Temporary use of real estate, including for commercial purposes, is permitted both for a fee and for free. At the same time, free rent of non-residential premises intended for business activities has its own characteristics.

If you don’t know them, there is a high probability of filing claims from the tax authorities. Therefore, in this article you will learn the features of leasing commercial non-residential premises free of charge between legal entities, as well as when the owner is an individual.

And also, we will tell you about all the important nuances, in addition you can, which contains all the necessary and essential conditions. In general, we will try to help understand this issue as much as possible.

When does an agreement for the gratuitous use of non-residential premises apply?

Many business representatives have a question about whether a lease agreement can be free of charge. Let us answer right away - no. The fact is that, from a legal point of view, rent involves paying a fee for the use of property, no matter for how long it is provided.

The use of property on a free basis is formalized by a loan agreement, which, however, has much in common with a lease agreement. In such a transaction, the parties are referred to as the lender and the borrower. However, throughout this material we will continue to use the word “rent”.

Between legal entities, a loan agreement (free lease) is used in cases where the enterprises are closely related to each other. And also, property is often provided free of charge for use by public organizations.

For example, we offer.

A gratuitous use agreement is also used when an object of cultural heritage is transferred in order to maintain it in proper condition.

Attention is important! Be sure to specify responsibility in the event of negative situations. We also recommend that you write down conditions regarding possible damage due to fire.

If we are talking about legal entities, then they are prohibited from transferring property free of charge to the founders (shareholders), as well as to citizens included in the management team of the company.

For example, it is impossible to conclude a loan agreement between an enterprise and its director (Part 2 of Article 690 of the Civil Code of the Russian Federation). There are no other prohibitions regarding free rent for companies by law.

Essential terms of the lease agreement for commercial premises and the possibility of free use

Naturally, first there should be a preamble, which indicates information about the owner and user of the property. The subject of the contract should provide detailed characteristics of the premises and the period for which it is transferred for use.

We recommend! For maximum comfort, it is advisable to insure your property.

Although the transfer of commercial premises for rent free of charge does not imply charging a fee for its use, the tenant (borrower) will still have to bear certain costs.

Thus, the tenant may be required at his own expense to:

- maintain the occupied property in proper condition;

- carry out routine repairs;

- bear or compensate the lessor for all operating costs.

All of these points must also be specified in the loan agreement (free rental).

Lessor legal entity

We have already noted above that an enterprise cannot transfer its property for free use to a certain circle of persons. In all other cases, free rental of non-residential premises between legal entities is completely legal.

The preamble to the agreement should indicate information about the official who acts on behalf of the company.

If the lender is a legal entity, then primary accounting documents must be drawn up for the agreement. Along with the acceptance certificate, the lessor must issue an invoice (regarding the collection of VAT).

If the owner is an individual

The contract will need to indicate the citizen’s passport details. In addition, you should refer to the details of the documents on the basis of which the property belongs to the person (certificate of ownership, registration certificate, and so on).

If premises in a residential building are transferred for use, then you should be prepared for the fact that you will have to resolve various issues both with the residents and with the management company. It is possible that the consent of the landlord’s spouse may be required to transfer the property for free rent.

Therefore, free rent of non-residential premises from an individual requires preliminary consideration of a number of issues.

Regardless of who the lessor will be, the agreement should include clauses regarding the financial responsibility of the borrower (tenant) for damage to property, the procedure for early termination of the relationship and the procedure for returning property.

https://youtu.be/xtBFF3Za9A4

What is free use of premises?

The current legislation, namely the Civil Code of our country, does not contain such a legal concept as the gratuitous transfer of residential or non-residential property. Such actions mean obtaining a loan.

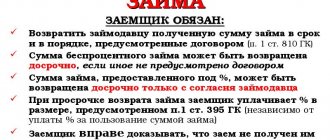

A loan is the transfer of any property, despite its belonging to a residential or commercial property, without receiving any material benefit. The parties to such a transaction are the lender, that is, the citizen or legal entity that owns the property, as well as the borrower, the person, or enterprise, organization that rents or leases this premises.

