Contents of the document

An application for payment of a lump sum benefit does not have a prescribed form or form. Therefore, it is written on a sheet of A4 paper in any form by hand with a ballpoint pen in compliance with the rules for drawing up standard documents containing a request to the organization.

The rules of office work list four main parts in the content of the application:

- addressee or “hat”;

- text of the appeal;

- description of applications;

- applicant's signature.

The following details are indicated in the header:

- full name of the organization where the document is being submitted;

- full name of the applicant in the genitive case;

- position indicating the structural unit, if applied at work;

- passport details and place of registration, if submitted to social security.

Between the addressee’s details and the text in the middle of the field, the word “application” is written in lowercase, followed by no punctuation.

The text of the appeal begins with the essence of the question: “I ask you to pay...., I ask you to appoint...”, then detailed information is indicated that reveals the question. For example, “in connection with the birth of a child...” and supplement with information:

- Child's full name;

- Date of Birth.

The “application” details must contain a list of attached documents. Typically these include:

- a copy of the child's birth certificate;

- certificate of birth of a child in form No. 24;

- a certificate from the second parent’s place of work confirming non-payment of benefits;

- other documents according to the situation.

The last mandatory detail, without which the application will not be valid, is the signature, transcript of the signature and the date the document was drawn up.

Monthly allowance for child care up to 1.5 years old 2020 | payment amount

Who is eligible to receive monthly child care benefits?

Article 256 of the Labor Code of the Russian Federation grants the right to take leave to care for a child up to three years of age to women who have given birth (adopted) a child.

In this case, child care benefits are paid only until the child reaches 1.5 years of age. If the child’s mother went to work earlier, care leave for up to 3 years can be granted to another close relative (father, grandmother, grandfather). Those. In fact, the right to receive a monthly child care allowance is given to the mother, father, guardian or other relative caring for a child under three years of age.

Where to apply for child care benefits

Citizens who are entitled to this type of child benefit can be divided into:

- officially employed;

- unemployed.

Employed citizens should apply with the necessary documents at their place of work.

Please note that starting in 2011, a new procedure was gradually introduced in many regions, according to which payment of benefits to working citizens is made by the branch of the Social Insurance Fund (FSS) at the place of residence. However, you should still submit documents to your employer. Unemployed citizens are issued and paid a monthly child care allowance at the social protection department at their place of residence (USZN).

If a citizen has the right to a monthly child care benefit and unemployment benefits, he can apply for benefits only on one of the grounds. In the meantime, the right to receive benefits remains if a citizen who is on parental leave, works part-time, at home, or decides to continue studying.

Often mothers confuse parental leave with maternity leave. Maternity leave (maternity leave) is assigned only to officially working mothers at 30 weeks of pregnancy and for a period of 140 calendar days. During this period, a woman receives maternity payments in the amount of 100% of average earnings. After the end of maternity leave, a woman begins maternity leave and is paid a monthly allowance for up to 1.5 years. If a woman does not officially work, a monthly allowance is assigned from the date of birth of the child. Learn more about all payments upon the birth of a child.

Payment amount

The law establishes the minimum monthly child care benefit in 2020. Unemployed citizens and employees with low incomes are paid exactly this amount, which since February 2020 is:

- 3277.45 rub. for the first child

- 6554.89 rub. for the second and subsequent

Note! These benefits will be indexed from January 1, 2020. More information about increasing payments

Amount of care allowance for officially employed citizens

For working citizens who are on parental leave, the monthly benefit is 40% of average earnings, but cannot be less than the minimum amounts specified above. In this case, the average daily earnings are determined based on income received for two calendar years preceding the year in which the right to benefits arose, and is divided by 730 or 731 (if one of the calculation years is a leap year).

You can use our monthly benefit calculator to estimate your benefit amount. (opens in a new window)

The maximum monthly child care benefit at the beginning of 2020 is RUB 27,984.66.

Unemployed mothers are entitled to a care allowance in the amount of 40% of their earnings if:

- were dismissed during pregnancy or during maternity leave due to the liquidation of the enterprise;

- dismissed during the period of maternity leave in connection with the husband's transfer from military units located outside the Russian Federation and transferred to the Russian Federation, or dismissed due to the expiration of the husband's employment contract in such military units.

