- Child Benefit Law

- Types of maternity benefits Benefit for early registration of pregnancy

- Maternity benefit

- One-time benefit for the birth of a child

- One-time benefit for wives of military personnel

- Additional maternity benefit

- Maternal capital

- Monthly allowance for children under 1.5 years old

- Allowance for a disabled child

State support for motherhood and childhood is one of the key areas of state social policy. It can be quite difficult for a young family to have a child, both financially and morally, so the Russian government is trying in every possible way to support its citizens. Support is provided in various forms, including through various federal and regional payments. In this review, we will talk about what types of child care benefits there are, who and in what amount are entitled to benefits for the first child and other child benefits, where and how to apply for them.

Child Benefit Law

The core of the legislation on child benefits is the Federal Law on state benefits for citizens with children, dated May 19, 1995 No. 81-FZ. It spells out a system of federal payments to financially support families when giving birth to children and caring for them. Art. 3 81-FZ establishes the following types of state benefits:

- for pregnancy and childbirth;

- with early registration for pregnancy;

- at the birth of a child;

- for child care;

- when transferring a child to a family for upbringing;

- pregnant wives and children of conscripted military personnel.

From January 1, 2021, according to the new law, the amounts and conditions of assignment have changed in relation to a number of child benefits in Russia.

In the constituent entities of the Russian Federation, there are legislative acts on regional payments at the birth of a child and other types of child benefits. For example, in Moscow, child benefits are carried out in accordance with the Laws of November 23, 2005 No. 60 “On social support for families with children in the city of Moscow” and of September 30, 2009 No. 39 “On youth”.

How to apply for a one-time benefit for the birth of a child at the MFC

Legal consultation is free.

Legal obligations for a lump sum payment at the birth of children are issued to the father or mother or the person who replaces them.

It is possible to assign a one-time type of payment at the birth of a child if they apply within the first six months.

If two or more children were born, then one-time payments must be calculated and paid for each of them.

If the child was stillborn, then the lump sum type of payments for the birth of children is not accrued. The payment amount is about 16,500 rubles.

If an overpayment occurs due to the fault of the person who submitted the application (for example, certificates were submitted with false data, concealment of facts that affect the right to receive payment), then the amounts that were paid will be withheld.

The amount that was overpaid due to the fault of the social service is not withheld only if we mean a counting error. This case requires recovery of damages from the guilty party according to the standard established by the legislation of the Russian Federation.

In order to apply for child care benefits through the MFC, you must first look at which one is located near you[/anchor] and make an appointment by calling the hotline.

Read also: How to sign up for a antenatal clinic through State Services?

They work on an extraterritorial principle, that is, you can choose the most geographically convenient option for yourself.

After this, study the package of documents that will need to be provided. , what needs to be filled out, and write it either by hand, or fill it out electronically and print it.

Payment of maternity benefits

Pregnancy, the birth of a child and caring for a newborn are not only important events in the life of a woman and the family as a whole. These events are grounds for receiving a number of benefits. Payments that can be received upon the birth of a child:

- for early pregnancy registration;

- actually for pregnancy and childbirth;

- child birth benefit;

- wives of conscripted military personnel;

- additional benefit for the birth of a child;

- matkapital.

The amount of child benefits paid on these grounds can reach impressive amounts and reduces the burden on the family budget. Next, we will talk about who is entitled to benefits at the birth of a child and how they can be applied for.

Benefit for early pregnancy registration

Social payments for registration before 12 weeks of pregnancy are provided for in Art. 9 81-FZ. Registration is carried out:

- at the place of work (study);

- at the social security agency at the place of residence if the woman does not work (does not serve, does not study).

The federal child benefit for early pregnancy registration is paid in the amount of 300 rubles. (Article 10 81-FZ). In the capital, according to Moscow Government Decree No. 1753-PP dated November 17, 2019, an additional 634 rubles are paid to women registered with a pregnancy of up to 20 weeks.

Maternity benefit

Payments to young families upon the birth (adoption) of a child are made for the following categories of women (Article 6 81-FZ):

- employed, insured in the compulsory social insurance system;

- dismissed due to the liquidation of enterprises and institutions in which they worked;

- full-time students at vocational schools, universities, institutions of additional education and scientific organizations;

- contract military personnel.

Calculation and payment of benefits at the birth of a child is carried out:

- at the place of work (study);

- for those dismissed from the social security authorities at their place of residence.

The benefit is paid if a woman goes on maternity leave. Payment, according to Art. 7 81-FZ, is carried out during the vacation period of 70 days before birth (84 days for multiple pregnancies) and 70 days after birth (86 days for complicated births, 110 days for the birth of two or more children).

