporting documents are used.

Main types of travel expenses:

1. Daily allowance.

To write them off as travel expenses, the following entry is used:

- Dt 26 Kt 71.

In this case, depending on the purpose of the trip, the operation can be carried out by debiting such accounts as:

- 20 (23, 25, 28) - if the employee is sent on a business trip for operational reasons;

- 08 - if the trip is related to the acquisition of fixed assets;

- 44 - if the business trip was carried out in connection with the purchase/sale of goods.

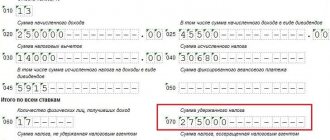

Moreover, if the daily allowance limit approved by the employer exceeds the norms established in the Tax Code, then the excess amounts are subject to personal income tax and contributions. The fact of their accrual is reflected by the following entries:

- Dt 70 Kt 68;

- Dt (08, 20, 23, etc.) Kt 69.

2. Travel, accommodation, etc.

For relevant travel expenses, postings are applied according to the same principle as in the case of per diem expenses:

- Dt 26 Kt 71 (in general) or correspondence on the debit of accounts 08, 20, 23, etc.

If expenses are confirmed by primary documents and an invoice, then input VAT is accepted for deduction, which is recorded by the following entries:

- Dt 19 Kt 71 - incoming VAT is recorded;

- Dt 68 Kt 19 - input VAT is accepted for deduction.

Let's study the procedure for accounting the salary of a posted employee.

Accounting for entertainment expenses

Representation expenses include:

- Official receptions, both for representatives of other organizations, officials of the taxpayer organization, and members of the board of directors and others, regardless of the venue;

- Transport provision for the delivery of these persons to the place of official reception and back;

- Buffet service during negotiations;

- Translation services during the official reception.

The list is closed and entertainment expenses not included in it are not taken into account in income tax.

Representation expenses do not include organizations:

- Entertainment;

- Recreation;

- Prevention or treatment of diseases.

Important! Representation expenses of a non-profit organization at the expense of targeted financing are not taken into account in income taxation.

Entertainment expenses are included in other expenses in an amount not exceeding 4% of labor costs for the reporting period. When representative expenses exceed the norm, a permanent difference arises.

Important! Expenses must be economically justified and documented.

Typical entries for hospitality expenses

| Dt | CT | Wiring Description |

| 26 | 71 | Payment of entertainment expenses by the reporting person |

| 26 | 60 (76) | Services of third parties are included in entertainment expenses |

| 90.08 (20, etc.) | 26 | Write-off of representative expenses |

Salary on a business trip: postings

While on a business trip, the employee also receives a salary. True, it is calculated not as usual, but according to average earnings (clause 9 of the Regulations). In addition, weekends while a person is on a business trip are paid double or single when subsequent time off is granted, provided that the accounting documents are correctly filled out (clause 5 of the Regulations, Article 153 of the Labor Code of the Russian Federation).

Find out about the nuances of paying for a business trip on weekends here.

Payroll for a posted employee is calculated using the following entries:

- Dt (08, 20, 23, etc.) Kt 70 - calculation of wages calculated based on average earnings;

- Dt 70 Kt 68 - personal income tax withholding;

- Dt (08, 20, 23, etc.) Kt 69 - calculation of insurance premiums.

The transfer of wages to the employee is made using correspondence accounts:

- Dt 70 Kt 50 - if the employee receives his salary at the cash desk;

- Dt 70 Kt 51 - if the salary is transferred to the card.

Read more about the nuances of accounting for travel expenses in the article “Procedure for accounting for travel expenses in 2017.”

Documentation of a business trip

A prerequisite for sending on a business trip is a written order from the employer (Article 166 of the Labor Code of the Russian Federation). Basically, this is an order to be sent on a business trip, but there may be another document. The form is not established, so an organization can establish its own form of the document, or it can use a unified one - No. T-9. It is necessary to indicate the place, duration, and purpose of the business trip. The travel certificate and official assignment have been cancelled, but the organization can use these forms of documents or establish its own in a local act, as well as establish other mandatory documents, for example, a sample estimate of travel expenses. In the same local act, it is necessary to establish the amount of daily allowance, you can set a limit on living expenses, and also indicate other travel expenses.

