Home / Labor Law / Payment and benefits / Vacation payments

Back

Published: 01/12/2018

Reading time: 6 min

0

1468

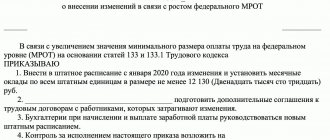

A logical addition to this document are various regulations adopted by the Government of the Russian Federation and which have entered into legal force, for example:

- Regulations on the specifics of calculating average wages dated December 24, 2007,

- letter of the Ministry of Health and Social Development No. 2337-17, etc.

- Two bonus algorithms

- Procedure for calculating vacation pay Calculation and bonus periods

- General rules and formulas

- Monthly bonus

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Possible mistakes and how to avoid them

The calculation of vacation pay involves calculating the average earnings (the rules for its calculation are reflected in Regulation No. 922 of 12/24/07). The risk of erroneous calculations can be reduced if the company’s LNA immediately reflects payments that are in the nature of bonuses, which will not be included in the calculation of average earnings.

It is advisable to exclude incentive payments that take place, for example, on an anniversary or professional holiday of employees in a certain field. Such payments generally do not relate to wages. In passing, we note that the situation in this case, from the point of view of legislation, is far from clear-cut and requires a careful approach. We will talk about it in more detail later.

Excluded from the premium calculation:

- companies not reflected in the LNA;

- not included in the calculation period (12 months before the vacation).

The latter can happen if the calculation of average earnings mistakenly includes a bonus for the 12 months not preceding the employee’s departure on vacation.

During the calculation period, several bonuses can be accrued at once, one of which is for the year preceding the vacation, the other for an earlier period (but the accrual took place during the calculation period). If the volume of earlier bonus accruals is higher, the accountant may mistakenly include in the calculation the larger amount of the two, for reasons that the law prohibits worsening the employee’s position, or include two bonuses in the calculation at once. According to the Regulations, this approach is incorrect. You only need to take the bonus for the year preceding the vacation.

Important! In the calculation of vacation payments, it is prohibited to include more than 12 monthly bonuses, respectively, quarterly bonuses (no more than 4), semi-annual bonuses (up to 2) accruals of the same nature, for example, with the wording “for exceeding the production rate” .

Let's take a closer look at the features of including certain bonuses when calculating vacation pay.

Two bonus algorithms

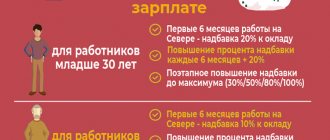

In accordance with the current labor legislation of the Russian Federation, bonuses

workers can be carried out either within the framework of the existing remuneration system in the institution, or outside it (Articles 129, 135, 144 and 191 of the Labor Code of the Russian Federation). In the first case, bonus payments are a component of the employee’s salary, in the second - not.

When calculating vacation pay, only those funds that were accrued to the employee as incentive payments are taken into account. They are considered part of the salary and, as a rule, are systematic. One-time (one-time) bonuses can also be taken into account when determining the amount of vacation pay, but only on condition that this is stated in the relevant financial documents of the institution (Rostrud letter No. 274-6-0 dated February 5, 2007).

Systematic payments can be monthly, quarterly and annual.

One-time (one-time) bonuses include cash incentives for performing particularly important work not included in the list of job responsibilities, as well as transfers in connection with professional holidays, anniversaries, victories in competitive events, etc.

One-time bonus payments

It was previously noted that one-time incentive payments are generally not included in the calculation of vacation payments. However, there are documents (for example, letter of the Ministry of Finance No. 03-03-06/1/150 dated 03/22/12, similar to an earlier period - the Ministry of Health and Social Development), according to which taking into account bonuses for an anniversary or professional holiday when calculating average earnings can take place if these payments are specified in the LNA, accrued in the calculation period and, most importantly, are part of the remuneration system.

In fact, whether or not to include bonuses for unearned services in vacation pay when calculating them is decided by the management of the company with full responsibility for this decision.

One-time, one-time bonus payments are usually not associated with a specific time interval. It may or may not coincide with the billing period. The specified bonuses accrued during the billing period are taken into account in full when calculating vacation pay.

However, if the accrual documents (order) indicate that the bonus was paid for work indicating the period, it must be taken into account in vacation pay as a bonus precisely for the period specified in the order. The period may be non-standard: six months, 2.3 or more years.

If the premium is accrued for a period of more than a year (it exceeds the billing period - 12 months), then it is distributed monthly. Further, the bonus is taken into account in full if the period is fully worked out. The billing period has been partially worked out - the bonus payment is included in proportion to the actual working time during the billing period.

