So, what documents are needed to register a legal entity? You will learn about this by reading this article, which consists of the following sections:

- Constituent documents of a legal entity

- Charter of a legal entity

- Foundation agreement of the organization

- Requirements for the design and content of constituent documents of a legal entity

- Constituent documents of organizations in Law No. 99-FZ of 05/05/2014 “On amendments to Chapter 4 of Part 1 of the Civil Code of the Russian Federation”

This article is written as part of a step-by-step guide to registering a business yourself:

- How to register an individual entrepreneur (PBLE) and an LLC with the tax office yourself in 2012

- Preparation and execution of necessary documents for registration.

- Registration of an LLC (CJSC, OJSC) or individual entrepreneur with the tax office

- When is it not necessary to register an individual entrepreneur?

- Registration of LLC (CJSC, JSC) or individual entrepreneur in the Pension Fund of the Russian Federation, Compulsory Medical Insurance Fund, Social Insurance Fund, Rosstat)

- Making a seal

- Opening a bank account

- Change of director and amendments to the Unified State Register of Legal Entities on his passport data

- Registration of changes in the charter, constituent documents, Unified State Register of Legal Entities

- Reorganization of a legal entity

- Methods for liquidating an organization

Model statutes

As you know, the charter is the constituent document on the basis of which LLCs carry out their activities (clause 3 of article 89 of the Civil Code of the Russian Federation, clause 1 of article 12 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies”, hereinafter referred to as the LLC Law).

The main constituent document of a joint-stock company is also the charter (clause 3 of article 98 of the Civil Code of the Russian Federation, article 11 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”, hereinafter referred to as the Law on JSC). Currently, standard charters can be used for state registration of newly created legal entities. However, the organization has the right to carry out its activities only on the basis of the charters approved by the founders (clause 1 and clause 2 of Article 52 of the Civil Code of the Russian Federation). One of the laws being commented on changes this situation for LLCs. Such organizations will be able to operate on the basis of standard charters that do not require special approval from the participants of the company.

Please note that joint stock companies will not be able to apply standard charters in their activities. To do this, it will be necessary to make appropriate changes to the Law on JSC.

List of constituent documents of a legal entity

Art. 52 of the Civil Code of the Russian Federation provides for a legal entity to have a single constituent document - a charter, which legal entities of any organizational and legal form must have, with the exception of a business partnership. For a business partnership, the legislation provides for a constituent agreement, the procedure for its execution and content is similar to the requirements for the charter.

The legislation does not provide for other constituent documents in 2020. But business practice includes the following:

- minutes of the general meeting of founders on the creation of a legal entity;

- minutes of the general meeting of founders on the appointment of a manager;

- order for the appointment of a director.

Let us note once again that from the point of view of legislation, these are not constituent documents, but in communication with counterparties they can be designated as constituent documents.

What is a standard charter

The legislation contains a certain list of information that must be reflected in the charter approved by the founders of the LLC (clause 4 of article 52 of the Civil Code of the Russian Federation, clause 2 of article 12 of the LLC Law). In particular, the charter must specify the rights and obligations of participants, information about the composition and competence of the LLC’s management bodies, the procedure and consequences of a participant’s withdrawal from the company, the procedure for transferring a share to another person, the procedure for storing company documents and presenting them to interested parties, and others intelligence. This means that the developer of the charter must have certain knowledge and skills in order to draw up a constituent document taking into account all the requirements for it. At the same time, not all LLC founders, when entering the specified information into the charter, need to prescribe some features that are characteristic only of their organization.

Legislators apparently recognized this fact and established that LLCs will be able to operate on the basis of a standard charter approved by an authorized government agency. Most likely, the Federal Tax Service of Russia will become such a government agency.

The form of the model charter has not yet been approved. However, it is already known that the form of the model charter adopted by the authorized government agency will be posted on the website of the Federal Tax Service of Russia. There is no need to print out the standard charter and submit it to the tax office.

From the explanatory note to the bill “For the purposes of registering a legal entity, it will not be necessary to submit a standard charter to the registration authority either in paper form or in the form of an electronic document, which will help reduce costs for both entrepreneurs and the registration authority (storage, issuance of certified copies of the charter) "

Foundation agreement of the organization

The constituent agreement is one of the types of constituent documents not for all organizations. So, from July 1, 2009, the constituent agreements of limited liability companies lose the force of constituent documents, as expressly stated in Law No. 312-FZ dated December 30, 2008. The Law “On Joint Stock Companies” also has a similar clause.

