Form TS-2 is used by those who pay the trade tax (TC) if they cease to be its payers. What to do if there is a need to deregister not all retail outlets, but only some? Is the TS-2 form relevant when liquidating an organization or closing an individual entrepreneur? We will answer these questions and explain how to correctly enter data into the TS-2 withdrawal notification form in our publication.

Also see:

- Trade tax in Moscow in 2020: rates, payment deadlines and BCC (tables)

- What's changing in the trading fee in 2020

Who is on the list of vehicle payers?

Chapter 33 of the Tax Code of the Russian Federation is devoted to the trade tax. It was introduced by Federal Law No. 382-FZ of November 29, 2014.

For 2020, the collection was and continues to be valid only in Moscow .

Payers of the fee include entities that carry out activities that fall under the Customs Union. That is, if an organization or individual entrepreneur is registered in Moscow, and the store is located in another region, they are not payers of the vehicle. And vice versa: if an entity is registered in another region, but trades in Moscow, it is obliged .

TS is established in relation to types of trading activities at certain facilities.

TS payers are organizations and individual entrepreneurs that conduct trading activities at trading facilities . We will reveal further what is meant by these concepts.

The legislation made it possible not to pay TC to some categories of business entities. These include individual entrepreneurs on a patent and payers of the unified agricultural tax (Article 411 of the Tax Code of the Russian Federation).

Notification of trade fee (form TS-1): nuances of filling out in 2020

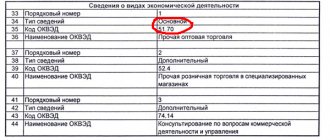

When the payer fills out the notification form for a list of his objects, he must fill out several sheets - one for each object - and reflect the following data in them:

SECTION 1. Information regarding the type of business activity

Field 1.1 “Date of occurrence or change of the taxable object” is filled in with the date in the format DD.MM.YYYY. If the taxable trade is the main one for a person, then when submitting information to the tax office for the first time, this field will indicate the date of commencement of his business activity. When using the accompanying trade option or submitting information about a change in the object, the field will be filled in with the date on which the object began to be used or changed its characteristics.

Field 1.2 “Trading activity type code” contains a two-digit numeric code characterizing the type of trade subject to the fee (see table below).

| Activities subject to trade tax | Activity code |

| Trade in fixed network facilities without trading floors | 01 |

| Trading in non-stationary network objects | 02 |

| Trade in fixed network facilities with trading floors | 03 |

| Trade by releasing goods from a warehouse | 04 |

| Organization of retail markets | 05 |

SECTION 2. Information about the object of trade

Field 2.1 “OKTMO code” must contain the code of the municipality on whose territory the object about which information is being submitted is located. The code can be found in a special reference book or found on the official website of the Federal Tax Service after entering the trading address. The field has 11 squares to fill out. If the code contains 8 characters, you need to enter the code numbers from the first to the eighth square, and from the ninth to the eleventh - put dashes.

Field 2.2 “Trading object code” contains a two-digit numeric code characterizing the type of object subject to the fee (see table below).

| Trade object type | Object code |

| Shop | 01 |

| Pavilion | 02 |

| Retail market territory | 03 |

| Kiosk | 04 |

| Trade tent | 05 |

| Vending machine | 06 |

| Object of peddling or distribution trade | 07 |

| Other | 08 |

Field 2.3 “Name of the object of trade” is filled in with the name of the object, if any (for example, at stores). If the object does not have a name (for example, a tent or a vending machine), then the field must be left blank.

Field 2.4 “Address of the object of trade” must contain the full address of the object of activity, filled in according to the appropriate lines (index, street, house, etc.). If the object is non-stationary and does not require the presence of an exact address, you can limit the detail of its place of operation to a populated area. The numerical designation of the region is indicated in accordance with the reference book “Subjects of the Russian Federation”. For Moscow, code 77 is provided.

Field 2.5 “Grounds for using the object of trade” is filled in with a digital code indicating the type of right of use. For property owners – 1, for tenants – 2, and in other cases – 3.

Field 2.6 “Permit number for placement of a non-stationary trade facility” is filled in with the number of the corresponding document. If trading is carried out in a stationary facility or permission is not available for another reason, then the field must be filled in with zeros.

Field 2.7 “Building cadastral number” is filled in only for those objects whose code in field 1.2 is marked with the values “01” or “03” and which do not have a cadastral number for a specific retail premises.

Field 2.8 “Cadastral number of the premises” is filled in if there is a cadastral number of the premises and if the value is “01” or “03” in field 1.2.

