At the moment, there are several types of child benefits - both one-time and longer-term. In most cases, financial support coming from the state is in one way or another connected with the Social Insurance Fund and with the contributions that the citizen made to this organization. A benefit for up to 1.5 years is just such a payment option, in which the recipient’s employment status, as well as annual earnings, should be taken into account. We will tell you further about how benefits are calculated for up to 1.5 years.

Calculation of benefits up to 1.5 years

Who can receive child care benefits up to 1.5 years old?

There are no strict rules that would clearly stipulate that only the mother of the child can receive benefits. According to Article 256 of the Labor Code of the Russian Federation, the following relatives have the right to receive payments:

- mother;

- father;

- guardian;

- any other relative who is responsible for caring for the child.

Article 256 of the Labor Code of the Russian Federation

If several relatives are looking after a child at once, then only one of them will be able to count on benefits. In this case, the recipient of the benefit must be subject to social insurance and, before the birth of the child, make payments to the Social Insurance Fund, on the basis of which the benefit is based.

In most cases, child care benefits are received by the child's mother.

After the birth of a child, a woman has the opportunity to go on a three-year leave (this rule also applies to cases of adoption of a baby). However, payments are provided only until the child turns one and a half years old.

Features of receiving benefits

There are several nuances that it is advisable to know for those who apply for payments from the state:

- payments can be made by both the employer and social protection authorities, depending on the specific circumstances;

- The mother (or any other guardian) will be able to retain the right to receive child care payments if she does not go to work during the vacation period. The exception is working from home or working part-time;

If the mother goes to work, then child care benefits for children up to one and a half years old cease to be accrued.

- if a potential benefit recipient worked in two organizations at once, then the funds will be transferred to only one of them. The choice of the organization that will handle the payments also belongs to the employee himself;

- It often happens that two types of leave coincide at once - maternity leave and parental leave. In such situations, the mother does not have the right to use two benefits at once - she will have to make a choice in favor of one of two types of payments. You can read more about receiving benefits under the BIR below.

Maternity benefit

Legislative framework

The concept of paying money as part of the social protection of compatriots who have small children in the Russian Federation is reflected in the Federal Law of May 19, 1995 No. 81-FZ “On state benefits for citizens with children.”

The procedure for calculating, determining the amount and making financial payments is contained in the Order of the Ministry of Health and Social Development of the Russian Federation dated December 23, 2009 No. 1012n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children.”

If the deadline for obtaining benefits is missed, you should be guided by the provisions of Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2007 No. 74 “On approval of the List of valid reasons for missing the deadline for applying for temporary disability benefits, maternity benefits, and monthly child care benefits.”

How exactly average earnings are calculated to establish the amount of child benefit is set out in Decree of the Government of the Russian Federation of December 29, 2009 No. 1100.

To determine the amount of “children’s” payments, legislative documents relating to taxation and contributions to social funds are also used.

Who to contact for benefits

Depending on their employment, recipients of child benefits can be divided into two large groups:

- employed (this means officially employed citizens with a white salary and a work record book);

- unemployed.

In fact, the main difference between employed and unemployed citizens is whether a person pays insurance premiums to the Social Insurance Fund or not. Therefore, this division should be treated very conditionally. Thus, the following persons fall under the category of unemployed:

- unemployed (who do not receive monthly payments at the labor exchange);

- students;

- entrepreneurs who are not involved in paying contributions to the Social Insurance Fund, etc.

The amount of the benefit is determined by insurance contributions to the Social Insurance Fund

Depending on belonging to one or another category, the citizen’s path will be laid through different organizations:

- employees will contact, first of all, their employers and the human resources department , which will require certain documents to obtain benefits;

- unemployed citizens will deal with the social security at the place of registration.

How to receive benefits for an employed mother

If the mother is officially employed, applying for benefits takes place in two simple steps:

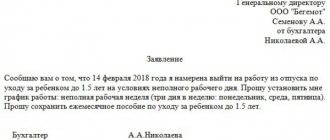

- An employee comes to the HR department and writes a free-form application, which states her desire to receive parental leave (up to 1.5 or up to 3 years - depending on the mother’s goals). The paper is filled out in the name of the general director of the company;

- After some time, the employee picks up a copy of Order No. 112 from the HR department, granting maternity leave. The order must indicate the start date of payments and the end date.

