Giving money to employees to carry out instructions from the manager and the production needs of the company is a regular practice. This process is always accompanied by the preparation of expense reports with attachments in the form of documents that confirm the employee’s expenses.

At first glance, everything is simple, but audit practice shows that violations related to the rules for drawing up reporting documents and their numbering are often recorded in this area.

ADVANCE REPORT ONLINE

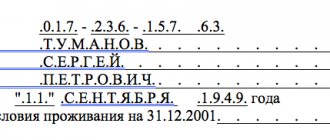

Accountable person

One or more company employees can receive the status of an accountable person. Their list is approved by the head in the Order or other internal accounting document. In fact, employees who are part of the legal entity’s staff, as well as specialists who work part-time and authorized by management to receive advance funds, are actually accountable.

The accountable person is obliged:

- carry out a production task from the manager (purchase of goods, organization of work, business trip to communicate with contractors, organize meetings, conclude transactions and other purposes);

- receive funds from the company upon application for expenses associated with the completion of the task;

- draw up and submit to the accounting department an advance report , as well as documents (appendices) confirming the costs of completing the task;

- transfer purchased goods for the company’s needs to an authorized person;

- return the money remaining from the advance payment, or receive compensation in cash for overspending.

Definition

An advance report is a reporting act that is filled out when using funds issued by an organization to its employee on account (reporting person) for any organized expenses related to work in this organization.

The report is initially drawn up by this person (who accepted the monetary resources) and sent to the accounting department for subsequent execution and transfer to the management of the organization, for its further acceptance and write-off of the final costs.

The issuance of cash to employees on account occurs for several main reasons related to the internal production affairs of the organization, including:

- advance payment for the organization’s daily expenses (for example, the purchase of stationery or household supplies);

- an advance considered as part of the payment of future travel expenses;

- an advance payment that compensates for travel expenses already incurred.

When transferring money from the cash register of an enterprise, a special order is issued (form No. K-2 Consumable “Cash outlay order”, approved by order of the Federal State Statistics Committee dated 08.18.98. No. 88).

The company's accounting department must contain a corresponding decree, which lists

the persons who have the right to purchase accounting funds for household purposes.

expenses (including expenses for fuel and lubricants). An appropriate decree also confirms the timing of the issuance of these funds (there are no restrictions in the legislation). After drawing up the document, it is signed by the manager, chief accountant or authorized persons.

Read our article on how to get money for various needs.

The organization also has the right to transfer funds through non-cash transfer - for example, to the personal bank account of employees. At the same time, in order to avoid problems with special authorities, individual bank cards should be created for accountable persons.

Federal legislation obliges the reporting entity to fill out an advance report on the expenditure of funds, regardless of the purposes for which or under what circumstances the funds were issued to it.

Persons who received funds in advance must submit a report to the company’s accounting department on the material resources they have spent, and make final settlement calculations for them no later than 3 calendar days after the expiration of the time until which they were issued, or before the day of the return of these persons from a business trip.

The final period for which resources are transferred to the employee for reporting purposes is established by the company management.

The transfer of available cash on account can only be carried out in relation to entities that have a working relationship with the company.

Issuing money to unauthorized persons is prohibited.

The provision of available cash in relation to a person is carried out only if there is full reporting of the relevant entity in accordance with the advance previously transferred to it. Providing cash from one individual to another is prohibited.

Funds paid in foreign monetary units are considered both as foreign currency and as rubles at the exchange rate of the Central Bank of the Russian Federation.

The closing of debt in foreign currency by the accountable person and the display of these funds in the advance report in rubles is carried out at the exchange rate of the Central Bank of the Republic of Belarus at the time the report was accepted by the management of the enterprise.

Attachments to the advance report

Attachments to the expense report are documents on separate sheets that confirm the fact of expenses of the accountable person. With their help, the employee reports to the company on the amounts issued, indicating the intended purpose of production costs.

Depending on the intended purpose of the costs, different documents or a package consisting of several documents (checks, BSO, travel documents, etc.) may be attached to the report. The company needs all this as justification for writing off funds, which will be taken into account as expenses when preparing financial statements.

The following may serve as supporting documents:

- cash receipt;

- sales receipt;

- document-replacement cash register (provided by entrepreneurs on the patent scheme);

- form of strict accountability;

- packing list;

- invoice;

- receipt for PKO.