Results

Accounting for transactions that characterize sending an employee on a business trip is carried out in several stages. First, the employee is given an advance amount and daily allowance, and after his return from a business trip, the mutual financial obligations of the employee and the employer are determined - based on the report and supporting documents. Any cash movements between the cash desk (current account) of the enterprise and the employee (his bank account) are recorded in transactions, the content of which is determined by the purpose of the business trip.

You can learn more about the procedure for maintaining accounting and tax records when traveling on business trips in the following articles:

- “A business trip ticket includes meals - should an employee be paid daily allowance for days on the road?”;

- “We pay personal income tax on travel expenses in 2017”.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Other travel expenses

In addition to those established in Art. 168 of the Labor Code of the Russian Federation for expenses that the employer is obliged to make, other expenses that have been agreed upon can also be reimbursed.

For example, the cost of packing luggage can be reimbursed as travel expenses. But in this case, it must be taken into account that it is better to indicate the possibility of compensation for such expenses in the local act of the organization, and in addition, confirm that this was done for production purposes - to ensure the safety of documents and property of the organization. If it is confirmed that we are talking about packaging the employee’s personal property, these expenses will need to be included in the employee’s income with subsequent withholding of personal income tax.

Another pressing and frequent question is paying for food on a business trip. The issuance of daily allowances is aimed at covering additional expenses of an employee on a business trip, including food. In this regard, the organization is not obliged to pay additionally for food. For example, even with regard to one-day business trips, the Ministry of Finance of the Russian Federation in Letter dated October 09, 2015 No. 03-03-06/57885 indicates that reimbursement of the cost of food is not an expense associated with a business trip.

But the organization has the right to provide for payment for food in a local act and pay it to employees in addition to the daily allowance. But these will be payments under the employment contract, which are subject to insurance premiums and included in income for the purpose of withholding personal income tax.

However, in some cases, the cost of food is considered differently. For example, if in a hotel the price of a room includes the cost of breakfast, when flying or traveling the cost of food is included in the ticket price, then this is not subject to insurance premiums (Appendix to the Letter of the Federal Insurance Service of the Russian Federation dated November 17, 2011 No. 14-03-11/08 -13985 ).

But the Ministry of Finance takes a different position, believing that if the cost of food in the ticket is highlighted as a separate line, then these costs are not taken into account when calculating income tax (Letter of the Ministry of Finance of the Russian Federation dated May 20, 2015 No. 03-03-06/2/28976).

Typical postings for daily allowances and travel allowances

To cover all expenses on a business trip, the employee is given money on account:

- Debit 71 Credit 50 (51).

If there is money left over after a business trip, it must be returned to the cashier:

- Debit 50 Credit 71.

In the case where the employee, on the contrary, also spent his own personal money, the organization, if there is appropriate evidence, must compensate them:

- Debit 71 Credit 50.

The employee must report all expenses incurred during a business trip. To do this, he draws up an expense report, to which he attaches all receipts, tickets, checks and other documents confirming expenses.

If the employee’s expenses, even if the documents are available, are not reasonable, the organization may not accept them. In this situation, the employee will have to return the money.

If the expenditure documents contain invoices with allocated VAT, it can be deducted:

- Debit 68 VAT Credit 19.

When an organization pays part of its expenses from its current account, it makes an entry:

- by debit 76 account and credit 51.

The receipt of tickets purchased for an employee is reflected by the following posting:

- Debit 50.3 Credit 76.

- by debit 71 and credit 50.3.

In addition to travel allowances - to pay for accommodation, travel, the employee is given a daily allowance - for food. These are the company's expenses normalized in tax accounting, by which it can reduce profits. For business trips in Russia, this norm is 700 rubles. per day, abroad – 2100 rubles. If you give an employee amounts exceeding these limits, you will have to withhold personal income tax.

Control and approval

The submitted document is checked, accounting entries are made according to the expense reports. What is control?

First of all, you need to make sure that the funds were spent on purpose. Then the presence of all necessary documents and their correctness are checked. You need to check the completion of the report, especially pay attention to the arithmetic part.

The expenditure of cash is confirmed by checks with item breakdowns or attached sales receipts, counterfoils of cash receipt orders, and other strict reporting forms.

If an employee paid using a bank card, then there should be receipts from payment terminals and checks.

The accountable person must be given a receipt stating that everything they needed was handed over and accepted for inspection. The report is certified by the signatures of the manager, chief accountant and responsible specialist. After the expense reports have been checked and approved, postings have been made on them, they are sent for storage.

