Definitions

Basically, the concept of guarantees and compensation is considered from the point of view of labor law. According to Article 164 of the Labor Code of the Russian Federation, guarantees mean the means, conditions and methods by which employees of organizations are granted various rights in social and labor relations. The guarantees that are provided by law and provide these rights to all employees can be of a material or intangible nature. The first includes maintaining salary during vacation or training, long business trip or sick leave, etc. The second concept includes maintaining a job or providing another position.

In relation to guarantees, concepts such as payments or additional payments are also used. Guaranteed payments mean those payments that are issued to an employee for the time until he fulfilled his labor obligations for good reasons, which are established by law. According to general rules, they replace wages. Guaranteed additional payments are provided above the established salary.

Compensation refers to monetary payments that are reimbursement to an employee for those costs associated with the performance of job duties and provided for by law.

If an employee spent money during production needs, the organization must compensate for the losses incurred in monetary terms.

The concept of guarantees and compensation in labor law can be used together if the case so requires. For example, if the employee is a donor.

In addition to reimbursement of expenses, employees are entitled to compensation for moral damage that may be caused in the workplace.

https://youtu.be/rN6q9JdAth8

Guarantees and compensation for workers

The state and the law provide and consolidate guarantees and compensation for employees, as the most vulnerable party to the labor agreement. We are talking specifically about those who work under an employment contract. It doesn't matter whether it's urgent or indefinite. If such a document was not signed, we may be talking about a civil contract. And, of course, guarantees and compensation to workers do not apply to the parties to such an agreement. Or maybe this is a case where the employee will be forced to file a claim to establish an employment relationship.

Thus, guarantees are a mechanism that includes conditions, means and methods for realizing the rights of an employee. These include the legal grounds for entering into labor relations, labor protection, restoration of illegally violated rights, wages, etc. And compensations are monetary payments to reimburse employees for expenses incurred during the performance of their duties.

Basic goals

The main purposes of providing guarantees and compensation are:

- Providing employees with average earnings in certain cases provided for by law when they do not perform their direct duties.

- Reimbursement for employees of monetary expenses specified in the law, incurred by them due to production needs.

The main guarantees and compensations in the labor law of the Russian Federation are prescribed in Article 165 of the Labor Code of the Russian Federation.

Types of guarantees

The main types of guarantee payments include:

- payments that depend on production situations or management actions (payment for downtime due to the fault of the employer, payment for forced absence in case of illegal termination of a contract, dismissal benefits);

- payments that provide the employee with the right to paid rest;

- additional payments that are due to employees who have not reached the age of majority;

- payments that do not depend on production, but are important for the state and society (state duties, participation in collective bargaining, military training, etc.).

Guarantees and compensation upon termination of an employment agreement

When an employee is transferred to a permanent but lower-paid position due to a medical certificate, the guarantees include maintaining his average salary for a month from the date of transfer. In case of a work injury or occupational disease - until full working capacity or recovery.

In case of temporary loss of ability to work, the employer pays benefits to the employee.

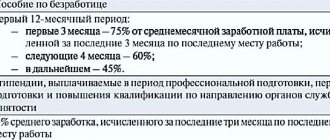

The employer must pay severance pay to the dismissed employee:

1) in the amount of the average salary for two weeks - for citizens if the employment contract is terminated due to:

- inadequacy of the position held or the function performed, due to health conditions, making it impossible to continue this work and refusal to transfer to another job;

- conscription of an employee to serve in the army;

- reinstatement of the employee who previously performed this work;

- refusal to transfer an employee related to the relocation of the enterprise to another location, etc. (Article 178 of the Labor Code of the Russian Federation).

2) in the amount of the average monthly salary - for citizens if the employment contract is terminated due to:

- liquidation of the enterprise;

- reduction in the number of employees;

- violations of the rules established by labor legislation, the conclusion of an employment contract, committed through no fault of the employee.

Special cases

In addition to the established guarantees, the legislation identifies the following types of guarantees and compensation in labor law:

- When going on business trips or other official trips.

- When moving to another city in order to fulfill work obligations.

- When performing government or public activities.

- When combining study and work.

- If necessary, stop work due to employee misconduct.

- on annual vacation.

- In exceptional cases of termination of employment relationships.

- Due to the delay in issuing the employment form due to the fault of the employer upon termination of the employment relationship.

- Other types of guarantees and compensations provided for by labor law.

Guarantees and compensation to employees in case of delay in issuing a work book or wages

If the deadline for issuing a work book to an employee upon termination of the employment contract is violated, compensation is the average daily salary for each delayed day. In addition, the employee may be entitled to compensation for moral damages.

Guarantees and compensation to employees for delayed wages are established in the form of monetary compensation, which is paid regardless of the employer’s fault.

Clarifying questions on the topic

Before getting a job, my wife was promised official employment. They even took my work book. Nine years after her dismissal, she was given back her clean pay. Accordingly, there have been no deductions all these years!

Basic principles

The basic principles of providing compensation and guarantees include:

- establishing a mandatory level of compensation and guarantees;

- the obligation of the heads of organizations to provide employees with statutory guarantees and compensation;

- the employee’s right to statutory compensation and guarantees;

- the possibility of improving the situation of employees compared to what is established by legislation in the field of compensation and guarantees at the agreement level at the expense of the contracting parties.

GIC for citizens engaged in public activities

Chapter 25 of the Labor Code of the Russian Federation defines the Civil and Civil Code for workers hired to perform public and state duties.

| Title and article number | Information posted in the article |

| Civil Code for citizens who are involved in the performance of public and state duties (Article No. 170) | For a citizen sent to perform public and state duties, the employer retains his job for the period of his absence. Payments to a citizen who is hired to perform the above actions are made by the organization that attracted him, in accordance with the Labor Code and Federal Law No. 90-FZ of June 30, 2006. |

| Guarantees for citizens elected to the commission on labor disputes and trade unions (Article No. 171) | Employees who carry out the duties mentioned in the title of the article in parallel with their main work are also provided with guarantees from the employer - the preservation of their salary and exemption from the main functions for participation in commissions or meetings of the body. Dismissals of citizens engaged in public activities are determined by Art. No. 373 TK |

| Guarantee obligations to citizens elected to government bodies or local governments (Article No. 172) | The activities of the persons indicated in the title of the article are regulated by the Federal Law and regional legal acts of the constituent entities of the Russian Federation (Federal Law No. 90-FZ of June 30, 2006) |

Citizens chosen to carry out public activities in parallel with work functions have the right to receive guarantees and compensation in accordance with the law.

Important! Chapter 26 contains several articles that stipulate the conditions for providing guarantees to citizens receiving different types of education.

Business trips

A business trip is understood as a trip by an employee at the direction of a manager for a specific period of time to perform his duties.

Today, legislation does not establish a maximum period for a business trip; it is determined by the employer individually, based on the nature of the assignment. A trip by an employee who has a traveling nature of work is not considered a business trip.

Sending an employee on a business trip must be formalized by order of the head of the organization. Based on this, a travel certificate is issued, in which it is necessary to indicate the beginning of the business trip and its end, as well as the point of travel. At the end of the business trip, the employee is required to submit a report on the work done.

When an employee is sent on a business trip, he is provided with guarantees and compensation, which are designated as mandatory in labor law. These include:

- Maintaining your job and position. An employee does not have the right to be transferred to another position or dismissed at the initiative of the employer (unless this is the liquidation of the enterprise).

- Maintaining wages. During the business trip, the employee retains his average earnings. If a citizen works part-time, then payment of travel expenses, as well as maintaining earnings, falls on the organization that sent him on the trip. If an employee is sent on a business trip by both organizations at once, then the salary must be maintained both at the main place and part-time.

- Reimbursement of travel expenses. Such reimbursements include: travel expenses, accommodation expenses, additional expenses and those expenses that are allowed to the employee with the consent and knowledge of the employer.

A special compensation procedure is provided for those employees who work on a rotational basis. Since this way of working is permanent for them, instead of daily allowances they are paid bonuses to the basic tariff rate.

Guarantees

The main purpose of the guarantees is to preserve the employee’s salary during his absence from work. For example, a specialist went on sick leave. At the same time, he is accrued sick leave payments. Examples of payments:

- Payment for absenteeism caused by the employer or force majeure circumstances (Article 374 of the Labor Code of the Russian Federation).

- Severance pay (Article 178 of the Labor Code of the Russian Federation).

- Money for paid leave (Article 114 of the Labor Code of the Russian Federation).

- Payments for study leave (Article 176 of the Labor Code of the Russian Federation).

Payments for the time during which an employee performed public and government duties are also called guarantee payments.

Sick leave and maternity benefits

If an employee is sick, he can go on sick leave. The employer is obliged to pay him benefits (Article 183 of the Labor Code of the Russian Federation). It is calculated on the basis of sick leave. The procedure for payments and their volumes are established by Federal Law No. 255 of December 29, 2006.

This is interesting: A driver's license was found in the name

Damage to health

If, as a result of an industrial accident, the employee’s health is harmed, he is paid the lost salary and is compensated for expenses for recovery (visits to clinics, etc.). Compensation is also paid when a person dies due to a work injury. In this case, the money is paid to the family of the deceased.

Passing the examination

Some employees are required to undergo a medical examination due to their line of work. During the examination, the employer must retain the salary for the employee (Article 185 of the Labor Code of the Russian Federation).

An employee may receive a day off in connection with donating blood. This day is also paid by the employer (Article 186 of the Labor Code of the Russian Federation).

Professional education

An employee has the right to off-duty training. At the same time, his salary remains at an average size. An employee may be sent by an employer to study in another city. In this case, the company accrues travel allowances to him (Article 187 of the Labor Code of the Russian Federation).

Additional grounds for guarantee payments

The law also stipulates these grounds for payments:

- Breaks included in working time (Article 109 of the Labor Code of the Russian Federation).

- Add. breaks provided for breastfeeding children under 1.5 years of age (Article 258 of the Labor Code of the Russian Federation).

- Additional payments to minor employees when their day is shortened (Article 271 of the Labor Code of the Russian Federation).

- Additional payments for women working in the Far North (Article 320 of the Labor Code of the Russian Federation).

An employer may transfer an employee to a lower-paid position due to health conditions that do not allow him to continue his previous activities. In this case, payments are also made:

- Until the employee recovers (Article 182 of the Labor Code of the Russian Federation).

- For mothers with children 1.5 years old, the average salary is retained (Article 254 of the Labor Code of the Russian Federation).

IMPORTANT! As a rule, guarantee payments are not an addition to the salary. This is simply maintaining average earnings.

Moving

Guarantees and compensation in labor law are briefly described for moving to work in another area.

Relocation usually involves various expenses, and the employer must reimburse them. The following are subject to compensation:

- expenses for moving the employee and his family, as well as for transporting basic property (the exception is cases when the employer provides the employee with the necessary means of transportation);

- expenses for arrangement in a new place.

The amount of compensation must be agreed between the parties in writing.

Military duty

Guarantees and compensations in labor law are also provided for citizens performing military duty. Such persons may be released from work while maintaining their place of work and average earnings (during military training), receive compensation related to the rental of housing, payment for relocation or travel from home to work, receive travel allowances for the duration of a medical examination, examination or treatment for the purpose of diagnosis for military registration, preparation for conscription or military service.

If an organization incurs expenses due to the implementation of the law on conscription, then they are reimbursed from the federal budget.

Combining study and work

Guarantees and compensations in labor law are also regulated for employees combining study and work. These include:

- Study leave (can be granted on the basis of a letter of invitation from an educational institution).

- Shortening the working day.

- Travel compensation.

Guarantees and compensation may be provided if:

- the institution has state accreditation;

- the employee fulfills the curriculum standards in a timely manner, has no debts for semesters, and completes all assigned work on time;

- The employee has never received higher education before.

If an employee receives education in several institutions at once, then payments are provided in connection with training in one of them.

If an employee studies by correspondence, the employer pays his travel expenses once a year. At the request of an employee studying part-time or in the evening, his work week can be reduced by seven hours for ten months before preparing for his thesis or passing state exams.