The essence

Nominal wage is the amount of funds that an employee receives in his hands for a certain period. When developing a policy in the field of monetary remuneration for work, it is necessary to take into account the following factors:

Complexity of work and level of qualifications of employees;

Harmful working conditions;

Remuneration must correspond to the effort expended;

A conscientious attitude towards work (must be encouraged);

An irresponsible attitude towards responsibilities that led to negative consequences should be followed by material punishment;

Labor productivity most often grows faster than average wages;

Monthly income is indexed according to the inflation rate.

It is necessary to use such forms and systems of remuneration that best meet the needs of the organization. The level of real wages depends on how clearly all these principles are observed. If monthly income increased by 15% and inflation for the current period was 10%, then purchasing power increased by only 5%. The number of goods that can be purchased with the money received is the real salary.

https://youtu.be/H3fsfkW8jJ0

Scope of this concept

The types of wages are not specified in the Labor and Tax Codes, they are not distinguished in accounting, and are not used in reporting and working documentation.

These terms are general economic terms and also relate to statistical information. The general definition of wages relates to the reward for work. Looking at it from different points of view, one can define salary as:

- compensation for labor in cash;

- part of the total product in financial equivalent, which becomes the property of the worker depending on the quantity and quality of his labor costs;

- the cost of labor resources used in the production process;

- part of the expenses of a manufacturer or entrepreneur intended to pay for hired labor.

https://youtu.be/cCYH13jne7Q

The state guarantees workers wages not lower than the minimum allowable amount established by law (minimum wage).

Reward system

To stimulate workers, the following principles and forms of remuneration are used in the West:

- The share of unstable elements (bonuses, bonuses, etc.) reaches 1/3 of total income. They are used as incentives for saving materials, increasing productivity and improving product quality.

- A differentiated evaluation system is used: personnel qualifications, volume and quality of work, financial results of the company.

- The tariff rate systems used encourage employees to improve quality parameters and master related professions.

- The results of the work of administrative and technical personnel are assessed based on the goals achieved.

- Related bonus payment plans encourage employees of different teams to perform work efficiently and on time.

- Some shareholders are employees of the organization.

Features of nominal wages

A person spends the received amount of monthly remuneration on the purchase of clothing, food, goods and other services. Taxes are paid to the state from it. Real and nominal wages can be the same only if the price level remains constant. But such a situation is impossible under capitalist conditions.

In a market economy, prices are constantly changing. As a result, the same amount determines different amounts of available funds. K. Marx argued that employees should be paid remuneration sufficient to maintain their ability to work, exist and acquire vital necessities.

What is the difference between nominal wage and real wage?

To further understand the issue, it is first necessary to clearly define each term:

- nominal salary (WIP) is the amount that an employee actually receives for his work. The amount is indicated in the payslip. There is no exact concept in the legislation, although the term is used everywhere;

- real earnings (REW) – the volume of goods that a citizen can purchase with the amount received as a salary.

Nominal wages are understood as monetary remuneration in a fixed amount, which the employer pays to the employee either for a certain volume of goods produced or work performed in a fixed time, or for the number of hours worked. This concept also includes various bonuses and incentive payments.

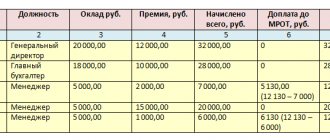

Nominal wages are usually divided into two types: accrued and paid.

Nominal accrued wages are payments for the employee’s labor activity, calculated in accordance with the accounting system adopted by the enterprise.

The paid nominal salary is the amount of money remaining after paying tax deductions from accrued wages, and given to the employee according to the statement.

The calculation of nominal wages is based on several calculation systems:

- Salary. Under this system, an employee receives a salary for his work in the amount of the salary fixed in the staffing table.

- Time-based. The basis for calculation is the time worked by the employee, which is paid at established rates.

- Piecework. Here the base is either the individual contribution of the employee to the total output (the volume of production produced by them) or his share in the total output of the team.

- Piece-time work. In this case, in addition to the fulfilled standard, the employee can receive incentive payments for exceeding the set plan.

- Chord. Under this system, an employee receives remuneration based on the shifts worked according to the schedule. Salaries are issued both upon completion of one of the stages of the production process, and upon completion of work.

- Scheduled and time-based. This calculation system provides remuneration for the fact that the employee has produced a certain standard of production and completed it within the allotted time.

- Mixed. In such a system, all of the above methods can be used in various combinations.

Real wages are the number of banknotes within which an employee has the opportunity to purchase various goods and services necessary for a comfortable existence. That is, this is the money that the employee received in his hands at the end of a certain working period and can now spend on food, medicine, clothing, payment for housing and communal services, education and recreation. This salary represents an indicator of a person's level of well-being.

Real wages are defined as high or low relative to current prices for goods and services necessary for life.

As for the price level, in a capitalist-type economy this is a constantly changing value, but in the Russian economy the change is mainly in the direction of increase.

Accordingly, over time, the real wages of most Russians can hardly be assessed as high.

Similarities

Both nominal and real wages represent the cost of labor power.

Both types of wages will have a monetary value and will be calculated in the currency in which the employer makes payments to its employees.

