One-time payments for children.

In the Krasnoyarsk Territory, there is an increasing coefficient for payments provided for by federal legislation.

At the birth of a child in a family, one of the parents is entitled to an allowance in the amount of 17,479.73 rubles. This amount is multiplied by the regional coefficient.

In the event that two or more children are born, one of the parents may qualify for a payment in the amount of 70,179 rubles. for every baby.

Child benefits in the Krasnoyarsk Territory can be obtained from social security at your place of residence or at work if one of the parents is officially employed.

One-time benefit for the birth of a child in Krasnoyarsk, full-time student

The changes will only affect parents who sent their children to kindergarten from April 2021. Documents for the use of maternity capital in Krasnoyarsk are submitted to the social protection authorities at the address of registration or actual residence. The payment is due to a mother who gave birth to a third child or a single father who adopted a third and subsequent children.

We recommend reading: Tax Deductions When Buying an Apartment for Non-Working Pensioners

If one of the parents or guardian of a newborn expects to receive a one-time social payment at the place of his official employment, training or contract service, he is obliged to provide the following documents:

Monthly benefits for children in Krasnoyarsk.

The mother or father can issue a payment for a minor in the amount of 414 rubles. (Law of the Krasnoyarsk Territory No. 3-876 of 12/11/12).

The benefit is assigned in an increased amount (579 rubles) to the following categories of citizens:

- single mothers;

- large families;

- if the parents have a disability.

Families in which the monthly income for each person does not reach the subsistence level can apply for the payment.

The benefit is provided until the child reaches 16 years of age. The payment period can be extended if he continues his studies at a secondary or higher educational institution, but only until he is 23 years old.

The amount of child benefit in Krasnoyarsk for a child born on January 1, 2021 is 11,589 rubles. The payment is assigned if each family member has an income of less than 1.5 times the subsistence level.

To receive financial assistance, you must contact social security no later than 180 days after the birth of the baby. In this case, the benefit will be assigned and paid from the date of birth.

If the mother or father of a minor applies later, the payment is transferred from the date of application until he reaches 18 years of age.

If the mother does not work and the child is under 1.5 years old, she can apply for a federal social security payment in the amount of:

- 3277.45 rub. on the first;

- 6554.89 for the second and subsequent children.

This benefit is multiplied by the regional coefficient and amounts to 4260.1 rubles. and 8521.36 rubles. respectively.

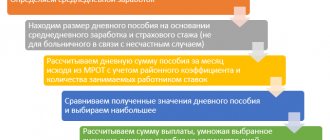

If a citizen worked before going on maternity leave, then the benefit is assigned at the place of service in the amount of 40% of the average income.

Additional child benefit in 2021 in Krasnoyarsk is provided for families where a third child was born.

At the initiative of the regional governor, if the average per capita income is below the subsistence level, in this case an additional payment of 12,400 rubles will be assigned.

This amount is equal to the monthly subsistence minimum per child in the region. The benefit is paid from the moment of birth of the minor until he reaches 3 years of age. The payment is assigned only if the baby was born in the region.

Child benefits in the Krasnoyarsk Territory in 2021

Despite the fact that most child benefits are due to any parent (adoptive parent, guardian), some of them can only be claimed by women-mothers . This is a maternity benefit (Maternity benefit) and payment for early registration of pregnancy.

Payments for 3 Children in the Krasnoyarsk Territory in 2021

State social support is of great importance for families, especially for parents with many children. Therefore, payments for a third child in 2021 are an important step for the development of a positive demographic component in Russia. Having become familiar with the simple rules for receiving them, families can easily write the necessary applications and receive financial assistance.

3. the size of the average per capita family income does not exceed two times the subsistence level of the working-age population established for the corresponding group of territories of the Krasnoyarsk Territory for the second quarter of the year preceding the year of application for a monthly payment.

The monthly payment is assigned from the date of birth of the child, with whose birth the right to a monthly payment arose, if the application for its appointment followed no later than six months from the date of birth of the child. In other cases, the monthly payment is assigned from the date of application for its appointment.

The monthly payment is assigned and paid in the amount of the subsistence minimum for children established for the corresponding group of territories of the Krasnoyarsk Territory for the second quarter of the year preceding the year of application for a monthly payment.

