» IP management

Any economic activity that is carried out cannot do without various financial transactions related to settlements, both between business entities and between individuals. Carrying out such calculations is clearly regulated by current legislation, and there is a certain limit. In order to find out what the payment limit is between a legal entity and an individual, you must read this publication.

- 2 Limitations of calculations

- 3 The procedure for mutual settlements between individuals and individual entrepreneurs

- 4 The procedure for mutual settlements between individuals and legal entities

- 5 Procedure for mutual settlements between individual entrepreneurs and legal entities

- 6 Which calculations are not subject to the limit rule?

- 7 Features of settlement under an assignment agreement

Participants in settlements

It's no secret that payments are required for the purchase of various goods, services and works. Participants in such transactions are legal entities, individuals, and individual entrepreneurs. They can make mutual settlements with each other in national and foreign currencies. Government bodies, which are called upon to monitor the correct payment of taxes, in order to ensure that tax evasion is minimal, set various restrictions. They are expressed in various restrictions.

It is important to know that various government bodies are also involved in settlements and are classified as legal entities, despite their specific position. But if you look closely at the procedure for various settlements between them and individuals, you can understand that they all go through only banks that are selected through a special tender procedure. There are two ways of such mutual settlements:

- carrying out cash payments;

- conducting non-cash payments.

In the first case, the transfer of funds occurs through the cash register, or from hand to hand. In the second case, offsets are carried out through the banking system, by electronic payments, or by payment through banking institutions.

Business entities include individual entrepreneurs and legal entities.

Features of cash payments between enterprises and citizens

Individuals can make payments to the cash desks of enterprises or individual entrepreneurs under agreements concluded with them without reference to the amount on the account. The previously developed and announced bill on introducing restrictions on cash payments for Russian citizens not engaged in commercial activities was not approved.

It is not allowed to make cash payments between legal entities and individuals in 2020 if the source of funds for payment is money recorded by the cashier in the form of revenue:

- in relation to transactions with shares, bonds and bills;

- in relation to payment for rent of real estate;

- if a loan agreement has been drawn up (in cases of issuance or repayment of debt and interest on it);

- for actions related to gambling activities.

To pay for the listed list of activities in cash, an organization can only use money cashed by check from a current account.

Calculation Limitations

The Central Bank of our country has established some payment restrictions. For 2020 they amount to 100,000 rubles. This is caused by limiting the circulation of cash, and thereby monitoring all financial transactions that occur between legal entities, individual entrepreneurs and individuals. These calculation limitations are caused by two important factors:

- so that such mutual settlements do not go into the shadows, and various taxes and fees are paid from them;

- to limit the circulation of so-called “black” cash.

Such payment restrictions were introduced back in the late nineties, but the rate on them in the amount of 100,000 rubles was also left for 2020.

It is important to know that between some legal entities, in order to avoid the above restriction, several agreements are concluded under which the amount exceeding the established limit is divided into several parts that do not exceed 100,000 thousand. Such mutual settlements are risky and can lead to the imposition of various financial sanctions by the tax authorities, and it will be difficult to prove your case even in court. In 2020, the amount of penalties for such violations is significant.

It is important to know that entrepreneurs are at risk of violating these rules.

This is due to the fact that in the market they can act not only as subjects of economic activity, but also as ordinary citizens who buy various goods for their needs, order services and work for their own benefit. In order not to cross the line between a simple buyer and an entrepreneur, it is necessary to strictly follow the various instructions and other recommendations given by government bodies supervising tax legislation. You can even seek legal assistance and attract qualified lawyers who can subsequently protect you from various penalties.

Cash payment limit in 2020

Home / Cash discipline

| Table of contents: 1. Limit size 2. Participants of limited settlements 3. Cash payments without restrictions | 4. Payments within one agreement 5. Penalties |

The cash payment limit is a legal limitation on the maximum amount within which organizations (IPs) are allowed to make and accept cash payments under one agreement.

Limit size

The procedure for cash payments is standardized by the Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U (hereinafter referred to as the Directive).

This act sets a limit of 100,000 rubles. for cash payments between the parties to the transaction.

If cash payments are made in foreign currency, the threshold is equal to the amount corresponding to 100 thousand rubles. at the rate established by the Central Bank of the Russian Federation on the day the money is received at the cash desk of the business entity.

Participants of limited settlements

Limitation of settlements applies to legal entities. individuals and individual entrepreneurs, but does not apply to individuals.

Below, in the table, possible variations of transactions using cash between parties falling under the scope of the Directive, as well as those free from compliance with the limit, are considered.

