What could be the financial incentives for staff?

Employee labor is a fairly expensive resource for any enterprise, but its importance in the company’s activities cannot be overestimated. A satisfied employee works better, more productively and more willingly to reveal his potential - this requires thoughtful stimulation of his interests.

Types of material incentives for personnel – monetary and non-monetary. Monetary incentives include the following forms:

- Wages (Article 132 of the Labor Code of the Russian Federation).

- Bonuses and incentives for achievements in work, additional payments, financial assistance, sometimes a share in profits or share capital.

- Allowances and compensations (in this case, the state takes an active part, protecting all kinds of guarantees for difficult working conditions, exceeding labor standards, types of work, payment of sick leave, vacations, etc.).

- Loans and preferential loans to personnel.

Taken together, monetary incentives are the economic motivation of employees, since it is thanks to such incentives that a person’s economic need for food, clothing, household items, and housing is realized.

Non-monetary material incentives are based, rather, on the moral needs of employees. To compensate, you can, for example, pay for cellular communications, provide free meals, issue vouchers to a sanatorium for the whole family, provide a personal car, provide a gym membership or gifts for key dates. In monetary terms, the employee does not receive special payments, but the conditions created for his work are an excellent motive for increasing labor productivity.

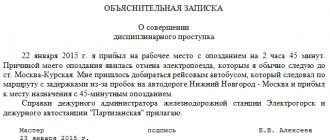

All of these methods of influencing an employee’s level of dedication to work are effective. But people are different - everyone has their own needs, interests, internal “levers” for action. At some enterprises, as a form of material incentive, a system of fines and penalties for various offenses is being thought out: being late, smoking in the workplace, oversight, shortcomings, etc. Of course, such measures cannot be applied to employee wages (Article 137 of the Labor Code of the Russian Federation), but they may well be imposed on bonus payments (deprivation or reduction of them).

At some enterprises, as a form of material incentive, a system of fines and penalties for various offenses is being thought out: being late, smoking in the workplace, oversight, shortcomings, etc.

Measures to encourage employees and their types according to the Labor Code

Measures of incentives for work are considered in the following provisions of the Labor Code:

- Article 22 of the Labor Code of the Russian Federation gives Russian employers the right to reward their employees for their conscientious, effective work, however, it does not oblige them to do this - it is this provision that regulates both the rights and obligations of employers.

- Article 189 of the Labor Code of the Russian Federation considers issues related to labor discipline at the enterprise as a whole, including the possibility of recording in the internal labor regulations mechanisms according to which incentive measures or disciplinary sanctions can be applied to employees.

- Article 191 of the Labor Code of the Russian Federation is directly devoted to incentive measures for employees and the procedure for their application, providing for the employer’s ability to use various measures and providing a short list of the main types of incentives. At the same time, employers are not limited in their ability to independently expand methods of encouraging workers, if they do not violate the principles of labor legislation.

In general, the standards of the Labor Code of the Russian Federation provide employers with almost complete freedom of action in matters related to the promotion of workers. However, if specific criteria and types of employee incentives are specified in local regulations or a collective agreement as mandatory, each employer is obliged to apply them - violation of this procedure may lead to the employer being held administratively liable.

Some categories of workers whose work is regulated by other legal documents and acts, for example, civil servants, may also have a strict procedure for applying and a list of types of incentive measures for effective work. In this case, the legal regulation of the issues under consideration is ensured by the relevant laws that relate to this department.

Regulations on material incentives for employees

Encouraging employees is a voluntary matter for the employer, but the presence of such payments implies the creation and approval of an internal document reflecting a policy that encourages staff. The provision on financial incentives should include:

- General information about the company, concepts used in the text, personnel and purposes of creating the document.

- Information about to whom, for what merits and with what frequency bonuses are awarded. You can assign personnel to divisions, workshops, departments, groups - depending on the specifics of the company’s activities. Bonuses can be based on the results of the year, quarter, month, amount of work performed, etc. – this also needs to be indicated.

- Methodology for determining the size of bonuses. Or an indication that this amount is determined by management depending on the circumstances and is not limited.

- The procedure for approving bonuses and deductions (if they are provided for at the enterprise).

- Final provisions. You can indicate here who is responsible for monitoring the implementation of this Regulation.

The regulation is signed by management and brought to the attention of employees. Its presence at the enterprise, of course, raises the status of the employer in the person of the staff, since there is no tension in the team, there is clarity, transparency and predictability of payments. Each employee knows what and to what extent he needs to complete in order to receive a bonus. It is better to make changes to the Regulations through the published document.

