How to register correctly

Powers of attorney can be issued to an individual, organization, or government agency. There is a separate type of power of attorney; it is issued by a legal entity to another legal entity.

In civil law there is no official, standard template for issuing powers of attorney from an organization to another organization. Most legal entities develop their own structure of trust documents.

The structure must meet the needs of the organization, and it may also include attachments with typical examples of powers of attorney.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Despite the fact that organizations independently develop the text of trust documents, there are elements common to all powers of attorney:

- Title of the document;

- date and place of issue of the power of attorney;

- data of the principal and attorney, a detailed list of transferred powers;

- period of validity of the document;

- signature of the principal’s representative who has the right to issue this type of power of attorney;

- if the transfer of powers must be notarized (rent agreements, real estate transactions, inheritance, etc.), the document must bear the notary's visa and the registration number of the power of attorney.

Watch the video. How to properly issue a power of attorney from a notary:

Power of attorney from a legal entity to an individual: sample and details of completion

A power of attorney from a legal entity allows a citizen to act as its representative within the competence agreed upon by the parties. In this article we will look at how to formalize it correctly, what changes have been introduced regarding cancellation, and also when certification by a notary is required.

A power of attorney from a legal entity allows a citizen to act as its representative within the competence agreed upon by the parties. In this article we will look at how to formalize it correctly, what changes have been introduced regarding cancellation, and also when certification by a notary is required.

How to correctly issue a power of attorney

A sample power of attorney from a legal entity to an individual involves the use of a written form, often using the official forms of the organization. The sheet is legibly filled out either in writing by hand or prepared and printed on a computer. The form of the document is drawn up arbitrarily; the legislator does not provide for the attributes of specific templates.

The principal should take seriously the drafting of the contents of the document, which will detail and list the actions that the representative has the right to perform. This is especially true for powers of attorney issued to conduct financial transactions, client relationships with the bank, organizing work with material assets, etc. Therefore, close attention is paid to the structure of the document:

Full information about the legal entity: from detailed spelling of the name without abbreviations to information about state registration and details.

For what period and when is the document issued (date of preparation). The validity period depends on the nature of the representative’s actions and is determined by the parties.

Full name and passport details of the citizen for whom the power of attorney is issued.

A detailed list of actions that are assigned to the trustee. You cannot use general phrases, for example, “as well as other actions that are implied by this document.”

The presence of signatures of the parties, and the signature of the citizen is certified by the signature of the principal. The organization's seal is used if it is provided for by the organization's regulations. But in addition to the seal and signature of the head, municipal organizations require the signature of the chief accountant.

The following are subject to notarization:

transactions provided for by law (Article 163, 185.1 of the Civil Code of the Russian Federation);

if the parties have expressed a desire for notarization, even in the absence of grounds provided for by the Federal Law (clause 2 of Article 163 of the Civil Code of the Russian Federation).

Important! The original copy is in the singular. When registering a power of attorney with a notary, the number of originals cannot exceed the number of parties that appear in the legal relationship (Article 60 of the Federal Law on Notaries).

In order not to delve into the complexities of tax legislation and not to deal with the preparation of all documents yourself, use the GlavAccount Assistant service. Experts in the field of accounting and law will do all the routine work for you.

Read more information about the sole executive body of a legal entity here

Who has the right to represent the interests of a legal entity

A company representative can be either an organization (legal entity) or a citizen (individual). The highest executive body of a legal entity is the director, who represents the interests of the organization without restrictions. He does not need a power of attorney; an exhaustive range of powers is enshrined in the organization’s Charter. But employees or third parties are issued a power of attorney to carry out certain actions by the highest executive body of the organization. These are accountants, directors of departments, invited specialists to solve specific problems: auditors, lawyers. A citizen does not have to be an employee of this company, as was required before 2012, so any person can represent its interests. An exception is a power of attorney to receive material assets in form M-2 and M-2a, which are issued to an employee of the organization.