Due date and responsibility

The period of time during which the accountant must give the accountant an advance report is determined by management before the money is transferred to the accountant. To do this, you should write a statement to the manager. In its text it is necessary to indicate:

- basis for issuing funds on account

- amount of money required to be issued

- advance report period

Within 3 days from the date indicated in the application, the citizen should report to the accounting department about the costs incurred. Sometimes money is given to the accountable for a long period of time (during vacation, sick leave, business trips). In this situation, the advance report must be sent to the accounting service within 3 days after starting work. Next, the document is checked and approved.

Video about the rules for filling out the report:

If the accountable person traveled outside the country, then the report must be submitted within 10 days after returning to the Russian Federation. In the absence of a report, cash discipline is violated. If tax inspectors discover this fact, penalties may be imposed on the company.

Recommendations for maintaining advance reporting

For business entities of all forms of ownership (except for budgetary organizations), a single form of advance report No. OA-1TEXT_LINKS has been developed. The first block of the form is filled out by the accountant. Here are indicated:

document details (number, date)

- name of legal entity

- Full name of responsible employees receiving money

- amount of money issued

- amount of money spent

- account numbers confirming the movement of money

- information about refunds or overspending

In the next block, the accountant records the data that the report has been received for verification. The accountant tears off this part of the form and hands it to the reporting employee.

On the back of OA-1, information is entered by the accountant and the accountable citizen. The accountant enters the details and attaches checks, receipts and other documentation confirming the expenditure of money. The accountant writes the advance amount and invoices into the accounting system confirming the movement of funds.

What is a subreport

To solve the problems set by the management of the enterprise, some employees may be issued accountable assets, which include:

- amounts of money;

- non-cash funds transferred to a bank account or card;

- monetary documentation.

Employees who received assets are required to provide an advance report to the accounting department, which will indicate for what purposes and in what amount the funds were spent. Subsequently, the document is checked by an accountant and entered into the accounting records of the enterprise according to a certain scheme.

According to the law, full-time and freelance employees, as well as third parties, can receive reports if this is specified in the accounting policy documents.

Travel expenses under the simplified tax system “income minus expenses”

When sending an employee on a business trip, the organization uses the simplified tax system to calculate travel expenses in the same way as under the OSNO. Having reimbursed the employee for all travel expenses stipulated by law, the enterprise has the right to reduce its income by them for tax purposes, subject to documentary confirmation and economic justification of the expenses incurred (subclause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation).

A distinctive feature is the date on which travel expenses are included in expenses. Since accounting for expenses on the simplified tax system is carried out on a cash basis, the date of recognition of expenses is considered to be the date of approval of the advance report. However, if the employee has spent his own funds and the company reimburses him for them, the reimbursed payments should be included in the book of income and expenses at the time of issuing money from the cash register (Clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

One more nuance. According to the Ministry of Finance, an individual entrepreneur without employees on a simplified basis cannot take into account the costs of his own trips. The department justifies this position as follows: a business trip is a trip by an employee at the direction of the employer. But an individual entrepreneur does not have an employer, just as he himself cannot be his own employee (letters from the Ministry of Finance dated 02/26/2018 No. 03-11-11/11722, dated 07/05/2013 No. 03-11-11/166). The courts, as a rule, do not agree with such conclusions (Resolution of the Federal Antimonopoly Service of the Far East of Russia dated August 22, 2011 No. F03-3248/2011).

For more information about the recognition of expenses under the simplified tax system, read the material “Accepted expenses under the simplified tax system in 2020 - 2020.”

How to fill out an advance report?

The form is usually issued by the company's accounting department. You can also use special services on the Internet.

The accountant will enter the serial number of the report, but the employee must indicate the date of completion. Then information is entered into the data block about the organization: name, OKPO, position and full name of the manager, full name of the chief accountant and the accountant who is directly involved in checking the report.

Next, fill in information about the accountable person: employee’s full name, position, unit name and code, personnel number.

Both of these blocks on the form issued by the accounting department are usually already filled out.

In a special table you need to enter all supporting documents with numbers, dates and names, indicate the amount for each. Calculate the total.

Storage

After the received report has been verified by the company's accountant and documented with suitable entries, and the balance amounts have been returned or withheld, the document is sent for storage.

