Inherited property can contain not only property (apartment, car, money), but also objects that need to be managed. Among them are enterprises, shares, securities, shares in the authorized capital of a legal entity. The period for entering into inheritance is 6 months. At this time, such property cannot exist independently. This can significantly reduce its cost. In such a situation, the notary must ensure trust management of the inherited property.

The concept of trust management

Trust management refers to the management of the testator's property, which requires constant monitoring. As a rule, this is a business or shares. The purpose of management is to preserve and increase the value of inherited property.

The notary has the right to appoint a trustee. In the period before entering into inheritance, the notary is the founder of the trust management.

The interested party may be:

- heirs;

- legal representative of a minor heir;

- legatee;

- creditors;

- guardianship department (if the heir is a minor or incompetent citizen).

Important! An heir who is not a trustee of the property does not have the right to participate in the management of the organization or enterprise of the deceased.

Difficulties in organizing trust management of inheritance

Trust management of inheritance has a number of features. Property is legally impersonal, that is, it does not belong to anyone except the deceased testator. The object passes into the temporary possession of an attorney, who, carrying out management activities for several months, actually has no rights to it.

An agreement on trust management of inheritance is drawn up if it is absolutely necessary. The notary decides whether such measures are really advisable, and then begins to search for a competent person.

The powers of the manager and the possibility of his appointment depend on what property is subject to inheritance.

If the deceased had a share in a joint stock company, management issues are resolved at collective meetings. When an heir applies to establish management of the testator’s shares, the notary will study the contents of the organization’s charter. Sometimes the documents state that the share of the deceased can be transferred to legal successors only with the consent of the remaining members of the company. If they disagree, the disputed property will be transferred to the balance of the company, and the relatives will be able to claim its value.

When registering securities management, the issuer's consent is not required. Entrusting them into the hands of the manager, the notary checks the availability of a license to trade in securities.

The enterprise is managed on the basis of the current charter. When transferring an object, an act is drawn up indicating the data of the inventory check.

Managing an inheritance is a great responsibility entrusted to the notary and administrator, however, without protective measures, it may be impossible to transfer property to legal successors.

Having inherited shares or a share of property, the heirs think about the need to control its safety, but they lose sight of the fact that without effective management, even if it is short-term, the enterprise can be driven to bankruptcy, and the market value of securities will significantly decrease. The reason for this may be not only the lack of control, but also the deliberate actions of competitors, unscrupulous co-owners who want to take advantage of the situation and expand the boundaries of their power. To protect the interests of the heirs, a trust management agreement was introduced.

USEFUL INFORMATION: How to accept and register an inheritance under a will

Thanks to this, the notary responsible for the safety of property can protect heirs from loss of valuables. You just need to submit the appropriate application and conclude an agreement, and in order to avoid mistakes when drawing it up, you should contact the lawyers of the ros-nasledstvo.ru portal. Specialists will help you understand the rules of the law and protect your rights, preserving and increasing bequeathed values.

Requirements for a manager

The estate manager must meet the requirements established by law:

- In accordance with Art. 1015 of the Civil Code of the Russian Federation, an individual entrepreneur, a legal entity or an individual can act as a manager. A local government body or the state cannot act in this role.

- In accordance with Art. 1173 of the Civil Code of the Russian Federation, the heir may be the manager.

- If the will specifies an executor, he can also be appointed administrator (with his consent).

- If an individual is appointed as a manager, he must be an adult and have legal capacity. If it is legal, then it should not be liquidated at the time of conclusion of the contract.

Important! Heirs do not have the right to influence the process of selecting a manager. The notary can agree on the candidacy with them, but is not obliged to do so.

The law provides for the possibility of simultaneously appointing several managers. They must perform duties in accordance with the terms of the contract.

If a conflict arises between managers, the notary has the right to terminate the contract and choose new candidates.

