Existing VAT rates

In addition to the settlement rates applied in a special regime (clause 4 of Article 164 of the Tax Code of the Russian Federation), there are basic VAT rates. These include:

1. The VAT rate is 0%, the application of which is given in paragraph 1 of Art. 164 Tax Code of the Russian Federation.

See also the material “What is the procedure for refunding VAT at a rate of 0% (receiving confirmation)?” .

2. VAT at a rate of 10% is calculated on the basis of the conditions given in paragraph 2 of Art. 164 Tax Code of the Russian Federation.

See also the materials “What is included in the list of goods subject to VAT at a rate of 10%”.

3. The VAT rate of 20% is applied on the basis of clause 3 of Art. 164 Tax Code of the Russian Federation.

What is the difference between VAT rates 18% and 18/118?

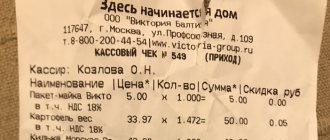

Tax Code of the Russian Federation (VAT rate 10.0%) in word format VAT rate 18% and 10%: how to calculate? In order to find out the amount of VAT on the sale of goods or services, you need to determine the initial tax rate. If the sale of goods occurs within the territory of the Russian Federation, 10% or 18% is used. To determine the amount of VAT, a tax in the required amount is charged on the initial cost of materials. For example, products can be sold at a price of 100 rubles per unit. The amount of VAT in the amount of 18% is equal to 100 rubles * 18% = 18 rubles. The total cost of the goods presented to the buyer is calculated by adding the price without VAT and the amount of tax, that is, 100 rubles + 18 rubles = 118 rubles. The procedure for calculating VAT at a rate of 10% is similar. At a price of 100 rubles, the tax amount is 10 rubles, the total cost is 110 rubles.

If shipment is expected at a rate of 18%, a calculation based on 18/118 is used. The final tax amount is 150,000 rubles /118*18 = 22,881 rubles.

VAT rate 18%: accounting and calculation example Example. LLC "Resurs" sells products in favor of LLC "Scheme" in the amount of 236,000 rubles, including 18% VAT equal to 36,000 rubles. According to the terms of delivery, Schema LLC must independently pick up the valuables from the warehouse on time, otherwise penalties in the amount of 5,000 rubles are provided. Schema LLC did not fulfill the terms of the contract, picking up the goods later than the established deadlines, as a result of which it transferred a fine in favor of Resurs LLC in the amount of 5,000 rubles.

Cases of application of estimated VAT rates

All cases of application of estimated VAT rates are given in paragraph 4 of Art. 164 Tax Code of the Russian Federation.

Estimated rates apply:

- Upon receipt of funds related to payment for goods (work, services) provided for in Art. 162 of the Tax Code of the Russian Federation. The VAT tax base can only be increased by amounts associated with payment for goods sold, that is, in situations where these amounts are actually part of the revenue. If such amounts are considered to be attributable to sales proceeds, they should also be subject to tax. The tax rate on additional amounts of money depends on the rate on the main transactions. So, if the tax rate for the main transaction was 10%, then the additional amount will be taxed 10/110, since the estimated tax is withheld from this amount (clause 4 of Article 164 of the Tax Code of the Russian Federation). If the principal amount was taxed at a rate of 20% VAT, then the calculated rate for additional amounts received related to revenue will be 20/120.

- Receiving advances for an upcoming delivery or transfer of property rights.

See also “Acceptance for deduction of VAT on advances received” .

- Tax withholding by VAT agents.

See more details in the material “Who is recognized as a tax agent for VAT (responsibilities, nuances)” .

- The estimated VAT rate for the sale of property taken into account along with the tax.

The Tax Code of the Russian Federation regulates the application of the settlement rate when selling property taken into account along with the tax in accordance with clause 3 of Art. 154 of the Tax Code of the Russian Federation, acquired externally. Its sale is taxed at a rate of 20/120 or 10/110. Such property includes:

- fixed assets purchased through targeted funding from the budget and paid including VAT, which is not deductible (letter of the Ministry of Finance of Russia dated April 1, 2010 No. 03-07-11/83);

- property received free of charge and accounted for at cost, taking into account the tax paid by the transferring party;

- fixed assets recorded at cost including tax;

In addition, sales transactions are taxed at the settlement rate:

- agricultural products and processed products under clause 4 of Art. 154 Tax Code of the Russian Federation;

- cars purchased from individuals for resale in accordance with clause 5.1 of Art. 154 Tax Code of the Russian Federation.

