Documents upon hiring an employee

It is important for each employee to have documentary evidence of his work activity at the enterprise. First of all, it can help confirm the length of service. The higher it is, the higher the sick leave payment, and in the future - the amount of the pension. The list of mandatory personnel documents drawn up when concluding a working relationship is as follows:

- employment contract. For information on drawing up a contract, see the material “Employment contract: forms and sample”;

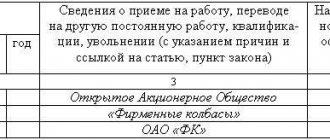

- employment history. We wrote about the rules for filling out in the article “Rules for filling out a work book”;

- medical book. It is necessary if the employee’s work involves harmful or dangerous working conditions. You will learn how to make a medical record and check the authenticity of the form provided by the employee by following the links;

- educational documents to determine whether the future employee’s education meets the requirements of professional standards. We also suggest that you familiarize yourself with the material on how to record your education in your work book;

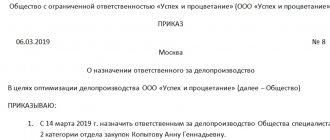

- employment order in form T-1;

- employee personal card (form T-2). The form of this form can be found in our article “Personal card of an employee T-2: sample filling.”

Don’t forget that each new employee should be familiarized with the job description and given timely instructions on labor safety!

Personnel “minimalism”

In addition to accounting and tax accounting, any legal entity or individual entrepreneur (if it has employees) is required to maintain personnel records.

However, practice shows that personnel records in small organizations are either completely absent, or only that part of it is present that is associated with the payment of wages and the calculation of taxes. Therefore, in this article we want to talk about a certain minimum of personnel documents that every organization should have. https://youtu.be/JTKgPQan2WM

Documents during the work process

During the course of his or her employment, an employee may be transferred to a new position. In this case, the following papers are drawn up:

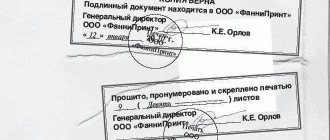

- order on the basis of which the employee is transferred (form T-5). You can see what a sample of filling out this form looks like in the material;

- additional agreement. For example, when transferring an employee to 0.5 rates or changing the salary.

Also, every employee has the right to annual paid leave. Rest is provided according to the vacation schedule. Here you will find a sample of how to fill it out. Try to avoid violations when drawing up a schedule. For information on how to add new information to Form T-7 if necessary, read the text “Adding to the vacation schedule.”

To release an employee on vacation, the employer issues an order to grant vacation, drawn up in form T-6. You can find out how to fill it out in the article “Filling out a vacation order.” We also suggest that you familiarize yourself with information on how to place an order for additional leave.

Primary documentation for personnel records and wages

In every organization conducting economic activity, there is a need to maintain personnel documents, as well as monthly calculations and payroll for employees.

Accounting calculates benefits, vacation pay and travel allowances, salary and piecework accruals, calculates taxes and insurance contributions, reports to funds and the Federal Tax Service.

Often, accounting also deals with personnel documents, because not every company has its own personnel department.

At the same time, not every accountant is also a well-versed HR employee. But the Labor Inspectorate is no joke these days.

Calculation and calculation of wages must be carried out in accordance with the provisions of Chapter 21 of the Labor Code of the Russian Federation.

The payroll calculation process is carried out in several stages.

The first stage is the analysis of the information contained in the primary documents on labor accounting and payment, compiled according to unified forms.