Both of these types of salaries cannot have the same amount, since contributions to the state are made at the expense of the employer, and accordingly, he includes these expenses in the wages of his employees.

Difference

How do real wages differ from nominal wages? The fact that the real salary is strictly tied to the existing prices of consumer goods and services, and the nominal one is just a certain amount earned by a specialist without taking into account inflation and taxes, the size of which does not reflect the real economic situation.

In order for a nominal salary to turn into a real one, all tax and pension contributions made by the employer must be subtracted from its value. Accordingly, the amount of nominal wages can often be calculated by the employer based on its own costs of doing business. Since the business owner is forced to make considerable tax contributions to the state, it is quite understandable that he will strive to save on the cost of paying employees. At the same time, the question of whether the employee can comfortably live on the money that is actually paid to him is unlikely to worry the employer.

Place in the economy

The so-called purchasing power of the population is calculated on the basis of real wages. The amount of purchasing power has an inverse relationship with the consumer price index or PPI.

If consumer prices rise, then purchasing power will correspondingly fall down.

In economics, it is practiced to use measures to compensate for the impact of inflation by changing the PPI value upward.

The difference between the levels of nominal and real wages will be an indicator of the magnitude of inflation. The nominal wage index is the ratio of the current wage level to the wage level of the previous year, multiplied by 100. The so-called real wage index is calculated as follows: the nominal wage index is divided by the CPI and multiplied by 100.

If the size of the nominal wage does not change, and inflation rises, then the purchasing power of the population also decreases, since what a person earns will not be enough to pay for the goods and services necessary for life.

We invite you to familiarize yourself with the average industry salary in 2020 according to qualifiers

In conditions of constantly growing inflation, the size of real wages will still decline even if the level of nominal wages increases. This is observed with an artificial increase in wages through forced indexation by the state. At the same time, the degree of satisfaction with the social situation of the population will decrease.

On the contrary, an increase in nominal wages in a relatively stable economic situation will indicate an increase in the level of well-being of citizens. And a slight increase in the price index will not have a critical impact on the standard of living of citizens and will even be an additional incentive for employers to increase nominal wages.

By the way, the nominal value of the work done by an employee, which is a large mathematical value, is not yet an indicator that the employee’s wages are high. During the default period of the 90s, salaries amounted to millions, and there was nowhere to spend these enormous sums due to a shortage of consumer goods.

The efficiency of the enterprise depends on the management policy in the field of remuneration, since wages are the most important incentive in the use of labor. This is part of the costs that goes towards monetary compensation for workers. There are real and nominal wages. You will find out further how they differ from each other.

- Nominal salary is the amount of funds that an employee receives in his hands for a certain period. When developing a policy in the field of monetary remuneration for work, it is necessary to take into account the following factors:

- • complexity of work and level of qualifications of employees;

- • harmful working conditions;

- • remuneration must correspond to the effort expended;

- • conscientious attitude towards work (must be encouraged);

- • for an irresponsible attitude to responsibilities that led to negative consequences, material punishment should follow;

- • labor productivity most often grows faster than average wages;

- • monthly income is indexed in accordance with the inflation rate.

It is necessary to use such forms and systems of remuneration that best meet the needs of the organization. The level of real wages depends on how clearly all these principles are observed. If monthly income increased by 15% and inflation for the current period was 10%, then purchasing power increased by only 5%. The number of goods that can be purchased with the money received is the real salary.

Reward system

To stimulate workers, the following principles and forms of remuneration are used in the West:

- The share of unstable elements (bonuses, bonuses, etc.) reaches 1/3 of total income. They are used as incentives for saving materials, increasing productivity and improving product quality.

- A differentiated evaluation system is used: personnel qualifications, volume and quality of work, financial results of the company.

- The tariff rate systems used encourage employees to improve quality parameters and master related professions.

- The results of the work of administrative and technical personnel are assessed based on the goals achieved.

- Related bonus payment plans encourage employees of different teams to perform work efficiently and on time.

- Some shareholders are employees of the organization.

A person spends the received amount of monthly remuneration on the purchase of clothing, food, goods and other services. Taxes are paid to the state from it. Real and nominal wages can be the same only if the price level remains constant. But such a situation is impossible under capitalist conditions.

In a market economy, prices are constantly changing. As a result, the same amount determines different amounts of available funds. K. Marx argued that employees should be paid remuneration sufficient to maintain their ability to work, exist and acquire vital necessities.

Content

- What are real and nominal wages?

- Parameters of nominal wages

- Real wage parameters

- Similarities and differences between nominal and real wages

- Dependence of real wages on nominal wages

- Applicability of the concepts of real and nominal wages

- Conclusion

State Games

Real and nominal wages are dependent quantities. The first represents the sum of the costs of goods that an employee can buy for the remuneration received after deducting taxes at a given price level. From this point of view, inflation is beneficial to entrepreneurs, as it allows them to pay less for labor. On the other hand, it significantly worsens the quality of life of workers. To maintain an optimal balance, an indexation indicator was introduced. It allows you to increase the amount of remuneration by a certain percentage established by law. The opposite situation is also possible. Real wages will decrease and nominal wages will rise if prices change faster than the amount of compensation.

