What is the annual bonus?

The year-end bonus is usually accrued in February of the year that follows the period.

Many employers have noted the fact that the most effective method of motivating employees is monetary incentives. Payment of bonuses has a beneficial effect on overall planned indicators, increased productivity, the proposal of innovative ideas, the desire for career growth, and so on, since subordinates try to conscientiously perform their job duties and keep up with their colleagues, because as a result, at the end of the annual period, their income increases.

The annual bonus does not apply to mandatory payments and the basic salary; the law does not oblige company owners to establish it, and therefore employers have the opportunity to independently determine the basic provisions for its calculation and enshrine them in the company’s internal regulations. The employer cannot pay the bonus at the end of the year without first settling the issue of its assignment - otherwise, claims from the tax inspectorate will follow, and the entrepreneur will not be able to take expenses into account in the tax base for income tax.

If the employment agreement with an employee specifies only certain provisions for the payment of bonuses, then a link should be made to that internal document that contains a complete list of the conditions for its appointment.

For this reason, it is necessary not only to mention the payment of bonuses in local documents, but also to indicate their size, procedure, conditions and terms of accrual. Information on bonus payments to employees can be provided in the following documents:

- employment contract with the employee;

- collective agreement;

- wage regulations;

- employer's order to award bonuses to some distinguished employees.

https://youtu.be/PQPBonLy6Gk

One-time bonus payments

It was previously noted that one-time incentive payments are generally not included in the calculation of vacation payments. However, there are documents (for example, letter of the Ministry of Finance No. 03-03-06/1/150 dated 03/22/12, similar to an earlier period - the Ministry of Health and Social Development), according to which taking into account bonuses for an anniversary or professional holiday when calculating average earnings can take place if these payments are specified in the LNA, accrued in the calculation period and, most importantly, are part of the remuneration system.

In fact, whether or not to include bonuses for unearned services in vacation pay when calculating them is decided by the management of the company with full responsibility for this decision.

One-time, one-time bonus payments are usually not associated with a specific time interval. It may or may not coincide with the billing period. The specified bonuses accrued during the billing period are taken into account in full when calculating vacation pay.

However, if the accrual documents (order) indicate that the bonus was paid for work indicating the period, it must be taken into account in vacation pay as a bonus precisely for the period specified in the order. The period may be non-standard: six months, 2.3 or more years.

If the premium is accrued for a period of more than a year (it exceeds the billing period - 12 months), then it is distributed monthly. Further, the bonus is taken into account in full if the period is fully worked out. The billing period has been partially worked out - the bonus payment is included in proportion to the actual working time during the billing period.

Important! The “regular” bonus for half a year is taken into account in vacation pay according to the same rules as monthly and quarterly.

Premiums for periods throughout the year and annually

Annual bonus payments are included in the calculation of vacation payments if the accrual was for the year preceding the vacation (in 2018 - for 2020).

If it is provided for by the LNA, but for some reason the accrual has not yet taken place, then the vacation pay will have to be recalculated when the accrual occurs (Rostrud, letter No. 1253-6-1 dated 05/03/07).

It is necessary to take into account this nuance: if the billing period is fully worked out, the bonus is fully included in the vacation pay calculation formula. It does not matter in this case whether the time worked was taken into account when calculating. The billing period may not have been fully worked out, but the period for calculating bonuses corresponds to it absolutely, and the bonus was calculated taking into account the actual time worked. And in this case, the amount must be included in full.

There are situations in which the billing period has been partially worked out and the bonus is included in the calculation in proportion to the time worked in the billing period:

- The bonus accrual period fully corresponds to the calculated one, but the bonus was accrued without reference to the actual time worked.

- The accrual period does not apply to the calculation period. In this case, it does not matter whether working time was taken into account or not.

According to the above, annual and quarterly bonuses are also taken into account. So, if the billing period is partially worked out, in this case:

- hours worked were not taken into account; despite the fact that the bonus is fully included in the billing period, it is recalculated in proportion to the actual working time worked in the billing period;

- hours worked were taken into account; the premium is not included in the billing period (partially not included), it is recalculated in the same way, i.e. in proportion to the amount worked in the calculation period of the FW.

How is the annual bonus paid to employees?

