General information

Budgetary institutions are required to carry out operations to spend funds in accordance with the estimate. This rule is enshrined in Article 161 of the Tax Code (clause 1). Preparation of budget estimates is the responsibility of these organizations. The list of costs that are reflected in the document is enshrined in Article 70 of the Tax Code. Such expenses include:

- Payment for the work of employees, salary (salary, remuneration, salary) of employees of government bodies, territorial self-government structures, persons holding government positions in the Russian Federation, municipal and civil servants, and other categories.

- Travel and other payments accrued in accordance with the employment contract, the legislation of the Russian Federation, regulations of the regions and the Moscow Region.

- Payment for work, supply of products, provision of services for municipal or state needs.

- Deduction of taxes and other obligatory amounts.

- Compensation for damage caused by the institution during the conduct of its activities.

Rules

The procedure for drawing up and approving the budget estimate is determined by the main manager of funds, under whose subordination the organization is located. The established rules must comply with the requirements of the Ministry of Finance. The chief manager of funds determines the details that the budget estimate contains. This:

- A stamp that includes the signature of the manager who has the authority to approve the document. The mark must contain a transcript of the painting.

- Document's name.

- The financial period for which the information is provided.

- Name of the organization that issued the document, OKPO code.

- The name of the units of measurement for the indicators included in the estimate. Their OKEI code is also indicated.

Sample budget estimate

The budget estimate form has already been given above. In order to more clearly understand the rules and requirements for its preparation, it is advisable to consider the example of a completed budget estimate given below.

Like most similar documents, it consists of three main parts:

- a cap;

- tabular part;

- final results of the estimate.

Formatting the header of the document does not contain any difficulties - you just need to fill out the fields of the form developed and approved by the department. In this case, the budget estimate is approved by the contractor and the developer, and agreed upon by a representative of the main budget manager.

Then the document must indicate its name, as well as the names of the following organizations: recipient, manager (if any) and main manager of the allocated budget funds. Also in the header of the estimate is the name of the budget, codes of the document being drawn up and the unit of measurement of the data provided in it.

The following is the tabular part of the budget estimate. It was already noted above that after changes were made to the regulatory framework, it consists of four sections, the content of which was also described in the previous parts of the article. In the example given, the data is contained only in the first section of the document in question.

The second and third sections do not contain indicators and are left blank. It is necessary to pay attention to the continuous page numbering of the document.

Section 4 contains the summary data. In the given sample budget estimate, the indicators in this section are identical to those indicated in the first part of the document, although the form of their presentation has been slightly changed.

The budget estimate is signed by those responsible persons who participated in the preparation and verification of its correctness. In the case under consideration, these are the head of the government institution, the head of the planning and financial service and the immediate executor

Content

As a rule, it is presented in the form of a table. It must contain line codes, names of the direction of funds and amounts, corresponding cost classification codes with details of KOSGU. Specific details are given in Order of the Ministry of Finance No. 74n. There are a number of sub-items that organizations use most often. Accordingly, the budget estimate must necessarily contain information about them. These are the sub-articles:

- Salary.

- Other payments.

- Salary accruals.

- Communication services.

- Fare.

- Communal payments.

- Rent.

- Property maintenance.

- Other services/work.

- Increase in the cost of fixed assets, intangible assets, non-productive assets, inventories.

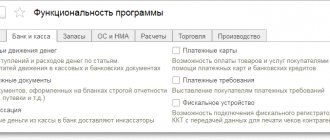

Filling out the budget estimate for 2020 - maintaining estimates in the GIIS “Electronic Budget”

According to the provisions of Order of the Ministry of Finance of the Russian Federation dated September 30, 2016 No. 168n, since 2020, municipal government institutions and state (subjects of the Russian Federation) institutions have been maintaining and compiling budget estimates using the GIIS “Electronic Budget”. The Letter of the Ministry of Finance of the Russian Federation No. 21-03-04/74624 presents the procedure for connecting institutions that receive funding from the federal budget. The GIIS “Electronic Budget” system provides the ability to maintain and generate:

- set of budget estimates;

- planned estimated indicators;

- budget estimates based on those communicated to the establishment of the LBO.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Wage

Information about it is reflected in subarticle 211. Here, labor costs under contracts are planned in accordance with the legislation on the civil service and the Labor Code. Expenses include payments for:

- Official salaries.

- Hourly payment.

- Tariff rates.

- Special and military ranks.