Legal characteristics of the mechanism

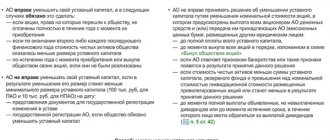

In Law 14-FZ of 02/08/98, trust management is mentioned only in Article 42. The norm allows a company to vest the powers of a director with an independent specialist or a specialized organization. But there is no mention of shares in it. Art. 8 of the law. The founders are not given the right to conclude an agreement.

The lack of relevant provisions in the sectoral law is causing debate. Some lawyers come to the conclusion that it is inadmissible to apply the legal mechanism to shares in the capital of an LLC. Their opponents consider such conclusions to be hasty and refer to Art. 1013 of the Civil Code of the Russian Federation. The article contains an open list of objects of trust management. It includes movable and immovable property, securities and other assets. The legality of the use of the instrument is also evidenced by the principle of dispositiveness of civil legislation.

The regulations provide a clear description of the procedure for the following cases:

- Inheritance. The rights to the business pass after the death of the owner to relatives or persons specified in the will. The notary concludes an agreement with the manager before the official determination of the heir. The specialist’s task is to ensure the safety of the share and protect the interests of the future owner (Article 1173 of the Civil Code of the Russian Federation).

- Inability to manage independently. The agreement is signed in the event that an LLC participant loses legal capacity or the share is transferred to a ward (Article 1026 of the Civil Code of the Russian Federation). The founder of the management becomes the guardianship body. Whether a citizen has relatives does not matter. The rule is enshrined in Art. 38 Civil Code of the Russian Federation. The norm recognizes the founder of trust management as a state body specializing in trusteeship issues. Official guardians cannot enter into such transactions. Similar rules apply when the court makes a decision on the unknown absence of the owner (Article 43 of the Civil Code of the Russian Federation). The tool is also used for patronage of sane adult citizens. Due to poor health, such persons cannot independently manage property (Article 41 of the Code).

- Entry into the civil service. The obligation to conclude a trust management agreement for shares is enshrined in clause 7 of Law 273-FZ dated December 25, 2008. A special feature of the status of civil servants is the ban on conducting commercial activities (Article 1 of Law 79-FZ of July 27, 2004). The inadmissibility of conflicts of interest was confirmed by the Supreme Court of Russia in a review of practice dated July 30, 2014. Subsequently, the servants of Themis repeatedly recognized the legality of trust management of shares in the capital of an LLC. The General Prosecutor's Office of the Russian Federation has developed special instructions for full-time employees (order No. 531 of 08/30/16).

Thus, the regulations do not contain direct prohibitions on the application of the mechanism to shares in the capital of a company. Concluding a transaction will not be considered a violation.

Rights and obligations of the manager

The manager must fulfill his duties as provided for by law and contract.

Main responsibilities of the manager:

- participate in the management of the enterprise;

- vote in meetings of the management team of the enterprise as the testator willed;

- provide a management report to the notary within the period stipulated by the contract, but no less than once every 2 months.

Manager rights:

- receive remuneration for the performance of duties provided for in the contract;

- hold a meeting of heirs;

- request the necessary documents;

- study the activities of the enterprise;

- make management decisions.

The manager does not have the right:

- exchange shares;

- withdraw from the company's membership;

- give or sell property;

- fulfill the obligations of the testator until the heirs take ownership of the property.

An exception is the situation when the will contains an order to pay a certain obligation at the expense of the inherited property.

Note! Expenses for trust management, for assessing property and for ensuring the safety of property transferred for management are carried out at the expense of the inherited property.

Contents of the agreement

The legislation does not provide for clear regulations for drawing up an agreement, however, Article 1016 of the Civil Code of the Russian Federation outlines essential conditions, including:

- composition of inherited property assets subject to management;

- the name of the individual or the name of the company who are the beneficiaries;

- the amount of established remuneration for the manager.

