As always, we will try to answer the question “Payment Order Fine In PFR Sample Filling Out 2020”. You can also consult with lawyers for free online directly on the website without leaving your home.

Error No. 2: In the payment order, the first three digits of the BCC were “392” due to the fact that the payment was made according to the updated calculation for 2020. Comment: Despite the fact that the transfer of the insurance premium was made for 2020, the KBK should begin with the numbers “182”, with the code assigned to the tax service, since control over insurance premiums from 2020 is under its jurisdiction. Error No. 3: Filling out the upper fields “in the header” of the payment order to pay insurance premiums to the Pension Fund. Detail 104 indicates the KBK (20-digit budget classification code), which can be found in Appendix 6 to Order No. 65n of the Ministry of Finance dated July 1, 2013 (you need to select codes that begin with 182). It should be noted that, according to paragraph. 7 p. 4 sec.

What octmo should I use to transfer a fine to the pension fund for SZVM in Sapnct Petersburg?

The Tax Code has limits - the maximum fine cannot exceed 30 percent of the amount of unpaid contributions. If contributions were transferred on time and in full, then the minimum amount applies - 1000 rubles (Article 119 of the Tax Code of the Russian Federation).

What is the fine for late submission of the DAM in 2020 to the Federal Tax Service?

The amount, as before, does not depend on how late the company was: one minute, a couple of hours or a month. For example, an insurer with a staff of 1 thousand people faces a fine of 500 thousand rubles if the reports are not submitted on time. For example, Order of the Ministry of Finance No. 65n dated July 1, 2013 regarding the application of the BCC. Payments administered by the tax authorities are transferred to the Federal Tax Service, and for accident insurance - to the Social Insurance Fund. Each type of payment administered by the Federal Tax Service has its own distinctive features.

If the company misses the tax payment deadline, the company will have to pay penalties. To do this, you will need to draw up a payment order for penalties in 2020. The example we have provided for you will help you do this correctly.

What is important in KBC? Sample of filling out an order to pay a fine

The payment order for penalties in 2020 is issued in accordance with the order of the Ministry of Finance of the Russian Federation “On approval of the rules for indicating information in details” dated November 12, 2013 No. 107n (hereinafter referred to as order No. 107n).

The main distinguishing feature of a payment order for the payment of a fine is the KBK code entered in field (104).

This is a 20-digit budget classification code that shows to which budget and for what type of income the transfer is sent.

Code digits from 14 to 17 indicate the type of payment transferred to the budget. The value specified here is 2100.

Another detail that will help to accurately identify the type of payment being transferred is field (110). Regardless of whose initiative the payment is made, “PE” is indicated in it.

A sample payment slip for payment of penalties can be downloaded on our website using the link.

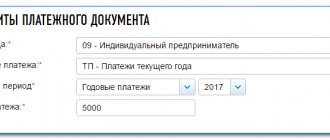

Insurance premiums for individual entrepreneurs for themselves in 2020

An individual entrepreneur pays insurance premiums for himself as long as there is an entry about him in the Unified State Register of Individual Entrepreneurs. This responsibility does not depend on the actual activities of the individual entrepreneur. Clause 7 of Art. 430 of the Tax Code of the Russian Federation defines exceptions to this rule, i.e. periods when an individual entrepreneur may not pay the CB legally:

Individual entrepreneur fixed payment 2020: amount in payment order

The recipient of the payment in payment orders for contributions to the Pension Fund and the Compulsory Medical Insurance Fund for himself in 2020, the individual entrepreneur indicates the Federal Tax Service inspection, in which he is registered as an entrepreneur. Individual entrepreneurs are not required to make contributions to the Social Insurance Fund for themselves, but can insure themselves in the event of temporary disability or maternity leave on a voluntary basis. The entrepreneur does not pay contributions for injuries in any case; this is not provided for by Russian legislation.

A five percent fine is calculated for each full and partial month of delay, including the day the calculation is submitted. They will count it as a full month, even if the due date was on the 2nd of the month, and the organization submitted the calculation on the 13th. The amount of the fine for late submission of calculations for insurance premiums in 2020 can be determined independently.