Dynamics

Changes in real wages are influenced by many factors. The level of prices, taxes, rent tariffs, etc. leads to a decrease in the amount of remuneration. The growth of real wages occurs on the basis of an increase in socialist production and employment. Even if the state increases prices for some goods, this does not greatly affect the level of remuneration received. Unemployment, a decrease in the need for qualified personnel, unfavorable economic situations, an increase in the level of low-paid professions - all these factors reduce the growth of nominal wages in the enterprise and in the state as a whole.

Some statistics

According to economists, in 2014 real wages in Russia decreased by 7.3% compared to 2013. This is the first time such a phenomenon has been recorded since 2000. The average monthly accrued amount of remuneration, according to Rosstat, increased by 9.2% in nominal terms. In December 2014, this ratio was already 6.1%. But the level of real income over the year increased by only 1.3%. If the price of oil does not change ($40 per barrel), then the purchasing power of Russians may decrease by 10% in 2-3 years.

"White"

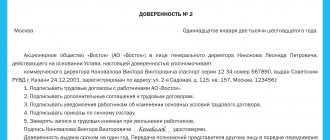

The law provides only for official salaries. Its size is set by the employer and recorded in documents. In accordance with the Labor Code, remuneration for labor must be higher than the minimum wage and paid twice a month. The accrual scheme appears in all documentation. Taxes are paid on it.

The Tax Code of the Russian Federation provides for the deduction of personal income tax (13%) from wages. It is paid for by the employee. And the unified social tax at a rate of 26% is the employer. It turns out that from an official salary of 50 thousand rubles. the employee will receive 43.5 thousand rubles, and the company will have to pay 63,000 (50 thousand - salary, 13 thousand - tax). Hence the tendency to reduce official salaries.

"Grey"

The nominal wage rate is negotiated verbally between the employee and the employer. Only the official part is displayed in the documents. Most often this is the minimum wage. Employees pay a smaller amount of personal income tax and other withholdings. But the compensation scheme for sick leave, vacations and dismissal payments is negotiated with the employer. Most often, these amounts are calculated based on the size of the “official” item. According to the law, the first three days of sick leave are paid by the employer, and the rest by the Social Insurance Fund. The fund makes calculations based on the level of the official salary. If, by agreement, sick leave is compensated in full, then the employer must pay the difference from his own pocket. Not everyone will agree to such a scheme.

But the worst thing is that the insurance period and the size of the future pension depend on the size of the “official” card. Therefore, some employees try to reach an agreement with management. Most often, the employer agrees to make the salary completely “white”, but on the condition that its costs do not increase. That is, if earlier he paid 50 thousand rubles for an employee, then this figure will remain the same. But the worker will receive only 34.5 thousand rubles (personal income tax - 13%, unified social tax - 26%). Employees most often do not agree to such a scheme.

"Gray denomination"

https://youtu.be/-wVjqFr2Fqs

Since the tax burden is tied to nominal wages, the employer is always tempted to set them as low as possible, down to the minimum wage. To compensate for the resulting gap between nominal and real wages, he pays employees additional funds outside of accounting documents or in another form.

Such schemes cause harm to the state and, if possible, are monitored and suppressed. If the wage fund is suspiciously low, and its nominal values are too far from real ones, the regulatory authorities will definitely become interested in this situation. A tax audit and explanation, and possibly more serious measures, are inevitable.

"Black"

This is an unofficial salary. Its full size is agreed upon orally. The organization maintains double-entry bookkeeping. The money is paid from unaccounted profits. This scheme is used by realtors and travel agencies in collaboration with agents. The average nominal accrued wages for enterprises in the field of transportation are also low. Most payments are made in cash. The employee has no guarantee that he will receive sick leave compensation, vacation pay or dismissal benefits. The employer risks a fine of 40% of the amount of unpaid wages. And if the debts exceed 500 thousand rubles. - become subject to criminal liability.

No matter how dangerous these schemes are, they are still used in practice. Indexation cannot always compensate for rapid price increases. People agree to informal income payment schemes, risk losing their pensions, but increase their purchasing power.

Conclusion

Real and nominal wages are interrelated quantities. The first is the amount that the employee receives in hand. The second is calculated from the number of goods that he can buy. In a market economy, these two indicators are not equal. Rising unemployment, rising prices and declining product quality reduce the purchasing power of the population.

The interaction between the worker and the employer is formed on mutually beneficial terms. Each of the participants in this relationship has their own tasks. It is important for a manager to find a qualified employee, and the latter, in turn, expect decent remuneration for their professional activities. Thus, the main issue is money.

Nominal wages

This is the amount that is intended to be paid per unit of time spent on work. Upon joining the company, the employer and the future employee enter into an agreement. This document confirms the fact that the citizen is employed. The contract specifies the basic conditions of professional activity in the company. It also contains clauses that determine the amount of monetary allowance and the frequency of its payment. The amount of remuneration depends on the system that the company uses for calculations. Nominal wages are all the funds that a worker receives for his activities in the organization. This includes, among other things, bonuses, incentives and other payments.