According to the articles of the Tax Code of the Russian Federation, advance reports in commercial or non-state enterprises are stored for different times depending on the type of paper:

- 4 years – storage period for accounting and tax reports, statements, advance reports, from which taxes are calculated;

- 10 years is the period for primary documentation in which expenses due to losses incurred are transferred to the coming periods;

- 5 years – for initial advance reports.

In government organizations, these types of documents must be stored for at least 5 years.

An advance was issued for business trip expenses as a report

So, an order was issued to send the employee on a business trip. It is necessary to organize his travel to his destination and accommodation. The organization can pay these expenses in advance from the current account. Such operations are recorded using standard transactions as settlements with suppliers. But usually the employee carries out such expenses on his own, for which he is given funds in advance on account.

An advance has been issued for travel expenses - the posting will be as follows:

Let's say an employee has a corporate bank card and pays for travel expenses with it. In this case, debiting from a corporate card in favor of a supplier, for example a carrier, is processed in the same way as if the funds were issued for travel expenses, by posting:

Accounting for expenses on foreign business trips

A business trip abroad is processed in the same way as in Russia, only it has some features:

- Additional expenses are added for obtaining a visa, a foreign passport, consular and other fees necessary for traveling abroad (subclause 12 of Article 264 of the Tax Code).

- The daily allowance limit, exempt from personal income tax and contributions when traveling to another country, is 2,500 rubles.

- When traveling abroad, the time for calculating daily allowances is determined by travel documents, and in case of their absence, by travel documents or by supporting documents of the receiving party (clause 7 of the regulations on business trips No. 749).

- Primary documents drawn up in a foreign language must be translated into Russian (clause 9 of the Accounting Regulations, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

If an employee purchased currency on his own, then when drawing up a report he must attach certificates of purchase. If such a certificate is not available, then the expenses will be recalculated at the rate of the Central Bank at the time of receipt of accountable money (clauses 5, 6, 7 of PBU 3/2006).

After the report is approved:

- the balance of the advance, returned in foreign currency, is credited to the cash desk with conversion into rubles at the official exchange rate on the date of receipt of money;

- overexpenditure made in foreign currency is issued to the employee in rubles, recalculated at the exchange rate on the day the advance report is approved.

For daily allowances in foreign currency, that part of them that is subject to personal income tax must be recalculated into rubles at the rate on the last day of the month in which the advance report was approved (letter of the Ministry of Finance dated November 1, 2016 No. 03-04-06/64006).

IMPORTANT! If the company’s local regulatory act specifies the amount of daily allowance in foreign currency and pays the employee in rubles, then there is no need to recalculate (letter of the Ministry of Finance dated April 22, 2016 No. 03-04-06/23252).

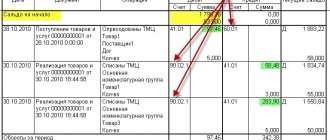

Report on the acquisition of inventory items

View gallery

Supporting documents for the report on the acquisition of goods and materials are invoices, invoices, cash register receipts, sales receipts, receipts for the receipt order, strict reporting documents. On the second page of the advance report, the accounting entries will be for the credit of account 71, only the correspondence for the debit is signed:

| Debit | Credit | Contents of operation |

| 10.1 | 71 | Purchase of raw materials and supplies |

| 10.3 | 71 | Purchase of fuels and lubricants |

| 10.5 | 71 | Purchasing spare parts |

| 41 | 71 | Purchasing goods |

Having completed his part, the accountable person signs and submits the report to the accountant, who must fill out a receipt at the bottom of the first page, indicating how many documents, on how many sheets and for what amount he accepted. Having signed and cut off the receipt, the accountant hands it over to the accountable person.

Expenses incurred by accountable persons on business trips

Reflection in accounting of the issuance of an advance for a business trip.

