Form SZV-K, which reflects a person’s work experience accumulated before 2002, is included in the personalized accounting information (clause 1 of the resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p). Despite the fact that since 2014 this information has been submitted as part of the RSV-1 calculation of the Pension Fund of Russia, the SZV-K form has not yet been canceled. However, neither the deadlines nor the frequency of submission of this form are currently established by any regulatory document. Thus, the need to draw up and submit the SZV-K form in relation to employees working in the organization may arise in the only case - at the request of the territorial branch of the Pension Fund of the Russian Federation.

By the way, the SZV-K form is the only source of data on work experience and/or other activities before January 1, 2002. Therefore, if your organization has been asked for such individual information, then provide it within the deadlines established by the Pension Fund of the Russian Federation.

How to pass

As a general rule, reporting in the SZV-K form can be submitted both in paper and electronic form (including on magnetic media or via the Internet).

In this case, the number of insured persons working in the organization (entrepreneur) is important. If you submit individual information for 25 or more people, then you must submit reports strictly electronically. If you are preparing data on experience for less than 25 people, then you can submit the report both on paper and electronically.

This procedure is provided for in paragraph 2 of Article 8 of the Law of April 1, 1996 No. 27-FZ.

However, in practice, fund employees ask to submit the SZV-K form in electronic form (in the format of generated packets of individual information). Even if the organization has less than 25 people. Electronic data will get into the database faster, and there will be fewer questions from fund employees about your organization. Therefore, regardless of the number, submit the SZV-K form electronically.

But for the employee, the SZV-K form will need to be printed out so that he can put his personal signature on it. Be sure to give one copy of this form to the insured, that is, to the same employee. Keep the second one with you; there is no need to hand it over to the Pension Fund of the Russian Federation.

As you can see, the SZV-K form will in any case have to be drawn up both electronically and on paper.

Who may be required to submit a SZV-K report

Who is required to submit reports in the SZV-K form? Unfortunately, there are no clear answers to these questions in the legislation. In 2020, the practice is such that the territorial bodies of the Pension Fund of the Russian Federation began to send request letters to policyholders (organizations and individual entrepreneurs) with requirements to submit a SZV-K report on certain persons. Policyholders began to receive such requests both “on paper” and electronically. Moreover, some requests are received with the mark “URGENT”. Many accountants and personnel officers were surprised by this urgency.

Pension Fund units, as a rule, request data on those insured persons for whom it does not have information about their work experience before 2002. The policyholder provides the following information on persons (clause 1, article 8 of Federal Law No. 27-FZ of 04/01/1996):

- those working for him under an employment contract;

- who have concluded civil contracts with him, for which insurance premiums are calculated.

Pension Fund requests can be received by both organizations and individual entrepreneurs. However, keep in mind that if the company or individual entrepreneurs do not and never have had employees, then it will simply be impossible to satisfy the Pension Fund’s requirement.

But what to do if the policyholder simply does not have information that could be included in SZV-K? This can happen when an employee, for example, does not have work experience for the period before 2002 or he has already quit at the time the request is received (his work book is missing). In such a case, in our opinion, it makes sense to send a letter to the PFR authorities indicating the reason why the policyholder does not have the opportunity to submit the SZV-K form. Let's give an example of a possible answer.

Responsibility

In their appeals, representatives of the fund warn about liability for failure to provide (distortion) information in the SZV-K form. Such liability is indeed provided for in Article 25 of the Law of December 17, 2001 No. 173-FZ. Please note that this is not a fine or penalty. This provision provides for compensation of material damage to the Pension Fund of the Russian Federation by the guilty parties. And material damage may occur if the organization does not submit (distort) information about the length of service. After all, the fund’s employees in this case may accrue an inflated pension. The payment of such pensions will entail an overspending of the Russian Pension Fund. Therefore, having discovered an overspending, the fund can go to court and demand compensation from the organization for this damage.

But it is worth recognizing that in practice it is very difficult to hold an organization accountable under this article. The fund is unlikely to be able to prove the connection between the distortion of data and the overstatement of the pension amount.

Filling procedure

To correctly fill out the SZV-K form, follow the Instructions for filling out individual (personalized) accounting forms, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Fill out the SZV-K form on the basis of the work book and other documents that confirm the employee’s insurance experience. For example, these are employment contracts, certificates from previous places of work, personal accounts and salary statements, certificates issued by the administration of a correctional labor institution, a military ID, a child’s birth certificate, and others.