However, the constituent agreement can still be concluded between the founders (participants) of the LLC, but will be in the nature of an internal document of the LLC and can only be used for the internal purposes of the legal entity.

Until 09/01/2014, for associations and unions such a document was one of the mandatory constituent documents, and autonomous non-profit organizations and partnerships may or may not have (i.e. have the right to conclude) a constituent agreement.

In the constituent agreement, the founders undertake to create an organization, determine the procedure for joint activities to create a legal entity, the size of the authorized capital, the size and nominal value of the shares (shares) of each founder, the conditions for the transfer of their property and participation in its activities, the conditions and procedure for the exit of the founders (participants) from its composition.

Requirements for registration of constituent documents of a legal entity

The title page of the charter (memorandum of association) must contain its name, i.e. the word “CHARTER” itself and the full name of the legal entity. Also in the upper right corner it is indicated by whom and when this charter was approved or the constituent agreement was concluded, for example “Approved by the owner’s decision No. 1 dated...”. At the bottom of the page the city and year of registration of this document are indicated.

Constituent documents must have their own internal structure, which may vary depending on the profile and organizational structure of a particular organization, but the general requirements are the same. They are:

The first section is necessarily “ General Provisions ”, which indicates the full name of the legal entity and its legal form, short name and English transliteration of the name. If this legal entity was created earlier and a new version of the constituent document is registered in connection with a change in the organizational and managerial structure or one of the types of reorganization has occurred, then the general provisions describe in detail the entire background of the creation and existence of this legal entity, indicating the numbers and dates of the corresponding registration numbers .

This section also indicates the location of the legal entity.

In the section on the owners (founders, participants) of a legal entity, their names with their organizational and legal form, OGRN and exact legal addresses of the legal entities - founders must be indicated.

The section “ Goals, objectives and types of activities ” describes the goals and objectives for which a legal entity is created and the types of activities that it will carry out. Types of activities are indicated in accordance with the All-Russian Classifier of Types of Economic Activities (OKVED).

The section “ Governing bodies of the organization ” must indicate the executive body of the company and the name of the position of the person performing organizational, administrative and managerial functions and having the right to act on behalf of a legal entity without a power of attorney, the procedure for his election or appointment and the terms of his powers. If the presence of such advisory bodies as a board of trustees or others is provided for, then all its powers and other details are also described.

In the “ Branches and Representative Offices ” section, it is important to indicate all existing branches, representative offices or subsidiaries, indicating their addresses, names, as well as their management bodies and powers.

In the “ Property of the Organization ” section of a legal entity, it is necessary to indicate the form of ownership, the procedure for ownership and use, as well as the procedure for the distribution of income.

At the end of the constituent document, as a rule, there are sections on the procedure for electing (selecting) an auditor, liquidation and reorganization of a legal entity and liability for its obligations.

Each constituent document is signed by the founders, and if it consists of more than 1 sheet, then it must be bound and all its pages numbered. On the back of the last page, on a sticker placed over the fastening threads, the following entry should be made: “Stitched, laced __ sheets.” The number of sheets is indicated both in numbers and in words. The signatures of the authorized persons and signatories of the constituent document are also placed here. The registration authority will not accept an unstitched constituent document.

Constituent documents of organizations in Law No. 99-FZ dated 05.05.2014, dated 05.23.2015 No. 133-FZ, dated 06.29.2015 No. 209-FZ “On amendments to Chapter 4 of Part 1 of the Civil Code of the Russian Federation”

In the Law of 05/05/2014 No. 99-FZ “On Amendments to Chapter 4 of Part 1 of the Civil Code of the Russian Federation,” Article 52 of the Civil Code is stated in a new wording:

Article 52. Constituent documents of legal entities

(as of 07/01/2018)

← Article 501. Decision to create a legal entity. faces | Article 53. Legal bodies faces → |

| Revision of Art. 52 Civil Code of the Russian Federation until 01.09.2014 | Revision of Art. 52 of the Civil Code of the Russian Federation from 01.09.2014 (as amended by laws No. 99-FZ, dated 05.05.2014, dated 05.23.2015 No. 133-FZ, dated 29.06.2015 No. 209-FZ) |

