Under what circumstances is financial assistance exempt from insurance premiums?

How is the allocation of financial assistance in an organization formalized?

When financial assistance is subject to insurance premiums

Are insurance premiums calculated if financial assistance is one-time in nature?

Is it necessary to subject insurance premiums to payments made to employees who have already resigned?

Under what conditions are insurance premiums for work-related injuries calculated?

Are insurance premiums from industrial injuries calculated for financial assistance to resigned employees?

Financial assistance in connection with the death of a close relative in 2019–2020

Financial assistance 4,000 rubles: taxation 2019–2020

Results

Under what circumstances is financial assistance exempt from insurance premiums?

Financial assistance is exempt from insurance premiums in the following cases:

- If one employee is provided with financial assistance in the amount of up to 4,000 rubles within the billing period (subclause 11, clause 1, article 422 of the Tax Code of the Russian Federation).

- If financial assistance is issued at a time as compensation for material damage resulting from emergency circumstances, natural disasters, as well as if individuals suffered from terrorist attacks (subclause 3, clause 1, article 422 of the Tax Code of the Russian Federation).

- If financial assistance is allocated as a lump sum due to the death of an employee’s family member (subclause 3, clause 1, article 422 of the Tax Code of the Russian Federation).

- If financial assistance is allocated to an employee of the organization due to the birth or adoption of a child (subclause 3, clause 1, article 422). Amounts of such assistance must be allocated in the first year after birth or adoption, and the non-taxable limit is set at RUB 50,000. Each parent has the right to receive the above amount (letters from the Ministry of Finance dated May 16, 2017 No. 03-15-06/29546, dated November 16, 2016 No. 03-04-12/67082, Ministry of Labor dated October 27, 2015 No. 17-3/B-521 , dated January 21, 2015 No. 17-3/B-18 (clause 1), dated November 20, 2013 No. 17-3/1926).

For information about what documents are required to receive financial assistance in connection with the birth of a child, read the article “How to apply for financial assistance to an employee?”

Situation: In March 2020, a new employee was hired at a budget organization (for him the organization is his main place of work). For April 2020, the employee was accrued:

salary for April in the amount of 463 rubles;

bonus for March in the amount of 90 rubles;

financial assistance at his request in the amount of 150 rubles.

When hired by the organization, the employee presented documents confirming that he has three children under the age of 18. Moreover, two children are the children of his wife from his first marriage, whom the employee adopted in 2020 in accordance with the established procedure. In 2020, the employee did not receive any other social payments (material assistance, gifts, etc.) from this organization.

Question:

How to correctly calculate and withhold personal income tax (hereinafter referred to as income tax) on an employee’s income in this situation?

When calculating income tax, the norms of paragraph 3 of Art. 175 NK. Organizations calculate income tax on all income accrued to employees at the end of each month, for which a tax rate of 13% is applied. Premiums are included in the income of the month in which they are accrued, regardless of the time periods for which such amounts are paid (subclause 12 of Article 172 of the Tax Code).

Thus, the amount of income accrued by the organization to the employee in April will be 703 rubles. (463 rubles (salary) + 90 rubles (bonus for March) + 150 rubles (material assistance)).

Taking into account the fact that 150 rub. is exempt from income tax in accordance with subparagraph. 1.19 art. 163 Tax Code financial assistance, the amount of taxable income will be 553 rubles. (703 rubles (accrued income) – 150 rubles (financial assistance)).

Income that is not remuneration for the performance of labor or other duties is exempt from income tax, incl. in the form of material assistance, gifts and prizes, payment for the cost of vouchers (except for vouchers specified in subclause 1.101 of Article 163 of the Tax Code), received from organizations that are the place of main work (service, study) - in an amount not exceeding 1678 rubles . from each source during the tax period (subclause 1.19 of Article 163 of the Tax Code).

According to paragraph 2 of Art. 163 of the Tax Code, when the payer receives the specified income from relevant sources during the tax period in an amount exceeding the amount within which such income is exempt from income tax, the excess amount is subject to income tax by the tax agent.

Based on sub. 1.1 and 1.2 art. 164 of the Tax Code when determining the size of the tax base when calculating income tax in accordance with paragraph 3 of Art. 156 of the Tax Code, an organization has the right to provide an employee with standard tax deductions in the following amounts:

- 93 rub. per month (subclause 1.1 of Article 164 of the Tax Code). The payer has the right to apply a standard tax deduction if the monthly income does not exceed 563 rubles.

