Individual entrepreneurs pay to the Pension Fund contributions to extra-budgetary funds from payments of their employees and contributions from income from their activities for compulsory pension and health insurance.

Payment of insurance premiums to the Pension Fund for different types of insurance is carried out by individual entrepreneurs using different payment documents, which are sent to the bank indicating the corresponding accounts and budget classifier codes (BCC).

Insurance premiums for an entrepreneur who has no employees consist of a fixed part in the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund, if the income does not exceed 300 thousand rubles for the reporting period. If the established amount is exceeded, the individual entrepreneur pays +1% above the tariff amount.

In 2020, the fixed amount of contributions to the compulsory pension insurance account is 19,356.48 rubles; towards compulsory medical insurance – 3796.85 rubles. They must be paid by December 31, 2020. If the income is higher and the fixed payment increases by 1%, the additional amount must be paid before April 1, 2017. Don't forget that there are new BCCs for paying dues this year.

Insurance premiums for individual entrepreneurs

From 2020, when calculating insurance premiums for individual entrepreneurs, the size of the minimum wage does not play a role. Instead, according to Article 430 of the Tax Code of the Russian Federation, fixed contribution amounts are established for 2020, 2020 and 2020 (see table above). To find out the monthly amount, you simply need to divide these amounts by 12.

If you did not pay to the Pension Fund, but sent the money to the tax authorities, and at the end of the year it turned out that the insurance premiums completely cover the tax (since 100% of the contributions are deducted from the tax), then you will have to withdraw this money back from the tax authorities, which will be quite problematic.

Deadlines for payment of fixed payments to individual entrepreneurs

The legislation establishes the following payment terms:

- The entrepreneur must pay the fixed payment by the end of the reporting period, that is, by December 31 of the current year.

- Contributions in the amount of 1% must be transferred to the budget before July 1 of the following year. The timing of the 1% payment has been changed, starting with the 2020 payment due in 2020.

Individual entrepreneurs can pay the first part at their convenience. These may be monthly or quarterly payments. The entrepreneur is given the right to pay this amount in one payment immediately or at the end of the year.

The main requirement is that the payment of the fixed amount be made before the end of the year.

However, individual entrepreneurs who are going to take contributions into account when calculating payments under special regimes should know the following:

- UTII - tax can be reduced by the amount of paid contributions in the relevant periods. That is, UTII per 1 sq. You can reduce your contributions if they were paid from January to March of this year.

- Simplified tax system - payment of fixed amounts can be taken into account when calculating both advance payments and the entire tax. It all depends on when it was produced.

Entrepreneurs who do not act as employers can pay contributions so that the amount of calculated tax payable is equal to 0, if the amount of income and expenses received allows this.

Insurance premiums for individual entrepreneurs on the simplified tax system in 2020

The main advantage of the Federal Tax Service Inspectorate service is a hint system that the user can use when filling out a payment document. An individual entrepreneur can generate a receipt on the Federal Tax Service website, then print it and pay through the bank. You can make a payment immediately by bank transfer after filling out a payment order.

Working under a simplified regime obliges you to maintain minimum reporting (KUDiR) and submit a declaration for the year to the tax authorities. In addition, it is necessary to pay “simplified” (at a rate of 6% or 15%), land, transport taxes, VAT when importing goods, and in isolated cases - property tax. Individual entrepreneurs and organizations using the simplified tax system can be tax agents for personal income tax and VAT. The simplified regime can be combined with UTII and the patent system.

What taxes does an individual entrepreneur pay?

Federal Law No. 123 determines the procedure for calculating tax amounts to entrepreneurs. When registering an individual entrepreneur, a businessman chooses a special tax regime taking into account the intended activity and the amount of profit. The special modes are as follows:

- STS – simplified taxation scheme;

- OSNO - general taxation system;

- UTII – single tax on imputed income;

- Unified agricultural tax - unified agricultural tax;

- PSN – patent taxation system.

An individual entrepreneur pays several types of taxes.

An entrepreneur can remain in the general regime, then he will pay income taxes, value added tax (VAT), personal income tax for himself and his employees. In addition to these, transport, land, pension, insurance premium and other taxes may be charged.