- income above 1-2 minimum wages (does not apply to payments for employment and maternity capital);

- the child for whom the benefit is issued has died;

- errors in documents, falsification;

- the mother is deprived of rights to one of the children.

- One-time benefit for registration in the early stages of pregnancy. The same 675.15 rubles. The benefit is not dependent on employment.

- A one-time benefit in the amount of 18,004.12 rubles. It is paid in Russia for every child born, regardless of whether the parents have a job.

- BiR. It is paid in a specific amount - 675.15 rubles per month. For 4 months, a pregnant woman will receive 2,700.6 rubles.

- Child care allowance up to 1.5 years old. The minimum amount established by law will be charged monthly. In 2021 it is 6752 rubles. This amount will be received by the unemployed, individual entrepreneurs, lawyers and other people who are engaged in private practice. If at the time of the birth of the third child the second is less than 1.5 years old, then the benefits are added up, but it cannot exceed 13,504 rubles.

Smallest benefit amount

A family can receive payments if the income per person is less than 2 minimum wages. The minimum wage indicator for 2021 is 12,130 rubles. If the family meets the requirements, it has the right to receive benefits in the amount of the minimum subsistence level, depending on the region.

Starting from 2021, large families can reduce the basis for calculating property taxes. In addition to square meters, which all citizens have the right to deduct when taxing, parents with many children additionally reduce the base by the cadastral value of 5 square meters. m of room, apartment or share in an apartment, 7 sq. m of a residential building or part of a house.

- They pay not only for the birth of their own children, but also for adoption.

- Not only working people can receive money, but also, under certain conditions, students, the unemployed, individual entrepreneurs and those engaged in private practice (for example, lawyers, notaries).

- The amount of the benefit depends on several factors: the duration of the vacation, the woman’s earnings, and the maximum payments that are determined annually by the Government of the Russian Federation in a special resolution.

- The duration of payments depends on the severity of the birth, the number of children carried and born, and complications. For example, you can get more from a caesarean section than from a natural birth.

- When calculating the amount of benefits, a woman’s earnings are taken for the 2 years preceding the vacation. For example, if you go on maternity leave in 2021, income for 2021 and 2021 will be taken.

Maternity benefit

A large family in Russia is considered to be a family with three or more children. The state is trying to support such heroes as best it can. In the article we will look at what they give for the 3rd child and how much in money. We will not discuss whether this is a lot or a little. There are other platforms for this. Our task is to suggest what parents with many children can receive from the state in 2021.

To apply for monthly payments for the third and subsequent children, you must contact the social protection department at your place of residence and provide the following documents: application, parents’ passports, birth certificates of all children and documents on family income for the three months preceding the application.

You may be interested ==> To recognize a family with many children, children must be registered in one place

The amount of the monthly benefit is equal to the minimum subsistence level for children established for the corresponding territory of the region. For example, for Norilsk this payment will be 17,584 rubles, for Lesosibirsk - 14,839 rubles, and for Krasnoyarsk - 12,424 rubles.

Families whose monthly income for each family member does not exceed twice the subsistence level of the working-age population can receive regional financial support. Thus, in Krasnoyarsk, for a family of five, when applying for payment, the monthly income should not exceed 127.5 thousand rubles.

- Firstly, for officially working parents, the amount of the benefit will depend on the average salary for the two previous years (2019, 2019) and is equal to 4%. It is worth noting that this amount should not be less than 6 thousand 131 rubles. The maximum amount of such monetary benefit is 23 thousand 089 rubles. The required package of documents: an application from the parent who will provide care, an application for assistance, as well as a certificate stating that the second parent does not receive such assistance.

- Secondly, if the enterprise was liquidated at the time when the woman was pregnant, she has the right to a payment in the amount of 40% of the average salary, but not more than 12 thousand 262 rubles.

- Thirdly, unemployed parents who lost their jobs before the child reached the age of three can receive monetary compensation in the amount of 500 rubles.