This follows from the provisions of paragraph 59 of the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p, and the Rules approved by Resolution of the Government of the Russian Federation dated October 2, 2014 No. 1015.

Form type SZV-K

At the top of the SZV-K form (on the right), you need to indicate the type of adjustment: “initial”, “corrective” or “cancelling”. How to determine what to put? We'll tell you.

If you are submitting information about the length of service for an employee for the first time, then put an “X” in the “Original” field. The same mark will need to be made if you submit the corrected SZV-K form after the inspectors returned the primary one to you due to errors.

Check the “Corrective” field if you yourself have found an error in the SZV-K form previously submitted and accepted by the fund, and now you want to clarify or correct this information. In this case, in the SZV-K form, indicate not only the data that you are correcting, but also those that remain unchanged.

Do you want to completely cancel previously submitted information about a covered employee? Then put a mark in the “Cancelling” field. This form must be presented together with the “original” one. At the same time, in the form itself, fill in the details from “Insurance number” to “Category of insurance premium payer,” inclusive, and, if necessary, the details of a civil law agreement or an author’s agreement.

Personal data and insurance number of the employee

At the top of the SZV-K form (on the left), indicate the insurance number of the individual personal account of the insured person (SNILS). Take it from the person's insurance certificate. Enter the employee's last name, first name and patronymic in the nominative case in the fields of the same name. This procedure is provided for in paragraphs 37, 60 of the Instruction, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Fill out the “Date of Birth” field as follows. Write the month of birth in words, and the date and year in numbers. That is, for example, September 15, 1985. This follows from the provisions of paragraphs 19, 60 of the Instruction, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Fill out the field “Territorial conditions of residence as of December 31, 2001” in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. In this case, only the following values are possible: empty field, “RKS”, “ISS”. For the values “RKS” or “MKS”, indicate the size of the regional coefficient as a number with a fractional part separated by a comma (for example, “MKS 1.7”).

Method of submitting SZV-K

Policyholders can submit information in the SZV-K form “on paper” or electronically (clause 2 of article 8 of the Federal Law of 01.04.1996 No. 27-FZ). The format for submitting information in electronic form is established by Appendix 3 to Instruction No. 2p. In our opinion, it is more logical to submit the SZV-K report electronically. After all, then the information will quickly get to the individual personal account of the insured person.

Form SZV-K is submitted to the Pension Fund of the Russian Federation along with a list of documents according to form ADV-6-1 (clause 7 of Instruction No. 2p). See “ADV-6-1: form and sample filling”.

Labor activity: place and period of work

The insurance period for assigning a labor pension is the total duration:

- periods of work and (or) other activities during which pension contributions were paid for the employee;

- other periods included in the insurance period in accordance with Article 11 of the Law of December 17, 2001 No. 173-FZ.

Enter information about places of work (other periods) in chronological order. That is, the first record will be about the person’s first place of work or about the first period that is included in the insurance period, if such a period preceded hiring. In this case, information must be reported only for periods before January 1, 2002.

If there is an overlap between work periods, for example, a person was fired on December 20, 1983, and accepted into the next organization on December 18, 1983, then proceed as follows. Indicate the previous period up to December 20, 1983 inclusive, and the next period - from the next day, that is, from December 21, 1983.

Enter the names of the organizations where the person worked (or, for example, served), on the form strictly in the same way as it is written in his work book (military ID). For this purpose, the field of the same name “Name of organization” is provided.

Please indicate the type of activity (code) in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Fill in the “Beginning of period” and “End of period” columns of the table in the following format: DD.MM.YYYY. In this case, a serial number is assigned only to rows containing the “Beginning of period” and “End of period” dates.

This follows from the provisions of paragraphs 37, 60 of the Instruction, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Situation: is it necessary to reflect in the SZV-K form the periods of activity of an employee who was previously a citizen of Ukraine, and is now a citizen of Russia? From 1984 to 2003, the employee studied, served in the army and worked on the territory of Ukraine.

In the SZV-K form, indicate the periods of study, military service and work of the employee until January 1, 2002.

The law allows you to include periods of work or activity outside Russia in your insurance period. But only if such a possibility is provided for by international treaties (clause 2 of article 10 of the Law of December 17, 2001 No. 173-FZ). For citizens of Ukraine, just such an agreement exists. When assigning a pension, they take into account the length of service they acquired in the territory of Ukraine and the former USSR (clause 2 of article 6 of the Agreement on guarantees of the rights of citizens of the CIS member states in the field of pensions of March 13, 1992).

