Key regulations on this issue

In the process of production activities, enterprises use certain materials, the accounting of which plays an important role in determining the cost of goods produced.

The tenth position in the balance sheet, called “Materials,” is designed to reflect the movement of inventory items at enterprises from the moment they are received at the warehouse and accepted on the balance sheet, and until they are written off for production needs and other administrative and economic needs.

As already noted at the very beginning, accounting in this category is of significant importance, since the cost of products and, ultimately, the financial result of any company will depend on the correct recording and write-off of these inventories.

According to Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000, accountant 10 is used to summarize information about the quantitative composition and movement of raw materials, inventories, household supplies, inventory and other assets of the company, including those that are in the process of processing or ways.

In accordance with another regulatory legal act of the Russian Ministry of Finance No. 119n dated December 28, 2001, this category must be reflected in the designated account at accounting prices or at their actual cost. The company’s “preferences” on this issue should be consolidated in its accounting policies. At the same time, document flow regarding the movement of inventory items can be carried out both according to established forms and using your own forms, which must necessarily contain the details of the organization. As for the write-off of materials and raw materials according to the 10th account, it can be carried out in such ways as FIFO, the average cost method, or on a monthly basis for each unit of product.

Thus, the designated account allows you to get an accurate idea of the movement of all inventory items in the enterprise. As for the balance sheet, the balance of the organization's inventory as of the reporting date can be seen in line 1210 2 of the active part of the document. For analytical analysis of 10 accounts, the names of items, enterprise warehouses, batches, etc. are taken as a basis.

Acceptance of inventories for registration in other cases

Materials can arrive at an organization’s warehouse not only through a transaction with a supplier.

Let's consider accounting for materials that were acquired in other ways: Account assignments for materials receipt

| Dt | CT | Characteristics of the operation |

| 10/15 | 98.2 | Materials received free of charge have been accepted for registration |

| 98.1 | 91.1 | The amount of income generated by materials received free of charge is reflected. |

| 10/15 | 91.1 | Materials arrived at the warehouse at market value as a result of liquidation of fixed assets |

| 10 | 75 | MPZ contributed as a contribution to the authorized capital |

It is worth noting that accounting for material consumption is always expressed by posting using account credit 10. It does not matter how the organization writes off inventories for production.

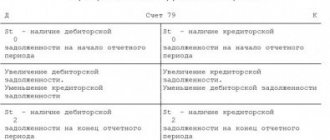

General idea of 10 count

Thanks to position 10 of the balance sheet, the company's management receives information about the movement and balance of inventories as of the reporting date. Based on this data, managers make appropriate decisions.

Since the 10th balance sheet account is active, its debit part reflects the capitalization of actually received inventory items. In this case, correspondence with account 15 “Procurement and acquisition of goods and materials” is used.

In a situation where 15 and 16 balance sheet accounts are not applied, the procedure for capitalizing inventory items is reflected in the accounting entry for the debit part of account 10 and the credit part of 60, 20, 23, 71, 76 and other accounts. In this case, the determining factor is the source of goods and materials and the nature of the costs of manufacturing and delivering materials.

Subaccounts and classification of inventories

Before moving on to sub-accounts, we should dwell in more detail on the materials and their classification. This category refers to the types of company reserves that play the role of raw materials in the production process of one or another type of company product, as well as in meeting business needs.

There is a certain classification of materials, depending on which 11 subaccounts are provided in the Chart of Accounts. When classifying these materials by type, their economic characteristics are used as a basis:

- raw materials and materials that are the basis of manufactured products and ensure the adequacy and continuity of the production process;

- purchased semi-finished products and components that also take part in the production of goods. However, additional efforts are required on them for use in the production process;

- fuel, which is used to provide heat, continuous operation of equipment and other production needs of the company;

- containers, as well as materials used for its production;

- spare parts used in the process of repairing fixed assets;

- other inventory items that were formed due to defects, waste from the production process, as a result of write-off of fixed assets, etc.;

- inventories that were transferred for processing to third-party enterprises and the cost of which does not affect the price of manufactured goods;

- construction materials required for the developer’s work;

- inventory and household supplies used as means of labor;

- special clothing and special equipment in the warehouse; And

- special clothing and special equipment transferred into operation.

FIFO and LIFO methods

Writing off materials in FIFO accounting requires compliance with the rule: regardless of the batch released into production, it is accounted for at the cost of the first purchase. After the complete write-off of the quantity of materials of the first batch, the rest is written off at the cost of the second, third, etc. batches. On the contrary, the remaining materials in the warehouse are assessed based on the cost of the last delivery.

The method is often used when purchasing similar materials or raw materials. It is beneficial to the enterprise in cases where the market value of inventories becomes cheaper.

Let's consider an example: in the warehouse of an enterprise there are 400 tons of the same cement, which was purchased from different sellers. 200 tons of the first batch were purchased for 3200 rubles. per ton, and the remaining 200 tons - 3,300 rubles. per ton. If 30 tons of cement are written off, the accountant will take into account the cost of one ton at 3,200 rubles. until the entire volume of the first delivery of material is written off. In this case, it does not matter at all from which purchase the cement will be taken.

The LIFO method implies the use of the opposite rule: first, inventories are written off at the cost of the last batch, and so on in descending order. Warehouse balances are accounted for at initial delivery prices.

The amount of materials consumed, accounted for using the FIFO or LIFO method, is determined by the formula:

P = He + P – Ok, where:

It is the amount of the balance of materials at the beginning of the month;

P – cost of accepted materials;

Ok – the cost of the balance of materials at the end of the month.

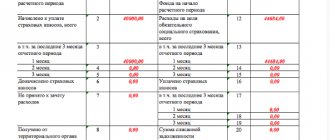

Account balance sheet

The balance sheet reflects information about the receipt and expenditure of inventory items in warehouses. The document indicates the beginning balance and the ending balance. Accounting for this category is carried out both in physical and in value terms.

If we talk about the balance sheet for warehouses, then a separate document is generated for each of these warehouses. Only after this the data obtained for each warehouse is compiled into a general document for the organization. This document is the basis for maintaining records of materials. All data entered into the electronic database is also reflected in warehouse cards. It is according to the latest documents that the enterprise reports on materials.

Allowed simplifications

The applicable accounting policies and procedures are flexible. Depending on the prevailing circumstances and the requirements of the time, the necessary changes are made to these documents at the government level.

Thus, in 2020, some changes were made, according to which small businesses and non-profit organizations received the right to use simplified accounting methods, including accounting for materials.

These assumptions are given by the Ministry of Finance of the Russian Federation in order to enable this category of business entities to develop better. However, in order to be able to apply the presented preferences, they should be fixed in the accounting policies.

Thus, the Ministry of Finance of the Russian Federation allows:

- valuation of purchased goods and materials at the seller's price;

- simplified write-off of those inventories that are used for management needs;

- now the designated categories of business entities have the right to write off the cost of business and production equipment at a time;

- From now on, the initial cost of OS can be formed by including only the price that was paid to their supplier, as well as the costs of their installation. Other costs incurred in the process of purchasing an OS should be classified as expenses;

- Now it is possible to abandon the formation of a reserve fund designed to cover losses in the event of a decrease in the value of goods and materials.

Accounting for receipt of materials: documents and postings

Accounting for materials in an organization is an important process that should be given close attention, primarily in order to ensure the safety of materials. The receipt of materials has a number of features that we will consider in this article.

The content of the article:

1. Receipt of materials

2. Accounting for receipt of materials

3. Initial cost of materials

4. Receipt of materials from additional expenses

5. Receipt of materials: postings

6. Receipt of materials: documents

7. Receipt of materials in 1C Accounting 8

Let's look at each of these questions in order.

- Receipt of materials

Receipt of materials occurs when:

- purchasing materials,

- receipt of materials to pay for the share in the authorized capital of the organization,

- in case of receiving materials free of charge,

- when their surplus is discovered during inventory,

- creating materials in-house,

- when recording the balances generated during the dismantling of fixed assets,

- in some other cases.

The financially responsible person of the organization must accept materials and documents on them. Upon acceptance, both the quality and quantity of supplied materials are checked. The material group accountant checks the correctness of the suppliers' primary documents and the presence of all required details and data.

In some industries, for example, in construction, there are often cases when the same material is received from different suppliers in different units of measurement, or is released into production in different units in which it was received.

In such cases, it is recommended to reflect the receipt of materials simultaneously in two units of measurement (clause 50 of the Guidelines for accounting for inventories). This method is quite labor-intensive.

An alternative option is to develop a local regulatory act (LNA) that allows you to determine the conversion factors of one unit of measurement of inventory into another unit of measurement.

- Accounting for receipt of materials

Accounting for the receipt of materials must be maintained in accordance with the provisions of the company's accounting policies.

An organization can accept one of the following options for recording the receipt of materials:

- at the accounting cost of the acquisition using accounts 15 “Procurement and acquisition of material assets” and account 16 “Deviation in the cost of materials”,

- at actual cost without using accounts 15 and 16.

The accounting policy must determine how transportation and procurement costs (TPC) associated with the purchase of materials will be taken into account:

- included in the actual cost of materials on account 10.

- reflected in a separate subaccount of account 10.

- counted on account 15.

If, upon receipt of materials, it is possible to unambiguously associate transportation costs with a specific batch of materials, then delivery can be included in the cost of materials.

If both goods and materials are delivered by one vehicle, the proposed method cannot be used.

Accounting for receipt of materials should be carried out in accordance with the provisions of PBU 5/01 “Accounting for inventories”, approved. Order of the Ministry of Finance of Russia dated June 9, 2001 No. 34n, and Methodological guidelines for accounting of industrial enterprises, approved. By order of the Ministry of Finance of Russia dated December 28, 2001 No. N 119n.

The Chart of Accounts recommends dividing materials by type in accounting, generating data about them in separate sub-accounts:

10-01 — Raw materials and supplies,

10-02 - Purchased semi-finished products and components, structures and parts,

10-03 – Fuel,

10-04 -Containers and packaging materials,

10-05 — Spare parts,

10-06 - Other materials,

10-07 — Materials transferred for processing to third parties

10-08 - Construction materials, this account is used by organizations not involved in construction,

10-09 — Inventory and household supplies. On this account, the accountant reflects, for example, the cost of inventories that cannot be recognized as part of fixed assets, but which are used for a long time.

10-10 — Special equipment and special clothing in the warehouse.

Analytical accounting is carried out by names of materials (this can be a nomenclature, a batch, etc.) and warehouses.

- Initial cost of materials

The initial cost of purchased materials may include:

- cost of materials in accordance with the supply agreement,

- the cost of transportation costs for the delivery of materials from the supplier’s warehouse to the buyer’s warehouse,

- the cost of information and intermediary services related to the purchase of materials,

- customs duties,

- non-refundable taxes,

- costs of maintaining procurement and storage facilities,

- costs of bringing materials to a state suitable for use,

- other costs associated with the purchase of materials.

An approximate nomenclature of inventory items is given in Appendix 2 to the Guidelines for accounting for inventories.

If the company is one of the organizations that have the right to use simplified methods of accounting and reporting, and has determined this in its accounting policies, the initial cost is formed only from the cost under the supply contract, other expenses are taken into account as part of the company’s other expenses.

If materials are not purchased, but are received by the organization in other ways, then the initial cost is determined according to different rules:

- when they are manufactured by the organization itself - at the actual cost of production (clause 7 of PBU 5/01),

- when making a payment for a share in the authorized capital - based on the value agreed by the founders, if it is not determined by the legislation of the Russian Federation (clause 8 of PBU 5/01),

- when received under a gift agreement or free of charge, or as residuals upon disposal of fixed assets - at the current market value as of the date of acceptance for accounting (clause 9 of PBU 5/01),

- received under agreements providing for the fulfillment of obligations (payment) in non-monetary means - at the cost of the transferred property (clause 10 of PBU 5/01).

The cost of materials in accounting is determined without VAT, except in cases where VAT is included in their cost (clause 2 of Article 170 of the Tax Code of the Russian Federation):

- in the production and sale of goods (works, services) not subject to VAT,

- used in the production and sale of goods (work, services), the place of sale of which is not the territory of the Russian Federation,

- when the buyer is not a VAT payer or is exempt from VAT,

- for the production and sale of goods (work, services), the sales operations of which are not recognized as the sale of goods (work, services) under clause 2 of Art. 146 of the Tax Code of the Russian Federation.

4. Receipt of materials from additional expenses

The composition of additional costs can be very diverse:

- delivery and forwarding services,

- cargo insurance,

- information and consulting services,

- intermediary services

- warehousing services.

Let's look at receipts with additional expenses using an example.

Example 1

Office paper and stationery were purchased from Supply LLC for a total amount of 11 thousand rubles. The cost of paper is 4,200.00, stationery is 6,800.00, VAT is not taken into account. Delivery was carried out by a specialized transport company. Delivery cost 600 rubles.

Solution

The accounting policy of the organization determines that the proportion for the distribution of transportation costs is determined based on the cost of materials.

To simplify the calculations, we will consider 2 items - office paper and stationery.

The cost of office paper will increase by (4,200 * 600) / 11,000 = 229.09,

The cost of office supplies will increase by (6,800 * 600) / 11,000 = 370.91.

On account 10 the total cost will be:

office paper will be - 4,200 + 229.09 = 4,429.09,

office supplies – 6,800 + 370.91 = 7,170.91

5. Receipt of wiring materials

Accounting entries for receipt of materials are shown in Table 1

Table 1

| No. | Fact of economic life | Wiring | |

| Debit | Credit | ||

| 1 | Receipt of materials in general | 10 | 60, 76, 71, 20… |

| 2 | Accounting for VAT on received materials | 19 | 60, 76 |

| 3 | Payment for materials to the supplier | 60 | 51,71… |

| 4 | Receipt of additional expenses | 10 | 60 ,76, 71… |

| 5 | Materials received free of charge | 10 | 91-1 |

| 6 | Materials received as payment for a share in the authorized capital | 10 | 75-1 |

| When transferring ownership only after payment | |||

| 7 | Accepted materials for which ownership has not been obtained | 002 | |

| 8 | Paid materials were removed from off-balance sheet accounting | 002 | |

| 9 | Paid materials have been capitalized | 10 | 60 |

| When using simplified accounting methods | |||

| 10 | The cost of purchased materials is included in expenses | 20 | 60, 76, 71… |

Materials accepted for safekeeping are accounted for in off-balance sheet account 002, raw materials supplied by customers are accounted for in off-balance sheet account 003.

6. Receipt of materials documents

When accepting materials from the supplier, the buyer checks the main accompanying documents - the delivery note (form TORG-12) or the waybill (form TN 2).

Documents for the receipt of materials, in the case where the organization uses unified forms, are as follows:

- Receipt order M-4

– they register the receipt of materials. Instead of issuing an M-4, you can put a stamp on the supplier's invoice. The stamp must contain the same details as the receipt order. This procedure must be fixed in the accounting policies of the organization,

- Material accounting card M-17

— it is started immediately upon receipt for each type of material separately; instead of the M-17 card, it is possible to maintain a personal account in the materials accounting book (for non-automated accounting),

- Certificate of acceptance of materials M-7

issued in the case of uninvoiced deliveries, when there are no accompanying documents, or there are discrepancies between the actual availability and condition of materials and the document data. In this case, Form M-4 is not filled out; the act itself is drawn up by the commission in 2 copies. Excess materials are received or taken for safekeeping, and if a shortage is detected, a claim is sent to the supplier.

- Requirement-waybill M-11

is written out when materials come from other departments of the organization,

- Invoice for the release of materials to the M-15 side

can serve as a document when accepting customer-supplied materials for processing. In this case, it is recommended to put a stamp on the document (oh,

- Act M-35

will be needed to register the receipt of materials after dismantling the equipment.

To accept materials in an organization, a power of attorney in form M-2 or M-2a, or in any form, is issued to the responsible person.

7. Receipt of materials in 1C

When ensuring the receipt of materials in 1C, it is necessary to remember that if the accounting policy determines that the company uses accounting prices and accounts 15 and 16, then posting the difference from account 15 to account 16 will have to be done manually, using the “operations entered manually” functionality.

Analytical accounting in 1C is carried out using “Subconto”. In a typical configuration for materials accounting:

1st subconto – nomenclature,

2nd subconto - warehouses,

3rd subconto – parties.

Party subconto is maintained only if the accounting policy provides for batch accounting.

The accounting section “Receipt of materials in 1C” allows you to organize the accounting of material and materials in only one option - with the inclusion of goods and materials in the initial cost of materials using the document “Receipt of additional. expenses."

Example 2

Let's look at how to reflect the receipt of materials and additional services for their delivery in 1C. Let's assume that an organization purchased a computer for 120 thousand rubles. and consumables: a computer mat for 500 rubles and liquid for cleaning the monitor screen for 1,200 rubles. Delivery cost – 1,500.00. We do not take VAT into account in the example.

Solution

All purchases are reflected in one document - TORG-12 for a total amount of 101,700.00. Admission will be carried out using two different documents. The company will take into account the computer as part of fixed assets, the rug and liquid - as part of the materials:

- The first document “Receipt (act, invoice)” is drawn up with the type of operation “Equipment” - the receipt of a computer in the amount of 100 thousand rubles is reflected.

- The second document “Receipt (act, invoice)” is drawn up with the transaction type “Goods” - the receipt of materials in the amount of 1,700 rubles is reflected. After the operation, you can print the Receipt Order in form M-4.

3. The third document “Receipt of additional. expenses" - delivery services in the amount of 1,500 rubles are reflected.

The document is located in the “Purchases” section. Positions in the document can be filled in by selection on the “Products” tab. Another option is to create a document based on either the first or second admission document, and then add the missing positions by selection.

As a result of the document, the cost of materials will increase

After completing the document, the initial cost of materials will be:

computer mat – 500 + (500 * 1,500 / 101,700) = 507.37

monitor screen cleaning liquid for 1,200 + (1,200 * 1,500 / 101,700) = 1,217.70

Read more about accounting for materials in 1C Accounting 8th edition. 3.0 watch in the video:

https://youtu.be/myTRTgwZXAA

In our article we looked at the procedure for recording the receipt of materials, if you still have questions, ask them in the comments below.

For step-by-step instructions on writing off materials, see this article

Accounting for receipt of materials: documents and postings

Tags: materials accounting