Important! The “regular” bonus for half a year is taken into account in vacation pay according to the same rules as monthly and quarterly.

Premiums for periods throughout the year and annually

Annual bonus payments are included in the calculation of vacation payments if the accrual was for the year preceding the vacation (in 2018 - for 2020).

If it is provided for by the LNA, but for some reason the accrual has not yet taken place, then the vacation pay will have to be recalculated when the accrual occurs (Rostrud, letter No. 1253-6-1 dated 05/03/07).

It is necessary to take into account this nuance: if the billing period is fully worked out, the bonus is fully included in the vacation pay calculation formula. It does not matter in this case whether the time worked was taken into account when calculating. The billing period may not have been fully worked out, but the period for calculating bonuses corresponds to it absolutely, and the bonus was calculated taking into account the actual time worked. And in this case, the amount must be included in full.

There are situations in which the billing period has been partially worked out and the bonus is included in the calculation in proportion to the time worked in the billing period:

- The bonus accrual period fully corresponds to the calculated one, but the bonus was accrued without reference to the actual time worked.

- The accrual period does not apply to the calculation period. In this case, it does not matter whether working time was taken into account or not.

According to the above, annual and quarterly bonuses are also taken into account. So, if the billing period is partially worked out, in this case:

- hours worked were not taken into account; despite the fact that the bonus is fully included in the billing period, it is recalculated in proportion to the actual working time worked in the billing period;

- hours worked were taken into account; the premium is not included in the billing period (partially not included), it is recalculated in the same way, i.e. in proportion to the amount worked in the calculation period of the FW.

What bonus rules are important for calculating holiday pay?

So, according to the rules stated above, the bonus should be taken into account when calculating vacation pay if it:

- taken into account in the wage system;

- named in the employer’s internal regulations reflecting the bonus procedure;

- accrued in the calculation period or must be taken into account (annual premium) in this period;

- cannot be regarded as a duplicate payment of the same frequency for a similar bonus indicator in the same period;

- recalculated in proportion to the share of time actually worked during the calculation period, if such recalculation is necessary in relation to it.

Of the duplicate payments, the current rules do not prevent the choice of the largest one. The rules for such a choice should be reflected in the internal regulations on bonuses.

The possibility of accepting bonuses in the calculation of average earnings in full or in part depends on three circumstances:

- whether the calculation period has been fully worked out;

- whether the entire period for calculating the premium is included in the calculation period;

- bonuses were calculated in proportion to the share of time worked or without taking this ratio into account.

Calculation example

Let the employee receive a bonus at the end of the year. It must be included in the calculation of average earnings when this employee needs to calculate vacation pay.

Formula: Pr.otp. = (Rdn / Rdn) * (Rdn - RdnI) , where:

- Pr.dep. — bonus included in the calculation of vacation pay;

- Pr.n. – accrued bonus at the end of the year;

- Rdn – amount of r. days in a year for which the bonus is accrued;

- RdnI – amount of r. days not included in the calculation.

There were 247 working days in 2020. The employee did not actually work the entire working period; according to the working time sheet, 41 days must be excluded. The bonus for the year was accrued in the amount of 60 thousand rubles.

We count. Pr.dep. = (60000 / 247) * (247 - 41) = 50039.46 rubles. This bonus amount must be taken into account when calculating vacation pay for an employee.

Main

- The calculation of payments for an employee's vacation includes bonus amounts according to the rules prescribed in Regulation No. 922 of 12/24/07.

- All bonuses included by the employer in the calculation are necessarily recorded by the company's LNA.

- From a legal point of view, including long-service bonuses for professional holidays in vacation pay costs is risky. By registering such an opportunity in the LNA, the company must be ready to prove the legality of including these amounts in expenses to the fiscal authorities.

The procedure for calculating vacation pay

If the bonus is provided for by a collective agreement or regulatory resolution of the organization, it will be taken into account when calculating vacation pay. In whole or in part - depends on the employee’s work activity, the presence/absence of missed work days, etc.

Billing and bonus periods

When determining the amount of payments, accounting staff operate with such concepts as billing and bonus periods.

The first refers to the time preceding the start date of the vacation. The standard duration of the billing period is 12 calendar months. If an employee has recently joined a company, wages for actual time worked are used to calculate vacation pay.

The bonus period is the period for which the incentive payment is accrued.

