Tax audits in 2020 - the list of organizations included by tax authorities in the visit schedule is contained in a separate document called “Plan of on-site inspections of the Federal Tax Service Inspectorate”. From this article, the reader will learn whether it is possible to gain access to the information contained in such a document, and will also become familiar with the criteria for assessing enterprises, based on the results of the analysis of which a decision is made on the need to include them in the plan for upcoming inspections.

Types of tax audits

Tax inspection plan for 2020

Scheduled tax inspections for 2020: is it possible to preview the schedule?

Plan of on-site inspections of the Federal Tax Service for 2020: criteria for drawing up

Tax inspection schedule for 2020: additional criteria for drawing up

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Tax audit in 2020: list of companies

Types of tax audits

In order to ensure that entrepreneurs comply with the current legislation governing the procedure for calculating the amount and paying tax payments, tax authorities conduct regular audits. During such inspections, inspectorate employees study and analyze the organization’s internal documentation and compare the information received with the information specified in the provided tax reporting. In accordance with paragraph 1 of Art. 87 of the Tax Code of the Russian Federation, tax audits are:

- Cameral. Carried out at the location of the tax office. The object of the study is the reporting compiled based on the results of the tax period and submitted by the taxpayer to the regulatory authority.

- Traveling. Conducted at the location of the organization being inspected. They are more extensive in scope and allow you to verify compliance with the procedure for paying one, several or all taxes.

Appealing the decision of an on-site tax audit

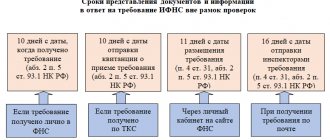

Within 1 month after the date of familiarization with the inspection report, the inspected party has the right to object to the circumstances specified in the document (clause 6, article 100 of the Tax Code of the Russian Federation). All objections must be submitted in writing, in response to which the fiscal authority must make one of the following decisions within 10 days:

- impose a fine on the audited organization;

- agree with the objections and cancel the results of the inspection;

- subject the company to another inspection within 1 month.

During meetings, a company representative has the right to be present when reviewing the company’s inspection materials. If an organization or entrepreneur does not agree with the decisions of the tax authorities, they have the right to file an appeal (Article 139.1 of the Tax Code of the Russian Federation). The complaint must be filed immediately after the tax authorities’ decision is made.

Tax inspection plan for 2018

It is obvious that conducting an audit (regardless of which of these categories it belongs to) is a very labor-intensive procedure that takes a lot of time and requires the involvement of highly qualified tax inspectors.

It is impossible to check all organizations operating in the territory under the jurisdiction of one branch of the Federal Tax Service in one tax period. That is why, at the end of the calendar year, tax officials draw up a special schedule, which includes individual enterprises that will be subject to audits next year. Thus, at the end of 2020, each territorial branch of the department will prepare a schedule of tax audits for 2020, containing a list of organizations subject to inspection, as well as the deadlines within which each of them must be carried out.

There is an opinion that there is simply no plan for tax audits, and the decision on the need to conduct an audit in relation to a certain enterprise is made spontaneously by tax authorities, based on the results of its current activities or as a result of receiving complaints from individuals or legal entities (including counterparties of the enterprise ). In fact, tax authorities still draw up inspection plans - this is indicated by the provisions of letters and instructions issued by the Federal Tax Service, in particular clause 3 of the Federal Tax Service letter “On VAT Refund” dated January 23, 2009 No. ШС-21-3/40.

How an inspection plan is formed

There are several factors that determine the annual inspection plan of Rostrud. Firstly, these are the requirements of Federal Law No. 294-FZ on the timing of inspections. Secondly, in order to achieve the main goal of the event - ensuring safe working conditions - the first thing to take into account is the “significant” risk. In addition, inspections are carried out more often at employers who have recorded cases of violations of employee rights.

In addition, when drawing up a draft annual inspection plan, Rostrud ensures:

- compliance with the requirements for the preparation of plans, their approval and submission to the prosecutor's office;

- consideration of the actual implementation of activities by employers subject to inclusion in the annual inspection plan;

- the possibility of including branches of legal entities in the annual plan of inspections as independent objects of inspection.