In addition, the calculated rate is applied when transferring property rights in accordance with clauses 2–4 of Art. 155 Tax Code of the Russian Federation. The list of cases in which the use of the estimated tax rate is allowed is exhaustive (determination of the Supreme Arbitration Court of the Russian Federation dated December 24, 2008 No. VAS-15099/08, resolution of the Federal Antimonopoly Service of the Moscow District dated August 29, 2008 No. KA-A40/8063-08).

Zero tax

The first paragraph of Article 164 of the Tax Code specifies the categories of transactions that are exempt from payment of the tax in question. But since, by law, they cannot not contribute money to the budget at all, there is a VAT rate of 0 percent.

First of all, companies that will sell goods abroad fall under this value. In this part, the zero VAT rate for exports is described in detail in Article 165 of the Tax Code. True, there is an important condition. Thus, the VAT rate - 0 - for export is applied only if the company proves that its goods have gone abroad. To do this, you need to submit the appropriate set of documents to the tax office. However, in terms of exports, starting from 2020, the zero rate can be abandoned. We talked about this in detail in the article “VAT changes from 2020: overview“.

Also, those companies that provide international transportation services are not subject to tax. Moreover, we are talking about the transportation of goods and the transportation of passengers. Thus, numerous transport companies fall under this criterion.

Some specific types of production are not yet subject to value added tax. For example, these include the space industry, as well as companies involved in the oil sector.

Filling out invoices for estimated rates

An invoice for the sale of property registered by an enterprise at a cost including VAT is determined by the rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. According to these rules:

- in column 5 the difference between prices is entered, taking into account tax;

- Column 8 reflects the estimated amount of tax (subparagraphs “e”, “h” of paragraph 2 of the filling rules);

- column 7 reflects the calculated rate that is applicable in this situation, the rate is indicated without the % symbol (i.e. 20/120, etc.);

- Columns 4 and 9 indicate the full price and sales price including VAT.

Read more about the rules for issuing advance invoices in the article “Rules for issuing advance invoices in 2020 - 2020.”

What is VAT for dummies

Estimated rates 18/118 and 10/110 Unlike the base rates, which are expressed as a percentage, the settlement rates are formulas corresponding to the base rates of 18% and 10%. Paragraph 4 of Article 164 of the Tax Code of the Russian Federation regulates situations in which the use of such rates is necessary. In practice, the most common use of settlement rates is when receiving advance payments (advance payment) for the upcoming delivery of goods, performance of work or provision of services.

Since the received payment already includes the tax amount, the following formula is used to calculate VAT: VAT amount = Advance payment amount * 18/118 (or 10/110). In other words, the calculated rates are added up according to the formulas: 18 / (100 + 18) and 10 / (100 + 10).

Results

Cases when estimated VAT rates are applied are described in clause 4 of Art. 164 Tax Code of the Russian Federation. Estimated VAT rates are determined as the ratio of the VAT percentage rate to the tax base, taken as 100 and increased by the percentage rate. In invoices, the estimated rate is indicated in column 7 as 20/120 or 10/110 without indicating the % symbol.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

The standard rate is the calculated value of the finished amount of overhead costs (cost estimate) and the amount of attribution to the cost of the balances of work in progress, finished products in the warehouse and sold products.

[p.236] The value of the internal interest, especially in cases where the level of the calculated interest is difficult to determine, expresses the upper limit of the calculated interest rate, within which the capitalized cost of the project is not negative and the project makes sense to implement. [p.114] Most terms are given in the singular (Coin, Payment check, etc.), but in many cases the plural is also used (Duties, Interest rates, Clearing houses, etc.). Titles of articles consisting of two or more words are arranged in the sequence that is accepted in everyday speech and literature (Transfer operations, not Transfer operations On-call loans, not On-call loans, etc.). 1 [p.3]

Clause 4 of Article 164 of the Tax Code of the Russian Federation applies calculated rates. Estimated rates are the percentage of the basic tax rate (10% or 18%) to the tax base, taken as 100 and increased by the corresponding tax rate (10% or 18%). They are used in strictly specified cases, when [p.733]

Taxpayers must calculate the amount of tax as a percentage of the tax rate provided for in paragraph 2 (10%) or paragraph 3 (20%) of Art. 164 of the Tax Code of the Russian Federation, to the tax base taken as 100% and increased by the corresponding tax rate. The calculation method comes down to using rates of 10/110 and 20/120. [p.195]

The estimated quarterly rate is determined by dividing the actual costs of transportation to other oil depots for the corresponding quarter of the previous year (3 n) by the number of petroleum products actually transported to other oil depots in this quarter (P) according to the formula [p.272]

A term used in banking, stock exchange, trading and insurance practice to denote the difference between interest rates, securities rates, commodity prices, and other indicators. In exchange trading, margin is the amount of money paid to a clearing house (see [P 6]) by a broker or broker by clients to cover unfavorable fluctuations in the value of a futures contract (see [K 124]) after its registration, an agreed limit, above which profits or the loss may not be issued. (See also “Operations, foreign exchange” [O 58]). [p.160]

In addition to the number of standard hours performed on a shift, the pay card also indicates the actual time spent on piecework and time-based work and downtime. The earnings of a shift worker are distributed among its members in proportion to piecework tariff rates and piecework time worked [p.236]

Due to the deterioration of mining and geological conditions for the development of oil fields, prices in force since July 1, 1967 no longer reflect the changed level of socially necessary labor costs and do not provide full economic calculations. Exploration costs are only reimbursed by 60% in wholesale oil prices. Under these conditions, there is a clear lack of estimated profit for the formation of economic incentive funds. Taking this into account, the All-Union Research Institute of Organization, Management and Economics of the Oil and Gas Industry (VNIIOENG) has developed a draft of new enterprise wholesale prices (selling prices), providing for the establishment of a single price for each association with a reduction in the number of zonal prices from eight to three or four. Price fluctuations between zones are outlined in the ratio of 1 2.5. The projected oil prices take into account possible increases in current production costs due to an increase in the reimbursement rate for geological exploration costs by approximately 2.5 times, a significant increase in both payments for production assets (1.7-2 times) and rental payments (approximately 2.5-3 times). [p.265]

The law, instead of deductions from enterprise profits to the budget in the form of payments for funds, labor resources and deductions from estimated profits, provides for a single tax on balance sheet profit. The income tax rate is 22% for the union budget and 23% for republican budgets. It is envisaged to introduce a number of benefits and preferences to the single tax, through which state regulation of economic development should be carried out. In particular, taxable profit is reduced by the following amounts [p.135]

To stimulate an increase in labor productivity and quality indicators of work, bonuses have been introduced for workers in the amount of up to 20% of the tariff rate (including additional payments for professional skills and working conditions) for completing tasks to reduce the labor intensity of products and increase labor productivity depending on the level of development of the design (calculated) labor intensity at necessary quality indicators, [p.182]

Completed primary documents for accounting for time spent and work performed are sent to the accounting department, which, guided by current tariff rates, regular salaries and the Regulations on remuneration, determines the amount of wages due to each worker and employee. The calculation method depends entirely on the system of remuneration of labor and equipment and the organization of production. [p.147]

Worker category Hourly tariff rate, kopecks. Time worked, hour. Salary according to tariff, rub. (2 X 3) KTU Estimated salary, rub. (4X5) Above-tariff part of wages, rub. Monthly salary, rub (4X7) [p.169]

The number of standard hours worked by each shift, as well as the actual time spent on piecework and time-based work and downtime are indicated on the pay card for each shift. Accounting is carried out on the basis of the daily report of the drilling foreman. The earnings of a shift worker are distributed among its members in proportion to piecework tariff rates and piecework time worked [p.43]

Thus, practice has shown that establishing rental payments with the condition of maintaining a single level of profitability for all associations cannot give the desired results. Subsequent rates of long-term annuity payments inevitably entail fluctuations and sharp differences in the levels of estimated profits across associations over time, which has an adverse effect on the formation of economic incentive funds. [p.116]

The establishment of rental payments in the form of a per-ton rate, the size of which varies from year to year depending on the amount of total profit, for each oil-producing region creates conditions for obtaining an estimated profit sufficient to create funds for economic stimulation, replenish working capital and cover losses in the housing and communal services sector, financing of capital construction. [p.119]