List of abbreviations used:

- LE – organization (legal entity);

- FL – a citizen who is not registered as an individual entrepreneur (individual);

- Individual entrepreneur - individual entrepreneur.

| Transactions subject to the limit | Unlimited deals |

| YUL + YUL | LE + FL |

| Legal entity + individual entrepreneur | IP + FL |

| IP + IP | FL + FL |

Cash payments without restrictions

Cash can be spent without restrictions on:

- payment of wages and other payments included in the wage fund;

- insurance payments and social payments (maternity pay, vacation pay, sick leave, etc.);

- issuing money to employees on account (including for travel expenses);

- payment of money by an individual entrepreneur to himself for personal expenses, if such funds are not used to conduct commercial activities.

It is prohibited to issue money from the cash register of an organization (IP) for purposes not specified in the Directive.

For example: a business entity plans to issue a loan to an employee. In this case, the cash proceeds should be handed over to a financial institution (bank), and then the funds should be received by check and handed over to the employee.

In this case, the subject will pay the bank commission twice: for depositing funds into the account and for withdrawing cash by check.

An individual entrepreneur has the right to withdraw any amount from the cash register; to do this, it is necessary to issue an expenditure order, indicating the following wording as the basis: “For personal needs.”

Compliance with the limit is also not required for the following types of calculations:

- Operations carried out through the Bank of Russia;

- Customs payments, as well as payments for taxes and duties;

- Banking operations that are carried out in accordance with the legislation of the Russian Federation.

Payments within one agreement

Cash within the current limit can be spent on:

- acquisition of products (except for securities), services, works;

- refund of funds for a previously purchased transaction item, provided that it was paid for in cash.

The settlement threshold cannot be exceeded within a single agreement. In this case, the specifics of concluding the contract do not matter.

| Type of contract | The limit applies to payments under the contract, regardless of the subject of the transaction. |

| Duration of the agreement | The period for which the contract is concluded does not matter; exceeding the settlement limit is prohibited. |

| Frequency of payments | The total volume of cash payments, divided into several parts, cannot exceed the threshold of 100,000 rubles. |

| Additional agreements and obligations | Fines, penalties, penalties and other compensation payments, as well as additional payments within the framework of additional payments. agreements to the main contract cannot be made in cash if the main payment for the allowable amount has already been made. |

| Calculation method | Transferring money belonging to an organization (IP) through an authorized person in an amount exceeding the permissible threshold is not legal. |

If the total price of the agreement is more than 100,000 rubles, you can pay part of the amount within the limit in cash, and the remaining funds should be transferred by bank transfer.

When concluding several agreements with one counterparty, even signed at the same time, the total value of cash obligations can be anything. But the amount of cash payments for each contract separately should not exceed the permissible limit.

If several agreements with a similar subject of transaction have been concluded between the parties and the terms of the agreements have not undergone significant changes, the court qualifies such contracts as “one agreement” with all the ensuing consequences.

Penalty for exceeding the cash payment limit

For non-compliance with the procedure for handling cash, fines are provided, according to Art. 15.1 Code of Administrative Offenses of the Russian Federation:

- from 40 to 50 thousand rubles. for legal entities persons (organizations);

- from 4 to 5 thousand rubles. for officials and individual entrepreneurs.

Cases related to non-compliance with the Directives of the Central Bank of the Russian Federation are within the competence of the tax authorities (Article 23.5 of the Code of Administrative Offenses of the Russian Federation).

The period during which inspectors can impose a fine for failure to comply with the cash payment threshold is no more than 2 months from the date of such violation. It does not matter when the violation was actually discovered.

Administrative liability for non-compliance with legislative norms applies to both the recipient of funds and the payer (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Judicial practice universally supports this position with decisions in favor of the budget.

Read in more detail: Cash payment limit between legal entities

Did you like the article? Share on social media networks:

- Related Posts

- Cash accounting book (form KO-5)

- Cash limit for LLCs and individual entrepreneurs in 2020

- Cash discipline in 2020

- Payroll (form T-51)

- Advance report (form AO-1)

- Sample of filling out form AO-1

- Expense cash order (form KO-2)

- Order on accountable persons

Leave a comment Cancel reply

The procedure for mutual settlements between individuals and individual entrepreneurs

An individual entrepreneur is a business entity and participates in various business transactions on an equal basis with legal entities. They have the right to open their own bank accounts, keep a cash book, that is, have a cash register, and of course carry out mutual settlements as with individuals. person and legal entity. By the nature of its activities, an individual entrepreneur has a dual legal status, due to the fact that he can act as an individual and as a subject of economic activity. An individual is not a participant in economic activity and acts only as a consumer of various services, which also includes the purchase of goods and various works. From this we can come to the conclusion that the features of mutual settlements between individual entrepreneurs and individuals will be as follows:

- between an individual and an individual entrepreneur, mutual settlements will take place only in cash, this does not contradict the rules established for 2020;

- such payment can be made either by paying in cash or through banking institutions, through a plastic card.

