How many hours per week does an employee work at 0.5 rate?

The law provides for the possibility of concluding a part-time employment contract, both at the place of main work and part-time. As a result, the employee works part-time, and his work is paid in proportion to the time worked. Read the article carefully so as not to confuse part-time work with short-time work.

The procedure for establishing and paying for part-time work is regulated by Art. 93 Labor Code of the Russian Federation. An employment contract at 0.5 rate also falls under the same standards, since in this case we are talking about a part-time or weekly work schedule, when the duration of daily or weekly work is reduced by 50%.

A logical question arises: if an employee is employed at 0.5 rate, how many hours a day is he required to work? You should proceed from the general standard of working time established for this position. If full-time employment requires a 40-hour work week, then a part-time employee must work 20 hours per week. Hours worked in excess of half the norm are paid as overtime.

| What else you need to remember when applying for a part-time employee | |

| The right to vacation, length of service, etc. Part-time work does not in any way limit the right to paid annual leave, accrual of length of service, reduction of working hours on the eve of holidays and other guarantees enshrined in law. Make a record of hiring in the work book without the notes “part-time”, “0.5 times”, etc. | Read in the “Personnel System”: Is it possible to break the official salary into even smaller shares - 0.75, 0.25, 0.1 |

| Lunch break. An employee who works no more than 4 hours a day may not be given a lunch break if the corresponding clause is in the employment contract or local regulations of the employer. | Read in the Personnel System: How to set a break for rest and nutrition |

https://youtu.be/8FgUjzRC6Yk

What rights does an employee have when working part-time?

The offer of part-time work can be made by the employee himself or by his employer. But approval of such a schedule occurs only if the employee does not mind working part-time. He must be notified of this two months in advance.

Part-time working conditions do not at all affect the rights of a working employee. The employee has the same paid vacation as other full-time employees. In case of a partial day, all holidays are retained, and compensation is paid based on the average salary for one month.

How much is work paid for at 0.5 rate?

Part-time work, including half or quarter rate, is paid in proportion to the volume of work performed or the number of hours actually worked (Part 3 of Article 93 of the Labor Code of the Russian Federation). The most common method used is time-based payment.

How to pay salary in proportion to time worked

Step 1. Determine the cost of one hour of work, based on the full official salary and standard working hours, taking into account all compensation and allowances due.

Step 2. Multiply the result by the number of hours actually worked by the employee.

Step 3: Subtract taxes.

Example

The employee was accepted at 0.5 times the rate for the position of secretary of the organization with an official salary of 21,120 rubles. He works five days a week (4 hours a day instead of standard and receives a salary in proportion to his output. There were 22 working days in the month worked. We determine the cost of one hour of work:

He works five days a week (4 hours a day instead of standard and receives a salary in proportion to his output. There were 22 working days in the month worked. We determine the cost of one hour of work:

21,120 rubles: (22 days * 8 hours) = 120 rubles

According to the report card, the employee worked 88 hours in 22 days. We multiply 120 rubles by 88 hours and get 10,560 rubles - a monthly salary calculated in proportion to the time worked.

The magazine “Personnel Affairs” discussed when an employee does not have the right to dictate his terms when working part-time

If an employee works at 0.01 rate with a five-day work week, how to timesheet him?

https://youtu.be/wtlE2TIFp6c

1. If employees are employed at 1 rate + 0.5 rates, are on a long business trip - in the report card put them “K” and 0 hours - all days, including weekends, and in column 11 all should days be taken into account with weekends (counted as 8 and 4 hours depending on the rate)? OR should we not add weekends in this case? The answer to your question depends on how exactly the employee is registered for these 1+0.5 rates.

This could be either a combination or an internal part-time job.

- If this is a combination:

For the days an employee is on a business trip, enter the letter code “K” or the numeric “06” in the time sheet, but do not indicate the number of hours actually worked (For more details, see

Clause 1 of the Appendix to this answer). Regarding weekends, the following must be taken into account. Clause 8 of the Instruction of the Ministry of Finance of the USSR, the State Committee for Labor of the USSR and the All-Russian Central Council of Trade Unions dated 04/07/1988 N 62 “On business trips within the USSR” stipulates that workers on business trips are subject to the working hours and rest time regime of those associations, enterprises, institutions, organizations to which they are sent.