Consequently, when calculating income tax on income for April, the employee has the right to receive a standard tax deduction in the amount of 93 rubles. (553 rubles less than 563 rubles);

- 52 rub. for each child per month (subclause 1.2 of Article 164 of the Tax Code).

Subclause 1.2 of Art. 164 of the Tax Code establishes that parents with two or more children under the age of 18 are provided with a standard tax deduction in the amount of 52 rubles. per child per month.

According to Art. 119 of the Code on Marriage and Family, adoption is a legal act based on a court decision, by virtue of which the same rights and obligations arise between the adoptive parent and the adopted child as between parents and children.

In this case, the fact of adoption of a child must be confirmed by a copy of the relevant court decision (Article 121 of the Code on Marriage and Family).

Adoption is considered established from the day the court decision on adoption enters into legal force (Article 122 of the Code on Marriage and Family).

Based on Art. 216 of the Code on Marriage and Family, registration of adoption is carried out on the basis of a court decision on the adoption of a child by the bodies registering acts of civil status at the place where the decision on adoption was made, upon a joint application of the adoptive parents or one of them, or upon notification of the court. Based on the results of registration of adoption, a record of the act of adoption is drawn up, on the basis of which the body registering acts of civil status makes the necessary changes to the record of the act of birth of the child. Based on changes in the child’s birth certificate, adoptive parents are issued a new birth certificate for the adopted child, and the previous certificate is cancelled. Adoptive parents are also issued a certificate of adoption of the child (Resolution of the Council of Ministers dated December 14, 2005 No. 1454 “On the procedure for organizing work with citizens in civil registration authorities for issuing certificates or other documents containing confirmation of facts of legal significance”).

According to paragraph 4 of Art. 164 of the Tax Code as the basis for providing a standard tax deduction established by sub. 1.2 art. 164 of the Tax Code, for parents of minors there is information available to the tax agent about the presence of a child (children) with the payer, and in the absence of such information - a copy of the birth certificate of the child (children).

An employee (raising three children under the age of 18: a natural child and two adopted children) as a parent with two or more children under the age of 18, has the right to apply a standard tax deduction in the amount of 52 rubles. per child per month.

Thus, when calculating income tax on income for April, the employee is provided with a standard tax deduction in the amount of 156 rubles. (3 (children under 18 years old) × 52 rub.).

Taking into account the above, we will calculate the income tax subject to withholding from the employee’s income.

In April, the employee received income in the amount of 703 rubles; The income tax base is 304 rubles. (703 rubles – 150 rubles (income exempt in accordance with subclause 1.19 of article 163 of the Tax Code) – 93 rubles (standard tax deduction in accordance with subclause 1.1 of article 164 of the Tax Code) – 156 rubles (standard tax deduction in accordance with subclause 1.2 Article 164 Tax Code)); the amount of income tax is 39.52 rubles. (RUB 304 × 13%).

Larisa Rimkevich, economist

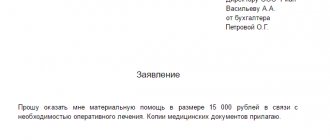

How is the allocation of financial assistance in an organization formalized?

To allocate financial assistance, the manager must issue a special order. An application written in any form is required from the employee who needs help. Supporting documents should be attached to it, which can be a birth or adoption certificate of a child, a death certificate of a family member, etc.

In the payment document, in the column “Base of payment”, the accounting department must indicate the number and date of the manager’s order to allocate financial assistance. If payments are made in tranches rather than in a lump sum, such a link should be included in each payment document.

Tax-free financial assistance 2019

Who can receive financial assistance at work? To give financial assistance or not to give is the right of the employer. Financial assistance may also be paid selectively. During a calendar year, an employee has a non-taxable limit of financial assistance of 4,000 rubles for various purposes. The limit of 4,000 rubles does not depend on the connection in which the money was issued. It could be:

- wedding;

- birthday;

- financial assistance for the anniversary (taxation 2019);

- acquisitions;

- treatment, etc.

Taxation of financial assistance in 2020 and insurance premiums from it vary depending on whether payments exceed 4,000 rubles.

The only exceptions are:

- death of an employee or his relative;

- birth of a child;

- natural disasters and terrorist attacks.

When a subordinate becomes a parent, he can be paid up to 50,000 rubles without calculating insurance premiums. Financial assistance in connection with the death of a family member, compensation for damage due to injury, terrorist attack, emergency or accident are not included in the base for calculating insurance premiums and personal income tax. Thus, taxes on financial aid and the maximum amount in 2020 remain unchanged for now.