When making payments between an individual and an individual entrepreneur in cash, according to the requirements established for 2020, financial funds must be received at the cash desk, and then capitalized by the individual entrepreneur by entering them into the report to determine the tax base. If payment in money between an individual and an individual entrepreneur occurs through a bank card, then the funds are accumulated in the entrepreneur’s bank account and are also entered into the report for subsequent taxation.

It is important to know that there are no restrictions (limits) between the conduct of mutual settlements between an individual and an individual entrepreneur.

What are the penalties for violating restrictions?

If there is a law, then there is responsibility for breaking it. In this case, for exceeding the limit there is an administrative penalty with a fine. In this case, not only the legal entity, but also its manager, as a private entity who violated the law, is subject to a fine.

A fine for a legal entity is imposed in the amount of 40–50 thousand rubles, for a manager - ten times less: 4–5 thousand.

Of course, for a large company such a fine will be quite insignificant, but for a small individual entrepreneur it will be quite significant.

Please note that if a violation is detected, there is a certain statute of limitations for considering the crime. It is 2 months from the date of signing the agreement under which the limits on cash payments were exceeded. If the criminal fact has not been revealed after this time, then the organization can forget about the fine. In any case, before signing an agreement, you must carefully study all its terms and try to avoid violating the law.

The procedure for mutual settlements between individuals and legal entities

In order to answer this question, it is necessary to understand that legal participants in economic relations do not have the same privileges as entrepreneurs, and all their financial transactions must go through a financial report. In this case, if entrepreneurs are not required to have bank accounts, then legal entities are required to have them.

Individuals, on the contrary, are not subject to any limit related to restrictions on cash transactions. From this we can come to the conclusion that, as in the case of individual entrepreneurs, mutual settlements between an individual and a legal entity are not subject to restrictions (limit). The state has not established any additional limits for such operations for 2020. Such mutual settlements between individuals and legal entities can take place according to the following algorithm:

- for cash payments, when payment is made in cash to the cash desk of a legal entity;

- for non-cash payments, when payment is made through a bank account, and the funds immediately go to the legal entity’s account.

As in the case of individual entrepreneurs, there is no limit on settlements between such entities for 2020.

Who does it apply to?

The Directive of the Bank of Russia, according to which cash flows are recorded, stipulates who specifically is subject to the above-described restrictions.

The table indicates the presence and absence of a limit when carrying out transactions between various participants:

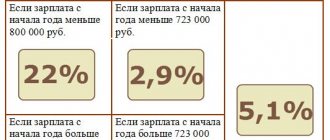

| Entity | Individual entrepreneur | Individual | |

| Entity | valid | valid | no restrictions |

| Individual entrepreneur | valid | valid | no restrictions |

| Individual | no restrictions | no restrictions | no restrictions |

In this case, legal entities and individual entrepreneurs formalize the transaction as follows:

- if they are a seller, issue a check every time they accept cash, including to individuals and legal entities;

- if they are buyers, issues a power of attorney for the employee responsible for the transaction to identify the company.

If cash is accepted at the cash desk, a receipt order is issued and the cash book is filled out.

Remember, concluding several contracts into one with cash payment is absolutely legal, it is unacceptable if they describe the same item with the same counterparty.

The procedure for mutual settlements between individual entrepreneurs and legal entities

As stated above, legal entities and individual entrepreneurs act as subjects of economic activity, therefore the rule on setting limits on mutual settlements between them applies in full. For 2020, the amount of 100,000 remained unchanged. It follows from this that when carrying out various economic activities in which the subjects are legal entities and individual entrepreneurs, the limit amount of cash with which they can pay each other should not exceed 100,000 rubles. Such calculations can occur as follows:

- up to 100,000 rubles, when money is transferred in cash to the cash desk and then transferred to a special bank account of a legal entity or individual entrepreneur;

- if the amount exceeds more than 100 thousand rubles, then all mutual settlements between these entities should occur only through bank accounts, because a limit begins to apply.

Current limit

Within the framework of Russian legislation, the current limit between individual entrepreneurs and organizations is 100,000 rubles . It is worth noting that the amount and frequency of payment does not matter . There are exceptions that allow you not to comply with this limit:

- Transactions with individuals.

- Issuance of accountable materials to company employees.

- Payments to staff.