Incentive payments in documents

In addition to the Regulations on material incentives for company employees, information about possible bonuses and additional payments must be mentioned in the employment contract with each employee (Article 57 of the Labor Code of the Russian Federation) and in the collective agreement, if there is one.

A bonus or incentive salary supplement is income for an employee on which income tax is paid in the amount of 13% (Article 210 of the Tax Code of the Russian Federation), withheld by the employer. Insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Compulsory Medical Insurance Fund for these payments in favor of personnel are also calculated on the basis of Article 7 of Federal Law No. 212-FZ.

A bonus or incentive salary supplement is income for an employee on which income tax is paid in the amount of 13%.

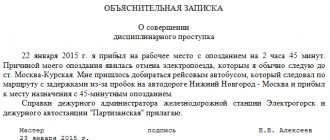

Payment of the bonuses themselves occurs on the basis of the Regulations developed by the enterprise - once a month or a year, based on the results of work performed or project closure. The bonus fund is included in the wage fund and is taken into account in the cost of goods, works and services as labor costs (Article 255 of the Tax Code of the Russian Federation). However, for this, documentary evidence of such expenses is required (entries in labor and collective agreements, Regulations,

).

Improving the financial incentive system

In order for your well-thought-out and approved system of bonuses and incentives for staff to really work, motivating people to do more fruitful work, follow some rules:

- An employee’s work must be assessed objectively - remuneration must be appropriate and adequate precisely to his contribution to the overall result, meaningful and fair.

- The employee must know how his work will be evaluated and what reward he will receive.

- The employee must be rewarded on time.

If there is an oppressive atmosphere in the team, hostility, tension, staff turnover, reconsider your system of material incentives. You can attract an experienced HR manager (or even a psychologist) to your team and entrust him with this work.

Material incentives for personnel can be expressed in monetary and non-monetary form, in the form of bonuses, incentives, allowances, compensation, benefits and various bonuses. By developing a working bonus system for employees, you raise the potential of your enterprise, increase the level of labor productivity and take yourself as an employer to a qualitatively new level.

Hello student

1.2 Characteristics of material incentives

Material and monetary incentives are incentives for employees with cash payments based on the results of their work activities. The use of material and monetary incentives makes it possible to regulate the behavior of management objects based on the use of various monetary payments and sanctions.

The main part of an employee’s income is wages, which are heterogeneous in structure. It consists of two parts: constant and variable.

Sometimes these parts are given the status of a powerful stimulus. However, according to psychologists, the effect of increased earnings is positive for three months. Then the person begins to work in the same relaxed mode that is familiar to him [4].

It is necessary to review all rates affected by inflation at the beginning of each half-year. This will contribute to the timely overcoming of the gap between tariff wages and changes in gross wages and retail prices, to ensure a gradual, phased introduction of new tariffs as certain production results are achieved, and at the same time to prevent the deepening of the contradiction between monetary incomes and their market commodity coverage.

The tariff category must really reflect the qualifications of the employee, which will contribute to growth not only vertically, but also horizontally.

The transformation of the tariff into a tool for stimulating not only potential, but also actual results of labor, is a compromise between the need for more flexible and energetic differentiation of wages through the basic salary.

It is known that individual distribution in conditions where actual differences in the result of labor, according to experts, averages 23% for workers, and reaches 200-300% for engineering and technical workers, is a powerful factor in increasing labor activity [5].

Additional payments are characterized by the features of incentive forms of material incentives; additional payment is a form of remuneration for additional results of labor, for the effect obtained in a specific area. Additional payments are received only by those who participate in achieving additional labor results and additional economic benefits. Additional payments, unlike the tariff, are not a mandatory and permanent element of wages.

The increase in the amount of additional payments depends mainly on the increase in the individual labor efficiency of a particular employee and his contribution to collective results. If performance indicators decrease, additional payments can not only be reduced in size, but also completely canceled. Additional payments are considered as an independent element of wages, and occupy an intermediate position between the tariff rate and bonus payments.

It should be noted that one group of additional payments in its economic essence is closer to the tariff part, the other to the bonus part. Additional payments of the first group are established by law, they apply to all employees and their size does not depend on work results, they are a measure of payment for the main factors of labor contribution. In this case, additional payments are designed to stimulate work overtime, on holidays, at night, and for working conditions.

The second group of additional payments is more characterized by the features of incentive forms of material monetary incentives, since these additional payments, like a bonus, are a form of remuneration for additional results of work. Such additional payments include premiums to tariff rates for combining professions, increasing the volume of work performed, professional excellence and high achievements in work. Among these progressive forms of incentives, the most common is an employee’s bonus for combining professions and positions.

A salary supplement is a cash payment above the salary that encourages an employee to improve their qualifications, professional skills and long-term performance of combined work responsibilities.

In general, it should be noted that the system of additional payments to tariff rates makes it possible to take into account and encourage a number of additional quantitative and qualitative characteristics of labor not covered by the tariff system.

This system creates relatively long-lasting stimuli. But for its effective functioning, it is necessary for the enterprise to have a clear system of certification of workers of all categories, highlighting certain characteristics or even criteria for establishing one or another type of additional payments and with broad participation of the workforce in this work.

Compensations are monetary payments established to reimburse employees for costs associated with the performance of their labor or other duties provided for by federal law.

The most important area of financial and monetary incentives is bonuses. The bonus stimulates special increased results of work and its source is the material incentive fund. It represents one of the most important components of wages.

The purpose of bonuses is to improve, first of all, the final performance results expressed in certain indicators. The main characteristic of a bonus as an economic category is the form of distribution based on the result of labor, which is personal labor income.

The award in its part is of an unstable nature. Its value may be greater or less, or it may not be accrued at all. This trait is very important, and if she loses it, then the bonus loses its meaning. In essence, it turns into a simple additional payment to wages, and its role in this case is reduced to eliminating shortcomings in the tariff system.

The application of the bonus is intended to ensure a prompt response to changing conditions and specific production tasks.

The manager must take into account some psychological tendencies that appear during stimulation. First, the employee is more likely to behave effectively. The higher the value and frequency of rewards resulting from such behavior; secondly, when the reward is delayed, it is lower than when it is immediate; thirdly, effective labor behavior, which is not deservedly rewarded, gradually weakens and loses the features of efficiency.

Bonuses, as an independent lever for solving problems, have their own mechanism of influencing the interest of employees. This mechanism consists of two parts: the mechanism of a separate system and the interaction of all bonus systems.

The bonus mechanism is a set of interrelated elements. Its mandatory components are: bonus indicators, conditions for its application, source and size of the bonus, circle of bonus recipients.

The bonus indicator is the central, core element of the system, determining those labor achievements that are subject to special encouragement and should be reflected in a special part of the salary - bonuses.

Bonus indicators should include production indicators that contribute to the achievement of high final results. Bonus conditions are provided; the number of logical conditions for human activity should not exceed four. As this number increases, according to psychological studies, the likelihood of an error and the time required to make a decision sharply increases [6].

It is necessary to decide who exactly is included in the bonus circle. The fact is that bonuses cover only those employees whose work needs to be further encouraged. This need is determined by the tasks and specific conditions of work and production. The central place in the incentive system is the size of the bonus. It determines the connection between labor results and an increase in the amount of incentives.

The employee sees the effectiveness of the bonus system used in the amount of money received in the form of a bonus. The size of the bonus can be set as a percentage of salary, economic effect, or a fixed rate. That is, in relative and absolute terms.

The source of payment of the bonus is the material incentive fund, which is formed from the profit of the enterprise in the amount of four percent of the wage fund.

When determining the circle of award recipients, it is necessary to proceed from the address and target direction. These are bonuses for above-plan, above-norm achievements in work, completion of important tasks, and demonstrated initiative that yielded specific results. Due to their purposefulness, such incentives have greater stimulating power and therefore can be more effective in increasing work activity.

1.3 Characteristics of moral stimulation

Moral stimulation is the most developed and widely used subsystem of spiritual stimulation of work and is based on the specific spiritual values of a person.

Moral incentives are those incentives whose action is based on a person’s need for social recognition.

The essence of moral stimulation is the transfer of information about a person’s merits and the results of his activities in the social environment. It has an informational nature, being an information process in which the source of information about the merits of employees is the subject of management; the receiver is the object of stimulation, the employee and the team, the communication channel is the means of transmitting information. Therefore, the more accurately such information is transmitted, the better the system performs its function.

In the management aspect, moral incentives in relation to management objects serve as signals from the subjects about the extent to which their activities correspond to the interests of the enterprise.

Moral incentives are means of attracting people to work that are based on the attitude towards work as the highest value, on the recognition of labor merits as the main ones. They are not limited to incentives and awards; their use involves the creation of such an atmosphere, such public opinion, moral and psychological climate, in which the work collective knows well who is working and how, and everyone is rewarded according to their deserts. This approach requires ensuring that conscientious work and exemplary behavior will always receive recognition and positive evaluation, will bring respect and gratitude. Conversely, poor work, inactivity, and irresponsibility must inevitably affect not only a decrease in material remuneration, but also the official position and moral authority of the employee.

The moral incentives for employees developed at the enterprise must meet the following requirements:

1) provide incentives for specific indicators on which employees have a direct impact and which most fully characterizes the participation of each employee in solving the tasks facing him;

2) establish incentive measures for success in work so that more significant incentive measures are used for higher achievements;

3) provide confidence that, subject to the fulfillment of the increased obligations assumed, participants will be rewarded in accordance with the results achieved;

4) strengthen the interest of each employee in the constant improvement of his production performance;

5) be simple, intelligible and understandable for employees;

6) take into account increasing social and political activity and professional and technical skills, sustainability of high results in work;

7) preventing the devaluation of moral incentives [7].

To effectively use moral incentives it is necessary:

1) the presence of provisions on moral incentive statuses and knowledge of them by employees;

2) make wider use of various forms of moral encouragement in the interests of developing creative initiative and activity;

3) moral encouragement should be supported by measures of material incentives, ensure the correct interaction of material and moral incentives, and continuously improve them in accordance with new tasks, changes in the content, organization and working conditions;

4) widely inform the workforce about each moral encouragement given to an employee;

5) present awards and express gratitude in a solemn atmosphere;

6) reward employees in a timely manner - immediately after achieving certain successes in work;

7) analyze the effectiveness of incentives;

strictly follow the established procedure for making entries about promotions in workers’ work books [8].

strictly follow the established procedure for making entries about promotions in workers’ work books [8].

One of the main conditions for the high effectiveness of moral incentives is to ensure social justice, that is, accurate accounting and objective assessment of the labor contribution of each employee.

Conviction in the validity and fairness of recognition of an employee’s labor merits, in the correctness of his reward, raises the moral authority of work, elevates the personality, and forms an active life position.

Of particular importance is the principle of publicity of moral encouragement, that is, wide awareness of the entire team. Comprehensive information about the results achieved by employees and a festive atmosphere when presenting awards. To do this, it is necessary to inform each employee not only verbally, but also issue a brochure with moral incentives for quality work. And in a prominent place, at the enterprise, hang a poster - a table with the name and points of each employee, and a board of honor with those who distinguished themselves.

When organizing moral incentives, it is important to ensure a combination of incentive measures with increased responsibility for work results. Which will entail an increase in responsibility in the team.

An effective method of strengthening labor discipline is rewarding for conscientious work.

An extremely important factor influencing the effectiveness of moral stimulation is the frequency of its use. So, the more outstanding results a person shows, the less frequently the incentive due to him should occur. The closer to average the indicator, the more common it is.

The number of incentives applied does not yet ensure high authority and effectiveness. Therefore, it is necessary to pay attention to the quality selection of candidates for promotion. The best people in the team must be rewarded in strict accordance with the incentive regulations. Moral incentives are effective to the extent that their distribution is assessed by employees as fair. Fairness depends on the accuracy with which they reflect the level of performance results.

Numerous sociological studies have shown that the motives of work, the influence of moral incentives on workers largely depend on age, gender, qualifications, education, length of service at the enterprise, and level of consciousness. It is necessary to take this into account when developing incentive conditions [9].

A distinctive feature of moral incentives is that its function, connecting incentives with the results of activity, is expressed in a discrete form of the ratio of incentives. The mutual ordering of various stimuli increases their overall stimulating effect. They are classified according to status at two levels: less significant and more significant. The achievement of some of the promoted employees, the second stage, is recognized as higher in comparison with the achievements of the rest.

Moral incentives differ in a set of elements that form the spatial and temporal certainty of evaluative information about a person and which are called elements of the stimulating mechanism. These elements fill the form and content of the award, creating courage and a festive mood.

Internal elements include: content, text about merits and type of media - work book, certificate, certificate, form; photo; icon.

To external: name of the stimulus, official status, delivery procedure, frequency of use, aesthetic merits. They influence authority, significance, actual status.