The constituent agreement of a legal entity is concluded, and the charter is approved by its founders (participants). A legal entity created in accordance with this Code by one founder acts on the basis of a charter approved by this founder. In the constituent agreement, the founders undertake to create a legal entity, determine the procedure for joint activities for its creation, the conditions for transferring their property to it and participation in its activities. The agreement also determines the conditions and procedure for distributing profits and losses between participants, managing the activities of a legal entity, and the withdrawal of founders (participants) from its composition. |

A business partnership operates on the basis of a constituent agreement, which is concluded by its founders (participants) and to which the rules of this Code on the charter of a legal entity apply. The internal regulations and other internal documents of a legal entity may contain provisions that do not contradict the constituent document of the legal entity. |

Comments on Article 52 of the Civil Code of the Russian Federation

As follows from the new editions of the articles and the Civil Code, the legislator proposes to leave only one constituent document - the charter. And only for business partnerships the legislator leaves a constituent agreement, which has the force of a legal charter.

For the first time, the law directly provides for both standard forms of charters (which founders can use to register an organization at their discretion) and that such standard forms of charters are approved by an authorized government body. Thus, the legislator, apparently, on the one hand, wanted to close down the numerous registration business, which will now only be engaged in making money in queues, and on the other hand, to formalize and speed up the procedure for registering an organization.

Clause 5 of Article 52 of the new edition of the Civil Code establishes mandatory requirements for the content of the charter of legal entities. At the same time, from a systematic analysis of articles - 65.1, 116 - 123 of the Civil Code, it follows that the specified requirements are now uniform for both commercial and non-profit organizations.

Thus, the charter of any organization must contain:

- Name and brand name

- Location

- Subject and goals of activity

- Activity management procedure

- Other information provided by law for legal entities of the corresponding organizational and legal form and type.

Federal Law No. __-FZ of June 29, 2015 introduced changes to Article 52 of the Civil Code, the essence of which is to provide the founders (participants) of a legal entity (at the first stage - only LLC) with the opportunity to act on the basis of a standard charter approved by an authorized state body, by adopting general meeting of participants (founders) of the relevant decision. The law proceeds from the fact that a standard charter approved by an authorized state body will not require its subsequent approval by the LLC participants and the giving of such a charter in paper form. For the purposes of registering a legal entity, it will not be necessary to submit a standard charter to the registration authority either in paper form or in the form of an electronic document, which will help reduce costs for both entrepreneurs and the registration authority (storage, issuance of certified copies of the charter). In this case, individual information about a specific LLC using a standard charter (information about the name, location, amount of the authorized capital of the legal entity) will not be reflected in the charter, but only in the Unified State Register of Legal Entities (USRLE).

It is also possible for an LLC to act on the basis of individual charters, that is, with the charter indicating individual information about the LLC and provisions not provided for in the standard charter. Such a document will exist in traditional paper form. At the same time, an LLC will be able to refuse to use a standard charter, as well as switch to using standard charters, at any time in the manner prescribed by the legislation on state registration.

Read more about creating an organization:

- Filling out application P11001, P21001

- Submitting documents to the tax office

If for some reason you cannot prepare a package of necessary constituent documents for registration, then you can contact us for such a service and we will definitely try to help you in person or through remote consulting.

Now these documents must be submitted for registration in order to register an LLC (CJSC, JSC)

The article was written and posted on June 15, 2012. Added - 05/05/2014, 06/25/2015, 01/19/2016

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

Contents of the model charter

The list of information that must be contained in the standard charter is listed in the new paragraph 2.1 of Article 12 of the LLC Law. However, this list is open, since the charter may also contain other information that does not contradict the LLC Law and other federal laws. Since the form of the model charter has not yet been approved, it is impossible to talk about what information will be included in it.

For example, it is not known whether the developers will include a provision in the standard charter stating that the LLC has a seal. Note that if this norm is spelled out in the standard charter, then the company applying such a charter will be obliged to affix a seal on its documents (see “LLC and JSC can refuse to use seals: how to do this and in which documents the seal remains mandatory for now props").

At the same time, it is obvious that the standard charter will not contain “personal” data of a limited liability company. We are talking about the name of the organization, its location and the amount of authorized capital. According to the commented law, this information will be indicated in the Unified State Register of Legal Entities (USRLE).

Loss and restoration of constituent documents

In practice, documents are often issued to the contractor strictly for a specific time:

- They are delayed by the contractor and are not returned on time.