The main condition for obtaining a power of attorney from a legal entity to an individual is full legal capacity and the age of majority.

An individual issues a power of attorney to a legal entity

A collegial or sole executive body represented by the general director or manager manages the current activities of the company (Article 53 of the Civil Code of the Russian Federation). Therefore, a citizen, when issuing a power of attorney to a legal entity, must take into account that only the manager will act on it. If notarization is required, the notary will ask you to provide complete information on the legal entity:

- legal address;

- information about state registration in the Unified State Register of Legal Entities;

- certificate number OGRN, checkpoint.

The boss has the right to delegate certain powers by way of delegation to employees. This category of transactions is subject to notarization (Article 187 of the Civil Code of the Russian Federation).

Types of powers of attorney

A power of attorney for an individual from an LLC in business is conventionally divided into: general (general), special and simple (one-time).

Special. Allows you to enter into an unlimited number of actions of the same type.

One-time. Gives the right to carry out a one-time order, for example, to obtain a medical certificate, specific documents, letters. The validity period is usually short.

General power of attorney for all powers from a legal entity.

A general power of attorney for all powers allows the authorized person to perform a wide range of actions without specifying clients (third parties) and types of agreements. Written execution and signature of the manager are mandatory elements of the document. Affixing it with the seal of the legal entity after 2013 is not mandatory, however, if this provision is provided for in the text of the agreement, then the seal is attached. The validity period is set independently; there are no restrictions on the period from September 1, 2013. If the validity period of the document is not specified, then the law establishes a time period of one calendar year. To avoid discrepancies and disagreements - validity periods and dates of issue, it is better to duplicate them in text. The names and details of the company, full name and passport details of individuals must be indicated in full. The powers under a general power of attorney include:

operations with real estate objects;

representation of interests in judicial and government bodies;

collecting and processing the necessary information;

management of company bank accounts;

legal actions to comply with and register the rights of legal entities, protest and appeal against actions of tax authorities in case of violations on their part.

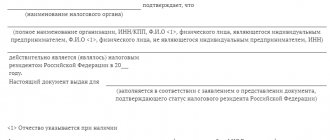

The documentary form of delegation of representative functions will be a notarized power of attorney with a full list of powers from a legal entity to an individual. The notary checks, on the one hand, the competence of the legal entity by checking individual constituent and other documents. On the other hand, the competence (legal capacity, passport data) of the future representative. In the final part of the power of attorney, the notary places a final inscription confirming the fact of verification of both parties.

Termination of power of attorney

The conditions for termination of the power of attorney are established by Art. 188 Civil Code of the Russian Federation. These include:

expiration of the established period of validity;

the person refused to use the granted powers;

the legal entity has ceased operations;

the individual is recognized as incompetent or partially capable or missing;

the legal entity was entered into bankruptcy proceedings with the deprivation of the right to independently issue a power of attorney.

Upon termination of the issued document, it should be immediately returned to the principal or legal successor.

Cancellation of power of attorney

If the company considers it necessary to cancel the power of attorney, then after the changes in 2020, the cancellation occurs in the same documentary form in which it was drawn up. The principal has the obligation to notify the representative and partners (third parties) in writing of his decision. It is not prohibited to notarize the cancellation of a simple written power of attorney.

For simple writing.

The manager issues an order, which is sent by notification to the authorized person. The individual must return the document to the records management department, which is recorded in the power of attorney ledger. If it is not possible to warn the trustee and partners, then they send an application for publication of the notice in a public publication that publishes information about bankruptcy (Article 189 of the Civil Code of the Russian Federation). This is the printed edition of Kommersant. In this case, the law provides for mandatory notarization of the principal's signature. Counterparties will be considered notified upon the expiration of thirty calendar days from the date of publication of this information, unless the principal notified them of the cancellation earlier.