The period for receiving benefits is up to six months from the end of maternity leave. Payment is assigned within 10 calendar days after submitting the application. If payment deadlines are unlawfully delayed or benefits are denied, contact a free lawyer on our website who will promptly help you find a solution to this problem.

Amount of benefit for the birth of children:

- for workers according to average earnings;

- for students according to the size of the scholarship;

- for contract military personnel according to the amount of salary;

- for those dismissed in the amount of 300 rubles.

One-time benefit for the birth of a child

The state makes one-time payments at the birth of a child (Article 11 81-FZ); one of the parents can receive payments for children. When two or more children are born, the allowance is assigned for each child.

The basic (initial) benefit amount is 8,000 rubles (Article 12), every year from February 1 this value is recalculated (Article 4.2). You can calculate the amount of payment to a family in connection with the birth of a child, taking into account indexation; from February 1, 2021, it is 18,004 rubles 12 kopecks.

A one-time benefit for the birth of a child is paid by the employer at the place of employment (service) of one of the parents. If the recipient does not have official employment, he will receive a payment from the social security authority at his place of residence. To receive payments for children, you need to submit an application, attaching a certificate from the registry office and a certificate stating that the other parent did not apply for benefits.

You must apply for payment within six months after the birth of the child. The deadline for paying a one-time benefit is up to 10 days after submitting the application to the employer. If the payment is processed by the social security authority, the money will be transferred to the applicant by the 26th day of the month following the month of submission of documents.

Sample application for a one-time benefit

One-time benefit for conscript wives

According to vol. 12.3 81-FZ, benefits are paid to pregnant wives of military personnel on conscription. It is prescribed for a pregnancy of 180 days or more, the benefit amount is 28,511 rubles 40 kopecks. In Art. 12.5 and 12.6 81-FZ also stipulate that children of military personnel are entitled to a monthly payment until they reach the age of 3 years, but no later than the end of their service period. Amount to be paid – 12219 rubles 17 kopecks.

Additional maternity benefit

This payment is assigned according to the Decree of the Moscow Government dated November 23. 2005 No. 60. Muscovites dismissed during the liquidation of an organization or termination of the activities of an individual entrepreneur can receive a one-time compensation payment within 12 months before they are recognized as unemployed. The amount of the benefit is 1,584 rubles (Moscow Government Decree 1753-PP).

Maternal capital

New opportunities have appeared for recipients of maternity capital for children in 2021: registration times have been reduced and the scope of use of funds has expanded. The amount of maternity capital depends on the date of emergence of the right to state support, as well as the date of birth of the first, second, etc. child. So, if the right to state support arose before December 31, 2021, its value will be 466,617 rubles, but if the second child was born after January 1, 2021, and the first before January 1, 2021 - 616,617 rubles.

Monthly child benefits

Art. 13 81-FZ provides for monthly payments to young families at the birth of a child until he reaches one and a half years old. What payments are due for the first, second, third and subsequent children is stated in Art. 14 and 15 81-FZ. A mother, father or other person on parental leave can receive child care benefits. In addition, for the first and second child you can receive another, “Putin’s” benefit, subject to certain conditions regarding income level (Federal Law of December 28, 2017 No. 418-FZ).

Monthly allowance for children under 1.5 years old

The following may apply for monthly payments of child benefits up to 1.5 years (Article 13 81-FZ):

- mothers, fathers, other relatives, guardians caring for a child, subject to compulsory social insurance and on parental leave;

- contract military personnel, fathers serving in the internal affairs bodies, fire service, penal system, customs service;

- mothers, fathers, other relatives, guardians caring for the child and dismissed due to the liquidation of organizations

- other categories of recipients.

A monthly allowance is paid for a child up to one and a half years old, depending on the category of the recipient. Workers (employees) receive it at their place of employment, individual entrepreneurs from the Social Insurance Fund, child care benefits for an unemployed mother are paid by the social security body. Payments are made until the child reaches the age of one and a half years (Article 14 81-FZ). The monthly child care benefit is calculated depending on the minimum wage, the income limit for calculating insurance premiums and the average daily earnings. If the recipient is not officially employed, he is paid a minimum benefit.

| Payments per month | Money for the first child | For second and subsequent children |

| Minimum amount for unemployed | RUB 3,375 77 kopecks | 6751 rub 54 kopecks |

| Minimum amount (including minimum wage) | 4852 RUR | |

| Maximum amount of child care benefit | RUB 27,984 66 kopecks | |

Allowance for a child under 3 years old or “Putin payments”

On the initiative of V.V. Putin, Federal Law No. 418-FZ of December 28, 2017 on monthly payments for children was amended to provide for the extension of child benefits up to 3 years. Therefore, social payments for children under 3 years of age began to be called “Putin’s”. A monthly allowance for children after one and a half years of age is provided to families if certain conditions are met. The amount of the benefit is equal to the minimum subsistence level established for children in a particular region.