How is nominal wage calculated?

There are two closely interacting categories in the labor market: employers and employees.

The latter are ready to exchange their services for a monetary reward. Its size is calculated based on labor costs per unit of time. Personal factors, such as employee expenses for personal needs, as well as current market prices for goods and services, are not taken into account here.

Since wages are regarded as income received by an individual, citizens pay part of it to the state treasury in the form of taxes and insurance contributions. Naturally, the resulting salary amount will be less than that agreed upon by the terms of cooperation with the employer.

Without delving into complex economic concepts, we can say that a nominal salary is a sum of money that is accrued to an employee on paper and appears only in accounting documents. Its size is calculated taking into account the amount of work done over a certain time period (hour or month), but without taking into account various taxes and fees.

It includes the main part of the remuneration, calculated according to the adopted tariff schedule, as well as mandatory additional payments, coefficients and bonuses.

In addition, the nominal salary includes additional remunerations, which include:

- payment for sickness absence,

- vacation pay,

- payment for forced downtime,

- maternity and baby care time,

- preferential hours when employing minors,

- compensation upon dismissal.

Thus, the additional part of the salary includes all types of payments for the time during which the employee did not actually perform his official duties.

Real and nominal salary

What is the difference between them? The nominal salary, as mentioned above, is the funds that the employee receives for the work he has done, and the real salary is the volume of services and goods that can be purchased with this money. Due to the latter, purchasing power is formed. This factor is considered key when calculating the economic indicator of welfare growth. Inflation has a direct impact on reducing purchasing power. The more intensively prices rise while nominal payments remain unchanged, the fewer products and services a citizen will be able to purchase, since he will not have enough funds.

Methods for estimating real wages

Usually, a conditional consumer basket is considered for this. At the same time, a list of goods that should be included is determined and price increases for them are monitored. It goes like this. At the beginning of the reporting period, the total cost of products and services included in the list is determined. When the time runs out (for example, in a month), the total price is determined again. Next, the data is compared and it is determined by how many percent the new indicator is higher or lower than the old one.

This method depends significantly on the composition of the basket. Usually they try to include essential goods on the list, without which no one can live normally. Therefore, various options for such assessments can be used. At the state level, in order to ensure objectivity, a consumer basket is considered, which includes a relatively large list of essential goods and services.

Sometimes some measure the purchasing power of money based on the exchange rate against major currencies. However, this indicator is approximate, since the currency is not always involved in pricing.

Index

It was introduced for change statistics. It is expressed as a percentage. The calculation is carried out by dividing the nominal salary indicator by the price index and multiplying by 100. Statistical figures reflect processes that take place in real life. This information is used by government agencies to respond in a timely manner to certain changes. With high inflation and the absence of indexation of nominal wages, dissatisfaction with the social situation arises among the population. A slight increase in prices is good for the economy. It acts as an incentive to increase employee salaries. But high inflation is destructive.

Wages are the result of time worked, remuneration for work in monetary terms. This is precisely the description of wages given by Article 136 of the Labor Code of the Russian Federation. General economic theory divides wages into real and nominal. In this article we will analyze each of the concepts in detail and determine the difference between them.

Nominal salary is the amount that the employee actually receives as payment for his work. This is the amount indicated on the payslip. The concept of nominal wages is not regulated by law, but it exists and is quite widespread.

Real wages represent the quantity of goods that can be purchased for the wages received.

Often, an employee can afford to purchase goods with a nominal salary that are several times less than a few months ago. Thus, real wages are an indicator of the welfare of stable developing countries.

Parameters of nominal wages

So, we dealt with the concept of nominal wages above. It only remains to add that its size directly depends on the labor produced.

Elements of wages that form the nominal profit of an employee for various forms of remuneration:

- rate, salary, working time (amount in hours, days);

- the significance of the task performed or the number of units produced;

- summary data on the length of time worked and compliance with the quality standard;

- the size of the actual value within the period fixed by the schedule.

Each of the listed configurations has its own indicators that affect the amount of salary. Many enterprises practice additional motivation and incentives for better/faster completion of tasks: bonuses, which are applied to all forms of payment based on the results of the month, quarter or year.

As mentioned earlier, the level of real wages is an indicator of the economic growth and well-being of a country.

Characteristics of parameters influencing the size of real wages:

State intervention in them partly gives balance to the distortion of market processes. Economic and social methods of influence are used through legislative and regulatory spheres of influence.

Similarities and differences between nominal and real wages

Common features:

- Both are pay representatives.

- Presented in monetary terms and the currency in which the employer makes payments.

- Their size is not equal due to contributions to the state in the form of taxes, which must be made by the employer.

The main difference between nominal (accrued) and real wages is that nominal income, unlike real income, is in no way related to the well-being of workers and does not reflect their purchasing power.

Based on the above, it is obvious that it is the size of the real salary that is responsible for the employee’s material security.

The direct codependence of real wages on nominal wages is especially clearly visible in a situation where the level of nominal wages is growing faster than inflation.

For example, the amount of accrued wages increased by 17% percent, while the inflation rate was 7%. It turns out that real wages (purchasing power) increased by 9.34%. That is, an employee can afford 9.34% more goods and services than in the previous year (month, quarter).