Tax period indicator If the status “TR” is indicated in field 106, field 107 indicates the payment deadline (DD.MM.YYYY) established in the requirement; if “AP” - indicate 0. 108 Number of the document-basis of payment TR - number of the tax authority’s requirement; AP - number of the decision to bring to responsibility. When indicating the number of the corresponding document, the “No” sign is not placed. 109 Date of the payment basis document The date of the document that is the basis for the payment (date of the request, decision) is indicated in the format DD.MM.YYY 22 Code When paying a fine based on the request of the tax authority, the UIN of the payment is indicated. If the UIN is not specified, and also in other cases, 0 is indicated. 24 Purpose of payment For example, “Payment of a fine for transport tax for 2020 based on the requirement of the Federal Tax Service No. 21 for the city. The number and date of the requirement are indicated in fields 108-109 of the payment order , if there is no requirement, zeros are entered in the fields.

Keep in mind that the BCC is taken not from the period for which you pay the fine or penalty, but from the BCC of the year in which you pay it. Those. When paying fines and penalties in 2020, you must take the KBK from the list of codes for 2020.

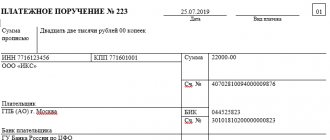

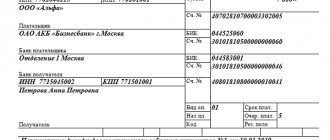

Sample of filling out a payment form PFR fine upon request

This means that if you submit information lately for 5 people, you will be fined 2,500 rubles, and if for 150 people, the amount will be 75 thousand. The more people there are on the staff of an organization or individual entrepreneur, the more unprofitable it is to commit violations. How to fill out a payment order for fines? Every accountant faces this question from time to time. Drawing up such a document has its own nuances. How to properly fill out a payment order to pay a fine? What are the features of filling out payments for the transfer of sanctions for insurance premiums? Where can I find a sample of filling out a tax payment form?

Thus, the last dates for submitting reports in the SZV-M form in 2020 are February 15, March 15, April 17, May 15, June 15, July 17, August 15, September 15, October 16, November 15, December 15, 15 January 2020. Please note: if the number of employees exceeds 25 people, reporting must be submitted electronically with an enhanced qualified electronic signature.

Where to pay the fine for SZV-M in 2020: sample payment order Companies have a question about paying the fine for SZV-M: it is not clear where to pay the fine sent by the fund, for example, for late submission of SZV-M - to the fund's KBK or tax The main details for paying the SZV-M fine are KBK - 392 1 16 20010 06 6000 140, where 392 is the code of the payment administrator, which is the Pension Fund.

Important! Order of the Ministry of Finance No. 65n specifies the administrator for pension contributions of the Federal Tax Service, so the recipient of the funds (field 16) will be the name of the Federal Tax Service, as well as the rest of the recipient’s details must correspond to it. The remaining fields of the payment order are filled in based on regulatory requirements. Table 1.

Where to pay a fine for calling a sample of filling out a payment order 2020

The UIN must be indicated in payment orders for the transfer of taxes and contributions. To reflect the UIN code, field “22” of the payment order is intended, which is called “Code” (clause 1.21.1 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

If penalties are due

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office since 2020.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties to the Social Insurance Fund in fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document”, enter 0 (clauses 5, 6 of Appendix 4 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). And if penalties are paid at the request of the fund and according to the inspection report, their details are given in the purpose of payment.

How to fill out payments from January 1, 2020

- Field 101 indicates the status of the person who issued the document. In 2020, when transferring insurance premiums to the Federal Tax Service, you must indicate code “01” in this field. When paying contributions for yourself or employees, an individual entrepreneur must indicate the status “09”.

- In the “recipient” field you need to indicate the name of the Federal Treasury and in brackets - the name of the tax office to which the payment is transferred.

- Field 104 indicates the BCC in accordance with the legislation of the Russian Federation in 2020:

- 1821020201006 1010 160 – insurance contributions to the Pension Fund for employees of legal entities and individual entrepreneurs;

- 1821020209007 1010 160 – insurance contributions to the Social Insurance Fund for employees of legal entities and individual entrepreneurs;

- 1821020210108 1013 160 – insurance contributions to the FFOMS for employees of legal entities and individual entrepreneurs;

- 1821020214006 1110 160 – fixed contributions to the Pension Fund (individual entrepreneur for himself);

- 1821020210308 1013 160 – fixed contributions to the FFOMS (individual entrepreneurs for themselves).

- Field 105 indicates the OKTMO of the tax authority to which the payment will be transferred.

- In field 106 you need to indicate the type of payment - “TP”.

- In field 107 you must indicate the period for which insurance premiums will be transferred.

