Home page • Blog • Online cash registers and 54-FZ • How to make a return to a buyer using an online cash register: step-by-step instructions

Online checkout returns are a frequent and very significant operation in trade of any scale. There are many reasons why a cashier needs to return money to a customer. How to make a return at the online checkout to avoid mistakes. First, let's figure out what types of checks there are and what a “sign of payment” is.

Sign of payment in a cash receipt - what are they?

After the adoption of the new law on cash registers and the transition to online cash registers, a new check format came into force, and checks began to be presented not only in paper, but also in electronic form. The first type is mandatory, and the second is issued at the buyer’s request.

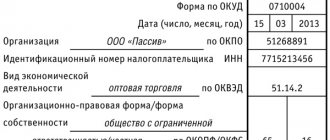

Checks, regardless of their type, must contain:

- Data of the seller organization;

- Serial number of the check;

- Tax system of an organization or individual entrepreneur;

- Settlement transaction amount;

- Date and time the check was created;

- Calculation sign;

- Fiscal storage data, operator and other information.

Discount on annual technical support of the cash register

Servicing the cash register for 1 year with a benefit of 3600 ₽ on the “Standard” and “Maxi” tariffs.

Technical support includes consultations on the operation of the cash register. Find out details

https://youtu.be/_CeMiQtOJqU

When to return goods via online checkouts

Returns through online cash registers occur differently than returns to old-type cash registers. How to technically carry out the return procedure depends on the model of your online cash register and its capabilities, as well as the software and firmware version.

To return a purchase, the buyer must punch a special receipt. The sign of settlement in which funds are returned to the buyer—an individual—is called return of receipts. It is issued when:

The need to return money to the buyer for the goods he purchased, which he refuses.

Incorrect value or quantity of goods in the receipt (seller's error during registration).

After returning the goods and receiving funds in the amount of its full cost, the buyer is given a cash receipt, which states that a “return of receipt” has occurred. However, for the tax inspectorate, a receipt alone is not enough, so you need to take care of preparing other documents that confirm the correctness of the procedure for returning goods through the online cash register.

On the left you see what a receipt for a refund looks like.

Additional ways to return an erroneous payment

If you were unable to use the automatic method to get your money back, then you should contact Beeline specialists directly. To do this, you need to prepare an application for a refund, as well as provide an application for transferring money, indicating a phone number. Application forms are available on the company's website. They can be downloaded and provided to specialists. The review period is three days. But practice shows that the money is returned within a week.

Call the support line

The fastest way to file a complaint is at any time with the Beeline hotline. Telephone numbers for receiving complaints:

- 8 800 700 0611;

- 0611;

- +7 495 797 2727 – for subscribers located in the Beeline international roaming zone.

The call center employee, while remaining on the line, will check the necessary information and also advise on your further actions if the cause of your dissatisfaction could not be eliminated immediately.

Through your personal account on the operator’s official website

It’s not faster, but it’s more convenient to write a complaint against Beeline online - from the company’s official website by logging into your personal account. The application is received by the support department, for which you need to go to the specialized form in the contacts section. In your personal account, when filling out an application to the support service, do not forget to fill out the feedback form. You can send a claim to Beeline through your personal account after registering it.

This is also important to know:

How do you return money from your phone to your card?

To obtain information, just click the “Ask a Question” button, which is located in the upper right corner, but in this case, the answers are sent not by a person, but by a program.

It is equally convenient to write your complaint to Beeline by email. Email address for claims against Beeline: [email protected] The text requirements will not differ regardless of where and how you want to file a claim. Write it in a timely manner and referring to legislative acts so that the Beeline company cannot evade responsibility.

Through mobile applications and social networks

Modern information technologies allow you to write your complaint to the company’s management even using a smartphone in a matter of minutes:

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Ask a Question

- Through the Beeline application - for this you need to first download and install the program on your mobile device, and then select a form of communication with the operator;

- Contact the support service on the operator’s official community page on social networks - the employees on duty are online almost all the time, so you won’t have to wait long for an answer.

Contact by email

This method allows you to return money without visiting the office or wasting time on calls. The request can be sent remotely, within the walls of your home. The essence of such an appeal is that a letter must be sent to the address. Here you need to provide your passport details and attach receipts (you can also use a photo) or a check, and provide a completed application.

Visit the office

Another way to return erroneously sent money is to contact the center where customer service takes place.

Here you need to tell the consultant in detail about the incorrect and erroneous transfer of money. This option is the most reliable. To apply you will need:

- a check (receipt) confirming the fact of payment;

- statement.

The Beeline company has provided refunds both in cash and by transfer to a card. When choosing to receive funds on a plastic card, you must provide details in the application.