| № | Debit | Credit | Contents of operation |

| Accounting entries when issuing an advance in cash for a business trip | |||

| 1 | 71 | 50-1 | An advance was issued from the organization's cash desk to an employee for a business trip |

| Accounting entries when an employee receives tickets for travel to a business trip and back purchased by the organization | |||

| 1 | 71 | 50-3 | Tickets were issued to a posted employee for reporting |

| Accounting entries when an organization purchases and transfers to an accountable person electronic tickets for travel to and from a business trip | |||

| 1 | 76 subaccount “Other settlements with various debtors and creditors” | 60, 76 | Confirmation of purchase of electronic tickets received |

| 2 | 71 | 76 subaccount “Other settlements with various debtors and creditors” | Electronic tickets were handed over to the posted worker for reporting |

| Accounting entries when transferring money for travel expenses to employees' bank cards | |||

| 1 | 71 | 51, 52 | Advance payment for a business trip is transferred to the bank card of an employee of the organization |

| Accounting entries when receiving money for travel expenses using an employee's corporate card of the organization | |||

| 1 | 71 | 55 subaccount “Special card account” | Reflects the funds on the corporate card, withdrawn by an employee of the organization from a special card account for a business trip |

Reflection in accounting of the return of unspent accountable amounts of funds issued for business trips.

| № | Debit | Credit | Contents of operation |

| Accounting entries when returning the unused portion of the advance in cash | |||

| 1 | 50-1 | 71 | The unspent balance of the business trip advance is returned by the employee to the organization’s cash desk |

| Accounting entries when returning the balance of funds from employees’ bank cards | |||

| 1 | 51, 52 | 71 | The unspent balance of the business trip advance is transferred from the organization’s employee’s bank card |

| Accounting entries when the employee returns the balance of funds to the organization’s corporate card | |||

| 1 | 55 subaccount “Special card account” | 71 | Reflects unspent funds on the corporate card, previously withdrawn by an employee of the organization from a special card account for a business trip |

Reflection in accounting of write-offs of travel expenses made by accountable persons.

| № | Debit | Credit | Contents of operation |

| Accounting entries in a production organization | |||

| 1 | 20, 23, 25, 26, 29 | 71 | Documented travel expenses are written off to the cost of products (works, services) |

| Accounting entries in a production organization during business trips related to the sale/purchase of inventories | |||

| 1 | 44 subaccount “Business expenses” | 71 | Documented travel expenses written off as business expenses of the organization |

| Accounting entries in trade organization | |||

| 1 | 44 subaccount “Distribution costs” | 71 | Documented travel expenses are written off as the organization's distribution costs. |

| Accounting entries in the absence of supporting documents | |||

| 1 | 20, 26, 44, etc. | 71 | Travel expenses attributable to the days of business trip extension agreed upon with the employer are written off. Costs are written off as normal travel expenses based on an order to extend the trip |

| Accounting entries when reflecting VAT on travel expenses, if the organization uses account 76 “Settlements with various debtors and creditors” | |||

| 1 | 19 subaccount “VAT on work performed (services) of third parties” | 76 | The amount of VAT on documented travel expenses is taken into account (accrued), if it is separately highlighted in the submitted documents |

| 2 | 76 | 71 | and at the same time VAT was written off on travel expenses incurred for settlements with accountable persons |

| Accounting entries when reflecting VAT on travel expenses, if the organization does not use account 76 “Settlements with various debtors and creditors” | |||

| 1 | 19 subaccount “VAT on work performed (services) of third parties” | 71 | The amount of VAT on documented travel expenses is taken into account (accrued), if it is separately highlighted in the submitted documents |

| Accounting entries when presenting VAT for deduction from the budget | |||

| 1 | 68 subaccount “VAT calculations” | 19 subaccount “VAT on work performed (services) of third parties” | The documented amount of VAT on travel expenses has been accepted for deduction from the budget after approval of the advance report for the business trip. |

Reflection in accounting of the write-off of travel expenses made by accountable persons, if the business trip is related to the procurement and acquisition of inventory, creation and acquisition of non-current assets.

| № | Debit | Credit | Contents of operation |

| Accounting entries if a business trip is related to the creation and (or) acquisition of non-current assets of the organization | |||

| 1 | 08 | 71 | Documented travel expenses are included in the cost of acquired or created non-current assets. The amount of travel expenses is attributed to the increase in the value of assets based on paragraph 8 of PBU 6/01, paragraphs 8 and 9 of PBU 14/2007 |

| Accounting entries if a business trip is related to the procurement and (or) acquisition of inventory items | |||

| 1 | 07, 10, 41, 15 | 71 | Documented travel expenses are included in the cost of purchased or procured inventory items. The amount of travel expenses is attributed to the increase in the cost of assets based on paragraphs 6 and 7 of PBU 5/01 |

Reflection in accounting of an employee’s delay on a business trip due to emergency circumstances.