In the same sub-article, deductions of financial assistance, bonuses, year-end remunerations and other incentives are planned. It also reflects payment for annual and educational leave, compensation for unused vacation, benefits for the first 2 days of the employee’s incapacity for work. To calculate the required amount of funds, the staffing table is used, as well as regulatory documents regulating the salary system.

Features of making changes to the estimate

Budget commitment limits may change. If such changes are present, they must be reflected in form 0501012. All required changes are made to this form. Changing the form is carried out in accordance with this sequence:

- The budget commitment limit has been reduced. The amount of limit reduction is recorded in the required line with a minus sign.

- The funding limit has increased. The increase amount is fixed with a plus value according to the required BCC.

- Redistribution of money within the limits of budget obligations. You must follow the rules given above. If the value for a certain BCC decreases, a negative amount must be recorded. It is distributed among the lines that will be enlarged.

The paper is approved in the standard manner. This must be done within 10 days from the date of receipt of the notification about the LBO adjustment. The next step is that the modified project is entered into the electronic system.

Other payments

This sub-article is considered by some experts to be the first and most voluminous of all that the budget estimate includes. This is due to the fact that deductions are planned for it for additional compensation and payments provided for in the contract. These include, among others:

- Daily allowances for business trips.

- Monthly allowance for young children.

- Reimbursement of the cost of uniform shoes and clothing.

- Reimbursement of costs for the purchase of periodicals and printed materials.

- Cost of public transport tickets.

- Other similar costs.

When making calculations, the staffing table, local acts regulating the corresponding payments, information on the number of planned business trips during the year, etc. are used.

Salary accruals

Planning of these costs is carried out according to subsection 213. This takes into account the costs of deducting the unified social tax, contributions at insurance rates for compulsory social insurance against occupational diseases and industrial accidents. When reflecting these costs, it is necessary to take into account the provisions of Chapter 24 of the Tax Code and use information about the payroll. It must be remembered that the costs of paying unified social tax and contributions to the FFOS under civil contracts with individuals are reflected in articles and sub-articles that summarize information on payment for work under these agreements.

Pricing in state or municipal contracts.

State or municipal contracts are concluded between the Contractor and the State Customer in cases where construction and installation (repair) work is financed from the state budget of any level.

The conclusion of state or municipal contracts is regulated by Federal Law No. 44 “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs”, as well as the Civil Code of the Russian Federation.

According to clause 8 of Article 3 of Law No. 44-FZ, a state contract and a municipal contract are a civil contract concluded between the customer and the supplier. The government contract is concluded to meet state and municipal needs. To successfully conclude a government contract, a potential supplier needs to know its key features and provisions.

According to the Civil Code, a state (municipal) contract is a contract where the supplier is obliged to transfer goods to the state (municipal) customer or, at his direction, to another person, and the customer must pay for the goods supplied.

There is a difference between a state and municipal contract. This difference lies only in the level of financial resources from which the supplier will receive money for services rendered, work or goods supplied.

According to the Budget Code of the Russian Federation (Article 10 of the Budget Code of the Russian Federation), a three-tier system operates in Russia. Budgets are:

- the federal budget of the Russian Federation and the budgets of state extra-budgetary funds;

- budgets of the constituent entities of the Russian Federation (89 budgets - 21 republican budgets, 55 regional and regional budgets, 10 district budgets of autonomous okrugs, the budget of the Autonomous Jewish Region, city budgets of Moscow and St. Petersburg) and the budgets of territorial state extra-budgetary funds;

- local, including municipal districts, city districts, municipalities of federal cities of Moscow, St. Petersburg and Sevastopol, urban and rural settlements, districts. Each entity must form and approve its own budget, thanks to which it fulfills its spending obligations. budgets (about 29 thousand city, district, township and rural budgets).

Thus, for participants in the public procurement system, the only difference is in the budget from which level funds will be allocated for procurement.

Transport services

They are planned according to subarticle 222. Typically, expenses for travel to the place of work during business trips, for retraining courses, advanced training (for part-time students, including) are reflected here. The same sub-item is used to plan costs for the delivery of non-financial assets. To determine the required amount of funds, data on the number of business trips during the year with the approximate cost of travel, plans for advanced training, and information on the average annual costs of hiring transport are used.

Communal payments

According to subarticle 223, consumption and payment are planned:

- Technological needs and heating, hot water supply.

- Gaza. The costs include, among other things, costs for the delivery of raw materials through distribution networks, fees for the provision of supply and sales services.

