There are no physical indicators: is it possible to submit a zero declaration?

If the UTII payer does not conduct business due to the loss of physical indicators (for example, when carrying out retail trade, he terminates the lease agreement for his retail space), when submitting the declaration, one must be guided by the explanations of the regulatory authorities.

And officials insist that the filing of zero declarations on UTII is not provided for by the legislation of the Russian Federation. In their opinion, the “imputed” person must submit to the tax authorities a declaration with the amount of tax calculated for payment, even in the absence of physical indicators (letters from the Ministry of Finance dated 04/15/2014 No. 03-11-09/17087, dated 07/03/2012 No. 03-11-06 /3/43, Federal Tax Service dated October 10, 2011 No. ED-4-3/ [email protected] ).

In this case, the Ministry of Finance, in letter No. 03-11-09/53916 dated October 24, 2014 (hereinafter referred to as letter No. 03-11-09/53916), proposes to fill out a declaration based on the indicators specified in the last UTII declaration submitted to the tax authorities. This letter also provides an example of the procedure for filling out the declaration. So, if it is impossible to indicate in the declaration a physical indicator for the first month of the quarter (the lease agreement for the retail space was terminated), this indicator must be taken from the last submitted declaration. In the next months of the quarter, when the lease agreement has already been concluded, the indicators are reflected on the basis of the new agreement.

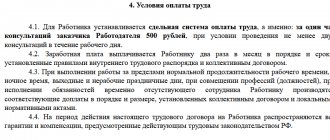

Thus, physical indicators must be indicated in the UTII tax return for each month of the quarter.

You can learn about the calculation of physical indicators in retail trade from the material “How to calculate the area of a sales floor for the purposes of applying UTII?”.

Consequences of submitting a zero declaration

Since the position on this issue is ambiguous, there is a possibility of getting a negative result. The tax inspectorate, when checking reports, is guided by the Tax Code and letters of the Ministry of Finance. Therefore, you may be assessed additional taxes based on the declaration for the previous period. Then you will still have to pay the tax and the resulting fines and penalties.

Organizations and entrepreneurs are trying to resolve disputes with the Federal Tax Service in arbitration court. Legal debates, as a rule, drag on for several months, but the court may take the side of the businessman. If the necessary physical indicators are missing: retail space, personnel, transport, the court will take your side. If their presence is revealed in court, the tax will definitely have to be paid. Therefore, if you have physical characteristics, you are not eligible to file a zero return. There are two options: deregistration or filing a completed return and paying tax.

This is important to know: Until what age is the child deduction available?

Considering the disagreement between the tax office and the Ministry of Finance, we recommend contacting the tax authority at your place of registration. There you will receive clarifications that will help you avoid sanctions.

Zero declaration on UTII for 2019

What to do if the entrepreneur did not conduct business during the reporting period? Do I need to submit reports and how to do this?

If an entrepreneur is registered as a UTII payer, then the report must be submitted, even if there is no activity. This rule must be followed until deregistration as a UTII payer, in accordance with the rules of Article 346.28 of the Tax Code of the Russian Federation.

Is it possible to submit a declaration with zero indicators if there is no activity? Two situations are possible:

- The individual entrepreneur ceased to operate, but the basic indicators for calculating the tax were retained (for example, own or rented retail space remained). In this situation, the tax is calculated based on the existing physical indicators and the basic profitability of the entrepreneur. This position is supported by both regulatory authorities (Letter of the Ministry of Finance dated 04/29/2015 No. 03-11-11/24875) and judges (clause 7 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 03/05/2013 No. 157).

- The individual entrepreneur does not operate, and there are no physical indicators for calculating tax (own property has been sold, lease agreements have been terminated, there are no employees). The regulatory authorities do not have a uniform position on this issue. The Ministry of Finance is categorical and requires the provision of a report before deregistration as a UTII payer (Letter dated April 15, 2014 No. 03-11-09/17087). In this case, the UTII declaration must be submitted with the indicators that were reflected in the report for the last period in which the activity was carried out. That is, the obligation to pay tax remains until deregistration.

The Federal Tax Service allows the possibility of submitting a report with zero indicators in the absence of physical indicators (Information from the Federal Tax Service dated September 19, 2016). But the report will still need to be submitted quarterly.

What happens if I do not submit zero reports?

The tax inspectorate will block the bank account and issue a fine in accordance with Article 119 of the Tax Code of the Russian Federation. The fine is 1000 rubles. You can also receive a fine for unprepared quarterly profit reports - 200 rubles for each document in accordance with Article 126 of the Tax Code of the Russian Federation. The pension fund and social insurance can also be fined in amounts starting from 1,000 rubles in accordance with Article 46 of the Law “On Insurance Contributions” 212-FZ.

If you plan to submit zero reporting in Moscow or the Moscow region, contact. Our specialists will prepare a package of documents and submit them to the regulatory authorities. You can be sure that the tax office will receive your return on time.

Sample zero declaration on UTII for individual entrepreneurs

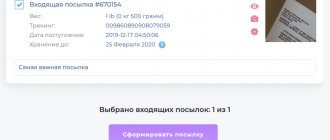

Individual entrepreneur Ivan Illarionovich Savelyev is registered as a UTII payer. Type of activity - provision of motor transport services for the transportation of goods. 1 truck was used in the activity. In December 2020, he sold the vehicle, but did not deregister as a payer. Thus, for the 1st quarter of 2020, he is required to submit a declaration by April 20. The entrepreneur follows the position of the Federal Tax Service and submits a zero declaration.

The document consists of a title page and three sections.

1. Fill out the title page:

- at the top of this sheet, as well as all other sheets of the report, fill out the TIN;

- tax period = 21 (Appendix 1 of the Rules for filling);

- code of place of provision = 120 (Appendix 3 of the Rules for filling).

2. Fill out section 1.

In this section, we fill in only the OKTMO code. The tax amount in our case is zero and we put a dash in line 020. The OKTMO code can be found using the service https://fias.nalog.ru/ExtendedSearchPage.aspx.

3. Fill out section 2.

Line 010 is filled out in accordance with Appendix 5 of the filling procedure. We put code 05 in it.

Next, fill in the address of the activity and OKTMO. We indicate the basic yield in accordance with Art. 346.29 of the Tax Code of the Russian Federation, coefficient K1 - in accordance with Order of the Ministry of Economic Development dated October 30, 2017 No. 579, K2 - in accordance with Art. 2 of the Law of St. Petersburg dated June 17, 2003 No. 299-35. In the lines indicating the physical indicator, tax base and calculated tax, we put dashes.

4. Fill out section 3.

Since the individual entrepreneur does not have employees, we enter 2 in line 005. If in the reporting quarter the individual entrepreneur paid insurance premiums, then they must be indicated in lines 020 and 030. Savelyev I.I. paid fixed insurance premiums in the amount of 5,000 rubles. In line 040 we put a dash.

Why no longer hide your real earnings?

Previously, entrepreneurs could earn 1,000,000 rubles and submit zero reports to the inspectorate. Many did this to reduce the tax base and avoid paying taxes. From July 1, 2020, the scheme does not work - Law No. 54-FZ obliges taxpayers to install online cash registers and issue checks when making transactions. Information from the cash register is sent to the fiscal data operator, and then to the tax office.

You can work without a cash register, but then you need a current account or strict reporting forms (SSR). In each option, the tax office will be able to calculate the amount of all transactions. And from July 1, 2020, entrepreneurs and companies on UTII and PSN will also be required to install cash register equipment. Filing zero reports in Moscow to hide profits is no longer relevant.

The procedure for terminating activities on UTII

From all of the above, it is clear that if an entrepreneur decides to cease operations, then this must be formalized. You can't just stop reporting. This will lead to penalties from inspection authorities.

If you decide to no longer conduct activities that fall under the UTII taxation regime, then, according to Art. 346.28 of the Tax Code of the Russian Federation, you must submit an application to the Federal Tax Service. This must be done within five days from the date of termination of business activities that fall under this tax regime. Application form approved

Zero UTII declaration - the Tax Code does not tell us anything about it. And if there is no clear regulation, questions, disputes and fines always arise. Can the UTII declaration be zero? Are the claims from the inspectors justified in this case? What are the consequences of submitting a “blank” UTII declaration? You will find answers to these questions in our article.

So, the answer to the question of whether the UTII declaration can be zero is obvious. Can not. In any case, you cannot do without the risk of getting involved in a tax dispute. Therefore, when suspending activities, you must either pay and declare the imputed tax, or be deregistered under UTII.

What does a sample of filling out a UTII declaration for the 3rd quarter of 2017 look like? What are the features of filling out a declaration when reducing the single tax on insurance premiums? Which form should I use? What is the deadline for submitting the declaration for the 3rd quarter? Is it required to submit a zero declaration? We will answer the most common questions and provide a specific example of filling it out.

Where, when and what to submit?

Even if the company did not operate all year, you need to submit zero reports to the regulatory authorities. There is no universal zero reporting - each form of taxation has its own balance sheets and declarations:

| Where? | To whom? | What? | When? |

| Inspectorate of the Federal Tax Service | BASIC | Zero balance sheet | Until March 31 of the year following the reporting year. |

| VAT declaration | Until the 25th day of the month following the quarter. | ||

| Income tax return | Until the 28th day of the month following the quarter. | ||

| OSNO without movements in the account and cash register, without objects of taxation for replaceable taxes and insurance contributions | Zero balance sheet | Until March 31 of the year following the reporting year. | |

| Single simplified tax return | Until the 20th day of the month following the quarter. | ||

| simplified tax system | Tax return | Organizations - until March 31. IP - until April 30. | |

| UTII | “Nulevki” are prohibited. You need to pay tax or deregister. | ||

| Russian Pension Fund | Individual entrepreneurs and organizations with employees | Standard report with reduced number of sections and tables | Until the 15th day of the 2nd month following the quarter. |

| Individual entrepreneur without employees | — | ||

| Social Insurance Fund | Individual entrepreneurs and organizations with employees | Standard report with reduced number of sections and tables | Until the 20th of the next month. |

| Individual entrepreneur without employees | — | ||

Do I need to submit a zero UTII declaration?

Are organizations or individual entrepreneurs required to submit a zero UTII declaration for the 3rd quarter of 2020, if no activities are carried out and there are no movements on current accounts? It is necessary to submit a UTII declaration in such circumstances. However, it will not be zero. The fact is that while a company or individual entrepreneur is registered as UTII payers, then it is necessary to submit declarations with the amount of UTII payable. You need to submit a declaration to the Federal Tax Service, even if you did not conduct imputed activities during the 3rd quarter of 2020 or did not receive any income (Letter of the Ministry of Finance dated April 29, 2015 N 03-11-11/24875).

To stop paying UTII and submitting returns, you need to submit an application for deregistration to the tax office (Letter of the Ministry of Finance dated April 15, 2014 No. 03-11-09/17087).

It is possible to submit a zero UTII declaration for the 3rd quarter of 2020 only if there are no physical indicators (Federal Tax Service Information). So, for example, in July you sold a retail store, but did not deregister. The physical indicator for July is 0. For August and September, too. As a result, you can submit a zero declaration for the 3rd quarter of 2020.

Arbitration courts in 2020 - 2020: you can submit a zero UTII declaration

These decisions include 2 decisions:

- Federal Antimonopoly Service of the West Siberian District dated August 17, 2016 No. A27-20410/2015;

- FAS East Siberian District dated March 16, 2017 No. A33-224/2016.

In both cases considered, entrepreneurs who had a zero UTII declaration were able to prove that they were deprived of the opportunity to conduct activities subject to UTII because they had terminated lease agreements (premises in one case and containers in another case).

In the first 2 instances, disputes with the Federal Tax Service were lost. But the cassation courts sided with the taxpayers, pointing out that in previous decisions the provisions of tax legislation were interpreted incorrectly.

***

Thus, we had to face an ambiguous, sometimes contradictory approach to assessing the need and legality of filing a zero declaration by UTII payers. Based on the foregoing, we can conclude that:

- if an entrepreneur is able to prove that he had no actual opportunity to conduct business, he can submit a zero UTII declaration (in this case, there is a high risk of a legal dispute with the Federal Tax Service);

- in other cases, you must choose: remove the company from tax registration or file a declaration based on imputed income not received (accordingly, you will have to pay tax on it).

Examples of filling out a declaration for the 3rd quarter of 2017

Next, we will consider a specific example of filling out a declaration for the 3rd quarter of 2020 and provide samples. Example. 07/14/2017 Alisa LLC registered as a payer of UTII for the transportation of goods. In July and August - 8 cars, in September - 9. Basic profitability - 6,000 rubles. K1 coefficient for 2020 is 1.798, K2 coefficient is 1. During the 3rd quarter, insurance premiums and sick leave benefits were paid at the expense of the employer - 12,000 rubles.

Tax base for UTII:

- for July – 44,544 rubles. (RUB 6,000 x 8 cars x 1,798 x 1/31 days x 16 days);

- for August – 86,304 rubles. (RUB 6,000 x 8 cars x 1,798 x 1);

- for September – 97,092 rubles. (RUB 6,000 x 9 cars x 1,798 x 1).

The tax base for the 3rd quarter is RUB 227,940. (RUB 44,544 + RUB 86,304 + RUB 97,092). UTII for the 3rd quarter – 34,191 rubles. (RUB 227,940 x 15%). The amount by which UTII can be reduced is 17,095 rubles. (34,191 rubles x 50% UTII payable – 22,191 rubles (34,191 rubles – 12,000 rubles).

Title page

The title page of the UTII declaration for the 3rd quarter of 2020 should show basic information about the company or individual entrepreneur. At the same time, in the fifth and sixth positions of the checkpoint there should be the numbers 35, which indicate tax accounting for imputed activities (subclause 1 of clause 3.2 of the Procedure, approved by order of the Federal Tax Service dated July 4, 2014 No. ММВ-7-3/353).

If you are submitting a declaration for the 3rd quarter of 2020 for the first time, then you need to enter code “0” in the “Adjustment Number”. And in the field “Code of place of presentation” put (letter of the Federal Tax Service dated February 5, 2014 No. GD-4-3/1895):

- “214” – if you submit exactly one declaration at your location;

- “310” – when you hand over the UTII at the place of business.

Take your tax code from the registration notice. Simply put, these are the first four digits of your TIN. Name or full name Don't forget to enter in CAPITAL LETTERS. This is a general requirement for any tax reporting. Take the OKVED code that characterizes your activities on the “imputed” site from the new OKVED2 classifier.

Here is the title page for our example:

Section 2: calculation of UTII by type of activity

Start filling out from section 2. If you have several types of activities or you work at addresses with different OKTMOs, fill out section 2 for each of them (clause 5.1 of the Procedure for filling out the declaration).

Take the type of activity code (line 010) from Appendix No. 5. The OKTMO code (line 030) can be found in the service "" on the Federal Tax Service website.

In lines 040 – 110, calculate UTII. Fill in column 3 lines 070 - 090 only if you switched to UTII or, conversely, deregistered in the reporting quarter. Include the day of registration and deregistration in the number of days of activity.

In our example, section 2 would look like this:

Section 3: reduction in insurance premiums

As part of the UTII declaration for the 3rd quarter of 2020, this section calculates the total amount of tax payable for all places and types of activities on UTII (page 040). That is, this section is formed on the basis of data from all Sections 2. In this case, the amount of insurance premiums is recorded on line 020. Cm. " ".

On line 020, indicate the total amount of insurance premiums and hospital benefits that can be used to reduce tax. We are talking about the amounts actually paid during the quarter within the limits of accruals. Please enter the amount without the 50% limit.

In our example, the filling sample will look like this:

Section 1: UTII payable

Lastly, based on the data in Sections 2 and 3, you need to fill out Section 1. In Section 1, indicate:

- on line 010 – code of the municipality in whose territory you are conducting the imputed activity;

- on line 020 - the amount of UTII payable for each municipal entity (each OKTMO). Just transfer the indicator from page 040 of Section 3 here.

Here is an example of filling:

You can also find a sample of filling out the UTII declaration for the 3rd quarter of 2020 in Excel format.

More information about the types of “nulls”

Zero balance sheet

Small businesses submit a special report entitled “Accounting (financial) reporting for small businesses.” This is a regular balance sheet and income statement, but more concise in form. However, it cannot indicate that . As a rule, the accountant indicates the authorized capital of the organization. A copy of the report must be sent to Rosstat.

Single simplified tax return

A simple two-page report. On the title page you need to indicate the details, and then fill out a table with a list of all taxes that the EUND replaces. It is necessary to observe the order of priority of the articles of the Tax Code of the Russian Federation, and indicate the article numbers themselves in the column on the right. When sending a declaration by mail, be sure to make an inventory of the attachment.

Zero income tax return

Declarations are submitted five times a year - based on the results of quarters and the year. In electronic and paper form, by mail or through the window. Only fill out the title page, and put dashes in sections 1 and 2. If income and expenses for the year are equal, profit and tax will be zero. However, in this case, the declaration is not considered “null” - it must be filled out as usual.

Zero declaration according to the simplified tax system

The title page and section 1 (KBK, OKTMO) are filled out. The tax office checks it most often. This is done using a regular request to the bank. They can check the card and account of an individual: if movement of large sums is recorded, most likely, you will be sent a request for explanation.

Report to the Pension Fund

Standard reporting according to the RSV-1 form. It contains the title page, sections 1 and 2. If hired employees were on maternity leave, maternity leave, leave without pay with the code “ADMINISTER”, individual information about the employees is submitted along with the RSV-1 form. The documents indicate the length of service of the staff and zero amounts of payments.

Report to the FSS

Standard report on Form 4-FSS. The accountant’s task is to fill out the title book, as well as tables No. 1, 3, 6 and 7.

If there is no activity, you need to deregister

Tax officials supported taxpayers, apparently based on the fact that it is often impossible to pay a single tax due to the physical absence of the object of taxation. At the same time, the obligation to file tax returns formally remains with the UTII payer until he is deregistered as a payer of “imputed” tax.

According to the explanations contained in the letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 5, 2013 No. 157, the absence of a taxpayer at the end of the tax period of the amount of tax to be paid does not in itself relieve him of the obligation to submit a tax return for this tax period.

But the financial department was not satisfied with this approach. They began to use the explanations given in paragraph 7 of the letter of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 157 as the main argument in support of their position, insisting that temporary failure to carry out activities does not exempt a company or entrepreneur from the obligation to pay tax.

The tax must be calculated based on the basic profitability and the value of the physical indicator for a specific type of activity.

The absence of physical indicators in the tax period, according to officials, means the termination of activities subject to a single tax and the emergence of an obligation to deregister as a UTII payer in the manner established in paragraph 3 of Article 346.28 of the Tax Code of the Russian Federation.

However, the imputators still have questions.

Firstly, the word “obliged” in paragraph 3 of Article 346.28 of the Tax Code of the Russian Federation applies to the transition from UTII to the general taxation system due to the loss of the right to use UTII. In other cases, the word “must” is not used (in the context of the topic at hand).

Secondly, it remains unclear how to calculate the single tax in the absence of physical indicators. After all, if activities are not carried out, such indicators may not exist.

Tax authorities are required to deregister the company and issue it a notice of this within five working days from the date of submission of all necessary documents.

Please note that in the application for deregistration it is required to indicate the date from which the organization actually ceases its “imputed” activities (according to the principle “the sooner the better”). It's all about paragraph 10 of Article 346.29 of the Tax Code of the Russian Federation. According to it, the company must calculate a single tax on imputed income for all days from the beginning of the month in which it was deregistered as a UTII payer.

That is, in case of delay, she will have to pay tax for the period when she no longer worked at the “imputation”. In this case, the tax calculation will need to be made based on the physical indicators that the company had at the time of termination of its activities.

Example LLC “Master” was engaged in laying fireplaces on orders from individuals and paid UTII for this type of activity. On April 4, 2014, the company ceased this activity. According to the rules of Article 6.1 of the Tax Code of the Russian Federation (clause 2), the period established by the legislation on taxes and fees begins the next day after the calendar date defining this period. In addition, a period defined in days is calculated in working days, if it is not established in calendar days. In this case, the next day after the cessation of activity falls on a day off, since April 5, 2014 is a Saturday. Therefore, the period during which it is necessary to inform the inspectorate about the termination of activities is calculated from Monday, April 7, 2014. This means that the application for deregistration had to be submitted before April 7, 2014 inclusive (within five working days). Then the date of deregistration of the company as a UTII payer would be the date specified in the application - April 4, 2014.

But the organization missed the deadline. And she filed an application for deregistration only on April 16, 2014, indicating April 14, 2014 as the date of termination of activity. Because of this, she had to pay a single tax for April in the amount of 87,780 rubles. instead of 25,080 rub.

The accountant of Master LLC calculated the tax as follows:

7500 rub/month. x 1.672 x 1.0 x 100 people / 30 days x 14 days x 15% = 87,780 rub.,

Where is 7500 rubles/month. — basic profitability for the provision of household services (clause 3 of Article 346.29 of the Tax Code of the Russian Federation); 1.672 - deflator coefficient K1 for 2014, established by order of the Ministry of Economic Development of Russia dated November 7, 2013 No. 652; 1.0 - correction factor K2; 100 people — physical indicator “number of employees”; 30 days — number of calendar days in a month; 14 days — actual number of days of activity in a month; 15% is the tax rate (Article 346.31 of the Tax Code of the Russian Federation).

The calculation formula is given in Article 346.29 of the Tax Code of the Russian Federation. The basic yield, according to Article 346.29 of the Tax Code of the Russian Federation, is adjusted by coefficients K1 and K2.

If the application had been submitted on time, the tax amount would have been RUB 25,080. (RUB 7,500/month x 1,672 x 1.0 x 100 people: 30 days x 4 days x 15%).

Thus, subject to the deadlines for overpayment of tax in the amount of 62,700 rubles. (87,780 - - 25,080) could have been avoided.

It is important to remember Before deregistration, the taxpayer calculates the amount of the single tax based on the available physical indicators and the basic monthly profitability.

Conclusion

In order not to pay tax if the activity is not carried out - suspended, terminated or there is no opportunity to carry out the activity, it is necessary to submit an application provided for in paragraph 3 of clause 3 of Article 346.28 of the Tax Code of the Russian Federation for deregistration as a UTII payer.

Unfortunately for taxpayers, the practice is such that when filing a zero return in such cases, the tax authority will charge additional taxes, fines and penalties, and the likelihood of defending your position in court is minimal and depends on the type of activity and confirmation of the impossibility of generating income.

Similar articles

- Zero declaration on UTII

- How to switch to UTII in 2020

- What taxes does UTII replace?

- The procedure for submitting a zero declaration for UTII

- UTII: deadlines for submission and payment in 2016-2017

Zero reporting

brief information

From 2006 to 2013, it was mandatory to pay a single tax on imputed income for individual entrepreneurs who were engaged in certain types of business. Entrepreneurs were required to submit reports to the Federal Tax Service, even if their commercial units were not functioning. In the absence of any activity, it was allowed to submit zero forms.

In 2013, this tax on imputed income was no longer mandatory. Now entrepreneurs can choose between several tax regimes:

- simplified taxation system;

- patent system.

After these innovations, filing a zero declaration was no longer required. Now, if an individual entrepreneur does not carry out his activities for some period, he has the right to determine for himself the tax system suitable for this and with zero income, budget contributions will also be equal to zero.

Upon termination of activities, the entrepreneur must notify the tax authorities within five days. The receipt of a corresponding application by the Federal Tax Service means that the individual entrepreneur is deregistered as a UTII taxpayer. If the deadline for filing an application is missed, tax on imputed income must be paid as usual.

Consequences

If an entrepreneur nevertheless submits zero reports, then there is a high probability of negative consequences from the tax inspectorate. When checking reports, tax inspectors, guided by the tax code and letters of recommendation from the Ministry of Finance, will charge additional taxes on a zero declaration, according to the last submitted reports in the previous period. As a result, the owner of the individual entrepreneur will still have to transfer funds to the budget, as well as pay any fines and penalties for late payments.

Many entrepreneurs, in order to avoid paying penalties and additional tax on zero UTII reporting, sue the Federal Tax Service. Legal arguments usually drag on for months. As a result, the court may side with the businessman. The downside of such actions will be high costs for a lawyer and a lot of wasted time.

If in court it turns out that the plaintiff, who is an entrepreneur, has retained physical indicators in his business, such as:

- workers;

- motor vehicles;

- sites or premises where activities were carried out.

Then, this will be the basis for attracting him to pay taxes. If all of the above indicators are missing, then the court will side with the plaintiff and release him from payment.

Solving problems with filing zero reports

In order to simply not waste time and effort proving your case in court, it would be more advisable to submit an application to the Federal Tax Service at the place of registration within five days to remove the payer from the imputed tax.

When drawing up an application, you should indicate the date of actual termination of the UTII details. Before this date, all contributions to the budget must be paid. When submitting, the actual amount to be paid is calculated - for this, the basic profitability of the enterprise for the last day and its physical indicators are taken.

Filing zero UTII reports will be considered a direct violation of the law. To date, the current regulatory legal acts in the Russian Federation do not provide any explanation for why an entrepreneur could fill out and submit such reports.

Declaration of UTII for individual entrepreneurs

Every entrepreneur who pays tax on imputed income must submit reports at the end of each quarter. While in this regime, a businessman must pay tax, even if there was a period of downtime in his activities.

The declaration form itself is necessary so that the entrepreneur can report to the tax authorities about his activities and pay the tax due under this regime to the budget.

The nuance that distinguishes this mode from others is that when filling out the declaration, the income and expenses of the individual entrepreneur are not indicated. All indicators are basic, that is, fixed, for any individual entrepreneurs on this form.

More information about UTII for retail trade can be found at. Information on the deadlines for filing and paying UTII is available at. Features of the use of UTII are generally described.

Where are the reports submitted?

Individual entrepreneurs must submit completed declarations at the place of registration, but sometimes questions may arise about where to submit declarations if the business does not have a clear or single location.

This may be related to their activities. For example, this could be transporting passengers or moving advertising (on vehicles). In any case, an individual entrepreneur submits all declarations at the place of his registration. This is explained by this. That when registering an individual entrepreneur, the TIN of its future owner is used.

Reporting procedure

A completed sample declaration can be found at the link below. You can also download a blank declaration form there.

Documents for download (free)

- Declaration form for UTII

- Sample of a completed UTII declaration

Before filling out, you should read the following rules to avoid mistakes:

- all data is entered into the lines, starting from the leftmost cell;

- After filling, all remaining empty cells are filled with dashes, exactly in the middle of the cell;

- all words used when filling out must be written in capital block letters;

- Pen ink colors should only be black, blue or purple. If the declaration is filled out in a different color, it will not be accepted by the inspection;

- in the case when an electronic reporting form is filled out in an Excel file, you should use the “Courier new” font of 18 points;

- physical indicator and cost indicator must be indicated in whole numbers following the rounding rule. In the case of the “k2” coefficient, the numbers are rounded to 3 digits;

- fines and penalties are not included in the reporting;

- each page of the report must be numbered;

- on the first sheet it is necessary to put down the date of filling in the surname and initials of the entrepreneur;

- sheets must be separated from each other. They must not be stapled or sewn together;

- Correcting errors with a proofreader or crossing out is prohibited. If an error is made, the sheet is replaced with a new one;

- You cannot double-sided print the declaration.

Design of the second section

In the second section, the entrepreneur enters information regarding his activities, OKTMO codes and location address.

Let's look at what information fits into each field line by line:

- line 040 – basic income of individual entrepreneurs;

- lines 050, 060 – coefficients “k1”, “k2”;

- lines 070, 090 – monthly physical indicators in the reporting period (quarter).

From 2020 to the present day, new columns in the second section of the declaration are in effect. Information is indicated in them if the entrepreneur deregistered or registered an LLC after a certain period of time. Using these columns, the imputed tax will be calculated for the actual days of the individual entrepreneur’s activities.

They include the following data:

- physical indicators - 2 columns;

- the total number of days when the individual entrepreneur’s activities were carried out, from the moment of registration until deregistration - 3 columns;

- tax base – 4 columns.

The tax base will be calculated as follows:

040 * 050 * 060 * 070 columns 2

This calculation will be used by entrepreneurs who carried out activities throughout the tax period.

If you need to determine the tax base for a certain number of days in a period, then the following calculation is used:

040 * 050 * 060 * (070 columns 2 * 070 columns 3) / for the number of days during which the activity was actually carried out.

If the individual entrepreneur was engaged in activities for the entire period, then dashes are entered in column 3. Line 100 includes all amounts received in column 4. In line 110, we multiply the amount received in line 100 by the interest rate - this will be the amount required for the calculation in section 3.

Design of the third section

In the third section of the UTII reporting, codes of taxpayer types are entered in line 005.

The following codes are entered in this line:

- if the individual entrepreneur has employees - 1;

- if there are no employees listed in the individual entrepreneur – 2.

Line 010 contains the amounts from line 110 of section 2.

If an individual entrepreneur carries out several types of activities, then the second section will be filled out for each type separately.

Entrepreneurs who indicated code 1 in line 005, indicating the presence of employees, fill out field 020 with the following data:

- amounts of insurance premiums;

- benefits;

- other payments transferred to employees.

All this data helps reduce the tax amount by up to 50% in accordance with Article 346.32 of the Tax Code.

Those entrepreneurs who operate without hiring employees fill out field 030. It indicates the amount of contribution transferred for themselves in the reporting period. In this case, the tax will be reduced by the amount of deductions paid.

The final amount to be paid for the imputed tax will be recorded in field 040.

LETTER dated April 23, 2012 No. 03-11-11/135

The Department of Tax and Customs Tariff Policy has considered the appeal regarding the possibility of submitting a “zero” declaration for the single tax on imputed income to the tax authorities and, based on the information contained in the appeal, reports the following. In accordance with Art. 346.26 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the tax system in the form of a single tax on imputed income for certain types of activities is established by the Code, put into effect by regulatory legal acts of representative bodies of municipal districts, city districts, laws of federal cities of Moscow and St. Petersburg and applied along with the general taxation system and other taxation regimes provided for by the legislation of the Russian Federation on taxes and fees, in relation to certain types of business activities, defined in paragraph 2 of Art. 346.26 of the Code.

According to Art. 346.28 of the Code, taxpayers of the single tax on imputed income are recognized as organizations and individual entrepreneurs carrying out business activities subject to this tax in the territory of a municipal district, city district, federal cities of Moscow and St. Petersburg, in which a single tax on imputed income has been introduced.

Clause 1 of Art. 2 of the Civil Code of the Russian Federation defines that independent activity, carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, sale of goods, performance of work or provision of services by persons registered in this capacity in the manner prescribed by law, is recognized as entrepreneurial. Based on paragraph 1 of Art. 346.29 of the Code, the object of taxation for the application of a single tax on imputed income is the imputed income of the taxpayer.

Imputed income is the potential income of a single tax payer on imputed income, calculated taking into account a set of conditions that directly affect the receipt of said income, and used to calculate the amount of a single tax on imputed income at the established rate (Article 346.27 of the Code). The tax base for calculating the amount of a single tax is the amount of imputed income, calculated as the product of the basic profitability for a certain type of business activity, calculated for the tax period, and the value of the physical indicator characterizing this type of activity (clause 2 of Article 346.29 of the Code).

Basic profitability is a conditional monthly profitability in value terms for one or another unit of a physical indicator characterizing a certain type of business activity in various comparable conditions, which is used to calculate the amount of imputed income (Article 346.27 of the Code).

Thus, the taxpayer calculates the amount of the single tax on imputed income based on imputed, and not actually received, income.

If during the tax period the taxpayer, in the course of carrying out business activities subject to a single tax on imputed income, has had a change in the value of a physical indicator, the taxpayer, when calculating the amount of the single tax on imputed income, has the right to take into account this change from the beginning of the month in which the change occurred the value of the physical indicator (clause 9 of Article 346.29 of the Code).

The absence in the tax period of physical indicators used to calculate the single tax on imputed income means the termination of business activity subject to this tax and the occurrence of an obligation to deregister as a taxpayer as established in paragraph 3 of Art. Code 346.28 order. So, paragraph 3 of Art. 346.28 of the Code provides that deregistration of a taxpayer with a single tax on imputed income upon termination of his business activities subject to taxation with a single tax on imputed income is carried out on the basis of an application submitted to the tax authority within five days from the date of termination of business activities subject to the specified tax.

The tax authority, within five days from the date of receipt from the taxpayer of an application for deregistration as a single tax payer on imputed income, sends him a notice of deregistration. Accordingly, paragraph 3 of Art. 346.28 of the Code establishes specific deadlines for an organization or individual entrepreneur to submit an application to the tax authority for registration and deregistration as a single tax payer on imputed income from the day the business activity begins and ends. Before deregistration as a taxpayer, the amount of the single tax on imputed income is calculated for the relevant type of business activity based on the available physical indicators and basic monthly profitability.

At the same time, according to Ch. 26.3 of the Code does not provide for the submission of “zero” declarations for the single tax on imputed income. At the same time, we inform you that in accordance with the Regulations on the Ministry of Finance of the Russian Federation, approved by Decree of the Government of the Russian Federation dated June 30, 2004 No. 329, and the Regulations of the Ministry of Finance of Russia approved by Order of the Ministry of Finance of Russia dated March 23, 2005 No. 45n, the Ministry of Finance of Russia considers individual and collective appeals of citizens and organizations for issues within the jurisdiction of the Ministry. In accordance with the Regulations and Regulations, unless otherwise provided by law, requests for the examination of contracts, constituent and other documents of organizations, as well as for the assessment of specific economic situations are not considered on the merits.

It should also be noted that, according to paragraphs. 1 clause 1 art. 21 of the Code, taxpayers have the right to receive free information from tax authorities at their place of registration (including in writing) about current taxes and fees, legislation on taxes and fees and regulations adopted in accordance with it, the procedure for calculating and paying taxes and fees, rights and responsibilities of taxpayers, powers of tax authorities and their officials, as well as receive forms of tax declarations (calculations) and explanations on the procedure for filling them out. In turn, according to paragraphs. 4 paragraphs 1 art. 32 of the Code, tax authorities are obliged to inform free of charge (including in writing) taxpayers, payers of fees and tax agents about current taxes and fees, legislation on taxes and fees and normative legal acts adopted in accordance with it, the procedure for calculating and paying taxes and fees, the rights and responsibilities of taxpayers, fee payers and tax agents, the powers of tax authorities and their officials, as well as present forms of tax declarations (calculations) and explain the procedure for filling them out.

In addition, based on Art. 87 of the Code, a tax audit is one of the forms of tax control, which falls within the competence of the tax authorities. In accordance with Art. Art. 137 and 138 of the Code, appeals against acts of tax authorities, actions or inactions of their officials are carried out in the manner established by Section. VII of the Code. Every person has the right to appeal against acts of tax authorities of a non-normative nature, actions or inactions of their officials to a higher tax authority (superior official) or to court.

Deputy Director of the Department of Tax and Customs Tariff Policy S.V.RAZGULIN