“Putin payments” at the birth of the first and second child are due to parents:

- who have Russian citizenship;

- if the child was born on January 1, 2021 and later;

- if the average per capita income in the family does not exceed two subsistence levels in the region for able-bodied people.

You can apply for presidential payments for children at any time until the child is 3 years old. If the application for child benefit occurred earlier than 6 months from the date of birth of the child, the payment is accrued from the date of his birth, if later, then from the date of application.

To receive the Putin benefit, one of the parents who is entitled to payments must submit an application to the social security authority at their place of residence.

Also, monthly payments for children under 3 years of age are provided for by Decree of the Capital Government No. 1753-PP for families whose average per capita income is not more than the subsistence level determined by the Moscow Government. Such benefits can be issued by:

- in the amount of 15,840 rubles single mothers (fathers), conscripted military personnel;

- in the amount of 10,560 rubles for other families.

How to apply for child benefits at the MFC for a child under 18 years of age

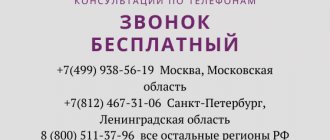

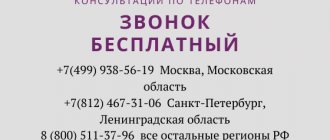

Free legal consultation

Initially, you need to clarify whether it is possible to apply for child benefits at the nearest branch of the MFC, to do this, call a single phone number, or select the multifunctional center closest to you from the table, and contact using a convenient method from the contacts section.

If such a service is available, make an appointment or, upon arriving at the department, receive an electronic queue coupon, wait for your number to be announced on the display, then go to the employee’s booth.

If such a service is not available at the MFC at your place of residence, you can apply for benefits at any other multifunctional center. You can also find out the status of consideration of your application.

Draw your attention to! Before applying for any type of benefit, it is necessary to register the child at the place of residence, this is a prerequisite.

Read also: MFC work schedule for the May holidays in 2019

What documents are required for child benefits under 18 years of age?

Before going to the MFC, you need to prepare a list of documents for applying for benefits for children under 18 years of age, which includes:

- Application for benefits according to the sample (to be completed on site)

- Original certificate of family composition (available on site)

- Birth certificates (if the child has reached 14 years of age - citizen’s passport)

- Certificate of family income for the last three months

- Original parents' passports and photocopies (copies can be made on site)

- For children over 16 years old, a certificate from the place of study

It is worth considering that the benefit is paid until the child reaches 16 years of age; if he continues to study after 16 years, then payments are extended until he reaches adulthood.

As soon as you, together with an MFC employee, prepare a package of documents, he will give you a receipt of receipt, and will guide you on the timing of the provision of the service and from what moment benefits will begin to be paid.

Amount of payments for child benefits up to 18 years of age

The amount of payments for a child under 18 years of age in 2017-2018 depends on the place of residence and is paid quarterly, the average check in Russia is 300 rubles per child, it should be noted that the benefit at the MFC cannot exceed the subsistence level, and is calculated using the formula:

SD = D / H / T

Where,

D - the total amount of income of both parents for the last month, three or years, depending on the region of residence, check with an MFC employee specifically in your case.

N - the number of family members, according to the certificate of its composition.

T - the number of months in the period for which the payment is made (quarter or year)

In some cases, the benefit amount may be increased for the following categories of families:

Read also: Registration of a car with the traffic police through the MFC and State Services

1. Low-income families. 2. Single mothers (need a certificate of form 25, issued on the spot). 3. Disabled people (need a certificate of disability - obtain it locally or at the ITU) 4. Large families and families of military personnel.

Payments to special categories of the population

Social benefits for children are paid to certain categories of recipients, including:

- families with disabled children;

- the poor;

- large families;

- single mothers;

- on the occasion of the loss of a breadwinner.

Allowance for a disabled child

Financial support for families with a disabled child is provided for by Decree of the Government of the Russian Federation No. 61 dated January 29, 2020. It stipulates social payments for disabled children when the child is transferred to a family for upbringing. The amount of payments is 18,004 rubles 12 kopecks, and for the adoption of a disabled child - 137,566 rubles 14 kopecks.

For Muscovites, Decree of the Capital Government No. 1753-PP provides for the payment of child benefits up to 18 and 23 years of age. In accordance with this act, the amount of benefits for caring for a disabled child under 23 years old is 12,672 rubles per month. The same amount of disability benefits for a child under 18 years of age is paid to non-working parents who are disabled people of groups I-II.