Consequently, when calculating length of service for the period before registration in the compulsory pension insurance system (before January 1, 2002), it is necessary to take into account the length of service acquired in Ukraine. This length of service is counted according to Russian rules and reflected in the SZV-K form in the same order. For example, a period of service in the Armed Forces of the Soviet Union is confirmed by marks on a military ID and is included in the pension experience.

Who is required to take the SZV-TD and when?

In 2020, employers have a new obligation - to submit another personalized accounting document to the Pension Fund.

This is the SZV-TD report, which is called “Information on the work activity of a registered person.” The form, format and procedure for filling it out were approved by Resolution of the Pension Fund Board of December 25, 2019 No. 730p (hereinafter referred to as Resolution No. 730p). Fill out and submit the SZV-TD via the Internet Submit for free

The SZV-TD is drawn up separately for each employee with whom an employment contract has been concluded, including those who work part-time or remotely.

According to the article of the Federal Law of 01.04.96 No. 27-FZ (hereinafter Law No. 27-FZ), it is not always necessary to submit the specified form, but only if the following events occurred:

- recruitment;

- transfer to another permanent job;

- dismissal;

- Submission by the employee of an application to choose the form of the work book: paper or electronic.

Prepare all documents for the transition to electronic work books in the Kontur.Personal service

Resolution No. 730p added to the list of activities that require reflection in the SZV-TD. The list also included: renaming the employer; assigning a new profession, specialty or qualification to an employee; injunction to engage in certain activities (hold a particular position).

It is logical to assume that personnel events from the additional list are not an independent reason for drawing up a report, because Law No. 27-FZ says nothing about them. And only in the case when the employer submits information in connection with the main list (hiring, dismissal, transfer or filing an application for a work book form), then he must indicate an additional event (for example, renaming the employer) in a separate line.

However, practice may turn out differently. Thus, on the PFR website in the section “Legislation on electronic work books” there is, among other things, an example of filling out the SZV-TD for the case of renaming the employer. It follows from the example that, in the opinion of Pension Fund employees, such renaming is an independent basis for filling out and submitting a report.

To avoid confusion, within the framework of this article, by personnel event (event) we will understand, first of all, hiring, dismissal, transfer, as well as filing an application to choose the form of the work book. At the same time, we will not exclude that renaming an employer, retraining an employee, and a court prohibition from engaging in a certain activity (holding a position) may be considered similar events.

https://youtu.be/y_gqysFp2qc

Labor activity: other periods counted in the insurance period

In the SZV-K form, you also need to indicate other periods counted in the insurance period. These include:

1) the period of military or other service equated to military service in accordance with the Law of the Russian Federation of February 12, 1993 No. 4468-1. At the same time, the time of study in military educational institutions of vocational education is also considered a period of military service (clause 2 of article 35 of the Law of March 28, 1998 No. 53-FZ). Depending on the duration and results of training (including expulsion from an educational institution), this time may be counted differently towards the service life (clause 4 of article 35 of the Law of March 28, 1998 No. 53-FZ). In this case, the final period of service is reflected in the military ID. It is this that the employer should indicate when filling out the SZV-K form;

2) the period of receiving sick leave benefits for temporary disability;

3) the period of care of one of the parents for each child until he reaches the age of 1.5 years (but not more than 4.5 years in total);

4) periods:

- receiving unemployment benefits;

- participation in paid public works;

- moving (resettlement) in the direction of the state employment service to another area for employment;

5) the period of detention of persons who were unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

6) the period of care of an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

7) the period of residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

period of residence abroad for spouses of employees sent:

period of residence abroad for spouses of employees sent:

- to diplomatic missions and consular offices of Russia;

- to permanent missions of Russia to international organizations;

- to Russian trade missions in foreign countries;

- to representative offices of federal executive bodies, state bodies under federal executive bodies or as representatives of these bodies abroad, as well as to representative offices of Russian government agencies (state bodies and government agencies of the USSR) abroad;

- to international organizations according to the list approved by Decree of the Government of the Russian Federation of November 26, 2008 No. 885.

Reflect the periods specified in paragraph 8 in the SZV-K form according to their actual duration, but not more than five years in total.

The periods listed in paragraphs 1–8 should be reflected in the SZV-K form in cases where they were preceded and (or) followed by periods of work (regardless of their duration) specified in Article 10 of the Law of December 17, 2001 No. 173-FZ. In this case, the time gap between the end of such periods and the beginning of work activity does not matter.

