- home

- Services

- Personalized accounting

- Definition of personalized accounting

- The procedure for maintaining and providing personalized accounting information

- Deadlines for submitting a report on personalized accounting

- Responsibility for violation of the procedure for providing personalized accounting information

- Assistance in maintaining personalized records

- Our tariffs

According to current legislation, all employers are required to provide information about their employees to the Pension Fund of the Russian Federation. They relate to accrued amounts transferred to individual personal accounts of employees of the enterprise. The law determines the rules for recording data regarding pension savings for each citizen individually.

Definition of personalized accounting

Personalized accounting in our country is a system that collects all information about the funded and insurance parts of future pensions. It was created by the Pension Fund of the Russian Federation, so it is also managed by it. Relevant reports must also be submitted here.

From the moment a person begins his working activity, an individual personal account is opened for him in the Pension Fund of the Russian Federation. It collects data about a person’s length of service throughout their entire career. Thus, the employee is in the hands of managing his own account. When calculating a pension, the following principle will apply: the more funds accumulated, the larger the pension.

All activities and management are regulated by Federal Law No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.”

The main tasks assigned to the organization and maintenance of personalized records are:

- the formation of a unified information system in the country that contains the most up-to-date information about insured persons;

- ensuring transparency of information on the calculation of savings and insurance contributions;

- Constant updating of the database with current reliable data received from employers.

The main functions of personalized pension accounting are:

- reliable provision of pension rights of citizens of the Russian Federation;

- prompt notification to insured persons of the current status of their personal accounts;

- effective control over the receipt of mandatory insurance contributions, which are transferred by employers in the compulsory health insurance system.

About the system

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-56-12 (Moscow)

+7 (812) 317-50-97 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Compulsory pension insurance is a security system. OPS is a mandatory program at the state level; it began operating in the Russian Federation in 2002 after the reform.

Within the framework of the system, a funded part of the pension is formed for all citizens of working age and insurance contributions are made towards it.

Until 2002, there was a distribution system, and after the reform, a distribution-savings system was introduced. Therefore, since 2002, all persons older than 1967 began to form a funded part - this is 6% of the monthly salary.

It is possible to receive the right to payment only if there are grounds, for example, after reaching retirement age.

The OPS system includes:

- The policyholder is a pension fund. All funds are sent to the OPS, and it then distributes them to the savings and insurance parts. The extra-budgetary fund distributes savings among insurers, keeps records and makes accruals.

- Insurers - NPF, UK, GUK. Insurers are considered to be non-state pension funds, management companies, and Vnesheconombank. These structures invest pension savings based on the choice of citizens.

- A citizen is an insured person. It is the citizen who is the owner of all savings and chooses the insurer. If he has not written a corresponding application to transfer part of the pension to a non-state pension fund or management company, then the money remains in the pension fund.

The procedure for maintaining and providing personalized accounting information

Currently, the procedure for maintaining personalized records of information about insured persons is established by Federal Law No. 27-FZ and the Instruction approved by Order of the Ministry of Labor and Social Protection of the Russian Federation dated December 21, 2016 No. 766n

The instructions set:

· the procedure for registration in the compulsory pension insurance system;

· the procedure for providing information about insured persons to the territorial bodies of the Pension Fund of the Russian Federation and the procedure for receiving this information by responsible officials of the Fund;

· the procedure for checking and monitoring the accuracy of information provided to the Fund;

· rules for document management, storage and destruction of documents containing personalized accounting information.

Registration with the Pension Fund of the Russian Federation is carried out by a citizen (his representative) personally or through the policyholder by filling out a questionnaire of the insured person. After checking the personal data, the insured person is issued an insurance certificate of compulsory pension insurance.

Policyholders are required to provide the territorial bodies of the Pension Fund with information about employees (insured persons) necessary for maintaining personalized records. In accordance with Federal Law No. 27-FZ, policyholders are all legal entities (including foreign ones), their separate divisions, as well as individual entrepreneurs and citizens operating in the territory of the Russian Federation and hiring under employment contracts or concluding civil contracts for which insurance premiums are charged in accordance with the legislation of the Russian Federation.

According to Article 11 of the Law, the policyholder is obliged to provide information to the Pension Fund of the Russian Federation regarding each insured person working for him (including those receiving remuneration under civil law contracts). This information includes:

- the amount of wages (income) on which contributions to compulsory pension insurance were calculated;

- amounts of accrued insurance premiums.