Field 2.9 “Cadastral number of the land plot” is filled in with the value “05” in field 1.2 and must contain the number of the plot on which the payer organized the retail market.

Field 2.10 “Area of the trading facility” contains a number indicating the number of square meters of area of the trading floor and market, if any. This value will be used below to calculate the fee amount rate.

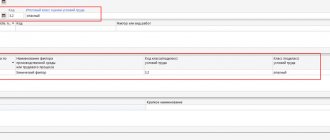

SECTION 3. Calculation of the fee amount

The next 6 fields on the page are devoted to determining the amount of the trading fee . Calculated once upon registration of an object, the amount is payable quarterly until the termination of the object’s activities and its deregistration. In case of changes in the characteristics of the object, the corrective form TS-1 is submitted with the calculation in the current fields of the new amount to be paid to the budget.

Important! This section must also be completed by those categories of persons who actually do not pay the trade fee, belonging to the category of beneficiaries. In this case, the values of the calculated amount lines and the benefit line will be equal and a zero value will be presented for payment.

Field 3.1 “Fee rate for a trading facility” is filled in for those facilities for which the unit of account is the presence of the facility itself (vending machine, tent, etc.) and must contain the corresponding value of the rate for the quarter in rubles established by Moscow Law No. 62 “On Trade Tax” (or, in the future, in other laws adopted in the relevant cities).

Field 3.2 “Fee rate established in sq. m" is filled in for those objects for which the unit of account is the footage of the object (shop, market, etc.) and must contain the corresponding value of the quarterly rate in rubles established by Moscow Law No. 62 "On Trade Fee" (or, in the future , in other laws adopted in the respective cities). Considering that Moscow has established a differentiated type of rates, it is assumed that the payer will independently calculate and indicate in this field the average rate for his specific facility.

An example of calculating the average rate. A legal entity conducts trading activities in a premises with an area of 70 sq.m. in the Zelenogradsky district, which belongs to the capital territory outside the Moscow Ring Road. The Moscow law defines a differentiated rate for this zone: 420 rubles each. for the first 50 sq.m. and 50 rub. for each subsequent square meter of area. Average rate per 1 sq. meter for this object = (420 rubles * 50 sq.m.) + (50 rubles * (70 sq.m. – 50 sq.m.)) / 70 sq.m. = 314.29 rub.

Field 3.3 “Calculated amount of fee for the quarter” contains the amount of the quarterly fee in rubles, calculated as the product of the average rate by the physical characteristic indicator. For the object from the previous example, the fee amount = 314.29 rubles. * 70 sq.m. = 22,000 rub.

Field 3.4 “Amount of benefits provided for a trade facility” is filled in if the activities carried out with the help of this trade facility are listed in Art. 3 of the Moscow Law and falls into the preferential category. The amount of the benefit cannot exceed the amount of the calculated fee specified in field 3.3. If we assume that the object from the example considered above is a beauty salon, then the amount of the benefit will be equal to the calculated amount of the fee for the quarter and will also be 22,000 rubles.

Field 3.5 “Tax benefit code” is filled in if there is a value in the previous field, and contains a twelve-digit code that refers to the relevant article, clause and subclause of the law containing the basis for applying the benefit. Of the proposed 12 squares, 4 are allocated for each value. For the beauty salon from the previous example, the benefit is provided for by subclause 1 of clause 3 of Article 3 of the Moscow Law “On Trade Fees”. This means that in the code these numbers will be reflected sequentially as 0003 (article), 0003 (item), 0001 (subitem) and field 3.5 after filling will look like:

| 0 | 0 | 0 | 3 | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 1 |

| Article number | Item number | Sub-clause number | |||||||||

Field 3.6 “Fee amount for the quarter” must contain the amount in rubles to be actually paid to the budget for the quarter. In the TS-1 form, a formula is written next to this field, based on which the value is calculated as the difference between fields 3.3 and 3.4, i.e. between the amount calculated at the average rate and the amount of the benefit. The total amount of the fee to be paid is indicated in full rubles, with kopecks:

- less than 50 – discarded;

- 50 or more - rounded up to the nearest full ruble.

What is trading activity and what is classified as an object of trade?

Let us decipher these concepts in order to correctly apply Chapter 33 of the Tax Code of the Russian Federation.

Here is a list of types of trade that are subject to a trade tax:

In this case, trade includes retail, small wholesale and wholesale purchase and sale of goods.

Who should pay the trade tax

The need to pay a trade tax directly depends on 2 factors:

- The chosen taxation system.

- Type of business activity.