If the erroneous transfer was for a significant amount, then in this case you can choose to return the money in cash or to a card. If the amount is small, then the best option is a phone number.

It is also worth noting that the funds are returned to the account without any commission accrued in the terminal.

Complain to Rospotrebnadzor or court

You have the right to file a complaint against Beeline with Rospotrebnadzor if the company itself does not respond to your complaint or wrongfully refuses to satisfy your demands. A prerequisite is that before complaining to Rospotrebnadzor, an official appeal directly to the violator is mandatory. You must have documentary evidence in your hands that you really contacted Beeline and tried to resolve the situation peacefully.

The competence of Rospotrebnadzor is control over compliance with consumer rights and supervision of the fulfillment of their direct obligations by individual entrepreneurs, legal entities, and government agencies. But this structure begins to act only upon filing a complaint, which cannot be anonymous.

Important

You can submit an application with complaints about the work and actions of Beeline in person to the territorial department, by registered mail, or on the Rospotrebnadzor website. You can also contact us by phone 8 800 100 00 04.

However, complaints regarding the return of money and recalculation of fees for services are not within the competence of Rospotrebnadzor. The court may satisfy such requirements.

Complain to the OPP about Beeline

Another organization to which a claim against Beeline’s actions can be filed is the Consumer Rights Protection Society (CPS). Here you can get qualified advice on your issue and help in resolving it.

Ways to contact the OPP:

- Sending an email to an address

- Call the hotline at +7 915 300 4182.

- By registered mail with return notification and a list of attachments (in Moscow to the address Smolensky Boulevard, 7).

However, this organization will still not resolve property disputes.

How to make returns via online cash registers: step-by-step instructions

Returns are processed differently depending on the reason for the return.

Same day refund via online checkout (seller error)

If, when issuing a check in front of the client, the cashier made a mistake in the number of units of goods or the price being punched does not correspond to the one recorded on the price tag, then a “Return of Receipt” check is first generated, and then a new check with the correct data. It is the cashier who returns it to the buyer and compensates for the monetary difference. No documents are required from the buyer.

However, the legality of the return must be confirmed by the tax office. Therefore, the cashier draws up a memo in which he writes which particular check was issued incorrectly, and confirms that 2 more checks were immediately printed - “return of receipt” and new receipt. It is necessary to attach both the incorrectly printed check and the “return of receipt” check to the note.

If you are interested in how to make a refund through an online cash register as quickly as possible, we recommend paying attention to the Evotor 5 smart terminal. Thanks to the touch screen, intuitive interface and Android operating system, it is now much easier to carry out standard operations when working with an online cash register, which means that with Evotor 5 you can significantly speed up the customer service process.

If the buyer wants to return the product in full, then the procedure is the same as if the buyer came in a week.

Refund to the buyer at the online checkout (the buyer returns the goods)

It happens that the buyer wants to return the product and get back the money paid for it. There may be several reasons: an incorrectly chosen size (if we are talking about clothes), the buyer changed his mind, a defect, etc. Regardless of when the buyer went to the store to return the purchased item (after a while or on the day of purchase), the return goods at the online checkout should go through the following algorithm:

Within what period of time is the organization required by law to return the erroneously transferred money to the counterparty?

Is liability established if the money is not returned immediately?

An organization, upon receiving erroneously transferred funds, is obliged to return these funds, regardless of the reason for their receipt: sums of money or other property were received as a result of his behavior, or because of the mistake of the victim, because of the actions of third parties, or in addition to them will. This procedure is established by Article 1102 of the Civil Code.

The deadlines for returning the unjustified receipt of someone else's property, in this case erroneously transferred funds, are not directly established by Chapter 60 of the Civil Code.

Thus, Article 314 of the Code contains rules according to which funds received without reason must be returned within a reasonable time, unless the obligation establishes a specific deadline for fulfillment and there are no conditions that may allow determining the period for return.

The period during which unjustifiably received funds must be returned begins to be calculated from the moment when the organization that received, in this case, the erroneously transferred funds, learned about the fact of unjust enrichment.

In other words, when it became known that the agreement under which the funds were transferred was terminated, or the money arrived as a result of mistakes, etc. Also, the beginning of a reasonable period is considered the moment when it became known about the receipt of unexplained amounts; in some cases, the beginning of the calculation of a reasonable period is the moment of the beginning of using someone else’s unreasonably received funds.

What is meant in this context by the concept of “reasonable time for fulfilling an obligation”?

The legislation does not directly define the duration of a reasonable period, since this concept is evaluative. To apply this concept to the norms of Article 314 of the Civil Code, reasonable, in accordance with the decisions of the Nineteenth Arbitration Court of Appeal No. 19AP-5751/11 dated December 2, 2011, the Thirteenth Arbitration Court of Appeal No. AP-7126/2008 of October 6, 2008, the Eighteenth Arbitration Appeal court No. 18AP-3581/12 dated June 4, 2012, a seven-day period is recognized.

