Last updated 02/17/2020 From the beginning of 2020, the Order of the Federal Tax Service of Russia came into force, approving a new procedure for calculating and reporting on paid insurance contributions to the budget of the Social Insurance Fund (hereinafter referred to as the FSS). The rules provide for the administration by tax authorities of paid contributions (pension, temporary disability, pregnancy and childbirth).

The provision of reports is transferred to the tax office, and all insurance premiums are included in a single calculation form.

What remains under the control of the FSS? The fund continues to administer and receive reports on contributions from accidents and occupational diseases. Therefore, a new version of form 4-FSS has been introduced.

No. ММВ-7-11/551 dated October 10, 2016

Order of the Federal Tax Service of the Russian Federation No. 381 of September 26, 2016

Although compensation for the costs of paying benefits has been paid by tax authorities since 2020, the FSS retained the functions of checking the expenditure of paid insurance premiums.

What documents need to be submitted to the Social Insurance Fund for reimbursement?

To avoid confusion when calculating compensation and submitting documents to the required authority, you need to clarify when the period of incapacity began.

The policyholder submits a package of documents to the Social Insurance Fund for compensation when the occurrence of temporary disability arose before December 31, 2016.

FSS Letter No. 02-09-11/04-03-27029 dated 12/07/16

Letter of the FSS of the Russian Federation dated December 8, 2016 N 02-09-11/04-03-27234 in addition to the letter of the FSS of the Russian Federation dated December 7, 2016 N 02-09-11/04-03-27029

Order of the Ministry of Labor of the Russian Federation No. 585n dated October 28, 2016

Regulatory acts approve the following list of documents:

- Application for the allocation of funds for compensation of insurance coverage.

- A calculation containing data on contributions paid to the budget and benefits paid to employees.

- Copies of documents proving the validity of the funds spent on social security. These include:

- sick leave (temporary disability, pregnancy and childbirth);

- birth certificates and certificates (one-time allowance for the birth of a child, child care allowance);

- certificates from the place of work of the child’s other parent (confirms the absence of receipt of maternity and child care benefits at the place of work of the second parent);

- death certificate (funeral benefit);

- certificate of registration in the early stages of pregnancy (allowance for registration up to 12 weeks).

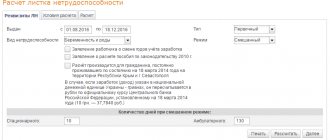

New certificate-calculation

Since 2020, the previous form 4-FSS has been replaced by a new reporting form - Certificate-Calculation. It is included in the package of documents for receiving compensation in 2020.

Its development is associated with changes in the procedure for reporting on insurance premiums. Since administration has been transferred to the tax authorities since 2020, the Social Insurance Fund no longer receives reports on the transfer of funds to the budget. Therefore, a document was needed in which the policyholder could reflect all the data on contributions.

But the Social Insurance Fund will not just agree with the figures reflected by the policyholders in the Calculation Certificate. According to the regulations, the FSS has the right to request confirmation from the tax authorities.

There is no approved form for the Certificate of Calculation in any legislative act. This suggests that the policyholder has the right to draw it up based on Order of the Ministry of Labor No. 585n dated October 28, 2016.

The following indicators should be reflected in the calculation certificate:

- the amount of debt on insurance premiums at the beginning/end of the billing period;

- accrued amount of contributions;

- additional accrued amount of contributions;

- the amount of expenses not taken into account;

- compensation received from the Social Insurance Fund;

- funds of the policyholder spent on social benefits, etc.

(doc format).

Calculation certificate provided when applying for funds

However, the FSS, in an internal letter, provided lower-level departments with a sample of the Calculation Certificate.

Application for reimbursement

As in the case of the Certificate-Calculation form, there is also no legally approved application form for reimbursement. In the same letter, the FSS recommended a single form of application. It is also published on the websites of FSS branches throughout the country.

The application must contain information about the policyholder (name, legal address, insurance registration number), bank details and amount of compensation.

The text of the sample application itself states that it must be submitted simultaneously with two applications:

- reference-calculation;

- breakdown of expenses for payment of benefits.

https://youtu.be/IUPbst6SFVE

FSS benefits (payments) – portal, calculator, amount for the birth of a child in 2020

The social policy of the Russian Federation presupposes the presence of many subtleties in the procedure for processing due payments.

First of all, people have a logical question: where to apply: to the Social Insurance Fund or to the employer?

The answer to this is not so obvious, since there are specific distinctions between the categories of citizens who have the right to implement one or another option.

Studying the features will allow us to understand the current situation with the distribution of responsibilities between these structures.

Who can be the recipient

Any citizen of the Russian Federation can become a recipient of payments - much depends on what kind of benefit is issued.

For example, pregnancy and childbirth, obviously, can only be used in relation to women. Whereas child care benefits are assigned to any close relative who actually provides care.

Advantages

The key goal pursued by the Government of the country when switching to direct payments for the Social Insurance Fund was the effective use of budget funds.

The adopted adjustments will provide the Fund with the opportunity to conduct checks on the legality of accrual of payments and the correctness of calculation of amounts before they are implemented.

This measure helps to minimize cases of fraud with sick leave certificates.

Additionally, “Direct” payments will allow optimizing the expenditure side of the Fund by eliminating non-targeted payments that affect the budget balance.

It is worth noting that the function of storing documentation does not apply to government agencies. That is, after a decision on the application is made by authorized persons, the applicant is obliged to pick up the provided documents.

You can obtain the necessary information through the FSS portal.

- The payment of benefits, namely its procedure, is also reflected on the website: there is a special table reflecting standard rates and taking into account the coefficient.

- In addition, you can use a special service to determine the required amounts - a calculator for calculating social benefits.

If the employer goes bankrupt or is unable to pay

Financing benefits from the Social Insurance Fund in cases where this must be carried out by the employer is allowed if the latter is not able to provide the required payments.

For example, a woman receives child benefit. While on vacation, the company was liquidated.

In such a situation, in order to further accrue financial support from the state, you will need to send a corresponding application with a package of established documents to the territorial branch of the Social Insurance Fund.

As part of the pilot project

The essence of the project is that when a certain event occurs, an employed person contacts the employer with all the papers. But the latter, instead of calculating benefits from the wage fund, sends a request to the Social Insurance Fund.

And the government agency is already dealing with the issue of calculating material support. The funds are transferred to the applicant’s bank account within 10 calendar days.

The main advantage for the employer is fewer problems with documentation.

A citizen can count on the exclusion of cases of fraud by unscrupulous employers.

Regions of direct payments

The Social Insurance Fund does not pay benefits through a pilot project in all regions. In particular, as of 2020, they operate in 39 regions of the country.

For example, in July of this year the following joined:

- Tyva Republic;

- Kursk region;

- Republic of Karelia;

- Kabardino-Balkarian Republic.

The project expires at the end of December 2020.

Whether it will be continued in the future will become known after the Government makes its decision.

How to apply

To apply for any benefit, you will need to meet certain requirements approved by authorized structures.

Therefore, before contacting the same Fund, it is necessary to first examine the issue of interest for the presence of subtleties.

Application to the Social Insurance Fund for benefits for a child under 1.5 years old

There is no legally approved application form for receiving benefits, but FSS branches have a sample for filling out an application for payments.

In addition, you can use the official website of the state structure, where there is also a lot of information regarding the provision of material support for categories in need.

Calculation

When calculating benefits for a child under 1.5 years old, the average monthly earnings are taken into account.

When determining this indicator, earnings for the previous two periods are taken into account, which must be divided by 730 days and multiplied by 30.4.

Amount and procedure of payments

The amount is set at 40% of average monthly earnings.

It is necessary to take into account that the minimum and maximum of these payments are legally established.

After the request is satisfied, the benefit is received from the Social Insurance Fund until the 26th day of the month following the month of application.

Employer compensation

When transferring child benefits to women or other persons entitled to it, the first three days of payment are received from the employer.

And only after their expiration, the Social Insurance Fund comes into effect and funds begin to be calculated from its budget.

In the future, the employer is reimbursed for the costs of the first three days of transfers - the required amount also comes from the Social Insurance Fund.

Documentation

As a standard, mandatory documents for the provision of a particular benefit include an application and a document confirming that the applicant has grounds for receiving specific financial support.

You can clarify the list of required positions for a specific case by obtaining advice from a civil servant.

For temporary disability

Temporary disability benefits are provided to insured persons as partial compensation for loss of income from work due to the fact that work is impossible due to short-term deterioration in health.

You can apply for payment only if you can prove that there is a basis for accruing support.

This is usually a certificate from a medical institution confirming the fact of illness or injury.

For pregnancy and childbirth

As for who pays the B&R benefit: the employer or the Social Insurance Fund, it depends on the woman’s status - whether she is employed or unemployed.

Benefits are calculated based on sick leave, the form of which is obtained at the antenatal clinic.

Along with it, you must send to the authorized body:

- statement;

- salary certificate – when applying through the Social Insurance Fund or if additional jobs are available;

- certificate of non-receipt of benefits;

- an extract from the work record book with a note of dismissal - also relevant when submitting a request to the Fund.

Additionally, a passport of a citizen of the Russian Federation is considered mandatory.

Barely upon early registration

If a pregnant woman registers with a medical institution before the 12th week of pregnancy, she can count on a small but pleasant payment.

To complete it, you only need an application and a certificate from the medical organization. The contents of the paper must indicate the exact duration of pregnancy.

At the birth of a child

To apply for a one-time benefit for the birth of a child in 2020, you must send the following documents to the accounting department at your place of employment:

- application for assistance;

- a certificate of birth of a child, issued upon registration at the registry office of the fact of the birth of a baby;

- passport of a citizen of the Russian Federation;

- child's birth certificate;

- a certificate confirming the fact that the second parent did not receive an identical benefit for this newborn.

Monthly childcare

To receive monthly payments for children you need:

- application for leave;

- application for benefits;

- passport of a citizen of the Russian Federation;

- child's birth certificate;

- a certificate according to which the other legal representative of the child has not previously issued appropriate financial support.

Payment for additional leave of the insured person when traveling to the place of treatment and back

If the insured person is sent to a place of treatment to compensate for additional leave, you will need:

- travel ticket – round trip;

- passport of a citizen of the Russian Federation;

- medical direction – the destination must correspond to the destination on the ticket.

For burial

Social compensation for burial at the expense of the state for burial is assigned to persons who have incurred the costs of the funeral of a loved one.

To obtain it, it is enough to provide a death certificate from the registry office.

Payment for caring for disabled children and people with disabilities since childhood

When caring for minors with a disability group, you must have with you, in addition to the application, a certificate of assignment of disability to a specific person and a certificate confirming cohabitation.

Accrual for pregnant women and those with children

Now a child's monthly allowance is provided regardless of the presence of alimony payments, pensions and other government subsidies.

Supporting pregnant women and having children is the main prerogative of the state, since they are the foundation for society.

Deadlines for contacting the service

The legislation approves certain time frames for applicants to apply for benefits.

- For example, in the case of applying for a one-time child benefit, you will need to send a corresponding request within 6 months from the date of birth of the child.

- If we consider support for parents when caring for a child under 1.5 years old, then they can also apply for payments within six months from the day the child reaches 1.5 years old.

Who should apply for a lump sum benefit upon the birth of a child? Find out here.

How to apply for unemployment benefits? Read on.

Source: https://subsidiiguru.ru/fss-posobija/

Reimbursement period

According to Article 4.6 of Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity,” the territorial body of the Social Insurance Fund, based on the received package of documents, is obliged to transfer money to the policyholder’s account within 10 calendar days. The starting point of the period is the date of submission of documents. However, in accordance with paragraph 4 of this article, the FSS department will organize an on-site inspection to verify the validity of the expenses. At this stage, the FSS department has the right to require additional supporting documents.

Based on the results of the inspection, the fund pays the funds or within three working days notifies the policyholder of a reasoned refusal.

Please note that the policyholder has the right to appeal the decision to refuse to pay insurance compensation by going to court.

New application forms and payment certificates

In the appendices to the Letter of the FSS of the Russian Federation dated 07.12.2016 N 02-09-11/04-03-27029 “On sending forms of documents that must be submitted by the insured for the territorial body of the FSS of the Russian Federation to make a decision on the allocation of the necessary funds for the payment of insurance coverage” given new forms of “Application for the allocation of necessary funds for the payment of insurance coverage” and “Calculation certificate submitted when applying for the allocation of funds for the payment of insurance coverage”, which you can download from the website of the Federal Social Insurance Fund of the Russian Federation using the link below.

Reduction of insurance premiums for benefits

Article 431 of the Tax Code allows you to reduce the amount of the monthly contribution. When determining the amount of payment to the budget, the policyholder has the right to deduct expenses incurred for the payment of benefits to employees:

- for temporary disability;

- for pregnancy and childbirth;

- for registration up to 12 weeks of pregnancy;

- at the birth of a child;

- child care upon reaching one and a half years of age;

- for burial.

The policyholder makes it easier to compensate for his social security costs by reducing the size of the next contribution. If the amount of the policyholder’s payment exceeds the amount of the contribution, then you will have to contact the Social Insurance Fund.

When submitting an application to the tax authority, the policyholder reflects expenses in a new unified reporting form, which is transferred to the tax authority.

The concept of FSS benefits

FSS benefits are financial assistance to socially vulnerable categories who have lost their regular income.

Among the insured events that serve as the basis for payments, we can highlight:

- Birth and adoption of a child.

- Illness or work injury, occupational disease.

- Illness of a child or other relative requiring care.

- Pregnancy and childbirth.

- Death of the insured.

Funds from the federal budget are partially allocated to the FSS for compensation to citizens. Such government transfers are transferred only when the fund has a deficit of its own funds.

The Social Insurance Fund budget is largely formed by employers (entrepreneurs and legal entities), who are required to make monthly insurance contributions for employees and pay penalties and fines if payments are late.

Employers transfer two types of contributions to the fund account: for maternity and for injuries (at least 2.9% of the salary, depending on the degree of risk of injury in the company).

Part of the funds comes in the form of voluntary donations from citizens and companies.

When insured events occur, the fund compensates the employer for a certain amount of expenses.

If the amount of benefits exceeds accrued contributions

It was discussed above what affects the reduction in the size of the policyholder’s monthly contribution. But a situation arises when the contribution is greater than the expenses. Then the policyholder has two ways to develop the situation, indicated by tax legislation:

- The right to offset the received excess amount against future contributions (if it fits within the current billing period).

- The right to receive a refund when contacting the Social Insurance Fund department with a package of documents.

Although the change in legislation has designated the tax authorities as the administrator of insurance premiums, the application should be submitted to the territorial social insurance fund (Law No. 255-FZ of December 29, 2006).

Reimbursement of expenses after January 1, 2020

If the policyholder’s application to the Social Insurance Fund is related to expenses incurred for periods starting from 01/01/2017, then the list of documents to be submitted includes:

- Application for the return of funds spent on social security.

- Help-calculation.

- Breakdown of Social Security Expenses.

Upon receipt of an application, the Social Insurance Fund department performs a desk audit of the submitted expense information or an on-site unscheduled audit. During the consideration of the application, the fund requests from the Federal Tax Service the information from the unified reporting form submitted by the policyholder. This is how a counter-check of data on social security expenditures takes place.

Based on the results of the audit, the fund department sends the result of the decision to the tax office in the form:

- confirmation of the declared expenses for payment to the policyholder;

- non-acceptance of expenses specified in the application for offset.

After this, the Federal Tax Service fills out an application for a refund and submits it to the territorial body of the Federal Treasury. After processing the documents, the funds are transferred to the policyholder’s account (within three working days).

When offsetting funds against future periods, the tax officer uses an internal document to reflect the resulting overpayment in the client’s card. The next time contributions are calculated, the amounts will be offset automatically (with the possible formation of an underpayment of the current contribution).

If the amount accepted for offset does not match the amount of the contribution, the difference must be made within the period established by law.

As part of the new procedure for interaction between the taxpayer, the Social Insurance Fund department and the tax policyholder, they can submit an application for reimbursement to the Federal Tax Service inspectorate, which transmits information about the received application to the Social Insurance Fund department. On this basis, the fund carries out the same control actions as in the case of personal receipt of a package of documents. The on-site inspection may be joint with representatives of the tax authorities.

Along with information about the policyholder’s need to return funds, the Federal Tax Service Inspectorate transfers data from a unified reporting form to the Social Insurance Fund department for making a decision. The following steps coincide with the case when the policyholder applies to the Social Insurance Fund.

The Federal Tax Service has the right to make decisions on holding the taxpayer accountable for the offense committed. This information is also brought to the attention of the FSS.

The policyholder now does not care which body to submit an application for reimbursement of social security expenses incurred. The developed procedure for interaction between the two structures established a clear flow of documents and exchange of information between them.

In the era of electronic communication, such data exchange can occur almost instantly. But the future will tell.