Sample application for parental leave

Required documents

In addition to the application, the employee will also need certain documents that confirm her status and guarantee that the application will be approved. Such documents include the following:

- birth (or adoption) certificate of the child for whom the payments are intended + copy;

- birth (or adoption) certificate of the eldest child (or children) + copy;

- a copy of the employee’s passport;

- a certificate from the child’s father, which confirms that the second parent does not receive any payments issued for the same child and does not use the required leave to care for him.

Sample of a child's birth certificate

If the benefit is issued to the father, a similar certificate may be required from the child’s mother - if she is also employed. This measure makes it possible to prevent the simultaneous receipt of child care benefits by two parents at once, which is not provided for by the laws of the Russian Federation.

Important! The application must be submitted no later than six months after the end of the BIR leave. The assigned payments should begin to arrive immediately the next day.

Cash assistance for children under 3 years old

Cash assistance for children under 3 years of age

A woman who will soon become the mother of a new citizen of the Russian Federation has every reason to rely on the state (employer) to provide financial assistance. This is about:

- benefits that are paid to pregnant women subject to certain conditions;

- looking after a child from birth to one and a half years;

- one-time payments at the birth/adoption of a baby;

- paid maternity leave;

- family (maternal) capital;

- monthly reimbursement.

Types of benefits, their size

| № | Name of child benefit | Conditions under which payment is made | Amount of cash benefits (rubles) |

| Benefits paid once | |||

| 1 | Early pregnancy recorded | If the expectant mother turned to a gynecologist and is observed by him from the first trimester of pregnancy, i.e. until the 12th week. | 628,47 |

| 2 | Maternity benefits or maternity benefits (B&R) | These payments are mainly received by working women (working experience of at least 24 months). In exceptional cases, payments are due to the non-working person, namely: • who received a settlement in connection with the liquidation of an enterprise; • female students, except for correspondence and evening courses; • military personnel. The amount of maintenance directly depends on the income of the pregnant woman for the previous 2 years (100% of average earnings are taken into account) and the duration of maternity leave: • with natural resolution of labor 140 days; • difficult 156 days; • multiple births 194 days; • adoptive parents of one minor (adopted child's age no more than 3 months) are provided with 70 days of leave, two or more - 110 days. | Benefit amount = average daily income * duration of maternity leave For example: Working 21 days a month, the expectant mother earned 21,000 rubles. Let's say wages haven't changed for the last two years. It turns out that the average daily income is 21,000 / 21 = 1,000 rubles. The birth occurred with complications, therefore, a vacation of 156 days was prescribed. It turns out that during maternity leave the woman in labor will receive 156 days * 1,000 rubles. = 156,000 rub. This amount is within the maximum and minimum limits, which means it will be paid in full. Min 43,615.65 Max 390 919.29 |

| 3 | At the birth/adoption of a child. | After the baby is born. | 16 759,09 |

| Adoptive parents, guardians of a minor/disabled child, two or more children. | 16 759,09/ 128 053,08 | ||

| 4 | To the wives of military personnel. | Women who are 25 weeks or more pregnant and whose husbands are serving. | 26 539,76 |

| 5 | Family (maternity) capital | Received after the birth of the second child. | 453 026 |

| Benefits paid every month | |||

| 6 | Child care from 0 to 1.5 years | According to the amount - 40% of the average monthly salary, choose the period - the last 2 years, but not less than the amount established by law. | Principle of calculation. First you need to find out the average salary. Suppose a woman received 25,000 rubles every month. We solve the usual proportion: 25 000 — 100% X - 40% X = 40 * 25,000 / 100 = 10,000 rubles. Min per child 3,142.33 Min on the second and subsequent 6284.65 |

| 7 | At the birth of the first or second child under 1.5 years of age | Innovation from January 1, 2020. Received by a family whose income is less than the regional subsistence level for the working population. | Regional cost of living |

| 8 | From 1.5 to 3 years | Unfortunately, the fixed amount paid from 1.5 years to the child’s third birthday has not been indexed for the last 20 years. But in some regions this law can be circumvented, or more precisely, additional monthly compensation can be issued. When kindergartens in the district are overcrowded, and for this reason a young mother cannot begin her work duties, the state reimburses 20% (first child) or 50% (second) of the amount that must be paid each month for attending kindergarten. There is no point in hoping to receive such a benefit if the spouse’s salary is enough to provide for the entire family. | 50 + regional coefficient |

| 9 | For children of military personnel | Wives of military personnel receive benefits for 3 years from the date of birth of the child. A prerequisite is that the father of the family is undergoing military service, so if he quits, payments stop. | 11 374,18 |

| 10 | Children living in unfavorable ecological zones | Child age 0–18 months | 3 241,05 |

| Child age 18-36 months | 6 482,10 | ||

| 11 | For the fifth family member until he turns 3 years old | At the subsistence level - depends on the region. | 8 247–22 222 |

What happens if maternity leave is interrupted?