An example of how the insurance period of a woman who first found work after the birth of a child is reflected in the SZV-K form

The first entry in A.P.’s work book Ivanova dated September 30, 2000. In 1998, Ivanova gave birth to a child. The certificate indicates the date of birth - February 1, 1998. The insurance period for assigning a labor pension includes the period of caring for a child until he reaches the age of 1.5 years. This period is determined on the basis of the birth certificate - from February 1, 1998 to July 31, 1999. Despite the fact that more than a year has passed between the end of the child care period and the start of work, this period is reflected in the SZV-K form on the basis of the child’s birth certificate.

This follows from the provisions of paragraph 3 of Article 2, Articles 10, 11 of the Law of December 17, 2001 No. 173-FZ, paragraph 2 of the Rules approved by Decree of the Government of the Russian Federation of October 2, 2014 No. 1015, paragraph 3 of paragraph 2 of the resolution of the Constitutional Court of the Russian Federation dated July 10, 2007 No. 9-P and paragraph 3 of paragraph 2.1 of the ruling of the Constitutional Court of the Russian Federation dated November 20, 2007 No. 798-O-O.

Specify the type of period (code) in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. For example, for the period of military service the code “SERVICE” is provided.

Example of filling out a new report

Next, we will take a closer look at filling out each section of the SZV-K form. Let's hope that our sample will at least help you understand the principle of filling out the new form.

Personal information and SNILS

At the beginning of the SZV-K form, you must indicate the personal data of the person in respect of whom the report is being filled out, namely:

- Last name, first name and patronymic (in the nominative case);

- date of birth;

- territorial conditions (there may be an empty field, code “RKS” or “ISS”, as well as the size of the regional coefficient).

Also, in the initial block of the SZV-K report, you need to indicate the insurance number of the individual personal account of the insured person (SNILS). It must be indicated without fail (clause 31 of the Instructions, approved by Resolution of the Pension Fund Board of January 11, 2017 No. 2n). Here's what filling the first block might look like using an example:

Form type

Also, at the top of the report submitted to the Pension Fund on the SZV-K form, you need to record the “Form Type” of the report. There can be three meanings: “original”, “corrective” and “cancelling” form. Mark the required type with an X:

The values of the SZV-K types are deciphered in the table below:

| Form type SZV-K | |

| Form type | When is it celebrated? |

| Original | If information about the length of service is submitted to an employee for the first time. The same type is noted if the corrected form SZV-K is submitted after the inspectors from the Pension Fund of the Russian Federation returned the report for revision due to errors. |

| Corrective | This is noted if the accountant independently identified an error in the already submitted SZV-K form, and now the erroneous information needs to be clarified or corrected. |

| Canceling | This type of form must be shown if you want to completely cancel previously submitted employee information. The “cancellation” form is submitted along with the “original” form. |

Information about work periods

The section “Periods of labor or other socially useful activity” is, in fact, the most important and informative section of the new report. Include information:

- on the start and end dates of employment (clause 33 of Instruction No. 2p);

- on the periods giving the right to early assignment of a labor pension to certain categories of citizens (clause 33 of Instruction No. 2p).

How to enter information about work periods

Information about the work must be shown in SZV-K in chronological order. Simply put: the first line should be about the first place of work (period of experience). However, remember that information needs to be shown only about work experience before January 1, 2002. That is, the report form should end with a maximum date of 12/31/2001.

If, when filling out the report, the work periods “intersect”, then they will need to be “joined”. Let's give an example. Let's assume that a citizen was fired on July 11, 1998, and was hired into the next organization earlier - on July 9, 1998. Then indicate the first period up to July 11, 1998 inclusive, and the next period - from the next day, that is, from July 12, 1998.

Show the names of employers (or places of service) in the “Name of organizations” field in this section exactly as indicated in the work book (or military ID). That is, if, for example, the full name is indicated in the work book, then write down the full name in the report, if it’s an abbreviated one, enter the abbreviated name.

As for the field “Type of activity (code)”, form it in accordance with the codes specified in Appendix 1 to the Instructions, approved. By Resolution of the Board of the Pension Fund of January 11, 2017 No. 2n. We present their decoding in the table:

| Types of labor or other socially useful activities (for SZV-K forms) | |

| Code | Name |

| JOB | Job |

| RABSVPK | Work supported by testimony |

| RABZAGR | Work abroad |

| SERVICE | Military service and other equivalent service |

| SLPRIZ | Military service by conscription |

| SLAVES | Work during the Great Patriotic War |

| SLDAPBL | Service in military units, headquarters and institutions that are part of the active army, in partisan detachments and formations during hostilities |

| IZLVTR | Time spent in treatment in medical institutions due to military trauma |

| REBLOCK | Work in Leningrad during the blockade (from September 8, 1941 to January 27, 1944) |

| SLPROZH | Accommodation for wives (husbands) of military personnel serving under contract |

| SOCIAL FEAR | The period of temporary incapacity for work that began during the period of work and the period of being on disability of groups I and II |

| DO NOT WORK | A non-working mother caring for her child |

| CARE-CHILDREN | One parent caring for a child |

| CARE-INVD | Care provided for a disabled person of group I, a disabled child, an elderly person |

| TRUDLITSO | Care by an able-bodied person for a disabled person of group I, a disabled child or a person who has reached the age of 80 |

| CARE-HIV | Care of parents and other legal representatives for HIV-infected minor children |

| BEZR | Receiving unemployment benefits, participating in paid public works, moving in the direction of the employment service to another area |

| REHABILIT | Detention of persons unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, serving their sentences in prison and exile |

| PROFZAB | Being on disability of groups I and II resulting from a work-related injury or occupational disease |

| REVISION | Staying in places of detention beyond the period prescribed during the review of the case |

| DVSTO | Preparation for professional activity - training |

| PRZAGR | Residence abroad of wives (husbands) of employees of Soviet institutions and international organizations |

| PROVOV | Living in areas temporarily occupied by the enemy during the Great Patriotic War |

| PRBLOCK | Accommodation in Leningrad during its siege |

| PRONTS | Being in concentration camps |

| PROZHSUPR | The period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities |

Labor activity: territorial and special conditions

Fill out the column “Territorial conditions (code)” of the table in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. For insured persons working in territories classified as regions of the Far North and equivalent areas, indicate the size of the regional coefficient established centrally for the salaries of employees of non-production industries in these areas. Specify this coefficient as a number with a fractional part separated by commas (for example, “ISS 1.7”).

Fill out the column “Special working conditions (code)” of the table in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

There are two cases when in this column you need to indicate not one code, but two. In this case, the second one is written on the line below.

The first case: an employee performs work that gives him the right to early assignment of an old-age pension in accordance with Lists No. 1 and No. 2, approved by Resolution No. 10 of the USSR Cabinet of Ministers of January 26, 1991. Here, indicate the code of the corresponding List position.

Second case: the right to early retirement arises in accordance with subparagraph 11 of paragraph 1 of Article 27 of the Law of December 17, 2001 No. 173-FZ. For such an employee, it will be necessary to additionally indicate the profession code in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Sample of filling out SZV KORR

Let's look at the step-by-step procedure for filling out the SZV CORR form. It consists of 6 sections. Sections 1-2 are completed for all three types of forms. You can find the form in the Resolution of the Pension Fund Board of January 11, 2017 No. 3p (Appendix 3). In addition, it can be downloaded from the Pension Fund website. To do this, go to the “Employers” section, click on the “Free programs, forms, protocols” link.

Form title

At the beginning of the form, provide information to identify the policyholder: number in the Pension Fund of Russia, INN and KPP. In the “Information Type” cell, enter a four-letter code (KORR, OTMN or SPECIAL). There are quite a few reporting period codes; they are indicated in accordance with the Classifier. It is presented in the Appendix to the Procedure for filling out reporting forms of Resolution No. 3p.

For example, in 2020, an accountant discovered incorrect information about an employee in the reporting to the Pension Fund for 2020. Then in the cells of the column “Reporting period in which information is provided” the numbers 0 and 2020 are indicated. In the column “Reporting period for which information is corrected” 0 and 2020 are entered.

Section 1

The section once again provides the details of the policyholder (employer). The number in the Pension Fund, KPP and TIN are indicated for two (current and adjusted) periods, even if they have not changed. Also enter the short name of your company.

Section 2

In this section you need to fill out a table with information about insured employees (full name and SNILS number). Indicate those persons for whom an error was made (CORR type), who were “forgotten” (OSOB) or turned out to be superfluous (OTMN).