The main condition for such a transfer is the return of the loan object in the same condition as it was before signing the contract, or in an improved one, as well as payment of all mandatory payments (utilities and other services) for the period during which the property will be used.

Free rental of non-residential premises and taxation of such transactions are regulated by the Tax Code of our state, but this will be discussed below.

These legal relations can arise between individuals and legal entities equally, without legal restrictions.

There are the following forms of such transactions.

- Between citizens (this category also includes stateless persons who own real estate). Typically, the subject of such an agreement is residential premises. A rental agreement is concluded between them. Taxation is carried out at the rates established for this category (income tax).

- Between citizens, individual entrepreneurs (who act as business entities), as well as legal entities. Mostly commercial real estate is rented, in some cases residential. The transaction is formalized by a lease agreement, and taxation is included accordingly.

- Between various legal entities, which include individual entrepreneurs. The transaction is formalized by a real estate lease agreement.

The main point when concluding rental transactions is that the owner of the property does not receive any profit or bonus from this. If the agreement is drawn up for gratuitous use, and it stipulates the presence of rental payments, the tax office may impose penalties and interest for this.

Applications and related documents when drawing up an agreement

In some cases, a free use agreement alone is not enough. You will also need attachments to the lease agreement for the free use of non-residential premises.

This will include such data.

First of all, you will need a graphic diagram (explication), because the tenant must know which part of the property he has every right to use.

Further, the attachments may include copies of the technical and cadastral passport, as well as other title documents.

If consent is provided from the landlord's spouse, then this is also included. A representative can sign the agreement on behalf of any of the parties. In this case, the enclosures must include a copy of the relevant power of attorney.

We've sorted out the applications. Now let's move on to the composition of the documents that are drawn up along with the contract.

Regardless of who is the lessor (lender), the transfer and return of property is formalized by an acceptance certificate. It describes the condition of the property at the corresponding point in time, and also records data from utility meters.

If property is transferred between legal entities, the lessor provides the lessee with an invoice. It is necessary for maintaining tax accounting for VAT.

7 (7). A Belarusian commercial organization plans to rent out part of the office space occupied by another organization.

Let's consider the questions that arose in this situation.

7.1. Is it possible to conclude a free use agreement instead of a lease agreement (the founders of the two organizations are common)?

Can.

The agreement for gratuitous use (loan) is regulated by Ch. 36 of the Civil Code of the Republic of Belarus (hereinafter referred to as the Civil Code) and is not a gift prohibited between commercial organizations. The Decree of the President of the Republic of Belarus dated July 1, 2005 No. 300 “On the provision and use of gratuitous (sponsorship) assistance” does not apply to it, since under gratuitous assistance |**| he understands "irrevocable" transfer.

** Information on how to correctly register and tax sponsorship of goods is available for subscribers of the electronic “GB”

Restrictions can only exist in cases where the lender himself is not the owner of the property, but, for example, its tenant. In the latter case, the lessor's consent to the loan transfer is required (clause 2 of Article 586 of the Civil Code). In addition, a special procedure for leasing and providing property for free use is established for state-owned objects by Decree of the President of the Republic of Belarus dated March 29, 2012 No. 150 “On some issues of leasing and free use of property.”

7.2. Is such an agreement for gratuitous use (loan) subject to state registration?

No.

Agreements for the gratuitous use of real estate (along with lease and sublease agreements), regardless of their term, as well as rights to real estate arising in connection with the conclusion of these agreements, are not subject to state registration (subclause 1.2 of Decree of the President of the Republic of Belarus dated December 19, 2008 No. 24 “On some issues of leasing permanent structures (buildings, structures), isolated premises, parking spaces”). These agreements are considered concluded from the date of their signing by the parties.

7.3. Is it possible in a gratuitous use agreement to assign all costs associated with the maintenance of the premises to the borrower?

Can.

The borrower is charged with the following responsibilities:

– maintaining the item received for free use in good condition, including carrying out routine and major repairs;

– incurring all expenses for its maintenance, unless otherwise provided by the agreement for gratuitous use (Article 649 of the Civil Code).

Thus, by default, the burden of these costs passes to the borrower. As for other (financial) expenses not mentioned in this article (land tax, real estate tax, depreciation), then, in the author’s opinion, their transfer to the borrower should be stipulated in the agreement.

7.4. Are there any advantages from a tax point of view for a gratuitous use agreement (loan)?

Available.

In general, the provisions of Ch. 12 of the Tax Code of the Republic of Belarus (hereinafter referred to as the Tax Code), which determine the procedure for calculating and deducting VAT under lease agreements (financial lease (leasing)), also apply to agreements for the rental of residential premises and gratuitous use (clause 3 of Article 93 of the Tax Code).

Please note that transactions involving the transfer of property for free use are not subject to VAT. This exemption applies if the lender is reimbursed for the costs of maintaining the property and (or) other expenses associated with the property (including accrued depreciation, land tax or rent for a land plot, real estate tax, related operating costs, capital and current repairs of this real estate, utility costs, including heating, consumed electricity), are not carried out, or the obligation to reimburse the lender for such expenses is provided for by the President of the Republic of Belarus (subclause 2.21, clause 2, article 93 of the Tax Code).

In addition, if the lender and the borrower are private unitary enterprises with a common founder, or one of the private unitary enterprises is the founder of the other, then the transfer of property rights between them within the same owner is not recognized as a sale, i.e. is not subject to either VAT or income tax (subclause 2.3, clause 2, article 31, clause 5, article 127 of the Tax Code). It is also not recognized as non-operating income (subclause 4.9.4, clause 4, article 128 of the Tax Code).

Is registration required?

As is known, a real estate lease agreement requires state registration (see paragraph 2 of Articles 609, 651 of the Civil Code of the Russian Federation).

Let's figure out whether these rules apply to a loan agreement (free use).

The loan agreement is given attention in Chapter 36 of the Civil Code of the Russian Federation. Article 689 makes reference to some legal norms on leasing, but they do not talk about state registration of the transaction.

Therefore, as a general rule, a free lease agreement does not require additional state registration.

An exception is made for cultural heritage sites. For an agreement in relation to them, state registration is required regardless of the period for which the agreement is signed.

Taxes and tax risks

Practice shows that transactions involving the transfer of property for free rent are the object of close attention from tax inspectors. The legislation currently does not contain clear rules for taxation of “gratuitous” transactions.

Let's take, for example, VAT for enterprises that provide property for use free of charge. The Federal Tax Service and some courts consider such an operation as a gratuitous provision of services. And if so, then VAT should be calculated based on the market value of the rental of such property.

At the same time, there is judicial practice according to which a loan agreement is considered as a transfer of property rights. In this case, VAT does not arise.

In the same way, there are many problems with income tax and personal income tax (if the lessor is a citizen). Therefore, if an enterprise plans to provide its property for free use, then it is necessary to consult not only a lawyer, but also an auditor.

At the same time, the most recent judicial practice should be studied. Then, for free rental of non-residential premises, taxation will be structured according to the optimal scheme. You should also be prepared for the fact that you will have to defend your rights in the courts.

Possibility of free use of residential premises, its rental

There are two types of free rental of premises by an individual:

- when, under such a transaction, residential premises are transferred to another individual;

- when transferring non-residential real estate to an individual entrepreneur or business entity.

In the first case, the contractual relationship is subject to the legal requirements of a gratuitous loan and a rental agreement. That is, the owner of the property transfers it for free use to the tenants, but does not receive any payment. Hiring differs from rent precisely in that it is concluded only between citizens, for living in an apartment or house.

If a citizen rents out his apartment or house to a legal entity or individual entrepreneur, where his employees will live, then this is already a free rental. That is, other legal relations arise here.

Based on them, taxation of participants in such transactions will occur.

It is important to remember that, according to the Law, an individual can also be the owner of non-residential (commercial) premises. Residential real estate has a special legal status, since it can only be used for people to live in it.

https://youtu.be/mkQQhknOoJk

Standard contract for free rental of non-residential premises

To make it easier to get an idea of what a free lease (loan) agreement should look like, we provide a sample agreement.

It can be used as a basis for preparing the text of your own deal. When editing, add your own points or exclude unnecessary ones.

We hope that this material has helped you understand the features of free rental of commercial real estate.

Agreement for free use of non-residential premises