Federal Law N 157-FZ “On Immunoprophylaxis of Infectious Diseases” (11/28/2018) Federal Law N 178-FZ “On State Social Assistance” (04/24/2020) Government Decree of the Russian Federation N 885 “On approval of the list of post-vaccination complications caused by preventive vaccinations, included in the national calendar of preventive vaccinations, and preventive vaccinations for epidemic indications, giving citizens the right to receive state one-time benefits" (02.08.1999) Federal Law N 117-FZ "Tax Code of the Russian Federation (Part Two)" (31.07.2020) Resolution Government of the Russian Federation N 1013 “On the procedure for paying state one-time benefits and monthly cash compensation to citizens in the event of post-vaccination complications” (02/10/2020) Federal Law N 166-FZ “On state pension provision in the Russian Federation” (10/01/2019) Federal Law N 44-FZ “On the procedure for recording income and calculating the average per capita income of a family and the income of a single citizen living alone for recognizing them as low-income and providing them with state social assistance” (04/24/2020) Resolution of the Government of the Russian Federation N 512 “On the list of types of income taken into account when calculating the average per capita family income and the income of a citizen living alone to provide them with state social assistance" (05/21/2020) Government Decree of the Russian Federation N 761 "On the provision of subsidies for housing and utilities" (07/28/2020) Federal Law N 256-FZ "On additional measures of state support for families with children" (07/13/2020) Decree of the Government of the Russian Federation N 275 "On the procedure for providing information necessary for the appointment and payment of a one-time benefit to the pregnant wife of a military serviceman undergoing military service on conscription, and a monthly benefit for the child of a military serviceman, ..." (December 31, 2009) Decree of the Government of the Russian Federation N 1051 “On the procedure for providing benefits for summer recreational recreation for children of certain categories of military personnel and employees of certain federal executive bodies who were killed (died), missing, or became disabled in connection with the performance of tasks in conditions armed conflict of a non-international nature in the Chechen Republic and in the immediately adjacent territories of the North Caucasus, classified as a zone of armed conflict, as well as in connection with the implementation of tasks during counter-terrorism operations in the North Caucasus region, the pension provision of which is provided by the Pension Fund of the Russian Federation" (02/10/2020) Decree of the Government of the Russian Federation N 1100 “On approval of the Regulations on the calculation of average earnings (income, cash allowance) when assigning maternity benefits and monthly child care benefits to certain categories of citizens” (05/21/2020) Order of the Ministry of Health and Social Development of Russia N 1012n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children” (09.24.2018) Decree of the Government of the Russian Federation N 481 “On monthly benefits for children of military personnel and employees of some federal executive bodies who died (deceased, declared dead, recognized unknown missing) while performing the duties of military service (official duties), and children of persons who died as a result of a military injury after dismissal from military service (service in the troops, bodies and institutions)" (05.21.2020)Federal Law No. 128-FZ "On benefits children of military personnel, persons serving in the troops of the National Guard of the Russian Federation and having a special rank of police, and employees of some federal executive bodies and federal government bodies who died (deceased, declared dead, declared missing) while performing military service duties (official duties ), and children of persons who died as a result of a military injury after dismissal from military service (service in the troops, bodies and institutions)" (01.10.2019) Federal Law N 81-FZ "On state benefits for citizens with children" (08.06.2020)

Last news

Basic payments for children in the region are tied to the regional subsistence level. Established from January 1, 2019, the new monthly payment in connection with the birth (adoption) of the first child is financed from the federal budget, and the new monthly payment for the birth of the second child is paid from maternity capital.

1. Register at the clinic before 12 weeks. In this case, both the woman and the state show mutual responsibility. The expectant mother demonstrates her interest in the normal course of pregnancy and a responsible approach to the birth of a child. The state in this way “thanks” the mother, showing that it is interested in her, the baby, and their health. Today the amount of such an incentive is 630 rubles. In 2021, after indexation, it will grow slightly.

You may be interested ==> Fee for checking gas stoves at ur from 01/01/2021

Child benefit from 3 to 7 years.

Now families raising children aged 3 to 7 years will receive a new federal benefit from 01/01/2020.

The benefit amount will be 5,500 rubles. in 2021.

And one level of the living wage in 2021 is 11,000 rubles.