- In the worst case, they are lost (both individually and in entire folders).

If lost, the question inevitably arises - how to restore the constituent documents of an LLC, CJSC, OJSC, etc. It is curious that the restoration of the constituent documents of an organization is a very common service provided by numerous law firms-registrars. It’s easy to verify this; just enter the corresponding query in the Yandex search bar:

From this we can conclude that it can be difficult to obtain the necessary information about the procedure for restoring documents - the Internet is filled only with offers of services. Let's consider a number of the following features of the process of restoring and obtaining duplicates:

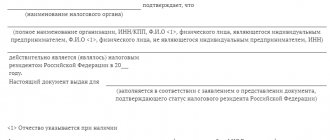

- For restoration, you should contact the tax authorities at the place of registration of the enterprise, if we are talking about documents certified by the tax authority: Charter, Certificate of State Registration (primary), Certificate of Tax Registration (TIN). The application form is free, simple written.

- For the restoration of constituent documents, a state duty is paid in the amount of 200 rubles. up to 800 rub.

- The production time for duplicates is up to 5 working days.

- The issuance of duplicate State Registration Certificates, or as it is now called Record Sheets, has been discontinued due to the loss of force of Government Resolution No. 438 and the publication of Government Resolution No. 462.

- To restore a letter with statistics codes, you should contact the territorial body of the State Statistics Committee.

- All requests for copies and duplicates, as well as direct receipt of ready-made documents from the tax authorities, can be made either by the head of the organization or by a representative based on a power of attorney in simple written form.

- The Unified State Register of Legal Entities extract represents only a “snapshot” of the Unified State Register of Legal Entities at a point in time, and therefore there is no point in “restoring” it - just request from the Federal Tax Service an Extract of the Unified State Register of Legal Entities for the current date, including through the electronic service

- Legal documents that do not contain the seal or signature of a state (tax) authority - Decisions and Minutes of general meetings of founders (participants), Orders of the General Director, are restored without contacting government agencies by issuing an additional copy(s).

- The seal of a legal entity, information about issuance and loss since 2002 are not necessarily reflected in the public register of seals, and are also restored by the organization independently.

Transition to a standard charter

Legislators provided that LLCs will be able to choose on the basis of which constituent document to carry out their activities - a standard charter posted on the website of the Federal Tax Service of Russia, or a charter approved by the founders.

For newly created organizations (including through reorganization), the issue of choosing a charter must be resolved at the creation stage. If the founders consider that the organization will act on the basis of a standard charter, then they must indicate this in the decision to establish the LLC and in the application for state registration.

Existing LLCs will be able to switch to standard charters at any time. To do this, you will need to send two documents to the tax office: the decision of the participants to switch to a standard charter and an application to make changes to the information contained in the Unified State Register of Legal Entities (Clause 2.1, Article 17 of the Federal Law of 08.08.01 No. 129-FZ “On State Registration of Legal Entities” individuals and individual entrepreneurs”, hereinafter referred to as Law No. 129-FZ). Note that the reverse transition - from a standard charter to a charter approved by the founders - is also possible at any time. This is provided for in the new wording of Article 12 of the LLC Law.

Types of constituent documents for different organizations

Limited partnerships and general partnerships operate with just one memorandum of association.

Both the charter and the memorandum of association are necessary for the activities of additional and limited liability companies, as well as associations of legal entities.

The charter is the only necessary document for JSC, LLC and additional liability company (if they are created by one person), municipal and state unitary enterprises, consumer and production cooperatives, foundations, public associations, as well as non-profit partnerships, organizations and institutions.

At the same time, a number of these organizations in some cases draw up other constituent documents of a legal entity. For example, an NPO can also enter into a constituent agreement. At the same time, in cases established by law, these organizations can act on the basis of regulations. But for commercial structures such an assumption is not provided.

Consequences of the transition to a standard charter

If an LLC decides to act on the basis of a standard charter, then in the future it will be easier for the organization to change information about its name, location and amount of authorized capital. After all, to do this you will only need to submit an application for amendments to the information about the legal entity contained in the Unified State Register of Legal Entities.

If the LLC applies the charter approved by the founders, then the changes made to the charter will have to be registered. And this procedure is more complicated. For state registration of such changes, you need to submit the documents listed in paragraph 1 of Article 17 of Law No. 129-FZ and pay a state fee.