| № | Debit | Credit | Contents of operation |

| 1 | 91-2 | 71 | Travel expenses incurred during days of forced delay due to natural disasters and other emergency circumstances have been written off. The amount of travel expenses is reflected in other expenses of the organization. Costs are reflected as extraordinary expenses based on paragraph 13 of PBU 10/99 with supporting documents. |

Reflection in accounting of the write-off of individual expenses incurred by an employee of an organization while on a business trip upon submission of an advance report.

| № | Debit | Credit | Contents of operation |

| Accounting entries when reflecting daily allowances for business trips | |||

| 1 | 20, 26, 44, etc. | 71 | Daily allowances for business trips have been written off. The daily allowance amount is established by the organization’s local regulations |

| 2 | 70 | 68 subaccount “Calculations for personal income tax” | Income tax (NDFL) is withheld from amounts of excess daily allowance from the employee. The norms within which daily allowances are exempt from taxation by personal income tax are established by paragraph 3 of Article 217 of the Tax Code of the Russian Federation |

| Accounting entries when writing off expenses for railway tickets (VAT is highlighted as a separate line) | |||

| 1 | 20, 26, 44, etc. | 71 | The cost of train tickets excluding VAT has been written off |

| 2 | 19 subaccount “VAT on work performed (services) of third parties” | 71 | VAT is reflected on the cost of railway tickets |

| 3 | 68 subaccount “VAT calculations” | 19 subaccount “VAT on work performed (services) of third parties” | Submitted for deduction of VAT on the cost of railway tickets after approval of the advance report for the business trip |

| Accounting entries when writing off fees for the use of bedding that are not included in the price of train tickets | |||

| 1 | 20, 26, 44, etc. | 71 | The cost of bed linen has been written off |

| Accounting entries when writing off the cost of renting residential premises (VAT is highlighted as a separate line) | |||

| 1 | 20, 26, 44, etc. | 71 | The cost of hotel services excluding VAT has been written off |

| 2 | 19 subaccount “VAT on work performed (services) of third parties” | 71 | VAT is reflected on the cost of hotel services |

| 3 | 68 subaccount “VAT calculations” | 19 subaccount “VAT on work performed (services) of third parties” | Submitted for deduction of VAT on the cost of hotel services after approval of the advance report for the business trip |

| Accounting entries when writing off travel expenses on public transport. In accordance with subparagraph 7 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation, the sale on the territory of the Russian Federation of services for the transportation of passengers by public urban passenger transport (except for taxis, including minibuses) is not subject to taxation (exempt from taxation). | |||

| 1 | 20, 26, 44, etc. | 71 | Public transport fares written off |

Reflection in accounting of transactions related to official business trips of the organization's employees.

| № | Debit | Credit | Contents of operation |

| Accounting entries on the date of receipt of cash foreign currency at the organization's cash desk for a business trip abroad | |||

| 1 | 50 subaccount “Organization cash desk in foreign currency” | 52-1 | The receipt of foreign currency funds for foreign business trips to the organization's cash desk from a current foreign currency account is reflected simultaneously in the currency of settlements and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date the bank issued funds (transactions in foreign currency) |

| Accounting entries on the last day of the reporting period when reflecting exchange rate differences in cash foreign currency at the organization's cash desk | |||

| 1 | 50 subaccount “Organization cash desk in foreign currency” | 91-1 | A positive exchange rate difference is reflected in the composition of the organization’s other income when revaluing the foreign currency balance in the cash register at the exchange rate of the Central Bank of the Russian Federation as of the reporting date of the financial statements or |

| 91-2 | 50 subaccount “Organization cash desk in foreign currency” | A negative exchange rate difference is reflected in the composition of other expenses of the organization when revaluing the foreign currency balance in the cash register at the exchange rate of the Central Bank of the Russian Federation as of the reporting date of the financial statements | |

| Accounting entries on the date of issue of foreign currency from the organization's cash desk for reporting | |||

| 1 | 71 subaccount “Settlements with accountable persons in foreign currency” | 50 subaccount “Organization cash desk in foreign currency” | The issuance of foreign currency funds to an employee on account of a business trip abroad is reflected simultaneously in the currency of settlement and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of expenditure of funds from the organization’s cash desk (transaction in foreign currency) |