Fixed payments to the Pension Fund for individual entrepreneurs using the simplified tax system for themselves

- In 2-NDFL, the codes for deductions for children have changed;

- KBK have become different;

- The limits on the simplified tax system have increased. For example, a limit of 100 million was set for fixed assets (their residual value) in 2020, and 150 million in 2020;

- Anyone can pay fees. The effective date of this rule is November 30, 2016;

- As of 01/01/2017, the minimum wage = 7.5 thousand rubles, and as of 07/01/2017 – 7.8 thousand rubles;

- If reporting deadlines are violated, a fine equal to the size of the maximum payment is not imposed;

- Individual entrepreneurs must sell all goods through online cash registers. When using them, the necessary information via the Internet immediately enters the Federal Tax Service database, which will allow you to correctly record the profit received and calculate the amount of additional contributions.

This was due to the inability of the Pension Fund (PFR) to cope with the large volume of work associated with receiving mandatory insurance contributions. Therefore, the debt on pension contributions began to grow rapidly, exceeding 200 billion rubles by the beginning of this year. Because of this, pensioners were left without indexation of pensions, and received only a fixed payment of 5 thousand rubles last year.

Individual entrepreneur: contributions to the Pension Fund 2020

- Payer code – the value “09” is entered, indicating that the transfers are made by an individual entrepreneur.

- KBK - for both types of pension contributions of private entrepreneurs the same value is used: 18210202140061110160.

- Information about the recipient of funds. To which Pension Fund should individual entrepreneurs pay their contributions? Since 2017, the tax office has been administering them, so a businessman should indicate in the payment slip the details of the Federal Tax Service at the place of registration, i.e. corresponding to the area of his residence. They can be obtained during a personal visit or viewed on the website of the regulatory authority.

- OKTMO - corresponds to the inspection where the funds are transferred. It must be taken along with the details at the Federal Tax Service office.

- Period code - as a general rule, how to pay contributions to the Pension Fund of Individual Entrepreneurs, in this field you need to indicate the number of the year for which the obligation is repaid. For example, if funds are transferred for 2020, “GD.00.2018” is entered in the payment slip. This principle does not change depending on whether the businessman transfers the entire amount at once or pays it off in installments.

- Type of payment - if insurance premiums of an individual entrepreneur are transferred to the Pension Fund on a timely basis, “TP” is indicated, if the resulting debt is repaid - “ZD”.

- Purpose of payment - it is stated that contributions are being transferred to the OPS, the number of the year for which the businessman is paying the budget is indicated.

What to do if there is an error in the payment receipt

If in 2020 errors in payments for insurance premiums were corrected by regional Federal Tax Service Inspectors and Treasuries (and there were plenty of them), then in 2020 the situation with incorrect BCCs, although it has become a little simpler, inaccuracies still occur.

But don’t worry too much if errors were made when preparing the receipt. According to the official Letter of the Ministry of Finance of the Russian Federation No. 03–02–07/1/2145, issued at the beginning of 2020, an insurance premium that was paid using incorrect details is considered paid. That is, no penalties will be charged on it. An incorrect BCC will not prevent controllers from seeing the payment and determining its purpose, but changes will still need to be made.

To correct the mistake, the payer will need to write an application to the Federal Tax Service. You can compose it in any form, the main thing is to accurately indicate:

- payment order number;

- the date of its formation;

- item number;

- purpose of payment (for example, for insurance contributions for compulsory pension insurance for the first quarter of 2020);

- the amount for which the receipt was generated;

- and what is the error.

You can also indicate a normative act that allows you to make clarifications - paragraph 7 of Article 45 of the Tax Code of the Russian Federation. A copy of the payment document must be attached to the application. When filling out an application to clarify the tax payment, a copy of the payment order must be attached to it

An application to clarify the details of a payment document will be considered by the Federal Tax Service within five working days. When considering the reasons for an erroneous payment, the tax controller has the right to request a reconciliation of calculations from the entrepreneur. But, as a rule, after a period of 5 days, the Federal Tax Service gives permission to redistribute funds without paying fines and penalties.

It is more difficult if the money does not go to the budget. This can happen if the following critical mistakes were made when preparing the receipt:

- the payment contains incorrect numbers in the Federal Tax Service account number;

- There were errors in the name of the receiving bank.

In this option, the entrepreneur will need to pay the fee again, indicating the exact details. Moreover, here the individual entrepreneur will not be exempt from paying penalties for the period until the payment reaches the addressee.