Information is provided on paper (by the policyholder in person or by mail) or in the form of an electronic document.

The Board of the Pension Fund of the Russian Federation has adopted a number of regulations approving the forms of documents for registration and maintaining personalized records, and also established the procedure for filling them out and sending them to the Fund’s bodies.

The form for providing information about insured persons was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated February 1, 2016 No. 83p (Form SZV-M).

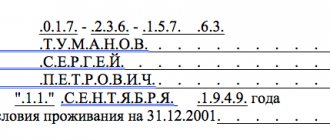

Form SZV-M includes:

- information about the policyholder (details, registration number in the Pension Fund of the Russian Federation, name, TIN, KPP, reporting period, type of form);

- information of the insured persons - last name, first name, patronymic, insurance number, TIN (if available).

Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p approved the forms of documents for registration of citizens in the compulsory pension insurance system and Instructions for filling them out.

In particular, the Resolution approved:

· Questionnaire of the insured person (ADV-1);

· Insurance certificate of state pension (ADI-1) and compulsory pension insurance (ADI-7);

· List of documents submitted by the policyholder to the Pension Fund (ADV-6-1);

· Information about the work experience of the insured person for the period before registration in the compulsory pension insurance system (SZV-K) and others.

The instructions for filling out personalized accounting document forms establish a detailed procedure for filling out and transmitting data to the territorial bodies of the Pension Fund of the Russian Federation and contains more than 80 different tables.

What is the compulsory pension insurance system?

The financial system of compulsory pension insurance is a complex of government measures (economic, legal, organizational), the purpose of which is to create sources of financing pension payments to individuals (Article 3 of Law No. 167-FZ of December 15, 2001). The main participants are policyholders-employers and insured persons, including citizens working on the basis of TD and GPD; IP; private practitioners; members of peasant farms, etc.

An insurance certificate confirms that a person has become a participant in the insurance policy (Article 7 of the Law). The document contains personal data about the individual, as well as the personal account number and date of registration in the system. Contributions transferred by policyholders for employees are recorded in individual accounts of citizens to ensure future pensions. The management of funds in the OPS is carried out by the Pension Fund of the Russian Federation, but the obligation to transfer personalized accounting data to the control authorities lies with employers (Article 11 of the Law).

Responsibility for violation of the procedure for providing personalized accounting information

The employees responsible for submitting this information are responsible for their correctness and reliability.

Control over the accuracy of the information provided is carried out by the territorial bodies of the Pension Fund. If errors are detected and (or) their inconsistency with the information available to the Pension Fund of Russia, as well as if they do not comply with the established forms and formats, the policyholder is given a notice that the errors have been corrected (in person against signature, by registered mail or electronically). The policyholder is given 5 working days to eliminate these errors.

For failure to provide information within the established time frame or provision of incomplete (inaccurate) information, as well as failure to eliminate errors, managers and officials of the policyholders bear financial responsibility established by Article 17 of Federal Law No. 27-FZ.

From 2020, a fine will be imposed on employers who:

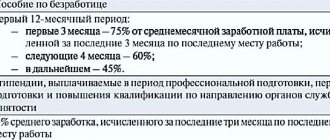

- failed to submit a report on time - in the amount of 5% of the amount of all insurance premiums that were accrued for the reporting period. The fine is charged for each month of delay. Its amount cannot be less than 1000 rubles and cannot exceed 30% of the accrual amount;

- submitted false information - in the amount of 5% of quarterly deductions. But this fine is collected through the court.

Therefore, the report must be kept correctly and correctly.

In addition to financial responsibility, it is worth noting that those involved in this at the enterprise, as well as responsible employees of the pension fund who painstakingly enter data into the database, decide the fate of future pensions. Both the correctness of the accruals and the correctness of the input, and therefore the management of pension savings, depend on them. In the future, this will directly affect the size of pensions.

A detailed study of numerous regulatory documents does not always guarantee the correct, timely preparation and submission of personalized accounting information. It is impossible to know all the nuances “from scratch”, and experience, as a rule, is gained through trial and error. Therefore, it will be most effective to transfer such a critical area of work to professionals specializing in the provision of these services.

Responsibility in the compulsory pension insurance system

If the policyholder evades submitting reliable data or does not provide information in full, he faces liability under Art. 17 Law:

- 500 rub. for each insured person - in case of violation of deadlines for submitting information, for submission of incomplete or false data to SZV-M, SZV-STAZH.

- 1000 rub. – in case of violation of the established regulations for sending data in electronic format.

When these offenses are detected, a report is first drawn up and handed over to the policyholder within 5 days from the date of signing. The violator has 15 days to appeal. If the document is not appealed, a decision is made and only then a demand for payment of sanctions is sent. The employer is given 10 days to comply.

Assistance in maintaining personalized records

Having worked in the consulting services market for more than 15 years, she professionally provides personalized accounting services in Moscow and the Moscow region to enterprises and individual entrepreneurs.

The company's specialists are highly qualified professionals in the field of accounting, taxation, labor legislation and law. Having extensive experience in maintaining personalized records, we guarantee the correctness and accuracy of its preparation at your enterprise and timely submission to the Pension Fund authorities. By transferring this work to us, you can be sure that maintaining personalized records at your enterprise will comply with all the requirements of current legislation.

What information must be submitted to the Pension Fund?

The employer is obliged to provide reports to the Pension Fund for each employee. The reporting form is uniform.

And this has its advantages:

- the volume of reporting data is reduced;

- eliminating inconsistencies between information on insurance premiums.

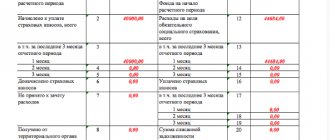

A single form contains all payment data since 2014, but it should be taken into account that the insurance and savings parts are not separated. Payment of contributions and debts on them from 2010 to 2013 is also taken into account in this form.

In the second section there is an addition - number 4. It is necessary to display data on the payment of SV for additional tariffing. Additional tariffs depend on the results of the assessment of working conditions.

This assessment is carried out once every five years. In addition, the uniform form does not display the amount of paid contributions in individual information.

Procedure and deadlines for submitting reports

Information about insured persons is provided to the Pension Fund in writing or on electronic media. Each method has its own deadlines and means.

In a written form

Paper media is still permitted, although the insurer prefers electronic reporting forms due to the ease of further processing of data. Written forms also exist to protect against loss of data from electronic media.

In addition, in the Russian Federation there are still areas with insufficient technical equipment, where it is not possible to send reports using modern methods.

A quarterly report on paper in the RSV-1 form is submitted by the 15th day of the second month after the reporting period.

Important! If the employer's staff exceeds the limit of 25 people, then reporting is possible only in electronic form.

On electronic media

Information is transmitted electronically via secure communication channels.

This form of reporting is more convenient for the insurer, as it reduces the time for collecting and processing information. To submit information, special complexes “Taxpayer” and “Sprinter” are used. Each employer is identified through an electronic digital signature.

Reporting on electronic media is submitted before the 10th day of each month in the SZV-M form. For late submission of reports, the employer is subject to penalties.

The quarterly report is submitted by the 20th day of the second month after the reporting period.

Providing PU information to a specialized department of the Pension Fund of Russia

Company management and citizens registered as individual entrepreneurs who have employees are responsible for reporting information about employees to the pension authorities.

It is established that information on insurance production must be transferred to the authorized bodies by the beginning of March. During employment, the applicant must provide reliable information about himself, and all facts are confirmed when using documentation. Filling out information about each employee is carried out in electronic and written format.

After all data is consolidated, it is transferred to the pension fund. Future social support for citizens who are temporarily unemployed, receive social benefits, are in prison, and are provided with pensions from the state budget.

Policyholders send data by the middle of each month. Sending information is required for the fiscal and pension authorities. The basis is the calculation made according to the accounting and financial statements. It is necessary to constantly monitor the relevance of the data. If there is a change in personal information, the specified authorities must be notified about this.

Initially, companies must collect all the information, after which they enter it in the prescribed form. The document contains information separately for each employee. You must fill out the form separately for each employee. This applies only to those persons who received payments for the current period. The basis is a formed agreement of labor or civil law type.

The divisions of the pension authority authorized to do so can exercise control functions in this area. If there is a violation of the rules regarding the submission or sending of inaccurate data, liability measures are imposed on the company. They are expressed in the form of a fine, the amount is five hundred rubles for each person registered in the system.

For more information about submitting data to the Pension Fund, watch the video:

https://youtu.be/PIua0OxsrKA

If the company's management conscientiously fulfills its duties, this ensures decent pension contributions in the future.