| 2 | 50 subaccount “Organization cash desk in foreign currency” | 91-1 | A positive exchange rate difference is reflected in the composition of the organization’s other income when revaluing the foreign currency balance in the cash register at the exchange rate of the Central Bank of the Russian Federation on the date of the transaction in foreign currency or |

| 91-2 | 50 subaccount “Organization cash desk in foreign currency” | A negative exchange rate difference is reflected in the composition of other expenses of the organization when revaluing the foreign currency balance in the cash register at the exchange rate of the Central Bank of the Russian Federation on the date of the transaction in foreign currency | |

| Accounting entries on the last day of the reporting period when identifying exchange differences on accounts payable of an accountable entity | |||

| 1 | 71 subaccount “Settlements with accountable persons in foreign currency” | 91-1 | A positive exchange rate difference is reflected in the composition of the organization’s other income when revaluing accounts payable expressed in foreign currency at the exchange rate of the Central Bank of the Russian Federation as of the reporting date of the financial statements or |

| 91-2 | 71 subaccount “Settlements with accountable persons in foreign currency” | A negative exchange rate difference is reflected in the composition of other expenses of the organization when revaluing accounts payable expressed in foreign currency at the exchange rate of the Central Bank of the Russian Federation as of the reporting date of the financial statements | |

| Accounting entries as of the date of approval of the advance report | |||

| 1 | 71 subaccount “Settlements with accountable persons in foreign currency” | 91-1 | The positive exchange rate difference on account 71 is reflected at the rate of the Central Bank of the Russian Federation from the moment the accounts payable on a foreign business trip arose (or the date of the last revaluation), until the approval of the advance report or The negative exchange rate difference on account 71 is reflected at the rate of the Central Bank of the Russian Federation from the moment the accounts payable on a business trip arose ( or the date of the last revaluation), until the advance report is approved |

| 91-2 | 71 subaccount “Settlements with accountable persons in foreign currency” | ||

| 2 | 20, 26, 44, etc. | 71 subaccount “Settlements with accountable persons in foreign currency” | The write-off of expenses for a foreign business trip is reflected simultaneously in the currency of settlement and in the ruble equivalent (RUB/equivalent) at the exchange rate of the Central Bank of the Russian Federation on the date of approval of the advance report |

| 3 | 50 subaccount “Organization cash desk in foreign currency” | 71 subaccount “Settlements with accountable persons in foreign currency” | The return of unused foreign currency funds to employees is reflected simultaneously in the currency of settlements and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of approval of the advance report (receipt of funds at the organization's cash desk) |

| Accounting entries on the date of return of the overexpenditure of the accountable amount. Foreign currency funds were received from a foreign currency account to the organization's cash desk on the day the debt was repaid to the accountable person | |||

| 1 | 71 subaccount “Settlements with accountable persons in foreign currency” | 91-1 | The positive exchange rate difference on account 71 is reflected at the rate of the Central Bank of the Russian Federation from the moment of approval of the advance report (or the date of the last revaluation) until the debt is repaid to the accountable person or |

| 91-2 | 71 subaccount “Settlements with accountable persons in foreign currency” | The negative exchange rate difference on account 71 is reflected at the rate of the Central Bank of the Russian Federation from the moment of approval of the advance report (or the date of the last revaluation) until the debt to the accountable person is repaid | |

| 2 | 50 subaccount “Organization cash desk in foreign currency” | 52-1 | The receipt of foreign currency funds to the cash desk for the issuance of overexpenditure is reflected simultaneously in the currency of settlements and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date the bank issued funds (repayment of debt to the accountable entity) |

| 3 | 71 subaccount “Settlements with accountable persons in foreign currency” | 50 subaccount “Organization cash desk in foreign currency” | The repayment of debt to an employee for overexpenditure (according to settlement documents) of the accountable amount of foreign currency funds from the organization's cash desk is reflected simultaneously in the currency of settlement and in the ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of repayment of the debt to the accountable person (expense of funds from the cash register organizations) |

| Accounting entries when returning the overexpenditure of the accountable amount in rubles by agreement with an employee of the organization | |||

| 1 | 71 subaccount “Settlements with accountable persons in foreign currency” | 50-1 | Reflects the payment of the amount of overexpenditure of funds from the organization's cash desk in ruble equivalent (RUB/equivalent) at the rate of the Central Bank of the Russian Federation on the date of repayment of the debt to the accountable person (expense of funds from the organization's cash desk) |