Therefore, it is easier not to reinvent the wheel, but to follow a proven path by filling out a payment order on the tax authority portal. In this case, the payment will definitely arrive as intended.

Obviously, knowing the right services and the nuances of issuing a receipt for the payment of insurance premiums, generating a payment and transferring money to the budget will not be difficult. The easiest and fastest way is to generate a payment document on the portal of the recipient of tax and insurance fees. When filling out an order on the website of the Federal Tax Service of the Russian Federation, even incorrect details will certainly not be fatal. Therefore, we recommend not to rely on bank tellers, but to do everything yourself. Fortunately, this doesn’t require much: access to the Internet, as well as minimal computer skills.

- Ellina Rozhkova

49 years old, higher education (philologist, journalist, marketing). I have experience working both in individual entrepreneurship and in large corporate businesses.

Important. Please note that starting from February 4, 2020, the details for paying taxes and contributions in 26 regions of the Russian Federation will change. Please read here: https://dmitry-robionek.ru/nalogi/novyye-rekvizity-dlya-uplaty-nalogov-i-vznosov-v-26-regionakh.html I recommend checking the details with your tax office after this date, and update your accounting programs.

Good afternoon, dear individual entrepreneurs!

Let’s assume that an individual entrepreneur without employees decides to pay mandatory contributions “for himself” for the full year 2020. Our individual entrepreneur wants to pay mandatory contributions quarterly, in cash, through a branch of SberBank of Russia. Also, our individual entrepreneur from the example wants to pay 1% of the amount exceeding 300,000 rubles per year at the end of 2020, but we will talk about this case at the very end of this article. (Of course, an individual entrepreneur on the simplified tax system has “income” with zero annual income, or less than 300,000 rubles per year should not pay this 1%.)

In this case, our individual entrepreneur must pay the state for 2018:

- Contributions to the Pension Fund “for yourself” (for pension insurance): 26,545 rubles

- Contributions to the FFOMS “for yourself” (for health insurance): 5,840 rubles

- Total for 2020 = 32,385 rubles

- Also, don’t forget about 1% of the amount exceeding 300,000 rubles of annual income (but more on that below)

A little hint. To understand where these amounts came from, I advise you to read the full article on individual entrepreneur contributions “for yourself” for 2018: https://dmitry-robionek.ru/calendar/pro-vznosy-ip-2018.html

But back to the article... Our individual entrepreneur wants to pay quarterly in order to evenly distribute the load throughout 2020.

This means that he pays the following amounts every quarter:

- Contributions to the Pension Fund: 26545: 4 = 6636.25 rubles

- Contributions to the FFOMS: 5840: 4 = 1460 rubles

That is, our individual entrepreneur prints two receipts for payment of insurance premiums every quarter and goes with them to Sberbank to pay in cash. Moreover, the deadlines for quarterly payments are as follows:

- For the first quarter of 2020: from January 1 to March 31

- For the second quarter of 2020: from April 1 to June 30

- For the third quarter of 2020: from July 1 to September 30

- For the fourth quarter of 2020: from October 1 to December 31

In our example, we will consider exactly the case when an individual entrepreneur pays quarterly. Almost all accounting programs and online services offer these terms for payment of contributions. Thus, the burden of mandatory insurance contributions for individual entrepreneurs is distributed more evenly.

And an individual entrepreneur using the simplified tax system of 6% can still make deductions from advances under the simplified tax system. Please note that if you have an individual entrepreneur account with a bank, it is strongly recommended that you pay contributions (and taxes) only from it. The fact is that banks, starting from July 2020, control this moment. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash

Follow the link: https://service.nalog.ru/payment/payment.html

Since we pay as individual entrepreneurs, we check the boxes as follows:

Click the “Next” button

And we immediately indicate the required KBK

- If we pay a mandatory contribution to pension insurance “for ourselves,” then we enter the BCC for 2020: 18210202140061110160

- If we pay a mandatory contribution to health insurance “for ourselves,” then we enter another BCC for 2020: 18210202103081013160

Important: enter KBK WITHOUT SPACES!

That is, when you issue these two receipts for pension and health insurance, you will do this procedure twice, but at this step you will indicate different BCCs and different payment amounts, which are indicated above and highlighted in yellow.