Who is eligible to receive benefits up to 7 years? These are those families whose monthly income does not exceed one subsistence minimum per family member.

When you can apply: you must contact the MFC after the adoption of the law: February-March 2021.

Child benefits from 3 to 7 years old: when to apply for them; increase in 2021.

Regional support for families with children.

Krasnoyarsk also provides other regional payments to support families with minors.

Among them are:

- subsidies for utility bills;

- compensation for a trip to a health facility;

- regional maternity capital;

- compensation for not providing a place in kindergarten for children under 3 years of age.

In the event that a child who is 1.5 years old is not given a ticket to a preschool educational institution, his parents can apply for a monthly allowance. It is 4109 rubles. per month. The payment is assigned until the child reaches 3 years of age.

At the birth of the third minor in the family, parents can claim regional capital. Its size in 2019 was 142,287 rubles. In 2021, payment indexation is provided.

Funds can be spent on needs such as:

- improvement of living conditions;

- purchase of transport;

- receiving one-time payments (up to 12,000 rubles per year);

- home renovation.

Funds can be allocated for these purposes only after the youngest child in the family turns 3 years old.

Children of military personnel who died while serving are additionally paid benefits, which can be used for summer recreational holidays.

Their size is 25,196.92 rubles. To receive help, the mother of a minor must contact social security.

Parents of a disabled child who cannot attend an educational institution and is educated at home are provided with assistance in the amount of 1,426 rubles. monthly.

If a minor is engaged in distance learning programs, the payment will be 213 rubles.

Payment upon birth of 3 children

- Subsidies directed to the expectant mother for pregnancy and childbirth.

- A one-time payment for future mothers who are registered with the antenatal clinic at a local clinic for a period not exceeding 12 weeks.

- One-time subsidy on the occasion of the birth of a baby.

- Monthly payment for caring for a third child up to one and a half and up to three years.

- One-time payment upon adoption.

- A one-time payment to the pregnant wife of a conscript soldier.

- Monthly payment for a child of a conscript.

- Regional benefits and allowances.

You may be interested in:: Two pensions for disabled people due to war injury

Maternity benefits

The baby's mother does not have to go on maternity leave. In some families, after birth, the mother goes to work and the father goes on maternity leave. This is done if the mother’s salary is higher than the father’s, or by other agreement of the spouses.

- Mortgage loan with no down payment for up to 30 years.

- Certificate for housing (or for construction) in an amount equal to 90% of the total cost of finished or planned real estate (one of the parents must live in our country for at least 12 years, and the total work experience of mom and dad must exceed 10 years).

- Providing a garden or vegetable plot of land (for life).

- Payment of housing and communal services tariffs with a 50% discount (or monetary compensation for payment).

- Providing children under 18 years of age with prescription medications.

- Priority for admission to kindergartens.

- Free entry to exhibitions, theaters and museums.

- Free education in art, music, and sports schools.

- Providing children with textbooks at the expense of the state;

- Free vouchers to health camps, holiday homes and sanatoriums.

- Tuition fees at higher educational institutions are charged at a 50% discount.

- Providing university students with scholarships.

- Employing parents part-time or working from home.

- Increase of leave for each parent by 5 calendar days.

- First-priority appointment in children's health care facilities.

- Free hot meals for schoolchildren.

Conditions of receipt and methods of use may differ in each region, as well as the amount of payments. The average size by region is 100,000 rubles. In some areas you can get cash or spend it on a car. And the most common way to use it is to improve living conditions.

1,500,000 for the third child in 2021

With the birth of a third child in Russia, a family receives the status of a large family. Mother and father have the right to count on government support. The state offers monetary compensation and benefits at the federal and regional levels.

Please keep in mind that each region has its own requirements and conditions for receiving financial assistance. In most cases, you will need a certificate of income, and in some – even an extract from the house register. When applying for any benefits and payments, keep in mind that the child must be registered at the place of residence or stay. How to register for a newborn, what documents are required for this, see here. Is maternity capital given for a third child? Maternity capital in this case can only be obtained if you did not use this program after the birth of your second baby. The certificate must be obtained from the regional branch of the Pension Fund. To obtain a certificate, provide the following documents: