Download sample documents:

- Sample letter to sponsor;

- Sample order for sponsorship;

- Sample agreement on the provision of gratuitous (sponsorship) assistance;

- Sample report on the use of sponsorship;

- Sample report from the director on the provision of sponsorship;

N.B. For simplicity of presentation and understanding, further in the text sponsorship is understood as free (sponsorship) assistance.

Distinctive features of sponsorship

The main purpose of providing assistance is to carry out the event specified in the contract. Providing assistance is not a free procedure. In exchange for providing the event, the sponsor obliges the recipient to advertise the details of the person providing the assistance.

The contract must indicate specific terms for advertising the person: (click to expand)

- Submission of information about the person, including indication of the trademark, brand name. Individual advertising of brands only is prohibited as part of sponsorship.

- The form of information dissemination is posters, banners, leaflets, announcements during television broadcasts or radio announcements.

- Places used to post sponsor information.

- Time and frequency of information submission.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The agreement must contain the specific location of the event, the fact of advertising and other important points that allow the assistance to be qualified as sponsorship funding. Sponsorship should be distinguished from charity, in which the recipient of assistance does not need to provide paid services. Accounting for sponsorship and charity has distinctive features.

Budgetary organizations, along with commercial structures, can accept sponsorship as part of extra-budgetary activities.

Receipt is taken into account as income, taxed in accordance with the chosen taxation system. Organizations have the right to provide sponsorship themselves using funds received from their activities. The extra-budgetary budget must include items that allow for sponsorship.

Charity from the point of view of the Federal Tax Service

How to report receiving gratuitous support so as not to pay VAT (which, as you know, is charged by default on sponsorship property)? The most important thing is to let the Federal Tax Service understand, experts say, that the sponsor did not sell the goods to the recipient of assistance. The fact is that, in accordance with Article 146 of the Tax Code of the Russian Federation, if the Federal Tax Service does not recognize the fact of the charitable nature of sponsorship, then the entity providing support will be obliged to calculate the corresponding VAT on the sale of goods or services.

It is therefore very important that the support provided by the sponsor is guaranteed to be presented as a charity. Otherwise, the assistance will be interpreted by the Federal Tax Service as a business activity, and you will have to pay legal VAT. In a number of cases, the fact that the object of assistance is not a political party or a commercial structure is not enough for the Federal Tax Service. Additional evidence may be required to demonstrate that the transaction does not involve a business interest on the part of the sponsor.

Experts recommend using the following mechanisms to prove the fact that the assistance is charitable. They are applicable if sponsorship is provided to a school, NPO and other non-profit organizations. The first mechanism implies that the relationship between the object and the subject of assistance began some time before the actual settlements between them. In this case, a document that reflects a request for sponsorship on a free basis can help. As a rule, this is a letter composed in a certain way. If sponsorship is provided to a budgetary institution, it is done on behalf of its head.

The second mechanism is the collection of documents that can clearly indicate that the support is charitable. Of course, a letter of sponsorship may be one of these. But most often these are correctly drawn up contracts, which reflect the gratuitous relationship between the object of assistance and the subject.

Alternatively, documents indicating that the funds or property were used for the intended purpose (and not as a mechanism for the sponsor to generate income). If we are talking about the transfer of material assets, then, as some experts note, documents that reflect a 100% discount that is not prohibited by law are quite suitable. That is, it turns out that the subject of charity, on the one hand, purchases the goods, on the other hand, pays zero rubles for it. Accordingly, VAT is also zero in this case.

In a number of regional divisions of the Federal Tax Service, the main criterion for distinguishing between sponsorship and charity is the content of documents of the second type, that is, a letter of sponsorship may not play a role for inspectors. The most important thing is the content of documents that reflect the nature of the civil legal relationship between the one who helps and the object of support. In this case, the structure of the gratuitous sponsorship agreement plays an important role.

Document flow of sponsorship: what includes

When providing financing, the main document is an agreement indicating the basic conditions for providing assistance and receiving advertising services in return. The agreement is concluded between the sponsor (advertiser) and the recipient of assistance (advertising distributor). If several persons participate in the event, for example a team of players, a separate agreement with each storage medium is not required. Basic documents for obtaining assistance:

| Documentary form | Additional terms |

| Sponsorship agreement | Contains information about the parties, the procedure for receiving funds, holding events, promotions, reporting procedures |

| Payment documents | Standard payment documents are provided, on the basis of which the recipient of assistance accounts for the funds |

| Record of acceptance | Compiled when transferring property, inventory items for events. |

Sample letter providing financial support for competitions

If the sponsor does not need advertising services, then sponsorship turns into ordinary charity.

Charity The definition of charity is given in Art. 1 of the Federal Law of August 11, 1995 N 135-FZ “On Charitable Activities and Charitable Organizations”

.

Attention: To maintain a high level of education in computer science, modernization of the computer class is required.

The technical update includes the purchase of 14 computers (system unit, monitor, keyboard, mouse), a removable hard drive, a video projector, an ActivBoard 595Pro interactive whiteboard, licensed software, furniture (tables, chairs, cabinets). The planned cost of modernization is 1,200,000 rubles, including delivery and installation of new equipment and dismantling of old equipment.

With financial support for the modernization of the computer class, we undertake to place advertisements for your company inside the school and on its territory.

Free sponsorship agreement

Let's consider sponsorship on a gratuitous basis; this is also possible and not prohibited by law.

But this type of sponsorship can only be provided for certain events defined in paragraph 9 of Art. 3 of Law No. 38-FZ.

Keep in mind that gratuitous assistance is not charitable if it is provided to commercial organizations, political parties, movements, groups and campaigns (clause 2 of Art.

2 of Law No. 135-FZ), and also if it does not pursue certain goals described in.

Those. the sponsor, for its part, provides financial support, and the sponsored person is obliged to disseminate information about him, which is advertising, and the sponsor is an advertiser.

Example, sample, text of a letter to a sponsor

Ekaterinburg, st. Universitetskaya 21 will host a demonstration of the capabilities of the Children's Professions Park project.

Taking into account your previous experience of participating in charity and sponsorship events held, the well-deserved trust of consumers in the products you sell, as well as the coincidence of the target audiences of our companies, we offer to take part in the development of a branch of the “Children’s Park of Professions” project in your city.

The budget for opening a branch, according to preliminary calculations, is 1.5 million.

dollars. It is planned to raise half of this amount from project sponsors.

Our company has developed three options for sponsorship: the general sponsor of the project, the official sponsor of the project direction, and the weekend sponsor.

Unique sample request letter to sponsor

Vladimir is the cradle of Russian culture and art.

Nechaev-Maltsov You and your enterprise (company) continue traditions in the field of charity and sponsorship. In this regard, I turn to you with a request to support my creativity and the development of pop chanson. (Option) Residents of Vladimir are well aware of the activities of your enterprise (company) in the field of charity and sponsorship.

Among my listeners and viewers there are many consumers of your products. In this regard, I turn to you with a request to support my creativity and the development of pop chanson. With sponsorship support it is planned to record the album “Pearl Beads”, create a stage costume and organize a tour.

Letter of financial assistance to an organization

In this regard, we are asking you to support the modernization of the computer class of school No. 108 in the Vybrgsky district of St. Petersburg. A few words about the school.

Five former graduates returned to the school in a new capacity - teachers. The school employs 38 teachers, of which 32 teachers have the highest qualification category “teacher” and 4 teachers have academic degrees. The regional leadership appreciates the merits of the teaching staff and the level of education at the school. At the beginning of the 21st century, the building was reconstructed.

The opening after major renovation was attended by the Governor of the Leningrad Region, Valentina Matvienko.

How to write a letter for sponsorship sample

Who do you contact with your request?Step 2.

Text of the letter to the sponsor.

1CommentFirst contact: how to write a letter to a sponsorFirst contact: how to write a letter to a sponsorHow to write a letter to a sponsor - bring up to dateHow to write a letter to a sponsor - justify the appealHow to write a letter to a sponsor - make an offerHow to write a letter to a sponsor - format it properlyMarina Belousova, BTL expertLeave a review Cancel reviewSending letters to sponsorsConference online “Crowdfunding: the other side of the coin”Legal

Perm, st. Motorostroiteley, 11-77 Regional public organization "Perm Synchronized Swimming Federation" r/c No. Nizhegorodsky Branch of OJSC "ALFA-BANK" (TIN 1, OGRN 7328, BIC cor.

account No. in VOLGO-VYATSK GU BANK OF RUSSIA) If you have questions, I will be happy to answer them! President of the Regional Public Organization “Perm Synchronized Swimming Federation” Source: Contact the addressee personally, preferably by name and patronymic.

Firstly, you will express your respect to the addressee, and secondly, a request addressed to a specific person imposes responsibility on him for its implementation. Give a compliment to the recipient.

By giving a compliment to the recipient, you answer his question: “Why are you asking me this question?” Note his past achievements or personal qualities.

A compliment is appropriate when it comes to non-standard requests, when you need to win the recipient over, when you need to draw attention to certain merits and qualities that are necessary and important for the fulfillment of your request.

Letter of sponsorship for athletes sample

Who do you contact with your request?Step 2.

Why are you contacting me?Step 3. Justification of the requestStep 4. Statement of the requestStep 5.

Summarize your request Template-sample letter about sponsorshipExample, sample, text of a letter to the sponsorExample, sample letter to the sponsor. Text of the letter to the sponsor.

1CommentSponsorship letter with a requestUnique sample letter of request to a sponsorMarina Belousova, BTL expertLeave a review Cancel reviewDistributing letters to sponsorsOnline conference “Crowdfunding: the other side of the coin”Legal consultationOrder a site auditApplication for a presidential grantCrowdfunding: how to get funding for a projectOrder letters to sponsorsConsultingUnique offer from

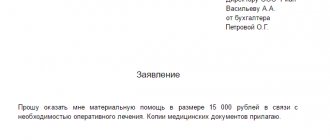

Letter of request

It must be expressed using any derivative form of the verb “to ask” (“we ask you”, “we make a request”, etc.), and since such a message is, in any case, a petition for some kind of service, it must be written in a respectful manner.

Taxation of assistance from a sponsor

Expenses incurred in the form of sponsorship are payment for advertising services. When taxing profits, amounts are included in other expenses. Confirmation of costs is a contract, an act for the provision of services, an order for an advertising campaign, calculations of the research and actions carried out.

When determining the amounts taken into account for tax purposes, it is necessary to distinguish between standardized and non-standardized expenses. The write-off rate is 1% of the amount of revenue received in the period. Non-standardized expenses are written off in full. Standardized expenses include expenses incurred for the purchase of prizes, brand advertising on sports uniforms, and others not included in non-standardized expenses. Read also the article: → “Organizational expenses (PBU 10/99).”

Amounts transferred in the assistance form are subject to VAT for the receiving party. If the host does not have a tax exemption, the sponsor must receive an invoice for the amount paid. The tax highlighted in the document is taken into account as a deduction to reduce the VAT base.

The tax on the advance payment is offset (restored) when issuing an invoice for services rendered. If property is provided as sponsorship, an advance invoice will not be issued. VAT on the service provided can be deducted in full, without taking into account standardized advertising expenses due to the lack of indication of a limit on the amount in the law.

FREE SPONSORSHIP OF A SPORTS ORGANIZATION: ACCOUNTING AND TAX ACCOUNTING FOR THE SPONSOR AND THE SPORTS ORGANIZATION

Legal regulation of the provision of free sponsorship assistance

| From the editors of "Business-Info" The material refers to the Tax Code of the Republic of Belarus (hereinafter referred to as the Tax Code) as amended before January 1, 2020. From January 1, 2020, it is set out in a new edition by the Law of the Republic of Belarus dated December 30, 2018 No. 159-Z. For commentary and comparison of norms, see here . Regarding taxation, the material is relevant as of the date of its writing. |

One of the sources of financing for physical culture and sports organizations, both commercial and non-profit (hereinafter referred to as sports organizations), are donations and free sponsorship.

| For information Commercial and non-profit organizations of physical culture and sports can be created in the Republic of Belarus (Clause 1 of Article 16 of the Law of the Republic of Belarus dated January 4, 2014 No. 125-Z “On Physical Culture and Sports”, hereinafter referred to as Law No. 125-Z). Commercial organizations are organizations that pursue profit-making as the main goal of their activities and (or) distribute the profit received between participants, non-profit organizations - do not have profit-making as such a goal and do not distribute the profit received between participants (Clause 1, Article 46 of the Civil Code of the Republic of Belarus, hereinafter referred to as the Civil Code). The list of organizations that belong to physical culture and sports organizations is given in paragraph 3 of Article 16 of Law No. 125-Z. |

A gratuitous agreement is an agreement under which one party undertakes to provide something to the other party without receiving payment or other consideration from it (clause 2 of Article 393 of the Civil Code). The terms of the agreement are determined at the discretion of the parties within the limits and in the manner prescribed by law.

Sponsorship (free of charge) assistance to a sports organization can be provided within the framework of:

• Decree of the President of the Republic of Belarus dated April 15, 2013 No. 191 “On providing support to organizations of physical culture and sports” (hereinafter referred to as Decree No. 191) or

• Decree of the President of the Republic of Belarus dated July 1, 2005 No. 300 “On the provision and use of gratuitous (sponsorship) assistance” (hereinafter referred to as Decree No. 300).

When providing gratuitous (sponsorship) assistance, an agreement is concluded. An approximate form of an agreement for the provision of gratuitous (sponsorship) assistance was approved by Resolution of the Council of Ministers of the Republic of Belarus dated July 13, 2005 No. 779. When concluding (amending) an agreement for the provision of gratuitous assistance, the parties stipulate which of the decrees - Decree No. 300 or Decree No. 191 - will be applied .

When providing gratuitous (sponsorship) assistance, the contract must indicate (clause 5 of Decree No. 300):

• organization, individual entrepreneur, providing free (sponsorship) assistance, recipient of such assistance;

• the amount (amount, cost calculation) of the gratuitous (sponsorship) assistance provided;

• the purpose of providing free (sponsorship) assistance;

• types of goods (works, services) that will be purchased with funds from gratuitous (sponsorship) assistance;

• the procedure for the recipient of gratuitous (sponsorship) assistance (with the exception of recipients being individuals) to the organization or individual entrepreneur who provided such assistance, a report on its intended use;

• information on the provision of free (sponsorship) assistance within the established limits - for bodies and organizations listed in clause 9 of Decree No. 300;

• other conditions determined by agreement of the parties in compliance with the requirements of Decree No. 300 and other acts of legislation.

| Note! Providing (sponsorship) assistance in violation of the requirements of legislative acts, as well as the use of gratuitous (sponsorship) assistance for purposes not provided for in the agreement on its provision, entail administrative liability in accordance with Article 23.84 of the Code of the Republic of Belarus on Administrative Offenses. |

| For information The procedure for receiving and using gratuitous assistance provided by foreign states, international organizations, foreign organizations and citizens, as well as stateless persons and anonymous donors by organizations and individuals of the Republic of Belarus is regulated by Decree of the President of the Republic of Belarus dated November 28, 2003 No. 24 (hereinafter referred to as Decree No. 24). The list of purposes for using foreign gratuitous assistance, defined by Decree No. 24, does not contain the support and development of physical culture and sports (clause 4 of Decree No. 24). Decree No. 24 loses force on March 4, 2020 due to the adoption of Decree No. 5 of August 31, 2015 “On foreign gratuitous assistance.” The named Decree No. 5 approved the Regulations on the procedure for receiving, recording, registering, using foreign gratuitous assistance, monitoring its receipt and intended use, as well as registering humanitarian programs (hereinafter referred to as Regulation No. 5). In accordance with Regulation No. 5, one of the areas of use of foreign gratuitous assistance, as well as property acquired with assistance funds, is for the development of physical culture and sports, children’s and youth sports, including the conduct of physical education, recreational and mass sports work ( paragraph 9 clause 3 of Regulation No. 5). |

Providing sponsorship under Decree No. 300

Within the framework of Decree No. 300, legal entities and individual entrepreneurs of the Republic of Belarus have the right to provide organizations, individual entrepreneurs, and other individuals of the republic with free (sponsorship) assistance in the form of funds, including in foreign currency ( Note 1

), goods (property), works, services, property rights, including exclusive rights to intellectual property, on the terms determined by Decree No. 300 (part one of clause 1 of Decree No. 300).

Sponsorship (free) assistance can be provided strictly for the purpose

, established in Decree No. 300, namely to support the Olympic and Paralympic movements of Belarus, team sports, physical culture and sports organizations, trade unions, their organizational structures, associations of such unions and their organizational structures of physical education, health, sports and mass work , sporting events and participation in them, including the training of athletes (their teams), construction and maintenance of physical education and sports facilities (paragraph 3 of part one of clause 2 of Decree No. 300).

Organizations and individual entrepreneurs accepting gratuitous (sponsorship) assistance submit a report in any form

on its intended use in accordance with this Decree and the concluded agreement for the provision of free (sponsorship) assistance (clauses and 7 of Decree No. 300).

If gratuitous (sponsorship) assistance is provided in the form of funds, the annex to the contract must indicate the types of goods (work, services) that will be purchased with these funds. Transfer of funds without specifying the types of such goods (works, services) is not allowed (clause 8 of Decree No. 300).

Legal entities keep records of all transactions involving the use of received gratuitous (sponsorship) assistance (clause 7 of Decree No. 300).

The total amount of gratuitous (sponsorship) assistance provided by government bodies and other government organizations named in part one of paragraph 9 of Decree No. 300 during a calendar year cannot exceed 1% of the revenue received by them from the sale of products (goods), works, services for the year preceding the year of provision of such assistance. The provision of gratuitous (sponsorship) assistance by government bodies and other government organizations that do not receive such revenue is not limited in size (part two of clause 9 of Decree No. 300).