Selected tax system

Trade tax must be paid only by individual entrepreneurs and organizations using OSNO or simplified tax system.

Payers of the Unified Agricultural Tax and entrepreneurs with a patent do not need to pay a trade tax.

As for UTII, according to the new rules, it is impossible to combine imputation and trade tax. Therefore, if you apply UTII, and a trade tax has been introduced for your type of activity in the region, then you will have to cancel the imputation and switch to another taxation system.

We suggest you read: Bankruptcy of an absent debtor, subsidiary liability

Table 1. Payment of trade tax depending on the tax regime

| Tax regime | The need to pay a trade tax |

| General taxation system (GTS) | Need to pay |

| Simplified taxation system (STS) | |

| Patent tax system (PTS) | No need to pay |

| Unified Agricultural Tax (USAT) | |

| Unified tax on imputed income (UTII) | If a trade tax has been introduced in the region for the type of activity UTII, then it is necessary to switch to a different taxation system |

Activities subject to trade tax

Trade tax must be paid to individual entrepreneurs and organizations engaged in retail, small wholesale and wholesale trade through:

- stationary retail facilities with a sales floor;

- stationary retail facilities that do not have a sales area (with the exception of gas stations);

- non-stationary retail facilities;

- warehouses.

In this case, the trade fee is transferred only in the case when a specific type of activity is expressly specified in the law. For example, in Moscow, sales from warehouses are not subject to the trade tax, this is due to the fact that this type of business is not provided for in the legal act of Moscow.

As for the activities of retail markets, it is also equated to trade. However, the fee is not levied on the retail outlets themselves, but on the entire market area itself.

Therefore, it can be expected that market owners will not want to pay the trading fee out of their own pockets and will simply distribute these costs among the traders, increasing their rent or the cost of the right to trade.

Note: in Chapter 33 of the Tax Code of the Russian Federation there are no definitions for many key terms (sales area, what are objects of stationary trade, etc.) therefore, in such a situation, representatives of the Federal Tax Service recommend focusing on the concepts used for UTII and PSN (see Art. 346.27 and Article 346.43 of the Tax Code of the Russian Federation).

Procedure for registering vehicle payers

to register as a payer within 5 days If this is not done, the tax authority will still register the “silent one” - based on information received from the authorized body. In Moscow this is the Department of Economic Policy and Development of the City of Moscow.

In order for the tax office to deregister the payer of the vehicle, it must be notified of this within 5 days from the date of termination of use of the object of trade or conduct of trading activities.

The payer is deregistered by sending them a notification in the TS-2 form.

KEEP IN MIND

Previously, no deadlines were set. The 5-day limit was introduced in 2020 by Federal Law No. 325-FZ dated September 29, 2019.

Below you can find TS-2 for free, as well as learn the nuances of filling out this notification.

To which authorities is the document sent?

According to Art. 416 of the Tax Code of the Russian Federation, the notification is sent to the tax office, which is located where the retail outlet is located. A notification can also be sent to the tax office, which is located at the address where the company is located. Or you can transfer it to the tax office at the place of residence of the entrepreneur.

Methods

There are several ways to submit a notification to the tax office.

It can be done:

- Personally, by going to the tax office;

- In person, by sending a notification by mail, registered mail;

- Via the Internet by uploading a notification to the FSN website.

In what cases should you use TS-2?

Form TS-2 is subject to application if the payer of the fee closes all retail outlets related to the tax office to which the notification is submitted. If only some of the facilities are closed, while others continue to function, then Form TS-1 should be submitted.

The situation is similar with the change in the taxation system. If an individual entrepreneur transfers all of his retail outlets to a patent, he must fill out form TS-2. If something remains on non-preferential taxation systems, use the TS-1 form.

If the organization is liquidated or the individual entrepreneur is closed , in this case there is no need to submit the TS-2 form. The tax office will deregister such an entity as a vehicle payer independently - based on the entry in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

The same applies to reorganization , during which the company actually ceases to exist in its previous form (accession, merger). But a company that appears again during such a transformation must register as a fee payer on a general basis.

Activities not subject to trade tax

Preferential types of activities

According to Moscow Law No. 29 of June 24, 2020, the following were exempted from paying the trade tax:

- retail trade through vending machines;

- trading at weekend fairs, specialized and regional fairs;

- trade in cinemas, theaters, museums, provided that at the end of the quarter the income from ticket sales is at least 50%;

- trade in the territory of the agri-food cluster (vegetable warehouse);

- retail facilities located on the territory of retail markets;

- autonomous budgetary and government institutions;

- organizations of federal postal services;

- non-stationary retail facilities (kiosks, tents, open trays) selling printed products;

- religious organizations regarding trade in religious buildings.