Postings

In accounting, according to the report, special postings are made. They have the following appearance:

On the date of issue of money for reporting

Dt 71, Kt 50. Money was given to the accountable person;

On the date of document approval

- debit 10 (08, 20, 26, 44), credit 71. Services, products paid for employees are registered. This could include office supplies, notary services, business trip expenses;

- Dt 50, Kt 71. The employee provided the balance of unused accountable funds;

- Dt 71, Kt 50. Overexpenditure was returned according to the report.

Payments using a bank card

- Dt 55, Kt 51.52. Money has been allocated for use using the company card;

- Dt 71, Kt 55. The person withdrew money from the corporate card (the employee was given funds on account);

- debit 73, credit 55. The write-off of cash from a special account, not confirmed by primary documents, is reflected;

- debit 50, credit 73. Cash contributed by the representative to reimburse expenses;

- debit 70, credit 73. The amount of money spent on the corporate card for personal purposes is withheld from wages.

Deduction from wages

- Dt 94, Kt 71. Accountable amounts not returned within the prescribed period are reflected;

- Dt 70, Kt 94. Accountable amounts not returned within the prescribed period are withheld from wages.

The advance report is one of the most important accounting documents. It is drawn up collectively, and both the reporting employee, accountant, and the head of the company participate in the process. The deadline for submitting the document and the time for its processing are established by law. You need to know the procedure for correctly filling out the paper and attach other documents that confirm the intended purpose of the payments. Based on the results, postings are made in accordance with the types of calculations and payments used.

https://youtu.be/_0FPZ_0vtkM

Receipts: cash and sales receipts

A receipt issued by the cash register when purchasing a product or ordering a service is the first most popular document accompanying the expense report. Such a check not only acts as an attachment on sheets to the expense report, but is also a primary accounting document. The receipt must contain all the details typical for the primary account and the exact amount spent by the employee - only in this case it is a full-fledged appendix to the report and justifies the costs.

There is one more requirement for this document - it must contain a specific list of purchases. The collective name of goods or “building materials” will not be enough; specifics are needed. By the way, a common problem with all cash register receipts is the low quality of their printing, rapid erasure and fading. To protect yourself, make a copy or save the photo in the Hamilton Expense Statement app.

Since tax reporting requires justification of the need for a product or service, ideally it is necessary to attach to the report a sales receipt that details the costs in detail. There is no strict form for drawing up a sales receipt, but it, like a cash receipt, must contain basic details. The presence of a seal and number on this document is optional.

The main difference between a cash register and a sales receipt is that the first is issued by a registered cash register, and the second is a form filled out by the seller of the product or service. Please note that if both checks are attached to the report, their issuance dates and amounts must match.

Read about how to prepare an advance report on checks here.

https://youtu.be/UTru6O8dFpc

Introduction

First, let's look at what this term actually means. An advance report is a document whose main purpose is to confirm the expenditure of funds by the reporting employee. That is, the whole procedure looks like this:

- The company allocates funds to the employee to complete a task.

- An employee purchases goods or pays for services using cash issued and receiving a check.

- The check is submitted to the accounting department or the responsible person, an advance report is filled out, which is subsequently taken into account when maintaining accounting.

An advance report allows you to control the allocation of company funds

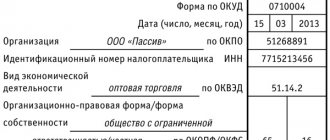

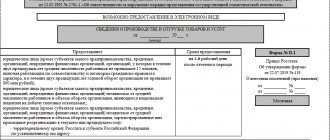

The document is filled out by the accountant and the employee to whom the funds were allocated. The document has a special form approved by the State Statistics Committee of the Russian Federation No. 55 of 2001, it is called AO-1 and is a primary reporting document.

Attention:

The execution of the document is started by the accountable person, who enters basic information into it. Then it is transferred to the accountant, who enters the necessary details and additions into it, after which it is transferred to the head of the company for approval and signature.

After the paper is signed by the manager, the accounting department closes the debt and records the receipt of inventory items, adding it either to expenses or to the repayment of existing debts. It should be remembered that, according to the legislation of the Russian Federation, the primary document does not have a standardized form, and the head of the company has the right to change it at his own discretion. But the rules for filling out an advance report for budget companies are somewhat different; they can only use approved forms.

PKO and BSO

A cash receipt order (PKO) is a receipt that confirms payment for a product or service. The PKO does not confirm that the product or service has been received by the customer, so it is necessary that this document be accompanied by an acceptance certificate or invoice. Only in such a set will the PKO be taken into account by the accounting department. PKO can be stored as numbered attachments to the reporting document, and acts and invoices can be placed in separate folders or also attached to the report.