Please note that one-time financial assistance is considered a payment for certain purposes, accrued no more than once a year on one basis, that is, on one order (Letter of the Federal Tax Service of Russia No. AS-4-3/13508). How a person receives the money - all at once or in parts throughout the year - does not matter (Letter of the Ministry of Finance of Russia No. 03-04-05/6-1006).

When financial assistance is subject to insurance premiums

In all other cases not specified in the previous paragraph, financial assistance, if provided to employees, becomes subject to insurance contributions. This norm is contained in subsection. 11 clause 1 art. 422 of the Tax Code of the Russian Federation.

The deadlines for making contributions are as follows: according to clause 3 of Art. 431 of the Tax Code of the Russian Federation, the payer of insurance premiums is obliged to transfer them to the budget no later than the 15th day of the month following the month of accrual.

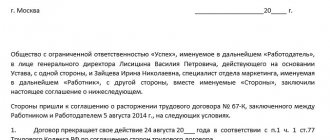

Example:

The collective agreement of Omega LLC contains a provision according to which employees of the organization have the right to receive financial assistance. The decision to allocate it is the prerogative of the manager, whose order indicates the corresponding amounts.

In February 2020, in accordance with his application, A.S. Chizhikov, an employee of the enterprise, was provided with financial assistance in the amount of 29,000 rubles. for paid treatment of the spouse during pregnancy.

In May 2020, another financial assistance was allocated to him, but in connection with the birth of a child - in the amount of 30,000 rubles.

As a result, contributions to compulsory social insurance will be charged only from 25,000 rubles. (29,000 – 4,000), since the non-taxable amount in the first case is 4,000 rubles. And financial assistance issued at the birth of a child is not subject to contributions at all, if it does not exceed 50,000 rubles. In this case, it is equal to 30,000 rubles.

NOTE! The Armed Forces of the Russian Federation allows not to impose contributions on financial assistance for treatment.

For more information about whether financial assistance for treatment of an employee is subject to payment, and whether there is a chance of not paying insurance premiums with such assistance, see the Ready-made solution from ConsultantPlus.

Documentation of financial assistance

Usually, to receive financial assistance, an employee writes an application and submits it to the head of the organization along with documents confirming special life circumstances. Next, an order is issued to pay financial assistance, on the basis of which the employee receives it.

Keep in mind that if you, as an employer, transfer certain payments to employees for good work and call them financial assistance in the order, then both tax authorities and representatives of extra-budgetary funds will probably recognize them as labor payments, from which you will have to pay both personal income tax and contributions.

Is it necessary to subject insurance premiums to payments made to employees who have already resigned?

In some cases, an organization needs to pay financial assistance to former employees, for example, due to difficult life circumstances. In this case, there is no need to accrue insurance premiums, because the base for calculating insurance premiums includes remunerations paid in favor of individuals subject to compulsory insurance under employment contracts or civil contracts (clause 1 of Article 420 of the Tax Code of the Russian Federation). Since there are no of the above agreements between the former employees and the organization, there are also no grounds for calculating contributions.

Income code and deduction code in 2020

Social pensions, received by those who do not have a single day of work experience (disabled people, disabled children, those who have lost their breadwinner, etc.), increased by 4.1 percent from 04/01/2020. Depending on the disability group, this ranges from 175 to 500 rubles. Pensioners who are officially employed may not count on indexation in 2020.

Financial assistance to pensioners in 2020

- The non-taxable payment limit, calculated on an accrual basis for the year, should not exceed 4,000 rubles. Amounts in excess of the established norm are subject to personal income tax on a general basis. The preferential minimum is regulated by Art. 217 Tax Code of the Russian Federation.

- Full exemption is granted to assistance provided in connection with the death of a close relative (parent, child, spouse). This situation must be confirmed by relevant documents (proof of relationship, death certificate).

- In the event of damage caused by a natural disaster, to confirm tax exemption, you must provide certificates from government services stating that such a phenomenon took place.

- If assistance is required by an employee as a result of terrorist damage, then documentary evidence from the Ministry of Internal Affairs will be required.

- The birth of a child is also a reason for providing a payment of up to 50,000 rubles. This amount is legally exempt from income tax (Article 217 of the Tax Code of the Russian Federation).

- The company may provide assistance that will be used to pay for the treatment of the employee or his family members. This payment is made from the net profit of the enterprise.