- Electricity for production, economic, medical, technical, scientific and other purposes.

- Sewage, water disposal, etc.

To calculate the required amount of funds, information is needed on the need for heat, electricity, gas and water, as well as information on suppliers’ tariffs.

Property maintenance costs

They are planned according to subarticle 225. This reflects the costs of paying for contracts for the provision of services, work related to the maintenance of fixed assets, non-productive assets, intangible assets, inventories that are in gratuitous use, operational management or lease. When making calculations, information from plans for current and major repairs of structures, buildings, utility systems, the cost of vehicle maintenance, information on the costs of providing maintenance services for fire and security alarms, computer networks, average annual costs for refueling and maintenance of office equipment are taken into account.

other expenses

They are planned according to subsection 229. Costs that are not related to remuneration for labor activities or the purchase of services are reflected here. Under subarticle 229, expenses related to:

- Payment of taxes, fees and other obligatory amounts, state duties, fines, penalties and other sanctions.

- Transfers of funds to trade unions for physical education and cultural work.

- Payments of State bonuses in various fields.

- Reception and service of delegations.

- Payments to athletes and coaches.

Types of estimates: individual, general, consolidated, cost estimates for centralized events.

⇐ PreviousPage 9 of 10Next ⇒A budget institution has its own financial plan (estimate of income and expenses). Budget estimate. The institution is the main planning document that grants the authority to the budgetary institution regarding the receipt of income and the implementation of expenses, determines the volume and direction of funds for the implementation of the budget. establishing its functions and achieving the goals set for the year in accordance with the budget assignment. The procedure for generating expenses is called estimated.

The cost estimates of the institutions must be linked to the economic and social development plan of the unit. The approved estimate is a plan for financing a budgetary institution and the basis for spending budget funds.

Types of estimates:

Individual. For a specific institution (reflects its specifics). The Ministry of Finance is developing standard forms of such estimates by type of institution. They serve as the main document when planning expenses for educational institutions, healthcare, social security, defense, management, etc.

Are common. They are compiled for the same type of institutions, clubs, libraries, obstetric centers, executive committees and others with a small amount of funding and the same staff, and for the same type of large institutions, the economic services of which are carried out through centralized accounting departments.

Cost estimates for centralized activities. Compiled by the ministry, department, executive committees of local councils. These estimates finance the costs of training, purchasing educational equipment, costs of health education, and sports competitions.

Consolidated industry estimates are individual estimates of homogeneous institutions and cost estimates for centralized activities combined into one estimate. Provides for expenses for all institutions of this department. The development of such estimates is possible due to the fact that individual estimates are based on common indicators of the economic and social development plan. The basis is the current cost norms. Compiled according to uniform forms and items of budget classification.

69. Management mechanism for non-production institutions.

The non-production sphere is usually understood as a set of industries and activities related to serving the national and socio-cultural needs of society and specific citizens. Services provided by non-production entities may be paid, free, or partially paid by consumers. The sources of formation of financial resources for these entities depend, on the one hand, on the type of services provided, and on the other, on the nature of their provision. The non-productive sphere can be divided into entities whose activities are based on the principles of self-financing, and entities operating at the expense of budgetary funds, as well as entities that are partially financed by the budget, but have their own sources of income. Funds from all sources received into the accounts of such institutions form a fund of financial resources, which is used to pay wages, reimburse material and similar costs, and for other purposes permitted by law.

The main source of financial resources for non-production institutions is the state budget and extra-budgetary funds. Additional sources: leasing inefficiently used PFs, voluntary donations, provision of paid services. Thus, in the system of financial relations, non-production institutions occupy a special place. First of all, we need to highlight their relationship with the state budget. Subjects in the non-productive sector that operate on self-financing terms have problems regarding the payment of taxes. In institutions that are financed from the budget, such relationships are usually one-sided - receiving budget funds. Since non-production sectors are organizational entities, they also have financial relations with higher-level organizations. We can highlight relationships with banking institutions regarding servicing accounts, obtaining and repaying loans. Financial relations developing in the non-productive sphere are the result of the distribution of national income created in the sphere of material production. The state’s ability to direct a given amount of financial resources to the non-productive sphere depends on the size of national income. There is a directly proportional relationship between them.

