Forms and types of financial statements

Accounting statements are a set of data reflecting the results of an enterprise’s activities for a specific period. Reporting is based on accounting data. The purpose of financial statements is to provide information to company owners, investors and government agencies. There are certain requirements for financial statements. You will learn more about them in the article “What requirements should accounting records satisfy?”

The following types of financial statements are distinguished:

- Statistical - for statistical authorities. Failure to submit it within the prescribed period threatens the company with a fine. Details are here.

- Managerial. Used by company management to control, manage and improve the efficiency of the enterprise. Specific accounting methods are used to prepare management reporting. We recommend our article “Management accounting in an enterprise - examples of Excel tables.”

- Directly financial statements as a system of data on the property and financial position of an enterprise and the results of economic activities for a period (month, quarter, year). A selection of materials in this section will tell you about it.

The order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n regulates the procedure for drawing up and forms of financial statements. In addition, when preparing reports, accountants rely on PBUs and regulations of Rosstat.

The forms of financial statements in 2020 are as follows:

- Balance sheet. Shows the size of the company's assets and liabilities.

- Income statement. Shows the company's income and expenses, as well as the final financial result (profit or loss).

- Statement of changes in equity. Characterizes the movement of capital of the company during the reporting period.

- Cash flow statement. Includes information about their sources and uses.

- Report on the intended use of funds. As a rule, it is filled out by non-profit organizations to provide information about contributions and other gratuitous receipts.

IMPORTANT! From 06/01/2019, new accounting forms are in effect in the wording approved by Order of the Ministry of Finance dated 04/19/2019 No. 61n.

The innovations are as follows:

- In all forms, data must be indicated in thousands of rubles, because unit of measurement “million rubles” excluded.

- Instead of OKVED, OKVED 2 should be used.

- In the balance sheet, lines appeared to indicate information about whether the company is subject to mandatory audit, as well as about the company (IP) auditor and their details.

- In the statement of financial results, the names of some lines have changed, and some lines have been completely excluded.

- OKUD codes have been changed in some reports.

Read more about the changes here.

See also “Completing Forms 3, 4 and 6 of the Balance Sheet”.

What is included in simplified financial statements

Please note that the limits of permissible revenue are periodically reviewed by the Government of the Russian Federation. At the time of writing, they are within the amounts indicated in the table.

IMPORTANT! SME status can be lost if the first two requirements for the number of employees and revenue are violated for 3 years in a row. This will also happen when the share of participation of legal entities is above 49%.

The composition of the reporting of small and medium-sized businesses is influenced by several factors:

- taxation system (TSS);

- type of activity (for example, the need to submit reports for small and medium-sized businesses on waste arises if organizations and individual entrepreneurs generate waste in the course of their activities);

- presence or absence of employees;

- requirements for the presentation of statistical reporting, etc.

Our specialists have compiled a detailed list of forms that small and medium-sized enterprises and individual entrepreneurs must report on.

| Reporting on taxes and contributions | ||||||

| SNO | Document's name | Periodicity | Document code | Who rents | Where to take it | For details, see the article: |

| BASIC | Tax return for value added tax | Quarterly | KND 1151001 | Organizations and individual entrepreneurs | To the tax office | “VAT return for 2017-2018 - form and sample” |

| BASIC | Tax return for corporate income tax | Quarterly/monthly (optional) | KND 1151006 | Organizations | To the tax office | “Tax return for income tax for 2017-2018” |

| BASIC | Tax return for corporate property tax | Once a year | KND 1152026 | Organizations that have property recognized as an object of taxation | To the tax office | “Tax return for corporate property tax” |

| BASIC | Tax return for personal income tax (form 3-NDFL) | Once a year | KND 1151020 | IP | To the tax office | “Tax return 3-NDFL in 2017-2018 - how to fill out? » |

| BASIC | Single simplified (tax) return - an alternative to submitting zero returns for income tax and VAT | Quarterly | KND 1151085 | Organizations, individual entrepreneurs on OSNO, if they do not conduct activities with the movement of funds through a current account (cash office) and do not have objects of taxation | To the tax office | “Unified simplified tax return - sample 2020” |

| UTII | Tax return for single tax on imputed income for certain types of activities | Quarterly | KND 1152016 | Organizations and individual entrepreneurs | To the tax office | “How to fill out the UTII declaration for the 4th quarter of 2020? » |

| Unified agricultural tax | Tax return for the unified agricultural tax | Once a year | KND 1151059 | Organizations and individual entrepreneurs | To the tax office | "ESKHN" |

| simplified tax system | Tax return for tax paid in connection with the application of the simplified taxation system | Once a year | KND 1152017 | Organizations and individual entrepreneurs | To the tax office | “Declaration form for the simplified tax system for 2017-2018” |

| simplified tax system | Single simplified (tax) return - an alternative to submitting a zero tax return under the simplified tax system | Once a year | KND 1151085 | Organizations, individual entrepreneurs, if they do not carry out activities with the movement of funds through a current account (cash office) and do not have objects of taxation | To the tax office | “Unified simplified tax return - sample 2020” |

| All NO systems | Tax return for transport tax | Once a year | KND 1152004 | Organizations for which vehicles are registered and recognized as objects of taxation | To the tax office | “Tax return for transport tax in 2017-2018” |

| All NO systems | Tax return for land tax | Once a year | KND 1153005 | Organizations owning land plots recognized as an object of taxation | To the tax office | "Land Tax Declaration" |

| All NO systems | Tax return for water tax | Quarterly | KND 1151072 | Organizations and individual entrepreneurs using water bodies subject to licensing | To the tax office | “Water tax in 2017-2018 – terms and payment procedure, rates” |

| All NO systems | Calculation of personal income tax amounts calculated and withheld by the tax agent | Quarterly | Form 6-NDFL (KND 1151099) | Tax agents - organizations and individual entrepreneurs with employees | To the tax office | "Calculation of 6-NDFL" |

| All NO systems | Certificate of income of an individual | Once a year | Form 2-NDFL (KND 1151078) | Tax agents - organizations and individual entrepreneurs with employees | To the tax office | “Certificate 2-NDFL in 2017-2018 (form and sample)” |

| All NO systems | Information on the average number of employees for the previous calendar year | Once a year | KND 1110018 | Organizations and individual entrepreneurs with employees | To the tax office | “We provide information on the average number of employees” |

| All NO systems | Unified calculation of insurance premiums (ERSV) | Quarterly | KND 1151111 | Organizations and individual entrepreneurs with employees | To the tax office | “Unified calculation of insurance premiums” |

| All NO systems | Information about the insurance experience of the insured persons | Once a year | Form SZV-STAZH | Organizations and individual entrepreneurs with employees | To the Pension Fund | “How to fill out the SZV-STAZH form for 2020 for submission in 2018?” |

| All NO systems | Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records | Once a year | Form EDV-1, attachment to SZV-STAZH | Organizations and individual entrepreneurs with employees | To the Pension Fund | “How to fill out and submit reports to the Pension Fund for the year?” |

| All NO systems | Information about the insured persons | Monthly until the 15th | Form SZV-M | Organizations and individual entrepreneurs with employees | To the Pension Fund | "SZV-M, SZV-STAZH" |

| All NO systems | Register of insured persons for whom additional insurance contributions for funded pension have been transferred and employer contributions have been paid | Quarterly | Form DSV-3 | Organizations and individual entrepreneurs with employees. Applies only to insurance premiums within the framework of voluntary insurance | To the Pension Fund | “What are the deadlines for submitting a report on the DSV-3 form in 2020?” |

| All NO systems | Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage | Quarterly | Form 4-FSS | Organizations and individual entrepreneurs with employees | In the FSS | “Form 4-FSS for the year - reporting form and example of completion” |

| All NO systems | Application for confirmation of the main type of economic activity | Once a year | Only organizations. Individual entrepreneurs are not confirmed (clause 10 of the Decree of the Government of the Russian Federation “On approval of the rules for classifying types of economic activities as professional risk” dated December 1, 2005 No. 713) | In the FSS | “Statement on confirmation of the main type of activity” | |

Option 1. “Simplified” forms.

Option 2. Regular forms.

https://www.youtube.com/watch?v=ytaboutru

They are used if it is not possible to provide information on:

- financial condition of a small company;

- financial results of her business.

It will not be possible to reflect such information when filling out simplified financial statements for 2020, since it is not recommended to enter new columns into the standard forms. At the same time, general report forms allow you to enter any information. At a minimum, the following information can be submitted as part of the Explanations.

- Affecting the value of the reporting indicators:

- use of PBU 18/02;

- application of the cash method, etc.

- About significant operations:

- contributions to the authorized capital;

- dividends to participants, etc.

Composition of financial statements

The composition of the provided forms of financial statements of an organization in 2019 depends on the size of the company, its organizational and legal form and the activities carried out. The most important report is the balance sheet. You can read more about it in this article.

The balance sheet is compiled for the reporting period and contains data for the previous 2 years. Why this is being done, read the article “Balance sheet of an enterprise for 3 years (nuances).”

Previously, companies were required to attach an explanatory note to the balance sheet. According to the Law “On Accounting” dated December 6, 2011 No. 402-FZ, in 2020 the explanatory note is not included in the mandatory financial statements, but in some cases the data requires comments. We recommend that you study the article “Drawing up an explanatory note for the balance sheet (sample)”, which, if necessary, will help you draw up a competent explanation for the financial statements.

Another document that allows you to analyze financial statements is the appendix to the balance sheet. Here you will learn how to compose it correctly.

Some organizations (credit, insurance companies, firms with assets exceeding 60 million rubles or revenues exceeding 400 million rubles, and a number of other companies) must include an auditor’s report in their financial statements. You can find out whether you are required to carry out a statutory audit procedure here.

But for joint-stock companies, an audit of financial statements is mandatory. Read about this in the article “All JSCs are now subject to mandatory audit.”

How an audit of financial statements is carried out and what indicators you should pay attention to, read the article “Audit of accounting for financial results (nuances).”

What is accounting reporting form according to KND 0710099

Code 0710099 is assigned in the KND to a form containing all the reports included in the full version of the accounting report. But this form is standardized to accept a report in machine-readable form and forms the basis for electronically submitted reporting. Its latest formats are reflected by the order of the Federal Tax Service of Russia dated March 20, 2017 No. ММВ-7-6/ And using the barcode available in the upper left corner of each page of the form, such a report can be easily submitted on paper.

The accounting (financial) reporting form KND 0710099 is not the only one that combines several forms with the code OKUD. A similar form with code KND 0710096 was created for a simplified version of accounting. Its electronic version is also presented in the order of the Federal Tax Service of Russia No. ММВ-7-6/

Preparation of financial statements

The preparation of reports based on the results of the period will proceed quickly if, during the entire reporting period, the facts of economic life at the enterprise were recorded correctly, on time and in full. Preparation of financial statements is the stage at which the accountant checks the correctness of the accounting of business transactions.

Let's look at how individual areas of accounting at an enterprise are reflected in the financial statements:

- Let's start with the balance sheet asset. This article will tell you how to reflect fixed assets on the balance sheet.

- When disclosing information about fixed assets, intangible assets and R&D, certain nuances arise. If you have property in account 08, you will find the article “On which line to show the balance of account 08 in the balance sheet?” useful.

- How the main production is reflected in the balance sheet, by what criteria direct and indirect costs are divided and how work in progress is taken into account, read in this article.

- The result of the enterprise's production activities is the finished product. In this publication, we explain the procedure for reflecting finished products in the balance sheet depending on accounting at actual or standard cost.

- Accountants may have questions about accounting for input VAT, as well as VAT as part of advances. We have prepared an article to help you: “How VAT is reflected in the balance sheet.”

- In what forms of financial statements is reflected the debt of the enterprise and by what rules it is reflected, read the article “Deciphering accounts receivable and payable - sample.”

- Before preparing financial statements, you need to conduct an inventory. How to do this, read here

- The final stage of preparation of financial statements is the reformation of the balance sheet. You will learn what this is from the publication “How and when to reform the balance sheet.”

After a thorough check of all areas of accounting, the accountant proceeds directly to the preparation of financial statements.

Balance sheet

Accounting financial statements, the forms of which were approved by Order No. 66n dated July 2, 2010, include, first of all, the company’s balance sheet and the so-called Form 2 - financial results report. The form is provided for the reporting calendar year and contains essential information on items, the importance and detail of which is established by the organization independently.

| Line | Explanations |

| Assets | |

| Tangible non-current assets | We indicate the cost of the organization's fixed assets, as well as capital investments in fixed assets. |

| Intangible, financial and other non-current assets | The total value of investments in intangible assets, development and design of intangible assets, we also indicate long-term loans, bonds and bills. |

| Reserves | Finished products, inventories, work in progress, fuels and lubricants, etc. |

| Cash and cash equivalents | The organization's funds are in the cash register or on the current account in rubles or foreign currency (equivalent). |

| Financial and other current assets | Accounts receivable in total for the financial period. |

| Passive | |

| Capital and reserves | The amount of authorized, additional, reserve capital and retained earnings. Non-profit organizations include endowed funds and especially valuable property. |

| Long-term borrowed funds | Credit obligations, loans and interest on them (obligation period - more than 1 year). |

| Other long-term liabilities | Creditor and reserves for future expenses for a period of more than one year. |

| Short-term borrowed funds | Loans, credits, installments (term - less than 1 year). |

| Accounts payable | Current accounts payable (suppliers, contractors, founders, budgets, employees). |

| Other current liabilities | Reserves for upcoming expenses, targeted financing (term - less than a year). |

| BALANCE | |

Completing financial statements

We have prepared for you articles-instructions on how to fill out all forms of an organization’s financial statements:

- Here you will read about the rules for drawing up a balance sheet with a detailed explanation (from which accounts the information for each line of the balance sheet is taken) and an example of filling it out.

- This article will tell you how to fill out an income statement.

- We will tell you about the rules for drawing up reports on changes in capital, cash flows and the intended use of funds in this article.

- Read about how to independently audit your financial statements here.

Users of accounting documentation and reporting

From the title it may seem that the main users of the above documents are accountants, and that’s all. But this is not true at all. Since the main purpose of financial or accounting documentation is an accurate reflection of the state of the enterprise in measurable indicators and figures, virtually anyone can be a user of the reporting.

There are internal and external users.

Internal ones include:

- heads of enterprises, structural divisions, departments - those people who are on the staff of the enterprise and use documentation to analyze the current situation and make the necessary management decisions;

- chief accountants of the enterprise and financiers - again, people on staff who study and maintain these documents to perform their immediate job responsibilities;

- internal auditors are people on staff and appointed by management directly to conduct reporting audits.

External users include:

- auditors - representatives of third-party organizations who are not directly interested in the activities of the enterprise, but study the papers in order to give an accurate assessment of the activities;

- shareholders and investors who are persons interested in the activities of the enterprise, but do not directly participate in its work. Such people study the documentation in order to determine whether the investment is worthwhile;

- representatives of tax and other government services who study reporting in order to check the activities of the enterprise and maintain documentation for compliance with legal requirements;

- clients and potential clients who, based on documentation, draw conclusions about the profitability and stability of the enterprise and make decisions, for example, about the start of service.

Most external users gain access to an enterprise's financial statements due to their public nature.

Back to contents

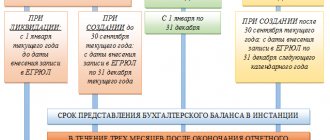

Reporting period for accounting

For financial statements, the reporting period is currently set at 1 calendar year. Accounting reports are submitted to the Federal Tax Service and statistical authorities within the deadlines established by the Tax Code of the Russian Federation and Law No. 402-FZ. For more information about the deadlines for submitting reports, read the article “When is the balance sheet submitted (deadlines, nuances)”.

The main government body user of financial statements is the tax inspectorate. You can submit reports not only in person or by Russian Post, but also through the Federal Tax Service website. This publication will tell you how to do this.

Search in the Open Data database from the Federal Tax Service of Russia

The service allows you to search for open data on taxpayers published by the Federal Tax Service of Russia on the official website.

Information can be found by taxpayer identification number.

Our open data tool has been updated with information on the amounts of arrears and debts for penalties and fines and information on tax offenses and penalties (total amount of fines) for their commission, which arose before December 31, 2020, and were not paid before October 1, 2020 of the year. It was these data that the Federal Tax Service published on December 1 in accordance with Article 102 of the Tax Code of the Russian Federation

Currently, the following information is loaded into our service:

- the average number of employees of organizations ( TOP-100 companies with the highest average value );

- special tax regimes;

- income and expenses of organizations ( TOP 100 companies with the largest amount of income and TOP 100 companies with the largest amount of difference between income and expenses );

- amounts of taxes, fees and contributions paid;

- from the Unified Register of Small and Medium Enterprises.

- information on the amounts of arrears and debts on penalties and fines

- information about tax offenses and penalties for their commission

Peculiarities of preparation of financial statements by different companies

The nuances of preparing financial statements depend on the legal form of the company, the applied taxation regime, and the scale of its activities.

Let's look at the most common cases:

- This article will tell you how to draw up a balance sheet for an LLC.

- About the features of accounting and preparation of financial statements in an LLC using a simplified system, read the article “Accounting for an LLC using the simplified tax system: submitting reports.”

- Instructions for filling out a simplified balance sheet are presented in this article.

- The legislation of the Russian Federation allows some companies to submit not all forms of financial statements. Check to see if your business qualifies as a small business and learn what kind of reporting you need to file. Details are here.

- Read more about the features of a small business balance sheet here

IMPORTANT! Entrepreneurs are not required to keep records and submit financial statements. However, we recommend that you prepare at least a balance sheet every year, since it provides visual information about the property used in business activities, financial results and the size of receivables and payables. The publication “How to Read a Balance Sheet (Practical Examples)” will tell you what other information can be gleaned from the balance sheet.

