Form

Order No. 52n of the Ministry of Finance of Russia dated March 30, 2020, together with other forms of accounting “primary” and registers, approved the form of accounting certificate 0504833. This index is its number according to the All-Russian Classifier of Management Documents.

Initially, the accounting certificate under consideration (f. 0504833) is intended for public sector organizations:

- state organs;

- local government bodies;

- PFR, FSS and FFOMS;

- budgetary institutions (state and municipal).

However, these circumstances do not in any way prevent any enterprise (firm, company, etc.) from including sample accounting certificate 0504833 in its accounting policy and fully applying it. Moreover: the certificate can be taken as a basis for developing your own form of the primary document for accounting purposes.

Also see “Accounting statement: how to draw it up correctly.”

As you can see, the accounting certificate form 0504833, in addition to the main details of the enterprise and responsible persons, includes standard items:

- name of the operation and its legal basis (document);

- Document Number;

- date of;

- account number for debit and credit (these can be accounts for both budget accounting and accounts used in the commercial sphere);

- transaction amount.

The basis for reflecting in accounting a particular transaction from the accounting certificate (f. 0504833) is the “Note on acceptance of the Accounting certificate for accounting” filled out by the chief accountant (or head of a structural unit). That is, filling out this mark serves as a simultaneous impetus for the reflection of accounting entries in the corresponding accounting registers.

If it is not possible to mark the acceptance of primary (consolidated) accounting documents for accounting (including electronic ones) and reflect the entries in the accounting certificate form 0504833, indicate:

- title of the primary document;

- basis, number, date and name of the business transaction.

Also see “Details of accounting documents: basic and mandatory”.

https://youtu.be/Md6TrG-2RBw

Form and required details

Since this is a primary document, two important conditions must be met:

- The form and procedure for compilation must be prescribed in the accounting policies of the organization.

- Availability of the mandatory details provided for in Article 9 of the Federal Law of December 6, 2011 No. 402 on accounting.

If an organization can develop the form on its own or use a sample for filling out an accounting certificate (0504833), which was developed and approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n for government institutions, then the requirements for the details are quite strict. The form must include:

- name of the organization;

- document number and date of its preparation;

- title of the document;

- the content of the reflected fact of economic life;

- units of measurement and method of reflection (monetary or natural);

- data from other primary documents (if necessary);

- position and full name the person who performed the operation;

- signature of the compiler.

Only if these requirements are met will the completed form be considered valid.

How to fill

Recently, this document is increasingly being compiled in electronic form. At the same time, do not forget about the standard requirements for registration: no typos, filling out all details, the exact name of the organization, dashes in empty fields, etc. It is important to avoid mistakes when entering dates.

Below is a sample of filling out accounting certificate 0504833.

On our website you can download accounting certificate 0504833 by .

If you find an error, please select a piece of text and press Ctrl+Enter.

Question to the auditor

Is it necessary to print an accounting certificate (f. 0504833) for each primary document? Now, when compiling the journal of transactions No. 2 with non-cash funds, we do not print a certificate for each payment document. For the journal of transactions No. 4 of settlements with suppliers and contractors, we print a certificate for each set of documents. Thus, each set of documents for a transaction includes an invoice, a delivery note, an accounting certificate or UPD and an accounting certificate. We do not print a certificate for the journal of transactions No. 7 on the disposal and transfer of non-financial assets for each invoice (form 0504102) or statement (form 0504210), since these forms contain postings. Or do you need to print to record the fact of the transaction in accounting? We always print to the journal for authorization.

Based on the methodological instructions to the order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n, the accounting certificate (form 0504833) is intended to reflect transactions performed:

- during the economic activities of the institution;

- when transmitting (receiving) primary documents in the form of electronic documents signed with an electronic signature;

- if it is not possible to fill out the section “Note on acceptance for accounting” in the prepared primary accounting document (when transferring the authority to maintain records and generate reports to the centralized accounting department).

The body providing cash services and the financial body reflect in the accounting certificate (f. 0504833) transactions that do not require documents from payers and accounting entities.

In addition, based on the accounting certificate (f. 0504833), entries are made to correct errors. Corrections are recorded by corresponding correspondence on the accounting accounts, a reference is given to the number and date of the document being corrected and (or) the document - the basis for making corrections.

In order to reflect in the accounting of transactions from the accounting certificate (f. 0504833), the chief accountant (head of the structural unit) fills in the details “Note on acceptance of the accounting certificate for accounting.” At the same time, accounting entries are reflected in the accounting registers.

If it is impossible to mark acceptance for accounting in primary (consolidated) accounting documents (including those presented in the form of electronic documents signed with an electronic signature), when generating an accounting certificate (form 0504833), the name of the primary document, basis, number, date and name of the business transaction.

The payment order form does not provide a mark on acceptance for accounting; therefore, an accounting certificate (f. 0504833) must be printed for each transaction on a personal account.

In the supplier's primary documents (acts of provision of services, performance of work), attached to the transaction log No. 4 of settlements with suppliers and contractors, there is also no attribute “Note on acceptance for accounting.” Consequently, it is also necessary to print an accounting certificate for these primary documents (f. 0504833).

When accepting non-financial assets for accounting, the institution’s commission for receipt and disposal of assets draws up an acceptance and transfer act (form 0504101) or a receipt order (form 0504207). The movement of non-financial assets is documented by invoice requirements (f. 0504204), write-offs are documented by acts and statements (f. 0504210). These documents contain the section “Accounting department’s note on acceptance for accounting.” We can conclude that when accepting non-financial assets for accounting, moving them and writing them off, it is not necessary to issue an accounting certificate (f. 0504833).

At the same time, from letters of the Ministry of Finance of Russia dated December 15, 2017 No. 02-07-07/84237, dated January 11, 2019 No. 02-07-10/531, dated December 21, 2018 No. 02-06-05/93727, it follows that the accounting certificate (f. 0504833) all transactions in the course of business activities are recorded (including on the basis of primary documents that contain the section “Accounting department’s note on acceptance for accounting”).