Necessary documents for applying for child care benefits:

For employed citizens:

- application for parental leave;

- application for benefits;

- birth (adoption) certificate of the child being cared for and its copy,

- birth (adoption, death) certificate of the previous child (children) and its copy,

- a certificate from the place of work (study) of the second parent stating that she (he) does not use parental leave and does not receive this benefit.

For unemployed citizens:

- application for benefits;

- child's birth certificate;

- work book with a record of dismissal due to the liquidation of the organization during pregnancy, parental leave until the child reaches the age of 1.5 years;

- a copy of the order granting parental leave until the child reaches the age of 1.5 years (for those dismissed during the period of parental leave up to 1.5 years);

- information about average earnings from which the specified benefit should be calculated;

- certificate from the employment service about non-receipt of unemployment benefits.

Important points regarding the payment of monthly benefits from the law:

- Persons entitled to receive a monthly child care benefit on several grounds are given the right to choose to receive benefits on one of the grounds.

- The right to a monthly child care allowance is retained if the person on parental leave works part-time or at home, as well as in the case of continuing education.

- If maternity leave occurs while the mother is on maternity leave, she is given the right to choose one of two types of benefits paid during the periods of the corresponding leave.

- In the case of caring for 2 or more children before they reach the age of one and a half years, the amount of the monthly child care benefit is summed up. In this case, the summed amount of the benefit, calculated on the basis of average earnings, cannot exceed 100% of the specified earnings, but cannot be less than the summed minimum amount of the benefit.

Deadlines for applying for and paying monthly care allowance

You should apply no later than 6 months from the date the child reaches the age of one and a half years. Monthly child care benefits are assigned within 10 calendar days from the date of contacting the employer with the necessary documents.

We are collecting votes in support of the adoption of a bill to extend the period for payment of monthly child care benefits from 1.5 to 3 years

Pay attention to other child benefits that are established by Federal Law No. 81-FZ “On State Benefits for Citizens with Children”

+ — Maternity benefit (maternity benefits) Click to collapse

Paid for the period of maternity leave (maternity leave) more details...

+ — One-time benefit for the birth of a child Click to collapse

Assigned when applying for benefits within 6 months from the date of birth for each child more details...

+ — Benefit for those registered in the early stages of pregnancy Click to collapse

To receive benefits, you must register with an antenatal clinic before a certain stage of pregnancy. more details...

+ — One-time benefit if the husband serves on conscription Click to collapse

A one-time allowance for the pregnant wife of a military serviceman undergoing military service upon conscription is paid regardless of other child benefits more details...

+ — Monthly allowance if the husband serves on conscription Click to collapse

A monthly allowance for a child of a military serviceman undergoing military service upon conscription is paid regardless of other child benefits more details...

and:

+ — Regional measures to support families with children Click to collapse

Some regions of the Russian Federation have outlined additional measures to support families with children. more details...

+ — Maternity capital Click to collapse

A certificate for maternity capital is issued at the birth of the second and subsequent children, its nominal value is 466,617 rubles. These funds can be spent strictly on specific purposes. Read more...

+ - From 2020 - additional monthly benefit for families with low income Click to collapse

The payment amount is equal to the regional subsistence minimum per child. Attention: for the second child, the payment amount is deducted from the maternity capital funds. more details...

6554,89

Add-ons

Simply applying for government assistance is not enough. Since the essence of the document is to receive a one-time benefit, you must prove your right to it. For this purpose, there is an “Appendix” field in the content.

Additionally you need to submit:

- a copy of the child's birth certificate;

- a certificate from the second parent’s employer that he did not receive benefits;

- a certificate from the employment service that the second parent is unemployed;

- a certificate from the social security authorities that the second unemployed parent did not apply for or receive benefits;

- certificate from the place of study;

- an extract from the work record book, if the payment is prescribed by social security;

- a copy of your passport when receiving social security assistance;

- explanatory if both parents are unemployed and not studying.

Where to apply for payment of a lump sum benefit upon the birth of a child.

From February 1, 2020, when a minor joins the family, an allowance in the amount of 17,479.73 rubles is paid. This amount is indexed annually.

When calculating benefits, the date of birth of the child is taken into account, regardless of when the parents applied for payment of compensation.

For residents of the Far North and areas equivalent to them, regional coefficients apply, so the amount to be paid will differ.

The benefit is indexed every year on February 1, so in 2020 it will be increased.

It does not matter who the minor is in the family. The benefit is paid in the same amount for the first, second and subsequent children.

If several children are born in a family at once, then the payment is made for each of them.