Under what conditions are insurance premiums for work-related injuries calculated?

The objects for taxation of contributions for injuries are payments if they are in accordance with paragraph 1 of Art. 20.1 of the Law “On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases” dated July 24, 1998 No. 125-FZ:

- when carrying out labor relations;

- execution of civil contracts, if they contain a clause on the payment of such contributions.

In sub. 3, 12 p. 1 art. 20.2 of Law No. 125-FZ defines the nature of material assistance, which is exempt from contributions for injuries. Contributions are not accrued:

- if financial assistance is issued at a time as compensation for material damage resulting from emergency circumstances, natural disasters, as well as if individuals suffered from terrorist acts (paragraph 2, subparagraph 3, paragraph 1, article 20.2 of Law No. 125-FZ);

- if financial assistance is allocated as a lump sum due to the death of an employee’s family member (paragraph 3, subparagraph 3, paragraph 1, article 20.2 of Law No. 125-FZ);

- if financial assistance is allocated to an employee of the organization due to the birth of a child or his adoption (paragraph 4, subparagraph 3, paragraph 1, article 20.2 of Law No. 125-FZ); the amounts of such assistance should be allocated in the first year after birth or adoption and should not exceed 50,000 rubles;

- if financial assistance was issued for other needs and its amount did not exceed 4,000 rubles. per employee for the billing period (subclause 12, clause 1, article 20.2 of law No. 125-FZ).

Thus, insurance premiums for injuries to employees will not be assessed on medical assistance in the same situations in which other insurance premiums are not charged on it.

Read about the rules for calculating and transferring injury contributions for payments subject to such contributions in this material.

Legislative regulation

Is financial assistance to an employee taxable? The answer can be found in the legislative acts of the Russian Federation:

- Art. 217, paragraph 8 of the Russian Tax Code. Circumstances under which financial assistance is/is not provided.

- Art. 224 NK. The limit of such financial support has been determined.

- Art. 421, 422 Tax Code of the Russian Federation. The moments under which insurance premiums are not paid in the case of financial assistance are listed.

- Art. 217 NK. Is material assistance subject to personal income tax? This article answers this question. The circumstances under which benefits are not taxed are directly listed here. Benefits that are also not subject to taxation are also listed. It was also said about the maximum permissible tax-free limit of 4,000 rubles.

- Ch. 23 NK. It lists which material payments are exempt from paying certain interest and taxes on them to the state treasury.

Financial assistance in connection with the death of a close relative in 2019–2020

Separately, it is necessary to say about financial assistance in connection with the death of a close relative in 2019–2020.

The fact is that the employer can list in the salary regulations the immediate relatives of employees, in the event of whose death the employee is paid financial assistance. For example, this could be a spouse, children, parents, grandparents, parents-in-law, brothers/sisters. However, the procedure for assessing financial assistance with insurance premiums depends on whether the deceased relative was a family member or not.

Financial assistance in connection with the death of a close relative in 2019–2020 is not subject to insurance premiums only if these close relatives are family members within the meaning of Art. 2 of the Family Code of the Russian Federation (see letter of the Ministry of Labor of Russia dated November 9, 2015 No. 17-3/B-538). In this article of the Family Code, only the spouse, parents (including adoptive parents) and children (including adopted children) are considered family members. So if an employer pays financial assistance in connection with the death of, for example, a grandmother or parents of a spouse or brother/sister, then this financial assistance will be subject to insurance premiums in the general manner.

Amount of monetary support

Is financial assistance to employees taxable? Yes, but not in all cases, as we established above.

What is the amount of such financial assistance? Depends on the category of citizens to which the applicant belongs. And from the severity of his financial situation. At the same time, the Tax Code of the Russian Federation has the following restrictions:

- The amount of assistance cannot be higher than 5 times the salary.

- The amount of financial support is calculated based on the funds spent by the citizen (this is judged by the documents attached to the application).

- If the amount of financial assistance is less than 4,000 rubles, it will not be taxed.

Financial assistance 4000 rubles: taxation 2019–2020

And a few more words about the taxation of material assistance up to 4,000 rubles. Financial assistance 4000 rub. — taxation in 2019–2020 does not provide for its inclusion in the income taken into account when determining the tax base for personal income tax (clause 28 of article 217 of the Tax Code of the Russian Federation).

For more information about in which cases financial assistance is subject to personal income tax and in which it is not, see the Ready-made solution from ConsultantPlus.

