What does registering as unemployed give?

In the Russian Federation, a state program to support unemployed citizens is provided at the legislative level. Its essence is to promote employment, and until this moment they have the right to receive unemployment benefits. This issue is regulated by Law No. 1032-1.

To register, it is important to meet the following criteria:

- Citizenship of the Russian Federation. Foreign citizens who work in Russia and have reached the age of majority can also register, but they will not receive benefits: such persons are only provided with information about current vacancies.

- Reaching working age.

- Ability to work in the absence of an official place of work.

- Failure to receive benefits, with the exception of payments for staff reduction or liquidation of the enterprise.

- Willingness to start work if a suitable vacancy is found and the interview is successful.

The following are not entitled to receive unemployment benefits:

- pensioners;

- persons under 16 years of age;

- convicts;

- who have submitted documents containing deliberately false data;

- individual entrepreneurs;

- notaries;

- lawyers.

Expert commentary

Kamensky Yuri

Lawyer

Note! Registration takes place within 10 days, after which a similar period is given for the initial selection of places of employment. During this time, an employee of the Employment Center offers the applicant suitable vacancies. If he refuses them two or more times or does not appear at the institution without good reason, he will not be assigned the status of unemployed (Article 3 of Law No. 1032-1).

Who is not entitled to increased unemployment benefits?

The increased payment in the amount of 12,130 rubles is not available to everyone who registered on March 1, 2020. The following categories cannot count on receiving the maximum benefit:

- persons who were employed for less than 26 weeks in the last year;

- citizens who have not been employed for a long time or are looking for work for the first time;

- persons dismissed for violations of labor discipline, as well as as a result of other serious acts;

- those dismissed who were on leave for a long time at their own expense;

- persons who were on maternity leave or child care leave before dismissal;

- self-employed or individual entrepreneurs who have ceased operations;

- citizens who cannot confirm the fact of official employment.

The listed persons can only count on the minimum amount of benefits. It is 1500 rubles.

Deadlines for registration with the Employment Center

Citizens have the right to register at any time after dismissal. However, the amount of the benefit depends on the period of registration with the Central Employment Center, since it is calculated from average earnings.

Payments are scheduled from the first day. Let's consider the main nuances:

- Information about suitable vacancies is provided to the unemployed twice a month. They are selected taking into account his education and work experience. If he refuses the offered places more than twice, the benefit payment may be canceled.

- When the applicant finds a suitable place of work, he is given a direction with which he is obliged to visit the organization within three working days.

- The benefit payment period is limited and usually does not exceed 1 year. At the same time, you can receive information about current vacancies without restrictions and for several years.

Important! If there are compelling reasons, payment of benefits may be terminated. If a citizen is initially denied recognition as unemployed, he can appeal the refusal in court.

Conditions

After submitting and registering with the CZN, a person is assigned obligations that are mandatory. So a citizen is obliged:

- come to the employment center twice a month. Employees of the Center must independently contact the person, set a date and time at which he should visit the institution. If a citizen ignores this requirement, then there is a high risk of reducing the amount of benefits or completely stopping payments. If the omission was made for a good reason and once, then penalties are not applied, but this requires an evidence base;

- undergo interviews. As vacancies become available, the employment center will offer employment that matches the person’s qualifications and skills. After notification, the citizen must appear for an interview with a potential employer within three days;

- make your choice in a timely manner. Each person must choose and get a job within 1 year. If this condition is not met, then the central planning authority may appoint a person to perform any work that does not require special skills or education, for example, carrying out city improvement work.

There are no requirements or deadlines for registration when terminating an employment contract at one’s own request.

However, it is recommended to collect all documents and register within fourteen days. Thanks to this, the entire amount of previously received wages will be taken into account, which affects the amount of the benefit.

How much do they pay after dismissal at the labor exchange?

Decree of the Government of the Russian Federation of March 27, 2020 N 346 “On the amounts of the minimum and maximum amounts of unemployment benefits for 2020” approved the minimum and maximum amounts of benefits for 2020:

- minimum – 1,500 rub. for all;

- maximum – 12,130 rubles. for people of pre-retirement age.

The detailed details of the calculation depend on the category of citizen. Minimum benefit in the amount of 1,500 rubles. is assigned as follows:

- first time job seekers;

- those trying to find a job after a long break - more than 1 year;

- who have ceased to be an individual entrepreneur;

- dismissed for committing guilty actions provided for in Art. 81 Labor Code of the Russian Federation;

- those who terminated employment contracts within 1 year, if the period of work at the previous place does not exceed 26 weeks;

- sent by the Central Employment Center to courses and other training, and expelled through their own fault;

- who did not provide a certificate of average salary for the last 3 months.

In connection with the pension reform, the highest possible payments have been established for persons of pre-retirement age. This was done in order to provide additional material support from the state, since after 50 years of age, finding a job can be problematic. Such persons are paid benefits in the following amount based on average earnings:

- first 3 months – 75%;

- from 4 to 8 months – 60%;

- further – 45%.