Section 3

This part indicates information that was incorrect (KORR) or “lost” (OSOB). First we enter the category code of the insured employee from the Classifier of the Pension Fund Resolution No. 3p. Examples of filling out this field: NR (hired employee), NRED (hired employee of an imputed enterprise), IP (individual entrepreneur). The “Contract type” field can have two values: “labor” or “civil law”. We indicate the one that is concluded with this person. Next, the number and date of concluding the contract with the employee are noted. These two fields must be completed if corrections are made for periods up to and including 2001. The column “Additional fare code” is filled in if we are talking about crew members of civil aviation aircraft (code AVIA).

Section 4

In section 4 we now include correct information about the amounts of payments to employees and insurance premiums. The first column is the month code for which corrections are needed. It represents the first three letters of the name of the corresponding month. Exceptions are March (MRT) and November (Nbr).

The following column is filled out differently depending on the period for which the data is corrected (supplemented):

- 1996-2001: in column 2 “Amount of payments” enter the amount of accruals that are taken into account for calculating the pension; in column 3, indicate the amount minus accruals for sick leave and scholarships;

- 2002-2009: the block with the payment amount is not filled in;

- from 2010: fill in all columns 2-6; reveal the structure of the total amount of payments; the base for insurance premiums is divided into maximum and exceeding the maximum. Also separately disclose the amounts for civil contracts.

The part on additional calculation of insurance premiums is also filled out depending on the period:

- 1996-2000: enter information in columns 7 and 8 (additional contributions paid by the employer and contributions paid from the employee’s earnings);

- 2000: fill out only column 7 of the table;

- 2002-2013: columns 9 and 10 are filled in (additional assessment of contributions to the insurance/funded pension);

- from 2014: the amount of contributions is entered only in column 11; Contributions calculated on a base above the maximum are not taken into account.

The last two columns must be completed if you are not a premium payer for individuals. In this case, the adjustment is performed only for the period from 2010 to 2013.

Section 5

Section 5 is intended to correct data on persons employed in certain types of work. In this case, contributions are calculated at an additional rate. For example, for employees of enterprises with hazardous production conditions.

In the table, enter the codes of the month and special assessment of working conditions from the Classifier. The remaining columns indicate the amounts of payments to employees for such types of activities. Everywhere we deposit the correct amount, taking into account corrections.

Section 6

In part 6 of the form we indicate the corrected terms of work of the insured persons (blocks 1 and 2 of the table). Columns 3 and 4 relate to the place and working conditions and are filled out if necessary based on the Classifier. For example, work with difficult working conditions is designated by code ZP12B or 27-2.

Using special Classifier codes, we also fill in the remaining columns. If there are no grounds, they are left blank. At the end of the form, indicate the required details: the position of the manager, his signature with a transcript and the date.

Work activity: work experience

Fill out the column “Grounds (code)” of the calculated work experience in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. In this case, set the value “SEASON” only if you have worked a full season on the work provided for in the lists of seasonal work. These lists are determined by industry (inter-industry) agreements (Article 293 of the Labor Code of the Russian Federation).

Fill out the column “Additional information” of the calculated work experience in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

However, in some cases there is a special procedure for filling out this column (see table below).

| Cases when the “Additional information” column must be filled out in a special way | How to fill |

| The employee was engaged in work with special working conditions not every day during the calendar period limited by the dates “Beginning of period” and “End of period” | Indicate the number of calendar months and days worked under special working conditions. For example: “2 m. 20 days.” |

| The insured person is convicted and is serving a sentence in prison | Provide the number of calendar months and days of work included in the length of service. For example, “2 m. 20 days.” |

| Insured person – diver | Enter the actual time spent under water (hours, minutes). For example, “26 hours 30 minutes.” |

At the same time, when the values “SEASON” or “DIVER” are indicated in the “Grounds (code)” column of the calculated work experience, it is necessary to make a breakdown by calendar years. For example, if an employee worked as a diver from September 23, 1989 to February 10, 1990, then two periods of activity must be reflected in the SZV-K form:

- from September 23, 1989 to December 31, 1989;

- from January 1, 1990 to February 10, 1990.

Work activity: length of service

Fill out the column “Grounds (code)” of length of service in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

In the “Additional information” column about length of service, depending on the value specified in the “Grounds (code)” column of length of service, indicate the relevant information:

- flying hours (hours, minutes);

- number of parachute jumps;

- number of descents (ascents);

- actually worked time (months, days);

- volume of work (share of rate) for the position held;

- number of teaching hours.

At the same time, if regulatory documents define the conditions under which the specified period is included in the length of service, fill out data on length of service broken down by calendar years. For example, if an employee worked as a pilot from September 23, 1989 to February 10, 1990, then two periods of activity must be reflected in the SZV-K form:

- from September 23, 1989 to December 31, 1989;

- from January 1, 1990 to February 10, 1990.

