When to cook

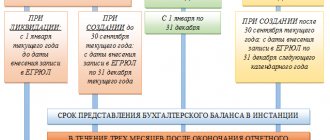

When declaring a liquidation procedure, an organization must compile a LP. First of all, an intermediate LB is formed, with the help of which the actual values are determined for the following key indicators:

- mutual settlements with counterparties;

- assets;

- liabilities;

- property value and so on.

Interim reporting is prepared after the publication of the notice of liquidation, 2 months after the release of the official Bulletin notifying creditors of the procedure being carried out. The PLB can be compiled repeatedly - based on indicators as of the reporting date or another date, so a copy of it does not have to be provided to the territorial tax office.

The final LB sums up the financial and economic activities of the organization.

stroki_otchet_o_celevom_ispolzovanii.jpg

Material information affecting the reliability of reporting is disclosed in separate lines or in additional appendices. The company makes its own decision about what data to provide in more detail. The company sets the code in its reporting according to the indicator that has the maximum value in the line of the form containing the combined data. An organization can refuse to use simplified forms by choosing full accounting reporting and enshrining this in its accounting policies.

"1C: Accounting 8": how to create a liquidation balance sheet

OLB is an accounting register that is compiled after the completion of all mutual settlements with counterparties (creditors, employees, government agencies) and reflects the economic condition of the institution at the time of its closure. The final liquidation balance is zero, since it is compiled at the stage of completion of the liquidation process. This document must be submitted to the Federal Tax Service once, on the date preceding the exclusion of the organization from the Unified State Register of Legal Entities. To reflect the opening balances in the OBL, the opening balances of interim reporting are used.

The formal type of reporting during liquidation is not fixed by any legal act, therefore both the final and interim LB are compiled according to Form No. 1 “Balance Sheet”.

The answer to the question, what is the liquidation balance code: 90 or 94, is as follows:

- 90 — LB code (final);

- 94 - PLB code.

Key value

To designate a certain time interval during which tax reporting is valid, a special codification is used.

This code acts as a 2-digit number, for example, it could be tax period code 34, 22 or some other. The presented codification conveniently groups reports according to the time of their creation. For example, this code makes it possible to quickly determine the period of time during which the payer calculated and transferred the tax to the budget.

A codification procedure has been developed for all types and codes of tax reporting. Let's take a closer look at how to determine the tax period of code 34 and other codes.

Groups and payer status do not play any role in determining the code. In other words, in 2020, the tax service approves codes personally for each form or report form, while the amount of contributions, taxes and the type of payer does not affect this. This encoding is used by organizations and individual entrepreneurs, as well as ordinary citizens and private practitioners.

Procedure for approving the SRS

Members of the liquidation commission must draw up the SRS, but due to the fact that the document contains accounting data, the final reporting of the organization is prepared by the chief accountant.

In the header of the document, it is necessary to indicate the LP, the period and date of preparation, as well as all information about the closing legal entity: full name, location, INN/KPP, legal form and type of activity. In the tabular part, indicators of current and non-current assets and liabilities are entered by accounting period. At the end of the OBL, the signature of the chairman of the commission with a transcript is placed.

As soon as the final LP is ready, it must be approved by the persons who initiated the liquidation. At the general meeting of participants, a decision is signed to approve the liquidation balance sheet.

Then a protocol on approval of the liquidation balance sheet is formed and endorsed, the preparation of which is marked on the OLB form.

At the end, the final statements are signed by the liquidator and the founders of the organization, an application in form P16001 is filled out, and all the necessary documents are completed and submitted to the Federal Tax Service for consideration and making a further decision on the liquidation of the institution.

Approval procedure

The document must be drawn up by members of the liquidation commission, but since the document contains accounting data, the organization’s final reporting is usually prepared by the chief accountant.

After the decision of the sole participant is made or the minutes of the meeting of founders are approved on the liquidation of the company, final reporting is prepared.

According to the protocol, in the head of the document it is necessary to indicate the liquidation balance sheet, the period and date of compilation, as well as all information about the closing legal entity: full name, location, tax identification number and registration number, legal form and type of activity. In the tabular part, indicators of current and non-current assets and liabilities are entered by accounting period. At the end, the chairman of the commission signs with a transcript.

As soon as the final LB is ready, its approval is necessary. The register must be approved by the persons who initiated the liquidation. At the general meeting of participants, a decision is signed to approve the liquidation balance sheet.

Then an approval protocol is generated and endorsed, the preparation of which is marked on the accounting form. The decision and minutes of approval are certified by all members of the meeting of founders or the sole participant of the LLC.

At the end, the final statements are signed by the liquidator and the founders of the organization, an application in form P16001 is filled out, and the entire necessary package of documents (including the protocol) is completed and submitted to the Federal Tax Service for consideration and making a further decision on the liquidation of the institution.

Accounting codes

6 tbsp. 15 402-FZ), the code for such a reporting period is 34 in the financial statements. Sometimes it has an annual duration (365 days), but starts from a different date, it is called financial.

There is also an intermediate one, which is limited to a month or a quarter - for monthly and quarterly registers, respectively.

Since accounting reports are submitted to the Federal Tax Service once annually (during the first 3 working months), the calendar year starting on January 1 is considered the main one. Thus, the reporting period in the financial statements is 2020. started on 01/01/2017.

Accounting periods

Financial statements are prepared by a legal entity to record its economic condition at a certain point in time, as well as provide information to government services about the results of its economic activities and the movement of assets for a certain time period. What is a reporting period in financial statements? This is the same time period for which a legal entity is obliged to report to regulatory authorities. Within a given number of days, the documents required by law must be drawn up and transferred to government services.

The procedure and frequency of reporting is regulated by Federal Law No. 402-FZ of December 6, 2011. It determines what should be used to support the items in the financial statements, the frequency of providing documents and responsibility for concealment or unreliability of the information provided. It is mandatory for everyone to transfer data on the enterprise at the end of the year (results for the year).

The need to prepare interim reports is determined by the organizational form, constituent documentation, legislation of the Russian Federation or the decision of the owners.

The organization is required to provide a report for a certain time period

Reporting period codes

In accounting documentation, each time period (month, quarter, half-year, year) is coded in accordance with the “Directory of Codes Defining the Tax Period.” This is a single form that is used by accountants throughout the Russian Federation.

The directory divides time periods into groups:

- by month – each month of the year is assigned a code from 1 to 12, respectively;

- by quarter - codes 21, 22, 23, 24 for the first, second, third and fourth quarters, respectively;

- for the year - code 34 (assigned only if interim financial statements are not prepared for the legal entity during the year).

A separate coding is provided to organizations that prepare reports on an accrual basis for different periods:

- first quarter – 21;

- half-year – 31;

- 9 months – 33;

- year – 34;

- by the number of months from 1 to 11 (for 1, for 2, for 3, for 4, etc.) - codes from 35 to 45, respectively;

- for 12 months – 46 (if accounting is carried out on an accrual basis only at the end of the year).

Consolidated groups of taxpayers provide reporting by period according to their coding:

- first quarter – 13;

- half-year – 14;

- 9 months – 15;

- year – 16;

- by the number of months from 1 to 11 (for 1, for 2, for 3, for 4, etc.) - codes from 57 to 67, respectively;

- for 12 months – 68 (if accounting is carried out on an accrual basis only at the end of the year).

Separate codes are provided for cases of enterprise reorganization. Termination of the activities of a legal entity obliges it to submit final reports for the last reporting period of its activities (code 90). Reporting period 94 represents the opening financial statements upon creation of a legal entity or change of owners.

Codes for reporting periods of financial statements for 2020

The annual report, which consists of the final balance sheet and its appendix forms, is submitted by accountants to the territorial tax inspectorates by the end of March of the following year. But there are situations when organizations provide intra-annual reports to the INFS: monthly and quarterly.

Due to the large number of financial documents processed by specialists, a special frequency coding was introduced to avoid confusion. Codes for reporting periods of financial statements for 2020. were amended by Appendix 3 (as amended on December 20, 2016) to the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] , and to determine the time interval for which you need to report in 2017-2018. The following designations apply:

- 21 - first quarter;

- 31 - 6 months (six months);

- 33 - 9 months;

- 34 - year;

- 50 is the last reporting period in the financial statements and tax reports during the reorganization (liquidation) of the institution.

Tax period code in financial statements

First of all, it should be noted that the reporting periods in tax and accounting documentation may not coincide and most often do not coincide. At the same time, both tax reporting and accounting have certain codes that undergo changes annually. Therefore, before filling out the necessary forms, it is better to double-check the available data on the codes in order to be absolutely sure that the documents are filled out correctly.

So for 2012 (accounting statements for which had to be submitted by March 30, 2013) the following codings were established:

- for the quarterly report – 21;

- for the half-year report – 31;

- for a report for nine months – 33;

- for the annual report – 34;

- for liquidation annual reporting in the event of dissolution (liquidation) of an enterprise - 90;

- for liquidation interim reporting in the event of dissolution (liquidation) of an enterprise - 94.

When filling out financial statements for 2013, the codes will need to be clarified.

Back to contents

Submission of interim accounting reports

According to paragraph 5 of Art. 13 402-FZ, accounting records that are compiled for an interval of less than one calendar year are considered intermediate. These can be monthly or quarterly registers.

Interim reports are submitted only when the organization is obliged to submit them in accordance with the current legislation of the Russian Federation, by-laws and regulations, as well as constituent documents or decisions of managers and owners (clause 4 of Article 13 402-FZ). In such cases, the OP dates must be fixed in the accounting policies of the institution.

The deadline for submitting intermediate forms is not established by current legislation. The deadlines and time intervals for which you need to report are determined by internal and external users of accounting.

DIRECTORY OF CODES DETERMINING THE TAX (REPORTING) PERIOD

| Code | Tax (reporting) period |

| Section 1. Codes for documents prepared for the tax period - month | |

| 01 | January |

| 02 | February |

| 03 | March |

| 04 | April |

| 05 | May |

| 06 | June |

| 07 | July |

| 08 | August |

| 09 | September |

| 10 | October |

| 11 | november |

| 12 | December |

| Section 2. Codes for documents compiled for the tax period - quarter | |

| 21 | 1st quarter |

| 22 | 2nd quarter |

| 23 | 3rd quarter |

| 24 | 4th quarter |

| Section 3. Code for documents compiled only for the tax period - calendar year | |

| 34 | year |

| Section 4. Codes for documents compiled on an accrual basis from the beginning of the year: | |

| 4.1. |

What are the intervals for accounting?

This is a time period of the financial, economic and operational activities of an institution, which is reflected by the accountant in accounting and final reports.

The only legally recognized interval is the calendar year, which begins on January 1 and ends on December 31 inclusive (clause 6 of Article 15 402-FZ), the code of such a reporting period is 34 in the financial statements. Sometimes it has an annual duration (365 days), but starts from a different date, it is called financial.

There is also an intermediate one, which is limited to a month or a quarter - for monthly and quarterly registers, respectively.

Since accounting reports are submitted to the Federal Tax Service once annually (during the first 3 working months), the calendar year starting on January 1 is considered the main one. Thus, the reporting period in the financial statements for 2020 began on 01/01/2017.

Preparing the final liquidation balance sheet

Codes for documents for reporting periods: quarter, half-year, nine months and tax period - calendar year

Organizations that use are not exempt from record keeping. Individual entrepreneurs, on the contrary, are not required to maintain it.

But they can compose at their own request. Financial reporting A system that characterizes the financial and property status of an institution and its performance results.

Bookmarked: 0

Accounting statements are documents that any enterprise must regularly submit to the tax service in order to have an idea of the state of the enterprise at the present time (property, economic). There are a number of points in such reports for which they must be provided. In general, financial statements include a list of documents consisting of more than one hundred items. Reporting concerns:

- enterprise income (these are cash receipts from successful sales of goods, services, return of funds from loans, receipt of funds from shareholders);

- expenses of the enterprise (payment of taxes by the enterprise, payment of loans, purchase of raw materials or equipment).

What are the deadlines for submitting financial statements in 2019?

Organizations that use are not exempt from record keeping.

Individual entrepreneurs, on the contrary, are not required to maintain it. But they can compose at their own request. Financial reporting A system that characterizes the financial and property status of an institution and its performance results.

Bookmarked: 0

Accounting statements are documents that any enterprise must regularly submit to the tax service in order to have an idea of the state of the enterprise at the present time (property, economic). There are a number of points in such reports for which they must be provided. In general, financial statements include a list of documents consisting of more than one hundred items. Reporting concerns:

- enterprise income (these are cash receipts from successful sales of goods, services, return of funds from loans, receipt of funds from shareholders);

- expenses of the enterprise (payment of taxes by the enterprise, payment of loans, purchase of raw materials or equipment).

What are accounting period codes?

In general, any type of financial statements shows what total money is spent and received by the enterprise, as well as the purpose of these expenses and income. From the analysis of reporting, one can judge what changes need to be introduced at the enterprise, and whether there is a need for them. Accounting reports have a special form, which is provided to the tax service. The forms contain special columns for each type of reporting that must be filled out. Such forms require correct and careful filling out, for which special codes are used.

Accounting reporting codes determine the period for which the report itself must be submitted. All reporting must be provided for a certain period of time, because this is how the enterprise is able to provide the most complete information about its work. And the completeness of information and its reliability play a very important role in financial statements, if not the most important one.

Also, by examining reports for each period of time, the enterprise has the opportunity to track its development and success of work, or vice versa. Thus, there is a chance to analyze which products are better not to be released anymore or which services do not make sense to provide, and, conversely, what development is worth paying attention to.

The code itself in reporting is used to simplify and speed up the understanding of information instead of writing names in letters.

Encoding must be used when submitting documents to the tax service. But as far as matters within the enterprise are concerned, it is not obligatory. The documentation that is completed between these periods can be completed without using these codes, but this is not advisable. Filling out documentation using accounting codes will help avoid problems if the company suddenly comes under inspection.

Why is the reporting period and period code necessary in financial statements?

Some of the main requirements for financial statements, and, in principle, for any other accounting document of an enterprise, are completeness of the facts provided, reliability of information, measurability and comparability of information. That is why any report, not just accounting, cannot be “in general”, but must contain information for a certain period of time. Only in this way can one trace the dynamics of development (or, conversely, decline) of production and draw some conclusions or predict a certain result.

For example, by looking at the column “income from sold products of type A” in weekly reports, you can understand whether this product is in demand, whether it makes sense to continue producing it in the form in which it is now, or perhaps it is necessary to think about modernization, or, maybe discontinue it altogether - and all this can be understood only from a few numbers in the accounting document.

Coding of reporting periods is necessary to speed up the perception of information, as well as to reduce the time for filling out a document - after all, it is much faster to put a couple of numbers than to print eight to ten printed letters.

At the same time, for example, interim reporting, which is compiled exclusively for internal use and is not subject to transfer to the tax service, may not contain coding for the reporting period, but it is still better to get used to filling out any document as if it were “for parade” - this will avoid unpleasant moments, if an audit ever comes unexpectedly.

Back to contents

When are financial statements submitted?

In addition to all the above types of reports, previously enterprises were required to submit intermediate reports. This requirement has now been removed for most businesses. Some of them still submit this documentation to the tax authorities. However, such a requirement does not mean that reporting at certain periods of time is not necessary. Any enterprise is required to maintain this kind of reporting without submitting it to tax collection services. In a six-month report, an enterprise must indicate the following results for a given period of time:

- The balance sheet held by the company.

- The results that the company has achieved financially.

- Changes in the capital of the enterprise.

- Movement and change in the amount of funds.

When preparing a nine-month report, an enterprise must provide the same data as in a six-month report. The only difference is the time period. These documents must be submitted to the tax service before a certain date specified in the legislation. The date must be confirmed before submitting documents.

Thus, when preparing reports to the tax office, it is necessary to clarify the changed codes entered in the required fields. This allows you to speed up inspection not only by government regulatory organizations, but also reduce the time for analyzing reports within the enterprise.

Submission of interim financial statements

In addition to annual reporting, enterprises previously submitted interim accounting reports to the tax service: for a month, a quarter, and six months. The latest edition of the Law “On Accounting” abolished this requirement, however, some organizations (for example, insurance companies) still submit interim (intra-annual) reports. It is recommended for everyone, without exception, to maintain interim accounting reports within the enterprise.

Back to contents

Code 31 in financial statements

Code 31 indicates reporting for six months, starting from the first of January of the current year. The package of documents for this period should include:

- half-year balance sheet;

- financial results report for six months;

- report on changes in the enterprise's capital for six months;

- cash flow statement for six months.

According to the new legislation, semi-annual reports are submitted to the tax service only if this is provided for by Federal laws.

If information is nevertheless submitted to the tax service, statistical reporting must be submitted before July fifteenth, 2013, a profit report must be submitted before July twenty-ninth, 2013, and personalized accounting data must be submitted before August fifteenth, 2013.

Back to contents

Code 33 in financial statements

Code 33 is used to mark reports that contain information about the enterprise for a reporting period of nine months. That is, from the first of January, for example, 2013 to the thirtieth of September 2013.

The package of reporting documents is the same as for the reporting period of six months:

- balance sheet for nine months;

- financial statement for nine months;

- statement of changes in the enterprise's capital for nine months;

- cash flow statement for nine months.

Statistical reporting must be submitted by October fifteenth, 2013, a profit report by October twenty-eighth, 2013, and personalized accounting data by November fifteenth, 2013.

Was the information interesting or useful?

Yes26

No15

Share online

Where is the interim liquidation balance submitted?

The interim liquidation balance sheet is submitted to the registering tax office. It must be accompanied by:

- notice of liquidation of a legal entity in form No. P15001 (with a note that it is submitted in connection with the preparation of an interim liquidation balance sheet) (Appendix No. 8 to the Order of the Federal Tax Service dated January 25, 2012 No. MMV-7-6 / [email protected] );

- list of claims stated by creditors;

- list of property of the liquidated organization.

Please note that a notification about the preparation of an interim liquidation balance sheet cannot be submitted to the inspectorate earlier than the deadline (Clause 4, Article 20 of the Federal Law of 08.08.2001 No. 129-FZ):

- established for the presentation of claims by creditors;

- the entry into force of a court decision on a statement of claim containing claims against the liquidated organization;

- completion of the on-site tax audit, registration of its results and entry into force of the final document based on the results of this audit, if such an audit was carried out.

Let us remind you that without providing an interim liquidation balance sheet, the liquidation of an organization cannot be completed. This means that you cannot immediately submit the final liquidation balance sheet to the tax office.

Only after settlements with creditors are completed, the liquidation commission must form the final liquidation balance sheet (clause 6 of Article 63 of the Civil Code of the Russian Federation). We talked about it in a separate article and gave an example of filling it out.

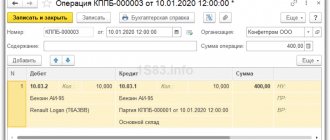

Preparation of financial statements for 2020 in the 1C: Accounting 8 program

Features of preparing financial statements for 2020 in the 1C: Accounting 8 edition 3.0 program.

The materials are current as of November 20, 2019.

Reproduction of the article is permitted with the author indicated and a link to the source

A video was recorded based on the materials in this article; if you prefer to listen and watch, you can watch it on the channel

In the 1C: Accounting 8 edition 3.0 program there are 3 forms of financial statements for commercial organizations.

Two forms “Accounting statements (since 2011)” and “Simplified accounting statements”.

If you don’t have any of them on the Favorites tab, then go to the All tab, find the required form in the Accounting statements folder and put an asterisk to the right of it.

Please note that “Simplified accounting reporting” is not only for organizations using a simplified taxation system, this small compact form, consisting of only 2 reports with collapsed indicators, can be submitted by organizations related to small businesses that apply any taxation system, including including OSNO.

The form “Accounting statements (since 2011)” has 2 editions:

- dated April 19, 2019 No. 61n (for 2020).

- dated April 19, 2019 No. 61n (for 2020).

They differ in the “Income Statement”.

The choice of the form of financial statements is selected when creating financial statements.

If the organization does not apply PBU 18, then for 2020 we select the Accounting Statement “dated 04/19/2019 No. 61n (for 2020)”.

If an organization applies PBU 18 and in 2020 used the Cost method (or it is also called the deferment method), then we also select the Accounting statements “dated 04/19/2019 No. 61n (for 2019)”.

But if an organization applies PBU 18 and has already used the new Balance Sheet method in 2020, then for 2020 it must submit reports in the form “dated April 19, 2019 No. 61n (for 2020).”

There have already been questions that when generating Accounting Statements, it is not possible to select Accounting Statements dated 04/19/2019 No. 61n (for 2020) or Accounting Statements dated 04/19/2019 No. 61N (for 2020). This is precisely due to the choice of method for maintaining deferred assets and liabilities in the accounting policy of the 1C: Accounting 8 program.

If we chose the balance sheet method, then we will not be able to fill out the “Statement of Financial Results” from the Accounting Statement form No. 61n dated April 19, 2019 (for 2020)

Features of filling out the title page of financial statements.

If an organization is subject to a mandatory audit, then it is necessary to submit an audit report to the tax authority either together with the financial statements or separately within 10 working days after its receipt, but no later than December 31.

When filling out the title page of the financial statements, indicate that “The financial statements are subject to mandatory audit” and, if possible, indicate the details of the audit organization that conducts the audit (if already known). You can select from the Contractors directory using the link “Organization to fill out the report”

But if the indication of the Name and Taxpayer Identification Number of the audit organization is not mandatory for completion, then the indication “Yes” or “NO” is mandatory for uploading in electronic format.

Those. even if the organization is not subject to mandatory audit, it is necessary to put a cross in the NO field.

When submitting an audit report along with financial statements, it must be prepared in PDF format and attached to the “Additional files” tab.

If the audit report is submitted after the financial statements have been sent, then it is sent in the form of a package with additional information. documents for the Federal Tax Service through the menu item More - Send a package with additional. documents for the Federal Tax Service.

Moreover, sending a package is possible only for a submitted report with the status “Passed”.

Also on the title page, pay attention to the choice of the Type of reporting.

Reporting can now only take 2 types:

- Regular. If this is reporting for a full year, then code “34” is automatically set. If this is reporting for the first reporting year of the organization (i.e. not complete), then the code “94” is automatically set

- Liquidation. The code “90” is automatically assigned.

There is no longer a separate code for interim liquidation financial statements.

There is one more issue that we encountered in filling out the title page.

On January 1, 2013, the OKOPF OK 028-2012 version was adopted and put into effect.

Unfortunately, I still see old organization codes for OKOPF in 1C databases.

The current OKPOF consists of 5 digits, for example LLC - 12300, JSC - 12200, PJSC - 12247, IP - 50102, etc.

The control ratios of the financial statements for 2020 also check the bit depth of this field.

Let me remind you that OKPOF is installed in the organization details in the Statistics Codes group.

Well, in conclusion, the most popular question of this month:

The accounting statements do not check the control ratios and the protocol comes:

“The declaration contains errors and requires clarification”

errors found

Code: — Description: 0400400010 The control ratio of the NBO form indicator is violated.

The whole problem is that the reporting for 2020 checks the control ratios established by Letter of the Federal Tax Service of Russia dated July 31, 2019 No. BA-4-1/15052,” which do not take into account rounding errors.

I’ll show you with a real example of the Simplified Accounting Reports form.

In this reporting, control ratios are not met based on data from the previous year 2020. And although reporting with exactly the same data was accepted last year, this year the protocol requires clarification.

At first glance, the balance seems to be correct and there are no errors.

But if you add up the indicators of lines 1210, 1250 and 1230 for 2020, then their sum will not be equal to the final balance line of 1,600.

1 498 + 1 467 + 186 is not equal to 3 150

If we take these figures in rubles before rounding to the nearest thousand and add 1,497,753.09 + 1,466,516.97 + 185,549.82, we get 3,149,819.88.

As we can see, the equality is satisfied.

That is, all the indicators in the report are correct, but when adding rounded numbers mathematically, the equality does not hold. This is exactly what the control ratios tell us.

Having understood the essence of the problem, the tax authorities issue a Letter dated February 18, 2020 No. VD-4-1/ [email protected] , in which it explains that the financial statements are considered accepted

and enters the GIRBO after the organization receives a receipt of acceptance, or a notice of entry,

or a notice of clarification

.

The Federal Tax Service draws attention to the fact that sending a notification of clarification to an organization is not a basis for refusing to accept a legal copy of financial statements and the audit report. If the tax authority sent a receipt of acceptance and a notification of clarification to the organization, then the financial statements are already considered accepted

.

The notice contains a proposal to provide clarifications or make corrections to the statements. At the same time, in relation to financial statements, the notification of clarification is of a recommendatory nature.

. Having received it, the organization has the right to decide whether or not to send the adjusted financial statements to the tax authority.

And in conclusion, I remind you that as of January 1, 2020, financial statements are not submitted to the Federal State Statistics Service (with rare exceptions). (Federal Law of November 28, 2018 No. 444-FZ)

If you have any questions, you can ask them to me at

A video was recorded based on the materials in this article; if you prefer to listen and watch, you can watch it at

After drawing up the final liquidation balance sheet

After the final liquidation balance sheet has been compiled, it must be approved by the persons who made the decision on liquidation. To do this, they need to draw up a protocol (decision) on approval or put the appropriate marks directly on the balance sheet.

Together with the final balance sheet, the liquidation commission places at the disposal of the founders (participants) all the property remaining after settlements with creditors. These assets must be distributed among the founders (participants) in accordance with their shares in the authorized capital.

Once all calculations have been made, the final package of documents for liquidation must be submitted to the tax office:

- application in form P16001 (notarized);

- final liquidation balance sheet;

- protocol (decision) on approval of the final liquidation balance sheet;

- a receipt for payment of state duty in the amount of 800 rubles.

- certificates from funds confirming the absence of debt (they are not required to be submitted, since the tax office must independently request this data from the Pension Fund and the Social Insurance Fund).

Regulation of the use of code ciphers

The current forms of accounting records and appendices to them are contained in the order of the Ministry of Finance, issued on July 2, 2010 under No. 66n. This normative act provides recommendations for filling out and preparing accounting documents.

Additional clarifications can be found in PBU 4/99:

- numerical indicators are indicated in ruble equivalent;

- the currency assets at the enterprise's disposal are converted into our national currency, taking into account the official exchange rate established for the ruble by the Central Bank of the Russian Federation;

- Data can be given in thousands or millions of rubles.

What is OKEI code 384 in financial statements? We answer.

The units of measurement of numerical indicators in the reporting forms under consideration are designated by codes from OKEI. This type of classifier was approved by Decree of the State Standard of Ukraine dated December 26, 1994 under No. 366. An accountant can enter one of the codes in the cell allocated for units of measurement:

- if, when filling out, they convert valuations into thousands of rubles, enter code 384 in the financial statements;

- The code 385 indicates the use of numbers in millions of rubles.

Now you know what code 384 means in financial statements.

When to cook

When declaring a liquidation procedure, an organization must compile a LP. First of all, an intermediate LB is formed, with the help of which the actual values are determined for the following key indicators:

- mutual settlements with counterparties;

- assets;

- liabilities;

- property value and so on.

Interim reporting is prepared after the publication of the notice of liquidation, 2 months after the release of the official Bulletin notifying creditors of the procedure being carried out. The PLB can be compiled repeatedly - based on indicators as of the reporting date or another date, so a copy of it does not have to be provided to the territorial tax office.

The final LB sums up the financial and economic activities of the organization. OLB is an accounting register that is compiled after the completion of all mutual settlements with counterparties (creditors, employees, government agencies) and reflects the economic condition of the institution at the time of its closure. The final liquidation balance is zero, as it is compiled at the stage of completion of the liquidation process. This document must be submitted to the Federal Tax Service once, on the date preceding the exclusion of the organization from the Unified State Register of Legal Entities. To reflect the opening balances in the OBL, the opening balances of interim reporting are used.

The formal type of reporting during liquidation is not fixed by any legal act, therefore both the final and interim LB are compiled according to Form No. 1 “Balance Sheet”.

Accounting codes in 2018

Codes for documents compiled for the tax period - month

01 January 02 February 03 March 04 April 05 May 06 June 07 July 08 August 09 September 10 October 11 November 12 December Section 2. Codes for documents compiled for the tax period - quarter 211 quarter 222 quarter 233 quarter 244 quarter Section 3. Code for documents compiled only for the tax period - calendar year 34 Section 4. Codes for documents compiled on a cumulative basis from the beginning of the year: 4.1. Codes for documents for reporting periods: quarter, half-year, nine months and tax period - calendar year 211 quarter 31 half-year 33 nine months 34 year 4.2. Codes for documents with reporting periods of one month, two months, three months, etc. and tax period - calendar year 35 one month 36 two months 37 three months 38 four months 39 five months 40 six months 41 seven months 42 eight months 43 nine months 44 ten months 45 eleven months 46 year Section 5. Codes for documents compiled for a consolidated group of taxpayers 5.1. Codes for documents compiled for reporting periods: quarter, half-year, nine months and tax period - calendar year 131 quarter 14 half year 15 nine months 16 year 5.2. Codes for documents compiled for reporting periods: one month, two months, three months, etc. and tax period - calendar year 57 one month 58 two months 59 three months 60 four months 61 five months 62 six months 63 seven months 64 eight months 65 nine months 66 ten months 67 eleven months 68 year Section 6. Codes for documents drawn up by the responsible managing partner under an investment partnership agreement 251 quarter 262 quarter 273 quarter 284 quarter Section 7. Codes for documents drawn up during reorganization (liquidation) of organizations7.1 . Codes for documents compiled on a cumulative basis from the beginning of the year: 50 last tax period (unless other codes are provided for in the procedures for filling out tax returns) 511 quarter 52 half-year 539 months 90 year 7.2. Codes for documents compiled for a quarter or month 511 quarter 542 quarter 553 quarter 564 quarter 71 for January 72 for February 73 for March 74 for April 75 for May 76 for June 77 for July 78 for August 79 for September 80 for October 81 for November 82 for December Section 8. Other codes 95 the last tax period when switching to a different taxation regime 96 the last tax period when terminated and entrepreneurial activity99otherProcedure for approving the SRS

Members of the liquidation commission must draw up the SRS, but due to the fact that the document contains accounting data, the final reporting of the organization is prepared by the chief accountant.

In the header of the document, it is necessary to indicate the LP, the period and date of preparation, as well as all information about the closing legal entity: full name, location, INN/KPP, legal form and type of activity. In the tabular part, indicators of current and non-current assets and liabilities are entered by accounting period. At the end of the OBL, the signature of the chairman of the commission with a transcript is placed.

As soon as the final LP is ready, it must be approved by the persons who initiated the liquidation. At the general meeting of participants, a decision is signed to approve the liquidation balance sheet.

Then a protocol on approval of the liquidation balance sheet is formed and endorsed, the preparation of which is marked on the OLB form.

At the end, the final statements are signed by the liquidator and the founders of the organization, an application in form P16001 is filled out, and all the necessary documents are completed and submitted to the Federal Tax Service for consideration and making a further decision on the liquidation of the institution.

08/26/2018 | no comments

When declaring a liquidation procedure, an organization must compile a LP. First of all, an intermediate LB is formed, with the help of which the actual values are determined for the following key indicators:

- mutual settlements with counterparties;

- assets;

- liabilities;

- property value and so on.

Interim reporting is prepared after the publication of the notice of liquidation, 2 months after the release of the official Bulletin notifying creditors of the procedure being carried out. The PLB can be compiled repeatedly - based on indicators as of the reporting date or another date, so a copy of it does not have to be provided to the territorial tax office.

The final LB sums up the financial and economic activities of the organization.

Submission of interim accounting reports

According to paragraph 5 of Art. 13 402-FZ, accounting records that are compiled for an interval of less than one calendar year are considered intermediate. These can be monthly or quarterly registers.

Interim reports are submitted only when the organization is obliged to submit them in accordance with the current legislation of the Russian Federation, by-laws and regulations, as well as constituent documents or decisions of managers and owners (clause 4 of Article 13 402-FZ). In such cases, the OP dates must be fixed in the accounting policies of the institution.

The deadline for submitting intermediate forms is not established by current legislation. The deadlines and time intervals for which you need to report are determined by internal and external users of accounting.

DIRECTORY OF CODES DETERMINING THE TAX (REPORTING) PERIOD

| Code | Tax (reporting) period |

| Section 1. Codes for documents prepared for the tax period - month | |

| 01 | January |

| 02 | February |

| 03 | March |

| 04 | April |

| 05 | May |

| 06 | June |

| 07 | July |

| 08 | August |

| 09 | September |

| 10 | October |

| 11 | november |

| 12 | December |

| Section 2. Codes for documents compiled for the tax period - quarter | |

| 21 | 1st quarter |

| 22 | 2nd quarter |

| 23 | 3rd quarter |

| 24 | 4th quarter |

| Section 3. Code for documents compiled only for the tax period - calendar year | |

| 34 | year |

| Section 4. Codes for documents compiled on an accrual basis from the beginning of the year: | |

| 4.1. |

Profit reporting

Codes that refer to several distinctive forms that are completed quarterly.

Everything begins with a growing year, regardless of the outcome or beginning of the previous or current year.

- The twenty-first period is taken out for the first period of time;

- Tax period code thirty-one, which is a report for one half-year;

- Tax period thirty-three is not, as everyone thinks, a quarter, but data for the first nine full monthly reports;

- Tax period code thirty-four – information from January to December;

Provided that reporting must be submitted every month, in such a situation completely different measures are used to resolve the issue.

Thirty-five is the first month of the beginning of the year, thirty-six is the second month of the year, thirty-seven is the third month, and so on. All the basic rules and features are described in income tax reporting and are regulated in the order of the Federal Tax Service of Russia dated the nineteenth day of October two thousand and sixteen.

If tax period fifty is used in reporting, then the company was in reorganization or in the process of liquidation; such a code only states such actions of the company in tax reporting.

Preparing the final liquidation balance sheet

Codes for documents for reporting periods: quarter, half-year, nine months and tax period - calendar year

Similar articles:

Obtaining originals of judicial acts from the “Card Index of Arbitration Cases”. Instructions for participants in the process Obtaining originals of judicial acts...

Additional codes: OKVED code 55.30 - Activities of restaurants and cafes This group includes: - production, sale and...

What to do if the deadline for entering into inheritance is missed. If the heir has not submitted an application and the necessary documents...

How can I look up my taxpayer number on the Internet? Even if the taxpayer has not personally submitted an application to the Federal Tax Service...

| 21 | 1st quarter |

| 31 | half year |

| 33 | nine month |

| 34 | year |

| 4.2. Codes for documents with reporting periods of one month, two months, three months, etc. and tax period - calendar year | |

| 35 | one month |

| 36 | two month |

| 37 | three months |

| 38 | four months |

| 39 | five months |

| 40 | six months |

| 41 | seven months |

| 42 | eight months |

| 43 | nine month |

| 44 | ten months |

| 45 | eleven months |

| 46 | year |

| Section 5. Codes for documents compiled for a consolidated group of taxpayers | |

| 5.1. Codes for documents compiled for reporting periods: quarter, half-year, nine months and tax period - calendar year | |

| 13 | 1st quarter |

| 14 | half year |

| 15 | nine month |

| 16 | year |

| 5.2. Codes for documents compiled for reporting periods: one month, two months, three months, etc. and tax period - calendar year | |

| 57 | one month |

| 58 | two month |

| 59 | three months |

| 60 | four months |

| 61 | five months |

| 62 | six months |

| 63 | seven months |

| 64 | eight months |

| 65 | nine month |

| 66 | ten months |

| 67 | eleven months |

| 68 | year |

| Section 6. Codes for documents drawn up by the responsible managing partner under an investment partnership agreement | |

| 25 | 1st quarter |

| 26 | 2nd quarter |

| 27 | 3rd quarter |

| 28 | 4th quarter |

| Section 7. Codes for documents drawn up during the reorganization (liquidation) of organizations | |

| 7.1. Codes for documents compiled on an accrual basis from the beginning of the year: | |

| 50 | last tax period (unless other codes are provided for in the procedures for filling out tax returns) |

| 51 | 1st quarter |

| 52 | half year |

| 53 | 9 months |

| 90 | year |

| 7.2. Codes for documents compiled for a quarter or month | |

| 51 | 1st quarter |

| 54 | 2nd quarter |

| 55 | 3rd quarter |

| 56 | 4th quarter |

| 71 | for January |

| 72 | for February |

| 73 | for March |

| 74 | for April |

| 75 | for May |

| 76 | for June |

| 77 | for July |

| 78 | for August |

| 79 | for September |

| 80 | for October |

| 81 | for November |

| 82 | for December |

| Section 8. Other codes | |

| 95 | last tax period upon transition to a different taxation regime |

| 96 | last tax period upon termination of business activity |

| 99 | other |

A few words about the essence of financial statements

As any manager of an organization knows, financial statements are documentation that represents a complete and reliable picture of the economic, business and property status of the enterprise. The reports reflect:

- products manufactured at the enterprise, or work performed, or services provided - depending on the activities of the enterprise;

- income received from the sale of property;

- income received as a result of repayment of loans or interest on deposits;

- funds received from the shareholders of the enterprise;

- expenses for the purchase of raw materials and equipment necessary for production;

- loan repayment expenses;

- taxes paid and tax benefits received.

- and another hundred or so different items for which the company received any amounts during the reporting period or parted with some amounts.