In our opinion, it is advisable for an institution to generate an accounting certificate (f. 0504833) for all business transactions, incl. carried out on the basis of primary documents that contain the section “Accounting department’s note on acceptance for accounting.” This approach will avoid possible claims from regulatory authorities.

Multifunctional help (f. 0504833)

The form of the certificate is quite simple; its form fits on one page. At the same time, this primary document serves as the basis for reflecting many different business transactions in accounting. Let's consider in what cases you need to use the Help (f. 0504833).

| N p/p | Contents of operation | Instruction N 174n | Instruction N 183n |

| 1 | 2 | 3 | 4 |

| 1 | Capitalization of inventories when purchased under a leasing agreement | Paragraph 34 | Paragraph 34 |

| 2 | Acceptance for accounting of the difference between the actual and planned cost of finished products that arises when determining the actual cost of finished products at the end of the month | Points 40, 64 | Points 40, 64 |

| 3 | Reflection in the accounting of trade margins: accrual of margins on goods, write-off of realized margins, write-off of margins upon other disposal of goods (except for sales) | Points 46, 47, 152, 153 | Points 46, 47, 180, 181 |

| 4 | Attribution of investments made during R&D and technological work for which positive results were not obtained to the financial result of the current financial year | Paragraph 53 | Paragraph 53 |

| 5 | Reflection of cost distribution operations across accounting accounts and types of finished products, works, services | Points 60, 62, 153 | Points 60, 62, 181 |

| 6 | Attribution to reduce the financial result of the current financial year of expenses incurred by the institution as a result of the sale of goods, incl. in the process of promoting goods | Paragraph 66 | Paragraph 66 |

| 7 | Reflection in accounting of transactions of internal raising of funds between sources of financial support using account 304 06 “Settlements with other creditors” | Points 72, 73, 85, 97, 146 | Points 72, 73, 77, 78, 88, 100, 174, 175 |

| 8 | Crediting funds received for temporary disposal to the institution’s own funds in the event of assigning debt not claimed by the owner during the limitation period to off-balance sheet account 20 “Written off debt not claimed by creditors” | Paragraph 73 | Paragraphs 73, 78 |

| 9 | Exchange differences | Points 74, 75, 77, 78, 81, 82, 93, 94, 128, 129 | Points 74, 75, 80, 81, 84, 85, 96, 97, 156, 157 |

| 10 | Accrual of income from subsidies provided to the institution for other purposes | Paragraphs 93, 150 | Paragraphs 96, 178 |

| 11 | Write-off from the balance sheet of the unrealistic amount of debt for advances provided | Paragraph 98 | Paragraph 101 |

| 12 | Reflection of the difference between the value of shares and other forms of capital participation in accordance with the agreement and the balance sheet (residual), actual value of the invested property | Paragraph 119 | Paragraph 122 |

| 13 | Acceptance (increase) and execution (repayment) of debt obligations | Paragraphs 124, 125 | Paragraphs 127, 128 |

| 14 | Calculation of pensions, benefits and other social payments to former employees of the institution. Calculation of social security payments for categories of citizens who previously held positions in accordance with the legislation of the Russian Federation, or payments for special merits | Paragraph 128 | Paragraph 148 |

| 15 | Deductions from the accrued amount of wages, scholarships, as well as from the amounts of remuneration under civil contracts | Paragraph 129 | Paragraph 157 |

| 16 | Accrual by the institution as a tax agent of the amount of VAT on rental payments due in accordance with the lease agreement | Paragraph 129 | Paragraph 157 |

| 17 | Reduction of obligations assumed under state (municipal) agreements for the needs of the institution in the amount of the previously transferred advance payment | Paragraph 129 | Paragraph 157 |

| 18 | Accrual of taxes, fees, insurance premiums and other obligatory payments to budgets | Paragraphs 131, 151 | Paragraphs 133, 159, 179 |

| 19 | Reducing the debt of the guilty person for property damage by the amount of deductions made from wages (scholarships) | Paragraph 140 | Paragraph 168 |

| 20 | Reducing the debt of an accountable person to return unused funds (cash documents) by the amount of deductions made from wages (scholarships) | Paragraph 140 | Paragraph 168 |

| 21 | Accrual of income from rental property | Paragraph 150 | Paragraph 178 |

| 22 | Accrual of income in the amount of subsidies received for the implementation of government tasks | Paragraph 150 | Paragraph 178 |

| 23 | Accrual of income in the amount of accounts payable written off from the balance sheet due to the absence of creditor claims during the limitation period | Paragraph 150 | Paragraph 178 |

| 24 | Assignment to reduce the financial result of the institution the amount of receivables recognized as unrealistic for collection | Paragraphs 152, 153 | Paragraphs 180, 181 |

| 25 | Attribution of expenses associated with the sale of non-financial assets to the reduction of financial results | Paragraph 152 | Item 180 |

| 26 | Attribution of the cost of work performed by the institution, services provided to reduce the financial result | Paragraphs 152, 153 | Item 180 |

| 27 | Attribution of the book value of goods sold by the institution for the reporting period (decade, month) to the financial result | Paragraph 152 | Item 180 |

| 28 | Attribution of the cost of sold finished products to the financial result of the current financial year | Paragraph 153 | Item 181 |

| 29 | Attribution of expenses incurred earlier and taken into account as deferred expenses to the financial result of the current financial year | Paragraphs 153, 160 | Paragraphs 181, 188 |

| 30 | Conclusion of accounts for the current financial year | Paragraph 156 | Paragraph 184 |

In addition, in accordance with the Methodological Instructions, on the basis of the Certificate (f. 0504833), accounting entries related to the correction of errors are made.

Let us pay attention to the features of using the Certificate (f. 0504833) for documenting a number of operations in which difficulties arise.

Trade margin. The markup of goods to the retail price, depending on the adopted accounting policy, can be made either immediately upon receipt of the goods, or when they are transferred from the warehouse to the retail department. In the first case, a Certificate (f. 0504833), reflecting the calculation of the markup, is attached to the supplier's invoice, in the second - to the demand invoice.