The amount of remuneration in monetary terms is determined on an individual basis and in most cases is within 3% of the appraised value of the property. The manager receives compensation for costs associated with the performance of functions. If the amount of expenses exceeds the remuneration provided for in the agreement, then Article 1174 of the Civil Code of the Russian Federation provides for the possibility of compensation at the expense of inherited property values.

The agreement must reflect the rights and obligations of the founder and manager. The competence of the founder includes:

- monitoring the activities of the manager in terms of the effective implementation of the management mission;

- requirement to provide documentation reflecting management activities within the scope of authority;

- control of income provided for increasing the value of assets transferred to trust management;

- payment of remuneration for the management process and compensation for the provided costs.

The manager’s responsibilities are based on ensuring safety along with increasing the value of entrusted assets, limited by the law. Can the trustee sell or gift the property to third parties? Alienation operations are prohibited at the legislative level.

The manager has the right:

- require documents to study activities in order to increase profit and profitability indicators;

- set dates and hold scheduled and unscheduled meetings regarding the effectiveness of the activities carried out with the invitation of beneficiaries;

- make management decisions in order to increase the value of the entrusted property.

When concluding an agreement, there is no need to name all heirs due to possible changes in composition during the management period. It is prohibited to appoint persons who are members of the company as trustees.

The selection of a candidate to perform the duties of a manager is aimed at minimizing commercial risks and improving financial results before the legal successors take over the inheritance.

2020 zakon-dostupno.ru

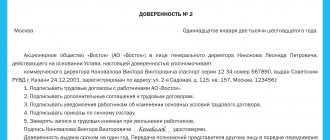

Agreement on trust management of inherited property

The agreement is drawn up in writing. The parties to the document are the manager and the notary.

The document does not contain information about the beneficiary. By default, they are the heirs of the deceased.

The exception is the situation when the will includes a testamentary refusal. In this case, the legatee is indicated as the beneficiary.

The contract can be terminated by the notary unilaterally. This is possible when gross violations are detected in the management process. In such a situation, the notary removes the manager, demands a report and appoints a new one.

How to file a claim for division of inherited property?

The manager performs his duties on a remuneration basis. He has the right to receive remuneration established by the contract.

How to apply?

Algorithm for appointing a trustee:

- The stakeholder initiates the process.

- The notary orders a property valuation.

- The notary selects a candidate for the manager.

- The founder and manager enter into an agreement.

- The manager regularly prepares a report and submits it to the notary.

Form and content

The law does not establish the exact form of the agreement for trust management of inherited property.

But the document must comply with the general requirements for contracts:

- executed in writing;

- consists of 2 copies (1 – for the notary, 1 – for the manager);

- contains the validity period and date of preparation;

- includes a complete list of property transferred to management;

- signed by the parties personally.

Sample agreement for trust management of inherited property: alt: Agreement for trust management of inherited property

Validity

In accordance with Art. 1173 of the Civil Code of the Russian Federation, the contract is concluded for a period of no more than 5 years. If, after the expiration of the term, the heirs do not make a demand for the transfer of property to them, then the contract is extended for another 5 years.

Within 6 months from the date of opening of the inheritance, the founder of the trust management is a notary. After the recipients are presented with a certificate of inheritance rights, these powers are transferred to them.

From this moment on, the heirs can at any time demand termination of the contract and the transfer of property to them. But this is a right, not an obligation of the heirs.

The agreement also terminates in the following cases:

- death of the beneficiary (if established by the contract);

- refusal of the beneficiary to receive benefits;

- death of the manager - an individual or individual entrepreneur; bankruptcy or liquidation of a manager – a legal entity;

- refusal of the manager to perform duties;

- initiative of the management founder;

- death of the notary - the founder of the management (within 6 months from the date of opening of the inheritance).

Methodological recommendations on the topic “On the inheritance of shares in the authorized capital of limited liability companies”, approved at a meeting of the Coordination and Methodological Council of Notary Chambers of the Southern Federal District, North-Kazakhstan Federal District, Central Federal District of the Russian Federation on May 28 - 29, 2010. Table of contents:

- General provisions (clauses 1.1. - 1.6.)