Note. From the moment when the organization became aware, or it should have learned about the fact of unreasonably received funds, interest must be accrued on the entire amount received, in accordance with Article 395 of the Civil Code for the use of other people's funds. In some cases, the courts determine the moment from which interest begins to accrue, the expiration of a seven-day period, or from the moment when the recipient of the funds learned about this fact and this date is set by the victim.

Writing an application

The buyer must come with a receipt and passport.

If we are talking about the interaction between the cashier and the buyer, product returns through online cash registers begin with filling out an application. The buyer writes an application in any form, but it must include his full name, passport details, reason for refusing to purchase, purchase price, date of application and signature. Some stores print such application forms in advance to avoid errors during registration. After the buyer has filled out the form, the cashier is obliged to verify the correctness of the passport data and check details specified in the application.

Many entrepreneurs are wondering: how to process returns through online cash registers if the receipt was not saved, for example, it was lost by the buyer. In this case, it is necessary to restore the purchase information from the fiscal registrar and indicate in the application that the receipt was lost.

In order to securely save all information about your purchases, we recommend purchasing an ATOL 25F cash register. This fiscal recorder fully complies with the requirements of 54-FZ and is characterized by ultra-fast printing speed - up to 250 mm/sec.

Please note that you do not need to collect the check from the buyer (although many do this), just make a copy. An application for a refund written by the buyer is an effective confirmation for the Federal Tax Service that the money was actually returned to the client and was not withdrawn by the entrepreneur in order to avoid taxes.

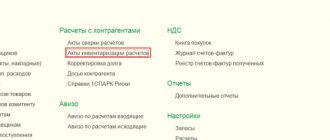

Registration of an invoice for the return of goods

Since there is no single standard for the invoice form for returning goods at an online checkout, an entrepreneur can independently develop a sample and use it in such situations. The invoice is drawn up in two copies and signed by two parties: one is the buyer, the other is the seller.

Printing a receipt for returning goods at the online checkout

After the buyer writes an application, confirms the fact of purchase, and issues an invoice, a return receipt is printed. The only difference between a refund check and a regular check is that in a refund check, in the “payment attribute” field, not “receipt” is indicated, but “return of receipt”, i.e. the same check is issued as you saw above in the example picture.

Transfer of funds to the buyer

After all the documents have been prepared and signed, all that remains is to return the money he paid for the goods in cash. If the return occurs only partially (for example, the buyer bought fish, milk and slippers, and wants to return the slippers), then the whole procedure follows the same algorithm, the name and quantity of the product and the amount of the return are indicated in the application.

Claim to a judicial authority

Please note! If the claim was not considered by the store, or a negative response was received, then the next stage of refund for the consumer is the court.

To do this, the buyer must draw up a statement of claim and send the document to the appropriate authority (magistrate or district court, taking into account the cost of the claim).

To avoid rejection and leaving the claim without consideration, you will need to provide all the necessary information in the document:

- passport details of the applicant, as well as details of the respondent, that is, the store;

- name and details of the judicial body authorized to consider a specific case;

- cost of claim;

- information about third parties, for example, witnesses;

- circumstances of violation of the buyer’s legitimate interests;

- reference to evidence to confirm the legality of the implementation of a refund to the buyer;

- designation of the fact of compliance with the claim procedure;

- a requirement to terminate the agreement with the seller and to recover the amount of money paid for the goods, including, if necessary, indicating violations of the return deadlines and demanding a penalty;

- attachment of a document, including paper, confirming the circumstances set out in the claim;

- The statement of claim also ends with the personal signature of the applicant and the designation of the specific date of drawing up the document.

You can send an application to the court in person, through the office, by mail or electronically. Due to the low cost of the claim, some cases can be considered in absentia and remotely, through the official website of the court. You can also upload the necessary documents there.

ATTENTION! View the completed sample claim form for the return of goods:

Watch the video. How to properly write a complaint to a store:

Dear readers of our site! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right. It's fast and free! Or call us at :

+7-495-899-01-60

Moscow, Moscow region

+7-812-389-26-12

St. Petersburg, Leningrad region

8-800-511-83-47

Federal number for other regions of Russia

If your question is lengthy and it is better to ask it in writing, then at the end of the article there is a special form where you can write it and we will forward your question to a lawyer specializing specifically in your problem. Write! We will help solve your legal problem.

How to process a refund using online cash registers if the purchase was made by bank transfer.

The procedure for returning a non-cash payment via an online checkout is not fundamentally different from that which is carried out if the buyer pays in cash. First, the client fills out an application, including standard information plus details for a cashless transfer. Then an invoice is prepared and a receipt “return of receipt” is printed. Within ten days the funds will be credited to the buyer's account.