Attention! When calculating a markup on a product and when writing off a sold trade invoice, a corresponding calculation must be attached to the Certificate (f. 0504833). Instead of drawing up two documents each time (a certificate and a calculation), an institution can, based on the provisions of paragraph 7 of Instruction No. 157n, independently develop the appropriate primary documents to reflect the accrued and realized markup in accounting.

Distribution of costs among accounting accounts and types of finished products, works, and services. In this case, the Certificate (f. 0504833) must also be accompanied by a corresponding calculation. As in the situation with the reflection of markups, an institution, in order to optimize document flow, has the right to independently develop the appropriate primary documents to reflect the cost distribution in accounting.

Exchange difference. The exchange rate difference may reflect, among other things: change in the ruble equivalent of balances of non-cash and cash funds expressed in foreign currency. Since such transactions are purely accounting in nature and do not affect the actual balance of the corresponding funds, they should be reflected on the basis of the Certificate (f. 0504833).

A certificate (f. 0504833) recording transactions on analytical accounts of account 201 00 “Institutional funds” must be certified by the signature of the manager (authorized person) (clause 8 of Instruction No. 157n). A sample form for completing the certificate is provided at the end of the article.

Internal fundraising between sources of financial support. These operations may affect, among other things: cash and non-cash accounts. But, since they are purely accounting in nature and do not affect the actual balance of funds, they are issued with a Certificate (f. 0504833).

When the Certificates (f. 0504833) reflect transactions on accounts 201 11 “Cash on personal accounts in the treasury authority” and 201 34 “Cash” in terms of raising funds between sources, such certificates must be certified by the manager (authorized person) with his signature (clause 8 Instructions No. 157n).

Transfer of balances to the inter-reporting period. When changing the type of institution, chart of accounts, budget classification, the corresponding letters of the Ministry of Finance of Russia were ordered to reflect the transfer of balances to the inter-reporting period in Certificates (f. 0504833).

Other operations. Not all business transactions contain unified forms of primary documents in the accounting instructions. In this case, two options are possible: 1) develop the form of the primary document yourself; 2) use Help (f. 0504833).

For example, the instructions do not define a primary document to reflect the depreciation transaction. Clause 90 of Instruction No. 157n mentions the turnover sheet for non-financial assets, but it is an accounting register and not a primary document. Also, depreciation should be reflected in the inventory card for accounting for fixed assets; it also represents an accounting register, and not a primary document.

Based on the principle of calculating depreciation in a linear manner (based on the book value of the object and the depreciation rate), the Certificate (form 0504833) should indicate the calculation of depreciation or, following the example of the procedure for reflecting the calculation of the markup on goods, attach a table of calculations to the Certificate (form 0504833). Finally, you can develop a special document that combines calculations, invoice correspondence, and analytics.

REFERENCE————¬¦ CODES ¦ ———- OKUD form ¦ 0504833 ¦31 May 12 ———- for ————- 20— Date ¦31.05.2012¦ ———- FGU NII FHM FMBA ¦ ¦Institution ——————————————— according to OKPO ¦ ¦ ———- Structural division _____________________________ ¦ ¦ ———- Unit of measurement: rub. according to OKEI ¦ 383 ¦L————

| Name and basis of the operation being carried out | Document Number | date | Account number | Sum | |

| by debit | on loan | ||||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. Exchange rate difference. Balance before revaluation 17 USD = 499.17. The Bank of Russia exchange rate as of May 31, 2012 was 32.4509. 17 USD = 551.66 | 00000000000000000 420134510 | 00000000000000000 440110171 | 52,49 |

Blanker.ru

An accounting certificate (form 0504833) is used by budgetary organizations to reflect business transactions and operations carried out by the body providing cash services.

Also, on the basis of the certificate, accounting entries are made related to the correction of errors that were identified by the subject of accounting. Corrections are recorded by a corresponding entry in the accounts, with reference to the number and date of the document that is being corrected.

An accounting certificate is issued for the following types of transactions:

- making a correctional entry;

- by means on the way;

- when concluding accounts for the current year;

- transfer of budget expenditure indicators that were formed at the end of the reporting year.

In addition, an accounting certificate is prepared for client documents (for non-bank transactions).

The certificate form is filled out in the manner accepted for a particular institution (automated or by hand). An accounting employee prepares the certificate. When filling out the form, indicate the current month and year. Enter the name of the institution, department, OKPO code, and unit of measurement into the appropriate fields.

In the tabular part of the certificate, fill in:

- name and basis of the operation being carried out;

- document number and date;

- account numbers;

- sum.

The certificate is signed by the performer and the inspector.

At the end of the form, the chief accountant makes a note that the certificate has been accepted for accounting. At the same time, accounting records are reflected in the accounting registers. The financial director of the institution is responsible for the timeliness and accuracy of the certificate, as well as its storage.

Nuances of the main content of the help

The main part of the accounting statement devoted to corrections should detail:

- the essence of the mistake made;

- numbers and dates of documents to which corrections are associated;

- justification for corrections and decisions made on adjustments;

- necessary calculations with their breakdown by periods to which the calculated amounts relate, if this is important for accounting and tax calculations.

The text of the certificate may not include the calculations themselves necessary for its preparation. They, as well as copies of primary documents, in the process of accepting which an error was initially made, can be appendices to the certificate.

A prerequisite will be the simultaneous reflection of transactions related to accounting and tax accounting. For tax accounting, the certificate will serve as the necessary documentary justification for accepting expenses for accounting (Clause 1, Article 252 of the Tax Code of the Russian Federation).

When maintaining automated accounting, tax-related data can be filled in automatically using accounting data by pressing the appropriate button, as happens in the 1C program. when filling out the document “Operation (accounting and tax accounting)”. If corrections concern operations of a standard nature and entail changes in several cumulative registers, then in programs for making corrections, instead of an accounting certificate, it is possible to use an operation such as “Adjustment of register entries” (1C program), which will allow corrections to be made correctly in all reports containing erroneous data.