- The procedure for registering inheritance rights and the rights of the surviving spouse to a share in the authorized capital of the LLC (clauses 2.1. - 2.10.)

- The procedure for registering an inheritance for a share in the authorized capital if there are no heirs by law and by will or have refused or not accepted the inheritance (escheated property) (clauses 3.2. - 3.4.)

- Establishment of trust management of shares in the authorized capital of a limited liability company (clauses 4.1. - 4.11.)

- Amendments to information about a limited liability company contained in the Unified State Register of Legal Entities in connection with the inheritance of shares and trust management of shares in the authorized capital of the company (clauses 5.1. - 5.2.)

Appendix No. 1. Certificate of right to inheritance by law Appendix No. 2. Certificate of ownership

4. Establishment of trust management of shares in the authorized capital of a limited liability company

4.1. The possibility of establishing trust management of shares in the authorized capital of a limited liability company that is part of the hereditary estate is provided for by the provisions of Art. 1173 Civil Code of the Russian Federation.

4.2. The founder of the trust management is a notary, and in the case when inheritance is carried out under a will in which an executor of the will is appointed, the rights of the founder of the trust management belong to the executor of the will.

4.3. Any person can act as a trustee, except for a state body and local government body, as well as an institution (Article 1015 of the Civil Code of the Russian Federation).

Trust management of inherited property can be carried out both as a business activity and outside its framework. In particular, trust management carried out by a citizen or a non-profit organization, albeit for a fee, but not systematically, is not an entrepreneurial activity. In such cases, a civil servant can also act as a trustee, since Art. 17 of the Federal Law of July 7, 2004 N 79-FZ “On the State Civil Service of the Russian Federation” contains a ban on carrying out only entrepreneurial activities.

4.4. In accordance with paragraph 1 of Art. 1016 of the Civil Code of the Russian Federation, the name of the legal entity or the name of the citizen in whose interests property is managed is one of the essential conditions of the general composition of the trust management agreement.

However, since the rules provided for by Chapter 53 of the Civil Code of the Russian Federation “Trust management of property” apply to relations for the trust management of inherited property only insofar as otherwise does not follow from these relations, the requirement to indicate by name the beneficiaries in the trust management agreement for inherited property seems inappropriate : the composition of the heirs who accepted the inheritance may change repeatedly during the term of the agreement, and making changes to it may be difficult.

All heirs who have the right to inherit the property transferred to trust management must be recognized as beneficiaries.

As beneficiaries, heirs can receive rights of claim against the trustee (on the submission of a report, on the transfer of property upon termination of the contract, etc.).

4.5. The list of persons upon whose application trust management of an inheritance can be established, contained in clause 2 of Art. 1171 of the Civil Code of the Russian Federation, is not exhaustive.

An application for the establishment of trust management of an inheritance in the form of a share in the authorized capital of a company can be submitted to a notary by one or more heirs, a local government body, a guardianship authority or other persons acting in the interests of preserving the inherited property. Other persons may be, in particular, participants in a limited liability company, a share in the authorized capital of which requires management.

The notary may request statements from all the heirs known to him in order to agree with the latter on the candidacy of the trustee in order to prevent controversial issues in the future.

However, if it is impossible to receive such applications from all persons intending to accept the inheritance, the notary is obliged to establish trust management and independently decide on the candidacy of the trustee.

4.6. Trust management of shares in the authorized capital of a company is established by a notary to ensure the normal operation of the company during the period necessary for the heirs to take possession of the inheritance.

The exercise of powers to own shares in the authorized capital of a limited liability company is impossible without documentary confirmation of rights to this share.

4.7. When transferring into trust management a share in the authorized capital of a limited liability company, the trustee, as a person who has the right to exercise the powers of the owner in relation to the property that is the object of trust management, is vested for the period of trust management, along with property rights, also with non-property (organizational) rights of a company participant with limited liability.