Non-production sectors, that is, education, science, healthcare, are priorities in the budget policy of the Republic of Belarus. The increase in spending exceeds the increase in funding for most other industries. Expenditures on health care in the consolidated budget are planned in the amount of Br18.2 trillion, or 3.6% of GDP. This means an increase of 1.8 times compared to the current year. Resources in the amount of Br1.6 trillion are planned for the implementation of the state scientific, technical and innovation policy. Budget expenditures on education are set at Br23.8 trillion.

70. Income from business activities of non-production institutions…….

The non-production sphere is usually understood as a combination of industries and types of activities, St. with public service and social and cultural needs of society and specific citizens. Finance in this area is the relationship that arises in connection with the formation of money. income from subjects of the non-productive sphere, their use in order to perform their functions.

Services provided by non-production entities may be paid, free, or partially paid by consumers. The term “free” should be understood in the sense that they are free for the consumer, but not for the manufacturer. The one who provides such services necessarily incurs corresponding costs. Thus, the sources of formation of financial resources for these entities depend, on the one hand, on the type of services provided, and on the other, on the nature of their provision.

The non-productive sphere can be divided into entities whose activities are based on the principles of self-financing , and entities operating at the expense of the budget. funds , as well as entities partially financed by the budget. financing, but having their own. sources of income.

Funds from all sources received into the accounts of such institutions form a fund of financial resources, which is used to pay wages, reimburse material and similar costs.

The predominant source of financial formation. resources of non-productive institutions are the budget and extra-budgetary funds.

Sources of income for budgetary institutions can be: receipts for work (services) performed of a material nature in accordance with concluded agreements with subsidiaries and organizations and on orders from the population; From the sale of products from training and production workshops; From leasing premises and structures; receipt of funds for additional preparation services.

Additional services

, for example, in the field of public education, one can include the study of individual disciplines, cycles of disciplines, in-depth study of subjects and other services (work).

General education schools of all types, orphanages, boarding schools can organize clubs, courses, grow planting materials and varietal seeds for sale, create handicrafts, as well as perform work and provide services for repairing household appliances, photography, etc.

Budgetary organizations can engage in entrepreneurial activities:

- for the sale and rental of fixed assets and property of institutions for purposes not related to their activities; - trade in purchased goods, equipment; - provision of intermediary services; - acquisition of shares, bonds and other securities and receipt of income from them.

Paid forms of activity of non-production institutions are not considered entrepreneurial if the income from them goes entirely to their development and improvement. Funds received from various sources form a single fund of financial resources . To store both budgetary and extrabudgetary funds, a current account is opened in a bank institution, and current accounts for the budget and extrabudgetary funds are closed.

⇐ Previous9Next ⇒

Other works

The costs for them are planned according to subsection 226. Here they reflect the costs of contracts for the provision of services and the performance of work not taken into account in the subsection. 221-225. In particular, they reflect payment:

- For private security, installation of alarms.

- For life, property, health, and civil liability insurance of vehicle owners.

- For providing medical assistance to law enforcement officers and military personnel.

- For rental of special video, audio, and film recordings.

- For renting living space during business trips.

- For services in the field of information technology. In particular, the costs of purchasing user rights for software, purchasing, and updating databases are taken into account.

- For the production of forms for state certificates, etc.

Budget estimate in the “Electronic Budget”: how to fill it out?

Currently, there is a special framework created to ensure accountability, transparency and openness of the activities of organizations. The budget estimate in the “Electronic Budget” allows you to improve the quality of financial management in the field of managing municipal and state funds. The document is drawn up by making adjustments to it within the limits of obligations brought to the organization. The budget estimate in the “Electronic Budget” includes 4 sections. The form indicators are almost the same as those provided for the standard document form.

Filling out the budget estimate for 2020 - procedure for subordinate institutions

Each government institution in Russia has the obligation to formulate its own budget estimate, since it is on the basis of this that the manager of budget funds will create a Summary Statement for the totality of subordinate institutions.

The formation of the budget estimate begins after the receipt of information about the amount of budget assignments that were allocated from the budget. The budgeting process can be divided into 3 stages:

- calculation of estimated planned indicators;

- preparation of a draft budget estimate;

- annex to the calculation estimate with detailed justification of cost items.

The text of Order of the Ministry of Finance of Russia dated November 20, 2007 No. 112n, which guided the main managers of budget funds for quite a long time, is adjusted from time to time. Currently, new requirements have come into force that must be taken into account when drawing up and approving estimates for the planning period 2020-2021 and estimates for 2020. The new conditions for exiting the Order of the Ministry of Finance of the Russian Federation dated February 14, 2020 No. 26n are justified. Here is a list of the main points that have changed since the new Order of the Ministry of Finance came into force:

- The budget estimate with justifications, which has been approved, must be sent to GRBS (RBS) within 1 working day. days from the date of its approval.