Only one of the parents can receive the benefit (Law No. 81-FZ of May 19, 1995). Compensation is assigned to the mother, father, and guardians of the child.

In addition to Russians, foreign citizens temporarily or permanently residing in the country also have the right to receive it.

If the child’s legal representative is officially employed, he writes a job application for a one-time benefit.

If the parents are unemployed or retired, you must contact the local social security authorities for payment.

If the mother and father are officially divorced, only the person with whom the minor lives can receive compensation.

When the parents have not officially registered the marriage and paternity has not been recognized, the benefit is paid to the woman.

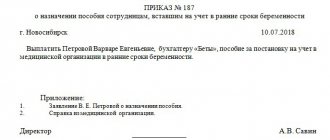

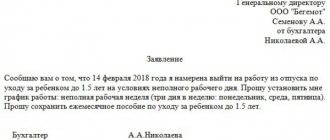

Sample application

There is no standard form for applying for a lump sum benefit upon the birth of a child. However, organizations have standard samples developed by the HR department or accounting department. Each social security agency offers its own developed template for completion.

Form for working citizens

Recommendation: when applying for benefits to the social security authorities, you need to write an application in two copies. One is handed over to an employee of the organization, and the second, which remains with the applicant, is marked with the date of receipt of the document. This will ensure control over the period for receiving benefits and help avoid unnecessary controversial issues.

.

Find out when they will transfer and how much EDV will be.

Main conditions for receiving benefits for children under 3 years of age

The basic conditions for receiving a monthly allowance for caring for a small child are set out in Law No. 305-FZ and in Articles 1, 6 of Federal Law No. 418.

- The innovations apply only to the 1st or 2nd child born or adopted no earlier than 01/01/2018.

- The income of 1 family member per month is no more than double the regional subsistence level (calculated for the 4th-6th month of the previous year).

- The child and his parents or guardians must be Russian citizens and permanently live in the country.

The mother has the right to apply for government assistance. If she is deceased or has limited rights, the money is received by the father, adoptive parents or guardians.

Federal Law No. 418 does not provide for the accrual of benefits for a third child. However, in some regions exceptions are made for large families. Conditions for receiving money:

- The family must be low-income.

- The region where she lives should receive subsidies to help parents with many children.

The amount of the benefit in this case is calculated in the same way as for the 1st or 2nd child.

Benefits for families with disabled children

| 2017 (RUB) | 2018 (RUB) | |

| Monthly compensation for the parent of a child under 23 years of age | 6000 | 12000 |

| Monthly compensation to the parent of a disabled child of groups 1 and 2, if he does not work | 6000 | 12000 |

From 02/01/2020, the payment for Muscovites will be increased exactly twice

In addition, new material assistance will appear: an annual compensation for the purchase of clothes for attending school, its amount will be 10,000 rubles.

To apply for benefits, you must contact the social protection department. A mandatory condition is a certificate from a pediatrician confirming the disability status.

Additional Information

- What payments and benefits are entitled to a disabled child?

- Read about benefits for caring for a disabled child in this article.

- Details about pension payments to disabled children are described on this page.

New amounts of other child benefits

New indexations of child benefits are planned from February 2020. The amounts will increase by 1.038 times. Young families will receive one-time payments from the Social Insurance Fund:

- For visiting an antenatal clinic before 12 weeks of pregnancy (Article 10 of Law No. 81-FZ) – 680.4 rubles.

- Upon receipt of a certificate of incapacity for work related to pregnancy and childbirth - 100% of the average salary (Article 8 of Federal Law No. 81 of 1995). Full-time female students receive a payment equal to the stipend, while contract employees receive a payment equal to their salary.

- For a child born after February 1 - one-time RUB 18,143.96. (Article 8 of Federal Law No. 81).

- Pregnant women whose husbands are serving in the Russian Army are entitled to reimbursement of expenses in the amount of 28,732.85 rubles. (Article 12.4 of the same law).

- The amount paid under the maternity capital certificate will be 453,026 rubles. (Clause 6 of Law No. 256-FZ of December 29, 2006).

The size of regular payments will also change. For caring for children under 1.5 years old, officially employed mothers will receive 40% of the average monthly salary for 24 months. The maximum amount is no more than 27,984.66 rubles. For wives of conscripts, the benefit will be 12,314.07 rubles. Additional payments are provided for single mothers with low incomes.