You will find one of the possible examples of preparing an accounting certificate in connection with an identified accounting error on our website.

What to do if errors from previous years have been identified in the current period? Get free trial access to the ConsultantPlus system and learn how to correct such errors using examples with postings.

What kind of document is this

At its core, an accounting certificate is a primary accounting document, but at the same time it also serves as a register. In it, an authorized specialist records operations for which there is no full-fledged primary record:

- bug fix;

- debt write-off;

- determining the amount of reserve for doubtful debts;

- formation of the initial cost of a fixed asset, which consists of several operations;

- maintaining separate VAT accounting;

- and so on.

In some cases, a regular accounting certificate is required, and in some cases only a calculation certificate, in which the accountant, in addition to the entry itself, makes calculations. For example, an example of how to draw up an accounting statement to form the initial cost of a fixed asset looks like this:

In addition, there are other varieties of this important paper that are not primary. In particular, if it is necessary to compile information at the request of a government agency or court, in which to describe accounting data already reflected in the system by an accountant, for example, on debt, an accounting certificate is also drawn up. In court, for example, it can be used to confirm expenses incurred by a company or the amount of damage from someone else’s actions, as well as the validity of the stated adjustments. A sample accounting certificate of debt for the court can be downloaded at the end of the article.

It is important to remember only one thing: you cannot draw up this paper for transactions involving the capitalization or sale of material assets if third-party contractors were involved in the process. In this case, a different primary is used.

When do we need help?

Let's figure out when you might need an accounting certificate.

Before we take anything into account, we make a calculation

An accounting certificate is used to record the calculation of any amounts for which the accountant is responsible.

This is relevant, for example, when maintaining separate records of taxable and non-VAT-taxable transactions. In this case, the certificate calculates the share of “taxable” and “non-taxable” revenue, on the basis of which the amount of VAT taken into account in the cost of goods (work, services) and the amounts accepted for deduction are determined.

By the way, the courts agree that if all the necessary calculations of the share of revenue and VAT amounts are made in the accounting certificate, then this is separate accounting.

Example. We prepare an accounting certificate for separate accounting

Condition

Delovoy Mir LLC trades wholesale and retail. For retail trade, the organization pays UTII. For wholesale trade, it applies the general taxation regime and pays VAT on it. In May 2010, a loader was purchased and put into operation at a cost of 250,000 rubles. (including VAT - 38,136 rubles), which is used in both types of activities. For the second quarter of 2010, revenue excluding VAT for wholesale trade amounted to 1,200,000 rubles, and for retail trade - 800,000 rubles. Total revenue for the second quarter of 2010 (excluding VAT) is 2,000,000 rubles.

Solution

The accountant drew up a certificate with the following content.

Delovoy Mir LLC June 30, 2010

Accounting certificate-calculation

In May 2010, a loader was purchased, which is used for both wholesale and retail trade.

For the second quarter of 2010, revenue excluding VAT amounted to:

— for wholesale trade — 1,200,000 rubles;

— for retail trade — 800,000 rubles.

Total revenue for the second quarter of 2010 (excluding VAT) is 2,000,000 rubles. (RUB 1,200,000 + RUB 800,000).

The share for calculating the amount of VAT (on taxable activities) accepted for deduction was 0.6 (RUB 1,200,000 / RUB 2,000,000).

VAT on the purchased loader is RUB 38,136.

The amount of VAT accepted for deduction is 22,881.6 rubles. (RUB 38,136 x 0.6).

The amount of VAT (for activities subject to UTII) included in the cost of the purchased loader is 15,254.4 rubles. (RUB 38,136

The role of the document in accounting

Any business operation in the life of an institution must be reflected in accounting, and this topic is far from new for accountants. Each fact of activity must be documented. Making entries without supporting primary documentation is unacceptable.

For most operations of the financial and economic activities of an enterprise, special unified forms of primary documentation are provided. The use of unified forms is not necessary, and forms can be developed independently or existing ones can be modified. However, many organizations prefer to use unified forms of primary and accounting registers.

But not all events in the economic life of an economic entity can be reflected on special forms. For certain types of transactions there are neither forms nor accounting standards. But this does not mean that such facts can be hidden, that is, not reflected in accounting. It is for such operations that special forms of primary documentation are provided - accounting certificates.

An accounting certificate can reflect absolutely any operation: from the calculation of wages or vacation pay to the formation of the cost of the finished product or the cost of paying taxes to the budget. This primary documentation form is universal and allows you to disclose the mandatory details for registering facts in accounting.

When to prepare an accounting statement

First of all, let’s determine what kind of certificate it is. This is a primary accounting document that is used to reflect the specific business transactions of an institution. For example, Article 313 of the Tax Code of the Russian Federation regulates the list of situations in which an accounting certificate is used:

- When identifying inaccuracies and errors in accounting. In such a situation, a sample accounting certificate confirming the correction of the error is drawn up, which confirms that the corrections have been made to the accounting.

- If specific accounting details are required. For example, when maintaining separate accounting for VAT.

- If necessary, make explanatory notes on business transactions. For example, to reflect transactions to write off receivables or payables.

- To confirm calculations made during business transactions. An example of this situation could be the calculation of compensation for delayed wages, the calculation of vacation compensation upon dismissal, or the calculation of vacation or maternity pay.

When is a certificate required?

There are no special deadlines for drawing up an Accounting Certificate. Institutions complete this form as needed. Let's consider several situations when it is necessary to draw up form 0504833.

Situation No. 1. Transfer of leased property to the balance sheet. From January 1, 2020, operating lease objects are recorded on the balance sheet - account 111.40 in the amount of lease payments for the entire lease term. If the lease agreement was concluded before the new rules, the accounting must be adjusted - the objects must be transferred to the balance sheet and taken into account in the amount of the remaining obligations under the agreement. Such an operation must be documented with an Accounting Certificate (f. 0504833).