- Estimates containing information classified as state secrets must be approved no more than 20 days later. days from the date of delivery of the LBO to the institution.

- In shifts, it is now also required to provide forecast indicators.

- The structure of the budget estimate is undergoing changes.

- There was an increase in the number of sections of the estimate.

Each main manager of budget funds of a constituent entity of the Russian Federation and the federal budget must approve the procedure in the form of a single document. Managers of regional budget funds can establish:

- powers of the manager and chief manager of local budget funds;

- terms and rules for drawing up and approving draft budget estimates;

- terms and time of registration, making changes, maintaining and approving budget estimates.

The same powers are granted to the main managers of federal budget funds, but in relation to funds from the federal budget, not the regional one.

Decor

Maintaining budget estimates, as mentioned above, is carried out by adjusting limits. It is necessary to take into account that the amounts of increase in the volume of prescriptions are reflected with a “+” sign, and decreases, accordingly, with a minus sign. Adjustment of the estimate is carried out by approving amendments to values that change:

- Volumes of prescriptions when the volume of LBO changes. The limit must be communicated to the organization according to established rules.

- Distribution of assignments by classification codes of costs that require and do not require changes in the indicators of the list of the main manager of funds and LBO, as well as by additional codes of analytical quantities for which adjustment of the list and volume of limits is not required.

The procedure for drawing up budget estimates was supplemented by Order of the Ministry of Finance No. 168n. In accordance with the provisions, adjustments to the document can be carried out by agreeing on amendments to values that change the volume of assignments, entailing their redistribution between sections.

Requirements for drawing up and maintaining budget estimates

After making the last changes, correct preparation of the budget estimate implies the following four sections:

The first of them should contain the expenses necessary to ensure the normal functioning of the institution, in particular:

- wages and other benefits to employees of the organization, as well as travel expenses and similar payments that are provided for by current legislation;

- costs of purchasing goods and performing work necessary for the operation of the institution;

- payment of fees, taxes or other payments to the budget of the Russian Federation that are mandatory;

- compensation for damage caused by a government institution in the process of carrying out its activities;

The second section of the document under consideration contains costs associated with the exercise of powers of the manager of budget funds . In practice, it is not always filled, since such functions are performed by government institutions quite rarely;

The third section reflects expenses not included in the first two;

The fourth section is final , it contains the results of the estimate.

When drawing up and subsequently maintaining a budget estimate, it is necessary to take into account that the main indicators used in this case must be given with an indication of the corresponding budget classification codes.

Key tasks

A budget estimate is a document that allows you to solve a number of problems. Among its main tasks:

- Increasing the availability of information about the financial activities and state of a public legal entity, organization, assets and liabilities.

- Introduction of tools that ensure the relationship between budget and strategic planning, monitoring the achievement of results from the implementation of state programs at the federal and regional levels, as well as those developed by municipal authorities. The budget estimate of a government institution, in addition, allows you to analyze the results of extra-program activities and the quality of performance of municipal and state functions.

- Ensuring that information on actual and planned financial performance indicators in the field of management of public funds of process participants is posted in the public domain. The electronic system allows you to publish information about other legal entities receiving transfers from the budget.

- Ensuring the integration of operations for the formation and implementation of income and expense items, accounting, preparation of financial reports, and other analytical information.

- Strengthening the relationship between the budget process and planning procedures for the purchase of products, services, and work to meet the needs of public legal entities, the formation, placement of supply orders, and execution of municipal and government contracts.

Another task is to ensure the relationship between registers of obligations and the assigned powers of organizations, in accordance with the law.

Goals for creating budget estimates

The budget estimate is formed with the following goals:

- Ensuring the availability of information about financial processes in the company and its assets.

- Create a strong connection between strategic and budget planning.

- Monitoring the implementation of government programs.

- Analysis of the productivity of activities implemented outside the programs.

- Guarantee of free access to information about planned and actual values.

- Integration of actions for planning and implementation of expenditure and income items, accounting values.

- Strengthen the connection between the work of planning and budgeting purchases.

Limits from the BS are allocated to institutions on the basis of a pre-executed procurement plan. Upon agreement with the budget financing manager, adjustments may be made to this plan.