Legal entities not named in parts one and four of clause 9 of Decree No. 300, as well as individual entrepreneurs, have the right to provide free (sponsorship) assistance without limiting its size (clause 10 of Decree No. 300).

| For information For more information on the legal regulation of the provision of gratuitous (sponsorship) assistance in accordance with Decree No. 300, see here . |

Providing sponsorship under Decree No. 191

In the case of support for physical culture and sports organizations according to the list in accordance with Appendix 1 to Decree No. 191, sponsorship assistance is provided in the form of free transfer by legal entities and individual entrepreneurs to sports organizations in accordance with the law and taking into account the specifics established by Decree No. 191, funds (including including by sending payment for goods (work, services) for sports organizations under debt transfer agreements), gratuitous provision of services (performance of work) and (or) gratuitous transfer of property, including property rights, including the amount of expenses for the provision of such gratuitous (sponsorship) assistance as part of non-operating expenses for tax purposes. At the same time, there is a requirement (recommendation) to provide free (sponsorship) assistance to clubs in the type(s) of sport and other physical education and sports organizations whose teams participate in the championship of the Republic of Belarus and (or) championships, cup draws of other states in basketball, baseball, volleyball, water polo, handball, mini-football, motorball, beach volleyball, field hockey, ice hockey, football are prohibited on the basis of decisions of government bodies (part one subclause 1.1 clause 1 of Decree No. 191).

| From the editors of "Business-Info" From December 31, 2020, the second sentence of part one of subclause 1.1 clause 1 is set out in a new edition by Decree of the President of the Republic of Belarus dated December 31, 2016 No. 519 (hereinafter referred to as Decree No. 519): “At the same time, the requirement (recommendation) for the provision of free (sponsorship) ) assistance to sports organizations on the basis of decisions of state bodies is prohibited.” |

According to Appendix 1 to Decree No. 191, sponsorship is provided to the following sports organizations:

1) National Olympic Committee of the Republic of Belarus;

2) public association “Paralympic Committee of the Republic of Belarus”;

3) republican federations (unions, associations) for sports included in the program of the Olympic Games;

4) Belarusian University Sports Association;

5) trade and production private unitary enterprise “Belarusian Biathlon Club”;

6) clubs for team sports.

Part one of subclause 1.1 of clause 1 of Decree No. 191 does not apply to clubs in the type(s) of sport and other physical education and sports organizations whose teams do not participate in the major league (in ice hockey - in the extra league) of the championship of the Republic Belarus and (or) championships, cup competitions of other states (part two, subclause 1.1, clause 1 of Decree No. 191).

Legal entities and individual entrepreneurs providing support to sports organizations in accordance with part one, sub-clause 1.1, clause 1 of Decree No. 191, have the right

(clause 13 of Decree No. 191):

• on the basis of a free (sponsorship) assistance agreement, provide assistance to sports organizations without limiting its size

;

• when providing gratuitous (sponsorship) assistance in the form of funds, do not indicate in the contract the types of goods (works, services)

, which will be purchased by sports organizations (performed, provided for them) at the expense of these funds.

When concluding a sponsorship agreement with government organizations ( note 2

) in accordance with Decree No. 191, it is necessary to take into account the conditions established by clause 2 of Decree No. 191.

| From the editors of "Business-Info" From December 31, 2020, paragraph 2 of Decree No. 191 was amended by Decree No. 519. The changes did not affect the essence of the material. |

Recipients of sponsorship assistance must ensure the targeted use of funds by type of expense in accordance with paragraph 5 of Decree No. 191 in accordance with estimates agreed with the Ministry of Sports and Tourism of the Republic of Belarus (in relation to republican federations) or with the local executive and administrative body (in relation to the club).

Accounting at the sponsor

The sponsor's accounting is carried out on the basis of:

• Instructions for accounting of income and expenses, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated September 30, 2011 No. 102 (hereinafter referred to as Instruction No. 102);

• Instructions on the procedure for applying the standard chart of accounts, approved by Decree of the Ministry of Finance of the Republic of Belarus dated June 29, 2011 No. 50 (hereinafter referred to as Instruction No. 50).

| Contents of operation | Debit | Credit | Base |

| Funds were donated free of charge ( notes, ) | 90-10 | , , , | Paragraph 4 p.13 of Instruction No. 102 |

| Supplies donated free of charge | 90-10 | Paragraph 4 p.13 of Instruction No. 102 | |

| Services provided free of charge, work performed | 90-10 | , | Paragraph 4 p.13 of Instruction No. 102 |

| Fixed assets transferred free of charge | 91-4 | Paragraph 11 clause 14 of Instruction No. 102; paragraph 71 of Instruction No. 50 |

Tax accounting with the sponsor

When providing (receiving) gratuitous (sponsorship) assistance, legal entities, individual entrepreneurs and other individuals calculate and pay taxes, fees (duties) in accordance with the law (part one, paragraph 13 of Decree No. 300).

Individual state support, benefits for the payment of taxes, fees (duties), including the right to include in non-operating expenses for tax purposes the amounts of gratuitously transferred funds, the cost of gratuitously provided services (performed work) and transferred property, in the prescribed manner are provided by the President of the Republic of Belarus or by law (part two, clause 13 of Decree No. 300).

Value added tax

The objects of VAT taxation are turnovers on the sale of goods (work, services), property rights on the territory of the Republic of Belarus, including turnovers on the gratuitous transfer of goods (works, services), property rights (subclause 1.1.3 clause 1 of Article 93 of the Tax Code), with the exception of cases of gratuitous transfer specified in clause 2 of Article 31 and subclause 2.5 of clause 2 of Article 93 of the Tax Code.

Cash does not relate to goods, and therefore is not subject to inclusion in the tax base for value added tax (part four, clause 3, article 93 of the Tax Code).

In case of gratuitous transfer of goods (work, services), property rights produced (performed, provided) by the payer, the tax base is determined based on the cost of such goods (work, services), property rights. When transferring purchased goods free of charge, the tax base is determined based on the price of their acquisition (part two, clause 3, article 97 of the Tax Code).

In case of gratuitous transfer of fixed assets and intangible assets, individual items as part of current assets and property accounted for as part of non-current assets, the tax base is determined based on their residual value (part three of clause 3 of Article 97 of the Tax Code).

The residual value and purchase price are accepted as of the date of gratuitous transfer, taking into account revaluations (markdowns) carried out in accordance with the law (part four, clause 3, article 97 of the Tax Code).

When providing gratuitous assistance, the transferring party should take into account that the amounts of value added tax presented upon acquisition or paid upon import of goods (work, services), property rights, attributable to the turnover of the gratuitous transfer of goods (work, services), property rights, are subject to deduction in the manner established for the deduction of value added tax on goods (works, services), property rights, taxed at a rate of 20%, regardless of whether this gratuitous transfer is subject to value added tax (part one, clause 15, article 107 NK).