Situation No. 2. Error in the accounting account. Let's say the inspectors found an accounting error. In 2020, the accountant did not take the phone into account. Its cost was written off as current expenses to account 0.401.20.221 “Expenses for communication services.” According to the inspection report, the accountant corrected the error and put the phone number in account 101.34 “Machinery and Equipment”. He reflected additional entries in the Accounting Certificate (f. 0504833).

Situation No. 3. Reserves for future expenses in accounting. For 2018, the institution’s accountant calculated the reserve for upcoming expenses for vacation pay and issued an Accounting Certificate (f. 0504833).

Situation No. 4. Borrowing funds from a personal account. For example, in a budgetary institution, accounts payable for utilities arose under KFO 2. The manager allowed to raise money for payment from government funds under KFO 4. The accountant reflected this operation in the Accounting Certificate (f. 0504833) and attached an order to it. When the money for paid services is credited to the account, the accountant will restore the expense and also draw up an Accounting Certificate (f. 0504833).

Situation No. 5. Offset of advance payment under the contract. If the supply agreement provides for an advance, then after shipment of the goods it is necessary to offset the obligations against the advance: Debit 302.00 Credit 206.00. This operation must be reflected in the Accounting Certificate (f. 0504833).

All cases when it is necessary to draw up form 0504833 can be found in Accounting Instructions No. 162n (for government institutions), 174n (for budgetary institutions), 183n (for autonomous institutions) and Instructions for the unified chart of accounts No. 157n.

Red reversal

The scope of application of accounting certificates is quite diverse. The document can confirm settlement transactions, detail information about a specific event, and contain information about separate accounting, as well as make corrective entries. Among the mentioned operations, there are separate entries with negative numerical values - the so-called red reversal.

This operation is used not only for error correction, to correct incorrect values, but also for special types of events. For example, to write off trade margins or to adjust material and production costs.

The peculiarity of the operation is that the accounting entry itself is prepared in the same way as an erroneous entry. But the amount in this case is reflected with a minus sign. All so-called disadvantages in accounting are usually recorded in red. Hence the name of the operation - “red reversal”. For clarity, let's look at an example.

Based on the results of the audit, an overcharged amount was identified for insurance premiums on the salaries of key personnel for March. 100,000 rubles were credited, but 97,000 rubles were needed. The surplus amounted to 3,000 rubles.

The postings will be as follows:

| Debit | Credit | Sum | A document base |

| Insurance premiums accrued | 100 000 | Payroll for the reporting month | |

| Corrections made using the red reversal method | — 3000 | Accounting certificate, payslip |

Purpose and example of filling out accounting certificate 0504833

Accounting certificate 0504833 is used by representatives of budgetary organizations or enterprises to reflect the characteristics of economic activities carried out by the body within the framework of cash services.

Also, on the basis of this document, accounting records are recorded that are directly related to the correction of certain types of errors when they are identified by the subject of the relevant accounting. All corrections are marked using a special account entry with a simultaneous indication of a link to the current numbering and date of generation of the documentation.

To understand the key features of such a document, it is necessary to refer to the order of assignment, the established instructions for filling out, the applicable download form, as well as certain provisions of the current federal legislation.

The document in question is completed in each specific case by an authorized employee of the organization’s accounting department. When generating a certificate, the current date must be indicated. The full name of the enterprise is entered into the relevant sections, as well as details, including units of measurement, OKPO codes, and so on.

It is worth noting that in certain cases it is necessary to indicate the full names of the organization’s structural divisions. As for the tabular part of the certificate, the following information is entered into its frame:

- the name and applicable grounds for carrying out each specific operation;

- number and actual date of documentation generation;

- Account number;

- set amount.

The document is signed by both the authorized contractor and the management of the enterprise. At the end of the certificate, the chief accountant of the organization puts a special mark on the acceptance of the paper for accounting. At the same time, an operation is carried out to enter correct information into the accounting registers.

The financial director of the organization bears administrative responsibility for the correct completion of the document and for the timely completion of the relevant process.

Structure: how to write a sample accounting statement

Regardless of its purpose, the document must be executed correctly, since it plays the role of a primary one. Then there will be no unnecessary questions from the tax inspectorate. We recommend using an in-house template, since the legislation of the Russian Federation does not provide for a mandatory accounting certificate form.

The procedure for preparing this document consists of 3 stages:

- Creating a “header” and specifying the following data:

- Title of the document;

- Date of preparation;

- company details (name, tax identification number, checkpoint, etc.);

- the operation being performed, features;

- list of responsible persons.

- information about what has changed;

- previous performance;

- correct method of calculation.

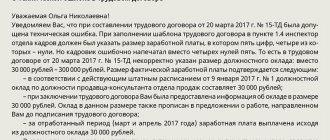

“Economist of LLC “Guru” N.V. Kurnosova made a technical error when calculating depreciation on fixed assets. For 2020, the amount was 21,000 rubles, while it was erroneously indicated as 22,500 rubles. Detailed calculation: …….On February 1, 2020, N.V. Kurnosova corrected the error by posting Dt 44 Kt 02 - 21,000 rubles. Corrections were made by recording Dt 44 Kt 02 – 1500 rubles. (reverse)"

- identification of persons;

- confirmation of the need to perform a business transaction.

As was said, the company’s management has the right to independently develop and approve by order a sample certificate in order to use it to solve its business problems. At the same time, it is included in the accounting policy of the enterprise.

You can take as a basis accounting certificate 0504833, which was developed by the Ministry of Finance for public sector institutions (order No. 52n of 2020).

Typically, this document is drawn up in electronic form, taking into account standard design requirements: no typos, filling out all details, exact names of organizations, etc. It is important not to make mistakes when entering dates.

- Creating a “header” and specifying the following data:

- Title of the document;

- Date of preparation;

- company details (name, tax identification number, checkpoint, etc.);

- the operation being performed, features;

- list of responsible persons.

- information about what has changed;

- previous performance;

- correct method of calculation.