- Pay attention to the liquidation balance sheet - it is compiled if a decision is made to close the company. In this case, an interim liquidation balance sheet is first formed, and then the final one. For more information about the liquidation balance sheet, read the article “Where to submit the liquidation balance sheet.”

Drawing up company financial statements is a responsible and complex job, which is usually carried out by chief accountants. If you want to learn how to fill out and submit reports, as well as understand the nuances of preparing reports for various types of companies, read the materials in our “Accounting Reports” section.

Legislation on accounting documentation

More recently, until January 2013, issues of maintaining financial documents affected only some entrepreneurs. Only organizations that were on the general taxation system were required to keep books. Those on the simplified system may not have documented their activities as thoroughly.

Since January 2013, the requirements of Order No. 402 of the Ministry of Finance of December 6, 2011 came into force, according to which all enterprises are required not only to maintain accounting documentation, but also to annually report on it to regulatory authorities.

True, with the tightening of measures, there was also a relaxation: entrepreneurs were relieved of the need to submit interim reports. Now only a very small number of organizations, whose activities are regulated by special federal laws, submit reports not only once a year, but also once every three, six and nine months.

On the one hand, this made life easier not only for entrepreneurs, but also for tax officials. On the other hand, the burden on the tax office at the beginning of the reporting period increases enormously.

However, it is worth noting that the Russian accounting system is systematically moving towards international standards and a more simplified scheme, therefore, at the moment, far from the latest innovations and changes have been introduced. The process of searching for optimal forms of documents and their execution will continue and we should expect other innovations in the new year.

Back to contents

Audit and publicity

According to legal requirements, all enterprises whose financial statements are subject to publication in the public domain must undergo an annual audit.

Previously, the inspectors’ conclusions had to be submitted along with the company’s documents to the regulatory authorities; since 2013, this rule is no longer in effect, but for public reports all the previous requirements have been preserved.

The inspection must be carried out by third-party organizations with appropriate permission and trained specialists.

During the audit we study:

- content and composition of financial reporting forms;

- correspondence of various indicators from various documents to each other;

- interconnection of indicators;

- correctness of evaluation of reporting items;

- correct formation of consolidated reporting.

Without a signed audit report, the company's documents are considered invalid. The audit is carried out completely: for the entire enterprise as a whole, for the entire reporting period.

In addition to independent verification, some companies are also required to hold a shareholders meeting before publication, at which information is approved for release to the public.

Back to contents

Mandatory Public Reporting Requirements

The documents that the organization will provide to interested users must comply with all the requirements imposed on them by law.

Back to contents

General requirements

The main documentation requirements are:

- completeness – all data must be reflected in full;

- timeliness - every fact, every operation should be reflected as immediately as possible, as soon as it was completed;

- prudence - it is unacceptable to create hidden reserves, record premature income, and so on;

- consistency - analytical accounting data must be identical to the accounting data for turnover and balances on the last day of each reporting period;

- priority of content over form - economic activity should be taken into account according to its economic content, not its legal content;

- rationality - documentation must be maintained on production volumes and conditions of economic activity of the enterprise;

- reliability - documents should reflect the true state of affairs at the enterprise as fully as possible;

- neutrality - only facts should be reflected, without propaganda information, advertising or the like;

- integrity - data should be reflected as much as possible, taking into account the activities of all branches, if any;

- sequence - information must be submitted in chronological order;

- materiality - reporting should contain only those information that are important for a correct assessment of the enterprise;

- Comparability – all data provided must be comparable with the same data for other periods.

In addition, reporting must be prepared in Russian and indicators must be entered in national currency, even if some transactions were carried out in foreign currency.

Back to contents

Content requirements

Since the publicity of financial statements means that anyone can read them at any time, some measures have been taken to protect enterprises and facilitate the preparation of documents: it is allowed to publish abbreviated forms of reports containing only the totals for the necessary sections.

For example, you may not include intermediate results; It is permitted not to include in documents information that constitutes a commercial or other secret of the enterprise.

Reports that are posted publicly must contain:

- full name of the organization and its legal form;

- reporting date and reporting period;

- clear indication of the currency and format of the presented numerical indicators;

- last name, first name, patronymic and full position of the persons who signed the reports;

- date of approval of documents at the general meeting;

- the address where you can review the report data and receive a copy of the documents;

- information about the branch of the State Statistics Committee to which the enterprise submitted its annual financial statements.

In addition, it is necessary to annually comply with the once accepted publication form and provide data for the previous period along with new data.

Back to contents