The provisions of part one of clause 15 of article 107 of the Tax Code do not apply to amounts of value added tax presented upon acquisition or paid upon import of goods (work, services), property rights transferred free of charge within one legal entity (part two of clause 15 Article 107 of the Tax Code).

Income tax

In case of gratuitous transfer of goods (work, services), property rights (except for fixed assets and intangible assets), the proceeds from their sale are reflected in the amount of no less than the amount of costs for their production or acquisition (performance, provision), the amount of value added tax calculated for a gratuitous transfer, and the costs of a gratuitous transfer, and for a gratuitous transfer of fixed assets and intangible assets - no less than their residual value, the amount of value added tax calculated for a gratuitous transfer, and the costs of a gratuitous transfer. Sales proceeds, costs of production or acquisition (execution, provision), costs of gratuitous transfer are reflected in the reporting period in which the goods were actually transferred (work performed, services provided), property rights were transferred (part one of paragraph 5 of Article 127 NK).

When taxing profits, revenue and costs associated with the gratuitous transfer of goods (work, services), property rights, which are not recognized as sales in accordance with subclauses 2.1-2.3, 2.5-2.8, clause 2, Article 31 of the Tax Code (part two, clause 5 Article 127 Tax Code).

In certain cases, sponsors may receive tax benefits.

in the amount of no more than 10% of gross profit) is also exempt from income tax

), transferred to

budgetary organizations of physical education and sports

or used to pay bills for goods (work, services) purchased and transferred to these organizations, property rights (subclause 1.2 clause 1 of Article 140 of the Tax Code).

| For information A budget organization is recognized as an organization created (formed) by the President of the Republic of Belarus, state bodies, including local executive and administrative bodies, or another state organization authorized by the President of the Republic of Belarus to carry out managerial, socio-cultural, scientific, technical or other functions of a non-profit nature, which is financed from the appropriate budget on the basis of the budget estimate (clause 1 of Article 16 of the Tax Code). Budgetary organizations do not include the following organizations (clause 2 of Article 16 of the Tax Code): • receiving subsidies from the budget to cover losses from business activities and maintenance of fixed assets; • receiving funds from the budget to carry out business activities. For Belarusian organizations, gross profit is recognized as the amount of profit from the sale of goods (work, services), property rights and non-operating income, reduced by the amount of non-operating expenses (clause 2 of Article 126 of the Tax Code). |

In the tax return (calculation) for income tax and contributions to the innovation fund, the amount of gross profit is reflected on line 10 of Section I of Part I, and the amount of benefits according to the norms of subclause 1.2, clause 1 of Article 140 of the Tax Code is indicated on line 12 “Preferential profit, which does not depend on the nature of the sale of goods (works, services), property rights.”

| For information The tax return (calculation) form is approved in Appendix 3 to the Resolution of the Ministry of Taxes and Duties of the Republic of Belarus dated December 24, 2014 No. 42. From the editors of "Business-Info" From February 16, 2020, Resolution of the Ministry of Taxes and Duties of the Republic of Belarus dated January 3, 2019 No. 2 established a new form of tax return (calculation) for income tax and approved a new Instruction on the procedure for filling out tax returns (calculation) for taxes (duties), shopping books. |

In the case of providing sponsorship in accordance with subclause 1.1 of clause 1 of Decree No. 191, organizations have the right to include the costs of providing sponsorship as part of non-operating expenses. In this case, revenue and expenses for such gratuitous transfer are not determined, and all expenses, including gratuitously transferred funds, are taken into account as part of non-operating expenses. If an organization has included the costs of a gratuitous transfer as part of non-operating expenses, then in relation to such a transfer, income tax benefits are not additionally applied on the basis of subclause 1.2 of clause 1 of Article 140 of the Tax Code.

Accounting for a sports organization

Sports organizations maintain accounting records

, prepare and present accounting and (or) financial statements in accordance with the requirements of the Law of the Republic of Belarus dated July 12, 2013 No. 57-Z “On Accounting and Reporting”.

Accounting for received gratuitous (sponsorship) assistance

is regulated by the Instruction on accounting of gratuitous assistance, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated October 31, 2011 No. 112 (hereinafter referred to as Instruction No. 112), according to which it is different for commercial and non-profit organizations.

Free sponsorship received by a non-profit sports organization

in accordance with Decrees No. 191 and No. 300, is reflected in accounting:

| Contents of operation | Debit | Credit | Base |

| Fixed assets and intangible assets were received free of charge | Paragraph 2 p.5 of Instruction No. 112 | ||

| Supplies received free of charge | 10 | 86 | Paragraph 2 p.5 of Instruction No. 112 |

| Goods received free of charge | 86 | Paragraph 2 p.5 of Instruction No. 112 | |

| Funds received free of charge ( notes, ) | 50, 51, 52, 55 | 86 | Paragraph 3 p.5 of Instruction No. 112 |

| Works and services received free of charge | , | 86 | Paragraph 4 p.5 of Instruction No. 112 |

Commercial organizations

receipt of gratuitous assistance is reflected in the accounting records with the following entries:

| Contents of operation | Debit | Credit | Base |

| Fixed assets and intangible assets were received free of charge ( note 4 ): - if depreciation is accrued for fixed assets and intangible assets in accordance with the law. | 08 | Paragraph 2 of the first paragraph 4 of Instruction No. 112. | |

| For information Accounted for as part of deferred income, gratuitous assistance received in the form of fixed assets, intangible assets is reflected in the debit of account 98 “Deferred income” and the credit of account 91 “Other income and expenses” for the amount of accrued depreciation of fixed assets, intangible assets from their original cost throughout their useful life (part two of clause 4 of Instruction No. 112). | |||

| — if fixed assets and intangible assets are not subject to depreciation in accordance with the law ( Note 5 ). | 08 | 91 | Paragraph 2 of the first paragraph 4 of Instruction No. 112. |

| Receipt of supplies free of charge ( note 6 ): Method 1 | 10 | 98 | Paragraph 3 of part one of paragraph 4 of Instruction No. 112 |

| For information Accounted for as part of deferred income, gratuitous assistance received in the form of inventories is reflected in the debit of account 98 “Deferred income” and the credit of account 90 “Income and expenses from current activities” (subaccount 90-7 “Other income from current activities”) on the actual cost of used reserves for the production of products, performance of work, provision of services (part three, paragraph 4 of Instruction No. 112). | |||

| Method 2 | 10 | 90-7 | Paragraph 3 of part one of paragraph 4 of Instruction No. 112 |

| Free receipt of funds ( notes, ) | 50, 51, 52, 55 | 90-7 | Paragraph 4 of the first paragraph 4 of Instruction No. 112 |

| Receipt of works and services free of charge | 60, 76 | 90-7 | Paragraph 5 of part one of paragraph 4 of Instruction No. 112 |

Tax accounting for a sports organization

Value added tax

Funds, goods (work, services), property rights received free of charge from a sponsor (resident of the Republic of Belarus) are not subject to VAT from a sports organization, since the acquisition, including the gratuitous receipt of goods (work, services) and funds, is not an object VAT taxation on the basis of clause 1 of Article 93 of the Tax Code.

At the same time, when transferring gratuitous assistance in the form of goods, works, services, property rights, the sponsor (VAT payer in the Republic of Belarus) can present (allocate) the amount of VAT in the primary accounting documents, depending on whether the turnover on the gratuitous transfer is recognized as an object of taxation or No.

Allocated VAT amounts presented by sponsors in primary accounting documents in sports organizations:

1) are accepted for deduction when registering goods (work, services, property rights) in the event that a sports organization carries out entrepreneurial activities (part three of clause 15 of article 107 of the Tax Code);

2) apply to the increase in the cost of these goods (works, services), property rights, if the sports organization does not carry out business activities on the territory of the Republic of Belarus (part two of paragraph 4 of Article 106 of the Tax Code).

Income tax

When receiving sponsorship (free of charge) assistance, the amount of money received, the cost of goods (work, services), property rights, and other assets received free of charge, as a general rule, are subject to income tax as part of non-operating income on the date of their receipt (subclause 3.8, clause 3 of Art. .128 NK). At the same time, gratuitous assistance received in the form of fixed assets, intangible assets, inventories, in contrast to accounting, is taken into account as part of non-operating income in the full amount.

However, it should be noted that the law establishes some exceptions for the gratuitous receipt of assets:

• non-operating income does not include the cost of unused state property that was in republican and municipal ownership and received free of charge by sports organizations in accordance with the law (subclause 4.11, clause 4, article 128 of the Tax Code);

• non-operating income does not include the cost of goods (work, services), property rights and funds received free of charge by both commercial and non-profit organizations upon transfer within one owner by his decision or the decision of an authorized body (subclause 4.9.4 Clause 4 of Article 128 of the Tax Code).

For non-profit sports organizations

Non-operating income does not include the cost of goods (work, services) received free of charge, property rights, amounts of funds received free of charge provided that these goods (work, services), property rights, funds are used for their intended purpose. If the intended purpose of the transferring party is not determined, and the gratuitous (sponsorship) assistance is used to perform the tasks provided for by the charters and (or) constituent agreements of the receiving organizations, its cost is also not included in the non-operating income of the organization (subclause 4.2.3 clause. 4 Article 128 Tax Code).

In case of misuse of funds, works, services and property, including property rights granted in accordance with Decree No. 191 at the disposal of sports organizations, and (or) team sports clubs receive support if the conditions specified in clause 2 of Decree No. 191, such funds, works, services and property, including property rights, are taken into account when calculating taxes in the prescribed manner (part two of clause 16 of Decree No. 191).

| From the editors of "Business-Info" From December 31, 2020, part two of paragraph 16 of Decree No. 191 was amended by Decree No. 519. The changes did not affect the essence of the material. |

Note 1. Cases of the use of foreign currency, securities in foreign currency and payment documents in foreign currency when conducting foreign exchange transactions between resident entities of foreign exchange transactions are established in Article 11 of the Law of the Republic of Belarus dated July 22, 2003 No. 226-Z “On Currency Regulation and currency control", Chapter 5 of the Rules for Conducting Currency Transactions, approved by Resolution of the Board of the National Bank of the Republic of Belarus dated April 30, 2004 No. 72, and clause 8 of the Procedure for settlements between legal entities and individual entrepreneurs in the Republic of Belarus, approved by the Decree of the President of the Republic of Belarus dated June 29, 2000 No. 359.

Providing and receiving gratuitous assistance in foreign currency between legal entities of the Republic of Belarus without the permission of the National Bank is unlawful (subclause 25.15, clause 25 of these Rules).

| From the editors of "Business-Info" From March 1, 2020, on the basis of Resolution of the Board of the National Bank of the Republic of Belarus dated December 19, 2018 No. 612 “On some issues of conducting currency transactions,” Chapter 5 (clauses 25-27) of Rules No. 72 is set out in a new edition. Rules No. 72 exclude the possibility of settlements in foreign currency for settlements carried out on the basis of permits from the National Bank of the Republic of Belarus. |

Note 2. For the purposes of Decree No. 191, state organizations are understood as state organizations or organizations in the authorized capital of which 50% or more of the shares (shares) are owned by the Republic of Belarus and (or) its administrative-territorial units.

Note 3. The procedure and amount of payments between legal entities, their separate divisions, and individual entrepreneurs are established in Chapter 4 of the Instruction on the procedure for conducting cash transactions and the procedure for cash settlements in Belarusian rubles on the territory of the Republic of Belarus, approved by the resolution of the Board of the National Bank of the Republic of Belarus dated March 29 .2011 No. 107.

| From the editors of "Business-Info" From June 1, 2020, Instruction No. 107 lost force on the basis of Resolution of the Board of the National Bank of the Republic of Belarus dated March 19, 2019 No. 119. You should be guided by Chapter 7 “The procedure for settlements between legal entities, their separate divisions, individual entrepreneurs” of the Instruction on the procedures for conducting cash transactions and cash settlements, approved by Resolution of the Board of the National Bank of the Republic of Belarus dated March 19, 2019 No. 117. |

Note 4. Initial cost of fixed assets received free of charge from other persons

determined based on their current market value on the date of acceptance for accounting as investments in long-term assets (part 5 of clause 10 of the Instructions for accounting of fixed assets, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated April 30, 2012 No. 26).

The current market value is the amount of money that would be received if the fixed asset were sold under current market conditions (paragraph 5, clause 2 of the specified Instructions).

Invoices of enterprises for similar values can serve as confirmation of the current market value.

Note 5. Cases in which depreciation is not calculated are established in clause 35 of the Instruction on the procedure for calculating depreciation of fixed assets and intangible assets, approved by the resolution of the Ministry of Economy of the Republic of Belarus, the Ministry of Finance of the Republic of Belarus and the Ministry of Architecture and Construction of the Republic of Belarus dated 02.27.2009 No. 37/18/6. In addition, from January 1 to December 31, 2020, organizations and individual entrepreneurs have the right not to charge depreciation on all or individual fixed assets and intangible assets used by them in business activities (clause 2 of the resolution of the Council of Ministers of the Republic of Belarus dated February 16, 2015 No. 102).

Note 6. The choice of the method of reflecting gratuitous assistance in the form of inventories in accounting must be fixed in the accounting policy. In order to simplify accounting, it can be recommended that organizations stipulate in their accounting policies to reflect the receipt of gratuitous assistance in the form of inventories on the credit of account 90-7, because if the organization provides in its accounting policies for the attribution of gratuitous assistance in the gratuitous receipt of inventories to the credit of account 98 and if such receipt of inventories will be recognized as non-operating income for profit tax purposes, then in this case temporary differences will arise that will lead to the formation of a deferred tax asset. Reflection of a deferred tax asset in accounting is carried out in accordance with the norms of the Instructions on accounting of deferred tax assets and liabilities, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated October 31, 2011 No. 113.

12.11.2015

Tatyana Gerasimovich, auditor, DipIFR

Accounting for the recipient of sponsorship funds

An income account is used to record data on the receipt of sponsorship. When accounting for sponsorship, you must:

- Keep separate records of income from sponsorship and other financial flows.

- Direct the funds received strictly for the purposes specified in the agreement.

- Report to the sponsor for the funds spent with documents evidencing the advertising campaign.

- Include the amount received as income from the provision of services.

- Use the amounts spent on the event to reduce the tax base.

Example of accounting for income received from a sponsor

The organization "Sportlandia", which uses the simplified tax system, has entered into an agreement with the company "Silhouette" to conduct an advertising campaign as part of a sporting event. The amount of assistance reflected in the contract and act for the provision of services amounted to 38 thousand rubles. The cost of the event was 5,000 rubles. The following entries are made in the accounting of the Sportlandia enterprise:

- The receipt of funds is reflected: Dt 51 Kt 62/2 in the amount of 38,000 rubles;

- The services provided were accounted for: Dt 62 Kt 90/1 in the amount of 38,000 rubles;

- The expenses incurred are reflected in the accounting: Dt 90/2 Kt 44 in the amount of 5,000 rubles;

- The advance payment was offset: Dt 62/1 Kt 62/2 in the amount of 38,000 rubles.

The primary accounting documents are the contract, act, and payment forms.

Who can become a sponsor?

There are a lot of wealthy people in the world who want to help financially.

To help those in need, it is enough to meet two criteria:

- have a desire to help other people financially;

- have financial opportunity.

Everyone who sponsors citizens in need can be divided into several categories:

- Wealthy Russians who want to support financially. According to Rosstat, for every thousand Russians there is at least 1 millionaire. They are ready to donate part of their savings to those in need.

- Organizations. Large companies and enterprises annually spend part of their income on providing monetary assistance to the population. Sponsorship allows them to save significantly, increases their rating, and improves the company’s reputation.

- Concerned citizens. Ordinary Russians, who have their own problems, pay for expensive operations for children by sending paid SMS, and also jointly build churches, cancer centers, and hospices.

- Charitable foundations. Organizations created specifically to provide assistance to the population carefully check applications and appeals, and then make payments.

- State. You can send a request to the Russian government, deputies of the State Duma, or personally to the President of the Russian Federation. Depending on the situation, the response may be immediate.

Finding a sponsor, rich or not, is never easy. This is due to the fact that usually financial assistance is needed urgently, and the institution of sponsorship is not widespread. Therefore, citizens do not know where and to whom they can turn.

Taxation of the recipient of funds

For tax purposes, sponsorship is taken into account as income received from the provision of advertising services. The closed list of income not subject to profit tax (Article 251 of the Tax Code of the Russian Federation) does not include sponsorship investments, which obliges the receiving party to include the amounts or valuation of property in the income as a fee for the provision of services.

If the amount of receipts from the amount of services provided exceeds the amount, the amounts are taken into account as part of non-operating income (clause 14 of Article 250 of the Tax Code of the Russian Federation). Expenses received by an organization in carrying out a sponsored event are taken into account when calculating the income tax base. In a similar manner, income is taken into account by organizations that use the simplified tax system for accounting (Article 346.15 of the Tax Code of the Russian Federation).

Tax accounting of gratuitous assistance

Providing financial support to other legal entities is regulated not only by accounting standards, but also by the instructions of the Tax Code of the Russian Federation. The main tax payments levied on amounts of property assistance are VAT and income tax.

Legislation in force in 2020 requires enterprises that provide gratuitous financial assistance to allocate funds from their net profits. According to the Tax Code of the Russian Federation, expenses associated with charity and targeted contributions are not included in the calculation of the taxable base.

Taxation of aid amounts with VAT

Sponsorship for the provision of services is received by recipients in the form of an advance payment. The date of formation of the object of VAT taxation is the day of receipt of funds at the cash desk, into the account or signing of the act of transfer of a tangible asset. The enterprise is obliged:

- Before confirming the intended expenditure, charge VAT on the amount of the received advance payment. The amount is determined by calculation.

- Issue an invoice addressed to the sponsor.

- Take the amount into account when declaring.

- Offset the advance after the provision of services during the period of the operation.

Persons who are not VAT payers are not taxed on income from sponsorship. Organizations do not have a declaration obligation.

Accounting for receiving financial assistance

According to the instructions for using the standard chart of accounts, passive account 98 (subaccount 2) is used to reflect information on the amounts of gratuitous receipts. In this case, the accounts of the property transferred into possession are debited.

As the allocated funds are used, the amounts are recognized as non-operating income, partially written off to account 91.1. This is necessary according to PBU: assets received free of charge as a result of charity are considered non-operating income and must be reflected in account 91. A decrease in the amount of assistance received occurs when:

- release into production of MPZ;

- calculation of depreciation charges;

- repayment of accounts payable;

- carrying out other operations using targeted financing.

Accounting data must fully reflect the sources of non-operating income and the conditions for their application.

Common mistakes in accounting for sponsorships

Accounting for sponsorship of events while simultaneously advertising a person must be carried out in strict accordance with the law. Errors often occur in business accounting that need to be eliminated.

| Incorrect position of accounting workers | Explanations |

| There is no contract when providing assistance | The document is the basis for executing the transaction; its absence deprives the sponsor of the opportunity to take into account the costs of receiving services, and the recipient – the costs of the event |

| Proceeds from sponsorship are not included in income | Sponsor funds are actually a payment for the provision of services and participate in taxation |

| Providing assistance is not included in the sponsor's expenses | Persons have the right to take into account amounts as part of advertising expenses, taking into account the standardization of costs; the amount exceeding the standard is used to reduce the base in a later period |

Is sponsorship a benefit for business?

How are things going with taxes for the party that provides support? The most remarkable thing is that the provision of sponsorship can be considered an expense of the organization.

That is, the amounts of money transferred to the object of support (or the cost equivalent for property) can be used to reduce the tax base if, say, the sponsoring organization operates under the simplified tax system.

True, this will be legitimate only if the intended use of funds is proven. As follows from some Letters from the Ministry of Finance, the Federal Tax Service recognizes the following expense items to reduce the tax base:

- advertising events through the media;

- production of advertising banners, lighting elements;

- printing of brochures, booklets, catalogs.

The corresponding expenses must be confirmed by documents that are primary in nature. As a rule, the subject of reducing the tax base, acceptable from the point of view of the Federal Tax Service, is the presentation of sponsorship as advertising expenses. The most important criteria here are economic feasibility, correct documentary evidence, and focus on making a profit. Specific types of expenses provided for by law in this part are set out in Article 264 of the Tax Code of the Russian Federation.

In some cases, however, the law makes it possible for both subjects and objects of assistance to receive preferences related to taxation. The fact is that in 2012, amendments were made to the Tax Code of the Russian Federation, according to which some sponsorship relationships may, on the one hand, not provide for the calculation of VAT (which is beneficial for support objects), on the other hand, be subject to a reduction in the tax base regarding the subjects of provision help. We are talking about advertising of a social nature (aimed at informing certain social groups and the population as a whole about the existence of such and such problems and possible measures to solve them).

First contact: how to write a letter to a sponsor

Marina Belousova, BTL expert Teacher-expert in applied socio-economic programs at the Specialist Training Center at MSTU. N.E. Bauman

Recommendations on how to write a letter to a sponsor are based on personal experience and as a result of analyzing the effectiveness of my clients’ communications. Resolving the issue of additional funding for socially significant activities and attracting sponsors begins with establishing the first contact.

You can, of course, just call the sponsor and offer cooperation, but tomorrow he will forget about your conversation. But the letter can be read and re-read, assessing the prospects for sponsorship. So, the first letter to the sponsor is the most important.

The future of your project and activities will depend on how well you write it.

The purpose and objectives of the first letter are to interest the sponsor in cooperation, bring information about the project to him, show the benefits and establish contact.

How to write a letter to a sponsor - bring you up to date

Let's look at how it will look in a letter.

At the beginning of your letter, tell us about a project, event, organization, that is, about an object or person who needs additional funding.

From it, a potential sponsor should find out: the name, goals, timing and location of implementation, and the uniqueness of the project. In this part or another, briefly tell us about your experience in implementing similar projects.

Example 1

The World Championships, held every two years by the International Water Ski and Wakeboard Federation, are the culminating competition between teams from different countries. From July 18 to 24, two hundred of the strongest athletes from fifty countries of the world will perform in the city of Dubna.

Russia, Denmark, Italy and South Korea competed to organize an event of this scale. Considering Dubna’s successful experience in organizing the Russian stages of the Water Ski World Cup from 2004 to 2009, the IWWF Executive Council unanimously supported Russia.

How to write a letter to a sponsor - justify the appeal

Then justify the reasons why you are contacting THIS ORGANIZATION. Show maximum awareness of its activities, corporate social responsibility, and recognize the merits of the campaign.

Assume that your project is consistent with the organization's corporate policy of supporting socially significant projects and charitable activities.

Emphasize that your target audiences overlap or overlap.

Example 2

The excellent level of organization of international competitions and the presence of the “World's Best Water Ski Stadium” are the result of constructive relations between municipal authorities and local business structures.

For a long period, Sberbank systematically supported the development of sports activities of Dubna residents. The positive image of the Bank, socially oriented products and services have created a well-deserved demand among residents of the city.

Dubny.

How to write a letter to a sponsor - make an offer

Finally, state the amount of the project budget. Invite the campaign to review the contents of the sponsorship portfolio and choose a package according to its capabilities. Set a time frame within which you expect to receive a response. Inform: where and how a potential sponsor* can obtain additional information.

Example 3

Taking into account Sberbank’s priorities in the field of sponsorship and charity, supporting national sports, we propose that the joint-stock company sponsor the World Water Ski Championship and use our capabilities to support the Bank’s brand at the Russian and international level.

The competition budget is ... rubles.

Half of the cost estimate is covered by the state budget, IWWF sponsors, sales of spectator tickets, souvenirs, advertising services, etc.

The other part of the expenses is expected to be made at the expense of sponsors, who are offered three options for participation - packages: General Sponsor, Official Sponsor and Competition Sponsor. In exchange for sponsorship, the organizers provide a wide range of advertising and PR services.

We hope that the information contained on the official website of the competition will help you choose a reliable investment object for your business.

How to write a letter to a sponsor - format it properly

The letter is drawn up in accordance with all the rules of office work and includes: details of the recipient, sender and contact person, an appeal to him, the main content, and the final phrase. The letter is signed by the head of the organization that is applying for sponsorship of the event or the project manager.

The first and last parts of the letter provide a summary of the sponsorship portfolio and can be static sections of the letter template. The second part is compiled individually. Focus on this section.

List the attachments to the letter, which are drawn up in separate documents with the details of the organization (project). The first document should be a generalized cost estimate for the implementation of the project and the holding of the event. The second document contains the general content of sponsorship packages (options), that is, what the sponsor will receive by supporting you.

Start sending emails with sponsors you know personally. This type of sending is called warm mailing and is based on some important rules.