- In fields 108 and 109 , when paying insurance premiums in the usual manner, you must indicate “0”. But if penalties or fines are paid, the claim number must be indicated in field 108, and the date of the claim in field 109.

- Field 110 is not filled in.

Sample instructions for contributions from January 1, 2020

- KBC for payment of contributions for injuries in 2020: 3931020205007 1000 160.

- In the “recipient” field you must indicate the name of the Federal Treasury, and in brackets - the name of the Social Insurance Fund.

- Field 105 indicates the OKTMO of the organization.

- In the “code” field , intended to indicate the UIN, you must enter the value “0”.

- In field 101 you must indicate the status “08”.

How to indicate the number and date of the document - grounds for paying penalties

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

A sample payment order for the payment of penalties in 2020 can be viewed and downloaded on our website:

Where to pay a fine for failure to submit a certificate of registration in 2020

The organization's accountant, when filling out a payment order to the Pension Fund of Russia, indicated the payer status code “14” on the basis that this was required by the tax inspectorate in Letter dated January 26, 2020 No. BS-4/11//NP-30-26/947/02-11 -10/06-308-P.

Fines for SZV-M

It is important to say that a fine can be imposed not only on the organization as a tax payer, but also on its officials, for example, a director or accountant, who are responsible for the timely submission of reports to the funds. The amount of penalties in this case can range from 300 to 500 rubles.

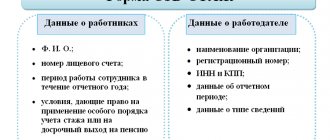

Notice Payee: INN: KPP: Recipient's bank: account: BIC: corr/s: KBK: OKTMO OKATO: Abbreviated name of the authority: Payer: Full name: Address: INN: Name of payment: Amount: Payer: (signature) Cashier On On this page you can fill out and print out the Receipt and payment details. The fine for late submission of the report SZV-M reg. No. 060-051-014447 to the Pension Fund Branch for the city UIN is a Unique Accrual Identifier. This identifier is represented as a code that consists of 20 or 25 digits.

If accounting was maintained without primary documentation, relevant registers, reporting, as well as an audit report for the established storage periods. Federal Law No. 27 on individual accounting in the compulsory pension insurance system determines the amount of penalties that threaten each employer who untimely or incompletely submits personalized information about his employees to the Pension Fund. The fine for failure to submit the SZV-M form on time is 500 rubles for each employee.

How to fill out a payment order for fines (nuances)

Important! Order of the Ministry of Finance No. 65n specifies the administrator for pension contributions of the Federal Tax Service, so the recipient of the funds (field 16) will be the name of the Federal Tax Service, as well as the rest of the recipient’s details must correspond to it. The remaining fields of the payment order are filled in based on regulatory requirements. Table 1.

Comment: These lines are not filled in by the contribution payer; they remain empty for bank employees to enter data. Info Home → Accounting consultations → Payment order Current as of: June 1, 2020

How to issue a payment order for a fine to the tax office When issuing a payment order to transfer payments to the budget system of the Russian Federation, you must be guided by the Rules, approved. By Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, Regulations, approved.

What does a sample payment form look like at the Pension Fund of Russia in 2020?

1.2 tbsp. 114 of the Tax Code of the Russian Federation). We will tell you how to issue a payment order to pay a fine in our consultation and give an example of such a payment order. How to issue a payment order for a fine to the tax office When issuing a payment order to transfer payments to the budget system of the Russian Federation, you must be guided by the Rules, approved.

If it exists, then TR is indicated, if not, ZD. The number and date are also required to be entered in the and fields. If the request does not indicate the BCC number, then you must find it yourself; without it, the payment will not go through.

General concept of penalties and what they are paid for

In the economic world, three concepts of debt are used, namely: penalty, penalty and fine.

Let's try to understand their differences. (click to expand)

| Penya | Penalty | Fine |

| In fact, the penalty is the same penalty, only more applicable by the tax authorities and is also charged for each day of delay as a percentage according to the formula. | Penalty is used to repay the debt of one legal entity to another; it is the most common method of resolving disputes and is provided for when an agreement is concluded between counterparties. It is calculated either as a percentage or a specific amount is indicated. The actual penalty or penalty in the narrow sense is established, as a rule, for a continuing violation, calculated as a percentage of the amount of the unfulfilled obligation or in a fixed sum of money; | The fine is paid one-time and must be initially agreed upon in the contract. The fine is collected for a one-time or ongoing violation in a fixed monetary amount or as a percentage of the amount of the unfulfilled obligation. |

The penalty, as a rule, is paid by one counterparty to another. Penalty is applied, as a rule, to debts of enterprises, as a measure of punishment for delay in monetary obligations. It is a type of penalty and is paid for each day of delay.