The following is an example of an accounting statement with the corresponding text:

| “Economist of LLC “Guru” N.V. Kurnosova made a technical error when calculating depreciation on fixed assets. For 2020, the amount was 21,000 rubles, while it was erroneously indicated as 22,500 rubles. Detailed calculation: ……. On February 1, 2020, N.V. Kurnosova corrected the error by posting Dt 44 Kt 02 - 21,000 rubles. Corrections were made by recording Dt 44 Kt 02 – 1500 rubles. (reverse)" |

- identification of persons;

- confirmation of the need to perform a business transaction.

Purpose of accounting certificate 0504833

Accounting certificate 0504833 is used to reflect a certain list of transactions:

- carried out within the framework of economic activities;

- carried out in the process of cash settlement without requiring a certain set of documentation from direct payers or accounting entities;

- for the transfer of primary documentation, executed in electronic form using a digital signature, by the person who is directly responsible for the formation of acts of economic activity;

- the certificate is used if it is impossible to reflect a special note on acceptance for accounting within the primary documentation - an example is that this is relevant in cases of transfer of accounting powers to other budget organizations or employees of centralized accounting departments.

It is worth noting the fact that, among other things, on the basis of the established form of the certificate in question, all errors that were made by the authorized accountant during preparation can be corrected.

Accounting certificate form 0504833

The correction technique is to reflect special correspondence within the accounting accounts. Certain references may also be made to the number and date of execution of the amended document.

The provisions of the current federal legislation do not provide for the possibility of making corrections in the relevant documentation. If a defect is discovered, a new form must be generated.

The most common mistakes made when creating such documentation are as follows:

- there is no signature and its transcript from an authorized person in a special field - the mark must be written in blue pen and not covered with an organizational seal;

- the actual date of generation of the certificate was not indicated in the established format;

- the imprint of the organizational state seal was not affixed in the prescribed place.

Filling out the document in each specific case falls on the shoulders of an authorized accountant or other employee of a budget organization. If, as part of the registration process, the established provisions of the current legislation are not observed, then certain sanctions may be imposed on the organization, and the management may face, in addition to administrative, criminal liability.

Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381 approved the form of the new form 4-FSS and the procedure for filling it out.

The land tax declaration form can be downloaded

Accounting certificate of debt for the court: sample

This document can be drawn up in a very general form with references to background data that the form wants to prove in court. It is not at all necessary to refer in the certificate to the fact that it is issued specifically for judicial purposes.

The following is a sample of writing an accounting statement about a “receivable”, which often has to be “knocked out” from the counterparty through the court.

LIMITED LIABILITY COMPANY "GURU" Address: 105318, Moscow, st. Gogolya, 8, office 15. TIN 7722123456, KPP 772201001 Moscow February 06, 2020 Accounting statement No. 3-s As a result of the inventory of settlements with counterparties on February 6, 2017, receivables from Buben LLC were identified (TIN 7719456789, KPP 771901001, address: Moscow, Kvasovaya St., 9, building 6), for which the statute of limitations has not expired (inventory act dated 02/06/2017 No. 22-inv). This debt arose under the goods supply agreement No. 12/7 dated October 22, 2016. The amount of debt is 500,000 (five hundred thousand) rubles 00 kopecks. The payment deadline under the agreement is December 31, 2016 (inclusive). General Director ______________ /V.V. Krasnov/ Chief Accountant ______________ /E.A. Shirokova/

If you find an error, please select a piece of text and press Ctrl+Enter.

Instructions for filling

In the vast majority of cases, the relevant documentation is filled out electronically using specialized software. At the same time, it is important not to forget about the established standards applied when filling out.

Instructions for preparing such a document are as follows:

- the exact name of the budget organization must be indicated;

- dashes must be placed in empty sections;

- all dates are indicated in strict accordance with the real state of affairs;

- The presence of even the most minor typos within this document is not allowed.

Below is a current example of filling out the certificate in tabular form:

| Current name of the operation being performed | Documentation numbering | Date of preparation | Account number | Amount (in rubles) | |

| by debit | on loan | ||||

| Writing off the amount as payment under the lease agreement | 45 | 01.04.2017 | 140130485 | 15726945 | 150 000 |

| Write-off of debt obligations for accrued penalties | 45 | 01.04.2017 | 149349900 | 126474733 | 15 000 |

| Crediting an amount to an account outside the main balance | 45 | 01.04.2017 | 04 | No | 125 000 |

It is worth noting that the order in which the fields are filled out is directly determined depending on certain amounts established within the framework of tax accounting. In cases where the accrual and payment of established funds is determined by payrolls, it is more appropriate to register for each structural unit of the organization.

In the vast majority of cases, such a certificate is prepared by the organization’s accountant. This is usually done when the document is required by a company employee or in situations where it is requested by the territorial tax authorities.

The documentation in question always includes the following sections, which are for informational purposes only:

- information about the organization, including its current details and full name;

- tax deductions of a property and social nature;

- current codification of transactions performed;

- the total amount of income for a certain reporting period of time and the amount of tax fees withheld.

It is worth remembering that the purpose of the document and its correct order are fully regulated by law.

Download form

The form of the certificate in question was adopted by a special Order of the Ministry of Finance of the Russian Federation on April 30, 2015, along with other forms of primary documentation and registers. Index 0504833 indicates the numbering order contained in the state classifier of management documentation. Initially, the relevant certificate was intended for organizations that operated in the public sector.

Among them it is worth highlighting the following:

- government bodies;

- local government bodies;

- Russian Pension Fund;

- Federal Population Insurance Service;

- other budgetary institutions related to the state or municipalities.

It is worth noting that any organization can include a corresponding document in its accounting policy and apply it on a general basis. In addition, the certificate can be taken as a basis as part of the formation of your own primary documentation for operations that are carried out in accounting format.

The established form of an accounting certificate includes, in addition to the fundamental details of the organization, the following established positions:

- name of transactions and legal documentation for each specific accounting stage;

- reference number;

- actual date of formation;

- credit or debit account number - such accounts can be accounts of organizations in both the budgetary and commercial sectors;

- the amount of transactions performed.