The opposite situation shows the dependence no less clearly. Salary growth is slower than the rate of inflation - this is a common story. Let's take a closer look at it.

For example, nominal wages increased by 40%, while inflation was 45%. It turns out that the size of real wages became lower by 2.33%. In other words, an employee with such data, despite a significant (in numbers) increase in nominal wages, will be able to purchase 2.33% less goods and services. That is, the standard of living of such an employee has become lower.

Applicability of the concepts of real and nominal wages

The terms in question cannot be found in any of the codes of the Russian Federation. Their existence is limited to general economic theory and directly relates to statistical data.

The very concept of “wages” can be explained using the following theses:

- reward for completing tasks, presented in monetary terms;

- cost of time of each individual specialist;

- the company's costs of paying employees.

The state ensures that wages do not fall below the minimum established by law.

Conclusion

From all of the above, the following conclusions can be drawn:

- Nominal and real wages have different values, but are closely related.

- The concepts of accrued and real wages exist only in general economic theory and are used in statistical research.

- What matters for purchasing power is real rather than nominal wages.

Simply put, it's not the number on your payslip that matters, it's what you can buy with that amount that matters.

by type of economic activity

(rubles; 1995 – thousand rubles)

| 2004 | 2005 | 2006 | 2007 | 2008 | |

| Total in the economy | 6739,5 | 8554,9 | 10633,9 | 13593,4 | 17226,3 |

| Agriculture, hunting and forestry | 3015,4 | 3646,2 | 4568,7 | 6143,8 | 8200,8 |

| Fishing, fish farming | 7084,9 | 10233,5 | 12310,8 | 14797,0 | 19322,9 |

| Mining | 16841,7 | 19726,9 | 23145,2 | 28107,5 | 33127,2 |

| extraction of fuel and energy minerals | 19903,3 | 23455,9 | 27614,5 | 33275,5 | 38943,4 |

| extraction of mineral resources, except fuel and energy | 10876,6 | 13176,0 | 15363,7 | 19092,7 | 22953,7 |

| Manufacturing industries | 6848,9 | 8420,9 | 10198,5 | 12878,7 | 15878,6 |

| production of food products, including beverages, and tobacco | 6065,8 | 7303,8 | 8806,7 | 11069,2 | 13798,3 |

| textile and clothing production | 3356,5 | 3986,0 | 4964,3 | 6589,5 | 8057,9 |

| production of leather, leather goods and footwear production | 3774,7 | 4695,3 | 5649,1 | 7537,0 | 9423,3 |

| wood processing and production of wood products | 4614,6 | 5895,4 | 6950,4 | 8815,6 | 10818,6 |

| pulp and paper production; publishing and printing activities | 7892,0 | 9418,6 | 10923,6 | 13792,0 | 17043,2 |

| production of coke and petroleum products | 13729,3 | 19397,1 | 22319,6 | 28565,0 | 34908,6 |

| chemical production | 7682,7 | 9928,3 | 11599,3 | 14615,9 | 18055,5 |

| production of rubber and plastic products | 5956,8 | 6879,2 | 8767,7 | 11082,6 | 13664,0 |

| production of other non-metallic mineral products | 6422,4 | 7921,8 | 9983,8 | 13193,3 | 16338,5 |

| metallurgical production and production of finished metal products | 9196,8 | 10260,7 | 12001,5 | 14990,7 | 18003,3 |

| production of machinery and equipment | 6514,2 | 8379,8 | 10418,0 | 13479,8 | 16683,3 |

| production of electrical equipment, electronic and optical equipment | 6431,7 | 8218,8 | 10289,8 | 13114,4 | 16420,8 |

| production of vehicles and equipment | 7828,0 | 9377,4 | 11431,2 | 14013,6 | 17222,5 |

| other production | 5182,0 | 6386,8 | 8278,0 | 10114,1 | 12405,0 |

| Production and distribution of electricity, gas and water | 8641,8 | 10637,3 | 12827,5 | 15587,3 | 19071,8 |

| Construction | 7304,7 | 9042,8 | 10869,2 | 14333,4 | 18314,1 |

| Wholesale and retail trade; repair of vehicles, motorcycles, household products and personal items | 4906,2 | 6552,1 | 8234,9 | 11476,3 | 14589,2 |

| Hotels and restaurants | 4737,3 | 6033,4 | 7521,7 | 9339,0 | 11597,0 |

| Transport and communications | 9319,9 | 11351,1 | 13389,9 | 16452,3 | 20668,5 |

| of which communication | 8974,2 | 11389,1 | 13220,3 | 16042,6 | 19669,6 |

| Financial activities | 17383,8 | 22463,5 | 27885,5 | 34879,8 | 41488,8 |

| Real estate transactions, rental and provision of services | 7795,4 | 10236,8 | 12763,2 | 16641,6 | 21629,9 |

| Public administration and military security; compulsory social security | 7898,6 | 10958,5 | 13477,3 | 16896,3 | 21388,1 |

| Education | 4203,4 | 5429,7 | 6983,3 | 8778,3 | 11303,2 |

| Health and social service provision | 4612,0 | 5905,6 | 8059,9 | 10036,6 | 12982,2 |

| Provision of other utility, social and personal services | 4822,7 | 6291,0 | 7996,4 | 10392,2 | 13555,4 |