Labor activity: total work experience

When filling out information as of January 1, 2002, to assess the pension rights of the insured person (conversion), consider the following.

Calculate the indicators “Total length of service” and “Experience giving the right to early assignment of a pension” taking into account the requirements of paragraph 61 of the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. In this case, the length of service giving the right to early assignment of a pension must be shown in the SZV-K form in the context of the relevant working conditions:

- territorial;

- special;

- determining the right to a pension for long service.

In the appropriate columns, indicate the total length of service under working conditions (years, months, days).

Example of filling out the EDV-1 form

Instructions for filling out the EFA-1 form

Type of information - an X indicates the type of form being submitted:

- Original

- Corrective

- Canceling

With the “Correcting/Cancelling” type, it is submitted if it is necessary to correct/cancel the data in section 5 of the previously submitted EFA-1 form with the “Original” type.

Reporting period (code) - the reporting period is indicated in accordance with the Parameter Classifier. For reporting from 2020 onwards, indicate 0 (reporting period - year), and indicate the year 2019 .

Section 3 “List of incoming documents” - in the column “Number of insured persons” the number of insured persons is indicated, the information on which is contained in the forms submitted simultaneously with EDV-1.

Section 4 “Data as a whole for the policyholder” - is filled out only if EDV-1 is submitted simultaneously with the SZV-ISH forms or with the SZV-KORR “Special” form and contains data as a whole for the policyholder for the reporting period.

Section 5 “Basis for reflecting data on periods of work of the insured person in conditions that give the right to early assignment of a pension in accordance with Article 30 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions” - is filled out if in the forms SZV- EXPERIENCE (with the type of information - ISH) and SZV-ISH, submitted simultaneously with the EDV-1 form, contain information about insured persons employed in the types of work specified in paragraphs 1-18 of part 1 of Article 30 of the Federal Law of December 28, 2013 N 400 -FZ:

- underground work, work with hazardous working conditions, in hot shops, with difficult working conditions, as working locomotive crews, in field geological exploration, prospecting, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work, logging work and timber rafting, work on loading and unloading operations in ports, as crew members on ships of the sea, river fleet and fishing industry fleet, drivers of buses, trolleybuses, trams, flight crews, dispatchers and ITS of civil aviation, in underground and open-pit mining, rescuers and etc.

and an example of filling out EDV-1

You can download:

- FORM form EDV-1 (.xls, 44 Kb)

- EXAMPLE of filling out the EDV-1 form (.xls, 45 Kb)

Examples of creating a package of documents with EFA-1

| № | Description of the situation | Package: Shape "type" |

| 1 | Standard situation: presentation of information for the entire organization for 20 employees | SZV-STAZH “initial” + ODV-1 “initial” |

| 2 | During the reporting period, the SZV-STAGE form was submitted for 20 employees, the submitted information was taken into account on the personal account, but later an error in the period of service of 1 employee | SZV-KORR “corrective” + EDV-1 “initial” |

| 3 | For the reporting period, the SZV-STAZH form was submitted for 20 employees, but 1 employee did not work during the reporting period, so the previously submitted information canceled | SZV-KORR “cancelling” + EDV-1 “initial” |

| 4 | During the reporting period, the SZV-STAZH form was submitted for 20 employees, but for 1 employee the information was not included in the personal account due to a discrepancy between the full name and SNILS | SZV-STAZH “supplementary” for 1 employee + EDV-1 “initial” |

| 5 | During the reporting period, the SZV-STAZH form was submitted for 20 employees; 1 employee forgot to provide information | SZV-STAZH “special” for 1 employee + EDV-1 “initial” |

| 6 | It is required to provide information for the entire organization for 20 employees for 2001 (previously, reporting for this period was not submitted) | SZV-ISH for 20 employees + EDV-1 “initial” with section. 1-4 |

| 7 | An error was identified in the previously submitted information for 2014: 1 employee was additionally charged insurance premiums, 1 employee had an error in the period of service - the CHILDREN code was not indicated in the additional information | SZV-KORR “corrective” + EDV-1 “initial” + DAM with completed line 120 and section 4 |

For instructions on filling out the SZV-STAZH , read the material “ SZV-STAZH: detailed information from PFR specialists ”

Familiarization of the employee with the SZV-K form

When you have entered all the data into the SZV-K form, familiarize it with the employee for whom you are submitting such a report. After this, he must put his personal signature on the form. Be sure to give one copy of this form to the insured person.