Let's look at an example calculation:

At the last workplace, the average income of a citizen for 3 months was 40,000 rubles. Registration was completed within two weeks from the date of voluntary dismissal. For the first three months he will be paid the following allowance: 40,000 x 75% = 30,000 rubles.

It can be seen here that the average monthly salary exceeds the maximum allowable benefit level, so only 11,280 rubles will be paid.

If the applicant quit for any reason, had an employment relationship with the employer for at least 26 weeks and applied to the Employment Center within 1 year after termination of the contract, in the first 3 months he will be paid 75% of the average monthly earnings for the last 3 months before dismissal, and the amount of the benefit decreases to 60%.

For example:

The citizen worked at the enterprise for 5 years; he does not belong to the category of persons of pre-retirement age. In 2020, he decided to resign of his own free will, and after his dismissal, he submitted an application to the Employment Center within 10 days. The average salary over the last 3 months was 20,000 rubles. How is the calculation made:

20,000 x 75% = 15,000 rub. This amount exceeds the maximum limit, so he will only be paid RUB 8,000.

Benefit payment terms

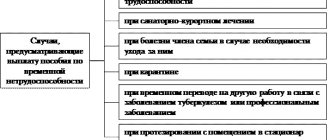

It is important to take into account that the benefit is not assigned for life, but for a certain period depending on the situation, after which payments stop:

| Dismissed for any reason within 12 months before registration, if the work activity in the company exceeded 26 weeks | Never officially worked, fired for wrongdoing, or worked less than 26 weeks |

| Total duration – 6 months for 1 year | 3 months in total for 1 year |

The maximum duration of receiving payments is 24 months. Benefits for more than 1 year are transferred only if the applicant complies with the rules established by the Central Employment Service:

- regular receipt of referrals without refusing vacancies;

- lack of official employment.

Amount of unemployment benefits in 2020

In connection with the spread of coronavirus infection, urgent measures were taken to increase unemployment benefits. Its maximum amount was increased to 12,130 rubles (previously it was 8,000 rubles). Citizens who have lost their jobs and applied to the employment center since March 1, 2020 can count on this benefit.

This amount of benefits will be assigned to everyone who was declared unemployed during this period in accordance with the established procedure, except for those dismissed for violation of labor discipline and other guilty actions as provided by law.

For those who were fired before March 1, a maximum threshold of 12,130 rubles was also established. However, the difference is that benefits will be calculated for them in the general manner, and the amount depends on wages. For those laid off starting from March 1, this dependence is abolished, that is, they will in any case be paid the maximum benefit.

In regions where regional coefficients are provided, the benefit amount is multiplied by them. For example, in Vorkuta, taking into account the coefficient of 0.6, the amount of the benefit will be 19,408 rubles . And in Moscow and the Moscow region, regional additional payments have been established; taking them into account, the amount of benefits will be 19,000 rubles and 15,000 rubles per month, respectively.

Increased amounts of unemployment benefits will be paid for three months - from April to June 2020 inclusive. Funds are allocated from the federal budget. Further, most likely, they will be calculated according to the previously approved methodology.

In addition, if an unemployed person has minor children, he is entitled to another 3,000 rubles for each child. More on this later.

How to join the labor exchange: step-by-step instructions

You can register as unemployed not only at the Employment Center itself, but also through the MFC. This is necessary to receive benefits. If a citizen does not plan to receive payments, but wants to be provided with information about vacancies, he can use the electronic service for registration, if one is provided on the CZN website.

How does the registration procedure work at the Employment Center:

- An applicant for unemployed status pre-registers for an appointment through the official website of the labor exchange. Here you can choose a convenient date and time. You can come without an appointment, but then there is no chance that you will be accepted as quickly as possible.

- On the appointed day, the citizen comes to the CZ with a package of documents.

- Within 10 days, the head of the government agency makes a decision to assign the citizen the status of unemployed.

- Based on the results on the 11th day, the applicant is given a decision to establish status and grant benefits, and a personal file is also created.

Expert commentary

Gorchakov Vladimir

Lawyer

If the benefit is issued through the MFC, the step-by-step algorithm looks the same. The only difference is in the pre-registration procedure: it is also available through the MFC website, but upon arrival at the department, the applicant will have to take a coupon from the terminal. Sometimes you have to wait a few minutes for your turn, but the appointment is usually carried out no later than the appointed time.

Documentation

When visiting an Employment Center or MFC, a citizen is provided with:

- passport;

- educational documents;

- employment history;

- certificate of average earnings for the last 3 months of employment.

Disabled people will need an individual rehabilitation program received at a medical institution after passing a commission, because the choice of place of work must take into account the recommendations of specialists.

After receiving the documents, the Employment Center employee will ask the applicant to sign the notification, which will indicate the date of readiness of the decision - no later than 11 days from the date of receipt of the application.