7. The following macroeconomic indicators are given (in monetary units):

| Indirect business taxes | 11 | Corporate income tax | 9 |

| Wage | 382 | Unified social tax | 43 |

| Income received abroad | 12 | Income received by foreigners | 8 |

| Interest on government bonds | 19 | Net exports | |

| Rent | 24 | GDP by expenditure | |

| Property income | 63 | GDP by income | |

| Export | 57 | Balance of primary income | |

| Import | 10 | GNI | |

| Cost of capital consumed (depreciation) | 17 | PVP | |

| Government procurement of goods and services | 105 | CHND | |

| Dividends | 18 | LD including interest on government bonds | |

| Retained earnings of corporations | 4 | Disposable income (Disposable income) | |

| Interest payments | 25 | Personal savings | |

| Gross Investment | 76 | Net Investment | |

| Transfer payments to households | 16 | Tax revenues to the state budget | |

| Personal consumption expenses | 325 | State budget expenditures | |

| Personal taxes | 41 | Government Budget Balance |

Determine: GDP (in two ways), GNI, NVP, NNI, LD, RD, personal savings, trade balance (Xn), net investment.

8. Using the data given in the table, find the unknown indicators

9. Using the data given in the table, find the unknown indicators

10. A certain society consists of two social groups, within each of which income is distributed evenly. It is known that the average per capita income in the first group is 5 thousand rubles. per month, in the second – 25 thousand rubles. per month, and throughout society the average per capita income is 20 thousand rubles. per month. Determine the value of the Gini coefficient for this society.

11. The country’s economy is described by the following data: in 2008, the actual unemployment rate was 5%, real GDP was 48 billion rubles. and potential GDP 50 billion rubles. In 2009, these figures were respectively 10%, 42 billion rubles. and 50 billion rubles. Determine the natural rate of unemployment and the Okun coefficient in 2008.

a) 4.7% and 2.4; b) 3.3% and 2.4; c) 6% and 3; d) 5% and 2.

12. The economy of the Russian Federation is described by the following data: in 2008, the level of actual unemployment was 7%, real GDP was 41,428.6 billion rubles. and potential GDP 44304.9 billion rubles. In 2009, these figures were respectively 8.2%, 38,155.7 billion rubles. and 41591.6 billion rubles. Determine the natural rate of unemployment and the Okun coefficient in 2008.

13. The economy of the Russian Federation is described by the following data: in 2008, the actual unemployment rate was 7%, real GDP was 41,428.6 billion rubles. and potential GDP 44304.9 billion rubles. In 2009, these figures were respectively 8.2%, 38,155.7 billion rubles. and 41591.6 billion rubles. Determine the natural rate of unemployment and the Okun coefficient in 2009.

a) 4.7% and 2.4; b) 3.8% and 2.2; c) 6% and 3; d) 5% and 2.

SECTION 3. QUESTIONS FOR CONSIDERATION

1. Does it make economic sense for an economy to have only one single interest rate? Why yes or no?

2. Do you think the unemployment rate in Udmurtia is high or low? What are the reasons for this situation?

3. The current rate of inflation in Russia is slightly higher than the level of moderate (creeping) inflation. What should the Central Bank do in this situation? What will be the consequences of the measures taken?

4. Economic growth is considered a necessary but not sufficient condition for eradicating poverty. Why?

There is no such concept as the nominal accrued average monthly wage of employees in the Labor Code. It can only be found in economics textbooks and statistical reports. There, nominal wages are usually used for comparison with real wages. What is the difference between nominal wages and real wages?

What is the difference between a nominal salary and its real value?

This difference is most clearly manifested in crisis conditions - during a period when, due to inflation, there is an increase in nominal wages and a decrease in its real size.

What is inflation? This is the depreciation of national and foreign currencies (if the crisis affects more than just one country).

However, this depreciation is the result of a systemic crisis that affects all areas:

- a drop in the level of production due to a decrease in demand for products due to their obsolescence, deterioration in quality, overproduction, etc.

- this fall entails a decrease in labor demand;

- which in turn leads to a rapid increase in nominal prices of goods and services, which become the only currency instead of banknotes and are usually exchangeable for similar assets and offers;

- this leads to a budget deficit, which is closed by issuing a large volume of money supply;

- and this contributes to a sharp drop in real wages and its growth in nominal values.

This dependence clearly shows the difference between real and nominal wages. But to see this connection and difference more clearly, you can use the following conditional example: a year ago the nominal salary was 10,000 rubles, and with this amount one could purchase 50 kg of meat at a price of 200 rubles/kg.

In addition to the connection discussed above between these types of remuneration, there is another relationship that arises due to the increase in demand for labor. Under these conditions, especially if we are talking about highly qualified and experienced specialists or professions that are rare in the labor market, but very in demand, the level of wages increases, both nominal and real.

What if the inflation rate is acceptable and there is no crisis in the country? Then, even without a growing demand for labor, workers can receive high wages. A similar phenomenon was observed in Russia until 2008.