2. To cancel a notarized power of attorney, contact the notary’s office again with an application for cancellation (Article 189 of the Civil Code of the Russian Federation). The notary enters information about the cancellation into the Unified Register of Notaries (UISN). The service is paid. The document loses its legal force the next day after the information is entered into the register. Counterparties are considered informed of the notarized revocation of the power of attorney on the next day, if the principal has not notified them himself on the same day.

Important! If a third party was presented with a power of attorney, but he did not know or was not notified of the cancellation, then for him the powers of the representative will remain valid, as for legal successors (Article 189 of the Civil Code of the Russian Federation).

Sometimes a power of attorney is not issued separately, but is included in an agreement, a decision of a meeting of founders, etc., the cancellation mechanism is similar. If certified by a notary, we issue a notarized refusal. If the document is in simple written form, we cancel in writing.

Basic filling rules

As follows from the provisions of Articles 185 and 185.1 of the Civil Code of the Russian Federation, a trust document can be drawn up in free form or have a clear notarial form. In both cases, only written completion is allowed.

If a power of attorney requires notarization, it will not be valid without a notary’s signature. If the transferred powers do not require mandatory notarization, then the signature of the head of the organization or another person who has the right to sign powers of attorney will be sufficient (Article 185.1 of the Civil Code of the Russian Federation).

How to draw up a general power of attorney for real estate with the right to sell?

How to issue a notarized power of attorney to represent interests, read here.

How to issue a power of attorney to represent interests in an insurance company, read the link:

Note! Any trust document issued by a legal entity must bear the seal of that legal entity. If there is no manager’s visa and legal entity’s seal, then the document is considered invalid.

In addition to the details of the principal and the attorney, the text of the power of attorney must contain a complete list of powers transferred to the attorney. Authority must be stated clearly, without the use of abstract expressions or general phrases. Inaccurate wording may become a reason for revoking the power of attorney or invalidating it.

Art. 53 Civil Code of the Russian Federation and Art. 185 Civil Code of the Russian Federation

Representation through individuals (citizens) is a common practice for all areas of activity. General and specific conditions for issuing a power of attorney, regulated in Art. 185 of the Civil Code of the Russian Federation, provide for the authorization of a certain person to perform legally significant actions.

Indication of a representative as a “person” allows us to establish that an organization or enterprise can act as a trustee, since civil law recognizes two categories of persons:

- Individuals (citizens);

- Legal entities.

Thus, written authorization can be issued not only to citizens, but also to a legal entity. A similar rule is contained in clause 3.10 of the Federal Tax Service Letter No. 2668/03-16-3 dated July 22, 2016, which directly states that a power of attorney can be issued to an enterprise or organization.

Consequently, the execution of a power of attorney for a legal entity will mean that the actual execution of powers under this document will be carried out by one of the approved management bodies. The list of management bodies of the organization is regulated by its constituent documents, and the specific sole manager is approved by the owners of the company.

A power of attorney for a legal entity can be issued in two ways:

- In the form of a written document certified by the signature and seal of the enterprise;

- In writing, followed by notarization.

Is it possible to change the details

The provisions of the power of attorney cannot be changed after it has been signed. You can make minor changes if a mistake was made. After making changes, you must put a signature, seal and a note about the correction.

Remember! Any amendment to the power of attorney can only be made by the organization that issued it. More specifically, its employee authorized to do this. If it is necessary to change the powers or the attorney, the old power of attorney is revoked and a new one is drawn up.

A power of attorney is a document that is issued by an organization to its attorney for him to represent its interests. After issuing a power of attorney, the representative can sign contracts, payment documents and perform other actions provided for by the trust document on behalf of the legal entity.

Powers of attorney are used in various circumstances, most often these are:

- representation of a legal entity in government bodies and institutions;

- when interacting with judicial authorities;

- when receiving parcels and documentation at the post office or courier service;

- when registering the company's vehicles with the traffic police. When driving cars owned by the organization.