Presentation of the charter to interested parties

In practice, it may be necessary to present the charter to third parties (for example, counterparties, court, company members or auditor). How will it be possible to present a standard charter posted on the website of the Federal Tax Service of Russia? Legislators have provided that in such cases it will be sufficient to notify that the LLC operates on the basis of a standard charter. Interested parties will be able to familiarize themselves with the standard charter for free on the website of the Federal Tax Service of Russia.

In addition, information that the LLC operates on the basis of a standard charter will be contained in the Unified State Register of Legal Entities (also see “What will change from June 30 in the procedure for obtaining information and documents from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs”).

From the explanatory note to the bill

When using standard charters, the founders of legal entities will not need qualified legal assistance to draw up the charter, counterparties of legal entities will be able to reduce the time for checking the constituent documents, and the registration authority may not check the compliance of the charter with the law.

Branches and representative offices

Currently, paragraph 3 of Article 55 of the Civil Code of the Russian Federation states that information about branches and representative offices must be indicated in the Unified State Register of Legal Entities. Until September 1, 2014, this norm stated that information about branches and representative offices should also be reflected in the constituent documents (see “Amendments to the Civil Code of the Russian Federation: new types of legal entities, mandatory audit for all joint-stock companies and forced liquidation of organizations”). After this date, this requirement was excluded from paragraph 3 of Article 55 of the Civil Code of the Russian Federation, but it remained in the laws on LLCs and JSCs.

This meant that when creating or liquidating a branch (representative office), organizations still had to prepare a new edition of the charter or accept changes in the form of a separate document. Next, you should notify the tax authority about making appropriate changes to the charter (Article 19 of Law No. 129-FZ). Until recently, such requirements were contained in paragraph 5 of Article 5 of the Law on LLCs and paragraph 6 of Article 5 of the Law on JSCs.

Thanks to the laws under comment, organizations will be spared the need to indicate in their charters information about the opening (closing) of a branch or representative office, as well as notify the tax authority about this. One of the amendments provides that a JSC can create branches and open representative offices in accordance with the provisions of the Civil Code (new edition of paragraph 6 of Article 5 of the Law on JSC; came into force on July 1, 2020). And, as we have already said, the Civil Code does not currently require information about branches and representative offices to be indicated in the charters. The new version of paragraph 5 of Article 5 of the LLC Law directly states that information about branches and representative offices is reflected in the Unified State Register of Legal Entities.

Let us note that the adopted laws do not oblige LLCs and JSCs to exclude from their charters the information already contained in them about branches and representative offices.

Procedure for adoption of the charter

Both the entire list of constituent documents of a legal entity and the charter itself must be in accordance with the law. The normative nature of the document is fully revealed because it contains a lot of imperatively defined conditions. In addition, as a transaction, the charter is similar to an accession agreement, since new participants who join a particular legal entity join the existing charter.

Unlike the constituent agreement discussed above, it is not concluded, but approved. Not all founders must sign the document, but only authorized persons. The charter comes into force when the registration of constituent documents of legal entities is completed.

According to some legal scholars, in developed countries the importance of the document invariably declines, since many aspects, even without it, are regulated by legal acts, and not by the rules that are formulated in it.

Registration period for legal entities and individual entrepreneurs

Let us note another amendment made to Law No. 129-FZ. Legislators have reduced the period given to tax authorities for state registration of legal entities and individual entrepreneurs. Now tax authorities must register a new organization or individual entrepreneur within five working days. After the changes come into force, this period will be three working days, counted from the date of submission of the necessary documents (clause 3 of article 13 and clause 3 of article 22.1 of Law No. 129-FZ).

The period for making a decision to refuse state registration is also reduced from five to three days (clause 3 of Article 23 of Law No. 129-FZ).

*Federal Law dated 06.29.15 No. 209-FZ “On amendments to certain legislative acts of the Russian Federation regarding the introduction of the possibility of legal entities using standard charters” and Federal Law dated 06.29.15 No. 210-FZ “On amendments to certain legislative acts of the Russian Federation and the recognition as invalid of certain provisions of legislative acts of the Russian Federation.”

Document storage

The originals of the charter and accompanying documents are stored at the address of the legal entity. They should always be available to the director and founders, so the main office is an ideal storage location. Given the high importance of constituent documents, it is advisable to purchase a small safe. Employee work books, originals of all important documents and money should also be kept there.

The location of storage of documentation is fixed in the charter.