The key basis for reflecting a particular transaction from an accounting certificate within the framework of accounting is the note completed by an authorized accountant confirming the acceptance of the certificate for accounting. This means that when this mark is filled out, all related entries in special accounting registers can be made in the future.

If an authorized employee of the organization does not have the opportunity to mark the acceptance of accounting documentation, including electronic ones, for accounting, then within this framework, the certificate in question indicates the name of the primary document, as well as the basis and date of the business transaction.

It is worth noting that each interested person can download the relevant certificate from the official websites of registration and regulatory authorities, as well as find it in the public domain by entering a special request into search engines. You can also use OKUD, the all-Russian classifier of management data, to achieve the corresponding goal.

The universal transfer document was approved by the Federal Tax Service of Russia by letter dated October 21, 2013 No. ММВ-20-3/ [email protected]

How to correctly fill out and submit an application to confirm the right to a property deduction for personal income tax, we tell you in this article.

For a sample act on the provision of services under a civil contract, see

Accounting certificate for separate VAT accounting: sample

Home — Articles

- 22,881.6 rubles).

The following entries will be made in accounting.

| Contents of operation | Dt | CT | Sum |

| VAT is accepted for deduction | 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT” | 19 “VAT on purchased assets” | 22 881,60 |

| VAT is included in the cost of the loader | 01 "Fixed assets" | 19 “VAT on purchased assets” | 15 254,40 |

Chief Accountant --- -------

— calculation of the amount of interest on received and issued loans. The certificate must indicate the details of the loan agreement, the loan amount, the interest rate, the term of the agreement, the period for which interest is calculated;

— calculation of the amount of interest on loans received, included in expenses for tax purposes. In addition to the data already listed, this certificate must reflect how interest is normalized (on comparable loans or based on the refinancing rate). If the comparability method is used, then data on comparable loans is provided, and if interest is normalized based on the Central Bank rate, then it is indicated whether the agreement contains conditions for changing the interest rate and the size of the Central Bank rate;

— conversion into rubles of the cost of goods (works, services), whose price is expressed in foreign currency or in currency. e.;

— calculation of the amount of VAT previously legally accepted for deduction and subject to restoration;

— calculation of the amount of temporary disability benefits. In this case, the accounting certificate is attached to the sick leave;

— recalculation of the tax base under the simplified tax system for past periods when selling fixed assets before the expiration of the period determined by the Tax Code of the Russian Federation. The certificate must indicate for which fixed asset the recalculation is being made, the date it was accepted for accounting and the accrued amount of depreciation for the period of its operation. Since, in addition to recalculating the base for the “simplified” tax and additional payment of tax, you will also have to pay penalties, it is also better to reflect their calculation in the certificate.

We make corrections to the accounting

If errors are detected in accounting, you make corrective entries in the month in which the distortions were identified, without adjusting the accounting and reporting for the period when the error was made.

A certificate of corrective entries records the fact of incorrect reflection of business transactions in accounting accounts. Based on this certificate, you will enter corrective entries into accounting on the date specified in the certificate.

An accounting certificate is also the primary document on the basis of which you make corrections in tax accounting. However, unlike accounting, in tax accounting, errors are corrected in the period in which they were made. Except in cases where an error resulted in an overpayment of tax. Then it is allowed to adjust the tax base of the current year.

Since the accounting statement is prepared to explain the corrections made, all necessary information should be included in it. You need to describe in the certificate the reasons for the error and how to correct it in accounting and tax accounting. This is done so that over time one does not forget why the corrections were made.

Example. We prepare an accounting certificate to make adjustments to accounting and tax accounting

Condition

In April 2010, the accountant of Delovoy Mir LLC identified an error made in August 2009. He incorrectly reflected the cost of consulting services provided by Audit LLC. The cost of services, according to the agreement dated 01.08.2009 N 1-A and the act dated 31.08.2009 N 1, amounted to 150,000 rubles.

At the same time, the accounting and tax records reflect the services provided only in the amount of 100,000 rubles.

The error was discovered on 04/12/2010 when reconciling mutual settlements with LLC “Audit”.

Solution

As of the date the error was discovered (04/12/2010), an accounting certificate must be prepared.

LLC "Business World" April 12, 2010

Accounting certificate-calculation

On August 31, 2009, Audit LLC, under contract No. 1-A dated August 1, 2009, provided consulting services worth RUB 150,000. (excluding VAT), which is confirmed by the act of services rendered dated 08/31/2009 No. 1.

As a result of a technical error when recording the transaction, the cost of consulting services, to be included in general business expenses, was reflected in the amount of RUB 100,000.

The distortion was identified on April 12, 2010 as a result of reconciliation of settlements with LLC “Audit”.

To correct an error in accounting, such an entry was made.

| Contents of operation | Dt | CT | Sum |

| Expenses include the previously unaccounted cost of consulting services | 91, subaccount 2 “Other expenses” | 60 “Settlements with suppliers, contractors” | 50 000 |

For profit tax purposes, the amount is 50,000 rubles. included in other expenses and reflected in line 040 of Appendix No. 2 to sheet 02 of the income tax return for the second quarter of 2010.

We reflect transactions in the absence of documents

It is not uncommon for a situation where it is known for certain that there is income or expense, but for some reason there are no supporting documents. This is where an accounting certificate can help. For example, if you have an agreement that allows you to estimate the amount of the expense, and the expense was actually carried out, then reflect the expense in your accounting based on the accounting certificate. And after receiving the documents, if necessary, clarify its amount.

Attention! Including any expenses in tax expenses based on an accounting statement alone is risky.

Example. Accounting for expenses without original documents

Condition

Delovoy Mir LLC owns non-residential premises. The agreement with public utilities dated January 1, 2010 No. 1 provides for monthly utility payments in the amount of 7,800 rubles, including VAT - 1,190 rubles. Acts and invoices for utilities arrive with a significant delay (several months).

Solution

To recognize utility payments in accounting for those months when documents were not received, the accountant draws up an accounting certificate. Since, as mentioned above, it is risky to take into account expenses on the basis of only an accounting certificate, utility payments are not recognized in tax accounting for profit tax purposes.