Child benefits for low-income families

From July 1, 2021, it will be possible to receive a low-income benefit for a child from 3 to 7 years old; for this, the income per family member must be less than the subsistence level. The assignment of benefits for children from low-income families will be made based on applications that can be submitted through the State Services portal, the MFC or the social protection authority. Payments for a child from a low-income family will be accrued from January 1, 2021, if by this date he is already 3 years old, or from the date of birth, if the child was born after January 1, 2021. The benefit amount is half of the subsistence level in the constituent entity of the Russian Federation established for children.

In the capital, social assistance to low-income families with children is provided according to Moscow Government Decree No. 1753-PP in the form of monthly payments per child:

- up to 3 years in the amount of 10,560 rubles;

- from 3 to 18 years old in the amount of 4224 rubles.

Benefits for large families

Large families require government support, because often parents do not have sufficient income to support a large number of children. In Moscow, you can apply for benefits for a family with 3 or more children if there are appropriate grounds. Monthly benefits for 3 children in Russia ease the financial burden on the budget of a large family.

Social assistance is provided to large families in accordance with Moscow Government Decree 1753-PP. The amount of monthly payments to large families is:

- for compensation of expenses due to the increase in the cost of living for families with 3-4 children - 1268 rubles, with 5 or more children - 1584 rubles;

- for the purchase of children's goods for a family with 5 or more children - 1901 rubles;

- families with 10 or more children – 1,584 rubles;

- a mother of many children who has given birth to 10 or more children and receives a pension – 21,120 rubles;

- to pay for housing and utilities for families with 3-4 children - 1103 rubles, with 5 or more children - 2205 rubles;

- For using a telephone, a family with 3 or more children is entitled to 264 rubles.

In addition, large Moscow families are also entitled to payments at the birth of the third child and subsequent children, timed to coincide with certain events. The amounts of such child benefits for large families:

- for a family with 10 or more children on International Family Day – 21,120 rubles annually;

- for a family with 10 or more children for Knowledge Day - 31,680 rubles annually;

- for the purchase of children's clothing for training - 10,560 rubles annually;

- parents awarded the Badge of Honor “Parental Glory of the City of Moscow” - 211,200 rubles at a time.

Child benefits for single mothers

Child benefits to single mothers are paid in accordance with current regulations. In Moscow, cash payments to single mothers for children are assigned in accordance with Decree of the Capital Government No. 1753-PP. The monthly child care benefit for a single mother (single father) is:

- for children under 3 years old 15,840 rubles;

- for children from 3 to 18 years old 6336 rubles.

Survivor's benefit for children

In Moscow, you can apply for a child survivor's benefit in accordance with City Government Decree No. 1753-PP. In the event of the loss of a breadwinner, a child is entitled to social benefits in the amount of 1,532 rubles per month; they are provided for disabled people from childhood to 23 years.

How to get child benefit

Each type of child benefits has its own design nuances, but the general scheme is the same. To receive social benefits for your first child or apply for another child benefit, you need to:

- Make sure there are grounds for receiving payments.

- Prepare and submit an application with documents attached to the employer, the MFC, the social protection authority and other authorized body.

- Receive notification of the results of the application review.

It is important not to miss deadlines for submitting documents. So, in order to receive maternity benefits for the birth of a child, you must submit an application no later than six months from the date of birth. If the deadline is missed, you will have to prove that this happened for good reasons.

If problems arise during the registration process, for example, the applicant is refused to accept documents, you need to call the child benefits hotline number. We also advise you to contact a professional lawyer for a free consultation; with our help, all problems will be solved.

Documents for obtaining child benefits

The list of documents for receiving child benefits depends on the type of payment. And even for one benefit, the list of required documents may differ depending on the specific situation.

So, when applying for child benefits after the birth of a child, you need a certificate of birth of the child and a birth certificate. When submitting an application through the MFC you will also need:

- passport;

- bank account details for transferring payments;

- employment history.

If the application is submitted to the employer, then you must additionally submit a certificate from the place of employment of the second parent (if he does not work, then from the social security authority) stating that he did not apply for benefits.

The list of documents and certificates for obtaining child benefits can be clarified in social security.

Registration deadlines

The period within which benefits or a decision on this issue is provided is no more than 10 days. You can be notified that the documentation is ready either by the phone numbers you left or by email.

Read also: Permissible noise level in Tyumen and the Tyumen region

In addition, you yourself can check the readiness of the documents on the official website using the registration number, which is indicated at the top of the receipt, which is issued to you after receiving your package of documents.

By typing the registration number in the appropriate column, you can check the status of the document, click “check readiness” and you will be told whether it is ready or not. Save your time and nerves by optimizing the procedure for receiving benefits through multifunctional centers that make your life easier.