Based on the direct economic feasibility of equal incentives for oil-producing associations for mobilizing additional oil production resources, in 1973 a methodology for calculating incentive funds for above-plan production was worked out and then applied by first applying a single standard for contributions to the material incentive fund in the amount of 12.5 kopecks. from the ruble of estimated profit, and then (1974) a single per-ton rate. In 1973, the uniform standard for contributions was 12.5 kopecks. was distributed to accrue a material incentive fund for above-plan estimated profits obtained from additional oil production under socialist obligations in 22 oil regions. Moreover, in 15 associations this standard was higher than differentiated deductions from the planned estimated profit, and in seven associations it was significantly lower. [p.142]

In the calculations of zonal prices, rental payment rates are developed taking into account production costs and capital intensity of oil production, and annual regulation of their levels is envisaged depending on changes in the sum of these two quantities, i.e., reduced costs, the size of which depends on the mining and geological conditions of field development . This procedure for establishing sliding rates of rental payments takes into account the objective business conditions of individual associations and creates the prerequisites for normal self-supporting activities of associations to generate estimated profits. [p.152]

In Russian practice, the calculated interest rate is used based on the determination of the opportunity cost of capital /5, 41/. [p.101]

ESTIMATED TAX RATES BY QUALITY CATEGORIES ON [p.178]

Ts.r. are established on the basis of the planned cost of oil or gas (including the rate of repayment of exploration costs) for individual enterprises or groups of them with the obligatory inclusion in it of such a percentage of profit that would allow each enterprise to have a certain estimated profit for the formation of an incentive fund. [p.121]

The number of standard hours worked by each shift is indicated on the pay card for each shift. Accounting is carried out on the basis of the daily report of the drilling foreman. In addition to the number of standard hours performed on a shift, the pay card also indicates the actual time spent on piecework and time-based work and downtime. The earnings of a shift worker are distributed among its members in proportion to piecework tariff rates and piecework time worked [p.190]

In order to encourage ATK to timely fulfill its obligations within the specified time frame, payment for transport work was made dependent on the fulfillment of accepted applications (for the specified volume and on time) at calculated rates based on the time tariff. [p.26]

Your results may differ slightly if you used a second discount rate other than 8%.) (b) To determine the estimated rate of return on an investment, you must first adjust the cash flows for non-cash items (in this case, depreciation). [p.878]

The development of the world market with its numerous sectors entails an increase in the volume of foreign exchange, credit, and financial settlement transactions. Document flow and the number of business papers—payment and unified commercial and financial documents—are increasing. There is an exchange of information between market participants, the transfer of information about exchange rates and securities, interest rates, the situation in different markets, the reliability of partners, etc. Information flows go beyond national borders. As a result, a data bank is being formed for the information services market on a global scale. An organizational structure has been created within the UN to coordinate the work of intergovernmental and other organizations of economic, commercial, financial, and telecommunications profiles. Permanent working groups develop new and improve existing standards for international currency, credit, financial, and settlement operations. Temporary working groups periodically discuss the problems of securities, traveler's checks, gold and other precious metals, and banking operations using the SWIFT network. The information exchange system is intended for use not only by a narrow circle of professionals, but also by all participants in the market economy. [p.416]

At first glance, balances on clients' settlement (current) accounts are the cheapest source of resources for commercial banks, since interest on them is either not accrued at all or accrued at low rates. However, maintaining current accounts involves providing cash services to clients, which in turn is associated with significant overhead costs for maintaining a staff of tellers, cashiers, security guards, premises, and equipment. [p.407]

Example 1.2.14. Certificate of deposit with a nominal value of 20 thousand rubles. with interest accrued at a simple interest rate of 40% per annum, issued for one year. At what price can it be purchased 60 days before maturity to ensure the profitability of such a financial transaction in the form of a simple interest rate of 45% per annum? The estimated number of days in a year is 365. [p.33]

Example 1.3.10. When taking into account the presented bill of exchange in the amount of 30 thousand rubles. 40 days before its maturity, the bank’s income amounted to 1.5 thousand rubles. Determine the profitability of this financial transaction for the bank in the form of a simple annual interest rate with an estimated number of days in the year equal to 360. [p.56]

Example 1.3.11. Discount type deposit certificate with a nominal value of 300 thousand rubles. purchased 100 days before its maturity at a price determined by a simple discount rate of 30% per annum, and 40 days later sold at a price determined by a simple discount rate of 28% per annum. Find the profitability of such a financial transaction in the form of a simple annual interest rate for an estimated number of days in the year equal to 360. What will be the profitability if the owner of the certificate holds it until maturity [p.57]

Example 1.3.12. The bill is accounted by the bank 120 days before its maturity at a simple discount rate of 39% per annum. Determine the profitability for the bank of such a financial transaction in the form of a simple annual interest rate, if a) commissions are not withheld b) commissions are withheld in the amount of 1% of the amount paid for the bill. The estimated number of days in a year is taken to be 360. [p.58]

Advertising cost per 1000 people. Advertising media specialists calculate the cost of circulation in a particular medium per thousand people. If a full-page, full-color ad in Newsweek magazine costs $58,000, and the magazine's estimated readership is 6 million people, the cost of advertising per 1,000 readers will be about $10. The same ad in Business Week may cost $26,000. dollars, but to reach only 2 million people, which means that in this case the cost of advertising per 1000 people will already be 13 dollars. An advertising specialist ranks magazines by cost per 1000 readers and usually gives preference to publications with the lowest settlement rates. [p.527]

The rates of rent payments per 1 ton of oil were determined in proportion to the size of the total profit per 1 ton of oil of each oil producing association in comparison with its industry average value. Due to the fact that rental payment rates turned out to be differentiated among oil-producing associations depending on the level of total profit, the estimated profit per 1 ton of oil noticeably leveled out for associations located in approximately equal natural and geological conditions. [p.118]

With the transition of the industry to a two-tier management system and the liquidation of oil and gas production units as self-supporting enterprises, it is economically more expedient to set rental payment rates depending on two factors of production costs and the capital intensity of oil production, with annual regulation of rates as the amount of total profit changes. This procedure for calculating rental payment rates creates the prerequisites for the normal activities of associations in terms of the formation of estimated profits, and therefore material incentive funds, reflects the objective conditions prevailing in the industry, and makes it possible to take into account the main economic indicators of associations: 1) the cost of oil production, 2) the cost fixed production assets and standardized working capital, 3) volume of oil production, 4) cost of products sold, 5) total profitability, 6) standard profitability, 7) total profit, estimated profit. [p.119]

This procedure for calculating rental payment rates creates the prerequisites for the normal activities of associations in terms of the formation of estimated profits, and therefore material incentive funds, reflects the objective conditions prevailing in the industry, and makes it possible to take into account the main economic indicators of associations: 1) the cost of oil production, 2) the cost fixed production assets and standardized working capital, 3) volume of oil production, 4) cost of products sold, 5) total profitability, 6) standard profitability, 7) total profit, estimated profit. [p.119]

Transition from the standard of deductions to the material incentive fund from each ruble of estimated profit received from additional oil production, to a uniform industry-wide per-ton rate of deductions for each ton of oil and every 1000 m3 of gas produced in excess of the national economic plan according to socialist obligations and counter plans of associations. The size of this per-ton rate was determined taking into account the amount of estimated profit and a uniform standard of deductions - 12.5%. [p.143]

At the heart of Meggin's concerns was the need to improve the performance of the company's most valuable asset—its financial advisors. These specialists spent a lot of time searching for information, monitoring stock prices, research reports, customer checking accounts, information about Merchant's products, interest rates, and other miscellaneous information, and less of their time serving as financial advisors. The company's information systems, created on mainframes, were expensive and inconvenient to use. The customer database, product information, pricing, analytics reports—all different types of data—were housed in multiple, incompatible systems. Financial advisors had several terminals on their desks, each of which required fluency in a dozen different applications and its own set of exotic keyboard commands. [p.97]

Gd gt TO + Tv + Tv + Tc3 Tv, Tpz - labor costs of employees of auxiliary and general plant services, man-hours sopr - labor intensity, respectively, in related industries, t3 - in industries producing raw materials, per - in industries of the first group of interfaces, tm — in industries of the second group of interfaces, people. -h/t Ru - specific consumption of material and raw materials, i.e. consumption rate Mpl and Mbaz - the share of cooperative supplies in product output in the planned and base periods, % Tpl and Tbaz - loss of working time in the planned and base periods, % Chup, Chub - number of semi-permanent personnel in the planned and base periods Vor - estimated production growth without taking into account structural changes, % E - savings for each factor, % 2E - savings in labor costs for all factors, % DChp., - growth number of industrial production personnel in the planning period, % DVpl - increase in production output in the planning period, % RSD - piece rate per unit of production, rub. rt - worker's tariff rate per unit of time, rub., kopecks. Tf - time actually worked by the worker [p.69]