In addition, consumer service facilities (hairdressers, beauty salons, laundries, dry cleaners, repair of clothing, shoes, watches, jewelry, repair and production of metal haberdashery and keys) were exempted from paying the trade tax, subject to the following conditions:

- The main activity is the provision of household services, not trade.

- The area of the object does not exceed 100 square meters. meters, and, directly, the retail space occupied by equipment intended for display and display of goods is no more than 10% of the total area.

For example, a beauty salon with an area of 50 sq. meters, you will not need to pay a sales tax if no more than 5 square meters are allocated for the trade of related products (shampoos, creams, etc.). meters.

According to representatives of the Federal Tax Service, online stores also do not have to pay a sales tax, but only on condition that their activities do not involve direct contact between the seller and the buyer (sales through couriers or forwarders).

Moreover, the sale of goods through an online store falls under the description of trade from a warehouse, and, as you know, in Moscow it is not subject to trade tax.

Please note that despite the fact that the above types of activities are preferential and are exempt from paying the trade tax, it is still necessary to submit a notification (indicating the appropriate category of benefit) about registering as a payer of the trade tax.

We invite you to read: Compensation for damage in case of an accident under compulsory motor liability insurance

The basis for calculating the sales tax is not the actual income received, but the very fact of using the retail facility. Moreover, a retail facility is understood not only as real estate (shops, tents, kiosks, etc.), but also as movable property (delivery and distribution trade objects).

Therefore, the need to pay a trade tax does not depend on factors such as:

- Ownership of a commercial property. The fee must be paid by those persons who directly use the facility for trade, regardless of whether it is the owner or the tenant.

- The amount of income received. The size of the trade fee directly depends only on the number of square meters, as well as the type and location of the trade facility.

- Place of registration of a businessman. The trade tax must be paid by everyone who trades in the territory where it is established, regardless of the place of residence of the entrepreneur (for example, an individual entrepreneur registered in Smolensk, but operating in Moscow is required to pay a trade tax).

- Regularity of trade. The trading fee is calculated and paid for the entire quarter at once. Therefore, regardless of the seasonality of the business and the number of days worked in the quarter, the trading fee will still have to be paid in full.

What happens if you don’t submit the TS-2 form?

Let us remind you that the TS-2 form must be submitted within 5 days from the date of termination of trading activities through the trade facility. If you are late with the date of submission of the notification, the tax office will deregister not from the date indicated in the notification, but from the date of filing the notification (clause 8 of Article 416 of the Tax Code of the Russian Federation).

If the actual date of termination of activity and the date of submission of the notice fall in the same quarter, then the delay is not so critical.

The collection period is quarterly. That is, if even 1 day in a quarter an activity that falls under the TS was carried out, then it must be paid in the full quarterly amount. But if trading was stopped in one quarter, and the notification was submitted late in the next, then you will have to pay the vehicle for the “extra” quarter.

If you do not submit a notification in the TS-2 form at all, then the fee will be charged full regardless of the actual conduct of the activity.

Rules for filling out a notice of deregistration of a trade tax payer

The notification of deregistration of the trade tax payer is filled out quite simply.

But there are nuances that you need to know about:

- You can fill out the notification by hand, using a regular ballpoint pen;

- You can fill out the notification on your computer;

- if data does not need to be entered in a certain field, a dash is placed in its place if the notification is filled out by hand;

- each character is entered in a separate box;

- handwritten data is entered in capital letters, printed;

- when filling out on a computer, use the Courier New font;

- font size 16 or 18;

- divisions in dates – dot;

- You cannot use a proofreader to correct errors in the notification;

- When filling out a notification on a computer, each page must be printed on a separate sheet of paper;

- The notice sheets are fastened together with a paper clip;

- You can submit a notification to the tax office by putting it in a file.

Form TS-2: fill it out correctly

Form TS-2 was approved by order of the Federal Tax Service of Russia dated June 22, 2015 No. ММВ-7-14/249. In the same order you can find the procedure for filling out the notification and the format for submitting it electronically.

Next, you can download the TS-2 form for free from our website using a direct link:

NOTIFICATION FORM TS-2

The TS-2 form is simple and contains a minimum of information:

| Payer identification data (TIN, KPP, name of organization/full name of individual entrepreneur) |

| Code of the tax authority to which the notification must be submitted |

| Date of deregistration as a fee payer |

It is very important to indicate the date correctly so as not to accidentally add an extra quarter.