Power of attorney from a legal entity to an individual

A power of attorney is a document that is required quite often in the current activities of enterprises and organizations. With its help, the management of a particular company entrusts the performance of certain functions to a trusted person, and also assigns a certain share of its rights and powers to him.

Who can act as a proxy

According to the law, the principal’s representative can be either a legal entity or an individual. If we are talking about an individual, the main condition is that it is a person who has reached the age of majority, and, as they say, “of sound mind and sound memory.”

The representative should not raise doubts in the principal, since from the moment the power of attorney is signed, all responsibility for actions that occur with the use of the document falls on him.

For what actions can a power of attorney be issued?

A power of attorney issued on behalf of a legal entity to a specific person can relate to a variety of aspects of the organization’s activities:

- representation in credit institutions or courts;

- resolving issues related to the company's property;

- dispatch and delivery of inventory items, etc.

Who writes the power of attorney

A power of attorney on behalf of an enterprise has the right to be drawn up by any employee authorized to do so by order of the company’s management or if this function is specified in his job description. In any case, this should be a person who has an idea of exactly how to draw up this kind of paper.

Document validity period

If the date is not indicated in the document, it is automatically equal to one year.

The period of validity of the power of attorney can be absolutely any - here everything is left to the trustor. Moreover, any power of attorney can be extended if desired.

Do I need to go to a notary?

It is not always necessary to have a power of attorney certified by a notary - in most cases, the power of attorney is valid without his seal and signature. However, there are types of powers of attorney that must be certified at a notary office. These are, for example, agreements concerning the transfer of debt, assignment of claims, as well as all powers of attorney that are issued with the right of subrogation.

What is the “right of subrogation”

Some powers of attorney are issued with the right of substitution. This form of the document means that the principal’s representative has the opportunity, in case of some circumstances, to transfer the functions entrusted to him to another person.

Such powers of attorney are always certified by a notary, and in advance the representative is obliged to notify his principal of the need to delegate the affairs entrusted to him.

It should be noted that in practice this type of paper is not encountered very often. This is due to the fact that it is more convenient for business managers to issue powers of attorney for several people with whom they are personally acquainted rather than trusting someone with the ability to delegate delegated powers.

How to draw up a power of attorney

There is currently no single unified form of power of attorney from a legal entity to an individual. Representatives of organizations have every right to draw up a document in any form or according to a template in force in the company. It is important to follow only two basic rules: that in its structure the document complies with office work standards, and in its content it includes a number of mandatory information. These include:

- full name of the enterprise that issues the document, including its constituent details;

- number, place, date of drawing up the power of attorney;

- last name, first name and patronymic name of the person for whom it is issued and his passport details indicating registration at the place of residence.

The main part of the power of attorney must include a complete list of powers, rights and obligations that this document provides to the bearer. Maximum attention should be focused on this section of the power of attorney, spelling out all the points in detail and carefully. If the principal's representative receives the right to sign various types of papers, this must also be noted. Finally, you must indicate the validity period of the document.

How to draw up a document

The law does not establish any special requirements regarding the execution of a power of attorney, as well as regarding its preparation. This means that it can be formed either on an ordinary sheet of any convenient format or on the company’s letterhead. It is permissible to write a document either by hand or in printed form - this does not play a role in determining its legality.

There is only one immutable point that needs to be taken into account: the power of attorney must contain two signatures, one of which must belong to the authorized person, the second - to his principal. In this case, the second signature certifies the authenticity of the first, therefore the use of facsimile autographs, i.e. printed by any method is excluded.

As for the seal or stamp, it is necessary to certify the form with their help only when the regulatory legal acts of the organization stipulate the requirement to use various types of stamp products.

The power of attorney is always made in one original copy.

Is it possible to revoke a power of attorney?

The law clearly states that at any time any power of attorney can be canceled or revoked. If the power of attorney has lost its relevance, then it must be canceled by notifying the interested party that the document has lost its legal force. It’s good if the principal manages to get the original power of attorney back.