One of its reasons was the demand for goods fueled by consumer loans and, accordingly, the growth of their production, which provided employees of such enterprises with good wages in nominal terms. And if it is possible to take out a loan, the level of real wages does not matter. But this is gradually leading to a crisis.

Nominal earnings depend on the wage system, the volume of labor functions performed, supply and demand in the labor market, and the economic state of the country as a whole. The real one depends on the nominal one, as well as on the price level and inflation, which are closely related to the economic situation in a particular region.

A deceptive situation arises during an economic crisis. It would seem that wages are rising, and, therefore, a person’s well-being and purchasing power should increase. But along with the increase in wages, prices also rise, and sometimes their growth outpaces the rate of increase in earnings.

As a result, for the same money a person can purchase fewer goods and is forced to switch to cheaper products or completely give up some.

Let's look at an example. In 2020, in the distant Russian hinterland, a worker’s salary was 10,400 rubles, and in 2020 it was raised to 12,000 rubles.

A kilogram of apples in 2020 cost 40 rubles, but due to the introduction of economic sanctions and for other reasons in 2020 it increased by 29.5% and amounted to 51.8 rubles per kilogram. In 2020, a citizen could buy 260 kilograms of apples with his salary, and in 2016 - only 232 kilograms.

As a result, with earnings growing by 15.3%, prices increased by 29.5%. Thus, the rise in prices outpaced the rate of increase in wages, and purchasing power decreased.

https://youtu.be/ZFNu1IOJxBU

In order to somehow equalize these indicators, the employer must annually index payments to the percentage of inflation. But not all companies adhere to this rule. And the inflation rate in the country officially recorded by Rosstat does not always correspond to the real state of affairs.

How a financially responsible person is dismissed at his own request - read in this article. We suggest you read: How to correctly write a complaint to an employer?

How long is the statute of limitations for labor disputes - see here.

When assessing wages, not only its quantitative, but also its qualitative component is important. To assess the extent to which its level can satisfy the needs and desires of an employee, wages are divided into two types - nominal and real.

What are their differences and which type is best to be guided by when assessing the level of remuneration - more on this later in the article.

Nominal wage (SN) is the amount of money that an employee actually receives for his work. It reflects the quantitative aspect of remuneration and consists of the following components:

- Basic salary. It is paid to the employee for all time worked and includes additional payment for overtime and night time, bonuses and other mandatory types of payments.

- Additional salary. This includes the amount of funds that an employee receives for sick leave, vacations, breaks in work and in the event of dismissal.

That is, we can say that nominal wages include all funds, payments and compensations that an employee receives for a specific period (day, week, month).

The main indicator characterizing changes in the quantitative aspect of remuneration is the nominal salary index. It is calculated by dividing the average monthly salary of one year by the same indicator of another year. The result obtained allows us to estimate how many times the nominal salary increased or decreased in the new year. This figure can then be multiplied by 100%.

To calculate this indicator, the following average annual salary indicators for each year are given:

- in 2014 – 25,000 rubles;

- in 2020 – 35,000 rubles.

Inzp = 35000 / 25000 = 1.4 (140%)

That is, the size of nominal wages in 2020 increased, compared to 2014, by 1.4 times (or by 40%). However, this indicator alone is not enough to assess how good or bad it is.

The main disadvantage of this type of salary is that it is very difficult to display and understand the real level of well-being of the employee. To understand how much his purchasing power will change with a quantitative increase in salary by two, three or more times, an indicator such as real wages is used.

We invite you to familiarize yourself with the Job Responsibilities of a Payroll Accountant. Payroll accountant: responsibilities and rights in brief

Real wages are an estimate of the money an employee receives using the amount of goods and services he can purchase with them.

The change in the level of real salary can be determined by dividing two indicators:

- index of nominal salary (calculated in the previous example);

- inflation rates (consumer price growth index).

Irzp = 140 / 120 * 100 = 117%

https://youtu.be/1g9shNRQKHQ

We can say that the level of real wages in 2020 increased by 17% compared to the previous year. Using such calculations, you can more accurately determine exactly how much the employee’s salary level has changed and whether this change was positive.

To understand the difference between nominal and real salary, you need to consider what differences there are between them:

- when determining the first form of remuneration, inflation is not taken into account, unlike calculations of real wages;

- a nominal salary simply provides quantitative information about the level of remuneration of an employee, but it is impossible to understand to what extent his requirements are met.

Direct dependency

It is observed in situations where the nominal salary is accompanied by maintaining the previous price level. That is, provided that the inflation rate does not exceed the percentage increase in the nominal wage, the real one will also increase.

Consider the following situation:

- growth of nominal salary is 25%;

- the inflation rate is 105% (that is, prices increased by 5%).

The growth of real salary in this case will be approximately 20% (125 – 105%). Calculation using such a simplified formula is allowed in cases where the inflation rate is insignificant.

Obviously, in this case there is a positive trend. In such a situation, the growth of nominal wages in subsequent periods, provided that the inflation rate remains unchanged, will also lead to an increase in real wages.