Let me remind you once again about the payment amounts for the full year 2020:

- Contributions to the Pension Fund “for oneself” (for pension insurance): 26,545 rubles

- Contributions to the FFOMS “for yourself” (for health insurance): 5840 rubles

If you do it quarterly, the amounts will be as follows:

- Contributions to the Pension Fund: 26545: 4 = 6636.25 rubles

- Contributions to the FFOMS: 5840: 4 = 1460 rubles

It is clear that if the individual entrepreneur has worked for less than a full year, then you will have to recalculate the contributions yourself, taking into account the date of opening (or closure of the individual entrepreneur). Instead of paying fees for a full year.

And again click on the “Next” button. In the “IFTS Code” field, enter the tax office code. Let our individual entrepreneur live in the mountains. Ivanovo, and its tax office code is 3702 (see screenshot below).

Of course, you will enter your tax office code.

If you don’t know the code of your tax office, then pay attention to the hint on the right (see the picture above).

Click the “Next” button

We select the status of the person who issued the payment as “09” - taxpayer (payer of fees) - individual entrepreneur.

- TP – current year payments

- And indicate the tax period: GY-annual payments 2018

- Enter the payment amount (of course, you may have a different amount)

Next, enter your information. Namely:

- Surname

- Name

- Surname

- TIN

- Registration address

Please note that you need to pay fees on your own behalf. Click the “Next” button and check everything again...

After making sure that the data is entered correctly, click on the “Pay” button. If you want to pay in cash, using a receipt, then select “Cash payment” and click on the “Generate payment document” button

That's it, the receipt is ready

- Since we entered KBK 18210202140061110160, we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs.

- In order to issue a receipt for payment of the mandatory contribution for health insurance, we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

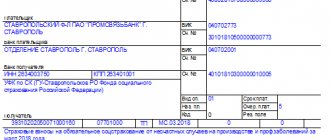

Example of a receipt for a quarterly payment for compulsory pension insurance:

Example of a receipt for a quarterly payment for compulsory health insurance:

We print these receipts and go to pay at any Sberbank branch (or any other bank that accepts such payments). Payment receipts and receipts must be kept!

Important: It is better not to delay the deadline for paying mandatory contributions “for yourself” until December 31, as the money may simply “get stuck” in the depths of the bank. It happens. It is better to do this at least 10 days before the expiration date.

How to generate a receipt for payment of 1% of an amount exceeding 300,000 rubles per year?

Indeed, those individual entrepreneurs whose annual income in 2020 will be MORE than 300,000 rubles are also required to pay 1% of the amount exceeding 300,000 rubles.

In order not to repeat myself, I send you to read a more detailed article about individual entrepreneur contributions “for yourself” in 2020: https://dmitry-robionek.ru/calendar/pro-vznosy-ip-2018.html

We are now more interested in another question: where can I get a receipt for paying this 1%? Let me remind you once again that this payment must be made strictly before July 1, 2020. (based on the results of 2018, of course). So here it is. Unlike 2020, there is no separate BCC for paying 1%.

This means that when the time comes to pay this 1%, you will need to generate exactly the same receipt as for paying contributions to compulsory pension insurance.

That is, when issuing a receipt for payment of 1%, indicate BCC 18210202140061110160 (but it is possible that this BCC will change in 2019. Therefore, follow the news and update your accounting programs in a timely manner). There was already an attempt to introduce a separate BCC for 1% at the beginning of 2020, which was described here: https://dmitry-robionek.ru/fiksirovannye-vznosy/kbk-dlja-oplaty-1-procenta-pri-dohode-bolee- 300000-rublej.html

In fact, you have exactly the same receipt as when paying a mandatory contribution to pension insurance. Only there will be a different payment amount, of course.

That's all, actually.

But finally, I will repeat once again that such payments need to be processed in accounting programs and services. There is no need to do everything manually in the hope of saving several thousand rubles...

PS Let me remind you that the service can be found at this link: https://service.nalog.ru/

Best regards, Dmitry Robionek

Receive the most important news for individual entrepreneurs by email!

Stay up to date with changes!

By clicking on the “Subscribe” button, you consent to the processing of your personal data and agree to the privacy policy.