How to make an application for registration

A blank application form is issued to the applicant at the time of submitting documents to the Employment Center. To fill out you will need the following information:

- FULL NAME. applicant;

- gender, date of birth, registered address;

- phone number;

- education;

- year of graduation and name of educational institution;

- qualification;

- position and length of service;

- additional qualifications and skills;

- conditions at the last place of work: salary, position, period and nature of work.

The applicant's signature is placed at the end of the document.

Arrangement order

The registration process itself takes place within 11 days from the date of application. All this time, employees of the Employment Center:

- Drawing up a citizen’s personal file

- Issue an order on the basis of which the applicant will be classified as unemployed citizens

- His data will be entered into a unified database of unemployed specialists

During the registration process, employees of the Employment Service will select vacancies for the citizen, which he must definitely consider. You can refuse only one of the offers, and the rest must be considered by him, and the specialist must contact the potential employer.

At the same time, the Center’s employees cannot offer any vacancy available in the database. When selecting possible options for a new workplace, they must take into account:

- Skills, knowledge and abilities of the candidate, responsibilities performed at previous places of work

- Income level at last place of employment

If employment does not take place during the period of registration of documents, then throughout the year the Employment Service will regularly offer employment options, and the citizen is obliged to consider these offers.

If, after a year, a job has not been found, then the Center’s employees have the right to offer any vacancies that do not take into account the skills and income level at the specialist’s previous place of work. When this situation arises, an unemployed citizen may be offered additional training or retraining courses.

Grounds for refusal to grant benefits

Benefits may be denied in the following cases:

- the applicant refused the offered vacancies more than twice within 10 days after registration;

- false information was provided when submitting documents;

- the applicant did not appear at the CZN without good reason within 10 days from the date of registration to receive referrals;

- more than two refusals of offers of retraining or vacancies.

Registration at the labor exchange as an unemployed person after dismissal, regardless of the grounds, allows you to quickly find a new job and receive financial support from the state. This makes the search somewhat easier in the current conditions and allows you to find an organization for employment as quickly as possible.

When do payments stop?

According to the law, the period during which benefits are continuously paid does not exceed 12 months from the date of registration. During this time, the person will be offered several employment options corresponding to their level of education, as well as training for a new position.

In a number of situations, the employment service may stop paying the required funds:

- Refusal of an unemployed person to apply for 2 vacancies

- Two-time refusal to undergo training in another specialty

- Employment (independently or with the participation of the employment center)

If within a year the exchange cannot find offers for resigned employees, funds will continue to be paid.

What is the best way to quit for the employment service?

When dismissal due to staff reduction, the unemployed citizen is paid severance pay by the former employer for the first 3 months , and only then the Central Employment Service pays unemployment benefits. Upon dismissal by agreement of the parties, the employer can pay a one-time severance pay if this is provided for in the agreement, and for the rest of the time, until the citizen gets a job, he receives benefits from the labor exchange.

The amount of the benefit depends on the average salary for the last 3 months, but cannot exceed the maximum value established by law; currently it is 8,000 rubles as a general rule. We will tell you more about this later.

It is not difficult to register with the employment center (service) for any reason for dismissal, but the total amount of payments due to the applicant in most cases will be higher if you quit due to staff reduction.

How long does it take to register with the CZN?

The Employment Law does not stipulate how long after dismissal an employee must register with the employment center. Everyone has the right, at a time convenient for him, according to the work schedule of the Central Employment Center, to apply for registration and obtaining unemployed status.

A certain period is set only for those who are laid off due to staff reduction and want to receive payments for the 3rd month of unemployment. All other citizens can register when they consider it necessary and appropriate to do so.

If you contact the Central Employment Service a year after dismissal or later, you can only count on the minimum allowance (currently it is 1,500 rubles).

Amount of payments for the unemployed

Unemployment benefits are cash benefits that some people can receive if they are unemployed on their own initiative (you must obtain status from a government agency). They are regulated and controlled by the government and vary depending on jurisdiction and location.

Benefits are collected in the form of monthly cash compensation, which is often only a percentage of the person's previous salary. Taxes are generally not withheld from unemployment benefits, although this may vary. In addition to meeting the eligibility requirements for unemployment benefits, workers are also required to search for work and regularly report the status of their search.

Typically, there is a waiting period between the end of employment and the start of benefits. In most systems, payments are only made for a specified period of time, although many places allow extensions under certain circumstances.

Filing an unemployment claim involves contacting the unemployment department through the appropriate government agency. In past years, unemployed workers had to wait in long lines to file a claim, but technological advances in recent years allow most workers to file claims electronically, either by phone or online.

While many people view unemployment benefits as a type of social security system, the premise is to provide temporary income to working-class citizens who unexpectedly lose their jobs or in circumstances beyond their control. The system discourages workers from receiving these benefits for long periods of time, providing only the portion of income to which the worker is accustomed. Therefore, most workers tend to actively look for a new job in order to fully restore their earning potential.

The amounts of cash payments are regulated and indexed based on federal legislation. The figures below show amounts as of 2020.

The amount of payments is tied to previous earnings

Unemployment benefits cannot exceed the minimum and maximum values