For the purposes of calculating income tax, material assistance to employees does not reduce the tax base (clause 23, article 270 of the Tax Code of the Russian Federation). At the same time, the Russian Ministry of Finance allows the accounting of financial assistance paid for vacation as part of labor costs. For income tax purposes and under the simplified tax system:

- financial assistance paid for vacation is taken into account in labor costs if its payment is provided for in an employment (collective) agreement or local regulation and is related to the employee’s performance of his job duties (clause 25 of article 255 of the Tax Code of the Russian Federation, subclause 6, clause 1 , clause 2 of Article 346.16 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated September 2, 2014 No. 03-03-06/1/43912, dated October 22, 2013 No. 03-03-06/4/44144, dated September 24, 2012 No. 03- 11-06/2/129);

- financial assistance paid for other reasons is not taken into account in tax expenses (clause 23 of article 270, clause 2 of article 346.16 of the Tax Code of the Russian Federation).

Read more about this relationship in the article “How does financial assistance to employees affect income tax?”

Dimensions of material aid

When the provision of financial assistance is mandatory, its amount is regulated by relevant regulatory documents.

An employee who returns to his place after completing his military service must be paid assistance in the amount of at least one minimum wage, which is established by law.

In other situations, the employer independently determines the amount of payments in a fixed amount or in basic amounts. This may be enshrined in a collective agreement or other internal document.

Results

Both the Tax Code of the Russian Federation and Law No. 125-FZ include a number of types of financial assistance in the list of payments not subject to insurance contributions. Among non-contributory financial assistance to employees, there are 2 groups:

- not taxed in full - these include payments made in connection with the occurrence of emergency situations (such as a natural disaster, terrorist attack, death of a family member);

- non-taxable until a certain amount is reached - this is financial assistance for the birth of a child (up to 50,000 rubles) and issued for other reasons (up to 4,000 rubles).

Financial assistance paid to people who are not in an employment relationship with the person making the payment will also not be subject to contributions.

And the obligation to charge contributions for injuries on the income of employees registered under a GPC agreement (subject to contributions for pension and health insurance) will arise for the employer only if such an obligation is provided for by the agreement.

Sources:

- Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Taxation of aid

Regardless of what taxation system the organization uses, all financial assistance can be divided into three main types, depending on the taxation of personal income tax and contributions to funds:

- in connection with the birth of children;

- in connection with death, natural disaster, terrorist attack;

- for any other reasons.

You also need to remember that financial assistance must be one-time, i.e., accrued once during the tax period, which is a year (Article 216 of the Tax Code of the Russian Federation). Let's look at the rules for paying benefits for all three events separately.

Financial assistance of 4,000 rubles and the procedure for paying personal income tax and insurance contributions in 2020

– compensation (payment) by employers to their employees, their spouses, parents, children (including adopted children), wards (under the age of 18), their former employees (age pensioners), as well as disabled people for the cost of goods purchased by them (for them) medications for medical use prescribed by their attending physician. Exemption from taxation is provided upon presentation of documents confirming actual expenses for the purchase of these drugs for medical use;

– taxpayers from among citizens who, in accordance with the law, are classified as citizens entitled to receive social assistance in the form of amounts of targeted social assistance provided at the expense of the federal budget, budgets of constituent entities of the Russian Federation, local budgets and extra-budgetary funds;

How to pay taxes on financial aid

- birth, adoption, establishment of guardianship rights - in the amount of no more than 50,000 rubles for each child when paid within 1 year after birth;

- the amount of partial compensation for sanatorium and resort vouchers in the Russian Federation in the amount of up to 4,000 rubles (taking into account the type of assistance, for example, to support the health of children due to severe environmental and climatic conditions, etc.);

- anniversary, special event (wedding) - up to 4,000 rubles;

- support for an employee in a difficult life situation, vacation - up to 4,000 rubles.

- death of an employee or a close member of his family;

- natural disaster;

- purchasing sanatorium and resort vouchers on the territory of the Russian Federation (compensation depending on the type of support, for example, for accompanying parents of children with disabilities to a place of recreation and recovery);

- emergency situation (terrorist attack and others).

08 Feb 2020 juristsib 456

Share this post

- Related Posts

- Calculation of Fees for Utilities in 2020

- How much do children under 18 now pay in 2020?

- What buildings need to be registered on a summer cottage in 2020

- Subsidies for housing and communal services in Moscow from 2020