Strict reporting forms (SRB) are tickets, travel passes, vouchers, vouchers, postal receipts that are issued by a printing house. The BSO can take different forms, but it must contain the basic details.

Accounting of advance reports

Let's look at some accounting entries for accounting for advance reports.

Example

LLC "Zagadka", against a report from the cash register, gave its staff employee cash in the amount of 50,000 rubles. for business expenses (purchase of building materials). The advance report was submitted by the employee within the deadline established by the enterprise, the expenses were documented. The employee spent 38,000 rubles, including VAT of 5,797 rubles. The remaining cash was returned to the company's cash desk.

The following entries will be made in accounting:

- Dt 71 Kt 50 - issuance of the amount of 50,000 rubles from the cash register for reporting to an employee on an expense cash order.

- Dt 10 Kt 71 - construction materials purchased by the accountable person according to the invoice in the amount of 32,203 rubles were capitalized.

- Dt 19 Kt 71 - VAT allocated on purchased materials in the amount of RUB 5,797.

- Dt 50 Kt 71 - funds in the amount of 12,000 rubles unused by the accountable person were returned to the enterprise’s cash register according to the cash receipt order.

- Dt 68 Kt 19 - VAT in the amount of RUB 5,797. accepted for reimbursement from the budget (if there is an invoice from the supplier and the VAT amount is allocated as a separate line in the cash register/sales receipt, receipt order).

- Dt 91 Kt 19 - VAT in the amount of RUB 5,797. written off as other expenses of the enterprise (in case it cannot be accepted for reimbursement from the budget due to the lack of an invoice).

How to prepare attachments to the expense report?

Supporting documents are attached to the expense report in the form of attachments on sheets. These can be either originals or printed electronic versions, however, in both cases, the documents must contain all the necessary details, and the latter also takes into account some nuances.

Please note that when preparing an advance report for a business trip, a boarding pass with information about the employee must be attached to the plane ticket, since it is he who confirms the fact of the flight. If the ticket is electronic, you must provide it in printed form and also attach your boarding pass to it. Despite the fact that electronic tickets lack a signature and seal, current legislation does not recognize this as a violation.

And one more nuance - it is advisable that documents evidencing the employee’s production expenses are issued on a working day. If the date corresponds to a holiday or weekend, the tax office may have questions.

Due dates

The accountable person is obliged to report to the management of the enterprise for the funds received by him for conducting business and administrative activities no later than three working days in accordance with the Federal Law.

After arriving from a business trip, the employee must also write a report no later than 3 calendar days after returning.

In case of violation of delivery deadlines, the episode is declared as a violation of cash discipline and is subject to a fine in accordance with current federal legislation.

In order to analyze acceptable and unacceptable cases of failure to comply with the deadlines for submitting an advance report, you should refer to the Federal Code of Administrative Offences, in particular, Article 15.1 regulates this issue.

It is necessary to take into account that there is no direct liability for violation of advance reporting at the legislative level, but the fact itself will still be recorded. Thus, organizations should not be afraid of sanctions from tax authorities.

The organization must regularly maintain control over the funds allocated to it to maintain its own performance, therefore, monitoring the flow of these funds is the concern of the organization, and not the federal authorities.

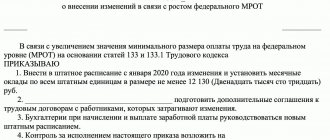

If an employee does not return the funds given to him in advance, the company can write them out from the employee’s salary, but here the rules are regulated by law (Article 137 of the Labor Code) .

Also, this situation can be resolved in court if the employee does not agree with the decision of the management of the employing organization.

The head of an organization is the person actually responsible for all the resources of the organization, i.e. in many cases, the debt for non-return of accountable money may formally appear not on the employee’s account, but on the manager’s account .

The funds issued on account will formally be considered a debt to the company, but at the same time they will not be his earnings and will not be subject to personal income tax.

How to calculate attachments to advance payment?

Several supporting documents may be attached to one advance report. The number of such applications is determined by the list of checks, invoices, BSO or PKO. The question arises: how to count document attachments in the expense report?

When preparing a report, you must paste all supporting documents onto separate sheets. Receipts and receipts are attached in chronological order by date of purchase. After this, the total number of all these documents is calculated and further reflected in the expense report.

What to consider

At the end of the article we will give an example of filling out an advance report for a business trip, but for now we will look in more detail at the points that need to be included in the paper.

- Full name of the employee. According to legal requirements, funds in the form of an advance can only be issued to those employees who officially work for the company on the basis of a civil or employment contract. Also, in addition to the full name, the position of the employee is indicated.