It is common for a modern woman to build a career. As a rule, childbearing age and the beginning of career advancement coincide. Lack of time for the work process or the desire to maintain her current position encourages a new mother to leave maternity leave prematurely.

There are other reasons when a woman is forced to work without having time to fully enjoy the joy of motherhood:

- difficult life situation;

- the family is in poverty - the benefits paid are not enough to support loved ones, especially for single mothers and young mothers caring for disabled people.

If you interrupt maternity leave

, of course, you will have to ask grandmothers, relatives, or hire a nanny for the baby, but more often the salary is higher than such costs.

In the situations described above, the calculation and payment of child care benefits from 0 to 1.5 years is not carried out.

At the same time, no one forces you to work all day; it is quite legal to shorten it or do work at home. You just need to sign an agreement with the employer and clearly state the working conditions:

- agree on earnings;

- stipulate the number of working days;

- indicate possible working hours and length of the working day.

Such cases are provided for by law and do not imply termination of payments.

Where do they calculate benefits and the list of required documents?

First, let's find out who is entitled to benefits:

- all working women;

- who received a settlement due to the liquidation of an enterprise;

- female students (full-time education);

- women military personnel, wives of military personnel;

- representatives of the fair sex working in a military unit as civilian personnel.

The payment is made depending on the category into which the woman falls: through the Social Insurance Fund (SIF) or by government agencies.

So, for example, in order to receive the BiR allowance, to which not only citizens of the Russian Federation, but also working foreign women are entitled, you need to contact the company’s accountant. Among the required documents you must provide:

- sick leave, closed in the antenatal clinic;

- application for payment;

- maternity passport;

- document on the amount of salary;

- account number to which funds will be transferred.

When contacting the FSS directly, they may require:

- maternity passport;

- a certificate proving the absence of such payments - necessary for those who apply for benefits at a location other than their place of registration;

- certificate 182 n;

- certificate issued by the employment service;

- work book.

Draw your attention to! Only a woman who is carrying a child can apply for BiR benefits.

Important! The full name in the passport and marriage certificate must be identical. The document requires timely replacement.

You should contact the organization whose entry is last in the work book when:

- a young mother quit her job one month before her labor and employment leave;

- moves because her husband is transferred to work in another area;

- looks after a disabled person of group 1.

If it is not possible to find an employer, the company’s accounts are under arrest, or the bankruptcy process of the organization where the woman worked has been launched, then you will have to go to court to prove the impossibility of receiving funds from the place of work. The court decision allows you to apply for benefits through the Social Insurance Fund.

Often the fair half of humanity works simultaneously in several organizations. Provided that she is officially employed and has worked for at least 24 months, a woman has the right to receive payments from each employer.

A future woman in labor who managed to visit a gynecologist before three months of pregnancy (12 weeks) has every reason to receive such a payment along with the BiR benefit. It is required to provide a corresponding application and a certificate indicating the exact date of registration with an obstetrician-gynecologist.

After maternity leave, as a rule, mothers receive benefits, which are paid until the baby is one year and 6 months old. It is worth noting that any family member who is ready to care for the baby (mother, father, grandmother, guardian) has the right to receive such payments.

To register the content, you must provide the following documents at your place of employment:

- statement;

- passport of both parents (original and copies);

- baby’s birth certificate (original and copies);

- a certificate confirming the absence of such payments from the second parent;

- a certificate from the registry office, which is issued during the registration of a new citizen (form F 24);

- details for transferring funds.

The remaining citizens who have every reason to pay benefits, but are currently not working, provide to the USZN:

- a written request to pay funds;

- passport of both parents (original and copies);

- a certificate confirming residence with the child;

- work book, certificate, or other document confirming the lack of work of the child’s parents;

- certificate on the number of family members;

- a certificate confirming the absence of such payments to the second parent.

Parents write a corresponding application for leave and payment of benefits at the same time.

If the baby’s father goes on maternity leave, the mother writes a corresponding statement about voluntary renunciation of maternity leave.

Parents who have adopted a child must present:

- Identity documents (mom and dad);

- birth certificate;

- court statement.

The family of military personnel submits to the USZN: their documents (both parents), the child, and also provide a document that confirms the parent’s service.

How to receive payments to an unemployed mother

Obtaining financial support for child care for an unemployed mother will be somewhat more difficult, since more documents and certificates will be required. We remind you that not only parents, but also relatives can receive benefits - only in those circumstances in which parents are unable to fulfill their duties due to:

- poor health;

- of death;

- deprivation of parental rights;

- stay in places of deprivation of liberty;

- abandonment of the child.

Unemployed mothers receive child care benefits through social welfare departments

In order to receive benefits, an unemployed mother should come to the district social protection office and write a corresponding application. Consideration of such applications takes employees about a week and a half.

Required documents

The following set of documents will be required for the application for financial payments for the baby:

- child's birth certificate;

- work book (if available). Relevant for cases where an employee is fired during maternity leave due to the liquidation of the organization;

- information on average earnings (on the basis of which benefits will be calculated) - applies to mothers with work experience;

- a document confirming the fact that the mother does not receive unemployment benefits and is not a member of the labor exchange;

- a certificate from the child’s father, which confirms that the second parent does not receive any payments issued for the same child and does not use the required leave to care for him;

- account number.

Information about average earnings allows the accountant to calculate the amount of future benefits

If the mother was fired for some reason during the period of leave, she will also need to provide a photocopy of the order granting leave to care for the baby until he reaches one and a half years old.

Video: Child care benefits for unemployed women

Documents for obtaining benefits

Payments of child care benefits will begin from the moment the package of documents is submitted to the relevant authorities. Today, the legislation of the Russian Federation has adopted a unified list of necessary documents, which it is best for pregnant women to collect in advance before the birth of the baby.

Women who have taken maternity leave from their official place of work must provide the following package of documents:

- — A copy of the passport of a citizen of the Russian Federation.

- — Certificate and copy of the birth or adoption of the child.

- — Application for parental leave addressed to the head of the organization.

- — Birth or adoption certificate, as well as death certificate of previous children.

- — A certificate from the spouse’s place of work stating that child care benefits are not accrued to him.

- — Application for the accrual of benefits.

To apply for child care benefits for women or other unemployed relatives, as well as those who do not receive unemployment benefits, the following package of documents must be provided:

- — Original and copy of the work book with a record of the last place of work. Dismissal at your own request or dismissal due to liquidation of the organization during pregnancy.

- — Application for accrual of child care benefits.

- — For those who were fired during parental leave, it is necessary to submit a copy of the order granting leave.

- — Certificate of average income level, taking into account the amount of benefits that will be calculated.

- — Child’s birth certificate.

- — A certificate from the labor exchange or employment authorities stating that unemployment benefits are not being paid.

Benefit amount

There is no single amount of benefit that the child’s parents can be guaranteed to receive. There is a rule according to which, when calculating payments, forty percent of the average salary of the benefit recipient is taken. At the same time, the average values are calculated based on wages for the last two years worked.

By the way! If in the previous two years the recipient of the benefit was in a DO, then other years can be taken as calculation years - this will contribute to an increase in the benefit. In order to change the accounting years, you must write an additional application and send it to the accounting department.

An example of calculating benefits for child care up to 1.5 years

Only in rare cases are monetary amounts fixed - this applies, first of all, to parents or guardians who did not make monthly payments to the Social Insurance Fund (usually deducted from each salary). You can see the details of the benefit calculation in the image below.

At the same time, we can talk about such concepts as minimum and maximum benefits. The calculation of minimum and maximum values is based on the minimum wage or minimum wage.

Smallest payouts

As in 2020, in 2020 the minimum wage is 11,280 rubles. To calculate the minimum allowance for the first child, we will need to take forty percent of this amount. 11,280*0.4 = 4,512 rubles. Regardless of the exact status of the recipient of payments, social protection authorities do not have the right to give him a smaller amount. The lower threshold of payments for the second child is 6,285 rubles.

The size of the minimum payments depends on the current minimum wage

It is important to keep in mind that there is such a thing as a regional coefficient, which has a direct impact on the amount of payments. Therefore, each site is expected to have its own financial support.

Largest payouts

This type of benefit does not have an upper limit as such. However, it has limitations - based on daily earnings and insurance premiums. For 2020, the highest possible average monthly earnings (to receive benefits) is approximately 65,500 rubles.

Form for calculating the maximum base for calculating insurance premiums

Based on these data, calculating the maximum benefit is very easy. 65,500*0.4 = 26,200 rubles. Of course, there are citizens with high salaries, but the Social Insurance Fund is not able to reimburse large amounts, since there is such a thing as a maximum base for calculating insurance premiums. This value is not static and changes every year, which must be taken into account when calculating payments.

Table 1. Dynamics of the maximum base for calculating insurance premiums in recent years

| Year | Maximum base for social contributions (rub.) | Maximum base for pension contributions (RUB) |

| 2017 | 755 000 | 876 000 |

| 2018 | 815 000 | 1 021 000 |

| 2019 | 865 000 | 1 150 000 |

Purpose of benefit

The money will be paid upon the birth of the child. To do this, you need to confirm the fact with a birth certificate. A copy of the document is provided to social security or at the place of work.

Working parents in 2020 will receive 40% of their average monthly salary. Payments are made by the employer, but they are compensated by the Social Insurance Fund. The state has established a minimum and maximum benefit amount.

| № | Recipient category | Amount from 01/01/2020 | Amount from 02/01/2020 |

| 1 | Working persons | The minimum set for the first one is RUB 4,852.00. The minimum set for the second is RUB 6,554.89. The maximum installed is RUB 27,984.66. | The minimum set for the first one is RUB 4,852.00. The minimum set for the second is RUB 6,751.54. The maximum installed is RUB 27,984.66. |

| 2 | Contract military personnel and citizens discharged during parental leave or BIR leave | The maximum established is 11,863.27 rubles. | The maximum established is RUB 12,219.17. |

| 3 | Unemployed persons | For the first - 3,277.45 rubles, for the second - 6,554.89 rubles. | For the first - 3,375.77 rubles, for the second - 6,751.54 rubles. |

From June 1, 2020, it was decided to increase the minimum amount of this child benefit to 6,751.54 rubles. From this moment on, the size of the payment will not depend on the birth of the child in the family. Parents of both the first and second children will receive the same amount.

If a woman does not work, then she has no accountable income. Therefore, the amount of payments is set by the state. In 2020, a non-working mother will receive 3,375.77 rubles to care for her first child, and 6,751.54 rubles for her second child.

Other types of monthly child benefits

The difficult situation with coronavirus in 2020 led to the introduction of temporary monthly measures to support families with young children:

- monthly payment to children under 3 years old of 5,000 rubles in April, May and June;

- monthly additional payment of 3,000 rubles for each child under 18 years of age to unemployment benefits in April, May and June.

We calculate payments

There are special calculators to determine the amount of financial support from the state, but if you wish, it is possible to calculate payments manually. To do this you will need the following formula:

Formula for calculating benefits up to 1.5 years

A clear example of calculations

Now let's try to apply the above formula in practice.

Example. Elena worked in the same place for 4 years, after which she went on maternity leave on February 25, 2019. On the same day, she wrote an application for a monthly child care benefit.

When calculating the amount of payments, income for the two previous years was taken:

- In 2020, Elena’s annual income was 720,000 rubles;

- In 2020 – also 720,000 rubles.

When calculating benefits, it is important to take into account the number of days spent on sick leave

Considering that Elena did not go on sick leave, we can calculate her average earnings by adding up her income for two years and dividing by the number of days worked:

(720,000+720,000) /731 = 1970 rubles.

Now that we know Elena's average earnings, we can easily plug it into the formula.

P = 1970 * 30.4 * 0.4

P = 23,955 rubles.

Considering that this amount is less than the maximum benefit, Elena will be able to receive it in full.

Calculator for calculating benefits for child care up to 1.5 years

Go to calculations

Benefit payment terms

As mentioned earlier, the time for writing an application for benefits is limited and is six months (from the moment the child turns one and a half years old). If the mother or any of the guardians does not take any action within the specified time period, she will no longer be able to take advantage of financial support from the state.

Social security authorities send payments by Russian Post

The benefit is assigned within 10 days from the date of sending the application and all accompanying documents. If the employer pays the mother, the time of payments will coincide with the time of payroll. If the benefit is calculated through social protection authorities, then the benefit can be sent in two ways:

- by mail;

- through credit organizations.