Power of attorney to court

Represent the interests of a legal entity, that is, an organization. A citizen can go to court with a power of attorney granted to him. The main thing is to correctly document the powers that are vested in connection with this form of civil relations. This document will confirm the right of an individual (usually an employee) before a court to take certain actions for which the company has authorized him on its behalf.

Legislative requirements for such a power of attorney do not require its strict and unambiguous form, however, the presence of mandatory components is necessary:

- all details of the principal company (you can issue a power of attorney on its letterhead);

- place and date of drawing up the power of attorney (the date is usually written in words and not in digital format);

- identification data of the authorized person (indicating his registration);

- an indication of the powers granted (the more precise the better);

- permission or prohibition to transfer powers;

- validity period of the document (at the request of the principal, rights can be revoked at any time);

- signatures of the authorized representative and management of the organization;

- seal (if it is used in the company).

Sample power of attorney for the right of an individual to represent the interests of a legal entity in court

LIMITED LIABILITY COMPANY "LORELEYA" Samara, st. Arzamasskaya, 8, office 1 tel. e-mail

The twenty-ninth of May two thousand seventeen

Limited Liability Company "Lorelei" (TIN 5467098312 OGRN 956784563123) represented by General Director Anton Vladislavovich Kramarsky, acting on the basis of the Charter,

citizen Artsybashev Maxim Anatolyevich, staff lawyer of Lorelei LLC, born on August 16, 1998 (passport 03 10 No. 875412, issued on April 12, 2010 by the Central Regional Department of the Ministry of Internal Affairs of Krasnodar) residing at the address: Samara, st. Aeroflotskaya, d. 26, kv. with which it provides special rights: signatures of all documents necessary for the high-quality execution of this instruction, including petitions, reviews, settlement agreements; submission and receipt of certificates, copies, documents that may be required during the trial.

The power of attorney was issued without the right of substitution for a period of 3 years.

/Artsybashev/ M.A.Artsybashev Signature M.A. I certify Artsybashev. General Director of Lorelei LLC /Kramarsky/ A.V. Kramarsky M.P.

Power of attorney to the tax office

Upon provision of such a document, a representative of the company can interact with the tax authorities: give or receive any papers, sign, make extracts and perform other actions provided for by law and listed in the power of attorney.

A power of attorney is required if the employee’s right to represent the company in the INFS is not stipulated in the Charter. A notarized declaration of such a power of attorney is required. The required components of a power of attorney are similar to any document of this type: details of the parties, a list of powers, validity period, a statement of the right to sub-power, the signature of the authorized representative and its certification by the management of the company, and, of course, the signature and seal of the management. The power of attorney will not be valid if:

- the date is not indicated or it is in the wrong format (numbers must be indicated in words);

- the signature is not personal, but facsimile;

- the signature of the individual is not certified;

- there is no seal of the organization (except for those cases when it is not used according to the charter);

- blots, corrections, erasures were made;

- there is no corresponding mark on the original power of attorney, if the document is not the primary one, but is being transferred.

Sample power of attorney to the INFS authorities

LIMITED LIABILITY COMPANY "Reconstructor" 620027, Ekaterinburg, st. Lunacharskogo, 15, office 1 tel. e-mail INN 7859306748 OGRN 165728592067486

Twenty-third of March two thousand seventeen

By this power of attorney, Limited Liability Company "Rekonstruktor" represented by General Director Natalya Mikhailovna Antropkina, acting on the basis of the Charter,

manager of the branch of Reconstructor LLC in Belorechensk, Krasnodar Territory, Bogatova Anna Vladimirovna, born on July 29, 1976, passport of a citizen of the Russian Federation, series 23 99 number 15364785, issued by the Department of the Federal Migration Service of Russia for the Krasnodar Territory in Belorechensk on October 3, 1999, registered under address: Krasnodar region, Belorechensk, st. Zarechnaya, 19,