According to tax legislation, penalties are charged for late payment of taxes, as well as advance payments thereon. If the company does not transfer the fine on time, its account may be blocked. Since the payment of penalties is given a certain period specified in the tax requirement and in case of its violation, a notification is sent to the bank about blocking the account and writing off the required amount.

Important! If your organization has several accounts, then one bank fulfills the tax requirement.

Payment of a fine to the pension fund

Many services even tell you what and how to do and how many numbers should be in a particular field. This is done to prevent the user from making mistakes. It is best to fill out a payment order on the official portal of the Federal Tax Service, since it is constantly updated there.

Penalty for late submission of SZV-M in 2020

This table outlines the costs for different payment purposes. Purpose of payment Payment of insurance premium to the Pension Fund Payment of a fine Payment of penalties Payment of a fixed payment Within the income limit: If the income limit is exceeded: Filling out a payment order to the Pension Fund Fields [1] and [2] are not filled in, they are needed for records of bank employees. This requirement is typical only for cases of settlements with the budget for taxes, insurance premiums, etc. If accounting was maintained without primary documentation, relevant registers, reporting, as well as an audit report for the established storage periods.

Payment of penalties by payment order in 2018-2019

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

So, the first difference is KBK (field 104). For tax penalties, there is always a budget classification code, in the 14th-17th digits of which the income subtype code is indicated - 2100. This code is associated with a significant change in filling out payment orders: since 2015, we no longer fill out field 110 “Payment Type” .

Previously, when paying penalties, the penalty code PE was entered in it. Now we leave this field empty, and the fact that this is a penalty can be understood precisely from the KBK.

ATTENTION! Since 2020, the procedure for determining the BCC is regulated by a new regulatory legal act - Order of the Ministry of Finance dated 06/08/2018 No. 132n. Order No. 65n dated July 1, 2013 has lost force. But this will not affect the general procedure for assigning penalties to BCC.

Review of the latest changes in taxes, contributions and wages

You have to restructure your work due to numerous amendments to the Tax Code. They affected all major taxes, including income tax, VAT and personal income tax.

The Central Bank announced further changes to the rules for filling out payment orders. So, from next month, when filling out bills for the payment of taxes, contributions, fines and other obligatory payments in the Volga-Vyatka and Ural Federal Districts, it will be necessary to indicate new abbreviated names of the recipient bank. The correspondence table of the old and new names is given in the letter of the Central Bank dated 09/04/14 No. 151-T.

New names of Bank of Russia divisions must be indicated in payment slips from October 1. At the same time, the Central Bank established a “transition” period. The letter stipulates that when filling out paper payments, it is allowed to use the previous names until October 12, 2014. After this date, payers are required to provide new details. If payments are sent electronically, then banks will accept them with both new and previous bank names until July 1, 2020.

Let us remind you that the mandatory details in the payment slip, without which the obligation to pay tax is not considered fulfilled, are the Federal Treasury account number and the name of the recipient's bank (subclause 4, clause 4 of the Tax Code of the Russian Federation). Therefore, if the name of the bank is indicated incorrectly, the payment will have to be transferred again.

What payer statuses are used in 2020

We have compiled a convenient table of payer statuses for the “101” field of the payment order, which are used after 10/02/2017.

Status code | Decoding |

| taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - legal entity | |

| tax agent | |

| federal postal organization that has drawn up an order for the transfer of funds for each payment by an individual, with the exception of payment of customs duties | |

| tax authority | |

| Federal Bailiff Service and its territorial bodies | |

| participant in foreign economic activity - a legal entity, with the exception of the recipient of international mail | |

| customs Department | |

| payer - a legal entity, an individual entrepreneur, a notary engaged in private practice, a lawyer who has established a law office, the head of a peasant (farm) enterprise, transferring funds to pay payments to the budget system of the Russian Federation (with the exception of taxes, fees, insurance premiums and other payments administered by tax authorities) | |

| taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - individual entrepreneur | |

| taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - a notary engaged in private practice | |

| taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - a lawyer who has established a law office | |

| taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - head of a peasant (farm) enterprise | |

| taxpayer (payer of fees for the performance by tax authorities of legally significant actions, insurance premiums and other payments administered by tax authorities) - an individual | |

| a credit organization (a branch of a credit organization), a payment agent, a federal postal service organization that has drawn up a payment order for the total amount with a register for the transfer of funds accepted from payers - individuals | |

| participant in foreign economic activity - individual | |

| participant in foreign economic activity - individual entrepreneur | |

| a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties | |

| organizations and their branches (hereinafter referred to as organizations) that have drawn up an order for the transfer of funds withheld from the wages (income) of a debtor - an individual to repay arrears of payments to the budget system of the Russian Federation on the basis of an executive document sent to the organization in the prescribed manner | |

| credit organization (branch of a credit organization), payment agent, who drew up an order for the transfer of funds for each payment by an individual | |

| responsible member of a consolidated group of taxpayers | |

| member of a consolidated group of taxpayers | |

| Social Insurance Fund of the Russian Federation | |

| payer - an individual who transfers funds to pay fees, insurance premiums administered by the Social Insurance Fund of the Russian Federation, and other payments to the budget system of the Russian Federation (except for fees for the performance of legally significant actions by tax authorities and other payments administered by tax and customs authorities) | |

| guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of value added tax excessively received by the taxpayer (credited to him) in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods outside the territory of the Russian Federation , and excise taxes on alcohol and (or) excisable alcohol-containing products | |

| founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to pay off claims against the debtor for the payment of mandatory payments included in the register of creditors' claims during the procedures applied in a bankruptcy case | |

| credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget system of the Russian Federation | |

| participant in foreign economic activity - recipient of international mail |

Advance payments

Before you start discussing a topic, you always need to introduce it correctly. So let's figure out what an “advance payment” actually is in the tax system of the Russian Federation.

So, let's start with taxes and analyze this concept. In accordance with the law, a tax is a generally obligatory, but individual payment, which is gratuitous and collected forcibly by government authorities. Taxes vary depending on the type of activity of the taxpayer, which is either an organization (LLC) or an entrepreneur (IP).

The tax is collected in order to form and ensure the state budget of the Russian Federation. Which in turn goes to finance various state, federal and municipal organizations, which supports the same taxpayers at the legislative and state level.

Now let’s understand the concept of “advance”. Advance payment is a very popular method in the country and in the world of depositing funds into the account of the performer of any work or service or the seller of any product. That is, in fact, this is payment for a process that has not yet been completed, be it work or purchase and sale.

Also, speaking about advances, we can say that this type of payment can be a form of financing projects or companies. Since this is actually payment for prospects that have not yet been realized, which will bring profit. Of course, if this does not happen, the advance payment will be returned, provided this provision is indicated in the contract, of course.

So, how does taxation and early payment fit together? Very simply, in the tax system such payments are paid regularly throughout the reporting period, which in total constitutes the final total tax. Accordingly, the entire amount of contributions is transferred to the amount of tax paid by the organization or entrepreneur.

Such contributions have special purposes - they are most often insurance contributions for company employees. They are allocated from the profit received by the organization in certain amounts for each reporting period, and are paid, again, monthly.

New rules for calculating penalties

From October 1, 2020, the procedure for calculating penalties for non-payment of tax in relation to organizations will change. Amendments were made to paragraph 4 of Article 75 of the Tax Code by Federal Law No. 401-FZ of November 30, 2016.

If payment is late by up to 30 calendar days, the penalty will be calculated as usual - based on one three hundredth of the Bank of Russia refinancing rate. According to the new rule, starting from the 31st day, the penalty will be one hundred and fiftieth of the discount rate.

The refinancing rate is now 8.5% per annum.

The changes apply only to legal entities. For individuals, including individual entrepreneurs, everything remains the same.

General provisions about the document

The payment order form, like all other forms of documents used to make payments, was prepared and approved by the Central Bank of the Russian Federation in Regulation No. 383-P dated June 19, 2012. It also presents the methodology by which the document is filled out, and Appendix No. 3 contains its approved form indicating numbered fields for ease of completion. We will not list all the payment details, since for our publication only field 110 is of particular interest. In payment order 2018

year, or rather in the Central Bank’s requirements for filling it out, there have been no changes yet, since the latest adjustments were approved quite recently - in August 2020. Let’s look at the vicissitudes of completing this detail.