Delovoy Mir LLC May 31, 2010

The act and invoice for utilities for May 2010 are missing. The following entries were made in accounting on the basis of agreement dated 01/01/2010 No. 1.

| Contents of operation | Dt | CT | Sum |

| Expenses include the cost of utilities | 20 "Main production" | 60 “Settlements with suppliers, contractors” | |

| VAT included in utilities | 19 “VAT on purchased assets” | 60 “Settlements with suppliers, contractors” |

The cost of utilities is not taken into account in tax accounting. VAT on utilities will be deducted upon receipt of invoices.

Another situation where an accounting certificate can be used for confirmation was proposed by the Russian Ministry of Finance. He indicated that in the case when fixed assets for which there are no invoices are transferred to the authorized capital, an accountant’s certificate can be registered in the sales book, which will reflect the amount of VAT calculated from the residual (book) value of fixed assets (without taking into account revaluation ), transferred as a contribution to the authorized capital.

Accounting statements will help you record any facts and calculations, confirm your position in a dispute with tax authorities, and, in general, their preparation will not take much time.

You should remember the following subtleties:

- Does not replace the document that must be drawn up by the transaction partners together. Therefore, it makes sense to record some operations in the certificate only for internal purposes.

- The certificate usually only confirms the information already provided in the internal accounting system. Therefore, a specialist must distinguish how to prepare a sample accounting certificate:

Such cases include drawing up an act of acceptance of goods received without documents. The tax office will consider that the submitted sample accounting certificate does not have a legal basis. As a result, expenses may not be recognized. It is impossible to take them into account when calculating tax. And challenging such a decision can be difficult.

- as a “primary”;

- for completely different purposes (informational, etc.). For example, to record a business transaction in a document that can become evidence in legal proceedings.

- In difficult situations, the accountant runs the risk of getting confused in the corrections. To prevent this from happening, we recommend including as much information as possible in the text of the certificate and attaching copies of settlement documents, as well as incorrectly completed documents.

Regardless of its purpose, the document must be executed correctly, since it plays the role of a primary one. Then there will be no unnecessary questions from the tax inspectorate. We recommend using an in-house template, since the legislation of the Russian Federation does not provide for a mandatory accounting certificate form.

The procedure for preparing this document consists of 3 stages:

- Creating a “header” and specifying the following data:

- information about what has changed;

- previous performance;

- correct method of calculation.

The following is an example of an accounting statement with the corresponding text:

| “Economist of LLC “Guru” N.V. Kurnosova made a technical error when calculating depreciation on fixed assets. For 2020, the amount was 21,000 rubles, while it was erroneously indicated as 22,500 rubles. Detailed calculation: ……. On February 1, 2020, N.V. Kurnosova corrected the error by posting Dt 44 Kt 02 - 21,000 rubles. Corrections were made by recording Dt 44 Kt 02 – 1500 rubles. (reverse)" |

- identification of persons;

- confirmation of the need to perform a business transaction.

Also see “Details of accounting documents: basic and mandatory”.

As was said, the company’s management has the right to independently develop and approve by order a sample certificate in order to use it to solve its business problems. At the same time, it is included in the accounting policy of the enterprise.

Accounting certificate (form 0504833)

Various forms have been developed for standard accounting documents, which should be taken into account in the relevant situation. Thus, accounting certificate form 0504833 is used only for budgetary organizations. Since the certificate is not a primary document, but only reflects transactions for adjusting reporting for budgetary organizations, it can only be issued for a certain number of transactions. For example, it may be required for adjustments in reporting documents, for providing information on moving funds, for using budget indicators, or for closing entries in current accounts.

Filling procedure

This document does not have standard forms that are used when issuing a certificate. It is worth saying that there are enterprises where the accounting staff performs them in handwritten form. It makes no difference in what format it will be completed, the main thing is that the filling rules are followed:

- of course, first of all, information about the enterprise is indicated, such as the name and structural unit for which the operation is carried out;

- it is also necessary to indicate the period for which the data is provided;

- the name of the operation and why it needs to be performed;

- number of the document on the basis of which this operation is carried out;

- date, amount and accounting information associated with the accounts;

- signatures and date of issue of the certificate;

- at the end there should be a note indicating that the certificate has been accepted for processing.

Situation one: it was necessary to correct an error in accounting or reporting

Let's say that for some reason you have over-charged wages, benefits, personal income tax and insurance premiums. Or identified the profits and losses of previous years. In general, you have discovered errors in accounting and tax accounting and reporting.

To correct errors, and reasonably, you will need to draw up an accounting certificate (see sample below). In it you will indicate the reason for the error (1), explain what you are correcting (2). Most likely, you will have to correct both the accounting entries (3) and the amounts (4). Also in the document you will provide the correct calculations (5, 6). But the rules by which you will correct errors are different in accounting and tax accounting. We'll tell you in order.

An error crept into accounting

In accounting, you correct errors in accordance with the requirements of PBU 22/2010. That is, incorrect entries for the current year must be corrected for the date when the error was discovered.

If the error relates to previous years, then you must first determine whether it is significant. And such an error will only occur when, separately or together with other shortcomings, it can affect the economic decisions of users of the statements (in particular, the founders of the company). You determine the materiality criteria yourself and consolidate them in your accounting policies.

More on this topic For more information on how to correct mistakes from previous years, read the article “What to do if you find last year’s error in the financial statements” (published in Glavbukh No. 2, 2013).

The error turned out to be significant, and the reporting for this period has already been submitted to the inspectorate and approved by the founders? Then make corrections in the current month. The same should be done if the error is insignificant. Or if your business is one of the small ones.

Well, if the accounting records for the period in which a significant error was made have not yet been submitted to the controllers and they have not been approved by the founders, the records must be corrected in December. It is clear that this procedure is applicable in the first quarter, during which annual reporting is prepared.

In any case, the error can be corrected in two ways: either by adding additional missing amounts, or by reversing excess amounts. You will reflect the appropriate option in the accounting statement.