The decision to pay a company’s employees a bonus at the end of the year is made by the head of a department of the enterprise or the owner of the company, if there are no divisions indicated in it, based on information about the work of the team from the personnel department. Personnel department employees provide the employer with information about the actual time worked by subordinates, about cases of violation of internal regulations, about the fulfillment, overfulfillment or non-fulfillment of the production plan.

Having studied the data provided to him, the employer determines the need to pay a bonus and its size, after which he issues an order to assign bonuses to an employee (Form T-11) or a group of subordinates (Form T-11a) . Then workers must read the text of the order, sign the paper, after which the order is transferred to the accounting department.

An accounting employee draws up a cash order (KO-2) , a payroll slip (form T-49) or a payroll slip (form T-53) . If funds are transferred to employees’ bank cards, a payslip (T-51) .

What governs the process of including premiums in the calculation?

The provisions on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 (hereinafter referred to as Regulation No. 922), are devoted to the nuances that are important for calculating average earnings, and it is this that specifically talks about bonuses.

Prizes are mentioned in sub. “n” clause 2 of Regulation No. 922, which notes that these payments must be provided for by the current wage system. But the main points regarding bonuses are set out in paragraph 15 of Regulation No. 922. They prescribe bonus payments accrued:

- Monthly, take into account their actual amount, but not more than one for each month of the calculation period in relation to each of the bonus indicators.

- For a period of work of more than a month, include in the calculation in their actual amount in relation to each of the bonus indicators, if the period of their accrual is not longer than the duration of the calculation period, otherwise - in the amount corresponding to the monthly part of the bonus for each of the months constituting the calculation period.

- For the year preceding the event with which the calculation is associated, take into account their actual amount, regardless of when this payment is actually accrued.

We talk about other types of bonuses in the material “What types of bonuses and employee benefits are there?” .

The general rule for bonuses, established by clause 15 of regulation No. 922, is the need to take into account the amount of the bonus in proportion to the time actually worked in the calculation period, if this period has not been fully worked out or there are periods in it that are not subject to inclusion in the calculation (clause 5 of the regulation No. 922). This rule applies provided that at the time of calculating the bonus, the actual time worked was not taken into account. Bonuses that take into account the share of time worked usually (but not always) include those accrued over a certain period, for example, monthly, quarterly, annual.

The following periods are not subject to consideration when determining average daily earnings (clause 5 of Regulation No. 922):

- maintaining average earnings;

- being on sick leave;

- failure to perform work due to the fault of the employer or for reasons beyond the control of either party;

- use of additional days off intended for caring for disabled children;

- other paid or unpaid periods of release from work.

The proportion taking into account the share of time worked for the distribution of each bonus is calculated as the ratio of working days actually worked in the calculation period to the total number of working days included in this period (letter of the Ministry of Health and Social Development of the Russian Federation dated June 26, 2008 No. 2337-17).

How to calculate the bonus for the year

An annual bonus can be a mandatory form of incentives for employees at an enterprise or optional - that is, awarded at the request of the employer and, if possible, the company’s budget for special merits in work.

Labor legislation determines the circle of employees who are not entitled to receive quarterly bonuses and year-end bonuses. Such employees include:

- subordinates who violated labor discipline and received disciplinary action;

- employees who have been temporarily suspended from performing their official duties;

- employees on parental leave to care for children under 3 years of age.

To determine the size of the bonus at the end of the year, you need to sum up all the employee’s income (without taking into account various types of increasing factors, if any are applied), and then multiply the result by a pre-agreed percentage of the bonus. The calculation formula is as follows:

RGP = (UZP x 12 months x PP) – (UZP x 12 months x PP) x 13%,

where RGP is the amount of the annual bonus;

EZP – monthly salary (without taking into account increasing factors);

PP – bonus percentage;

13% – personal income tax withholding.

Are bonuses taken into account when calculating vacation pay?

The basis for calculating vacation pay is the average salary for the previous period. It is formed by two main components: salary and additional payments. The task seems extremely simple: you just need to take the arithmetic average of income, that is, divide its amount by the number of months between vacations.

In practice, however, a number of difficulties may arise due to the peculiarities of the working conditions of each individual employee and the time characteristics of the period.

As everyone knows, bonuses can be one-time, monthly, quarterly and annual. A common situation is when an employee does not work the entire period, but only part of it. The reasons may be different: illness, absenteeism, downtime and, finally, a strike.

The general scheme for calculating monthly additional incentive remuneration is prescribed in the terms of the employment agreement (collective or individual employment agreement). Each organization has its own, and there is no point in considering their options in detail in this article. For example, an enterprise may provide bonuses for each employee who has no complaints or absenteeism in the form of a percentage or fixed increase in salary.

The quarterly bonus is calculated on the basis of wages for three months, if there are no gaps in the employee’s time sheet. In this case, only the months included in the period preceding the vacation are taken into account. For example, if an employee goes on vacation in the middle or end of March, then the quarterly bonus is accrued only for January and February. In this case, the bonus for the first quarter will be taken into account when calculating the next vacation pay.

Annual, quarterly, monthly and one-time bonuses included in the billing period are taken into account for the annual amount of vacation pay.

An example of how to calculate a bonus for a year

Programmer R.A. Knopkin a salary of 56 thousand rubles per month is paid. This salary was accrued to him for all 12 months of the past year. The employer instructed an accountant to calculate the annual bonus. The company's collective agreement contains information about the bonus percentage at the end of the year - it is 12%.

Over the past year, the programmer earned: 56,000 rubles. x 12 months = 672,000 rub .

The bonus at the end of the year will be: 672,000 rubles. x 12% = 80,640 rubles .

The accountant is obliged to withhold personal income tax from bonus payments in the amount of: 80,640 rubles. x 13% = 10,483 rub. 20 kop .

The employer will transfer insurance contributions from his own funds in the amount of: RUB 80,640. x 22% = 17,740 rub. 80 kop .

Total, Knopkin R.A. received in hand: 80,640 rubles. – 10,483.2 rub. = 70,156 rubles 80 kopecks .

How to take into account bonuses if the accrual period is less than a year

Monthly, semi-annual and quarterly bonuses in calculating average earnings are taken into account in full in the month of accrual, but no more than one for each indicator.

Example 1

Manager Vasechkin P.A. goes on vacation from 05/21/2019. In November 2018, he was awarded a bonus payment for the 3rd quarter of 2020 for fulfilling the sales plan in the amount of 5,000 rubles. In December 2020, a monthly bonus was paid for high volumes of revenue in December in the amount of 10% of the salary. In February 2020, an additional bonus was paid for high volumes of revenue in December 2020 in the amount of 5% of the salary.

The calculation period for vacation pay is 12 months: from 05/01/2018 to 04/30/2019. The bonus for the 3rd quarter of 2020 is included in the calculation of vacation pay in full, but only one bonus payment for December should be included, since it was paid for one period for the same indicator.

Common mistakes

Error: The employer did not issue an order to pay bonuses to individual employees, although local regulations do not say anything about bonuses for employees.

Comment: If the employer does not properly formalize the payment of bonuses to subordinates, he will not be able to reduce the tax base for income tax by the amount of funds paid as incentives.

Error: The head of the company paid an annual bonus to employees without deducting personal income tax and insurance contributions from the amount.

Comment: Premiums are considered employee income and are therefore subject to mandatory personal income tax and insurance contributions.

Bonus for a year and for a longer period

Annual bonuses are included in the calculation of average earnings only if accrued for the year preceding the year of payment of average earnings.

Example 2: annual bonus in calculating average earnings (the examples further complement the conditions of example 1)

In July 2020, Vasechkin P.A. the bonus was paid for 2020, and in February 2020 - for 2020. We will only include the bonus payment for 2020 in the calculation.

Please note that if bonus accrual for the year is made after the end of the billing period, then the employer is obliged to recalculate the average daily salary taking it into account and pay the difference to the employee.

If the premium is accrued for a period exceeding the calculated period (usually a year), then it is included in the calculation in the amount of the monthly part for each month.

Example 3:

In March 2020, Vasechkin P.A. a bonus payment was accrued for achieving the value of concluded contracts of 500 million rubles. from 04/01/2017 to 03/31/2019 in the amount of RUB 24,000.

The monthly part is equal to:

The calculation of holiday pay includes amounts from May 2020 to March 2019 (11 months). That is, the amount:

Answers to common questions about how to calculate your annual premium

Question No. 1: Will the employer be held administratively liable if he, at his discretion, still pays an annual bonus to an employee who has been subject to disciplinary action?

Answer: No, but the bonus amount paid cannot be taken into account when calculating the taxable base for income tax.

Question No. 2: Can an employer deprive an annual bonus if an employee performed the work assigned to him poorly, but the bonuses were approved in the collective agreement?

Answer: Bonuses are paid to employees at the request of the employer; the law does not oblige him to establish incentive payments.

This means that the employer, at his discretion, can deprive an employee of a bonus, even if it is reflected in the company’s local act. Rate the quality of the article. Your opinion is important to us:

What bonuses are taken into account when calculating vacation pay?

When calculating vacation pay, it is necessary to take into account monthly, quarterly, annual and one-time bonuses.

Article navigation

- What are bonuses for?

- Are one-time bonuses included in the average salary and vacation pay base?

- Is a one-time payment not related to wages included in the average salary calculation base?

- Are bonuses taken into account when calculating vacation pay?

- How is the bonus amount calculated?

- Is the annual bonus indexed when calculating vacation pay in 2020?

- An example of calculating vacation pay in the presence of a quarterly bonus in 2020

- How to take into account monthly, quarterly and annual bonuses when calculating vacation pay

- Brief conclusions

It's always nice to receive awards. The question arises of how they affect the average income, which, in turn, can be very important. What bonuses are included in the calculation base for vacation pay? How are they taken into account when calculating them? The reader will find answers to these and other questions, as well as examples of calculations, in our article.

But first of all, let's answer the most important question - whether it is necessary to take into account bonuses issued to calculate the amount of vacation pay. Yes, they need to be taken into account. But not all. The calculation includes: monthly, quarterly, annual, one-time bonuses. Cash gifts for holidays and anniversaries are not included.

Calculate vacation pay online

How to calculate and record the annual bonus?

This way you can avoid many mistakes. If a quarterly bonus of a quarterly type, unlike a similar payment for time already worked, does not have a clear calculation algorithm. Therefore, each organization independently creates a formula for calculating such incentives. At the same time, the current legislation contains clear recommendations regarding the establishment of bonus amounts:

- be sure to take into account the contribution to the result made by each employee;

- the amount of payment must be justified in economic terms.

Bonuses of this type can be paid for the following indicators:

If necessary, the employer can establish a differentiated method of paying bonuses depending on some important indicator.

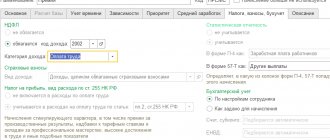

Reflection of the annual bonus in 6-NDFL

The personal income tax form, or 6-NDFL for short, is one of the accounting forms approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. MMV-7-11/450.

It is filled out in the prescribed manner by organizations or individual entrepreneurs who provide payments to hired individuals and who are obliged, within the framework of legal legislation, to pay taxes to the state budget.

It contains data on funds transferred to employees and other payments, which are also subject to taxation. The 6-NDFL declaration is submitted every quarter and at the end of the reporting year.

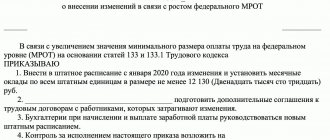

When is it paid?

The timing of payment of wages to employees is determined at the legislative level. According to the data reflected in the regulatory labor documentation of the Russian Federation, salaries must be paid to specialists no later than the 15th day of the month following the billing month.

For example, wages for November must be credited to the employee’s account no later than December 15.

Situations arise in which the payday falls on a weekend and/or holiday. In this case, the employer cannot delay the payment of funds. Payment will be made on the last working day before the weekend/holiday.

Information regarding the timing of salary calculation is reflected in the Labor Code of the Russian Federation. Article 136 of the Labor Code of the Russian Federation is devoted to this topic. Also, information relating to this issue is regulated by Federal Law No. 272, which entered into force on October 3, 2020.

According to Article 129 of the Labor Code of the Russian Federation, an annual bonus, paid once a year, may be included in the employee’s salary.

Thus, the payment of bonuses at the end of the year must be made no later than the 15th day of the month following the billing month. If the billing period is a calendar year, then, accordingly, the annual bonus must be paid before January 15 of the following year. In this case, the date of accrual of the annual bonus may coincide with the date of transfer of salary to the employee’s account.

For example, for 2020, the annual bonus must be paid by January 15, 2021.