In our material today, we will tell the reader about the procedure for deregistering UTII and the rules for filling out the corresponding application. At the bottom of the page you can apply for deregistration of UTII. The rules and documents in force in 2020 remain unchanged for 2020. The registration and removal of UTII payer occurs on the basis of applications.

If you are a UTII tax payer, a situation may arise when your commercial activity is outside the terms of application of this type of taxation. For example:

- refusal of a type of activity for which a special UTII taxation regime can be applied;

- in connection with the expansion of the volume of business activity, i.e. the area of the trading floor was increased and now exceeded 150 sq.m.;

- the share of participation in other organizations was more than 25 percent;

- at the end of the tax period, the average number of employees exceeded 100 people.

In the first case, within five days after the above changes you must submit an application for deregistration of UTII. Various application forms have been developed for organizations and individual entrepreneurs. In other cases, you go beyond the scope of applying UTII, thereby violating the rules for applying UTII. An application for deregistration in case of violation of the procedure for applying UTII is submitted no later than the last day of the month of the quarter in which one of the three violations described above was discovered.

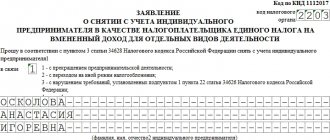

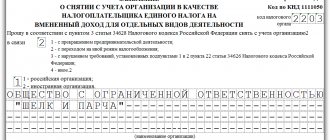

For organizations - Form UTII 3 (Application for deregistration of an organization as a taxpayer of a single tax on imputed income for certain types of activities (Form No. UTII-3). The deregistration of individual entrepreneurs from the register of UTII is regulated by Order of the Federal Tax Service of Russia dated December 11, 2012 No. MMV -7-6/94.

For individual entrepreneurs - UTII form 4 (Application for deregistration of an individual entrepreneur as a single tax payer on imputed income for certain types of activities (Form No. UTII-3). Deregistration of a legal entity from UTII registration is regulated by the Order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941.

Deadlines for deregistration of UTII

Based on your application, within 5 working days from the date of receipt, the tax office issues or sends by mail, depending on how you indicate in the application, a notice of deregistration, which will indicate the date of your deregistration.

Please note that this date will be the date you indicated in the application. That is, in the application you indicate the date of your removal from the special tax regime and the reason for terminating your activities or switching to another tax regime.

If you violated the deadline for submitting an application for deregistration of UTII due to termination of business activity, then the date of deregistration will be the last day of the month in which the application was submitted. For you, this will mean that you are required to pay tax for the entire last month, and not for the actual time of activity in this month (Tax Code of the Russian Federation, clause 10, article 346.29).

You have the right to voluntarily switch to a different taxation regime only from the beginning of the year, if you maintain the types of activities for UTII.

Switch to a different taxation regime during the year if during the year you cease activities subject to single taxation and begin to carry out another type of activity. In this case, the application for deregistration of UTII must contain the date of termination of this type of activity.

But if you have committed at least one violation, which is described above, then it is already your responsibility to switch to a different taxation regime from the last day of the month of the tax period in which violations of the requirements established by subparagraphs 1 and 2 of paragraph 2.2 of Article 346.26 of the Tax Code of the Russian Federation were committed.

Do not forget to provide a UTII declaration after you have deregistered as a UTII payer. The deadline for filing a UTII declaration in case of deregistration does not differ from the usual deadline for submitting a declaration, namely until the 20th day of the first month following the reporting quarter.

After deregistration, you must submit a declaration to the inspectorate with which you were registered as an “imputed person.” There are, for example, situations in which the inspectorate where you were registered as a UTII payer refuses to accept the declaration after you have been deregistered from the UTII register. For example, you deregistered on October 10, 2020. The deadline for submitting the declaration for the third quarter is January 20, 2020. Therefore, you have the right to submit a declaration before the end of this period, but by the time you submitted the declaration, the inspectorate had already removed you from the register and transferred your tax payer card to your main Federal Tax Service Inspectorate, at the place of your registration, and refuses to accept the declaration. In this case, the inspection's actions are illegal. This was stated in the Letter of the Federal Tax Service dated March 20, 2015. No. ГД-4-3/ [email protected] If you are faced with such a situation, you have the right to file a complaint, referring to the above letter from the Federal Tax Service.

A single tax on imputed income

An application for switching to the simplified tax system is submitted to the tax office in 2 copies (for Moscow - in 3 copies), one of which, already marked as accepted, must be returned. It must be preserved.

The moment of transition from UTII to the general taxation system depends on the reason for abandoning the special tax regime.

Organizations and individual entrepreneurs can voluntarily renounce UTII only from the beginning of the next calendar year. Consequently, in this case, the transition to a general taxation system is possible no earlier than January 1 of the next year. Section 4. To be completed only if you submit the application not in person, but through a representative with a notarized power of attorney or by mail.

The organization has engaged in activities in which it is impossible to apply the simplified tax system (for example, it began to produce a group of excisable goods or runs a gambling business).

The Federal Tax Service refused to close the individual entrepreneur because the entrepreneur had a debt under UTII - 448 rubles 55 kopecks - and the tax service considered that the entrepreneur first needed to go through bankruptcy proceedings.

When closing one store, the procedure is clearly stated in the tax legislation (clause 10 of article 346.29 of the Tax Code of the Russian Federation).

This fact must be notified to the tax authority territorially authorized to carry out actions at the place of residence of the individual entrepreneur within the specified time frame, otherwise the individual entrepreneur will be assigned a general tax regime.

For registered individual entrepreneurs or LLCs, a notification can be submitted:

- immediately along with other documents upon submission;

- within 30 days from the date of registration of an individual entrepreneur or LLC.

Therefore, based on the explanations of officials, UTII for a closed store should be calculated for the period from the 1st day of the quarter to the date when the outlet was closed.

Therefore, it is better to submit such an application in order to avoid possible claims from the inspectorate during the inspection. The main thing is to remember: in the application you need to enter the withdrawal code - 4. If you indicate a different number, the company (IP) will be deregistered as a UTII payer, and as a result, another object that continues to work will be deregistered.

5 working days after submitting the application, the tax office must issue a notice of application of UTII or a refusal. But inspectors do not always comply with this formality.

When submitting documents in person, take your passport with you. In this case, the inspector will issue a receipt with a signature, date and stamp - it confirms that you have submitted the documents.

You can send an application for registration under UTII by mail, the main thing is to meet the deadline for submitting the application.

The information on the site is provided for informational purposes only. Please consult with an attorney before making any decisions.

It is enough to meet the deadline determined by regulatory documents: the start of using UTII must be reported within 5 working days. In practice, for a newly registered individual entrepreneur to switch to UTII, an application must be submitted to the inspectorate within 5 working days from the date of registration.

The information on the site is provided for informational purposes only. Please consult with an attorney before making any decisions.

You can start using imputation both when registering an individual entrepreneur by submitting an application along with a package of documents, or by switching to it from another tax regime.

The procedure for filling out an application for deregistration of UTII

The procedure for filling out an application for deregistration of a UTII payer is described in Order of the Federal Tax Service of the Russian Federation dated December 11, 2012 No. ММВ-7-6/ [email protected] ). This application does not represent anything complicated or different from the procedure for filling out documents of this category. Let's dwell on just one point. This is the definition of the code for the reason for deregistration of UTII.

When filling out the application, you will be asked to choose one of four codes:

- “1” – if business activity is terminated;

- “2” – if there is a transition to a different taxation regime;

- “3” – if the requirements for the use of UTII established by paragraphs 1 and 2 of paragraph 2.2 of Article 346.26 of the Tax Code of the Russian Federation are violated;

- “4” – if the basis is not any of the above points.

The first 3 codes do not raise any questions. Let's find out under what circumstances to use the number 4 in this statement.

Code 4 must be set in one of the following cases:

- upon termination of one or more types of activities from those that are carried out by him on UTII;

- when changing the address at which the type of activity is carried out.

Title page

The title page of the application is filled out by the taxpayer, except for the sections “To be completed by a tax authority employee”

and

“Information about deregistration”

.

"TIN" lines

and

“KPP”

are filled in automatically from the client’s registration card in the “SBIS” system. The page serial number is also indicated automatically.

In the “tax authority code”

The code of the tax authority to which the application is submitted is indicated.

In the field “I request, in accordance with paragraph 3 of Article 346.28 of the Tax Code of the Russian Federation, to deregister the organization in connection with”

The reason for deregistration is indicated:

“1” - if the organization ceases the imputed activity as a whole;

“2” - in connection with the transition to another taxation system;

“3” - if the organization violated the terms of application of UTII;

“4” - if the organization closes a separate type of activity for which UTII was applied.

In a separate field, “1” is indicated if the application is submitted by a Russian organization and “2” if it is submitted by a foreign organization.

When filling out the line “name of organization”

The name of the organization is reflected, corresponding to the one indicated in the constituent documents. By default, this detail is filled in automatically in the program in accordance with the name specified in the taxpayer’s registration card.

In the "OGRN"

the main state registration number of the organization is indicated, which can be found in the certificate of state registration of the legal entity.

Attention! Field “OGRN”

Only Russian organizations can fill this out.

In the field “Date of termination of application of the taxation system in the form of a single tax on imputed income for certain types of activities”

the end date of the organization’s application of the taxation system in the form of UTII is indicated.

Attention! The date of termination of UTII application is not filled in if the organization indicated code “3” as the reason for deregistration.

In the field “Annex to the application is drawn up on ___ pages”

The number of pages of the attachment to the form of this application is automatically indicated.

When filling out the indicator “with a copy of the document on ___ sheets attached”

the number of sheets of a copy of the power of attorney confirming the authority of the representative of the organization is reflected (if the application is submitted by a representative of the organization).

In the section of the title page “I confirm the accuracy and completeness of the information:”

indicated:

“3” - if the application is submitted by the head of the organization,

“4” - if the document is submitted by a representative of the organization. In this case, the name of the document confirming the authority of the representative is indicated and a copy of the specified document is attached.

In the field “last name, first name, patronymic in full”

The full name of the head or other representative of the organization is indicated.

In the "TIN"

The TIN of the head or other representative of the organization is indicated.

When filling out the “Contact phone number”

The telephone number at which the taxpayer can be contacted is indicated.

Also on the title page, in the field “I confirm the accuracy and completeness of the information”

The date is automatically indicated.

This might also be useful:

- Coefficients K1 and K2 UTII for 2020

- Changes in UTII for individual entrepreneurs in 2020

- UTII for individual entrepreneurs in 2020

- Codes of types of entrepreneurial activity UTII

- Retail trade on UTII in 2020

- Calculation of UTII for less than a month in 2020

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Transition to UTII when registering an individual entrepreneur

And also, due to a violation of the conditions for applying UTII in terms of the number of employees (no more than 100 people) and the structure of the authorized capital (the share of participation of other organizations should not exceed 25%).

When a citizen registers with the Federal Tax Service as an entrepreneur, he has the right not to use the general taxation regime, but to immediately switch to one of the preferential ones, which gives a lower tax burden. One of these popular modes is imputation. To use it, you need to fill out and send an application for UTII registration to the tax service.

The application form for approval of tax registration of an individual entrepreneur as a payer of a single imputed tax is established by the federal tax inspectorate.

Currently, UTII payers are not required to report to the tax authority at the place of registration about any changes in previously reported information about the types and locations of activities.

Sometimes it is necessary to leave the simplified tax system due to legal requirements. In 2020, this also becomes relevant if the individual entrepreneur decided to become self-employed, and previously he used the simplified tax system.

Let’s say that an individual entrepreneur ceased operations (the corresponding entry was made in the register) on February 1, he must submit a declaration by April 20, indicating the tax period code on the Title Page - 51.

And here it is the second situation that does not cause difficulties: the company (individual entrepreneur) is not deregistered as a UTII payer when one of the stores registered in one inspection is closed, which means it reports the “imputed” tax in the same manner. That is, the declaration is submitted within the general deadlines, to the same tax office with which the company (IP) continues to be registered as a UTII payer.

There is this “Single tax taxpayers have the right to switch to a different taxation regime provided for by this Code from the next calendar year, unless otherwise established by this chapter.” — You can leave UTII starting next year.

We paid taxes regularly, submitted a report for the 1st quarter, according to UTII, as it turned out, I did not write an application for UTII and I was fined 10,000 rubles (When registering an individual entrepreneur, I asked if anything else needed to be done, they told me that they automatically send out all the documents (Is it possible challenge this situation and not pay the fine(???

What is meant here is not the OKVED code, but the code from the annex to the UTII declaration. For example, 01- “Providing household services.

Employees must be notified of dismissal in advance. This is usually done two weeks in advance, unless a different period is specified in the employment contract. The notice is drawn up in any form and issued to employees against signature.

An individual entrepreneur has the right not to indicate information about income and the cost of fixed assets in the notification. But after the transition to the simplified tax system, the limit is 150 million rubles. (both in terms of income and cost of fixed assets) they must comply on an equal basis with companies so as not to fall out of the special regime.

How to apply for UTII: submission deadlines

The deadline for submitting “liquidation” declarations depends on what taxation regime the individual entrepreneur applies.

The document in which the businessman reports the choice of imputation is called an application for registration, although, by analogy with the simplified tax system, some use the term “notification of transition to UTII.”

The tax authority, within the established five-day period from the date of receipt of the application from the individual entrepreneur, issues a notice of registration as a UTII tax payer. The start date of the UTII taxation system is the date recorded in the application for registration.

The basis for this point of view is Article 346.26 of the Tax Code of the Russian Federation, according to which UTII is applied along with the general taxation system and other regimes. At the same time, the word “along with” is interpreted as “together” or “simultaneously”, so imputation alone cannot be used.

About the nuances of taxes when closing an individual entrepreneur | ayudar info

Grishina O.P., magazine editor

To carry out (or not to carry out) entrepreneurial activities as an individual entrepreneur - each individual makes this decision independently. It must also independently choose the taxation regime (for example, simplified taxation system) that will be applied to the business activity being carried out.

Moreover, within one calendar year you can register as an individual entrepreneur, then deregister from tax registration and then register again. Current legislation allows such metamorphoses of the status of an individual. From the point of view of tax legislation, there are also no prohibitions in this regard.

However, there are a number of tax-related nuances that need to be taken into account.

Rules for registering an individual as an individual entrepreneur

The procedure for state registration of an individual entrepreneur is regulated by Chapter. VII.1 of Law No. 129-FZ[1].

Registration of an individual as an individual entrepreneur is carried out on the basis of his application and documents attached to it (their full list is given in Article 22.1 of the said law). The procedure for submitting these documents is determined by Art. 9 of Law No. 129-FZ.

The moment of state registration of an individual entrepreneur is recognized as the entry by the registering authority (IFTS) of the corresponding entry into the Unified State Register of Individual Entrepreneurs (clause 2 of Article 11 of Law No. 129-FZ). At the same time, registration itself as an individual entrepreneur is carried out within three working days from the date of submission of documents for registration (clause 3 of article 22.1 of Law No. 129-FZ).

For your information

An entry sheet in the Unified State Register of Individual Entrepreneurs in the form approved by Order of the Federal Tax Service of Russia dated September 12, 2016 No. ММВ-7-14/ [email protected] , individual entrepreneurs can currently only receive in the form of an electronic document sent to the email address specified in the Unified State Register of Individual Entrepreneurs and (or ) in the application submitted for registration (clause 3 of article 11 of Law No. 129-FZ). An individual entrepreneur can receive paper documents confirming the contents of electronic documents only on the basis of a separate request.

The grounds for refusal to register an individual entrepreneur are provided for in paragraph 1 of Art. 23 of Law No. 129-FZ.

In addition, in paragraph 4 of Art. 22.1 of this law contains additional grounds on which state registration of an individual as an individual entrepreneur is not permitted.

In particular, it is not allowed if the state registration of the same person in this capacity has not expired or a year has not elapsed from the date the court made a decision declaring him insolvent (bankrupt) due to the inability to satisfy the claims of creditors related to his previously carried out business activities , or a decision to forcibly terminate his activities as an individual entrepreneur, or the period for which this person is deprived of the right to engage in entrepreneurial activity by a court verdict has not expired.

Accordingly, the state registration of an individual as an individual entrepreneur loses force after making an entry about this in the Unified State Register of Individual Entrepreneurs, with the exception of certain cases (clause 9 of Article 22.3 of Law No. 129-FZ). Termination of registration as an individual entrepreneur, as a general rule, is also carried out on the basis of an application from an individual (clause 1 of the said article), within no more than five days from the moment of his application to the registration authority (clause 1 of Article 8 of Law No. 129-FZ).

It is appropriate to note here that the provisions of Law No. 129-FZ do not define a minimum period of time for re-registration of an individual as an individual entrepreneur if the entrepreneur previously lost such status by his own decision. And if we take into account the rather simple procedure for registering an individual (termination of registration) as an individual entrepreneur and the short deadlines provided for these procedures, it turns out that under such circumstances an individual can acquire and lose the status of an individual entrepreneur several times during the year.

However, using this mechanism for tax optimization purposes (for example, to change the object of taxation under the simplified tax system in the middle of the year) is dangerous. There are a number of tax risks associated with re-registration as an individual entrepreneur.

Expenses relating to the period of the previous business

Consider the following situation. An individual entrepreneur using the simplified tax system (taxable object “income minus expenses”) purchased and paid for goods. Then he registered the termination of the status of an individual entrepreneur and entrepreneurial activity, and subsequently registered again as an individual entrepreneur and at the same time submitted to the Federal Tax Service a notification about the application of the simplified tax system from the moment of registration (repeated). Does such an individual entrepreneur have the right to take into account, when calculating the “simplified” tax, the costs that he previously incurred for the purchase of goods?

Theoretically, these expenses can be taken into account by “simplified” companies during taxation after the sale of goods to buyers, provided they are paid to the supplier (clause 23, clause 1, article 346.16, clause 2, article 346.17 of the Tax Code of the Russian Federation). But the situation under consideration is not directly regulated by tax rules. In this regard, it makes sense to refer to Letter No. 03‑11‑11/65270 dated August 26, 2019, in which financiers argue as follows.

According to paragraph 2 of Art. 346.17 of the Tax Code of the Russian Federation, expenses of a taxpayer using the simplified tax system are recognized as expenses after their actual payment.

The specifics of calculating the tax base when an individual entrepreneur switches to the simplified taxation system from other taxation regimes and when switching from the simplified taxation system to other taxation regimes are established in Art. 346.25 Tax Code of the Russian Federation.

How to notify the tax office

In case of a voluntary transition, a notification to the tax service must be submitted no later than January 15 of the year in which the transition is planned. If you decide to change the regime later than this period, then the transition is possible only next year. The recommended form of notification is 26.2-3. Submission of a tax return payable in connection with the application of the simplified system and payment of the tax is carried out within the usual deadlines:

- for organizations - no later than March 31 of the year following the expired tax period;

- for individual entrepreneurs - no later than April 30 of the year following the expired tax period.

In case of termination of an activity in respect of which the simplification was applied, it is necessary to submit a notification within 15 working days after the relevant decision is made.

Consequences of temporary suspension

We should not forget that the suspension of an organization’s activities does not terminate the powers of its leader. He retains the right to act on behalf of the legal entity, which makes it possible to represent the interests of the LLC in disputes with tax authorities and negotiate with counterparties. The main thing is that all transactions are completed after the pause in work ends.

Knowing how to formalize the suspension of LLC activities correctly, managers and business owners have a real opportunity to survive difficult times and gather strength for the further development of the company. It is important to remember that the suspension of banking operations for a period of more than a year and failure to submit reports may lead to the exclusion of the company from the Unified State Register of Legal Entities at the initiative of the Federal Tax Service.