It may not coincide with the calculated one. In this case, the bonus is usually calculated in proportion to the time of work activity and is fully taken into account when transferring vacation pay.

Sometimes, even if the pay period is not fully worked out, incentive payments are given to employees in full, without reductions. The amount of vacation pay is adjusted as follows:

bonus amount ÷ standard number of days in the billing period × number of days actually worked

Example:

Employee P. received a bonus of 40,000 rubles for 250 shifts, but only worked 230.

When calculating vacation pay, the following will be taken into account: 40,000 ÷ 250 × 230 = 36,800 rubles.

General rules and formulas

According to the algorithm for calculating vacation pay established by Regulation No. 922 of the Government of the Russian Federation, the average daily earnings are used to determine the amount of payment. It is calculated like this:

- if the billing period is fully worked out: wages for the billing period ÷ 12 months ÷ 29.4 (average monthly number of calendar days) ;

- if the employee has gaps in the schedule: salary for the billing period ÷ (number of months worked × 29.4 + number of days in months partially worked) .

How to get sick leave at a clinic - all the answers to this question are in our material!

Business trips made on weekends are paid according to a special scheme. You can read more about this in our article.

What is more profitable for working pensioners in 2020: working or retiring? Our material will help answer this question.

How are bonuses taken into account when calculating holiday pay in 2020?

The formula for calculating bonuses is as follows:

- the amount of bonuses in a certain period is divided by the number of working days in the organization;

- the result obtained must be multiplied by the number of days worked by the employee.

This is interesting: Dividing your vacation into parts

The result of the calculations obtained becomes the amount that is included in the calculation of the average level of earnings.

How to reflect vacation pay, bonuses, and carryover wages in the report?

A pressing issue when calculating accruals is the procedure for reflecting them in the report. Filling out form 6-NDFL for vacation pay and bonuses involves the following points:

- the payment day is set to the date on which vacation pay was actually received;

- the procedure for withholding tax from this amount is carried out when it is calculated.

It should be taken into account that if the bonus is one-time, it should be taken into account as additional income. If bonuses are accrued systematically, then they are paid along with the main income.

The carryover salary is taken into account in the month in which it is accrued. All data is presented in lines 020 and 040.

Often, employers have a popular question: whether overpayment of vacation pay can be processed as a bonus. In practice, this option is possible, but only with mutual agreement with the employee. Otherwise, the matter will have to be resolved through court.

Errors when calculating vacation pay: how to fix?

If an error is discovered when calculating vacation pay, you first need to figure out whether vacation pay is overestimated or, conversely, underestimated. If the employee was paid vacation pay in a smaller amount than it should have been, then you should simply make an additional accrual and pay the employee extra.

But if vacation pay, on the contrary, is inflated due to incorrect application of the law, then there may be problems with withholding it from the employee’s salary. It is impossible to simply withhold vacation pay overpaid to an employee, since the error occurred due to incorrect application of the law. The employee's consent must be obtained.

You can contact the employee with a request that he write a statement to withhold this amount. If the employee agrees, the overpaid amount can be withheld in full. This deduction will already be considered as a deduction at the initiative of the employee, and there are no restrictions here. But if the employee refuses, then the overpaid vacation pay can only be returned through the courts.

To confidently carry out accruals and calculations of average earnings in the most difficult situations, register for the online course “Payroll settlements with personnel.” No fines or claims from the inspectorate are guaranteed.

Is the lump sum payment included for the holiday?

Holidays are one of the most long-awaited days for employees, since in addition to pleasant weekends, employees are often entitled to one-time bonuses.

In particular, bonus payments may be paid for the New Year, March 8, February 23, other holidays and various anniversaries, if this is provided for by the company’s bonus system.

Such one-time payments for holidays can be taken into account when calculating vacation pay if the necessary conditions are met :

- The opportunity to provide bonuses to employees is contained in the labor remuneration system.

- The accrual of funds occurred in the billing period.

It may be noted that the amount paid by an employee in connection with a holiday and not related to his work activity should not be included when calculating the average salary.

When determining the amount of average earnings, it is necessary to take into account bonuses that are of a production nature and provided for by the internal document of the institution, in particular, the regulations on bonuses.

That is, when bonuses are a reward for labor merits and work performed and other achievements of an employee, then the lump sum payment is included in the average salary. Such payment must be made on the basis of an order and reflected in the financial documentation of the organization.

Incompletely worked out billing period

In this case, the annual bonus is taken into account in full when calculating vacation, if it is accrued in proportion to the actual time worked in the calendar year (bonus period).

Example #3. Bonus when calculating vacation pay for a full period

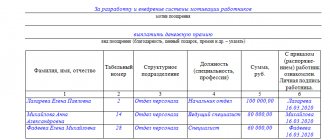

Ivanov V.A. from February 10 to February 23, 2014 he goes on vacation. In the billing period (from February 1, 2013 to January 31, 2014), he was accrued: - a monthly salary of 25,000 rubles; — in March 2013 — bonus of 10,000 rubles. for 2012; - in December 2013 - bonus 18,500 rubles. for 2013, taking into account the actual time worked; — from March 1 to March 31, 2013 — was on a business trip; — from April 1 to April 28 — on paid leave; — from May 1 to May 20 — was on sick leave; — from December 1 to 14 — he underwent a medical examination at the military registration and enlistment office.

From the calculation of vacation pay, we exclude the annual bonus for 2012, as well as the amount and periods during which the employee retains average earnings.

Amount of vacation pay: (RUB 25,000.00 x 8 months + RUB 2,727.27 + RUB 12,500.00 + RUB 13,636.36 + RUB 18,500.00): (29.4 x 8 months + 1.96 + 10.43 + 16.12) x 14 days = 13,132.19 rub.

Where: - RUB 2,272.73. – salary for April (RUB 25,000.00: 22 days according to schedule x 2 days worked); — 12,500.00 rub. – for May (RUB 25,000.00: 18 days according to schedule x 9 days worked); — 13,636.36 rub. – for December (RUB 25,000.00: 22 days according to schedule x 12 days worked); — 18,500.00 rub. – annual bonus for 2013; — 29.4 – the number of calendar days for a fully worked month; — 8 – the number of such months; — 1.96 – number of April days (2 days worked x 29.4:30 days in a month); — 10.43 – number of days in May (11 worked x 29.4:31 days in the month); - 16.12 - in December (17 worked x 29.4:31 days per month).

Ivanov V.A. On February 6, 2014 (3 days before the start of the vacation) he will receive 11,425 rubles. (less income tax 13%).

If, in the process of accounting for the annual bonus when calculating vacation pay, the time actually worked in the bonus period is not taken into account, then this bonus is not taken into account in full - in accordance with the time worked. To determine the accountable part of the annual bonus, it is divided by the standard number of working days according to the schedule in the billing period, and then multiplied by the number of days actually worked.

Example #4. Accounting for annual bonus without taking into account time worked

Ivanov V.A. got a job at the company on November 1, and in December he was paid an annual bonus excluding time worked in the amount of 25,000 rubles. Accountable part of the bonus = (25,000 rubles: 247 days according to the schedule x 44 days worked) = 4453.44 rubles.

Quarterly bonus when calculating vacation pay

The general grounds for calculating quarterly bonuses in the case of vacation pay apply if the employee has worked the full estimated time. If this period is partially worked out, the remuneration is calculated taking into account the following nuances:

- If it is proportional to the time worked, then it is taken into account in full.

- If its size is fixed, then it is calculated taking into account the hours worked.

- Those months included in the calculation period are taken into account.

So, if the beginning of the billing period is November, then only two worked months are taken into account in the third bonus quarter.

When calculating vacation pay, only the quarterly bonus included in the reporting period is taken into account. Amounts accrued beyond this period are not taken into account.

The process of calculating holiday pay including bonuses

The procedure for generating vacation pay, taking into account bonuses, is described in regulation No. 922. The main episodes when counting are indicated in paragraph 15:

- no more than one bonus is taken into account for each period (for example, you can receive two May bonuses, but only one will be taken into account);

- if the period is more than a month, then the premium amount is taken into account in the amount received or recalculated for each of the months taken into account;

- When calculating for the year, the actual amount of the premium is taken into account, regardless of the date and period of payment.

Such accounting difficulties arise due to rule 15 of paragraph, which states the need to relate the amount of the bonus to the time worked. This is especially important if the period contains holidays that are not subject to accounting or if it is only partially worked out. This is especially noticeable in bonuses dedicated to certain periods of time: monthly, quarterly, annual.

Formula for calculating vacation pay

Time periods not subject to accounting under clause 5 include:

- indicated on the sick leave or certificate of incapacity for work;

- failure to perform work due to the employer or without the fault of any party to the employment relationship;

- the use of additional days off or unpaid leave required when caring for disabled children;

- other exemption from work required by law.

When accounting, the ratio of days worked to the total number of working days is used.

Vacation pay calculator

Go to calculations

Accounting Features

The legislation of the Russian Federation indicates that the bonus is taken into account in calculating vacation pay if:

- the amount was taken into account during accounting;

- the bonus is mentioned in the internal act regulating bonuses;

- accrued in the period of time preceding the vacation;

- does not duplicate payments for similar reasons for the same period (two awards for one event);

- recalculated based on actual time worked, if necessary.

How to calculate and account for the annual bonus

In the case of duplicate payments or two bonuses under the same basis and for the same period, the employee has the right to choose the larger one when calculating vacation pay. Three events play an important role - the volume of work in the billing period, whether the periods of calculation and accrual coincide, whether the payment is made according to the volume of work or without taking it into account.

Useful video

Options for taking into account one-time bonuses when calculating average earnings - see the video:

Bonuses paid to employees on a one-off basis may be taken into account when calculating annual leave pay, subject to certain conditions.

The period for which this payment is assigned must be fully included in the estimated 12 months for vacation pay. Otherwise, only its proportional part will be taken into account.

This is interesting: Returning to work after vacation

Lump sums paid on the occasion of various holidays are calculated according to the same rules as other one-time payments.

Didn't find the answer to your question in the article?

Get instructions on how to solve your specific problem. Call now:

here - if you live in another region.

What are bonuses for?

Employees who are not privy to the intricacies of accounting sometimes think that the boss can give a bonus at his own discretion. This is partly true, but not every “incentive payment” (as bonuses are defined in Article 129 of the Labor Code of the Russian Federation) is included in wages and affects its average value. Russian legislation provides for a different approach to remuneration and monetary remuneration.

The award is given for specific labor achievements or performance results that directly or indirectly affect the economic performance of the enterprise. It is included in the actual amount of the employee’s salary and is provided for by the remuneration system adopted in this organization (Labor Code of the Russian Federation, Article 139, part two).

The calculation of average wages is regulated by Decree of the Government of the Russian Federation No. 916 of November 11, 2009. Subparagraph “n” of this legal act makes reference to the term “remuneration system”. It means a method of determining the amount of remuneration due to an employee based on labor costs and economic results.

The payment system is specifically established by a collective agreement (agreement, local act, which most often means an employment contract).

Thus, only payments that directly stimulate work activity are considered included in wages along with the official salary.

Consequences of errors in calculating premiums

Errors in accounting for bonuses when calculating average earnings are divided into 2 types according to their impact on the amount of income determined for the billing period:

- inflating this income and, accordingly, the amount of vacation pay;

- underestimating this income and, accordingly, leading to the accrual of vacation pay in a smaller amount.

Overstatement occurs when the following is included in the calculation of premiums:

- not included in the wage system;

- not reflected in internal regulations;

- accrued outside the calculation period or not related (if the premium is annual) to this period;

- duplicating each other in terms of bonuses at the same frequency;

- not recalculated in proportion to the share of time actually worked in the calculation period, if this had to be done.

An understatement occurs if income does not include any of the premiums accrued during the calculation period. In addition, both overestimation and underestimation may be associated with incorrect calculation of the bonus amount or its incorrect recalculation in proportion to the time actually worked in the calculation period.

In any case, identified errors require corrections, since:

- overstatement unlawfully increases labor costs included in the costs that reduce the profit base;

- understatement infringes on the rights of the employee.

It is quite easy to correct an underestimation of the amount: you need to recalculate and pay the employee the missing amount. Overstatement amounts due to a counting error can be withheld from the employee’s salary (Article 137 of the Labor Code of the Russian Federation). But overstated amounts that are not related to such an error and are essentially explained by the employer’s violation of the law when calculating average earnings are quite difficult to get back from the employee: he may not agree to voluntary deduction and the judicial authorities are unlikely to recognize his obligation to do this , since he is not to blame for the current situation.

Read about what other deductions are possible from an employee’s salary in the material “Art. 137 Labor Code of the Russian Federation: questions and answers" .

Are one-time bonuses included and how are they taken into account when calculating vacation pay using examples?

A bonus is one of the most effective methods of motivating employees for quality work. Such a payment is considered an incentive; it is included directly in the salary.

The decision to pay a bonus must be formalized in an order from the head of the organization. In the future, a reasonable question arises: should these bonus payments be included in the calculation of vacation pay?

Dear readers! The article describes typical situations, but each case is unique.

If you want to find out how to solve your particular problem , use the online consultant in the lower right corner of the site or call direct numbers:

here - if you live in another region.

It's fast and free!