4.8. In the event that the transfer of a share to the heirs of a deceased member of the company requires the consent of the remaining participants, such consent must be obtained before the establishment of trust management of the shares. In this case, an application for obtaining consent to transfer the share of a deceased participant to his heirs in the company is sent by the person who submitted to the notary an application for the need to establish trust management of shares in the authorized capital of the company. If consent is not received, then on the day following the expiration date of the period established for obtaining such consent, the share in the authorized capital passes to the company and cannot be the object of a trust management agreement for inherited property.

4.9. If the heir is a minor, then to conclude an agreement on trust management of shares in the authorized capital of the company in accordance with clause 2 of Art. 37 of the Civil Code of the Russian Federation requires preliminary permission from the guardianship and trusteeship authorities.

4.10. The description of a share in the authorized capital of a limited liability company as the object of an agreement for trust management of inherited property must contain the characteristics defined in clause 2.10 of these recommendations.

4.11. All other issues of establishing trust management of shares in the authorized capital of a limited liability company are resolved in accordance with the Methodological recommendations for trust management of inherited property, approved by the Coordination and Methodology Council of Notary Chambers of the Central Federal District of the Russian Federation (Minutes of the meeting No. 5/2007 dated December 7 - 8 2007).

Preparation of contract

The agreement is drawn up by the notary conducting the proceedings; it must indicate all the actions that the manager will need to perform in the interests of the heirs. Before concluding an agreement, you should find out if there are any obstacles. For example, if one of the heirs is a person under the age of majority, you will have to take care in advance of obtaining permission from the guardianship and trusteeship authorities.

Money cannot be transferred to trust management, as well as the rights of monetary claims against third parties who received loans from the testator. These rights are not considered indisputable, and the notary cannot be confident that they really exist and that the documents are real. Since the notary is not able to verify the authenticity - and this is not in his competence, the heir should go to court, demanding to collect the debt from the person who has a debt to the testator. This requirement may be attached to the requirement to recognize the right to inheritance.

Contract form

It must be in writing and signed by both parties. It stipulates what kind of property is transferred under management, and for real estate, location data is indicated. In addition, if real estate is transferred, it is necessary to formalize this using a transfer deed or other document indicating that the actual transfer has taken place. The real estate trust management agreement is used as a sample attached to this article.

But we note that when transferring other property there are some nuances. Thus, when transferring an enterprise, the rules of the agreement for the sale of the enterprise apply to the form of the agreement. If real estate is transferred, then it is necessary to carry out state registration, and its procedure will be the same as for the transfer of rights

If the contract was not concluded in writing or in an improper manner, then it may be considered invalid, so it is worth paying attention to its execution

Let us briefly list what should be contained in the agreement: a description of the composition of the property that is being transferred, a listing of the rights of the manager, and, on the other hand, the responsibilities that he will bear. Prohibitions on actions that could harm the interests of the heirs are stipulated. Most often, if you refer to standard agreements, the right to manage property is given. If we again take the example of shares, then we participate in shareholder meetings and make decisions, but at the same time we are not given the right to dispose of them.

Agreement conditions

There are several conditions considered essential. This is the composition of the transferred property, the list of beneficiaries, the amount of remuneration that the manager will receive for his work, and finally, the duration of the contract. In addition to the essential ones, various other conditions can also be identified; we will not list them due to the large number of options.

If we turn to those listed, we have already talked about the composition of the property, so now it is time to reveal the remaining points in more detail. And let's start with the beneficiaries. The list of heirs may undergo changes directly during the validity of the document, and therefore there is no need to list all heirs. Each person entitled to inheritance will be considered a beneficiary.

Sample trust agreement

Let's move on to the next condition - reward. Since the manager is involved to protect the property, his services are paid for with the funds of those who should subsequently receive this property. The total amount of payments can reach a maximum of 3% of the value of the property.