- In the “Destination of advance payment” item, it is mandatory to enter real data, which must match the attached payment document.

- All necessary dates and amounts, which can be confirmed by checks and receipts, are entered into the primary expense item. This will prove to the tax authorities that you actually sent the person on a business trip, spent money, etc. Make sure that the dates on the primary receipt and the receipts do not differ, otherwise all this may end badly.

Please note that reporting can be corrected if it has not yet been accounted for. If the accounting took place, but an error was found, then the document can be canceled (this is done by the manager, since he approved it). It is recommended that you do not throw away or delete the incorrect form in order to provide it to the tax authorities, if necessary, as proof that an error was made.

Standard filling sample

What documents can confirm that the funds were actually spent in the specified amount? There are two options:

- Confirmation by sales receipts or invoices (that is, confirming the purchase).

- Confirmation of payment (cash receipt or card statement).

Attention:

Advance funds are issued to the employee based on the submitted application. The reporting deadline is regulated by the company. She can install it in at least 1 day, at least in 50. But it is better to stick to the classic period of 3 days.

It is also recommended to strictly specify the terms of repayment of debts on both sides. For example, if an employee spent more money than he was given, then he must receive an additional payment within a certain period. The same should be true in the opposite situation - if the costs turned out to be less than what was issued, then the employee must return the “change.”

How to simplify the preparation of an expense report?

You can prepare an expense report much faster and easier in the specialized online application Hamilton Expense Report. Most of the information in the document is already filled in for the employee by default, and what needs to be entered is highlighted in red. To confirm expenses, employees must take photographs of their receipts and attach them to the online report. Next, to send the report to the accountant for verification, you need to click on the “Submit” button.

Thus, in a matter of minutes, an employee prepares only 100% correctly executed electronic advance reports, and all supporting documents for them are always available in the electronic archive.

The functionality of the Hamilton Expense Report application is also useful for other participants in the business process. For example, postings for a joint stock company are generated automatically for the accountant, and the signing of documents by the manager is carried out without printing them - using an electronic digital signature (EDS).

The use of such an application makes the process of working with advance reporting comfortable for all its participants, greatly simplifying and speeding it up. Read more about the conditions for drawing up an electronic advance report here.

How to fill it out correctly

Let's look at how to properly prepare an advance report. It is drawn up according to a unified form on the AO-1 form. The report should contain the following data:

- The amount of funds issued to the employee.

- Full name and position of the person to whom the funds are issued.

- About the purposes for which the money is allocated.

- Information about the previous advance, if any.

- Details and accounting notes.

Standard reporting scheme

The main thing is that the document answers the following questions:

- Was there any overspending?

- Were the reports submitted on time and were all supporting documents provided?

- Does the reporting sheet have any debt to the company?

- Do I need to make a deduction from my salary to pay off existing debt?

Attention:

the list of persons to whom advances can be issued is approved by the manager. Not every employee can receive money from the cash register - if he is not accountable, then the issuance is prohibited.

The report consists of one double-sided sheet. The main part, i.e. the front part, is usually filled out by the employee, since it contains information directly related to his person and the data that he knows. The front side indicates the name of the organization, reporting number, full name of the employee and other data about him (position, personnel number), date of filling out the document and purpose. There is also a plate on the front side in which data on previous advances is entered. On the reverse side are the documents confirming the payment (checks, receipts), as well as the total amount of money spent.

After the document has been completed by the employee, it is handed over to the accountant. He writes in it the corresponding amounts and accounts, as well as a note that the report has been checked and does not contain errors. The amount is always indicated in numbers and in words, after which the accountant’s signature is placed with a transcript (full name, position), the overexpenditure and balance, various details, etc. are indicated. This document is drawn up in a single copy, and it can be filled out both in traditional paper form and electronically. It should be understood that if errors are made when drawing up the document and the manager signs it without corrections, then tax officials may not take it into account and recognize the allocated amount as income with the subsequent additional accrual of personal income tax and other contributions. Therefore, be sure to check the documents before signing them.

What form is the advance report used on?

The advance report form (AO-1) was approved by Decree of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55. The resolution provides brief instructions on how to fill out the advance report form.

Currently, this form is not mandatory, and each organization or individual entrepreneur has the right to independently develop its own advance report form, having approved it in the accounting policy. The same position was confirmed in the letter of the Ministry of Finance of the Russian Federation dated March 6, 2013 No. 03-03-06/1/6700.

However, many organizations still continue to use this sample form to fill out an advance report. It is also implemented in most accounting programs.