- represent the interests of Rekonstruktor LLC in the Federal Tax Service of Russia Inspectorate No. 3 for the city of Belorechensk, for which purpose it gives it the powers to:

- receive and sign acts, certificates, demands, orders on conducting tax audits at the location of the branch, on the results of the audits and other documents addressed to the LLC branch;

- submit accounting and tax reporting, letters, requests, applications and other documents required by the Federal Tax Service of Russia;

- provide explanations to tax inspectorate employees on all issues that arise during the inspection process and as a result of the activities of the LLC branch;

- submit documents and receive extracts from the Unified State Register of Legal Entities in relation to the LLC;

- sign and exercise other powers granted by the tax legislation of the Russian Federation to carry out this instruction.

This power of attorney has been issued for a period of 3 (three) years without the right of substitution.

/Bogatova/ A.V. Bogatova Signature A.V. Bogatova is certified by the General Director of Reconstructor LLC /Anthropkina/ N.M. Anthropkina

Power of attorney to receive goods/money

This power of attorney helps the sale and purchase transaction proceed as smoothly as possible. Completion of a transaction or delivery of purchased goods always requires the signatures of specific persons - company representatives. The company authorizes its representative to perform all actions necessary for the transaction or acceptance of goods from the supplier on its behalf. Such a document is called a “power of attorney for goods and materials,” that is, for the transfer or receipt of goods and/or material assets.

The form of such a document, unlike other powers of attorney, is not free. To issue a guarantee for receiving inventory items, you need to use form M-2 if the procedure is carried out once, and M-2a if the process occurs on a regular basis. The forms were approved by Resolution of the State Statistics Committee of Russia No. 71a of October 30, 1997.

The form must be filled out on both sides. On the front side, in specially designated columns, indicate:

- OKPO code (as it appears in the statutory documents);

- the date when the power of attorney was issued, its validity period (usually for a month, then a new one can be issued), document number;

- data on legal entities - parties to the transaction;

- bank details of the company making the payment;

- passport details of the individual for whom the power of attorney is issued;

- grounds for issuing inventory items.

The reverse side is intended for information about the inventory items to be transferred: they are listed under serial numbers, the units in which they are measured, and their quantity (in words, not numbers). Blank lines are crossed out. The signature of the authorized representative is also certified on this side.

The power of attorney for goods and materials in form M-2 also has a tear-off spine where its number, expiration date are indicated, signatures are duplicated and links to permits are provided. This counterfoil is supposed to be kept in the accounting department.

In addition to the other components characteristic of any powers of attorney, the document for receipt of inventory materials requires the signature of the organization's chief accountant.

Note! Below is an example of a free form power of attorney. Typical interindustry forms M-2 and M-2a are discussed in detail on a separate page.

Sample power of attorney to receive goods and/or money (free form)

LIMITED LIABILITY COMPANY "Margarita" 620027, Izhevsk, st. Chuguevskogo, 105 tel. e-mail INN 4459306743 OGRN 234528592067485

Twenty first of May two thousand seventeen

By this power of attorney, Limited Liability Company "Margarita" represented by General Director Margarita Alekseevna Chudikova, acting on the basis of the Charter,

Georgian Valery Mikhailovich, born June 5, 1986, passport of a citizen of the Russian Federation series 24 99 number 88364785, issued by the Department of Internal Affairs of the Ustinovsky district of Izhevsk on December 15, 2005, registered at the address: Udmurt Republic, Izhevsk, st. Lenina, 100, accept the goods “Office chairs” from LLC “StulService” under Sale and Purchase Agreement No. 158, concluded between LLC “Margarita” and LLC “StulService” on 04/05/2017.

Within the framework of this instruction, Valery Mikhailovich Gruzin is given the right to sign acts and other documents on behalf of Margarita LLC, to submit and receive financial, accounting and other documents related to the implementation of this instruction.

The power of attorney is valid until December 31, 2017, without the right of substitution.