If the rate of inflation outpaces the rate of increase in wages, the purchasing power of money decreases. At the same time, despite the growth of quantitative indicators, their true value decreases. This will be seen in the following situation:

- growth of nominal salary – 20%;

- inflation rate – 40%.

The change in real salary in this case will be negative; it will decrease by approximately 20% (120 - 140%). In this case, despite a fairly significant increase in the level of salary, its real value decreased - the entire increase was “eaten up” by inflation.

If the real salary increases, then the nominal salary always changes only in a positive direction. This is due to the fact that in the modern economy there are always inflationary processes and the general price level is constantly increasing, without a tendency to decrease.

To assess the well-being of an employee and the purchasing power of his wages, such forms as nominal and real are used. And if the first displays only the amount of money, then the second allows you to determine exactly what benefits can be purchased for them. These indicators should always be considered together, since there is a close relationship between them.

- Moscow: 7(499)350-6630.

- St. Petersburg: 7(812)309-3667.

Average monthly nominal accrued wages

Nominal wages are the totality of all accruals to an employee for a certain period of time (usually a month), or for the amount of work performed. In fact, we can say that this is the amount that is specified in the employee’s employment contract, that is, before personal income tax is withheld.

The nominal salary can consist of the following payments:

- salary, tariff rate per unit of time or product produced;

- bonuses and incentive payments, allowances;

- additional payment for working conditions that deviate from normal (night time, overtime and holiday pay);

- one-time additional payments for additional work performed.

The average monthly nominal accrued wages of employees of organizations is the average calculated for a certain period (quarter, half-year, year).

The average can be used for the following purposes:

- in certificates of the established form for submission to various organizations (bank, social insurance, etc.);

- in reports submitted to statistical authorities;

- in reports used within the organization (average wages for the organization as a whole or for a certain category of employees).

As a rule, the term “nominal salary” is indicated only in official documents at the state level. In ordinary organizations it is omitted.

Factors influencing the amount of payments

If the economy is developing steadily, then an increase in nominal wages leads to an increase in the worker’s well-being. During a crisis this is not the case, but even then it is important to ensure its growth. The amount received is influenced by the following factors:

- Quantity and quality of work performed. Those who work more are expected to receive more. However, this does not happen in all jobs. Sometimes it is not possible to achieve a salary increase in this way.

- The current remuneration system for this profession at the enterprise.

- Availability of incentives for results in work activities.

- Difficulty of working conditions, intensity of work.

- The presence of harmful or dangerous conditions when performing work duties.

- How high is the production rate?

- The minimum wage established at the state level.

Not only the work process is important, but also the current tax burden. If taxes are high, nominal wages will be lower. The money remaining after mandatory payments have been made will be received in your hands. You also need to remember that some organizations may carry out indexing.

Difference between nominal and real wages

What is the difference between nominal wages and real wages?

Real wages are determined by the volume of goods that can be purchased for them.

The main difference between these two concepts can be seen in the following example.

Let's assume that a person's nominal salary is 60,000 rubles. He spends 50% of this amount on mandatory payments (taxes, rent, mobile communications, gasoline, Internet, etc.), another 30% goes on food and current expenses, the remaining 20% he spends on other expenses (clothing, cultural events, etc.). In real numbers, these amounts will look like this:

- 50% = 30,000 rubles;

- 30% = 18,000 rubles;

- 20% = 12,000 rubles.

After a year, the nominal wage remains the same, but as a result of inflation and higher tariffs, the distribution of expenses within the salary changes: 60% goes to mandatory payments, 35% to food, and only 5% remains for other expenses.

In real numbers it would look like this:

- 60% = 36,000 rubles;

- 35% = 21,000 rubles;

- 5% = 3000 rubles.

Thus, it turns out that for the same salary a person purchases significantly fewer goods and services. This means that while nominal wages remain unchanged, real wages have decreased significantly.

Even if the nominal increases, this does not mean that the real will increase. In this case, everything will depend on the economic situation (inflation, economic growth rates, rates of tariff increases, etc.).

Difference and relationship

Similarities

Both nominal and real wages represent the cost of labor power. Both types of wages will have a monetary value and will be calculated in the currency in which the employer makes payments to its employees. Both of these types of salaries cannot have the same amount, since contributions to the state are made at the expense of the employer, and accordingly, he includes these expenses in the wages of his employees.

Difference

How do real wages differ from nominal wages? The fact that the real salary is strictly tied to the existing prices of consumer goods and services, and the nominal one is just a certain amount earned by a specialist without taking into account inflation and taxes, the size of which does not reflect the real economic situation. That is, the first is formed in the form of a set of goods that can be purchased with the amount received, and the second is expressed in the cost of a certain type of work performed or hours worked.

Connection

A simple Phillips curve

In order for a nominal salary to turn into a real one, all tax and pension contributions made by the employer must be subtracted from its value. Accordingly, the amount of nominal wages can often be calculated by the employer based on its own costs of doing business. Since the business owner is forced to make considerable tax contributions to the state, it is quite understandable that he will strive to save on the cost of paying employees. At the same time, the question of whether the employee can comfortably live on the money that is actually paid to him is unlikely to worry the employer.