As a rule, the buyer is recommended to keep all the paperwork and receipt issued for return. If the money does not arrive in due time, then you need to contact the bank whose card holder you are and present these documents.

Refund period

Refund periods according to law may vary. When cash is returned to the buyer, the procedure takes about three days. However, this period can be extended to ten days, in particular when transferring money at the buyer’s expense.

If the store delays payment of funds, the buyer has the opportunity to demand payment of a penalty for each day of delay. According to the rates of the Central Bank, the amount of the penalty can be determined up to one percent for each day of delay.

Important! The store may also demand reimbursement of the costs of the penalty, but not from the seller, but from the organization that caused the delay in payment. Most often, this is caused by the work of banks serving the seller and buyer, especially if these are different credit institutions.

If the buyer bought for cash and wants to receive a refund by bank transfer

Yes, a non-cash refund can be made if the buyer, in the return application, expresses a desire to receive funds in a non-cash form and indicates his details. In this case, the funds are debited from the organization’s current account. If the buyer paid by card, then the refund occurs only in non-cash form. Refunds are issued only to the same card with which the purchase was made.

Returning goods by non-cash means takes place in several stages:

- The buyer brought the goods, a receipt or other document confirming the fact of purchase, a passport, a card.

- The seller checks the goods for compliance and integrity. If everything is in order, a refund will be issued. If the goods are returned in improper condition due to the fault of the buyer, then a statement of non-conformity is drawn up. The return certificate is drawn up in free form, which must include a description of the product, the reason for the return, the amount, and the buyer’s passport details. A payment order is sent to the bank.

How to return goods through a Pos terminal.

The procedure in this case looks something like this:

- Go to the operations menu (for some terminals this is the F key);

- Financial transactions - return of goods, insert the buyer's card;

- information about the card will appear on the screen, check it, press the green button, then enter the refund amount;

- If it is necessary to enter a PIN code, we transmit it to the client;

- Two checks are issued, one for the seller, the other for the buyer;

- We return the card and check.

The period for returning goods depends on the bank and payment system. Usually the transfer of money takes from 3 to 5 days. The return of goods in this way does not take place on the day of purchase. If the buyer returns the product on the day of purchase, the transaction is canceled.

Canceling an operation when returning on the same day looks like this:

- Go to the financial transactions menu, sub-item cancel transaction by number;

- enter the check number, click confirm;

- Confirm payment information;

- The refund receipt is printed.

Special cases

In order to cancel, you must fully comply with several rules that are regulated by the company. Set of rules:

- Payment to a bank card occurs only taking into account that the client provides all details, including the bank. At the same time, payment for the number should have been made from her.

- The subscriber code must not begin with a six.

- Two weeks have not passed since the error.

- The contact is serviced by the company.

- The replenishment amount did not exceed three thousand rubles.

- The payment occurred as a result of a maximum error of two digits in the number.

This is also important to know:

A claim for consumer protection: how to draw it up and where to file it

If all conditions have been met, then there will be no problems with performing the reverse operation.

How to make a correction check and when is it used?

The correction check is processed if the cashier made a mistake on the check and the buyer has already left; if at the end of the day the total receipts in the cash register do not match. Adjustments can be made either to increase or decrease funds.

What data is contained in such a check:

sign, here is a correction check;

check transaction type;

correction amount;

payment type;

and other information.

Such checks can be punched only before the shift is completed and the Z-report is generated.

On the left you see an example of a correction check.

When issuing a correction check, a special act is drawn up indicating the reason for the correction.

At the online checkout, it is recommended to make a correction check only if you find more money than needed. If the revenue is less, i.e. there is a shortage, the check does not go through.

Read more: Correction check at online cash register

If everything is still not clear, watch the following video:

How to make a refund using an online cash register: types of returns and adjustments of income/expenses

How to make a refund at the online checkout: refunds at the Mercury, Atol, Shtrikh M checkout

If your cash register does not support all existing functionality, or performing the necessary operations on your cash register is difficult, we recommend that you upgrade to new equipment. Get acquainted with the catalog of online cash registers of a new type. These cash registers fully comply with the updated legislation and Federal Law 54, and also support all the necessary functions and capabilities of a cashier. It is also recommended to switch to new cash registers for those who have not yet switched to online cash registers, but must do so, and for those whose equipment must be updated by law.

Need help using the online checkout?

Don't waste time, leave a request for technical support.

You might also be interested in:

Correction receipt at the online cash register

Online cash register receipt. Details in a new way

BSO - Strict reporting form according to 54-FZ.

Online cash register for dummies

Scanners for product labeling

The cash register is broken, what should I do?