Signature of Gruzin V.M. I certify. Head: / Signature / Margarita Alekseevna Chudikova Chief Accountant: / Signature / Sofia Aleksandrovna Ilinykh

When is a document required?

A power of attorney is required if an organization needs its representative to sign documents on its behalf. As a rule, powers of attorney are necessary in government bodies, such as courts, the tax service and when negotiating with other legal entities.

The attorney may be an employee of the company, a third party, or another legal entity. In the latter case, a power of attorney is issued from one organization to another.

What is the document made of?

You should not try to find a standard paper form for granting powers to an attorney; the text of the document must be drawn up by the principals themselves. The content and completeness of the certificate depends on the experience and legal knowledge of the compiler, however, there is a minimum that is desirable to comply with.

A competent legal power of attorney from a legal entity to an individual includes:

- a standard header at the top of the document, meaning that the text is placed on the letterhead of a legal entity; the header must contain details, logo, contact information;

- full naming;

- displaying the place where it was compiled;

- day of compilation in numerical and capital form;

- indication of the full name of the principal organization, including details;

- detailed personal information for the trusted person - identification card details, full name, date of birth, where residence is officially registered;

- a clear description of the actions that are entrusted to the trustee;

- terms of transfer of trust;

- term of office;

- signatures of all participants with transcripts, seal of the legal entity.

This sample power of attorney from a legal entity to an individual is suitable for independent drawing up when a simple form of certification is chosen. With the notarial approach, the notary will find out in detail from the applicant what needs to be conveyed to the attorney, and he himself will draw up a legally binding text that maximally protects the principal from deception.

Principal and attorney

A power of attorney has two key aspects. The person or body authorized to issue a power of attorney according to the company’s constituent documentation (for example, the general director) is called the principal.

Important! If TSN wants to issue a power of attorney, then this can only be done by the board of the partnership or the general meeting of owners. The second party to the trust document is the attorney. According to the Decision of the Supreme Court of the Russian Federation of June 6, 2011 No. GKPI11-617, any person who is not deprived of legal capacity can act as an attorney in a power of attorney.

Validity periods

The validity period of the power of attorney depends on the wishes of the principal. There are no restrictions on the validity period of a power of attorney. But the organization that issued the trust document can revoke it or invalidate it at any time.

An organization can delegate any powers to attorneys if their implementation does not contradict the legislation of the Russian Federation. But there is a peculiarity for legal entities with special legal capacity.

If a non-profit association issues a power of attorney, then the transferred powers should not run counter to the specialization of the activities of such an organization. If this rule is not observed, the trust document can be challenged in accordance with Art. 173 of the Civil Code of Russia.

Agency agreement

The structure of the text of the power of attorney and the agency agreement has similar features. In some cases, drawing up an agency agreement may be a more convenient way to achieve the desired result than issuing a power of attorney.

Articles 971 of the Civil Code of Russia and 975 of the Civil Code of Russia

Article of the Civil Code of the Russian Federation No. 971 defines the concept of an order. An order is an action performed by a person or organization within the framework of a contract.

There are a number of distinctive features of the agency agreement that are not present in the power of attorney:

- If a contract of agency is signed, it gives rise to an obligation to perform a particular action. A power of attorney only transfers powers, that is, the right to perform an action;

- an order is a form of civil transaction; a reward may be given for its execution. A power of attorney does not imply payment or compensation for the attorney.

Additional documents to certify the power of attorney

Employees who plan to deal with material issues on behalf of the company (financially responsible), or specialists selected by official representatives, must always have with them;

- personal passport;

- an explanatory letter containing the essence of the representative’s actions (request, order, complaint, application, etc., free form, on the organization’s letterhead);

- an order appointing a trusted representative;

- product documentation, if any, originals, copies;

- forwarding and/or transport documentation;

- proof of insurance, registration certificate for the car, if it is used by proxy.

Some receiving parties ask to confirm authority by a transaction agreement previously concluded with key management of the legal entity.