Who submits UTII declarations

All categories of taxpayers who apply the SNO “Unified Tax on Imputed Income” in the reporting period are required to report on imputation. Both organizations and individual entrepreneurs are required to submit reports to the Federal Tax Service.

If a taxpayer combines several tax regimes, for example, the simplified tax system and UTII, and “imputation” is not the main regime, he will have to submit a declaration to the Federal Tax Service. Otherwise, problems with the inspection cannot be avoided.

It makes no difference to controllers whether the taxpayer received income during the reporting period or not. This does not affect the reporting in any way: the distinctive feature of “imputation” is that the tax is calculated on the planned income. Actual performance doesn't matter.

UTII-4. Application for deregistration of an individual entrepreneur as a payer of UTII

Taxation on imputed income is a voluntary regime that an enterprise can choose for itself (or refuse) without special instructions. When ceasing activities under “imputation”, individual entrepreneurs are required to submit the UTII-4 form to the tax authorities . It is also used when not all activities are stopped.

Sample filling and blank form of UTII-4 form

Using the form

The main function of the UTII-4 form is to show that the individual entrepreneur is going to stop paying a single tax on imputed income. Therefore, the application is associated with the end of the entrepreneurial position. However, this is not always true.

Often the need to fill out UTII-4 is associated with a transition to another taxation system. Then the date of this transition must be indicated on the title page. After the application is processed by the tax authorities, the UTII regime will cease on the specified date.

Another reason is the excess of the limits established by law for individual entrepreneurs on a single tax. In this case, it is also assumed that you will switch to another system, however, in the process of filling out the form, you will see that these reasons have different codes.

Filling Features

- When printed, fill out the form with a blue or black ballpoint pen. For electronic reporting, the 18-point Courier New font is used. Letters are in capitals.

- In all graphs there is one character per field. There are dashes in empty fields.

- Choose your reason for filing carefully. Value 4 (other) assumes that the individual entrepreneur closes only certain specific types of activities, leaving others on UTII.

- All full names (individual entrepreneur and his representative, if any) are indicated in the nominative case.

- If the form is submitted Not entrepreneur, and an authorized person, it is necessary to indicate the contact details of this person and the name of the document that allows you to represent the individual entrepreneur.

In the appendix we indicate all types of activities. If there are more than three, we print more attachments on the title page (in the column “The attachment to the application is compiled on... pages”).

In the example, we have one type indicated; in all others on the form, we fill in the empty cells with dashes, as shown in the example.

- Activity codes can be found here. It is worth remembering that they do not comply with OKVED.

Submission deadlines and features

An application in form UTII-4 is submitted to the same authority as UTII-2 (registration of an individual entrepreneur as a single tax payer on imputed income). According to general rules, the tax office should be notified within 5 days after termination of activity. If the deadlines were not met, then the date will be the last day of the month in which the form was issued.

When switching to another taxation system (code 2), the date of registration as a payer of the simplified tax system or another tax is indicated.

When the UTII-4 form is not needed

The only case when the UTII-4 form is not needed is the closure of an enterprise on a single tax on imputed income. Here you will need to fill out UTII-3. In all other cases, when an entrepreneur decides to refuse the special regime, he must fill out and submit an application, since exit from UTII does not occur automatically. Lack of reporting can only lead to the appearance and further increase of the fine.

When to submit a UTII declaration

They report on “imputation” quarterly. Unlike other taxation regimes, UTII is calculated for each quarter separately. There is no talk of cumulative calculation.

The deadline for submitting the UTII declaration is until the 20th day of the month following the reporting quarter. If the due date falls on a non-working day or holiday, then it is permissible to report on the first working day after. For example, the deadline for submitting UTII for the 1st quarter of 2020 is not postponed. Submit the report to the Federal Tax Service by April 20, 2020.

All due dates for 2020:

| Reporting period | Last date for submitting the declaration |

| 1st quarter | 20.04.2020 |

| 2nd quarter | 20.07.2020 |

| 3rd quarter | 20.10.2020 |

| 4th quarter | 20.01.2021 |

Application of deductions

An organization can deduct from UTII the amount of contributions that were paid for insurance of individuals in the reporting quarter. Due to this amount, you can reduce the tax by no more than 50%.

For those working on UTII, the following rules apply in 2020:

- If there are no employees, the amount of contributions paid in the same quarter for your insurance is deducted from the tax. The 50% limit does not apply, meaning the tax can be reduced to zero.

- If you have employees, you need to add up the contributions for them and for yourself and subtract the resulting amount from the tax. It can be reduced by no more than 50%;

- If an individual entrepreneur on UTII, which provides services and does not attract employees, installed a cash register before July 1, 2020, he has the right to deduct the costs of its implementation. The maximum amount for tax reduction is 18,000 rubles for each cash register installed on time. The deduction was provided temporarily, and the last time it can be declared is in the UTII declaration for the 4th quarter of 2020. The following example of filling out a report for individual entrepreneurs shows how to reflect this.

The declaration form can be downloaded in Excel format and filled out on a computer. But we recommend filling out the declaration online using our online service. This will allow you to avoid mistakes and save time.

Create a UTII declaration

The UTII declaration for the 4th quarter of 2020 is filled out on the form approved by Order of the Federal Tax Service No. MMV-7-3 / [email protected] (hereinafter referred to as the Order).

When to pay UTII

It is important for the taxpayer not only to submit reports on time, but also to transfer taxes to the budget on time. The deadline for paying the imputation is the same for all categories of payers - until the 25th day of the month following the expired quarter. If the date falls on Saturday or Sunday, then submit the report on the first working Monday. The deadline for paying UTII for the 1st quarter of 2020 fell on Saturday (April 25). The payment date is moved to the first working Monday - 04/27/2020.

In 2020, tax payment deadlines:

- for the 1st quarter of 2020 - 04/27/2020;

- for the 2nd quarter of 2020 - 07/27/2020;

- for the 3rd quarter of 2020 - October 26, 2020;

- for the 4th quarter of 2020 - 01/25/2021.

How to pay tax after deregistration of UTII

When deregistering UTII, it is necessary to pay off the single tax debt:

- submit a quarterly return;

- pay the accrued amount to the budget.

The amount of tax is calculated based on the actual time worked for the terminated type of activity using the formula:

UTII = DB * K1 * K2 * FP * FD / KD * %, where

BD – basic profitability;

K1 and K2 – established coefficients;

FP – the value of a physical indicator characterizing the type of work or service;

FD – days of actual activity;

KD - number of days in a month;

% - UTII rate.

One more nuance: if the winding down of activities did not entail the dismissal of personnel, it is necessary to continue reporting and paying contributions to the Pension Fund and the Social Insurance Fund. Naturally, if an employee does not receive a salary due to lack of work, there is no need to make insurance contributions for him. Such situations occur during a temporary suspension, when employees are asked to go on unpaid leave for an indefinite period. In this case, reports to extra-budgetary funds will be zero.

Comments

How and where to submit

Submit the UNDV declaration form for the 1st quarter of 2020 to the Federal Tax Service at the place of registration of the individual entrepreneur, or at the location of the company, or at the place of business activity. Requirements have been determined for when you will have to submit reports at your location or registration. Firms and individual entrepreneurs that operate in the following areas are required to report at the place of registration:

- delivery or peddling trade;

- transportation by freight or passenger transport;

- placement of advertising and promotional materials.

The rest report at the place of business activity.

Submit your report on paper or electronically. For taxpayers whose staff number is equal to or exceeds 100 people, filing reports electronically becomes mandatory.

Important information about separate divisions

If a company operates through structural divisions, take into account important reporting requirements:

| Situation | How to report |

| The company has separate divisions in one territorial entity | If all branches and structural divisions of the company are located in the territory under the jurisdiction of only one Federal Tax Service, then prepare one UTII declaration. Include information about all divisions, branches and head office in the report. |

| The company has OP in different territorial entities | If the structural divisions of the company and the head office are located in different territories and are subordinate to different branches of the Federal Tax Service, then reports will have to be submitted separately. Prepare a separate sample of filling out UTII 2020 for each territorial department of the inspectorate in which the EP, branch or head office operates. |

An interesting situation: an organization opens a separate division in the same city as the head office, but in a different area. But the area of location is under the jurisdiction of another Federal Tax Service. Is it required to register an OP with the inspectorate and how to handle reporting? The organization is obliged to register a separate structural unit in the department of the Federal Tax Service in whose department the OP fell. Explanations are given in the letter of the Federal Tax Service No. GD-4-3/1895 dated 02/05/2014. Consequently, reports will have to be submitted separately. One declaration - at the location of the head office and the second - at the location of the separate division.

Which form to use

The reporting form was changed back in 2020. The adjustments are due to the fact that a special deduction was introduced for UTII taxpayers for the purchase of an online cash register. This information was entered into the report structure on a separate page. The updated tax return for the single tax on imputed income for certain types of activities 2020 was approved by order of the Federal Tax Service of the Russian Federation dated June 26, 2018 No. ММВ-7-3/ [email protected]

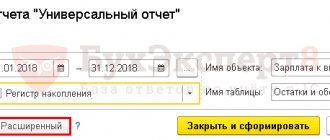

Fill out reports by hand or using specialized programs.

Form UTII-4 in 2020

Form UTII-4 was approved by order of the Federal Tax Service of the Russian Federation dated December 11, 2012 No. ММВ-7-6/941. The application is sent to the inspectorate where the individual entrepreneur is registered as a payer of “imputed” tax.

For 4-UTII, the 2020 form remains unchanged. You can find it on the Federal Tax Service website in the section for individual entrepreneurs.

An individual entrepreneur must send an application for deregistration as a payer of “imputed” tax in the UTII-4 form no later than five days:

- from the date of termination of activity on the “imputation”; the individual entrepreneur will be deregistered from the date indicated in the application when he stopped working in these types of businesses;

- from the date of transition to another tax regime; the date of deregistration will coincide with the date of transition;

- from the last day of the month of the quarter in which the requirements of paragraph 1, paragraph 2.2 of Art. 346.26 of the Tax Code of the Russian Federation, namely, the average number of employees of an individual entrepreneur exceeded 100 people; the “imputed” person will be deregistered from the first day of the same quarter.

The general rule is that you can leave UTII and voluntarily switch to the simplified tax system, OSN and other tax regimes only from the beginning of the next year, that is, from January 1. This day will be considered the day of transition to a different regime, the day of removal from the “imputed” registration, and also from this day the five-day deadline for filing the UTII-4 application is counted.

Zero UTII declaration: myth or reality

The essence of the “imputation” is that the taxpayer who has switched to this taxation regime is obliged to pay money to the budget. It makes no difference whether he worked the planned imputed income or not. Therefore, there cannot be a zero report on UTII.

If the taxpayer’s activities are suspended or terminated, then the Federal Tax Service must be notified within 5 days from the date of the decision to terminate the business. Otherwise, the tax will be charged in full. The position of the officials was confirmed in the letter of the Ministry of Finance of the Russian Federation No. 03-11-09/17087 dated April 15, 2014.

How to deregister UTII

You can voluntarily refuse to use UTII and switch to another regime only from the beginning of the calendar year. To do this, you must declare your desire to the tax office within the first 5 working days after the New Year holidays.

It’s another matter if the organization loses the right to “impute” for objective reasons:

- Special tax regimes can only be used by entrepreneurs who meet the conditions for the number of staff (up to 100 people), retail space (up to 150 square meters) and a number of other parameters.