Lawyers recommend paying attention to the specifics of conducting monetary transactions. It is more advisable to use a non-cash scheme if the company’s activities involve frequent settlements with amounts exceeding 100,000 rubles.

The law provides for penalties for non-compliance with the terms of the transaction. Often it is not possible to outwit the law, which leads to dire consequences. Interesting situations related to limit compliance are described below:

- Creating multiple agreements in addition to the main agreement. It is worth noting that the amounts indicated in addition to the main document will only be added to the base. The amount of the main and additional contracts should not exceed the agreed amount, otherwise an administrative fine will be imposed.

- Creation of similar contracts. This situation is typical for beginning entrepreneurs who, making one transaction, try to bypass the limit using two or three agreements. In this case, serious proceedings in the tax service and a fine are guaranteed.

- No contract. If there is no written purchase and sale transaction, it is considered invalid. If disputes arise between the parties, it will be difficult to resolve the problem.

The Central Bank introduced a law concerning cash payments under various lease agreements for real estate and vehicles, the return of interest on loans, the sale and purchase of securities and shares. The essence of the innovation is that it is possible to carry out such operations if the money for these needs is received at the cash desk from the company’s bank account. Please note that you cannot pay for services or goods using these funds.

You can find out more detailed information about this restriction on cash payments from the following video:

Which calculations are not subject to the limit rule?

There are business transactions that cannot be carried out through bank accounts, so the central bank has established some rules that allow you to increase the amount of cash, bypassing the rules for settlement limits between business entities. This may be in the following cases, which are set for 2019:

- when wages are paid to employees of a legal entity or individual entrepreneur;

- in the case of making various payments and charges that are of a social nature, which may include payment for hospital and other expenses;

- when a legal entity issues funds under a special report, for example in the form of travel allowances;

- There is a separate column for individual entrepreneurs, since the limit does not apply to the expenditure of funds that will be spent on the personal needs of a businessman, under one condition, if this payment is not used to carry out his commercial activities.

You need to understand that all the risks associated with violating the rules on the limit are borne not only by various enterprises, but by businessmen who are individual entrepreneurs. If we analyze the imposition of penalties for limit violations, we can see that entrepreneurs also paid a large amount of money in the form of fines.

This rule has been retained for 2020.

Restrictions on issuing money to employees on account

The procedure for registering cash issuance

Directive No. 3073-U (clauses 2, 6) provides for the possibility of spending proceeds and insurance premiums to be issued to employees on account, without taking into account the maximum amount of cash payments. As a rule, such issuance serves the purpose of financing travel expenses and transactions made on behalf of the organization.

In this case, the following documents are drawn up:

- An application from the employee in any form indicating the amount of money and the period for which it must be issued, with the resolution of the manager containing his signature and date of affixing. The absence of an application may be considered a violation of the procedure for storing cash, since money issued without reason is equated to free funds that must be kept in the cash register or deposited in the bank accounts of the organization (see resolutions of the 13th AAS dated October 29, 2015 No. 13AP- 20326/15, 12th AAS dated December 23, 2015 No. 12AP-11295/15).

- Expenditure cash order for the issuance of money.

- Advance report. Within 3 working days after the end of the established period, the employee reports on the funds spent, attaching documents confirming the expenses incurred. If the attached documents do not contain the necessary details or they are unreadable, then the organization will not accept the expenses, and personal income tax will be payable on the amounts spent (determination of the RF Armed Forces dated 03/09/2016 No. 302-KG16-450).

Restrictions on the disposal and re-issuance of accountable funds

When performing transactions with the issuance of money on account, the following nuances must be taken into account:

- The cost limit applies to the employee who received the money on account. Despite the fact that the volume of funds issued in this way is not limited, transactions will be made by the employee on behalf of the represented organization and should not exceed 100,000 rubles in amount. each.

- In accordance with clause 6.3 of Directive No. 3210-U, an employee can only have 1 accountable amount. Before receiving a report on it, funds cannot be issued to him for the report.

Regarding whether, in case of non-compliance with this rule, there is a violation under Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, ambiguous judicial practice has developed. For example, the resolution of the 15th AAS dated November 24, 2015 No. 15AP-18097/15 states that there is no violation. However, the resolutions of the 13th AAS dated 02/24/2016 No. 13AP-32329/15, the 9th AAS dated 01/19/2016 No. 09AP-54852/15 indicate the existence of grounds for prosecution in accordance with this rule in similar cases. There is no practice of district courts, since cases of administrative offenses involving the collection of a fine of up to 100,000 rubles. are not considered on the merits in cassation proceedings.

Funds in an amount exceeding the cash balance limit are placed in a current account; measures for this are taken by the organization independently (clause 7 of instruction No. 3073-U).