In return for rest days not used during a business trip, other rest days upon return from a business trip are not provided. We recommend reading about the material at this link. If an employee is specially sent to work on weekends or holidays, compensation for work on these days is made in accordance with current legislation. Thus, in the report card

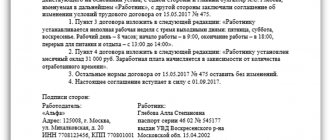

What does an employment contract look like for 0.5 wages (sample)

Remuneration is a mandatory clause of the contract drawn up during employment: the employer is obliged to stipulate in advance the size, procedure and timing of salary payment.

Read more in the article “Essential terms of the employment contract.”

Even if an employee works at 0.5 times the rate at his main place of work or part-time, the contract reflects the official salary or tariff rate in full, according to the staffing table. And the exact amount of payments due for 0.5 rates (this is how much money a specific employee will receive per month working part-time) can be specified additionally. Find out how to do this correctly, and make sure that the wording in the employment contract, employment order and personal card are completely identical.

Advice from the editor. When specifying the salary for 0.5 times the rate, use the wording “calculated in proportion to the time worked.” In this case, the exact amount may not be specified, since the contract already contains all the components of the formula: the full official salary and the number of hours that the employee is required to work. More useful information in the magazine “Personnel Affairs”: Part-time work: we analyze non-standard situations

Indicate in the contract for 0.5 rates how many hours per week you need to work, or specify the work schedule indicating the number of working days per week, start and end times of the shift, breaks, etc.

This is what an additional agreement to a part-time employment contract looks like (sample):

Conclusion

When hiring a part-time employee, be sure to include special terms of employment in the contract: part-time working hours, wages in proportion to the hours worked or the amount of work performed. Indicate the monthly official salary or tariff rate in full so as not to violate the norms of Article 57 of the Labor Code of the Russian Federation.

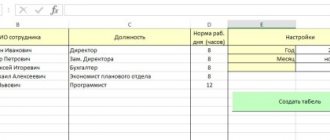

Filling out the working time sheet correctly

Didukh Yulia Author PPT.RU February 15, 2020 Labor legislation obliges employers to keep records of the time worked by employees. Organizations, regardless of legal status, and individual entrepreneurs must take into account hours worked.

Especially for this purpose, the State Statistics Committee has developed and approved forms of the Time Sheet N T-12 and N T-13. ConsultantPlus TRY FOR FREE We will provide instructions for filling out, which will help you correctly reflect the data and use the timesheet rationally.

The working time sheet, approved by Resolution of the State Statistics Committee dated January 5, 2004 No. 1, helps the personnel service and accounting department of the enterprise:

- take into account the time worked or not worked by the employee;

- monitor compliance with the work schedule (attendance, absence, lateness);

- have official information about the time worked by each employee for calculating wages or preparing statistical reports.

It will help the accountant confirm the legality of accrual or non-accrual of wages and compensation amounts for each employee. The HR officer must track attendance and, if necessary, justify the penalty imposed on the employee. A time sheet refers to the forms of documents that are issued to an employee upon dismissal along with a work book upon his request ().

It is worth noting that the unified forms of timesheets N T-12 and N T-13 are not required for use from January 1, 2013. However, employers are required to keep records (Part.

4 )

Topic: 0.25 working rate

Quick transition Payroll and personnel records Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries

Related topics:

- Specific rates of land tax are established by the Procedure for establishing land tax. Local tax. Chapter 31 of the Tax Code of the Russian Federation is established, and the local regulations are put into effect...

- The length of service of the Ministry of Internal Affairs is 25. Will there be a change in the length of service to 25 for police officers? Peculiarities of service in the police since the Soviet...

- 12-hour schedule 2/2 schedule with a shift duration of 12 hours violates the employee’s right to restThis conclusion was reached...