Example of filling out the SZV-K form

Torgovaya LLC received a request from the territorial branch of the Pension Fund of the Russian Federation to provide information in the SZV-K form in relation to A.I. Ivanov.

Ivanov currently works at Hermes. His SNILS number is 023-141-25761. Date of birth: September 25, 1950.

In accordance with the work book, Ivanov worked until January 1, 2002:

- from March 15, 1966 to May 23, 1967 – as a technician at ZAO Alfa in Arkhangelsk (an area equated to the regions of the Far North). The territorial area code is “ISS”. The regional coefficient on the territory of Arkhangelsk is set at 1.2 by resolution of the USSR State Labor Committee, the Presidium of the All-Union Central Council of Trade Unions dated November 20, 1967 No. 512/P-28;

- from September 15, 1970 to May 21, 1987 – as a gas welder at Proizvodstvennaya OJSC. This profession is named in List No. 2, approved by Resolution No. 10 of the USSR Cabinet of Ministers of January 26, 1991. The code for the corresponding position in List No. 2 is 23200000-11620. Code of special working conditions – “ZP12B”;

- from April 23, 1989 to September 10, 1989 – as a mechanic on seasonal work at the state institution “Scientific Institute”. Code of special working conditions – “SEASON”;

- September 4, 1991 to July 14, 1996 – as a smelter at. This profession is named in List No. 1, approved by Resolution of the Cabinet of Ministers of the USSR No. 10 dated January 26, 1991. The code for the corresponding position in List No. 1 is 1070500a-16613. Code of special working conditions – “ZP12A”;

- from July 15, 1996 to July 12, 1998 – as a crusher at . This profession is named in List No. 1, approved by Resolution No. 10 of the USSR Cabinet of Ministers of January 26, 1991. The code for the corresponding position in List No. 1 is 1070500a-11908. The code for special working conditions is “ZP12A”. In such conditions, Ivanov worked for 1 year, 6 months and 11 days. Place of work - the village of Tumanny, Kola district, Murmansk region (region of the Far North). The territorial area code is “RKS”. The regional coefficient in the territory of the village of Tumanny is set at 1.7 by Decree of the Government of the Russian Federation of May 27, 1992 No. 348.

There are no other entries in Ivanov’s work book before January 1, 2002.

In accordance with his military ID, Ivanov served in military unit 1528 from May 27, 1967 to June 9, 1969 as a sergeant.

Based on individual information, the Hermes accountant filled out the SZV-K form and submitted it to the territorial office of the Pension Fund of Russia within the proposed period.

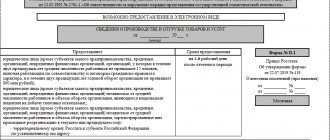

How to fill out SZV-K

The form consists of the following sections:

- Information about the insured person. Includes: SNILS, full name, date of birth and place of residence. This information is filled in based on your passport and insurance certificate. For the “territorial living conditions” indicator, an empty value is acceptable in the absence of supporting documents.

- Type of reporting form. Select from the suggested types and check the box. Initial - when submitting information for the first time, corrective - when changing the information of the original SZV-K about the length of service or other information about the insured person, canceling - to cancel previously provided information.

- Periods of activity. The section includes information about the periods of work experience of the insured person until December 31, 2001, based on the work record book. Fill in the name of the organization, activity code (required). To determine it, we use Appendix No. 1 of the Pension Fund Resolution No. 485p.

Let's look at a clear example of filling out SZV-K. The conditions for filling out are as follows:

GBOU DOD SDYUSSHOR "ALLUR" received a notification from the Pension Fund of the Russian Federation about the provision of information on employee Sergeev Sergey Sergeevich. According to the work book records, there is information that Sergeev S.S. works at the GBOU DOD SDYUSSHOR "ALLUR" in the position of "building maintenance worker":

- the employment contract with GBOU "ALLUR" was concluded on August 21, 2014;

- from 03/23/1980 to 03/25/1985 - work as a “turner” at the Stroyka enterprise (an area equated to the regions of the Far North);

- from 03.03.1986 to 04.11.1988 - work as a “general worker” at the Chaika enterprise (region of the Far North);

- from 11/14/1988 to 04/01/1999 - work as a “gas cutter” at the enterprise “Plant No. 12” (the position is classified as work with difficult working conditions).

This is what a sample looks like on how to fill out the SZV-K according to these conditions: