Features of accounting for utility payments

The volume of utility resources used is determined based on meter readings. If there are no meters in the premises, the volume of services provided is calculated based on the laws. For each communal resource, its own regulatory act has been created.

For example, for heating services, Federal Law No. 190 “On Heat Supply” dated July 27, 2010 is relevant. If representatives of the company do not agree with the accrued amount of resources, they can contact the structure involved in the supply of resources. If this structure agrees with the company’s claims, a document with changed data will be generated. Based on this document, the company issues an adjustment invoice.

Utility payments are accounted for on account 60. The following transactions appear as part of accounting:

- DT60 KT51. Transfer of payment.

- DT60/1 KT51. Posting is used if the agreement with the supplying organization specifies a condition for advance payment. Performed for the amount of the advance.

- DT60 KT60 “Advance” subaccount. This wiring is used in conjunction with the previous one. It is relevant when the company has received receipts. The payment debt is repaid in advance, transferred earlier.

Postings are carried out on the basis of an agreement on the provision of utility services and receipts.

Taxation of HOAs under the simplified tax system in 2019

When determining income under the simplified tax system, in particular, income received within the framework of targeted financing (clause 1, clause 1.1, article 346.15, clause 14, clause 1, article 251 of the Tax Code of the Russian Federation) and targeted revenues (clause 2, art. 251 of the Tax Code of the Russian Federation). These HOAs may include, in particular:

- entrance and membership fees for HOA participants;

- donations;

- budget funds to finance major repairs in accordance with Federal Law dated July 21, 2007 No. 185-FZ and the Housing Code of the Russian Federation;

- funds from homeowners going to the HOA for repairs.

These incomes are not taken into account only if the HOA keeps separate records of income and expenses for target funds. If there is no separate accounting, then the target revenues are taken into account in the income of the simplifier on general terms.

The HOA develops the procedure for maintaining separate accounting independently and consolidates it in its accounting policy for tax purposes. As examples for developing registers for recording the receipt and use of earmarked funds, you can use the sample registers given in the Recommendations of the Ministry of Taxes of the Russian Federation.

At the same time, in the simplified version of the KUDiR, the HOA does not reflect income and expenses that are not taken into account when calculating tax under the simplified tax system.

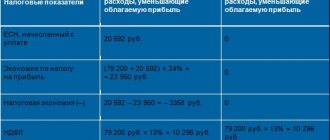

Features of tax accounting of payments

Payment expenses will be recognized only when they are economically justified. Economic feasibility refers to the direction of spending on the immediate needs of the company. Ultimately, these expenses should generate income for the organization. For example, expenses will be justified if they go to pay for utilities needed for production needs. Expenses will not be justified when, for example, a company pays for utilities for an educational institution independent of it. In the latter case, payments do not appear when determining the tax base.

Expenses may be recognized as direct or indirect expenses.

If the company has entered into an agreement with the supplying authority directly, payments based on paragraph 1 of Article 254 of the Tax Code of the Russian Federation are recognized as material expenses.

The latter are, on the basis of paragraph 1 of Article 318 of the Tax Code of the Russian Federation, direct costs.

If the lessor pays for the services and the tenant reimburses the costs, the expenses are recognized in the structure of other expenses on the basis of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. Other costs are considered indirect. They are reducing the income tax base in the current period. Direct costs must be allocated between work in progress and goods sold. Indirect expenses, in turn, do not remain in unfinished production.

Utility payments may also be included in the rent. In this case, they will be included in income tax expenses based on the instructions in paragraph 10 of Article 264 of the Tax Code of the Russian Federation. Will the costs included in the rent be direct or indirect? There is no clear answer to this question in the regulations. Therefore, the classification of payments as direct or indirect should be regulated by accounting policies. The ability to establish order in accounting policies is due to paragraph 4 of Article 252 of the Tax Code of the Russian Federation. Expenses are recognized on the basis of these documents:

- Agreement with resource providers.

- Lease contract.

- Payment papers establishing the fact of payment.

The period for attributing payments to expenses depends on the period specified in the primary documentation.

Accounting for housing and communal services enterprises

Features of the organization of accounting at housing and communal services enterprises and management companies

The management company works by regulating various issues related to housing and communal services, current and major repairs. Basically, apartment buildings are managed by such organizations. Specific requirements, nuances for tax and accounting in housing and communal services, a number of such features include the structure of expenses, features of settlements with consumers and suppliers of utility services, the scope of activity of the company that monitors accounting objects.

Accounting for payments from the lessor

There are two options for paying for services by the landlord:

- Payments are included in the premises fee.

- Service fees are reimbursed by the tenant.

Accounting in these two cases will be performed differently.

Payments are included in the rental fee

The lessor will make payments on the basis of invoices. They will be included in the expenses. The accounting treatment is determined by whether the provision of premises for rent is the main activity of the lessor company. If this is the main activity, payments are included in expenses for ordinary activities. Otherwise, they are included in operating expenses. The lessor's transactions will be as follows:

- DT62 KT90/1. Profit from renting out the property.

- DT90/3 KT68. VAT accrual.

- DT26 KT60. Expenses for services.

- DT19 KT60. VAT claimed by the utility company.

- DT86 KT19. Acceptance of VAT for deduction.

- DT90/2 KT26. Writing off the cost of resources.

- DT60 KT51. Payment for services.

If leasing premises is the main form of activity, expenses based on paragraph 1 of Article 254 of the Tax Code of the Russian Federation are included in material expenses. If this is not the main activity, expenses can be included either in other expenses (clause 1 of Article 264 of the Tax Code of the Russian Federation) or in non-operating expenses (clause 1 of Article 265 of the Tax Code of the Russian Federation).

IMPORTANT! The tax authorities believe that compensation received from the tenant is considered income related to the provision of rental services. These revenues will multiply the VAT tax base on the basis of paragraph 1 of Article 162 of the Tax Code of the Russian Federation. The company providing the premises can deduct VAT transferred to utility structures in full.

Housing and communal services and accounting entries

Housing and communal services enterprises, which are commercial organizations, keep accounts. housing and communal services accounting and generally in general order :

- according to the system of regulatory regulation of accounting in Russia;

- guided by general accounting principles and rules, as well as industry recommendations.

there is no separate accounting standard regulating accounting in the housing and communal services management company .

The following documents will help you properly organize accounting and make postings for housing and communal services:

- Methodology for planning, accounting and calculating the cost of housing and communal services (approved by Resolution of the State Construction Committee of the Russian Federation dated February 23, 1999 No. 9);

- letter of the Ministry of Finance of the Russian Federation dated October 29, 1993 No. 118 “On the reflection in accounting of certain transactions in the housing and communal services sector.”

When maintaining accounting records in housing and communal services, the accrual of revenue from the sale of housing and communal services is reflected in the general order by the following accounting entries (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit of account 62 “Settlements with buyers and customers” – Credit of account 90 “Sales”.

Costs associated with the provision of housing and communal services are reflected in the debit of the accounts:

- 20 “Main production”;

- 23 “Auxiliary production”;

- 26 “General business expenses”, etc.

Payments are not included in the rent

Receipt of compensation from the tenant will not be considered income, since it does not comply with paragraph 2 of PBU 9/99. The postings will be as follows:

- DT62 KT90/1. Income from the provision of an object for rent.

- DT90/3 KT68. VAT accrual.

- DT76 KT60. Tenant's debt for utilities.

- DT60 KT51. Transfer of utility bills.

- DT51 KT76. Receiving compensation for utility bills from the tenant.

In this situation, the lessor acts as an intermediary. Therefore, in some cases, the tenant pays him a small fee. The postings for this operation will be as follows:

- DT76 KT90/1. Reward amount.

- DT90/3 KT68. VAT accrual.

- DT51 KT76. Receiving rewards.

Remuneration within the framework of tax accounting is accepted as part of income from ordinary forms of activity or operating income.

Accounting for housing and communal services fines

For late payment of housing and communal services, contracts with consumers may provide for penalties. Even when the consumer does not directly interact with housing and communal services enterprises, but receives overbilled utility bills (for example, from the landlord), the resulting liability for violation of the terms of contracts for the provision of housing and communal services is subject to compensation.

This liability in the form of penalties is reflected in the general order as a sanction for violation of the terms of a business contract - as part of other expenses (clause 11 of PBU 10/99). Accordingly, the posting of penalties for housing and communal services is as follows:

Dt 91 “Other income and expenses”, sub-account “Other expenses” - Kt 76 “Settlements with various debtors and creditors”, sub-account “Settlements on claims”

If you find an error, please select a piece of text and press Ctrl+Enter.

Accounting for payments from the tenant

The most comfortable option for the tenant is to include utility bills in the rent. Why is this convenient? The company will not have to contact utilities directly. No need to waste time processing payments. In this case, expenses will be included in other expenses. The basis for this is paragraph 1 of Article 264 of the Tax Code of the Russian Federation. The company renting the premises can deduct input VAT. This operation is performed based on the invoice. The postings will be like this:

- DT76 KT51. Payment of rent.

- DT20 KT76. Write-off for rental expenses.

- DT19 KT76. VAT accounting.

- DT68 KT19. Acceptance of VAT for deduction.

ATTENTION! The letter of the Ministry of Finance No. 07-05-06/234 dated September 6, 2005 states: if the payment for electricity is not included in the rent, the lessor will not issue an invoice. This payment is expected to be paid as compensation.

Accounting for utility bills by owners

Property owners can pay for housing and communal services in three main ways :

- under an agreement that the housing and communal services organization concludes with resource supply enterprises. Payments in this case are calculated by the housing and communal services enterprise's own accounting department. When implementing this method, the organization uses its current accounts to accept utility payments, after which mutual settlements are carried out with resource-supplying enterprises. This payment option is by far the most popular;

— under an agreement that the enterprise entered into with a resource supplying organization and a unified settlement and cash center (hereinafter referred to as the ERCC). In this case, it is the ERCC that is responsible for the monthly accrual of the required amounts for payment, as well as sending out receipts to the owners of the premises. There are two possible situations here: residents’ payments are sent to the bank account of a banking organization, which is indicated in the agreement with the settlement center. The bank then sends the received funds to the settlement account of the housing and communal services enterprise so that it can repay the debt to organizations supplying resources; Apartment owners pay consumed resources directly to resource supply organizations, which is allowed in accordance with Part 7.1 of Article 155 of the Housing Code of the Russian Federation.

- under direct contracts that premises owners enter into with service providers. In such a situation, the owners make payments for utility services to municipal unitary enterprises and other suppliers independently, and this payment for utility services is not reflected in any way in the accounting records of the housing and communal services enterprise. For a housing and communal services company, this method is the most convenient, because it does not need to process regularly received funds. However, it has not yet received wide distribution. This is partly explained by the fact that homeowners’ associations (as well as management companies) do not have the right to refuse to enter into an agreement with a resource supply organization. This norm is also spelled out in Part 12 of Article 161 of the RF Housing Code.

Cost accounting in housing and communal services

The formation of costs associated with the provision of utility services is reflected in the debit of accounts 20 “Main production”, 23 “Auxiliary production”, 26 “General expenses”, etc.

Based on existing practice at enterprises in the housing and communal services sector, costs have been formed for many years according to the same scheme. In accordance with the Methodology for planning, accounting and calculating the cost of housing and communal services, the cost includes the costs of work for which housing and communal services enterprises are responsible under the contract. Thus, the object of calculation in the housing and communal services sector is a specific type of work specified in the contract. Based on this, a typical housing and communal services cost estimate includes:

— basic expenses provided for by the current legislation of the Russian Federation;

— additional costs associated with the operation of the housing stock;

— costs associated with the provision of utilities and maintenance of the local area.

When making payments for resources using the ERCC, the following accounting entries are used:

Debit 20 Credit 60 - invoices from suppliers for housing and utility services received.

Debit 19 Credit 60 - VAT reflected

Debit 26 Credit 60 - invoices received from the ERCC for services for accrual and collection of money from the population, as well as other general business expenses

Debit 19 Credit 60 - VAT reflected

Debit 76-6 Credit 90 - reflects the accrual of housing and communal services to the population according to the ERCC certificate

Debit 50, 51 Credit 76-5 - payment received from the public

Debit 76-5 Credit 51 - ERCC transferred payment to suppliers of housing and communal services (less remuneration)

Debit 90 Credit 68 VAT charged

Debit 90 Credit 20.26 - expenses written off

Debit 90 (99) Credit 99 (90) - reflects the financial result.

For late payment of housing and communal services, contracts with consumers may provide for penalties. Even if the consumer does not interact directly with housing and communal services companies, but receives overbilled invoices, for example, from the landlord, the resulting liability for violation of the terms of contracts for the provision of housing and communal services services is subject to compensation. This liability in the form of a penalty is generally reflected as a sanction for violation of the terms of a business contract as part of other expenses (clause 11 of PBU 10/99). Accordingly, the entry for penalties for housing and communal services will look like this: Debit 91 - Credit 76

An accountant in the housing and communal services sector must be fluent in a computer and be able to use programs designed for accounting in housing and communal services. The responsibilities of a full-time accountant of a housing and communal services enterprise include:

— accounting of material assets and their transfer to accountable persons;

— calculation and payroll of the organization’s employees;

— accounting of funds received into the company’s account;

— organization of accounting of settlements with resource-supplying organizations for the resources provided (heat, water, electricity);

— generation and submission of reports to fiscal and regulatory authorities;

— generation of reports for their accounting areas.

The list of responsibilities does not end there; their full list may be different and depends on the specific organization.