I remind you that you can subscribe to my video channel on Youtube using this link:

Our individual entrepreneur Apollo Buevy decided to pay the insurance premiums himself, without turning to an accountant for help. I went to the Federal Tax Service website, started filling out receipts and got confused in the KBK. We decided to help him and other individual entrepreneurs and compiled step-by-step instructions for filling out payment documents.

You can fill out payment orders and receipts through the “Pay taxes” service on the website of the Federal Tax Service.

We select the document we want to fill out. The payment order is intended for payment from your current account, while we fill out a receipt for payment through a bank cash desk or terminal. However, it will be possible to pay for it using the State Services portal or online banking with a bank card.

Click the “Next” button and you will be taken to the form for selecting the type of payment. We need a tax group “Insurance premiums”.

Having selected the desired group, we look for the required contributions to fill in the name and type of payment. If we fill out a document for pension contributions, then select the following lines in the drop-down menu.

If we need to fill out a receipt for payment of contributions to the Compulsory Medical Insurance Fund, then select the following lines:

Next, we proceed to filling out the payer’s data. You don’t have to specify the index; it will be automatically added after filling out the address fields.

Fill in the remaining details of the payment document. Please note that individual entrepreneurs do not have periods for contributions such as a month or a quarter, so you can set the tax period to a year. Although no matter what you put, it won’t be a mistake, the main thing is to indicate the year correctly.

Then we indicate the full name and tax identification number.

And let's move on to payment. Here you can choose a payment method.

If you choose cashless payment, you will be offered a payment method.

If you choose cash payment, receipts will be generated.

Now you can go to the bank and pay the receipts1.

Note! Payment of pension contributions in the amount of 1% on income over 300 thousand rubles is made according to the same BCC that is indicated above in the receipt. There is no separate BCC for payments for 2020! More information about fixed contributions of individual entrepreneurs can be found on the page of our encyclopedia. You can calculate contributions for an incomplete year using a calculator.

1 A part of the bar code of receipts has been specially removed so that someone does not accidentally print them out and pay.

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

Payment of insurance premiums for persons who voluntarily joined the compulsory health insurance system

Payment of insurance premiums by persons who voluntarily entered into legal relations under compulsory pension insurance is made in accordance with Article 29 of the Federal Law of December 15, 2001 No. 167-FZ (as amended by the Federal Law of November 27, 2018 No. 425-FZ) “On Compulsory Pension Insurance” insurance in the Russian Federation" and is carried out to the appropriate accounts of the Federal Treasury using budget classification codes intended to account for insurance premiums paid voluntarily.

The minimum amount of insurance contributions is determined as the product of the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid, and the tariff of insurance contributions to the Pension Fund of the Russian Federation, established by subparagraph 1 of paragraph 2 of Article 425 of the Tax Code of the Russian Federation, increased by 12 times (1 minimum wage x 22% x 12 months, 1 minimum wage as of 01/01/2019 – 11,280 rubles).

For persons applying the special tax regime “Professional Income Tax”, in order to receive a full year of insurance experience (to be registered for the whole year by voluntarily joining the compulsory pension insurance system), it is necessary to pay in the billing period no less than a fixed amount of the insurance contribution for compulsory pension insurance, determined in accordance with Article 430 of the Tax Code of the Russian Federation (for 2020 - 29,354 rubles). In case of payment of a smaller amount, a period proportional to the payment will be included in the insurance period.

The maximum amount of insurance premiums cannot be more than the amount determined as the product of eight times the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid, and the rate of insurance contributions to the Pension Fund of the Russian Federation, established by subparagraph 1 of paragraph 2 of Article 425 Tax Code of the Russian Federation, increased 12 times (8 minimum wage x 22% x 12 months).

How to fill out a payment order for payment of contributions

For non-cash payment, you should select the desired option, then a financial institution (in which the taxpayer has an account in the Bank-Client system) or a third-party payment system convenient for the payer.

As a rule, payment in the corresponding payment system is made through a bank card with a small commission charged.

Non-cash payment is available, as we already know, only to an individual or individual entrepreneur who has indicated his TIN in the online form on the Federal Tax Service website. If the TIN is not specified or if the taxpayer is a legal entity, you will have to pay in cash through the bank’s cash desk (or through “Bank-Client” using a payment order from the Federal Tax Service website as a sample).

To do this, you will need to fill out a payment document for the payment of insurance premiums that corresponds to the established formats. We are talking about a standard bank payment.