Scheduled tax inspections for 2018: is it possible to preview the schedule?

Many entrepreneurs are concerned about the question: is it possible to see the plan for on-site tax audits for 2020 after its approval? Knowing that tax authorities will come with an audit, you can put your papers in order in advance, correct existing shortcomings and ensure that inspectors have access to the necessary documents. Of course, any organization should strive to comply with the rules of tax accounting and reporting at any stage of its activities, but, as practice shows, violations can be found even among the most responsible entrepreneurs.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

Today, only a plan for conducting inspections for state-regulated activities can be found in the public domain - it can be downloaded on the official website of the Federal Tax Service of the Russian Federation by following the link: https://www.nalog.ru/rn77/yul/interest/control_verification/learn_audit_plan/ .

Plans for conducting audits in relation to other categories of taxpayers are not posted on publicly available resources and are used exclusively by employees of territorial divisions of the tax service. However, an entrepreneur can independently assess the likelihood that his company will be included in the audit plan and prepare for a successful audit.

Checking compliance with legislation on the use of cash register systems

During such checks they find out:

- what confirms the fact of purchase (receipt, BSO or nothing);

- whether the information from the check gets into the Federal Tax Service database and how quickly this happens;

- is the check filled out correctly (BSO);

- how cash accounting is maintained.

Features of conducting a cash discipline audit:

- short duration. For example, a test purchase in order to receive a receipt and check the time when information about the purchase entered the Federal Tax Service database can be carried out in a few minutes. And 20 days are allotted to verify the completeness of revenue accounting;

- the taxpayer is not required to inform about the start of the audit;

- there are no restrictions on the frequency of inspections;

- inspectors have unhindered access to information stored on the fiscal drive;

- during the test purchase, inspectors can check KUDiR and any other documents that relate to cash management;

- may be carried out based on a buyer complaint.

How to prepare?

Unlike desk and field inspections, which are quite predictable, checking compliance with legislation on the use of cash register systems is most often unexpected for employees

.

The best preparation for an inspection is to prevent possible comments

.

| Situations | What can be done? |

| Check based on customer complaint | Oblige sellers to issue checks or BSO |

| Using an old-style cash register or no cash register | Make sure that the company or individual entrepreneur is on the list of those who have a deferment for using online cash registers |

| Purchase data does not enter the Federal Tax Service database in a timely manner | Ensure stable internet at the point of sale |

| There are no required details on the check | Contact the cash register seller and check whether the model of the cash register you have installed is in the Federal Tax Service register (https://www.nalog.ru/rn77/service/check_kkt/) |

| Late entry of data into KUDiR, errors in cash documents | Constantly monitor the correctness of filling out all documents |

An inspection at a retail outlet can be carried out without the manager or owner

. Therefore, it is important to instruct staff on how to behave during the inspection.

Plan of on-site inspections of the Federal Tax Service for 2020: criteria for drawing up

The schedule of on-site tax audits for 2020 is compiled by employees of the Federal Tax Service based on an assessment of a number of criteria characterizing each specific enterprise. The list of such criteria is determined by the provisions of the Concept of the planning system for on-site tax audits, approved by Order of the Federal Tax Service dated May 30, 2007 No. MM-3-06/3 [email protected]

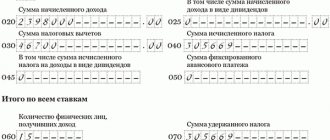

Based on the information provided in Appendix No. 2 of this Concept, tax authorities can pay attention to an organization or individual entrepreneur if:

- The amount of tax payments made by the taxpayer to the budget differs significantly from the average level of tax burden on entrepreneurs that has developed in the industry as a whole. The values of this indicator for different types of economic activity are given in Appendix No. 3 of the Concept.

- For two or more reporting periods, the organization operates at a loss.

- During the reporting period, the taxpayer received one or more tax deductions in a significant amount. In this case, a deduction is recognized as significant if the share of VAT deductions is equal to or exceeds 89% of the total tax amount calculated for the same reporting period, the duration of which is 1 calendar year.

- The growth rate of expenses exceeds the growth rate of income.

- The results of the financial and economic activities of the enterprise have repeatedly approached the values established as a limitation for the use of any taxation regime.

- The amount of expenses incurred during the year of entrepreneurial activity is as close as possible to the amount of income received for the same year (this criterion is used when assessing the performance of individual entrepreneurs).

Tax audit schedule for 2020

At the same time, the Federal Tax Service is not obliged to formulate public plans for tax audits. Moreover, the department's internal regulations require employees to treat the relevant plans as confidential documents not subject to disclosure. Actually, not even all employees of the Federal Tax Service have access to such information (letter of the Federal Tax Service of the Russian Federation dated April 4, 2008 No. ШТ-6-2/255).

The procedure for access of any persons to confidential information is regulated by the provisions of the Order of the Ministry of Taxes of the Russian Federation dated 03.03.2003 No. BG-3-28/96. It provides that the basis for providing information contained in tax audit plans of the Federal Tax Service must be the provisions of federal legislation. In particular, those that give certain persons special powers in terms of gaining access to information in the registers of the Federal Tax Service - for example, law enforcement agencies can receive privileges in this regard.

Some “liberalization” of the rules establishing a ban on disclosing the content of tax audit plans may be applied to the institution of plenipotentiary representation of the President of the Russian Federation. For example, in 2008, employees of the staff of embassies had the right, in a number of cases, to request information from the Federal Tax Service on the total number of inspections and individual entrepreneurs (Federal Tax Service letter No. ШТ-6-2/255).

It may be noted that the provisions of the Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/333 approved the conceptual principles of planning tax audits, as well as the criteria for the payer to independently assess the likelihood of an on-site visit by the Federal Tax Service. Despite the age of this legal act, its provisions are also applicable to the analysis of the situation with tax audits of organizations in 2020.

True, this normative act, like other sources of law adopted at the federal level, does not provide any unambiguous guidelines for the timing of relevant inspections. However, it will be useful to study in more detail the key provisions of Order No. MM-3-06/333 in terms of assessing the likelihood of a tax audit by the payer - we will do this a little later.

It is noteworthy that the objects of both on-site and desk tax audits can be any category of taxpayers.

Tax inspection schedule for 2018: additional criteria for drawing up

The following circumstances may also be significant for inclusion in the on-site inspection plan for a particular enterprise:

- The amount of wages paid to employees of an enterprise differs significantly to a lesser extent from the average amount of earnings paid to employees working in the same industry. When forming the staffing table and setting the amount of remuneration, the Federal Tax Service recommends that employers be guided by statistical data posted on the websites of the territorial branches of Rosstat, as well as the departments of the Federal Tax Service of the Russian Federation. In addition, such information can be obtained by sending an official request to Rosstat or the tax authority. In addition, when forming a plan for on-site inspections, tax officials are guided by information received during the consideration of complaints from citizens and legal entities that the company pays so-called gray wages, as well as about violations present during the registration of employees as employees of the company.

- During the implementation of financial and economic activities by an enterprise, there is interaction with counterparties who have the status of resellers or intermediaries; At the same time, the taxpayer is not able to justify the economic feasibility of using such a model of enterprise functioning.

- The taxpayer did not provide explanations or documents requested by the tax authority, and if the documents were destroyed or damaged, information about their destruction or damage.

What documents does the labor inspectorate study?

Order of Rostrud No. 160 dated June 13, 2019 contains a list of documents that employers can request from State Labor Inspectorate. Among them:

- local regulations regulated by labor law in establishing labor relations;

- documents establishing the legal form of the employer;

- staffing schedule;

- taking into account the recommendations of the trade union body;

- statements from company employees;

- orders and recording the fact of familiarization with them by employees of the organization;

- documents describing the rights and obligations of the parties to the labor relationship;

- documents on the conclusion, amendment, termination of an employment contract;

- income and expense book for accounting of work records;

- agreements on full financial liability, orders on personnel, on the termination of employment contracts, on the dismissal of employees;

- documents confirming the protection of personal data of employees;

- documents confirming compliance with working time and rest requirements;

- orders for granting vacations, written consents of employees to carry out professional activities on weekends and holidays;

- agreements on dividing vacation into parts, settlement in case of termination of an employment contract, documents on payment of compensation for vacation that was not used by the employee;

- documents confirming compliance with wage requirements, in particular the payment of wages;

- documents confirming compliance with mandatory requirements regarding the organization of labor protection: provision of personal protective equipment, medical support, and labor protection guarantees for a number of categories of employees, labor protection training, etc.

- documents that certify that the employee has a disability, as well as the validity period of the supporting documents.

In addition, the State Tax Inspectorate may request from government bodies:

- information about the absence of debt on insurance premiums and fines;

- an extract from the Unified State Register of Real Estate rights;

- information from financial statements;

- average number of employees for the previous year;

- information from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs;

- the amount of taxes paid for the current year;

- information about criminal records and facts of criminal prosecution.

Other criteria for assessing taxpayers

In addition to the above reasons for initiating a tax audit, the following factors may attract the attention of tax authorities:

- The taxpayer was repeatedly removed from tax registration in one branch of the Federal Tax Service and registered in another.

- The accounting data submitted to the regulatory authority contains information about the profitability indicator formed during the reporting period, which differs significantly from the average profitability indicator for the industry as a whole.

- The activities carried out by the enterprise have a high level of risk.

When forming a plan for conducting tax audits, Federal Tax Service employees evaluate each company according to each of the given criteria - the more matches they can identify, the higher the likelihood that the corresponding company will be included in the created schedule.

Tax audit in 2020: list of companies

In an attempt to find an audit plan for the coming year on the Internet, an entrepreneur may end up on one of the many resources that offer the service of assessing the likelihood that the tax authorities included the enterprise in the schedule they developed. Such sites do not have any access to official documentation used by the Federal Tax Service - as a rule, the information they provide is based on publicly available criteria specified in the Concept. That is why you should not trust information received from such sources.

To minimize the risk of being included in the list of companies in respect of which scheduled audits will be carried out, the taxpayer should conscientiously fulfill his tax obligations and comply with the requirements established by the legislator for the procedure for carrying out tax accounting at the enterprise.

***

So, scheduled tax audits for 2020, included by tax authorities in the consolidated plan for conducting on-site audits, are not included in the list of publicly available information. This means that taxpayers cannot know in advance that such an audit is planned for them - as a rule, they receive information about the upcoming visit of the inspector several days before the start of the event. The official list of on-site inspections planned by tax authorities is compiled only for those enterprises that are engaged in state-regulated activities. Companies that do not fall into this category can independently study the results of their financial and economic activities and, based on the information received, assess the likelihood of including them in the tax audit plan.

Who can be included in a scheduled tax audit?

In the provisions of Art. 89 of the Tax Code of the Russian Federation does not specify which persons - legal entities or individuals - can become objects of tax audits of one type or another. Hence the conclusion: absolutely all subjects of tax payment are subject to inspections: citizens, individual entrepreneurs, commercial firms, non-profit organizations, state and municipal structures.

This partly explains the fact that, from a purely technical point of view, it is difficult for the Federal Tax Service to draw up an inspection plan, even if it were required. Based on the provisions of the law, not only legal entities, but also all citizens of the Russian Federation would be included in the corresponding plan. It is extremely unlikely that the Federal Tax Service will have enough human and technical resources to assess the tax history of every Russian, to examine the personal tax profiles of citizens, in particular, for all those risks that are reflected in the provisions of Order No. MM-3-06/333 .

Read more about conducting an on-site tax audit in the article “Procedure for conducting an on-site tax audit (nuances).”